Académique Documents

Professionnel Documents

Culture Documents

Forcasted Sales Generation Revenue

Transféré par

Entropy UK LtdCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Forcasted Sales Generation Revenue

Transféré par

Entropy UK LtdDroits d'auteur :

Formats disponibles

Pre-PayCaf@

May 16

2008

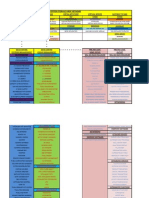

Sales Forecast and Predicted Generated Revenues

Our sales forecast and predicted generated revenue stream!

16/05/2008

Donald Lewis PRE-PAY CAF@ OUR FORECASTED REVENUE GENERATION AND OPERATING SALES FORECAST: Now that we have described and explained our Business Our Services Our Customers and all of Our Marketing Plans in Detail. Its now about that time that we need to attach some Numbers to Our Presentation Plan. Normally company sales forecasts would be based on Historical Sales. The Marketing Strategies already explained and all of our own Market Research Data Shows; That there are Two Real Types of Sales Forecasts that are Commonly Used Today; A BEST GUESS: Which is what you would really expect? And; A WORST CASE LOW ESTIMATE: That you are confident that you can reach no matter what happens. Well our forecast is based on the Best Guess Principle of Forecasting;

16/05/2008

Meaning that assuming that all of our operating systems and Infrastructure Service Facilities were all already finalised and in place; Then we would quite easily be able to generate a Fully Independent and Accurate Sales Forecast for our Entire Organisation and Service Operations. For Instance; Assuming that our company was already open for trade; For The Pre-Pay-Caf@ Enterprise Network to Reach A Total Profit Forecast Of 2 Million Pounds per Store; 2000000 shared between 52 weeks = 38461.53 Shared between 40 Hours per working week = 961.53 Based on 10 staff Members per Store working on the minimum wage. Profit per Hour =961.53 Staff wage Rate = 5.52% national minimum wage Staff National Insurance Contributions = 20% Wage and Contributions = 6.73 Plus Profit per Hour = 961.53 plus 6.73 Total Cost= 102.88 Based on an 8 Hour Working Day Total Cost= 823.04

3

16/05/2008

Times Seven Working Days = Total Cost = 5761.28 Times 52 Weeks in the Year = Total Cost = 299586.56 Which would then be the costs that we would charge your company for using our advertising services per year? Investors weigh the risk of investing against the potential gain using two classical formulas; Net Present Value! Internal Rate of Return! An Investment Deal involves The Amount Invested; And The Share Of The Ownership Purchased. For instance; An Investment placed of 500 = An Equity Share of 50% The Discount Rate isnt formally part of the deal but it affects the Net Present Value Analysis Discount Rate = 15% Investors Return on Investment! Final Payout Amount = 3000 Net Present Value = 862

4

16/05/2008

Internal Rate of Return = 43% All numbers are in denominations of thousands! NOTE: (these listed castings are fictitious and a full and intensive survey of all associated costs must first be ascertained in full) THE BASSIS AND SCOPE OF OUR ADVICE! Our marketing strategist team uses a combination of fundamental analysis and technological analysis, Based on information sourced from various different areas of technological and social sciences interests, applications, and services, derived occasionally from one or more of a large number of publically or commercially located sources.

Vous aimerez peut-être aussi

- Full Operating System Rapid Explanation 2011Document11 pagesFull Operating System Rapid Explanation 2011Entropy Uk LtdPas encore d'évaluation

- Certificate+SoR 290108Document2 pagesCertificate+SoR 290108Entropy UK LtdPas encore d'évaluation

- Pre Pay Cafe 2023Document2 pagesPre Pay Cafe 2023Entropy_UK_Ltd_2012Pas encore d'évaluation

- Pre Pay Cafe ExcelDocument6 pagesPre Pay Cafe ExcelEntropy UK LtdPas encore d'évaluation

- Full Proposed Technologies Involved 2011Document81 pagesFull Proposed Technologies Involved 2011Entropy Uk LtdPas encore d'évaluation

- Business Plan For Pre Pay Cafe 2010.Document264 pagesBusiness Plan For Pre Pay Cafe 2010.Entropy Uk LtdPas encore d'évaluation

- Welcome To The Future 2011Document909 pagesWelcome To The Future 2011Entropy Uk Ltd100% (1)

- Pre-Pay-CAF@' End User Profile Statistics!: Delivering DataDocument3 pagesPre-Pay-CAF@' End User Profile Statistics!: Delivering DataEntropy Uk LtdPas encore d'évaluation

- Immediate Problems We FaceDocument3 pagesImmediate Problems We FaceEntropy Uk LtdPas encore d'évaluation

- Copyright Registration!Document1 pageCopyright Registration!Entropy Uk LtdPas encore d'évaluation

- Processes of OperationDocument8 pagesProcesses of OperationEntropy Uk LtdPas encore d'évaluation

- Table of ContentsDocument5 pagesTable of ContentsEntropy Uk LtdPas encore d'évaluation

- Welcome To The FutureDocument25 pagesWelcome To The FutureEntropy Uk LtdPas encore d'évaluation

- Certificate of IncorporationDocument1 pageCertificate of IncorporationEntropy Uk LtdPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Wall Street Bonus ReleaseDocument2 pagesWall Street Bonus ReleaseNick ReismanPas encore d'évaluation

- CH 15Document24 pagesCH 15sumihosaPas encore d'évaluation

- 19 ConceptsandTheories CashflowForecasting OkDocument9 pages19 ConceptsandTheories CashflowForecasting OkPrecious J Alolod ImportantePas encore d'évaluation

- Forecasting - Module 4 AllDocument22 pagesForecasting - Module 4 AllSandeepPusarapu50% (2)

- CVP AnalysisDocument12 pagesCVP AnalysisKamini Satish SinghPas encore d'évaluation

- EK01 and EK02 V1 SettingsDocument3 pagesEK01 and EK02 V1 Settingscasandesh1gmailcom100% (1)

- Per Capita Multiplier MethodsDocument2 pagesPer Capita Multiplier Methodsagakuya2014Pas encore d'évaluation

- Imp Numerical Perfect CompetitionDocument27 pagesImp Numerical Perfect CompetitionSachin SahooPas encore d'évaluation

- Mba Case 2 - Value Based ManagementDocument13 pagesMba Case 2 - Value Based Managementdjmphd100% (1)

- Front Office Management and BudgetingDocument31 pagesFront Office Management and BudgetingdamianuskrowinPas encore d'évaluation

- Marginal costing definition and principlesDocument15 pagesMarginal costing definition and principlesShivani JainPas encore d'évaluation

- Strategic Planning Key Terms and Financial ForecastingDocument12 pagesStrategic Planning Key Terms and Financial ForecastingBasnet BidurPas encore d'évaluation

- Creative Accounting: & Earnings ManagementDocument29 pagesCreative Accounting: & Earnings ManagementrasheshpatelPas encore d'évaluation

- Economic Growth (Weil - 2E) Solutions (Ch.1&3&8)Document17 pagesEconomic Growth (Weil - 2E) Solutions (Ch.1&3&8)Hoo Suk HaPas encore d'évaluation

- R33 Residual Income Valuation Q Bank PDFDocument5 pagesR33 Residual Income Valuation Q Bank PDFZidane KhanPas encore d'évaluation

- Chapter 5 - Residual Income Valuation Calculation of Residual Income Using A Given EBITDocument11 pagesChapter 5 - Residual Income Valuation Calculation of Residual Income Using A Given EBITbingoPas encore d'évaluation

- Chapter08 KGWDocument24 pagesChapter08 KGWk_Dashy8465Pas encore d'évaluation

- The Basics of Profit Planning for Your Small BusinessDocument1 pageThe Basics of Profit Planning for Your Small BusinessRodj Eli Mikael Viernes-IncognitoPas encore d'évaluation

- Gar34943 ch06 PDFDocument46 pagesGar34943 ch06 PDFbilalPas encore d'évaluation

- Krispy Donut Case AnalysisDocument7 pagesKrispy Donut Case Analysisfaraz_soleymani100% (1)

- Garlington Technologies Inc S 2013 Financial Statements Are Shown Here Balance SheetDocument1 pageGarlington Technologies Inc S 2013 Financial Statements Are Shown Here Balance SheetAmit PandeyPas encore d'évaluation

- Financial Planning and ForecastingDocument15 pagesFinancial Planning and Forecastingalkanm750100% (1)

- AFN Formula Method Answer: A Diff: M 19. Financial Plan Answer: e Diff: M NDocument1 pageAFN Formula Method Answer: A Diff: M 19. Financial Plan Answer: e Diff: M NKaye JavellanaPas encore d'évaluation

- Permanent Income HypothesisDocument2 pagesPermanent Income HypothesiskentbnxPas encore d'évaluation

- Chap004 Cpa SolutionDocument86 pagesChap004 Cpa SolutionboydjolofPas encore d'évaluation

- Part 4 Modeling Profitability Instead of DefaultDocument5 pagesPart 4 Modeling Profitability Instead of DefaultWathek Al Zuaiby100% (7)

- Financial ForecastingDocument15 pagesFinancial Forecastingmanique_abeyratnePas encore d'évaluation

- Adjusted Exponential SmoothingDocument20 pagesAdjusted Exponential SmoothingJonas MondalaPas encore d'évaluation

- Job openings in R2R Process with Accenture in NoidaDocument3 pagesJob openings in R2R Process with Accenture in NoidaPeeyush Singh100% (1)

- Demand Analysis Problems and SolutionsDocument27 pagesDemand Analysis Problems and SolutionsHashma KhanPas encore d'évaluation