Académique Documents

Professionnel Documents

Culture Documents

(-) Rebate U/s 88D/88B/88C/88/10 (13A) /HBL Int. Paid

Transféré par

Somnath ChakrabortyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

(-) Rebate U/s 88D/88B/88C/88/10 (13A) /HBL Int. Paid

Transféré par

Somnath ChakrabortyDroits d'auteur :

Formats disponibles

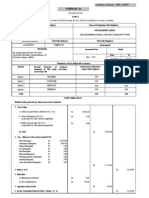

Name Gross salary P.Tax Interest received from bank (-) Dedn.

u/s 80C (-) Rebate u/s 88D/88B/88C/88/10(13A)/HBL int. paid Gross Arrear 1st instalment received Gross Arrear for March'09 08-09 A.Y 198442 1480 28468

Somnath Chakraborty 09-10 A.Y. 10-11 A.Y. P. Tax arrear paid 247632 359598 1560 1780 180 43799 54461.62 100000 100000 100000

91472

Year ending March' PAN NO. Residential Status Assesment year

2010 AEGPC9021B Own House 2010-2011

Own Houses Rented Houses

Name:

Somnath Chakraborty Computation of relief under section 89(1) in respect of arrears of salary Computation of Total income and tax thereon

Particulars

On 'Receipt' basis, 2008-09 2009-10 Rs. 247632 247632 1560 246072 43799 289871 100000 189871 189871

Assessment years 2010-11 Rs. 359598 91472 451070 1960 449110 54461.62 503571.62 100000 403571.62 403572

On 'Accrual" basis, 2008-09 198442 45736 244178 1480 242698 28468 271166 100000 171166 171166 2009-10 Rs. 247632 45736 293368 1560 291808 43799 335607 100000 235607 235607

Assessment years 2010-11 Rs. 359598 0 359598 1960 357638 54461.62 412099.62 100000 312099.62 312100

Salary (+) arrear Gross salary (-) P.Tax Net Salary Interest from bank Gross total income (-) Dedn.u/s 80C Net Total income Ronund up Tax on total income Ronund up (-) Rebate u/s 88D/88B/88C/88 TAX (+) Edn. Cess Tax payable

198442 198442 1480 196962 28468 225430 100000 125430 125430

1543 1543 0 1543 46 1589

3987.1 3987 0 3987 120 4107

34714.4 34714 0 34714 1041 35755

8233.2 8233 0 8233 247 8480

8560.7 8561 0 8561 257 8818

16420 16420 0 16420 493 16913

TABLE "A" [ See item 7 of Annexure I] Salary received in Total income ( as Total arrears in arrears increased by salary Tax on Tax on Difference in tax [ income of or advance relating received in arrears or total total Amount under the Previous to the relavent advance) of the relavent income ( income ( column 6 minus relevnt year(s) previous year as previous year as per as per amount under previous mentioned in mentioned in column I column 2) column 4) column 5] year ( column I [Add column(2) and (3)] ( Rs.) (Rs.) (Rs.) Rs.) (Rs.) (Rs) 2007-08 2008-09 125430 189871 45736 45736 171166 235607 1589 4107 8480 8818 6891 4711 11602

ANNEXURE I See item 2 of Form No 10E]

ARREARS OR ADVANCE SALARY 1 Total income ( excluding salary received in arrears or advance) 2 Salary received in arrears or advance [ 91472 (-) 0]

312099.6 91472 403571.6 35755 16913 18842 11602 7240

3 Total income( as increased by salary received in arrears or advance)[add item 1 and 2] 4 Tax on total income (as per item 3) [ including Edu. Cess, if applicable] 5 Tax on total income (as per item 1) [ including Edu. Cess, if applicable] 6 Tax on salary received in arrears or advance [ difference of item 4 and item 5] 7 Tax computed in accordance with Table"A"[ Brought from column 7 of table "A"] 8 Relief under section 89(1) [ Indicate between the amounts mentioned against item 7 and 8]

FORM NO. 10E [See rule 21AA] Form for furnishing particulars of Income under section 192(2A) for the year ending 31st March, .... 2010 for claiming relief under section 89(1) by a Government servant or an employee in a company, co-operative society, local authority, university, institution, association or body 1. Name and address of the employee Somnath Chakraborty 2. Permanent account number AEGPC9021B 3. Residential status Own House Particulars of income referred to in rule 21A of the Income-tax Rules, 1962, during the previous year relevant to assessment year 2010-2011 Rs. 1. (a) Salary received in arrears or in advance in accordance with 91472 the provisions of sub-rule (2) of rule 21A (b) Payment in the nature of gratuity in respect of past services, extending over a period of not less than 5 years in accordance with the provisions of sub-rule (3) of rule 21A (c) Payment in the nature of compensation from the employer or former employer at or in connection with termination of employment after continuous service of not less than 3 years or where the unexpired portion of term of employment is also not less than 3 years in accordance with the provisions of sub-rule (4) of rule 21A (d) Payment in commutation of pension in accordance with the provisions of sub-rule (5)of rule 21A 2. Detailed particulars of payments referred to above may be given in Annexure I, II, IIA, III or IV, as the case may be Signature of the employee Verification I, ..................................... do hereby declare that what is stated above is true to the best of my knowledge and belief. Verified today, the........... day of ........ . ..... Place:................... . Date:...................... Signature of the employee

ANNEXURE I

ARREARS OR ADVANCE SALARY 1 Total income ( excluding salary received in arrears or advance) 2 Salary received in arrears or advance 3 Total income( as increased by salary received in arrears or advance)[add item 1 and 2] 4 Tax on total income (as per item 3) [ including Edu. Cess, if applicable] 5 Tax on total income (as per item 1) [ including Edu. Cess, if applicable] 6 Tax on salary received in arrears or advance [ difference of item 4 and item 5] 7 Tax computed in accordance with Table"A"[ Brought from column 7 of table "A"] 8 Relief under section 89(1) [ Indicate between the amounts mentioned against item 7 and 8] Rs.312,100 Rs.91,472 Rs.403,572 Rs.35,755 Rs.16,913 Rs.18,842 Rs.11,602

Rs.7,240

Vous aimerez peut-être aussi

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuPas encore d'évaluation

- Arrears Relief Calculator For W.B.govt Employees 2Document4 pagesArrears Relief Calculator For W.B.govt Employees 2Rana BiswasPas encore d'évaluation

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelPas encore d'évaluation

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilPas encore d'évaluation

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Pas encore d'évaluation

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiPas encore d'évaluation

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaPas encore d'évaluation

- Form 16Document2 pagesForm 16Hari Krishnan ElangovanPas encore d'évaluation

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahPas encore d'évaluation

- 10e For - Ay-21-22Document4 pages10e For - Ay-21-22Ja M EsPas encore d'évaluation

- Form No 16Document5 pagesForm No 16Rabiul KhanPas encore d'évaluation

- Form No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocument2 pagesForm No. 16: Details of Salary Paid and Any Other Income and Tax DeductedSundaresan ChockalingamPas encore d'évaluation

- Table "A"Document5 pagesTable "A"hemantasharma123Pas encore d'évaluation

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraPas encore d'évaluation

- Form 16Document1 pageForm 16Manish Varghese MathewPas encore d'évaluation

- Form16Document10 pagesForm16anon-263698Pas encore d'évaluation

- Ganaesmurthy Form16Document4 pagesGanaesmurthy Form16sundar1111Pas encore d'évaluation

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Document4 pagesPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilPas encore d'évaluation

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111Pas encore d'évaluation

- Form 16Document2 pagesForm 16orkid2100Pas encore d'évaluation

- Form 16Document3 pagesForm 16Bijay TiwariPas encore d'évaluation

- 1827 PDFDocument3 pages1827 PDFhelloitskalaiPas encore d'évaluation

- Form16fy10 11Document3 pagesForm16fy10 11atishroyPas encore d'évaluation

- (See Rule 31 (1) (A) ) : Form No. 16Document8 pages(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandePas encore d'évaluation

- Form 16 For The AY 2017-18Document4 pagesForm 16 For The AY 2017-18Suman HalderPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Form 16Document3 pagesForm 16api-247505461Pas encore d'évaluation

- Form16.pdf HIRA PDFDocument2 pagesForm16.pdf HIRA PDFSuchitra BakulyPas encore d'évaluation

- Form No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument4 pagesForm No. 16 (See Rule 31 (1) (A) ) : Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceJeevabinding xeroxPas encore d'évaluation

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavPas encore d'évaluation

- 103497Document5 pages103497Ashok PuttaparthyPas encore d'évaluation

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111Pas encore d'évaluation

- Indian Numbering SystemDocument8 pagesIndian Numbering SystemelangomduPas encore d'évaluation

- AnilDocument2 pagesAnilaruncaoffice1979Pas encore d'évaluation

- ITR-A Released - Wef - 01.11.2022Document2 pagesITR-A Released - Wef - 01.11.2022sai charanPas encore d'évaluation

- Babu Form 16Document4 pagesBabu Form 16sundar1111Pas encore d'évaluation

- Form 16Document4 pagesForm 16Aruna Kadge JhaPas encore d'évaluation

- Form 16 Part A: WWW - Taxguru.inDocument10 pagesForm 16 Part A: WWW - Taxguru.inAjit KhurdiaPas encore d'évaluation

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiPas encore d'évaluation

- I.T. Form-16 (2017-18)Document129 pagesI.T. Form-16 (2017-18)beohosakotePas encore d'évaluation

- Form 10EDocument2 pagesForm 10EeswarPas encore d'évaluation

- R.V. Nerurkar High School - Form 16 1Document180 pagesR.V. Nerurkar High School - Form 16 1rvnjcPas encore d'évaluation

- ST 3 Revised For 2nd QuarterDocument16 pagesST 3 Revised For 2nd QuarterSam SmartPas encore d'évaluation

- Form 16Document6 pagesForm 16Pulkit Gupta100% (1)

- ITR-3 Indian Income Tax Return: Part A-GENDocument8 pagesITR-3 Indian Income Tax Return: Part A-GENRahul SharmaPas encore d'évaluation

- Summary of Tax Deducted at Source: TotalDocument2 pagesSummary of Tax Deducted at Source: Totaladithya604Pas encore d'évaluation

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajPas encore d'évaluation

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111Pas encore d'évaluation

- Milton Form16Document4 pagesMilton Form16sundar1111Pas encore d'évaluation

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsPas encore d'évaluation

- Trinidad and Tobago Emolument Income Tax 2012Document5 pagesTrinidad and Tobago Emolument Income Tax 2012Anand RockerPas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- 1 Form 16 16a LatestDocument25 pages1 Form 16 16a LatestNishant GhasePas encore d'évaluation

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharPas encore d'évaluation

- Instruction To Fill Form St3Document9 pagesInstruction To Fill Form St3Dhanush GokulPas encore d'évaluation

- Form 16Document2 pagesForm 16jwadje1Pas encore d'évaluation

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- Rishra TR Tap Cap Bank StatusDocument32 pagesRishra TR Tap Cap Bank StatusSomnath ChakrabortyPas encore d'évaluation

- 33kv Panel Ns RishraDocument8 pages33kv Panel Ns RishraSomnath ChakrabortyPas encore d'évaluation

- Technical Session - IDocument47 pagesTechnical Session - IKalapala Nancharaiah100% (6)

- Rishra BookletDocument19 pagesRishra BookletSomnath ChakrabortyPas encore d'évaluation

- Name Plate Details of 160MVA TransformerDocument1 pageName Plate Details of 160MVA TransformerSomnath ChakrabortyPas encore d'évaluation

- 132kv ExportDocument8 pages132kv ExportSomnath ChakrabortyPas encore d'évaluation

- 220kv ImportDocument8 pages220kv ImportSomnath ChakrabortyPas encore d'évaluation

- TQM FinalDocument17 pagesTQM FinalSomnath ChakrabortyPas encore d'évaluation

- 2002 Weda Tamu DieselDocument24 pages2002 Weda Tamu Dieselباسل ديوبPas encore d'évaluation

- Fixation & ArrearsDocument8 pagesFixation & ArrearsSomnath ChakrabortyPas encore d'évaluation

- CC C C CCCCCCDocument20 pagesCC C C CCCCCCSomnath ChakrabortyPas encore d'évaluation

- Technical DiaryDocument257 pagesTechnical DiarySomnath Chakraborty100% (2)

- TQM FinalDocument17 pagesTQM FinalSomnath ChakrabortyPas encore d'évaluation

- Anyakoha PDFDocument10 pagesAnyakoha PDFvenicePas encore d'évaluation

- Easy-Basic-&-Simple-Cover-Letter-Template-Dark-BlueDocument3 pagesEasy-Basic-&-Simple-Cover-Letter-Template-Dark-BlueNoah LoftonPas encore d'évaluation

- Management Bateman/Snell: Chapter 12Document2 pagesManagement Bateman/Snell: Chapter 12Ly SajidPas encore d'évaluation

- Code of Ethics For Electronics EngineeringDocument11 pagesCode of Ethics For Electronics EngineeringShiekaMikaelaEdaugalBesoPas encore d'évaluation

- Rednotes Labor LawDocument72 pagesRednotes Labor LawLoven Jake MasiasPas encore d'évaluation

- Group 8-Sociolinguistics (Chapter 8) Ethnicity and Social NetworkDocument6 pagesGroup 8-Sociolinguistics (Chapter 8) Ethnicity and Social NetworkFijay PratamaPas encore d'évaluation

- rps1999 PDFDocument429 pagesrps1999 PDFsyedPas encore d'évaluation

- Rolls-Royce: Company ProfileDocument3 pagesRolls-Royce: Company Profileonline.anupPas encore d'évaluation

- E-Bridge Bulletin 1Document2 pagesE-Bridge Bulletin 1mmanas3083Pas encore d'évaluation

- US IT Recruitment ProcessDocument19 pagesUS IT Recruitment ProcessUddeshya Srivastava90% (10)

- Wal Mart and The Demography Factor Management EssayDocument8 pagesWal Mart and The Demography Factor Management EssayGPPas encore d'évaluation

- Developing Agro-Industries For Employment Generation in Rural AreasDocument2 pagesDeveloping Agro-Industries For Employment Generation in Rural AreasRaj RudrapaaPas encore d'évaluation

- 19 AKELCO V NLRCDocument2 pages19 AKELCO V NLRCPaolo Miguel ArqueroPas encore d'évaluation

- Unemployment in Rural IndiaDocument2 pagesUnemployment in Rural IndiaVikasPas encore d'évaluation

- Recommendations To Improve Foster Care in TexasDocument13 pagesRecommendations To Improve Foster Care in TexasAnonymous Pb39klJPas encore d'évaluation

- Westmont Pharmaceuticals Et. Al. Vs SamaniegoDocument5 pagesWestmont Pharmaceuticals Et. Al. Vs SamaniegoSarah De GuzmanPas encore d'évaluation

- Writing ResumesDocument86 pagesWriting ResumesMohammad Anas Ashraf GagaiPas encore d'évaluation

- The Morality of Labor StrikesDocument2 pagesThe Morality of Labor StrikesJay Mark Marcial JosolPas encore d'évaluation

- 1 Tapping Into A Digital Brain AI-Powered Talent Management at Infosys - 1asdDocument13 pages1 Tapping Into A Digital Brain AI-Powered Talent Management at Infosys - 1asdstatwo99Pas encore d'évaluation

- (Good) Corporate Governance and The Strategic Integration of Meso EthicsDocument15 pages(Good) Corporate Governance and The Strategic Integration of Meso EthicsLe Ngoc Hong Buu100% (1)

- Article - Impact of Workplace DiversityDocument3 pagesArticle - Impact of Workplace DiversityMohd HafizPas encore d'évaluation

- Project Report On AmulDocument12 pagesProject Report On Amul155 het Sheth FY-BPas encore d'évaluation

- 2020 Business Studies Grade 10 Notes Term 4Document8 pages2020 Business Studies Grade 10 Notes Term 4froggie Ahmed0% (3)

- 658335Document3 pages658335Yogesh ShivannaPas encore d'évaluation

- Labor Studies Journal: Mandatory Overtime Work in The United States: Who, Where, and What?Document26 pagesLabor Studies Journal: Mandatory Overtime Work in The United States: Who, Where, and What?Jasmina GaitanPas encore d'évaluation

- Nha Resettlement ProgramDocument63 pagesNha Resettlement ProgramRuel Malabanan Alvarez BarinquePas encore d'évaluation

- RINLDocument21 pagesRINLSarbari GangulyPas encore d'évaluation

- G.R. No. 164301 August 10, 2010 BPI Vs BPI Employees UnionDocument24 pagesG.R. No. 164301 August 10, 2010 BPI Vs BPI Employees UnionJen DioknoPas encore d'évaluation

- Article On Child LabourDocument2 pagesArticle On Child LabourPiyush KhushlaniPas encore d'évaluation