Académique Documents

Professionnel Documents

Culture Documents

City Bank Term Paper

Transféré par

Nirob Hasan VoorDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

City Bank Term Paper

Transféré par

Nirob Hasan VoorDroits d'auteur :

Formats disponibles

Introduction

Its our great pleasure to introduce City Bank. Since our beginning, always we have been trying to maintain the best quality standard of our banking sector. We can give a loan for many people, business industry, bank etc. We constantly innovate by frequently introducing new balance sheet. City Bank is one of the oldest private Commercial Banks operating in Bangladesh. It is a top bank among the oldest five Commercial Banks in the country which started their operations in 1983. The Bank started its journey on 27th March 1983 through opening its first branch at B. B. Avenue Branch in the capital, Dhaka city. It was the visionary entrepreneurship of around 13 local businessmen who braved the immense uncertainties and risks with courage and zeal that made the establishment & forward march of the bank possible. Those sponsor directors commenced the journey with only Taka 3.4 crore worth of Capital, which now is a respectable Taka 330.77 crore as capital & reserve. City Bank is among the very few local banks which do not follow the traditional, decentralized, geographically managed, branch based business or profit model. Instead the bank manages its business and operation vertically from the head office through 4 distinct business divisions namely Corporate & Investment Banking; Retail Banking (including Cards); SME Banking; & Treasury & Market Risks. Under a real-time online banking platform, these 4 business divisions are supported at the back by a robust service delivery or operations setup and also a smart IT Backbone. Such centralized business segment based business & operating model ensure specialized treatment and services to the bank's different customer segments. The bank currently has 83 online branches spread across the length & breadth of the country that include a full fledged Islami Banking branch. Besides these traditional delivery points, the bank is also very active in the alternative delivery area. It currently has 25 ATMs of its own; and ATM sharing arrangement with a partner bank that has 225 ATMs in place; SMS Banking; Interest Banking and so on. Soon its Customer Call Center is going to start operation. The bank has a plan to end the current year with 50 own ATMs. City Bank is the first bank in Bangladesh to have issued Dual Currency Credit Card. The bank is a principal member of VISA international and it issues both Local Currency (Taka) & Foreign Currency (US Dollar) card limits in a single plastic. VISA Debit Card is another popular product which the bank is pushing hard in order to ease out the queues

2 at the branch created by its astounding base of some 400,000 retail customers. The launch of VISA Prepaid Card for the travel sector is currently underway. City Bank prides itself in offering a very personalized and friendly customer service. It has in place a customized service excellence model called GAP (Graceful-AppropriatePleasing) that focuses on ensuring happy customers through setting benchmarks for the bank's employees' attitude, behavior, readiness level, accuracy and timelines of service quality. City Bank is one of the largest corporate banks in the country with a current business model that heavily encourages and supports the growth of the bank in Retail and SME Banking. The bank is very much on its way to opening many independent SME centers across the country within a short time. The bank is also very active in the workers' foreign remittance business. It has strong tie-ups with major exchange companies in the Middle East, Europe, Far East & USA, from where thousands of individual remittances come to the country every month for disbursements through the bank's large network of 83 online branches. The current senior management leaders of the bank consist of mostly people form the multinational banks with superior management skills and knowledge in their respective "specialized" areas. The bank this year, is celebrating its 25th year of journey with the clear ambition of becoming the no.1 private commercial bank in the country in 3 years time. The newly launched logo and the pay-off line of the bank are just one initial step towards reaching that point.

Objective

Our objective is to earn competitive return from our various business activities at acceptable risk levels. Risk management involves overseeing the risks associated with all our business activities in the environment in which we operate, and ensuring that risktaking is within prudent boundaries and that the prices charged for products and services properly reflect the risk we take. Risk is calculated in terms of impact on income and asset value. We assess the potential effect on our business consequential to changes in political, economic, market and operating conditions, and the creditworthiness of our clients using four primary risk categories: credit, market, liquidity and operational risk. In the management of these risks we rely on:

The competence and experience of our dedicated professional staff operating with due segregation of duties; Sophisticated, quantitatively based analytical tools; Ongoing investment in technology.

3 This combination of prudence, analytical skills and technology, together with adherence to our operating procedures, is reflected in the strengths and quality of our earning over time.

Methodology

The Methodology of this project is to understand the financial position of a business through financial statement. In this term-paper several financial position are used to SWOT analysis in this business. The method is very simple. We took the information from the SWOT analysis of the business.

Financial Performance - Overall Activities

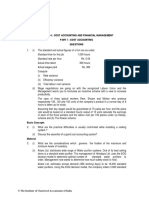

Highlights on the overall activities of the bank for the year 2007 and 2006 Sl. Particulars Year Under Review (2007) Previous Year (2006) 1,188.00 3,156.25 652.55 48,755.40 40,539.63 26,788.47 8,277.64 66.08% 6.24% 343.46 1,671.83 462.78 943.26 75.31% 7.18% 59.50

1 Paid-up capital 1,080.00 2 Total capital 2,601.00 3 Capital surplus / (deficit) 4 Total assets 47,445.75 5 Total deposits 40,881.41 6 Total loans and advances / investments 30,789.02 7 Total contingent liabilities and commitments 12,901.57 8 Credit deposit ratio 9 Percentage of classified loans / investments against total loans and advances / investments 10 Profit after tax and provision 240.02 11 Amount of classified loans / investments during current year 2,209.73 12 Provisions kept against classified loans / investments

4 13 Provision surplus/(deficit) against classified loans / investments 40.00 14 Cost of fund 7.55% 6.94% 15 Interest earning assets 42,757.28 40,820.24 16 Non-interest earning assets 5,998.12 6,625.51 17 Return on investment (ROI) 12.33% 8.58% 18 Return on assets (ROA) 0.71% 0.58% 19 Income from investment 860.27 431.45 20 Earnings per share (Taka) 28.91 20.20 21 Net income per share (Taka) 28.91 20.20 22 Price earning ratio (times) 25.09 19.31 On 5th July 2008, The City Bank Limited changed its brand name into, simply, City Bank. Bank's new logo along with a brand philosophy line or pay-off line were unveiled that day at a ceremony held at Radisson Water Garden Hotel, Dhaka, Hon'ble Advisor to the Ministry of Finance & Planning, Dr A B Mirza Azizul Islam did this honor to the bank by launching it. We give here a simple note on the philosophy that went behind the creation of this logo: It's a simple logo. Its beauty is in its simplicity of arrangement which is also bold. Since it is simple, it connects with people easily. The red and silver shape may mean a chess board. Chessboard stands for wisdom & vision. Since we are 25 years old, we are expert, wise & experienced. Chess is the game of the smart people who knows all the moves. Our game is to deal with your money matters and - as wise & experienced bankers, we are experts in that. The red and silver shape may also mean something dynamic. It may mean the checkered flag of Formula One Racing. Then it signifies speed and agility & fast pace. The red and silver shape may also mean a kite. It's a beautiful colorful kite, nose up, going to reach for the sky. In that case, it means the bank is soaring high into the skies of many possibilities in order to make customers' financial dreams come true The red and silver shape may also mean it's a flying chessboard. It's a chess-board that has taken wings and is flying. In that case it indicates to what extent this bank can go to serve customers better The logo has a dynamic shape. Such dynamism stands for modernity, the 21st century. That signifies, this is going to be a techno-savvy bank, a state-of-the-art tech-powered modern bank The color 'red' stands for emotion, passion, strength, vitality, action, confidence & courage.

5 The color silver symbolizes riches, just as gold does. Silver is glamorous & distinguished. Silver is the traditional 25th anniversary color or Silver Jubilee color. Another thing is: "Pieces of silver" means money or coin. And our pay-off line is "Making Sense of Money". Now the pay-off line "Making Sense of Money". No money, no bank. We all know how important money can be for any of us. Money is a need all by itself. It is the most precious thing. Money is the port key to any destination. It is everything between a person and his / her dreams & hopes. So, the money which is almost synonymous to life must make sense. And for your money to make sense, it must be handled by an expert. That is where we come in. We say, we make sense of your money. Because at City we are wise men of banking. With 25 years of experience, we know how to make your money more meaningful for you, how to lend you money in times of your needs or how to grow your money safely for you.

Retail Banking

One of the most remarkable success stories of last 50 years banking industry globally has been the conceptualization and innovative execution of banking with individual customers, their friends & families. The industry has termed it as Retail Banking or Personal Banking or Consumer Banking; and it has now - at a very rapid pace become the major revenue line for most of the top banks in the world. City Bank, too, recently has started its journey in Retail Banking. City Retail - add a little city to your life is the new brand-mantra, the pay-off line for City Retail. Our aim is clear. We want City Bank to become the most preferred bank to all individual clientele of the country, at least of the cities and towns where we operate. We want to provide our customers the best-in-class services, innovative products and financial solutions from smart outlets - all with a big smile that conveys and generates happiness all the way!

Deposit

City Bank offers a wide variety of deposit products to meet your financial needs. From current and savings accounts to Fixed Deposits and Pension Schemes each account is designed to give you the best value for your money. Please take a closer look at all the deposit products of City Bank has to offer and then visit any of our branches close to your location.

Current Account

Our current account meets the needs of individual and commercial customers through our schedule benefit. Minimum balance: Taka 5,000/Interest Rate: Nil Customer Benefit: Cheque-book facility Opportunity to apply for - safe deposit locker facility Collect foreign remittance in both T.C. & Taka draft. Transfer of fund from one branch to another by - Demand Draft - Mail Transfer - Telegraphic Transfer Transfer of fund on Standing Instruction Arrangement Collection of cheques through Clearing House. Online banking service.

Saving Account

It is a sound savings for retail customer. We give the major facilities and services to our customer through 77 branches allover in Bangladesh with our skilled manpower. Minimum balance: Taka 500/Interest Rate: 6.50

7 Customer Benefit: Cheque-book facility Opportunity to apply for - safe deposit locker facility Utility payment service Collect foreign remittance in both T.C. & Taka draft. Transfer of fund from one branch to another by - Demand Draft - Mail Transfer - Telegraphic Transfer Transfer of fund on Standing Instruction Arrangement Collection of cheques through Clearing House. Online banking service...

City Onayash

City Onayash earn easy on your savings account, earn profit every month! City Onayash is a unique kind of savings account which calculates interest on your daily balance and pays interest to you every month. It is a major departure from the conventional savings account available in the market. All such accounts calculate interest on the average or lowest balance of the month, while City Onayash does on daily product basis. Not only that, while those conventional savings accounts pays interest only twice a year - in December and June - City Onayash pays it to you every month. Happiness at each month end! Eligibility: Age: At least 18 years Nationality: Bangladeshi Availability: 7

All 83 of City Bank branches spread across the country. What you need to do: Just fill up the City Onayash account opening form and hand it over to our branch staff. Thats it! Enjoy saving in a unique way!

Special Feature: Withdraw and deposit cash as you wish without at all having your monthly interest earning eligibility. No hidden or undisclosed fees or charges or profit-cutting Interest forfeiture rules of a common conventional savings account do not apply here. So, stay tension-free-100% Every months interest earning goes into your account automatically. What better way to take care of you familys recurring monthly expenses? Interest Rate: 5.50

City Shomridhdhi

City Shomridhdhi - A unique offer from City Bank City Shomridhdhi is an exceptional DPS product that is distincity more attractive than the prevalent DPS products in the market. You receive a hefty sum at the end of the term against your monthly deposit of small installments. It's a perfect way to secure your financial future! Eligibility Age: At least 18 Years Nationatity: Bangladeshi Features

No initial deposit required Monthly installment deposit ranges from Tk. 500 to Tk. 20,000 Flexible tenor of 3, 5, 7 and 10 years On premature encashment, you get the maturity value of nearest term - not the routine savings rate.

Profitability Matrix: Term Interest Rate 3 (Three) Years 5 (Five) Years 7 (Seven) Years 10 (Ten) Years

10.00 10.25 10.50 11.00

City Projonmo

City Projonmo financial safety for your future generations backed by complete immense protection! City Projonmo is a unique monthly deposit scheme that you open for your kids to safeguard their future against all uncertainties and risks. As a guardian of the child you can open this account which builds great & unmatchable savings for you over the years. By the time your child is past his or her school age, there is this sufficient cash in your hand to take care of his / her higher education, marriage or other such large expenses. However, the most interesting part of this scheme is the full insurance protection that you automatically enjoy. This simply means, in case of death or total physical collapse of the parent or guardian, the bank will pay the full value of the scheme for the full term no matter in reality how many months or years have been actually completed by you. Eligibility: Age: At least 18 years Nationality: Bangladeshi

10 You will have to have a savings or current account in your name in order to operate your City Projonmo account. Availability: All 83 branches of City Bank spread across the country. What you need to do: Just fill up the City Projonmo account opening form. Submit it to the branch. And thats it! Enjoy earning for your junior ones! Profitability Matrix: Term Interest Rate 5 (Five) Years 9.25 10 (Ten) Years 9.50 15 (Fifteen) Years 9.00 20 (Twenty) Years 9.00

Fixed deposit

If you believe in long-term investments and wish to earn higher interests on your savings, NOW is the time to invest your money in our Fixed Deposit. Fixed Deposit Rate Term of Deposit 1 (one) month 3 (Three) months 6 (Six) months 01(One) year Below Tk. 1.00 crore Tk. 1 crore & above 02(Two) years Interest Rate 09.00 11.50 11.50 12.00 12.50 11.50

Auto Loan for salaried person, business person & self employed individuals Loan up to Tk. 20 Lacs 90% - 100% loan of car value 10

11

Flexible & low interest rate Owning a car is no longer a luxury. Car for your family is now a matter of fulfilling a necessity. Appreciating that basic need, City Bank introduces City Drive, a tailor-made auto loan scheme for individuals. Features Loan amount ranging from Tk. 300,000 to Tk. 20, 00,000 Car financing up to 90% of reconditioned or new vehicle price Lower interest rate & up to 100% financing for loan against cash security Loan tenor 12 to 60 months No hidden charges Competitive interest rate Loan processing fee 1% of loan amount Eligibility Age: 22 to 60 years Experience: Salaried executive total 1 year including 6 months with current employer Experience: Business person/propofessional 1 year Monthly income: Minimum Tk. 30,000

City solution

Dream Vacation? Son's admission to a foreign university? Medical treatment? Daughter's wedding? House renovation? Whatever the occasion or requirement may be, City Solution - any personal loan from City Bank - is there to solve all your problems and to fulfill all your dreams. You can access this facility from our selected branches across the country. Features

11

12 Loan amount ranging from Tk. 50,000 to Tk. 1000,000 Loan tenor 12 to 60 months No guarantor required for the loan amount up to Tk. 3 lac No hidden charges Competitive interest rate Processing fee 1% Eligibility Age: 22 to 60 years Experience: Salaried executive total 1 year including 6 months with current employer Experience: Business person 2 years Experience: Professional 1 year Minimum monthly income: Salaried executive Tk. 15,000 self employed Tk. 25,000 and business person Tk. 30,000

Loan take over plan

An exclusive offer for other bank's credit worthy customers who can now transfer their personal loan outstanding to City Solution with a preferential interest rate and waiver on processing fee. Eligibility Minimum 6 loan EMI repayment with existing bank A minimum take over loan amount is Tk. 1,00,000 and maximum Tk 9,50,000 Benifits No processing fee No extra cost for loan takeover

12

13 No processing fee for additional loan 1% reduced from City Solution interest rate

Credit card

City Bank is the first bank to issue Dual Currency Credit Card in Bangladesh. This card enables you simultaneous usage of your card both in home and in abroad. You do not need to carry two different cards for the same purpose. Features: Variable Interest Rate EMI Plan Balance Transfer Round the clock cash withdrawal facility at any Visa branded ATM throughout the world Round the clock purchasing power for goods and services at any Visa branded POS outlet 24% interest on Cash Advance No cash Advance fee at CITY ATMs Lowest Annual/Renewal Fee International Roaming facility Internet Transaction* Convenient Repayment option E-statement Limited Lost Card Liability Secured with your Photo Photo Card 24 hours customer service help desk

13

14

Eligibility: Bangladeshi Nationals Age range for primary card holder is 18 years to 60 years Age range for supplementary card holder is 18 year to 60 years Age bar can be relaxed for secured cards Minimum Gross Monthly Income(GMI) for silver card Tk 12,000 Minimum Gross Monthly Income(GMI) for gold card Tk 30,000 Minimum 6 month permanent employment for salaried executives (this indicates total length of service as a total of all companies he or she has worked for), and 1 year of experience in business or practice for self employed professionals and business person City Credit Cards: VISA Local Classic VISA Classic Dual VISA Gold Local VISA Gold Dual Variable Interest Rate Balance Transfer City Card EMI Plan

Debit card

CITY Visa Electron Debit Card - By your side, round the clock Now comes the Visa Debit Card from City Bank. Your life, therefore, becomes hasslefree and safe; and it is Visa Electron branded, which makes you the proud owner of a meaningful plastic. Features: 14

15

Cash withdrawal from 500+ Visa ATMs 24/7/365 all over the country Shop and dine at hundreds of merchant Visa outlets all over the country Balance enquiry Fund transfer from your account to credit card 24/7/365 PIN Change Mini statement Cash withdrawal @ Taka 12 per transaction at 250+ DBBL ATMs Eligibility: If you are an individual and have a savings, current or STD account in CBL, you are eligible avail this card. Just drop in any nearby CBL branch, collect an application form and submit duly filled up form. Within shortest time you will get the card delivered at your mailing address or at your designated branch.

Foreign remittance

By your side - all the way The city Bank's Foreign Remittance unit meets growing customer needs for fast, sucure & easy money transfers to an extensive range of destinations. Being a committed bank to its customers, we go all the lengths to remit your hard earned money safely to your loved ones. With us, apart from a range of high-class modem remittance solutions, you will get peace of mind which we believe counts to most. Facility City Bank Limited has 83 online branches across the country; besides, the Bank has a strong remittance network with other major banks of the country. Therefore, wherever your account is, we are able to send your money instantly. If you are a City Bank account holder, then please visit any of our branches. Our Foreign remittance service personnel will be there to help you out. If you are not an account holder, then please open an account of your choice with us to receive your remittance at earliest convenience.

15

16 CBL understands the value of your precious time. That's why have made the payment procedure simple & easy. You have the privilege of enchasing the remitted money instantly from your branch counter without going through any hassle. That is to say, if you are an account holder of City Bank, we can instantly credit the money to your account or pay cash to the receiver. So, place your trust with City Foreign Remittance Service. Send your money to your loved ones & experience peace of mind.

16

17

17

18

Corporate banking

City Bank is a major player in Bangladesh wholesale banking industry to offer the full scope of innovative, customized solutions and services. We offer service at the highest level. Our focus is not on short-term profit, but on building long-term relationships and standing by our clients whenever they need us. We have a unique business focus on enabling project financing, trade, investment and supply chain financing for clients. We aim to be a one-stop gateway for corporate and financial institutions looking to extend their business. And we are committed to using our country wide network to facilitate our clients growing trade and investment flows and supply chain financing needs across our business footprint. We focus exclusively on corporate and institutional clients domiciled or conducting business in our footprint, offering clients access to our extensive branch network and award-winning suite of state of the art services. City Bank fully understands the importance of time, convenience and efficiency to the success of your business. We make easy the complex financial world for you and help you maximize every opportunity.

Capital finance

Overdraft: A convenient and flexible form of short-term financing for routine operating expenses and overheads of your company. Guarantees and Bonds: City Bank issues a full range of Performance Guarantees, Advance Payment Guarantees, and Financial Guarantees and Bid bonds for supporting the underlying business of our customers.

Trade Finance

City Banks trade finance is tailored to meet the individual needs of your business. We can help even if your company has limited unstructured credit lines, due to reasons such as limited financial resources or sudden spike requirements. Thats because our risk evaluation focuses more on your performance track record, existing performance and collateral valuation.

18

19 Imports: Letter of Credit: When buying goods from overseas suppliers, you will wish to receive the goods as ordered in the right quantity, on time and at the designated place. You will also wish to make payments only after receipt of the required documents including the title of goods. We can solve your needs by issuing a documentary credit on your behalf. A documentary credit is our Bank's guarantee of payment for a shipment of goods against specific documents as stipulated on it. By using a Letter of Credit, we will only make payment after receipt of titles and other documents that should fully comply with the terms of the credit. You can enjoy a safer and cheaper alternative to making advance payment or deposits. Back-To-Back Letter of Credit: If you are an intermediary and your supplier wants to sell on documentary credit term only, you may apply for the issuance of a Back-to-Back Letter of Credit from us against the export Letter of Credit. A Back-to-Back Letter of Credit is issued against the export credit (the master credit), but the terms and conditions may not the same as the export credit. You must submit your own draft and invoice, together with the other shipping documents presented by your supplier to secure payment under the export credit. After processing, you will have the export proceeds to pay your supplier and the balance credited to your account. Deferred Letter of Credit: A DC which allows the nomination of a bank, or the issuing bank to effect payment against stipulated documents at a maturity date as specified or determinable from the wording of the credit. With this you are able to receive the goods now and pay later. Import bills for collection: By informing your supplier to send their shipping documents to City Bank, you will enjoy prompt advice upon our receipt of documents and efficient payment according to your instructions. Shipping Guarantee: To operate your business efficiently, it is vital your goods be cleared expeditiously. By issuing a shipping guarantee in the shippers favour, City Bank facilitates prompt clearance of goods until bills or lading is received.

19

20 Import Financing: City Bank will be able to provide financing solutions to pay for the suppliers documents under letter of credit or import collections. Open account invoice financing is also available. Performance bonds and other guarantees: City Bank offers tailored solutions to meet all your performance bond and guarantee needs. Exports: If you are in the export business, we can help you with Export L/C advising, L/C Safekeeping, L/C Confirmation, L/C Checking and Negotiation. For financing solutions, tap on to Pre-shipment Export Finance, Export Bills for Collections, Invoice Financing. Outsource your administrative functions to City Banks document preparation service. Export letter of credit advising: Benefit from prompt advising of export letter of credit from a wide international network through City Bank. Export letter of credit safekeeping: Rather than be inconvenienced by having to come to the bank to collect your export letter of credit, City Bank will safe keep your original and send you a working copy to facilitate the preparation of documents. Export letter of credit confirmation: Exporters may deal not only with unknown foreign buyers, but also with their banks which are less well known institutions and whose letter of credit (LC) may not be sufficient comfort. By requesting City Bank to confirm your export LCs, you obtain our guarantee of payment for document presented in compliance with the credit. Pre-shipment export financing: We provide pre-shipment finance against irrevocable letters of credit from or purchase orders in a number of currencies to allow you to trade with confidence. If you need to fulfill a sales contract but need funds to purchase raw materials or process goods for export, City Bank offers you pre-shipment export financing in a variety of currencies.

20

21 Letter of credit checking and negotiation: City Banks thorough checking standards will reduce the chances that your documents will be rejected. Strict service standards are applied to ensure that your documents are negotiated and dispatched quickly. Export bills for collection: Simplify dispatch tracking of payment and reconciliation of your export collections when you choose City Banks documents against acceptance, documents against payment or clean collections. Discounting of export collections is also available. Export invoice financing: To tide over any cash flow problems arising from credit terms to the buyers, the exporter may obtain invoice financing pending buyers payment. Document preparation: Benefit from lower costs, faster processing and fewer errors - outsource to City Bank the paperwork and administrative functions related to your export activities based on your letter of credit or purchase order.

Short and Mid-term Finance

Short Term Financing: As the responsive player in market, you may anytime need fund to utilize for a very short time due to either emergency or short term projects. In such case, City Bank is there to facilitate you. This can be a Short Term Loan or a Short Term Revolving Loan. You can get it either for your inland business or crossborder payment in foreign trade. Mid Term Financing: City Bank can also equip you the required fund for a longer period. If you worry about fund requirement for a bit longer, City Bank Term Loan will make you feel confident that, you got a friend for this.

21

22

Project finance

City Bank has been very active in the Our project financing solutions: mitigate sponsor exposure to project risk enhance use of leverage to increase project returns by lowering the weighted average cost of capital provide access to significantly longer tenor debt financings create optimum financing structures (source of debt, currency, derivatives) that take into account your companys particular capital needs as well as industry specific issues. Lease and Long Term Loans: We can customize a Term Loan or Lease to finance the fixed assets that your business needs (such as land, new premises, equipment and machinery). It may be a greenfield project or an expansion of an existing plant, that may be financed at competitive floating rate of interest.

Structured finance

A leading provider of cost-efficient, lease-based and asset-based financing solutions to businesses in Bangladesh, we can create and tailor the right structured solutions for your business needs in order to enhance shareholders wealth and your market competitiveness. These solutions include: Structured financing solutions: Principal to principal structured capital market transactions optimizes investment returns and reduces effective funding costs. Syndications: This normally involves getting a group of banks together (forming a syndicate) to provide the loan amount required by the customer under a set of common terms and conditions laid down in a loan agreement.

22

23 Choose City Bank and you gain access to full loan origination, distribution and trading capabilities, together with an unrivalled ability to match lenders and borrowers. Our leadership position and world class distribution capability result from the teams ability to read the market, and to provide superb sell down coverage. Local know-how: Our intimate knowledge of the diverse industries as well as understanding and working with regulatory bodies, means we can provide you with a solution designed solely to meet your needs. We also partner our clients to arrange syndicated loan facilities for project finance, aircraft finance, structured trade and acquisition financing including leveraged buy-outs. We have been successful in loan capital raisings for financial institutions, real estate development, hotels, telecoms, institutional banking and finance, public utility, oil and petroleum, light manufacturing and food sectors. Your partner for success: We have a proven track record in devising innovative capital-raising structures that exceed our clients' expectations. Our tailored solution for your business could include: Working capital and corporate funding Commodity and trade finance Islamic structures Project finance Structured, complex and tax-efficient capital raisings

Cash Management

In today's competitive financial environment, effective cash management has become a critical success factor. This is the right time to have integrated cash management solution. Our cash management services include local and cross border payments, collections, information management, account services, liquidity management and investment services for both corporate and institutional clients.

23

24 Payment Services We can help you save time and money by reducing processing costs while providing a value-added service to your suppliers. City Banks payment solutions can help to reduce your overall processing costs for domestic and global payments saving you time and money while providing a valueadded service to your suppliers. Our comprehensive payment services will be tailored to enhance your accounts payable process. This will eliminate many manual tasks involved in making payments, allowing you and your staff to spend more time focusing on your core business needs. We understand that most of your effort in the payment cycle is directed towards initiation; difficulties in the subsequent reconciliation process can jeopardize the whole process. With City Bank Channels you can now track the exact status of each payment through timely reports that can be uploaded seamlessly into your companys system. Collection Services: We have a comprehensive branch network and the local knowledge to help you with lower costs and greater efficiency. The City Bank Collections Solution leverages the Bank's extensive regional knowledge and widespread branch network across our key markets to specially tailor solutions for your regional and local collection needs. This Collections Solution, delivered through a standardized international platform, has the flexibility to cater to your local needs, thus enabling you to meet your objectives of reducing costs and increasing efficiency and profitability through better receivables and risk management. The key components of our solution include the following: Liquidity Management Let us help you to get the most out of your companys cash resources with physical sweeping, notional pooling, interest reallocation and investment.

Investment banking

We are a market leader across our footprint in innovative, landmark deals, multijurisdiction solutions and sophisticated product structuring for corporate and institutional clients. We hold leading positions in fixed income local currencies and loan syndications. Our indepth understanding of the local regulatory framework in the domestic debt and loan markets, product expertise and wide geographic reach, help you achieve your financing and investment objectives. 24

25

Debt Capital Markets Our proven knowledge, product capabilities and global reach make us well-suited to matching investors needs with the funding requirements of international and domestic issuers. Asset Backed Securities We structure, arrange and distribute asset-backed and future flow transactions for clients and our track record of innovative deals puts us at the forefront of developing securitization markets in our footprint. Credit Derivatives We offer investment tools and a range of local currencies to provide structured asset solutions to meet specific investment needs, achieve target yields on your portfolio and manage risk exposure. Convertible Bonds / Equity Derivatives Our convertible bonds and equity derivatives teams open avenues of financing and investing linked to the equity asset class - all underpinned by local market knowledge, deep client relationships and innovation

SME banking

SME Banking of City Bank is assuming a new and modern dimension. It is entering in to a wider horizon. The philosophy of extending banking services to SME's of the country is to meaningfully push every one of them up to the next level of respective business operations. The upward push would be meaningful as they would be business wise competitive for a sustainable future. It is therefore would be turning in to an abode of SME's to grow to the next level. Hence, the bank has named it City Business - for taking SME's to the next level. For the first time in the history of CityBank, SME Banking business processes are going to be driven thru a centralized platform model. This is a fundamental move away from a 25 years legacy system of decentralized geography based branch banking model. We all know this transformation process and momentum is already in place. This would be completed by 2008. For more details please contact with our branch nearest to you.

25

26

Treasure

City Bank Treasury & Market Risk Division City Bank Ltd. has a dedicated Treasury team who is capable of providing all treasury Solutions. Through our foreign correspondent business partners CBL is providing a wide range of Treasury products. In CBL Treasury, there are four teams who are specialized in their own area to ensure the best possible solution to our customer requirement. CBL has following teams in the Treasury: 01. 02. 03. 04. Foreign Exchange (Local & G7) Money Market Corporate Sales ALM & Market Research

Each team is dedicated to provide best solutions to their respective areas. Through our four dedicated team we provide the following services: 01. Client Solution & Risk Management Hedging solutions against adverse market movements Advice on efficient hedging policy Structured products to match customers' needs Corporate Advisory Services 02. Product Range Foreign Exchange i. ii. Local Currency spot & Forward* G7 Spot & Forward

Money Market i. ii. Call Money Term Deposits 26

27 iii. iv. Securities ( T-Bills, T-Bonds) Repo & Reverse Repo

Foreign Exchange & FC Interest Rate SWAP Foreign Currency & Commodity Derivatives 03. Market Information & News Update Economic Research & Technical Analysis Market Report ( Daily, Quarterly & Half Yearly)

Overnight deposit

Funds which are placed / borrowed for overnight are known as overnight deposit. Rates of the overnight deposit are fixed on a daily basis and the rate keeps on changing on the basis of demand and supply of any day. It is used to meet up the daily fund management of all financial institutes. Overnight deposit is also known in the market as call deposit. CBL is an active participant of the inter-bank call market. CBL injects market liquidity and plays an important role in the inter - bank call money market. Benefits Due to the nature of product it has minimum credit risk as the tenor is overnight. Very effective tool to manage daily liquidity management. Call money rates indicates the market liquidity. Traded in bulk volume.

Term Deposit

A deposit held at a financial institution that has a fixed term. These are generally shortterm with maturities ranging anywhere from a month to a year. When a term deposit is account are opened, the lender/borrower understands that the money can only be withdrawn after the term has ended or by giving a predetermined number of days notice.

27

28 Inter-bank term deposits are considered as relatively safe investment and these are especially very appealing to conservative, low-risk investors who are expecting a adverse interest rate movement. CBL has a strong presence in the inter-bank term deposits and Mudaraba Term deposits market. Due to our presence in both conventional banking and Shraiah banking CBL is one of the liquidity provider in the inter-bank Term deposit market. Benefits Due to its nature of fixed term, it minimizes interest rate risk during the tenor of the deposit. Helps to manage Balance Sheet Gap. Reduce too much dependency on call market thus helps to manage regulatory liquidity requirement. Depending on the forward yield curve can be used to maximize returns on investment.

Foreign Exchange

Foreign Exchange market is known as the market in which currencies are traded. The forex market is the largest, most liquid market in the world with an average traded value that exceeds $1.9 trillion per day and includes all of the currencies in the world. The volume of this market is increasing continuously. There is no central marketplace for currency exchange; trade is conducted over the counter (OTC). The international forex market is open 24 hours a day, five days a week, and these currencies are traded worldwide among the major financial centers of London, New York, Tokyo, Zrich, Frankfurt, Hong Kong, Singapore, Paris and Sydney The forex is the largest market in the world in terms of the total cash value traded, and any person, firm or country may participate in this market.

Local currency spot & forward

Our currency is not fully convertible thus it is not traded across the world. Our currency BDT is traded in our local market and this market is regulated as per our foreign exchange regulation and central bank core risk management guidelines.

28

29 The City Bank Ltd. is very active in the inter-bank USDBDT market and one of the leaders among the local private banks. CBL treasury provides market information and competitive price in USDBDT. It has wide source of foreign currency through its Exporter, Exchange Houses and different local and multinational corporate customers. Its dedicated local currency desk is designed to provide tailor made solution for USDBDT trade. Spot & Forward both are used to manage foreign exchange risk. Forwards, especially in our economy where our local currency BDT devalues periodically against USD, is very popular among the importer to hedge BDT devaluation risk. Major Currency Spot & Forward CBL also well equipped to price world major currency spot & forward price. CBL treasury is connected to the international market quotes very competitive prices on world major currency spot & forwards.

Operations of the Bank

Deposits

The bank mobilized total deposits of BDT 39,348.00 million as of December 31, 2007 as compared to BDT 33,332.65 million in 2006. Competitive interest rates, attractive deposit products, deposit mobilization efforts of the Bank and confidence reposed by the customers in the Bank contributed to the notable growth in deposits. The Bank evolved a number of attractive deposits schemes to cater to the requirement of small and medium savers. This improved not only the quantum of deposits; it also brought about qualitative changes in the deposits structure.

Advances

The Bank has formulated its policy to give priority to small and medium businessmen while financial large-scale enterprises through consortium of Banks. Total loans and advances of the Bank stood at BDT 31,877.86 million as December 31, 2007 as compared to BDT 26,842.14 million in 2006. Trade and commerce, garments industry, large and medium scale industries and construction are major sector in which the Bank extended credit.

29

30

Deposits

50000 40000 30000 20000 10000 0 2000 2001 2002 2003 2004 2005 2006 2007 2008

BDT in million

Depreciation

Depreciation is charged on freehold properties at the following rates on reducing balance method from the date of acquisition, other than the Vehicles on which straight-line method is applied. Name of Assets Land Furniture and Fixtures Office Equipment Vehicles Books Rate Nil 10% p.a. 20% p.a. 20% p.a. 20% p.a.

Loans and Advances

Required provisions have been kept against loans and advances as per instructions contained in Bangladesh Bank BRPD circular no. 05 dated June 05, 2006 and BRPD Circular No. 10 dated September 18, 2007 at the following rates:

30

31

Particulars A. For Unclassified Loans and Advances i) All Unclassified loans (other than loans under Small Enterprise and Consumer Financing and Special Mention Account) ii) Unclassified loans against Small Enterprise financial and Consumer Financial for Housing and professionals (to set up business) iii) Unclassified loans against other Consumer Financing iv) Outstanding amount of loans kept in the special Mention Account after netting off the amount of interest Suspense. B. For Classified Loans and Advances i) Specific Provision on substandard loans and advances ii) Specific Provision on doubtful loans and advances iii) Specific Provision on bad/loss loans and advances C. For Off- Balance Sheet Exposures

Rates

1% 2% 5% 5%

20% 50% 100% 0.50%

Deposit

Total Deposit of the Bank as on December 31, 2007 stood Tk. 40,540 million against Tk. 40.881 million of the previous year registering a marginal negative growth of Tk.341 million (0.83%). This reduction in deposits was the result of a strategic plan by reducing high interest bearing deposits, to not only reduce interest expense but also to match reduced lending in order to improve NPL of the bank. Deposit position of last years is depicted in the following bar diagram:

Deposit

50 40 30 20 10 0 2003 2004 2005 2006 2007

Cost of deposit however, increased during the year under report, due to high interest rate allowed against long term fixed deposit in earlier years. Deposit mix of the bank as on December 31, 2007 along with 2006 comparison is depicted in the table below:

31

32

Sl. No.

Type of Deposit Amount

2006 Share (%) 14.23% 17.53% 6.92% 44.82% 16.50% 100.00%

2007 Amount 7,625.59 7,761.12 3,229.63 16,308.43 5,614.86 40,539.63 Share (%) 18.81% 19.14% 7.97% 40.23% 13.85% 100.00%

1. 2. 3. 4. 5.

Current & Others Savings Short Term Fixed Deposits Scheme Total Deposit

5,815.47 7,167.83 2,829.34 18,324.06 6,744.71 40,881.41

Loans and Advances

The loans and advances portfolio of the bank at the end of the year 2007 stood at Tk. 26,788 million with loans diversified in both conventional credit and finance based on Islami Shariah. Total loan volume of the bank during the reviewed year decreased by Tk. 4,001 million, 13% reduction from previous year. The outstanding amount of loans & advances at the same period of previous year was Tk. 30,789 million. A major consolidation effort was undertaken to exit, reschedule, recover deteriorating credits in order to improve NPL, hence this reduction in loans & advances was part of a strategic plan. Last five years loans & advances volume is presented below:

Loans and Advances

40,000 30,000 20,000 10,000 0 2003 2004 2005 2006 2007 Tk. Million

32

33 Loan portfolio allocation, sector wise, for the years 2006 & 2007 is depicted in the table below: Sl. No. Sector Amount 1. 2. 3. 4. 5. 6. 7. Agriculture Large & Medium Industries Small & Cottage Industries Commerce & Trade Insurance, Real state & Service Transport & Communication Other Total Deposit 147.00 4,863.10 25.58 7,947.17 5,732.69 238.43 11,835.04 30,789.01 2006 Share (%) 0.48% 15.79% 0.08% 25.81% 18.62% 0.77% 38.45% 100.00% 2007 Amount 5.22 5,541.25 27.90 10,998.50 2,158.90 284.61 7,772.08 26,788.46 Share (%) 0.02% 20.69% 0.10% 41.06% 8.06% 1.06% 29.01% 100.00%

Net Performing Loans

It is a mammoth task to keep the non performing loans within a sustained level; through a planned strategy of improving real NPLs, your Bank was however able to reduce its nonperforming loans to Tk. 1,671.83 million compared to Tk. 2,209.73 million in 2006. The NPL ratio was recorded at 6.24% as of end of 2007 compared to 7.18% as of the end of 2006. It should be noted that 2007 NPL ratio improved over that of 2006, deposit reduction in total loans and advances. The following table shows category wise break0down of non performing loans in 2006 and 2007: Sl. No. 1. 2. 3. Classification Type Sub Standard Doubtful Bad/Loss Total Classified Loan 2006 100.45 175.95 1933.33 2,209.73 Million Taka 2007 348.08 129.86 1,193.89 1,671.83 33

34

Recovery of Classified Loan

During the year under review, your bank recovered, including recovery from written off loans, an amount of Tk. 547.77 million compared to Tk. 576.02 million during last year. As per rescheduling policy, your bank rescheduled Tk 889.18 million in 2007. Total recovery amount with rescheduling for the year 2007 stood at Tk. 1,436.96 million compared to Tk. 920.66 million of the previous year. In line with guidelines of write off policy, an amount of Tk. 687.52 million was also written off during the year under review. The following diagrams depict the banks performance vis--vis improvements in NPLs as well as recoveries.

Non performing 2,500 2,000 1,500 1,000 500 0 2003 2004 2005 2006 2007 2,094 1,800 1,332 2,210 1,672

Recovery

1,437 1500 921 1000 500 0 2003 2004 2005 2006 2007 602 494 303

34

35

Value Added Statement

For the year ended December 31, 2007

Particulars Income from Banking Services Less: Cost of Services and Supplies Value added by the Banking Services Non-Banking Income Loan written off and Provision Total Value Addition Distribution of value Addition To Employees as Salaries & Allowances To Shareholders To Government as Income Tax Depreciation

2007 Taka 5,806,509,476 (3,590,096,895) 2,216,412,581 1,045,899 (447,414,118) 1,770,044,362

2006 Taka 5,215,179,491 (2,891,070,310) 2,324,109,181 2,245,951 (841,674,976) 1,484,680,156

882,946,990 343,463,026 465,000,000 78,616,346 1,770,044,362

49.88% 469,377,203 19.41% 546,870,344 26.27% 413,000,000 4.44% 55,432,609

31.62% 36.83% 27.82% 3.73%

100.00% 1,484,680,156 100.00%

35

36

Economic Value Added Statement

For the year ended December 31, 2007

EVA is a measure of profitability which takes into consideration the cost of total invested equity. Shareholders/ equity providers are always conscious about their return on capital invested. As a commercial banking company, we are deeply concerned for delivery value to all of our shareholders/ equity providers.

Particulars

Share holders Equity Add: Provision for Loans and Advances

2007 Taka 2,874,366,986 963,612,192 3,837,979,178

2006 Taka 2,530,903,960 1,277,292,518 3,808,196,478

Earnings

Profit after Tax Add: Provision for Loans and Others 343,463,026 447,414,118 790,877,144 Average cost of equity (based on weighted average rate Patra issued by the Bangladesh Government plus risk factor) Cost of Equity Economic Value Added 240,021,193 841,674,976 1,081,696,889

13.75% 527,722,137 263,155,007

12.00% 456,983,577 624,713,312

36

37

Balance Sheet

As at 31 December 2007

Property and Asset

Cash In hand (including foreign currencies) Balance with Bangladesh Bank and Its agent bank(s) (including foreign currencies)

2007 Taka 771,568,562 2,705,998,489 3,477,567,051

2006 Taka 475,924,568 2,350,473,440 2,826,398,008

Balance with other banks and financial institutions

In Bangladesh Outside Bangladesh 4,672,954,417 109,529,003 4,782,474,420 1,438,813,121 135,657,686 1,574,470,807 1,435,000,000 5,873,020,642 532,064,208 6,405,084,850 27,040,242,081 3,748,779,901 30,789,021,982 1,282,090,427 3,133,685,810 47,445,751,884

Money at call and short notice

1,830,000,000 7,094,714,100 455,892,392 7,550,606,492

Investments

Government Others

Loans and advances

Loans, Cash credit, overdraft etc. Bills purchased and discounted 25,039,792,708 1,748,673,430 26,788,466,138

Fixed assets including premises, furniture and fixtures

Other assets Non-banking assets Total assets

1,390,732,198 2,935,556,719 48,755,403,018

37

38

LIABILITIES AND CAPITALS

Liabilities Borrowing from other banks, financial Institution and agents Deposit and other accounts Current deposit and other accounts Bills payable Saving bank deposits Fixed deposits Bearer certificate of deposit 850,000,000 6,735,767,915 889,821,320 7,767,124,764 25,152,920,036 40,539,634,035 4,491,401,997 45,881,036,032 5,221,288,738 594,785,472 7,167,831,748 27,898,108,479 40,881,413,837 4,033,434,087 44,974,847,924

Other liabilities Total liabilities Capital / Shareholders equity

Paid up capital Statutory reserve Other reserve Surplus in profit and loss account / Retained earnings Proposed dividend (stock) Total Shareholders equity

1,188,000,000 896,948,006 573,104,088 38,114,892 178,200,000 2,874,366,986

1,080,000,000 735,255,401 573,104,088 34,544,471 108,000,000 2,530,903,960 47,445,751,884

Total liabilities and Shareholders equity 48,755,403,018

OFF-BALANCE SHEET ITEMS

Contingent liabilities Acceptances and endorsements Letters of guarantee Irrevocable letters of credit Bills for collection Others contingent liabilities Total 847,890,070 1,569,361,688 2,622,378,064 3,211,005,932 8,277,635,754 1,090,738,041 1,830,293,797 4,518,970,170 5,461,568,637 12,901,570,645

38

39

Profit and Loss Account

For the year ended 31December 2007

2007 Taka Interest income / profit on investments Interest / profit paid on deposits and borrowings etc Net interest / net profit on investments Investment income Commission, exchange and brokerage Other operating income Total operating income (A) Salaries and allowances Rent, taxes, insurance, electricity etc. Legal expenses Postage, stamp, telecommunication etc. Stationery, printing, advertisements etc. Chief Executives salary and fees Directors fees Auditors fees Depreciation and repair of Banks assets Other expenses Total operating expenses (B) Profit / (loss) before provision (C=A-B) Provision for loans advances / investments Specific provision General provision Total provision for loans and advances / investment Provision for Off-Balance Sheet exposures Provision for gratuity Provision for diminution in value of investments Other provision Total provision (D) (134,999,808) (162,100,192) (297,100,000) (45,000,000) (50,000,000) (10,108,000) (45,206,118) (447,414,118) (758,428,806) (83,246,170) (841,674,976) 4,183,260,712 (3,235,362,655) 947,898,057 860,271,122 532,246,444 231,777,097 2,572,192,720 877,594,990 141,269,481 9,882,321 25,868,331 52,143,307 5,370,000 892,000 792,375 115,733,404 86,832,367 1,316,315,576 1,255,877,144 2006 Taka 3,772,069,319 (2,567,271,785) 1,204,797,534 431,448,405 756,731,706 257,176,012 2,650,153,657 771,990,634 122,374,347 7,874,625 28,625,396 40,616,762 4,235,000 853,000 274,000 93,020,263 85,592,341 1,155,456,768 1,494,696,889

(841,674,976)

39

40 Total profit / (loss) taxes (C-D) Provision for taxation Current tax Previous years tax Deferred tax 808,463,026 (125,000,000) (279,000,000) (50,000,000) (465,000,000) 653,021,913 (413,000,000)

(413,000,000) 240,021,913 33,172,558 273,194,471

Net profit after taxation 343,463,026 Retained earning brought forward from previous year 34,544,471 378,007,497 Appropriations Statutory reserve Proposed dividend (stock) 161,692,605 178,200,000 339,892,605 Retained surplus Earnings per share (EPS) 38,114,892 28.91

130,650,000 108,000,000 238,650,000 34,544,471 20.20

40

41

Cash Flow Statement

For the year ended 31 December 2007 A) 2007 Taka 2006 Taka 3,669,260,800 (2,224,779,585) 13,508,142 360,283,167 18,099,288 (776,225,634) (25,583,203) (735,110,965) 675,116,275 (298,215,322) 676,352,963

Interest receipts in cash 4,060,027,793 Interest payments (3,089,944,490) Dividend receipts 9,152,956 Fees and commission receipts in cash 273,225,031 Recoveries of loans previously written off 18,415,068 Cash payments to employees (882,964,990) Cash payments to suppliers (22,502,530) Income taxes paid (610,287,020) Receipts from other operating activities 1,082,895,263 Payments for other operating activities (332,231,710) Cash generated from operating activities before changes in operating assets and liabilities 505,785,371 Increase / (decrease) in operating assets and liabilities Statutory deposits Purchase of trading securities (Treasury bills) Loans and advances to other banks Loans and advances to customers Other assets Deposits from other bank / borrowing Deposits from customers Other liabilities account of customers Trading liabilities Other liabilities Net cash from operating activities 4,000,555,844 912,363,334 659,173,232 (150,953,034) (598,993,745) 4,822,145,631 5,327,931,002

(7,462,683,432) (1,022,490,397) 260,451,488 9,817,045,160 (103,262,308) 1,489,060511 2,165,413,474

41

42

B) Cash flows from investing activities Debentures Proceeds from sale of securities 76,171,816 Payments for purchases of securities Purchase / sale of property, plant and equipment (187,258,117) Payment against lease obligation Proceeds from sale of property, plant and equipment Net cash used in investing activities C) Cash flows from financial activities Dividend paid Net Cash from financing activities (111,086,301) (85,855,162) (240,137,363) (325,992,525)

D) Net increase / (decrease) in cash and cash equipments (A+B+C) 5,216,844,701 E) Effects of exchange rate changes on cash and cash equipment 259,021,413 F) Cash and cash equivalents at beginning of the year 11,708,889,457 G) Cash and cash equivalents at end of the year 11,708,889,457 (D+E+F) Cash and cash equivalents at end of the year Cash in hand (including foreign currencies) Balance with Bangladesh and its agent bank(s) (including foreign currencies) Balance with other banks and financial institutions Money at call and short notice Government securities 11,708,889,457 17,184,755,571

1,839,420,949 396,448,539 9,473,019,969

771,568,562 2,705,998,489 4,782,474,420 1,830,000,000 7,094,714,100 17,184,755,571

475,924,568 2,350,473,440 1,574,470,807 1,435,000,000 5,873,020,642

42

43

43

44

44

45

Loans and advances/ investments

a) loans and advances of conventional Banking / investments of Islamic Banking branches are stated in the balance sheet on gross basis. b) Interest / profit is calculated on a daily product basis but charged and accounts for on accrul basis. Interest / profit on classified loans and advances/ investments is kept in suspense account as per Bangladesh Bank instructions and such Interest / profit is not accounted for as income until realised from borrowers. Interest / profit is not charged on bad and loss loans / investments as per guidelines of Bangladesh Bank . Records of such interest amount are kept in seperate memorandum accounts. c) Provision for loans and advances/ investments is made on the basis of quarter-end review by the management following instructions contained in Bangladesh Bank BCD Circular no. 34 dated 16 November 1989, BCD Circular no. 20 dated 27 December 1994, BCD Circular no. 12 dated 4 September 1995, BRPD Circular no. 16 dated 6 December 1998, BRPD Circular no. 9 dated 14 May 2001, BRPD Circular no. 02 dated 06 December 2005. The classification rates are given below : General provision on unclassified loans & advances / invesments General provision on unclassified small % medium enterprise financing General provision on unclassified loans / invesments for housing finance and on loans for professions General provision on unclassified consumer financing other than housing finance and loans for professions General provision on special mention account Specific provision on substrandard loans and advances / invesments Specific provision on doubtful loans and advances / invesments Specific provision on bad / loss loans and advances / invesments 1% 2% 3% 5% 5% 20% 50% 100%

45

46

Fixed assets and depreciation

a) All fixed assets are stated at cost less accumulated depreciation as per BAS-16 Property. Plant and Equipment. b) Depreciation is charged for the year at the following rates on straight line method on all fixed assets and no depreciation on land is charged: Category of fixed assets Land Building Furniture and fixtures Office equipment Software Vehicles Rate Nill 2.50% 10% 20% 5% 20%

c) For additions during the year, depreciation is charged days of the year and for disposal depreciation is charged up to the date of disposal. d) Land was revalued in the year 2006. Detail information regarding revalution has been shown in the notes to the accounts.

General

A) These financial statements are presented in Taka, which is the Banks functional currency. Figures appearing in these financial statements have been rounded off to the nearest Taka. B) The expenses, irrespective of capital or revenue nature, accured / due but not paid have been provided for in the books of the Bank. C) Figure of previous year have been rearranged whenever necessary to conform to current years presentation. D) The external auditors of the Bank, M/s. Howladar Yunus & Co. Chartered Accountants worked in excess of 4,876 man hours at the Banks Head Office different branches. During their sudit, they audited above 80% of the Banks risk weighted assets as on the reporting date. E) All previous year figures for comparative purposes are those of The City Bank Limited only.

46

47

Cash

2007 Taka Cash in hand In local currency In foreign currency 713,887,282 57,681,280 771,568,562 Balance with Bangladesh Bank and its agent bank In local Currency 2,366,585,485 In foreign currency (9,801,033) 2,357,057,452 Sonali Bank Ltd. as agent of Bangladesh Bank (Local Currency) Sonali Bank Ltd. other than agent of Bangladesh Bank (Local Currency) 274,078,621 74,862,416 348,941,037 2,705,998,489 2006 Taka 439,131,304 36,793,264 475,924,568

2,515,054,010 18,527,453 2,169,581,463 128,551,531 52,340,446 180,891,977 2,350,473,440

Foreign currency balance with Bangladesh Bank on December 31, 2007 was negative due to an unresponded entry, which was responded on the following data and the balance become positive on that date. Cash Reserve Requirement (CRR) and statutory Liquidity Ratio (SLR) Cash Reserve Requirement and statutory Liquidity Ratio have been calculated and maintained in accordance with section 33 of Bank Companies Act, 1991 and BRPD circular no. 11 and 12, dated August 25, 2005. The minimum Cash Reserve Requirement on the Banks time and demand liabilities at the rate of 5% has been calculated and maintained with Bangladesh Bank in current and 18% Statutory Liquidity Ratio, including CRR, on the same liabilities has also been maintained in the form of treasury bills, bonds and debentures including FC balance with Bangladesh Bank. Both the reserves maintained by the Bank are in excess of the statutory requirements, as shown below:

47

48

2007 Taka Cash Reserve Requirement Required reserve Actual reserve maintained Surplus / (deficit) Statutory Liquidity Ratio Required reserve (including CRR) Actual reserve maintained (including CRR) Surplus / (deficit) Total required reserve Actual reserve held Total Surplus Held for Statutory Liquidity Ratio Cash in hand

Balance with Bangladesh Bank and its agent bank(S)

2006 Taka 1,945,317,000 1,957,657,000 12,340,000 7,008,262,000 8,370,218,335 1,361,956,335 7,008,262,000 8,370,218,335 1,361,956,335 439,073,804 2,086,208,531 5,844,936,000 8,370,218,335

2,171,060,000 2,201,544,235 30,484,235 7,821,976,000 10,696,769,000 2,874,793,000 7, 821,976,000 10,696,769,000 2,874,793,000 478,329,000 2,537,777,000 7,680,663,000 10,696,769,000

Government securities and bonds

Balance with other banks and financial institutions In Bangladesh 4,672,945,417 1,438,813,121 Outside Bangladesh 109,529,003 135,657,686 4,782,474,420 In Bangladesh Current account Janata Bank Ltd. Agrani Bank Ltd. Standard Bank Ltd. United Commercial Bank Ltd. Bangladesh Krishi Bank 202,806 14,239,491 2,549,620 200,000 17,191,917 3,602,806 16,890,867 4,531 2,552,420 23,050,624 1,574470,807

48

49

2007 Taka Short-term deposit accounts Social Investment Bank Ltd. Standard Bank Ltd. Standard Chartered Bank Savings accounts Social Investment Bank Ltd. Dhaka 29,890 3,891 7,870,974 7,904,755 493,745 493,745 Fixed deposit receipts Phoenix Finance & Investments Ltd.* Bangladesh Industrial Finance Company Ltd. IDLC Finance Limited International Leasing Co. Ltd. Industrial Promotion and Development Co. of BD. Ltd. (IPDC) Industrial & Infrastructural Development Finance Company Ltd. (IIDFC) National Housing Finance and Investment Co. Ltd. Uttara Finance and Investment Ltd. Farest Finance & Investment Ltd. Islamic Finance and Investment Ltd. Dutch Bangla Bank Ltd. Merchantile Bank Ltd. First Security Bank Ltd. Dhaka Bank Ltd. BRAC Bank Ltd. AB Bank Ltd. Prime Bank Ltd. Bank Asia Ltd. One Bank Ltd. Jamuna Bank Ltd. Habib Bank Ltd. 247,355,000 20,000,000 200,000,000 140,000,000 250,000,000 20,000,000 120,000,000 650,000,000 750,000,000 500,000,000 600,000,000 150,000,000 400,000,000 300,000,000 200,000,000 100,000,000 4,647,355,000 4,672,945,417

2006 Taka

14,682 11,412,122 11,426,804 480,693 480,693

247,355,000 20,000,000 6,500,000 200,000,000 100,000,000 140,000,000 20,000,000 100,000,000 20,000,000 200,000,000 300,000,000 50,000,000 1,403,855,000 1,438,813,121

49

50 * Term deposits amounting Tk. 22,355,000 is under lien against Lease Obligation Payable 2007 Taka Money at Call and short notice Banking company Sonali Bank Ltd. BRC Bank Ltd. The Oriental Bank Ltd. Eastern Bank Ltd. One Bank Ltd. Bangladesh Krishi Bank United Commercial Bank Ltd. IFIC Bank Ltd. Mutual bank Ltd. Bank Asia Ltd. Uttara Bank Ltd. 100,000,000 200,000,000 150,000,000 300,000,000 200,000,000 500,000,000 1,450,000,000 Non-banking finance institutions Phoenix Finance & Investments Ltd. Phoenix Finance & Investments Ltd. Investment Corporation of Bangladesh Industrial Promotion and Development Company of Bangladesh Ltd. Fareast Finance & Investment Co. Ltd. National Housing Finance and Investment Co. Ltd. 250,000,000 50,000,000 30,000,000 50,000,000 380,000,000 1,830,000,000 Investments Investment securities are classified as follows a) Government securities 28 days treasury bills 2 years treasury bills 5 years treasury bills Reverse repo with NCC Bank Ltd. 727,208,490 250,000,000 977,208,490 458,267,362 235,405,650 2,251,411,930 2,945,084,942 20,000,000 15,000,000 35,000,000 1,435,000,000 400,000,000 100,000,000 100,000,000 200,000,000 150,000,000 300,000,000 50,000,000 100,000,000 1,400,000,000 2006 Taka

50

51

2007 Taka b) Government bonds Prize bonds Government bonds 6,305,500 6,111,200,110 6,117,505,610 7,094,714,100 c) Other investments Debenture of Bangladesh Welding Electrodes Limited Debenture of IDLC Finance Limited ULC Securitized Bond IDLC Asset Backed Bond BRAC Securitization Bond Shares 368,000 100,000,000 11,486,850 3,764,337 7,657,104 332,616,101 455,892,392 7,550,606,432 Maturity grouping of investments On demand Over 1 month but not more than 3 months Over 3 months but not more than 1 years Over 1 year but not more than 5 years Over 5 years Government bonds Name of the bonds 3 years T&T Treasury bonds 5 years Treasury bonds 10 years Treasury bonds 15 years Treasury bonds Debentures of Bangladesh House Building Finance Corporation (bearing interest rate @ 5.5%) Debentures of Investment Corporation of Bangladesh (bearing interest rate @ 5%) 2,224,032,700 3,346,067,410 486,100,000 40,000,000 15,000,000 6,111,200,110 549,144,913 2,755,158,158 4,246,303,421 7,550,606,492

2006 Taka 6,152,200 2,921,783,500 2,927,935,700 5,873,020,642

368,000 100,000,000 25,871,645 11,024,925 69,944,482 324,855,156 532,064,208 6,405,084,850 181,375,356 507,976,212 1,307,020,240 2,516,840,842 1,891,872,200 6,405,084,850

150,000,000 964,911,300 1,741,872,200 45,000,000 20,000,000 2,921,783,500 51

52

2007 Taka Debentures of Bangladesh House Building Finance Corporation at redeemable value Principal Redeemed up to 31 December 2007 Redeemed value Debentures of Investment Corporation of Bangladesh- at redeemable value Principal Redeemed up to 31 December 2007 Redeemed value Loans and advances / investments i) Loans, cash credits, overdrafts etc. Inside Bangladesh Secured overdraft Quard against TDR Cash credit Murabaha Loans House building loans Loans against trust receipt Loans against imported merchandise Payment against document Consumer credit scheme Lease finance / Izara Hire purchase shirkatul melk Bai-Salam Musharska Industrial credit Export development fund Staff loan City card loans* Small and medium enterprise loans Transportation loans Bai-muajjal 2,243,144,722 9,347,508 6,650,487,648 31,393,741 23,967,722 272,106,278 2,484,080,608 424,050,119 242,846,963 34,792,449 269,740,360 395,227,122 1,439,550 8,849,321,383 66,313,409 662,088,222 251,081,080 399,008,851 284,611,303 138,363,073 50,000,000 35,000,000 15,000,000 100,000,000 60,000,000 40,000,000

2006 Taka

100,000,000 55,000,000 45,000,000

50,000,000 30,000,000 20,000,000

2,398,290,438 21,208,170 7,476,165,137 22,687,892 47,022,773 432,765,912 3,261,724,130 661,037,983 804,246,946 52,182,056 245,715,677 275,331,881 8,269,992 8,408,021,471 89,379,833 436,837,660 220,340,433 439,213,591 280,131,555 282,578,138 52

53 Other loans and advances 27,040,242,081 2007 Taka Outside Bangladesh ii) Bills purchase and discounted Payable Inside Bangladesh Inland bills purchased Payable Outside Bangladesh Foreign bills purchased and discounted 278,091,991 1,748,673,430 26,788,466,138 30,789,021,982 Performing loans and advances / investments Gross loans and advances / investments 30,789,021,982 Less: Non-performing loans and advances / investments Interest suspense Provision for loans and advances / investments 26,788,466,138 1,671,833,000 352,005,997 963,612,192 2,387,451,189 23,801,014,949 27,024,777,690 *City Card loans represents the legitimate claims raised against credit card up to December 30, 2007. Loans and advances / investments Loans 17,121,890,445 Cash credits Overdrafts 27,040,242,081 53 16,105,419,090 6,681,881,388 2,252,492,230 25,039,792,708 7,498,853,028 2,419,498,608 2,209,732,000 277,219,774 1,277,292,518 3,764,244,292 995,348,543 3,748,779,901 1,470,581,439 2,753,431,358 2006 Taka 1,306,380,597 25,039,792,708 1,177,090,413

54 Bills purchase and discounted 30,789,021,982 1,748,673,430 26,788,466,138 3,748,779,901

2007 Taka Loans and advances / investments geographical Location- wise Inside Bangladesh Urban Dhaka Chittagong Sylhet Bogra Khulna 30,364,286,903 Rural Dhaka Chittagong Sylhet Bogra Khulna Outside Bangladesh 30,789,021,982 Sector-wise loans / investments including bills purchase and discounted Public sector 194,140,066 154,231,852 32,394,918 41,345,339 422,112,175 26,788,466,138 20,662,930,175 3,348,073,259 194,397,281 1,144,784,030 1,016,169,218 26,366,353,963

2006 Taka

2,825,571,554 4,843,607,625 222,263,291 1,281,693,892 1,191,150,541

198,905,687 163,789,235 23,134,689 38,905,468 424,735,079 -

54

55 Co-operative sector Private sector 30,789,021,982 26,788,466,138 30,789,021,982 26,788,466,138 -

2007 Taka Deposits and other accounts Current deposits and other accounts Current / Al-wadeeah current deposits Foreign currency deposits Security deposits receipts Sundry deposits Bills payable Pay orders issued Pay slips issued Demand draft T.T. payable 742,575,283 33,831,215 112,838,614 576,208 889,821,320 Saving bank deposits Fixed deposits Fixed deposits / Mudaraba fixed deposits 18,324,063,772 Short term deposits / Mudaraba short notice deposits 16,308,429,606 3,229,631,684 7,761,124,764 5,112,087,783 91,265,878 73,279,474 1,459,134,780 6,735,767,915

2006 Taka

3,275,830,083 102,719,312 87,050,259 1,755,689,084 5,221,288,738 484,396,486 23,076,830 418,208 86,293,948 594,185,472 7,167,831,148

2,829,338,967

55

56 Non resident taka deposits Scheme deposits 27,898,108,479 40,539,634,035 40,881,413,837 Sundry Deposits Sundry creditors Foreign currency Margin on L/C 490,160,899 Margin on L/G Interest payable on three stage deposits Foreign correspondence charges Sanchaypatra Unclaimed foreign DD Security money- Supplies Security money- Staff Unclaimed balances Hajj deposits Margin on inland purchased Foreign bills purchased awaiting remittance Imprest fund- Cash Incentive Key deposits Risk deposits (consumer Credit Schemes and Lease finance) Lease deposits Agent commission on Consumer Credit Schemes CIB service charges Currency settlement Late payment charge Excess over limit charge Charge back Auto debit receipt/ payment (credit Card) Others 135,219,278 802,525 249,029,344 181,278,269 485,155,150 14,474,210 44,016,563 52,425 18,472,812 680,628 212,770 194,597 2007 Taka 1,832,942 304,797,872 1,165,347 713,200 3,744,910 12,664,269 232,766 89,350 349,936 324,665 443,324 1,029,056 2,105,099 55,473 1,459,134,780 Saving bank deposits 196,810,942 980,129 166,466,905 351,557,335 11,649,466 73,265,000 212,655 194,597 2006 Taka 65,197,356 382,374,528 520,764 586,500 2,471,663 12,136,512 228,144 72,050 803,639 1,755,689,084 72,186,116 5,542,672,630 25,152,920,036 1,309,468,318 5,435,237,422

56

57 Savings bank deposits Mudaraba savings deposits Scheme deposits City Bank sanchaya scheme Bonus deposit scheme Deposit pension scheme Three stage scheme deposit Monthly benefit scheme Education savings scheme Junior saving scheme Lakpati saving scheme Marriage savings scheme Mudaraba monthly profit City ichchapuron City projonmo 639,444,630 18,300,000 68,114,500 2,729,356,230 1,910,450,000 28,086,312 87,830,562 25,834,371 20,258,340 1,600,000 13,200,000 197,685 5,542,672,630 826,553,517 96,100,000 61,474,804 1,930,732,221 2,424,448,980 20,859845 50,065,224 9,498,048 15,004,783 500,000 5,435,237,422 7,525,568,887 235,555,877 7,761,124,764 6,718,782,651 449,048,497 7,167,831,148

Deposit pension scheme was closed from the year 1995 and its interest was 15% p.a. 2007 Taka Sector-wise deposits Government Deposit money banks Other public Foreign currency Private 525,900,931 241,316,025 2,752,608,193 91,265,878 36,928,543,008 40,539,634,035 Maturity analysis of inter-bank deposits Payable on demand Up to 1 month Over 1 month but within 3 months Over 3 month but within 1 year 37,277,989 40,807,607 61,211,410 102,019,019 241,316,025 Maturity analysis of other deposits 48,189,811 21,103,607 362,849,375 432,142,793 718,281,178 432,142,793 3,009,854,344 102,719,312 36,618,416,210 40,881,413,837 2006 Taka

57

58 Payable on demand Up to 1 month Over 1 month but within 6 months 13,496,053,335 Over 6 months but within 1 year Over 1 year but within 5 years Over 5 years but within 10 years Over 10 years 39,855,085,572 Maturity analysis of other deposits (bill payable) Payable on demand Up to 1 month Over 1 month but within 3 months Over 3 months but within 1 years Over 1 years but within 5 years Over 5 years but within 10 years Over 10 years 889,821,320 889,821,320 40,298,318,010 594,185,472 594,185,472 40,449,271,044 7,396,591,154 4,934,026,635 10,691,746,790 12,035,691,374 3,975,016,658 375,424,079 39,408,496,690 7,151,160,548 5,315,828,489 8,647,927,820 4,154,188,703 1,089,926,677 -

58

59

59

60

SWOAT ANALYSIS :

Strengths

Satisfactory business growth. Experienced top management Diversified product lines Equity base enhancement decision No short fall in Capital Adequacy Satisfactory NPL coverage Strong Capital base Experienced management team

60

61

Diversified funding sources Outstanding market share Corporate shareholding structure Diversified business exposure

Weaknesses

Declining Asset Quality Average Profitability Tight Liquidity position MIS at primary stage Limited market share Poor Corporate Governance Significant deterioration in Asset Quality having adequate provisions High ownership concentration Declining financial performance MIS needs further development Single unit Financial Institution High turnover in top & mid tier management

Opportunities

Satisfactory business growth SME and Agro based industry Investment Real time online banking Increasing awareness for Islamic banking

61

62

Business expansion opportunities SME financing Fund raising through new financial products Capital market operation Scope of product diversification

Threats

Increased competition Market pressure for increasing the SLR Overall liquidity crisis in money market Commercial banks portfolio Expansion to lease financing Increasing local and foreign cost of fund New entrants into the market

Findings

Through current ratios we understand the current position of the company. It is a comparison between current liabilities and current assets. In 2006, current assets were 1.10 times more than the current liabilities. Where as, in 2007, the ratio increased by 0.23 to 1.33. This means the company succeeded in decreasing its current liabilities and increasing its current assets. .

62

63

Conclusion & Recommendation

First, I express my deep gratitude to Almighty Allah for enabling the Bank to achieve tremendous progress in all aspects of the operations in the year 2007. I am grateful to our valued shareholders and customers, who have trusted us with their business. Without their continuous support we could not have achieved this success. I also take this opportunity of expressing my heart felt appreciation and gratitude to the Government of the Peoples Republic of Bangladesh and Bangladesh Bank, for their help and assistance, valuable guidance and advice extended to the Bank from time to time. Finally, I also put on record my appreciation and thank to the employees at all levels for their sincere and dedicated services to the Bank.

63

64

Reference

[1] Hossain Mehmood, Vice Chairman of City Bank Ltd. [2] Rubel Aziz, Director of City Bank Ltd. [3] Tabassum Kaiser, Director of City Bank LTD. [4] K Mahmood Sattar, Managing Director & CEO. [5]WWW.thecitybank.com [6]WWW.Google.Com

64

65

[7]WWW.Wiki.Com

65

Vous aimerez peut-être aussi

- Mission of IBBLDocument19 pagesMission of IBBLTayyaba AkramPas encore d'évaluation

- SJIBL Internship ReportDocument101 pagesSJIBL Internship ReportsaminbdPas encore d'évaluation

- Financial Valuation of Summit Alliance Port LTDDocument15 pagesFinancial Valuation of Summit Alliance Port LTDAnik DeyPas encore d'évaluation