Académique Documents

Professionnel Documents

Culture Documents

SymphonyIRI - Topline Report - Q3 2011

Transféré par

IRIworldwideCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SymphonyIRI - Topline Report - Q3 2011

Transféré par

IRIworldwideDroits d'auteur :

Formats disponibles

1 CopyrlghL Symphonyl8l Croup, 2011. ConfldenLlal and roprleLary.

Tim Eales

Director of Strategic Insight

SymphonyIRI Topline Report

The Quarterly European Barometer

Third quarter (Q3 2011)

Is economic uncertainty affecting FMCG sales?

2 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Key Findings

Confidence levels have decreased across

Europe France by the most and in Germany

the least.

Purchasing power is under pressure due to

increasing prices, impacting mainly non food

volume.

Prices are rising faster than earnings so this

means Consumer Recession.

After a pause, promotion activity has started to

increase again in the UK, The Netherlands and

Spain.

Own label is growing although National Brands

remain dominant.

Own label operators are starting to use the

trade promotion lever more.

PRICE RISES

PURCHASE

BASED ON NEED

MANAGE BUDGETS

3 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

2.6

1.1

0.8 0.8

0.5

-5.2

1.6

Germany France Netherlands Italy Spain UK Greece

GDP Growth Q3 2011 - % change vs. previous year

Source : Eurostat Q3 11 - Published 15

th

November 2011

Growth rates of GDP in volume

(based on seasonally adjusted data)

Euro area GDP up by 1.4%

Q2 11

4 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

September 2011

EU unemployment rate up from 9.5% in Jan 11 to 9.7%

4.5

8.3 8.3

9.9

17.6

22.6

5.8

Netherlands Germany UK Italy France Greece Spain

Source : Eurostat Sept 11

(4.3) (6.4) (7.8) (8.2) (9.7) (14.7) (20.4) (Jan 11)

JULY 11

AUG 11

5 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

4.7

3.9

3.7

3.9

1.3

3.5

1.9

Netherlands Germany UK Italy France Greece Spain

FMCG Growth Q3 2011 - % change vs. previous year

0.1

0.0

1.5

0.5

0.3

2.6

-1.8

VALUE TREND

VOLUME TREND

Italy and Spain, with the lowest price increases are showing growth

With prices up more in Germany and UK, volume is declining.

UNITS trend

for Greece

6 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

FMCG Consumer Reaction to Economic Uncertainty Q3 2011

Food prices are increasing (or at least no longer declining) in

almost all countries but this is not consistently impacting volume

sales, except in Germany. However, non-food volume is generally

flat or declining.

Prices are continuing to rise everywhere except for Food in Spain

and non Food in Germany.

Rising prices have predominantly resulted in increased value sales.

In Spain consumption has increased as Spanish are tired of

tightening their belt.

Consumer expenditure has changed in many countries, moving

spend from out of home to in-home. This will have contributed to

volume growth in some categories.

Promotion has decreased in France, Italy and Germany. Greece

has reported that companies are pulling back on trade promotions

in order to boost profits as sales are squeezed.

The trends that we saw for H1 have generally been repeated in Q3

apart from a small volume growth for food in the UK which could

have been driven by the poor summer.

Q3

2011

7 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

2.0

3.0

2.3

3.9

2.1

2.0

2.6

2.9

4.5

2.2

3.4

2.8

3.9

1.8

2.0

2.6

1.2

0.8

-1

0

1

2

3

4

5

6

VALUE VOLUME PRICE

In France, Food volume sales are still growing, with prices well up. Non-

Food volume is declining however.

Trend of Food Sales in France

(Packaged Food, Confectionery, Drinks, exc. Alcohol)

0.4

3.2

2.9

3.2

1.7

0.6

0.9

1.6

2.1

-1.0

1.4

1.5

1.4

-0.6

0.0

-0.3

-0.7

0.3

-2

-1

0

1

2

3

4

5

6

Trend of Non-Food Sales in France

(Pet Food, Health, Toiletry, Household)

SOURCE: SymphonyIRI, Hypermarkets & Supermarkets

YoY Value & Volume price change

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

8 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Overview - France

The inflation rate reached +3% in September (as expected).

Despite this background, the trend is still toward volume growth for

FMCG products in hyper and supermarkets (although the rate of growth

is decreasing).

Value sales in hard discounters are totally flat with volume decreasing in

this channel.

Private labels have been gaining market share as inflation returns (but

only in value).

Concerning food products, the situation is improved for home made

products and essential categories (compared with ready to eat or

pleasure products).

VAT on Food 5.5% & 19.6%

9 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

5.1

2.9

1.4

3.6

-3.0

0.9

2.3

4.1

4.5

6.5

4.3

2.6

6.4

-3.5

2.4

2.0 2.0

0.8

-4

-2

0

2

4

6

8

VALUE VOLUME PRICE

In Italy, Q3 2011 trend vs. 2010 has shown growth for Food in Value and

Volume despite prices rising but Non-Food volume is declining.

Trend of Food Sales in Italy

(Packaged Food, Confectionery, Drinks, inc.. Alcohol)

3.3

4.5

1.8

1.1

-2.0

-3.3

-2.7

-0.8

0.6

1.3

3.8

1.4

-1.9

-3.0

-2.4

-0.5

-0.9

0.8

-4

-3

-2

-1

0

1

2

3

4

5

Trend of Non-Food Sales in Italy

(Pet Food, Health, Toiletry, Household)

SOURCE: SymphonyIRI, All Outlets

YoY Value & Volume price change

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

VALUE GROWTH

FROM INFLATION

10 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Inflation rate in FMCG Italy: In Sept the inflation rate of FMCG is almost equal to the

general inflation rate in the country. Consumers in this sector will be impacted.

Tot. Italia Ipermercati + Supermercati + Superette

% Price changes - FMCG

-3.0

-2.0

-1.0

0.0

1.0

2.0

3.0

4.0

5.0

6.0

M

a

y

-

0

7

A

u

g

-

0

7

N

o

v

-

0

7

F

e

b

-

0

8

M

a

y

-

0

8

A

u

g

-

0

8

N

o

v

-

0

8

F

e

b

-

0

9

M

a

y

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

F

e

b

-

1

0

M

a

y

-

1

0

A

u

g

-

1

0

N

o

v

-

1

0

F

e

b

-

1

1

M

a

y

-

1

1

A

u

g

-

1

1

Difference (Mix effect) basket Inflation FMCG Inflation

s

e

t

-

1

1

11 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Overview - Italy

The macro economic scenario in Italy shows a low growth for both consumption

and GDP (+0,3% in Sept- Source: Istat). This rate of growth is below the

forecast from the beginning of the year. Moreover the trend is not positive,

considering that Industry production is -4,8% vs. August.

Unemployment is up to 8,3% in Sept 2011. The rate of youth unemployment

(15-24 years) is at 29.3% (+1.3%).

The purchasing power of households is under pressure. In the second quarter of

2011 it decreased by -0,2% vs. the previous quarter. (Source Istat).

2011 Q3 volume trends registered a positive performance for Food & Beverage

while Home Care and Personal Care are still suffering (even if we can see signs

of recovery). Home Care and Personal Care are performing worse in

supermarkets and hypermarkets whilst they are registering growth in Specialised

channels.

FMCG inflation is at around 3%. It is reaching the general inflation rate

registered from ISTAT. This means that the sector can not moderate prices

increases any more.

Large increase in the number of own labels, resulting in share improvement,

particularly in the premium price sector after 2 years.

Trade promoted volume is relatively high at around 25%. Retailer Own Brand

promotions are increasing more than National Brand promotions.

VAT on Food 4% & 10%

12 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

-0.5

0.0

-0.9

0.3

-0.6

-0.5

0.0

2.3

2.0

3.1

4.8

3.2 3.2

1.7 1.9

2.6

2.4

1.8

-6

-4

-2

0

2

4

6

VALUE VOLUME PRICE

In Spain, food prices started to rise but have since fallen again and

volume remains buoyant. Non-Food prices are rising now.

Trend Spain Food Sales in Spain

(Packaged Food, Confectionery, Drinks, exc. Alcohol)

-1.0

-0.1

0.4

1.4

0.6

2.0

0.8

2.2

4.0

3.8

4.4

5.2 5.2

2.6

3.9

2.8

3.2

2.5

-6

-3

0

3

6

Trend of Non-Food Sales in Spain

(Pet Food, Health, Toiletry, Household)

SOURCE: SymphonyIRI, Hypermarkets & Supermarkets

YoY Value & Volume price change

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

13 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

3.8

1.2

3.2

1.9

1.6

2.3

5.1

2.8

0.8

2.9

2.5

1.1 1.1

1.0

1.3

- 1.0

- 1.2

5.2

1.7

1.5

2.2

3.3

2.7

4.7

3.0

3.9

3.3 3.3

2.1

2.4

1.5

1.8

0.7

3.6

1.5

1.0

1.4 1.4

0.2

1.2

3.1

- 1.8

1.4

0.1

2.3

3.1

2.2

4.5

- 1.9

1.1

6.6

5.9

5.8

5.1

4.8

5.8

5.0

5.0

4.8

2.6

2.1

0.2

- 0.6

- 2.5

- 3.5- 3.6

- 4.5- 4.6

- 4.1- 4.1

- 4.4- 4.3

- 4.5

- 4.0

- 3.2

- 2.6

- 2.2- 2.3

- 2.1- 2.0- 2.1

- 2.3

- 2.1

- 1.8

- 1.3

1.0

1.3

1.0

1.1

1.1

1.2

0.1

3.9

4.3

1.4

2.1

0.0

- 3.6

0.2

- 0.7- 0.7

0.5

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

H

1

2

0

1

1

Q

3

2

0

1

1

P

0

1

-

0

8

P

0

2

-

0

8

P

0

3

-

0

8

P

0

4

-

0

8

P

0

5

-

0

8

P

0

6

-

0

8

P

0

7

-

0

8

P

0

8

-

0

8

P

0

9

-

0

8

P

1

0

-

0

8

P

1

1

-

0

8

P

1

2

-

0

8

P

0

1

-

0

9

P

0

2

-

0

9

P

0

3

-

0

9

P

0

4

-

0

9

P

0

5

-

0

9

P

0

6

-

0

9

P

0

7

-

0

9

P

0

8

-

0

9

P

0

9

-

0

9

P

1

0

-

0

9

P

1

1

-

0

9

P

1

2

-

0

9

P

0

1

-

1

0

P

0

2

-

1

0

P

0

3

-

1

0

P

0

4

-

1

0

P

0

5

-

1

0

P

0

6

-

1

0

P

0

7

-

1

0

P

0

8

-

1

0

P

0

9

-

1

0

P

1

0

-

1

0

P

1

1

-

1

0

P

1

2

-

1

0

P

0

1

-

1

1

P

0

2

-

1

1

P

0

3

-

1

1

(

*

)

P

0

4

-

1

1

P

0

5

-

1

1

P

0

6

-

1

1

P

0

7

-

1

1

P

0

8

-

1

1

P

0

9

-

1

1

Consumption Price

Sales Evolution FMCG Market vs. previous year: demand and price evolution

Spain - Prices stopped decreasing in March

14 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Overview - Spain

Unemployment was 21,5% in Q3, higher than Q2. Summer time historically

pushes employment with the rise of temporary jobs.

Annual inflation (CPI) for 2010 was +1.8%. By October 2011 it had risen to

+3.0%.

GDP has increased +0.1% and the new rate is +0.8%.

Sales in Q3 has increased +3.4%. This is due to the increase of

consumption, +2.3%, and also prices, +1.1%. Prices continue going up since

the beginning of the year - after decreasing for the last two years due to the

recession.

Although Spain is still in recession, shoppers have learnt to buy, and they

have internalized their shopping strategies, so they spent less time in front of

the shelf to choose their shopping basket. Shoppers also seem to be tired of

tightening their belts, and consumption has been positively affected.

Although shoppers are sensitive to prices, store and shelves are key drivers to

leverage sales.

Trade promotion levels are decreasing, under 18%.

Own label for Q3 is 41%. This is one point above 2010 total.

VAT on Food 8% and 18%

15 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

2.2

3.6

1.7

0.1

-5.0

3.4

1.3

-0.5

1.8

2.8

2.2

-2.3

5.5

2.4 2.0

1.5

0.4

1.0

-6

-4

-2

0

2

4

6

8

VALUE UNITS

In Greece, after a period of continuous price reduction, Food units

growth has been virtually halted in the latest quarter.

Trend of Food Sales in Greece

(Packaged Food, Confectionery, Drinks, exc. Alcohol)

-1.6

-1.9

2.6

-1.7

-9.4

0.7

-2.5

-1.7

-1.3

2.2

-8.5

-2.4

-1.5

0.3

-0.6

-0.3

0.2 0.0

-12

-10

-8

-6

-4

-2

0

2

4

6

Trend of Non-Food sales in Greece

(Pet Food, Health, Toiletry, Household)

SOURCE: SymphonyIRI, Hypermarkets & Supermarkets

YoY Value change

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

Price per unit

16 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Overview - Greece

Inflation in Greece was +1.7% for the first semester of 2011.

Unemployment rates during the first semester of 2011 reached 16.3%.

GDP for the first six months of 2011 was -7.3%.

Promotion intensity has declined, since companies are trying to meet

their profit margins. Within promotion activities, those with price off are

gaining share.

Retailers are promoting own label products more and more.

Food category sales seem to suffer less, due to consumption a

transfer from other small stores (e.g. kiosks, haberdasheries,

convenience) to supermarket/hypermarket stores.

The top 7 retailer groups are gaining market share at the expense of

smaller chains (due to both organic growth and stores network

expansion). Especially for Lidl where there was an increase of sales in

2011.

VAT on Food 23%

17 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

1.6

0.7

0.2

1.4

0.0

1.1

2.4

2.7

4.7

1.9 1.9

3.1

1.4

3.3

0.1

0.7

1.5

-0.2

-3

-2

-1

0

1

2

3

4

5

6

VALUE VOLUME PRICE

In the Netherlands, the growth rate of Food has slowed as prices begin

to increase. Non-Food volume has fallen.

Trend of Food Sales in the Netherlands

(Packaged Food, Confectionery, Drinks, exc. Alcohol)

-2.1

2.2

0.9

-2.1

0.5

-1.8

-1.3

0.2

-0.6

-5.2

4.1

-1.6

-1.0

0.9

-1.6

-1.9

0.1 1.5

-6

-4

-2

0

2

4

Trend of Non-Food Sales in the Netherlands

(Pet Food, Health, Toiletry, Household)

SOURCE: SymphonyIRI, All Outlets

YoY Value & Volume price change

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

18 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Overview The Netherlands

Unemployment is relatively low, in September it was 5,5%.

Food prices are beginning to increase, and it looks like volume growth

is declining.

Non-Food prices have been falling for most of the past year as

Supermarkets face increased competition from Drugstores. In 2011

the prices in supermarkets have increased again.

Trade promoted volume is quite stable.

VAT on Food : 6%

19 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

-0.8

-2.0

-0.7

1.8

-1.2

2.4

2.3

2.5

2.6

-1.2

1.1

-1.1

-2.4

-0.3

0.2

0.5

0.2

2.2

-3

-2

-1

0

1

2

3

4

5

VALUE VOLUME PRICE

In Germany, the effect of rising Food prices seems to have hit again in

Q3 2011 with Non-Food flat in volume as prices stabilise.

Trend of Food Sales in Germany

(Packaged Food, Confectionery, Drinks, exc. Alcohol)

0.9

2.3

1.7

2.5

0.8

0.4

-0.9

-0.7

-0.2

0.1

0.7

0.3 0.5

0.6

0.2 0.9

1.8

1.4

-3

-2

-1

0

1

2

3

4

5

Trend of Non-Food Sales in Germany

(Pet Food, Health, Toiletry, Household)

SOURCE: SymphonyIRI, All Outlets inc. Aldi

YoY Value & Volume price change

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

20 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

The uncertainties in Europe and the entire world, resulting from the

financial crisis in several countries, are causing consumers to spend

less money and calculate each single additional spending in detail

5.8% of the German population is without a job at the end of

September

The consumer price index climbs further and reaches an increase of

2.6% by the end of September

While sales for food categories in total remain stable compared to Q3

2010, dairy products and drinks are showing an increase in value

sales. Main reason for this positive development is the increase of

prices by 3.9% (drinks) and 6.8% (dairy products)

As the actual average price is continuously rising, value sales also

increase by 2.6%. In Q3 2011 volume sales however have dropped by

2.4% compared to 2010

In comparison to 2010, hard discounter ALDI is the only sales channel

- apart from beverage specialty - showing a decline in sales

Overview - Germany

VAT on Food 7% & 19%

21 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

5.1

3.3

2.5

1.8

1.5

1.9

4.0

2.3

4.4

1.0 1.1

1.7

-0.7

0.5

0.1

0.4

0.0 1.0

-1

0

1

2

3

4

5

6

VALUE VOLUME PRICE

In the UK, price rises are still hitting home as volume has declined in Q3

2011 on Non-Food but more resilient on Food in a poor summer.

SOURCE: SymphonyIRI, All Outlets, YoY Value & Volume price change

Excludes Northern Ireland

Trend of Food Sales in the UK

(Packaged Food, Confectionery, Drinks, exc. Alcohol)

2.4

2.1

1.0

1.5

-0.1

1.0

3.5

1.2

2.2

1.1

1.6

0.9

-1.2

1.3

-1.6

-1.4

-0.8

0.3

-3

-2

-1

1

2

3

4

5

6

Trend of Non-Food Sales in the UK

(Pet Food, Health, Toiletry, Household)

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 H1 2011 Q3 2011

22 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Overview United Kingdom

At 5.0% for October 2011, inflation is well above the Governments target.

Unemployment has risen above 8%. Temporary employment has increased within this

total. This level is expected to increase further.

GDP grew in the 3rd quarter of 2011 by 0.5% vs Q3 2011. This is below the Govt

forecast. The forecasts for 2012 and beyond has been reviewed downwards.

VAT was reduced in Dec 2008, returned in Jan 2010 and went up again in Jan 2011.

Credit has stabilised but the savings ratio has started to fall.

Own Label (OL) value share is currently increasing very slightly in Food & Drink, unit

share is up a little more but so far the anticipated rise of OL hasnt really happened since

brands are promoting strongly.

Prices started to rise before VAT went up in Jan 2011 and continue to go up. The current

rate of increase is over 4%.

FMCG sales started to falter and volumes are down in 2011. The growth in Q410 was as

a result of bad weather inducing stocking up, pre VAT sales, extra shopping day in the

Christmas week and perhaps a feeling to have a good Christmas before cutting back in

2011.

A spell of good weather, a different timing for Easter and the Royal Wedding all

contributed to growth at some stage but the underlying volume trend is still down.

Summer seasonal products have performed badly due to poor weather from May to July

but improved dramatically for 2 weeks at the end of September when there was a short

heatwave.

VAT on Food 0% & 20%

23 CopyrlghL Symphonyl8l Croup, 2011. ConfldenLlal and roprleLary.

Tim Eales

Director of Strategic Insight

SymphonyIRI Topline Report

The Quarterly European Barometer

Third quarter (Q3 2011)

Trade Promotion Trends

24 Copyright SymphonyIRI Group, 2010. Confidential and Proprietary.

24 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

0

10

20

30

40

50

60

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011

Deal levels vary enormously across Europe - Food

GERMANY

NETHERLANDS

UK

ITALY

SPAIN

FRANCE

% SALES WITH TRADE PROMOTION (Volume SP, NL, UK Value IT, GE, FR)

Trade Promotion level is still very high in the UK.

Continuing to fall in France and beginning to drop in Italy.

25 Copyright SymphonyIRI Group, 2010. Confidential and Proprietary.

25 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

0

10

20

30

40

50

60

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011

Deal levels vary enormously across Europe Non-Food

GERMANY

NETHERLANDS

UK

ITALY

SPAIN

FRANCE

% SALES WITH TRADE PROMOTION (Volume SP, NL, UK Value IT, GE, FR)

Trade Promotion levels have remained high in the UK, as well showing an

increase in Spain and The Netherlands.

26 Copyright SymphonyIRI Group, 2010. Confidential and Proprietary.

26 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

0

10

20

30

40

50

60

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011

Deal levels vary enormously across Europe All Products

GERMANY

NETHERLANDS

UK

ITALY

SPAIN

FRANCE

% SALES WITH TRADE PROMOTION (Volume SP, NL, UK Value IT, GE, FR)

The Netherlands and Spain have shown an increase in both Food and Non-Food

in the latest quarter.

27 Copyright SymphonyIRI Group, 2010. Confidential and Proprietary.

27 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Turning Insights Into Actions

Insights Recommendations

As prices rise, shoppers will be actively looking

for trade promotions.

Categories beginning to lose sales as

shoppers carefully manage their budgets.

Shoppers looking for value for money.

Shoppers buying more based on need than

want.

Private label offers are gaining share as offer

quality for value.

Reduce deal depth to maximise value sales

when on offer.

Innovate to stimulate interest and curiosity in

the category.

Maintain, if not, increase weeks on deal.

Stimulate need through media activity.

Understand the private label and brand

portfolio in each category and what erodes

key brand positions. Review shopper needs,

retailer strategies, market mix and develop

mitigation strategies in priority categories.

28 Copyright SymphonyIRI Group, 2010. Confidential and Proprietary.

28 Copyright SymphonyIRI Group, 2011. Confidential and Proprietary.

Final Notes

Source: SymphonyIRI Group InfoScan, syndicated retail tracking service

Methodology: Seven quarters of review, YoY data for FMCG

Country coverage: France, Germany Greece, Italy, the Netherlands,

Spain, United Kingdom

To gain deeper insights, predictive analysis and

recommendations on specific products, categories,

segments, channels or retailers

contact your SymphonyIRI Consultant

or email to: eu.marketing@symphonyiri.com

Contact: SymphonyIRI Group, eu.marketing@SymphonyIRI.com, Tel: +33 1 30 06 23 62

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 2019 09 20 New Balance Harvard Business CaseDocument7 pages2019 09 20 New Balance Harvard Business CaseFrans AdamPas encore d'évaluation

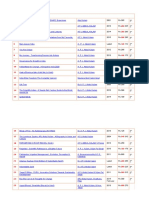

- Pulse Report Chilled & Fresh Q2-2014Document20 pagesPulse Report Chilled & Fresh Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Ambient Q2-2014Document20 pagesPulse Report Ambient Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Frozen Food Q2-2014Document20 pagesPulse Report Frozen Food Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Confectionery Q2-2014Document13 pagesPulse Report Confectionery Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Pet Q2-2014Document20 pagesPulse Report Pet Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Baby Q2-2014Document20 pagesPulse Report Baby Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Drinks Q2-2014Document20 pagesPulse Report Drinks Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Alcohol Q2-2014Document20 pagesPulse Report Alcohol Q2-2014IRIworldwidePas encore d'évaluation

- Pulse Report Frozen Food Q1 2014Document20 pagesPulse Report Frozen Food Q1 2014IRIworldwidePas encore d'évaluation

- Pulse Report Pet Q1 2014Document20 pagesPulse Report Pet Q1 2014IRIworldwidePas encore d'évaluation

- Pulse Report Alcohol Q1 2014Document20 pagesPulse Report Alcohol Q1 2014IRIworldwidePas encore d'évaluation

- Pulse Report Alcohol Q1 2014Document20 pagesPulse Report Alcohol Q1 2014IRIworldwidePas encore d'évaluation

- Pulse Report Pet Q1 2014Document20 pagesPulse Report Pet Q1 2014IRIworldwidePas encore d'évaluation

- IRI Price & Promo 2014 Full ReportDocument32 pagesIRI Price & Promo 2014 Full ReportIRIworldwidePas encore d'évaluation

- Pulse Report Household Q3 2013Document20 pagesPulse Report Household Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Frozen Food Q1 2014Document20 pagesPulse Report Frozen Food Q1 2014IRIworldwidePas encore d'évaluation

- Pulse Report Baby Q3 2013Document20 pagesPulse Report Baby Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Confectionery Q3 2013Document13 pagesPulse Report Confectionery Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Drinks Q3 2013Document20 pagesPulse Report Drinks Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Pet Q3 2013Document20 pagesPulse Report Pet Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Chilled and Fresh Q3 2013Document20 pagesPulse Report Chilled and Fresh Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Ambient Q3 2013Document20 pagesPulse Report Ambient Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report Alcohol Q3 2013Document20 pagesPulse Report Alcohol Q3 2013IRIworldwidePas encore d'évaluation

- Pulse Report-PersonalCare-Q3-2013Document20 pagesPulse Report-PersonalCare-Q3-2013IRIworldwide100% (1)

- Perfect In-Store Execution, A Major Source of Untapped ValueDocument12 pagesPerfect In-Store Execution, A Major Source of Untapped ValueIRIworldwidePas encore d'évaluation

- Pulse Report Pet Q4 2012Document20 pagesPulse Report Pet Q4 2012IRIworldwidePas encore d'évaluation

- Special Report: Private Label 2013 Retailers Re-Assess Quality As Shoppers Focus On Value Instead of PriceDocument37 pagesSpecial Report: Private Label 2013 Retailers Re-Assess Quality As Shoppers Focus On Value Instead of PriceIRIworldwidePas encore d'évaluation

- Pulse Report-FrozenFood-Q3-2013Document20 pagesPulse Report-FrozenFood-Q3-2013IRIworldwidePas encore d'évaluation

- Special Report: Pricing and Promotion in EuropeDocument31 pagesSpecial Report: Pricing and Promotion in EuropeIRIworldwidePas encore d'évaluation

- Pulse Report Personal Care Q4 2012Document20 pagesPulse Report Personal Care Q4 2012IRIworldwidePas encore d'évaluation

- Chapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFDocument58 pagesChapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFAbdul Rahman SholehPas encore d'évaluation

- W2-Prepares Feasible and Practical BudgetDocument15 pagesW2-Prepares Feasible and Practical Budgetalfredo pintoPas encore d'évaluation

- Security Questions in UPSC Mains GS 3 2013 2020Document3 pagesSecurity Questions in UPSC Mains GS 3 2013 2020gangadhar ruttalaPas encore d'évaluation

- Transfer Pricing 8Document34 pagesTransfer Pricing 8nigam_miniPas encore d'évaluation

- Q & A Set 2 PDFDocument18 pagesQ & A Set 2 PDFBharathiraja MoorthyPas encore d'évaluation

- Grafton Business Services 2023Document61 pagesGrafton Business Services 2023Vigh ZsoltPas encore d'évaluation

- Magnetic Effect of Current 1Document11 pagesMagnetic Effect of Current 1Radhika GargPas encore d'évaluation

- ED Tox PGS.2021Document4 pagesED Tox PGS.2021Jm unitePas encore d'évaluation

- Applied Thermodynamics - DraughtDocument22 pagesApplied Thermodynamics - Draughtpiyush palPas encore d'évaluation

- Nikulin D. - Imagination and Mathematics in ProclusDocument20 pagesNikulin D. - Imagination and Mathematics in ProclusannipPas encore d'évaluation

- MSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKDocument19 pagesMSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKLSBRPas encore d'évaluation

- Chapin Columbus DayDocument15 pagesChapin Columbus Dayaspj13Pas encore d'évaluation

- Torah Hebreo PaleoDocument306 pagesTorah Hebreo PaleocamiloPas encore d'évaluation

- Motion and Time: Check Your Progress Factual QuestionsDocument27 pagesMotion and Time: Check Your Progress Factual QuestionsRahul RajPas encore d'évaluation

- W 26728Document42 pagesW 26728Sebastián MoraPas encore d'évaluation

- Labor Rules English Noi Quy Bang Tieng Anh PDFDocument27 pagesLabor Rules English Noi Quy Bang Tieng Anh PDFNga NguyenPas encore d'évaluation

- Lesson 73 Creating Problems Involving The Volume of A Rectangular PrismDocument17 pagesLesson 73 Creating Problems Involving The Volume of A Rectangular PrismJessy James CardinalPas encore d'évaluation

- Science Project FOLIO About Density KSSM Form 1Document22 pagesScience Project FOLIO About Density KSSM Form 1SarveesshPas encore d'évaluation

- Trần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisDocument2 pagesTrần Phương Mai - Literature - Irony in "Letter to a Funeral Parlor" by Lydia DavisTrần Phương MaiPas encore d'évaluation

- QTP Common FunctionsDocument55 pagesQTP Common FunctionsAnkur TiwariPas encore d'évaluation

- Economies of Scale in European Manufacturing Revisited: July 2001Document31 pagesEconomies of Scale in European Manufacturing Revisited: July 2001vladut_stan_5Pas encore d'évaluation

- Samsung LE26A457Document64 pagesSamsung LE26A457logik.huPas encore d'évaluation

- Aero - 2013q2 Apu On DemandDocument32 pagesAero - 2013q2 Apu On DemandIvan MilosevicPas encore d'évaluation

- Sample A: For Exchange Students: Student's NameDocument1 pageSample A: For Exchange Students: Student's NameSarah AuliaPas encore d'évaluation

- Sayyid DynastyDocument19 pagesSayyid DynastyAdnanPas encore d'évaluation

- Volvo D16 Engine Family: SpecificationsDocument3 pagesVolvo D16 Engine Family: SpecificationsJicheng PiaoPas encore d'évaluation

- KalamDocument8 pagesKalamRohitKumarSahuPas encore d'évaluation

- JD For Library Interns Sep 2023Document2 pagesJD For Library Interns Sep 2023Bharat AntilPas encore d'évaluation

- Final Module in Human BehaviorDocument60 pagesFinal Module in Human BehaviorNarag Krizza50% (2)