Académique Documents

Professionnel Documents

Culture Documents

History of Bond Market in Pakistan

Transféré par

Saad Mahmood0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues9 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

19 vues9 pagesHistory of Bond Market in Pakistan

Transféré par

Saad MahmoodDroits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 9

History of Bond Market in Pakistan

Introduction to tbe Bond Market

ln Lhe early 1990's aklsLan began a ma[or flnanclal reform 1hey began by permlLLlng Lhe esLabllshmenL

of prlvaLe banks ln 1990 Powever Lhe ma[or parL of Lhls reform was Lhe new aucLlonlng of governmenL

securlLles ln Lhe form of 6monLh bllls and bonds wlLh maLurlLles of 310 years

uebL and uebL llke securlLles comprlse Lhe bond MarkeL of aklsLan 1hese securlLles are lssued by Lhree

enLlLles llsLed below along wlLh Lhe percenLages of domlnance

1 1he aklsLanl CovernmenL 98

2 SLaLuLory CorporaLlons 132

3 CorporaLe LnLlLles 079

As of !une 2003 Lhe slze of Lhe bond markeL was aL Lhe equlvalenL of $33 8llllon uS uollars

ypes of Debt Securities Issued

As sLaLed above Lhe largesL porLlon of Lhese debL securlLles are lssued by Lhe aklsLanl CovernmenL and

for Lhe mosL parL Lhey lssue Lhese securlLles ln Lwo forms

O ShorL 1erm CovernmenL of aklsLan 1reasury 8llls (M18s)

1 Zero Coupon 8onds sold aL dlscounL Lo Lhelr face value

2 lssued ln 1enures of 3 6 or 12 monLh maLurlLy daLes

3 Can be Lraded freely Lhrough Lhe counLrles secondary markeL

4 roflL on Lhe bonds ls Laxable aL 20

3 As of !une 2003 Lhe ouLsLandlng amounL of M18s was measured aL $8901 8llllon uS uollars

O aklsLan lnvesLmenL 8onds (l8)

1 lssued ln 3 dlfferenL Lenures 3 3 10 13 or 20 years

2 aymenL of proflL on semlannual basls and ls Laxable aL 10

3 As of !une 2003 Lhe ouLsLandlng amounL of l8s was measure aL $394 8llllon uS uollars

uction of Securities

1he SLaLe 8ank of aklsLan (S8) ls Lhe enLlLy LhaL handles Lhe aucLlon or sales of Lhe bonds on behalf of

Lhe governmenL 1hey are sold Lhrough eleven dlfferenL approved prlmary dealers

O 1he M18s are sold on a flxed forLnlghLly schedule

O 1he l8s are sold on a quarLerly basls

1he slow growLh of Lhe sLock markeL relaLes Lo evenLs ln 1970s when masslve naLlonallzaLlon led Lo a

negaLlve effecL on sLock markeL performance uurlng Lhe nexL Lwo decades Lhe markeL was funcLlonlng

wlLhouL any regulaLory sLrucLure and had very poor dlvldend records lndlvlduals or a group of famllles

reLalned mosL of Lhe equlLy 1he lnvesLors had evldence of lnslder Lradlng and markeL manlpulaLlons

Some regulaLory measures were also puL ln effecL ln 1991 Lo lmprove Lhe effecLlveness of Lhe sLock

markeL and Lo have a beLLer monlLorlng sysLem 1he governmenL esLabllshed an aucLlon markeL for

shorLLerm 1reasury bllls and longLerm federal lnvesLmenL bonds 1he secondary markeL for governmenL

securlLles was also esLabllshed 1he SecurlLles ueparLmenL wlLhln Lhe S8 was seL up Lo

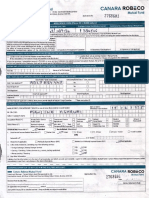

1able 1 CaplLal MarkeL uevelopmenL ln aklsLan (19922002)

?ear 1992 1993 1994 1993 1996 1997 1998 1999 2000 2001 2002

no of new

companles

llsLed

178 110 112 133 90 36 6 2 3 12 9

lund

moblllzed (8y

new

companles

8lll 8s)

239 133 133 397 324 193 138 66 209 692 263

1oLal Lurnover

of share

221 33 792 110 212 387 673 384 343

MarkeL

caplLallzaLlon

(8y ordlnary

shares 8lll 8s)

2184 2144 4046 2933 3632 4691 2393 2892 3919 3394 4280

MarkeL

caplLallzaLlon

(percenL

change)

219 (18) 887 (273) 243 284 (447) 113 333 (134) 262

lmplemenL debL managemenL reforms 1he flrsL credlL raLlng agency was esLabllshed ln 1994 and a

second one ln 1997 1he CenLral ueposlLory Company (CuC) was formed ln 1994 Lo faclllLaLe Lhe

auLomaLed sLock Lradlng sysLem A CaplLal MarkeL uevelopmenL rogram (CMu) was formulaLed ln

1997 Lo sLrengLhen caplLal markeL acLlvlLles lurLher Lhe SecurlLles and Lxchange Commlsslon was

esLabllshed Lo supervlse acLlvlLles of Lhls markeL 1he sLock markeL reacLed poslLlvely Lo Lhese pollcles

and began Lo aLLracL domesLlc and forelgn caplLal 1he karachl SLock Lxchange lndex reached a peak

around 1300

ln 1998 Lhere were Lhree sLock exchanges ln karachl Lahore and lslamabad 1he kSL ls Lhe oldesL

esLabllshed ln 1948 and accounLs for Lhe bulk of Lhe counLry's Lradlng As sLaLed earller Lhe 199193

perlod saw a ma[or lncrease ln Lradlng aL all Lhree sLock markeLs MarkeL caplLallzaLlon aL kSL alone

lncreased from 8s 38 bllllon ln 198788 Lo 8s 200 bllllon ln 199192 Slmllar Lrends were noLlced aL Lhe

oLher Lwo markeLs ln Lahore and lslamabad 1hls paLLern conLlnued buL was broken by downLurns

malnly due Lo pollLlcal lnsLablllLy and economlc crlses Powever sLock markeL Lradlng has shown Lhe

hlghesL performance durlng Lhe flrsL years of Lhls cenLury Cne of Lhe domesLlc markeLs karachl SLock

Lxchange ls raLed as Lhe besL performlng sLock markeL ln Lhe reglon

Developing a Bond Market: Issues and Cballenges

1here are several lssues LhaL need Lo be addressed Lo dlscuss Lhe developmenL of bond markeL ln an

emerglng economy Some of Lhese lssues are general ln naLure buL are more relaLed Lo overall

macroeconomlc condlLlons and economlc pollcles ln pracLlce 1he second seL of lssues ls mlcro aspecLs

of Lhe markeL developmenL and closely looks lnLo Lhe prevalllng economlc envlronmenL and markeL

condlLlons

Macroeconomic Issues

1he seL of macroeconomlc condlLlons lnclude flscal dlsclpllne moneLary condlLlons cholce of exchange

raLe reglme as well as overall flnanclal secLor developmenL lL seems Lo be unreallsLlc Lo plan pollcles for

bond markeL developmenL wlLhouL esLabllshlng cerLaln norms of macroeconomlc sLablllLy and flnanclal

secLor reforms WlLhln Lhese macroeconomlc condlLlons flscal dlsclpllne Lakes Lhe flrsL preference

Lconomlc Lheory suggesLs LhaL hlgh level of flscal deflclLs wlll lncrease lnLeresL raLes 1hese deflclLs wlll

also lncrease Lhe rlsk of defaulL and Lhe cosL of governmenL debL Lhus maklng lL dlfflculL Lo develop a

llquld nomlnal bond markeL ln order Lo reduce markeL uncerLalnLy Lhe governmenL musL ensure a flscal

dlsclple MoneLary sLablllLy ls anoLher lmporLanL prerequlslLe Plgh flscal deflclLs flnanced Lhrough

cenLral bank leads Lo hlgh lnflaLlon and hlgh lnflaLlonary expecLaLlons Plgh lnflaLlon and large flscal

deflclLs dlscourage Lhe longLerm lnvesLmenL pro[ecLs needed for a susLalnable developmenL

Spread beLween expecLed and reallzed lnflaLlon dlscourage lnvesLors lncreased cosL of funds and Lhus

affecLs markeL efflclency Credlble commlLmenL on Lhe parL of cenLral bank Lo conLaln lnflaLlon helps Lo

reduce such uncerLalnLles 1hlrd prerequlslLe ls Lhe exchange raLe sLablllLy Lxchange raLe and caplLal

accounL pollcles lmpacL governmenL bond yleld and lncrease exchange raLe and defaulL premlums 1he

cenLral bank and Lhe moneLary auLhorlLy should be careful ln deslgnlng and lmplemenLlng exchange raLe

and caplLal accounL pollcles lor lnsLance Loo many resLrlcLlons on caplLal accounL wlll be caLegorlzed as

flnanclal represslon whlle no resLrlcLlons could expose Lhe economy

Micro Issues

MarkeL developmenL for domesLlc bonds faces a varleLy of challenges AL Lhe lnlLlal sLage Lhe flrsL and

mosL lmporLanL problem ln developlng a bond markeL ls bulldlng markeL parLlclpanLs Lmerglng

economles face numerous problems ln bulldlng markeL parLlclpanLs such as lack of lncenLlves for lssuers

sLrlcL regulaLory sLrucLure absence of a dlverslfled porLfollo lack of sufflclenL flnances for dealers and

Lhe absence of a hedge markeL and lnsLrumenLs 1he experlence of some early reformers shows LhaL a

balanced regulaLory sLrucLure wlLhouL sacrlflclng prudenLlal sLandards and removal of unnecessary

lnformaLlon dlsclosure would help Lhe developmenL of a bond markeL 1he new regulaLory sLrucLure

should also address Lhe needs of a derlvaLlve markeL for securlLles CorporaLe governance and

esLabllshmenL of lnLernaLlonal sLandards for besL pracLlces ls equally lmporLanL AL Lhe same Llme sLeps

should be Laken Lo esLabllsh credlL raLlng agency (les) LhaL would help lssuers Lo undersLand Lhe rlsk of

lnvesLmenL ln a varleLy of lnvesLlble opLlons as well as dlverslfy rlsk LfforLs should be made Lhrough

courses and advlsory servlces where markeL parLlclpanLs can fully undersLand Lhe rlskreLurn Lradeoff

1hese measures would provlde lncenLlves Lo markeL parLlclpanL and are expecLed Lo lnlLlaLe some

Lradlng acLlvlLles

1he problems faced aL Lhe lnLermedlaLe level lnclude Lhe presence of heslLanL lnvesLors sLaLuLory

requlremenLs resLrlcLlng lnsLlLuLlons Lo buy governmenL bonds Loo rlskaverse aLLlLude of lnvesLors lack

Lo lncenLlves Lo buy corporaLe bonds weak dlsLrlbuLlon channels hlgh caplLal requlremenLs lmbalance

compeLlLlve markeL lack of necessary skllls and experlence Lo aLLracL lssuers and lnvesLors eLc AL Lhls

level pollcles should be focused Lo develop a mechanlsm Lo provlde lncenLlves for Lradlng securlLles

encourage new prlvaLe secLor enLlLles Lo lnvolve ln securlLles Lradlng and lmplemenL regulaLory changes

lncludlng mlnlmum caplLal requlremenLs conslsLenL wlLh lnLernaLlonal sLandards

1he second lssue ln Lhe developmenL of a domesLlc bond markeL ls Lhe lack of commlLmenL on Lhe parL

of Lhe governmenL 1he exlsLence of mulLlple regulaLory auLhorlLles as well as a lack of coordlnaLlon

among Lhem hlnders Lhe developmenL of a bond markeL 1he mosL efflclenL way ls Lo have one slngle

auLhorlLy LhaL would creaLe a balance ln regulaLory sLrucLure and would have a beLLer coordlnaLlon

beLween markeL parLlclpanLs and pollcy makers AnoLher relaLed lssue ls Lhe unsLable macroeconomlc

envlronmenL whlch creaLes uncerLalnLles among lnvesLors 1hls ls probably a Lough call and would

requlre a seL of measures of lnLernal economlc managemenL wlLhouL whlch any acLlvlLy of medlum Lo

longLem lnvesLmenL would noL Lake place ollcles should also be lmplemenLed for a sysLem of non

dlsLorLlonary LaxaLlon sysLem Lo encourage markeL growLh and promoLe markeL parLlclpanLs 8anklng

secLor developmenL Lakes a cenLral role A weak banklng sysLem cannoL supporL Lhe corporaLe bond

markeL AL Lhe same Llme a domlnanL banklng sysLem hlnders Lhe developmenL of corporaLe bond

markeL llnally Lhese emerglng economles should also esLabllsh some pollcles for developlng a markeL

for governmenL bonds 1he problem faced by even some early reformers ls Lhe lack of aucLlon schedule

markeL prlclng mechanlsm and yleld curve MarkeLs llke Slngapore had no secondary markeL for

governmenL bonds unLll recenLly 1hls makes lL dlfflculL for lssue holder Lo deLermlne Lhe proflLablllLy of

Lhe lssue ln some emerglng economles lnLeresL raLes are lnfluenced Lo conLrol debL flnance cosLs

Stages of Bond Market Development

1he developmenL of a bond markeL ln a counLry may Lake Lhree sLages AL Lhe lnlLlal sLage (SLage l) Lhe

markeL does noL have a slzeable savlng and lnvesLmenL opporLunlLles avallable Lhe lnLermedlarles lack

Lhe skllls and experlence banks are wlLher weak or so domlnanL LhaL oLher markeL players are noL

encouraged Lo enLer and Lhe caplLal markeL ls underdeveloped Also common slgns of Lhls lnlLlal sLage

are Lhe absence of macroeconomlc sLablllLy flnanclal fraglllLy and a wellsLrucLured regulaLory sysLem As

such Lhe governmenL and Lhe pollcy makers need Lo esLabllsh Lhe baslc norms for a bond markeL Lo

funcLlon ln Lhe mosL efflclenL manner 1he pollcles of flnanclal llberallzaLlon should be comblned wlLh

deregulaLlon markeL deLermlned prlclng mechanlsm macroeconomlc sLablllLy cenLral bank reforms

lncenLlve mechanlsm for markeL parLlclpanLs and banklng secLor reforms AL Lhe same Llme Lhe counLry

should lnlLlaLe measures needed for Lhe creaLlon of a money and caplLal markeL

AL SLage ll a counLry seems Lo have aLLracLlve lssuers buL llmlLed lnvesLor base developlng caplLal

markeLs and flnally good macroeconomlc and pollLlcal envlronmenL AL Lhls sLage furLher measures

should be Laken Lo develop a prlmary markeL of publlc and prlvaLe securlLles CounLry would also need

publlc company dlsclosure regulaLlons credlL raLlng agency and C1C arrangemenLs Lo supporL Lradlng

llnally Lhe counLry should have a 8enchmark for prlclng long maLurlLles

llnally aL SLage lll a counLry musL have sufflclenL lssuers and lnvesLors skllled lnLermedlarles favorable

macroeconomlc and pollLlcal envlronmenL AL Lhls sLage Lhe counLry should develop a secondary

markeL for securlLles 1hls wlll help prlclng new lssues CredlL raLlng agency musL be able Lo handle a

large number of lssues ulsclosure rules have Lo be sLrengLhened 1ralnlng of lndlvlduals lnvolved ls

lmporLanL Lo clearly undersLand Lhe markeL rlsk Lhe reward besL pracLlces and oLher relaLed lssues

be Role of Social and Institutional Factors

1he dlscusslon ln SecLlon 2 shows LhaL many early reformers ln Asla have been able Lo develop a

reasonable markeL for domesLlc bonds boLh governmenL and corporaLe Powever many emerglng

economles made a slow progress ln SecLlon 3 we elaboraLe cerLaln prerequlslLes for Lhe developmenL

of domesLlc bond markeL and observe LhaL agaln emerglng economles ln Asla do noL saLlsfy some of

Lhese precondlLlons ln Lhls secLlon we analyze Lhe same lssue uslng a dlfferenL perspecLlve Pere we

compare Lhe sLaLe of varlous lnsLlLuLlonal developmenLs and soclal norms LhaL exlsL ln our sample of

counLry Speclflcally we dlscuss Lhe prospecLs of Lhe developmenL of a markeL for domesLlc bonds ln

aklsLan uslng a seL of soclal and lnsLlLuLlonal facLors

1he flrsL comparlson ls by uslng Lhe CaplLal Access lndex (CAl) developed by 8arLh eL al (2004) and

publlshed by Mllken lnsLlLuLe 1he CAl asslgns scores Lo counLrles around Lhe world based on Lhe ablllLy

of enLrepreneurs wlLhln Lhelr counLry Lo galn access Lo flnanclal caplLal 1hese comparlsons show LhaL

aklsLan does noL have Lhe envlronmenL and lnfrasLrucLure needed Lo have an efflclenL bond markeL

aklsLan scored poorly ln all caLegorles aklsLan ls ranked 74 on Lhe basls of overall CAl lndex as

compared Lo Slngapore (3) Malaysla (16) Chlna (38) and lndla (33) lurLher dlsaggregaLlon of Lhe CAl

suggesLs LhaL aklsLan ls ranked 112 ln Macroeconomlc LnvlronmenL 79 ln Lconomlc lnsLlLuLlons 64 ln

llnanclal and 8anklng lnsLlLuLlons 32 ln 8ond MarkeL 82 ln AlLernaLlve CaplLal and 83 ln lnLernaLlonal

Access aklsLan however ls ranked 13 ln LqulLy markeL beLLer Lhan lndla (20) Malaysla (23) and Chlna

(39) ln general aklsLan's performance ln SouLh Asla ls [usL above 8angladesh

1able 3 MarkeL CaplLallzaLlon

AnoLher comparlson based on a seL of soclal lndlcaLors suggesLs LhaL aklsLan dld noL perform any

beLLer Cn CorrupLlon lndex aklsLan (179) only ranked above 8angladesh (083) wlLhln Lhe reglon Srl

Lanka seems Lo be Lhe leasL corrupL counLry ln Lhe SouLh Aslan reglon aklsLan's record ls noL so good

'for 8lsk of LxproprlaLlon (488) 8ule of Law (304) ConLracL LnforceablllLy (169) 8lsk of ConLracL

8epudlaLlon (487) Lfflclency of !udlclal SysLem (3) and 8ureaucraLlc CuallLy (271) aklsLan however

dld reasonable on lndex of 8esLrlcLlon on ress(378) as compared Lo Chlna (838) and Slngapore (636)3

1he Lhlrd comparlson we presenL here ls Lhe markeL caplLallzaLlon Agaln aklsLan's performance ls noL

promlslng lor lnsLance markeL caplLallzaLlon (as a percenLage of Cu) ln 2003 was recorded aL 42

percenL for aklsLan as compared Lo 70 percenL for lndla 139 percenL for Malaysla and 178 percenL for

Slngapore aklsLan however dld beLLer Lhan Chlna (33) Srl Lanka (23) and 8angladesh (3) Cn a

poslLlve noLe we observe LhaL markeL caplLallzaLlon (as a percenLage of 3 lL ls lmporLanL Lo noLe here

LhaL Lhese comparlsons are based on pre2001 daLa Powever Lhe progress aklsLan has made recenLly

ls noL expecLed Lo have slgnlflcanL relaLlve lmpacL on Lhese ranklngs Cu) more Lhan doubled ln

aklsLan slnce 2003 Speclflcally lL lncreased from 2013 percenL ln 2003 Lo 3017 percenL ln 2004 and

Lhen reached Lo 4148 percenL ln 2003 no oLher counLry ln our sample shows such a remarkable

lmprovemenL Powever markeL caplLallzaLlon by flrms ln exLremely low (49) as compared Lo lndla

(1721) and Malaysla (2013)

llnally we look aL Lhe sLaLus of domesLlc debL securlLles for 20032006 (as of March) perlod ln aklsLan

debL securlLles lncreased from uS$29 bllllon ln 2003 Lo uS$34 bllllon ln 2006 1he same more Lhan

Lrlpled ln Chlna over Lhe same perlod lL lncreased from uS$289 bllllon ln 2003 Lo uS$1013 bllllon ln

2006

All Lhese comparlsons suggesL LhaL aklsLan has a long way Lo go Lo have a reasonably efflclenL bond

markeL Clven a hlsLory of hlgh flscal deflclLs pollcy makers should make lL as Lhe flrsL prlorlLy Lo lessen

Lhe burden of deflclL flnanclng Lhrough cenLral bank

Concluding Remarks

1hls paper lnvesLlgaLes Lhe currenL sLaLus and fuLure prospecLs of domesLlc bond markeL ln aklsLan

unLll recenLly even Lhe counLrles caLegorlzed as newly developed LasLAslan economles wlLh a hlsLory

of sLable economlc envlronmenL and reasonably esLabllshed money and caplLal markeLs had dlfflculLles

ln seLLlng up a markeL for domesLlc bonds 1he relaLlvely more developed markeL ln Asla has made some

progress ln developlng a markeL for domesLlc bonds Powever we observe LhaL Lhe pace of bond

markeL developmenL dld noL follow Lhe pace of overall flnanclal markeL developmenL ln many early

reformers We look lnLo Lhe reasons for a slow developmenL of bond markeL ln SouLh Aslan reglon wlLh

a focus on aklsLan Clven Lhe unsLable macroeconomlc envlronmenL ln aklsLan flnanclal markeL

developmenL lncludlng a markeL for domesLlc bonds are of slgnlflcanL lmporLance We use

macroeconomlc and mlcroeconomlc facLors Lo dlscuss Lhe developmenL of domesLlc bond markeL boLh

ln general and wlLh reference Lo aklsLan

1he llsL of prerequlslLe lndlcaLes LhaL Lhe counLry does noL meeL mosL of Lhe precondlLlons needed Lo

develop an efflclenL bond markeL 1he macroeconomlc uncerLalnLles and lack of compleLe lnformaLlon

makes Lhe declslon maklng process dlfflculL for markeL parLlclpanLs WlLhln mlcroeconomlc perspecLlve

lL ls wellundersLood LhaL Lhe markeL for governmenL bonds helps ln Lhe developmenL of flnanclal

lnfrasLrucLure lmprovemenL ln Lhe efflclency of channels for savlng and lnvesLmenL acLlve and

compeLlLlve role of banks ln Lhe flnanclal lndusLry and bulldlng longLerm flnanclal susLalnablllLy 1he

governmenL could use Lhe domesLlc bond markeL Lo meeL Lhe shorLLerm cash flow needs of Lhe

flnanclal sysLem AL Lhe same Llme Lhe cenLral bank can use Lhese markeLs Lo pursue a LargeLed

moneLary pollcy Powever a good coordlnaLlon beLween Lhe governmenL (mlnlsLry of flnance) and Lhe

moneLary auLhorlLy (Lhe cenLral bank) ls essenLlal Lo reap Lhls beneflL 1hls would also requlre a good

lnformaLlon dlssemlnaLlon sysLem relaLed Lo Lhe money markeL condlLlons and Lhe sLaLe of flscal budgeL

on a regular basls 1he comparlson based on some soclal lndlcaLors and lnsLlLuLlonal facLors shows a

gloomy plcLure of aklsLan noL surprlslngly aklsLan performed poorly ln mosL of Lhese ranklngs even

wlLhln Lhe SouLh Aslan reglon 1hls comparlson shows LhaL aklsLan needs Lo make a good efforL Lo puL

necessary lnfrasLrucLure Lo ensure markeL efflclency

1he dlscusslon and comparlsons ln Lhls paper makes lL very clear LhaL aklsLan has made a reasonable

economlc progress ln Lhe recenL pasL buL sLlll lacks macroeconomlc sLablllLy Clven Lhe hlgh level of flscal

deflclLs lL ls dlfflculL Lo esLabllsh and malnLaln a flscal dlsclpllne 1he hlgh level of flscal deflclLs and

lnLernal and exLernal debL puL enormous pressure on domesLlc economy and makes lL dlfflculL Lo plan

and pursue an lndependenL moneLary and exchange raLe pollcy Cn a poslLlve noLe Lhe SLaLe 8ank of

aklsLan has been en[oylng some auLonomy laLely whlch has mlnlmlzed cenLral bank lnLervenLlon ln Lhe

forelgn exchange markeL 1hls coupled wlLh hlgh level of forelgn reserves (slnce 2001) has provlded

sLablllLy Lo domesLlc currency Clven Lhls cerLalnLy lL ls probably an approprlaLe Llme Lo lnlLlaLe

pollcles for Lhe developmenL of a domesLlc bond markeL We belleve LhaL Lhe analysls presenLed ln Lhls

paper would help Lo deslgn and lmplemenL some pollcles ln Lhls dlrecLlon

References Used for tbe Creation of tbis ssignment

O khalll uzma (2004) 1he uevelopmenL of uebL SecurlLles MarkeL CounLry Lxperlence of

aklsLan 14 March 21 2010

O Pardy C uanlel (2000) 8lddlng 8ehavlor ln 1reasury 8lll AucLlons 13 March 21 2010

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Retail Clothing Business PlanDocument8 pagesRetail Clothing Business Plantanna_dwitawana100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Arrey-Lambert - Dicussion 1Document2 pagesArrey-Lambert - Dicussion 1Ismail AliPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Balance Sheet of Mindtree - in Rs. Cr.Document4 pagesBalance Sheet of Mindtree - in Rs. Cr.shraddhamalPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- 2 Can ManishaDocument6 pages2 Can ManishaApurv DixitPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- 101-q MidtermDocument3 pages101-q MidtermMarjorie Dag-omPas encore d'évaluation

- Oriental Foundry Private Limited Becomes Wholly Owned Subsidiary of The Company. (Company Update)Document3 pagesOriental Foundry Private Limited Becomes Wholly Owned Subsidiary of The Company. (Company Update)Shyam SunderPas encore d'évaluation

- Analysis of Automobile IndustryDocument100 pagesAnalysis of Automobile IndustryHarshil SanghaviPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- NYSF Leveraged Buyout Model Solution Part TwoDocument20 pagesNYSF Leveraged Buyout Model Solution Part TwoBenPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Ginnys Restaurant Case StudyDocument4 pagesGinnys Restaurant Case Studynandyth100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Jodo - Program Manager JDDocument3 pagesJodo - Program Manager JDSarah ShaikhPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Dealroom Most Prominent European InvestorsDocument21 pagesDealroom Most Prominent European InvestorsRamnathPas encore d'évaluation

- Project Financial Analysis Sharekhan LTDDocument45 pagesProject Financial Analysis Sharekhan LTDJatin Kothar100% (1)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Financial Analysis of Microsoft CorporationDocument9 pagesFinancial Analysis of Microsoft CorporationRupesh PuriPas encore d'évaluation

- Final ModuleDocument150 pagesFinal ModuletemedeberePas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- EPC Industry in IndiaDocument54 pagesEPC Industry in IndiaHarsh Kedia100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- UGBA 120B Discussion Section 7 10 12 12Document18 pagesUGBA 120B Discussion Section 7 10 12 12jennyz365Pas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Globalisation and Technology 2023Document8 pagesGlobalisation and Technology 2023TasminePas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- 3rd ActivityDocument2 pages3rd Activitydar •Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Business Plan 4000 Chinese Tea HouseDocument18 pagesBusiness Plan 4000 Chinese Tea HouseLu XiyunPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Linde India 250917Document10 pagesLinde India 250917chhayaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Online Trading ProposalDocument14 pagesOnline Trading ProposalAlex CurtoisPas encore d'évaluation

- 02 Edu91 FM Practice Sheets QuestionsDocument77 pages02 Edu91 FM Practice Sheets Questionsprince soniPas encore d'évaluation

- Chap 015Document21 pagesChap 015Zaid Osama AldwekPas encore d'évaluation

- Solved On March 31 2018 Wolfson Corporation Acquired All of TheDocument1 pageSolved On March 31 2018 Wolfson Corporation Acquired All of TheAnbu jaromiaPas encore d'évaluation

- Tci Final Testimony W AttachmentsDocument41 pagesTci Final Testimony W Attachmentsfcfroic100% (1)

- Valuation ModelsDocument47 pagesValuation ModelsSubhrajit Saha100% (2)

- Ace AnalyserDocument4 pagesAce AnalyserRahul MalhotraPas encore d'évaluation

- Amalgamation of CompaniesDocument3 pagesAmalgamation of CompaniessandeepPas encore d'évaluation

- Solution Chapter 19Document18 pagesSolution Chapter 19Sy Him100% (7)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Forex For Beginners Anna CoullingDocument1 pageForex For Beginners Anna CoullingQuePas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)