Académique Documents

Professionnel Documents

Culture Documents

City Limits Magazine, January 1978 Issue

Transféré par

City Limits (New York)0 évaluation0% ont trouvé ce document utile (0 vote)

61 vues20 pagesCover Stories: Planner and coordinator of urban studies at SUNY-Purchase appointed executive director of ANHD; Leventhal Appointed New HPD Commissioner, Surprise Choice by Susan Baldwin.

Other stories include Susan Baldwin on Community Development Credit Unions' nationwide attempts to get low income neighborhood residents to collectively accumulate savings to save housing; A coalition of anti-redlining groups win a public hearing; Bernard Cohen on the Consumer-Farmer Foundation support of housing rehabilitation projects; Philip St. Georges on the daunting issue of the increased number of city-owned building; A profile of WVMV community radio in Manhattan Valley; Bernard Cohen on the impact neighborhoods are starting to have on policy in Washington.

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentCover Stories: Planner and coordinator of urban studies at SUNY-Purchase appointed executive director of ANHD; Leventhal Appointed New HPD Commissioner, Surprise Choice by Susan Baldwin.

Other stories include Susan Baldwin on Community Development Credit Unions' nationwide attempts to get low income neighborhood residents to collectively accumulate savings to save housing; A coalition of anti-redlining groups win a public hearing; Bernard Cohen on the Consumer-Farmer Foundation support of housing rehabilitation projects; Philip St. Georges on the daunting issue of the increased number of city-owned building; A profile of WVMV community radio in Manhattan Valley; Bernard Cohen on the impact neighborhoods are starting to have on policy in Washington.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

61 vues20 pagesCity Limits Magazine, January 1978 Issue

Transféré par

City Limits (New York)Cover Stories: Planner and coordinator of urban studies at SUNY-Purchase appointed executive director of ANHD; Leventhal Appointed New HPD Commissioner, Surprise Choice by Susan Baldwin.

Other stories include Susan Baldwin on Community Development Credit Unions' nationwide attempts to get low income neighborhood residents to collectively accumulate savings to save housing; A coalition of anti-redlining groups win a public hearing; Bernard Cohen on the Consumer-Farmer Foundation support of housing rehabilitation projects; Philip St. Georges on the daunting issue of the increased number of city-owned building; A profile of WVMV community radio in Manhattan Valley; Bernard Cohen on the impact neighborhoods are starting to have on policy in Washington.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 20

CITY LIMITS

COMMUNITY. HOUSING NEWS

JANUARY 1978 VOL. 3 NO.1

LEVENTHAL APPOINTED

NEW HPD COMMISSIONER

KRA VITZ, A PLANNER,

IS DIRECTOR OF ANHD

Alan Kravitz

Alan S. Kravitz, a planner and coordipator of urban studies at the

State University of New York College at Purchase, has been appointed

executive director of the Association of Neighborhood Housing Developers.

The announcement of Kravitz's selection, effective Jan. 23, was made

by Margaret McNeill,president of ANHD and director of the West Harlem

Community Organization.

In addition to teaching, Kravitz, 35, has served as a consultant to

several community-based housing organizations.

He is co-author of a forthcoming book, A Critical Ecology of Urban

Life, advocating decentralization and the development of a wide range of

neighborhood institutions. Among his other writings is a recent essay, sub-

mitted for inclusion in a House of Representatives subcommittee report, on

the negative effects of "planned shrinkage" of cities.

continued on page 12

SURPRISE CHOICE

by Susan Baldwin

Nathan Leventhal, a lawyer

who at 34 has already seen several

brief tours of duty in government,

has been appointed Commissioner

of New York City's Department of

Housing Preservation and Develop-

ment(HPD).

Mayor Edward I. Koch an-

nounced the surprise appointment

January 13, subject to clearance

from the Department of Investiga-

tion, at the end of his second week

in office.

The new administration was

under mounting pressure from

housing activists and tenants with-

out heat in the bitter cold of winter

to choose its top official. They were

concerned about the steady decline

of city housing and services as well

as the impact of the City's fourth-

year Community Development

application.

As former Mayor John V. Lind-

say's Rent and Housing Mainten-

ance Commissioner in 1972-73,

Leventhal was credited with speed-

ing up implementation of the Maxi-

mum Base Rent (MBR) law, inaugu-

rating the city's low income coop-

erative conversion program, and

supervising the transition to the new

housing court enforcement system.

continued on page 9

Community Credit Unions Seek

by Susan Baldwin

Redlining-a hard fact of life, like the midwinter

flu, for the people fighting to save low and moderate

income housing in the inner city.

"Teach Your Dollars to Have More Cents." This

motto is a kind of medicine of the future being tested

today all over the nation by Community Development

Credit Unions (CDCU's) to combat the widespread

disinvestment in inner-city housing by the savings banks

and savings and loan institutions.

The medicine, in the form of the accumulated sav-

ings of the residents of low income neighborhoods, can

work to save housing, says James N. Clark, executive

director of the National Federation of CDCU's, but

only if credit unions' mortgage loans are introduced

into the neighborhoods as part of a comprehensive pro-

gram devised and supported by a wide range of public

and private agencies.

Clark, who works out of the federation's national

headquarters in Brooklyn, spoke to CITY LIMITS in

mid-January in the wake of recent Congressional legis-

lation permitting the federally-chartered CDCU's to

make 30-year mortgage loans. The previous limit was

ten years.

For the 4OO-odd CDCU's, of which there are three

in New York City, having the right to make 30-year

mortgage loans "demands that the CDCU's become

more organized," says Clark. "They must learn how to

lobby and be ready to go to court" to defend themselves

against the attacks of other savings and lending institu-

tions which object to the CDCU's tax-free status and

the 12% limit mandated by law on the interest they

charge to their members.

CDCU's are part of a large and growing national

credit union movement. For the most part an outgrowth

of the 1960's Office of Economic Opportunity (OEO)

programs, they are important to the residents and

businesses of low income city neighborhoods because

often they provide the only accessible savings and credit

mechanism to generate vital community development

activities at less than usurious cost.

CDCU's differ from traditional credit unions in

that their charters do not require that members be

bound by some common association, such as church

membership or place of employment, but only that

they be residents of the same community and in need of

financial help.

The president of the National Federation of

CDCU's is Adolfo G. Ahtyon. He sat recently in the

organization's temporary Brooklyn headquarters, read-

ing the applications for membership that came in the

2

day's mail, and talked about the future of CDCU's in

low income neighborhoods. "You know," he told a

visitor, "I really do think we'll make it."

The federation, whose stationery bears the dollar-

and-cents-wise motto, is three years old this month.

"I got involved with this national movement quite by

accident," Alayon continued. "It was 1971, and a

number of us who had experience in the federal govern-

ment's OEO credit unions were meeting in Washington

trying to figure out what to do since [President] Nixon

had impounded all the neighborhood money. I said

this was a political problem, and the next thing I knew,

I was the head of a political action committee that

finally grew into the national federation. "

Alayon and other credit unions' representatives

volunteered the year-and-a-half that it took, beginning

in 1975, to do a low -income credit union feasibility

study. Last April they won a $72,000 demonstration

grant from the Community Services Administration

(CSA) to underwrite the national staff's salaries.

"Weare writing up a proposal right now based on

the feasibility study," said Alayon. "We hope to re-

ceive a $20 million CSA grant, possibly by this sum-

mer," he added, which the federation would use to

support from 150 to 200 new CDCU's around the

country. He noted that, even if the $20 million is not

forthcoming, the federation has been promised $2 mil-

lion to continue its current work, with which it will be

able to help about 20 new CDCU's.

Alayon is the president of CABS-Consumer

Action Program for Bedford-Stuyvesant-which, with

three other New York City CDCU's known as the "New

York Four," gave early leadership to the national move-

ment. Of the three local CDCU's in operation today,

CABS, originally a federal demonstration program

funded by OEO, has 3,200 members and between

$800,000 and $900,000 in assets. The Lower East Side

Federal Credit Union (LESFCU), another product of

the OEO years, has 1,800 members and assets of about

$500,000. The third, East Harlem's Union Settlement

Federal Credit Union, was chartered in 1957 with

meager staff contributions gleaned from a friendly

poker game. Today it lists more than 1,300 members

and assets of $1.2 million.

A fourth member of the "New York Four," the

Manhattan Economic Development Credit Union, was

placed in involuntary liquidation by the federal govern-

ment last fall after four years' operation under the juris-

diction of the Mid-West Side Community Corporation.

"It's not easy to run a credit union in a poor neigh-

$$$ Freedom For Poor People

borhood such as ours," says Cecilio Fernandez, a

member of CABS' board of directors. "You have to

absorb more losses than you would if you were in a

better neighborhood. The main point we have to keep

in mind is that we are providing a service for a large

group of people who have no other place to go to

borrow money, and that we are offering interest rates

comparable with any bank's."

What are the factors that draw to the COCU's the

members who help them survive the hazards of limited

capitalization and the hostility of competing financial

institutions? An ongoing study, done for the federation

by the research division of the Credit Union National

Association (CUNA), and updated to 1976, provides the

following answers:

"(1) For many members the credit union is the only

source of consumer credit;

"(2) Loans at credit unions generally may be ob-

tained at lower rates than those available from other

financial institutions, and in the case of COCU's, the

rate differentials are likely to be more pronounced than

for other credit unions;

"(3) The income generated from the loans tends to

stay in the community in the form of dividends, reserves

and salaries, rather than accrue to outside lenders;

"(4) Financial counseling and consumer education

services have helped members better understand the use

of credit and more wisely utilize their limited financial

resources; and

"(5) Savings have stayed in the community and

have been recycled through loans."

The study, which reports the responses of slightly

less than half the 400 COCU's, reveals that the respon-

dents have granted a total of about $440 million in loans

to members since 1971, and that members pay about

$4.4 million less in inttrest each year than they would

pay to traditional fin 1 institutions.

Commenting r on the early days of his credit

union, Eugene anager of Union Settlement,

said, "It was a staff credit union (of the

Union Settlement House), operating a few hours per

week with limited assets and knowledge. In 1963, a

full-time treasurer was made available by the parent

organization; trust and assets began to grow and mem-

bership was slowly opened to the community.

"Those in good standing had to vouch for the

integrity of those they were recommending for member-

ship," Sklar continued. "Those on welfare were granted

an initial loan maximum of $100 which, upon good

experience, could slowly grow to $250. And so, the

board struggled with whether we were social workers or

bankers before deciding we were benevolent bankers

and sending recalcitrant borrowers off to the collection

agency."

Screening of would-be members is a key to stability,

all New York COCU's agree. "We want to help every-

one who needs help," said the federation's Alayon, who

still works for CABS, "but this can become a big prob-

lem if it is not adequately controlled. If you just accept

members off the street, you'll get rip-off artists who

travel around the city joining credit unions. You have to

monitor the membership and you have to watch that

continued on page 18

Reprinted/rom the Santa Cruz (Calij.) Community Credit Newsletter.

3

CAREY ASKS $5 MILLION

FOR NEIGHBORHOODS PROGRAM

Gov. Hugh Carey has proposed a $5 million

appropriation for the neighborhood preservation

program, a ten-fold increase over the current

budget.

Carey requested the increased funding in his

executive budget for 1978-79. The State Legisla-

ture must adopt the budget by March 31 for the

fiscal year beginning April 1.

The State Division of Housing and Com-

munity Renewal has been flooded with applica-

tions from community-based housing organiza-

tions for funding under the new neighborhood

preservation program.

More than 100 groups from all over New York

State applied for grants totaling $7.2 million, a

DHCR spokesman said. The program has $500,000.

The response was so much greater than anti-

cipated that the administrators of the program

have asked for additional help.

DHCR is hoping to complete its evaluation of

the applications and make final decisions by

Feb. 1. The spokesman declined to predict how

many groups would be funded.

The new law permits community-based hous-

ing organizations to contract with DHCR for

grants to cover their operating expenses. The con-

tracts are renewable up to three years.

Approximately $350,000 is expected to go to

New York City groups and $150,000 to groups in

upstate New York.

Organizations that are not selected this time

will be eligible for the next round of funding,

scheduled for next spring after the new state

budget has been approved. _

KOCH PLEDGES

ERP SPEED-UP

Mayor Edward I. Koch and Deputy Mayor

Herman Badillo announced this month the imple-

mentation of a "speed-up" formula in the Emer-

gency Repair Program (ERP) that would insure

earlier inspections of no-heat buildings and pro-

vide for more timely payment of verified repair

bills submitted by private contractors.

"Our goal," the Mayor said, "is to encourage

small repair contractors to work for ERP, knowing

that they will not have to wait months before they

are paid-months that they can't afford to wait."

Noting past delays in City payment to small

fuel service contractors, Koch stressed that,

under the new program, contractors with legiti-

mate bills would be paid within a 12-day period.

The Mayor has also authorized overtime pay

for ERP employees whenever prolonged or severe

cold weather increases the backlog of unan-

swered tenant requests for no-heat inspections

beyond the normal range of one or two working

days. .

4

ERP can provide regular fuel delivery and

boiler repair to multiple dwellings where the ten-

ants agree to pay their rents directly to the City

rather than to landlords who conSistently fail to

provide heat. For further information, call: Ray-

mond O'Connor, Director of Recoupment, ERP,

125 Church Street, N.Y.C. 10007; telephone, (212)

566-1044.

In a related matter, Mayor Koch said he is

preparing an executive order that would allow

the City to issue a vacate order to tenants in land-

lord-abandoned or City-owned under-occupied

multiple dwellings, with the idea of relocating

these tenants to a "safe and warm building, rather

than spend tens of thousands of federal dollars to

bring heat" to such dwellings.

"The City does have a right to relocate these

tenants," Koch explained, noting that such a

course would be taken only for buildings "not

in a prescribed treatment program." _

,

"

ANTI-RECLINE COALITION WINS BANKING HEARING

The New York State Banking Department,

responding to pressure from a coalition of anti-

redlining groups, has scheduled a public hearing

Jan. 25 on proposed regulations governing bank

mergers and new branches.

Superintendent Muriel Siebert agreed to the

hearing after meeting Dec. 6 with more than 60

representatives of anti-redlining community

groups who assembled at her office at the World

Trade Center.

Herb Steiner, chairperson of South Brooklyn

Against Investment Discrimination, told Siebert

the coalition members were concerned that they

had not been consulted while the regulations were

being drafted.

"We feel that when the new regulations were

proposed, we were not made part of that," Steiner

said. "We wish that there had been some outreach

to call our people in so that your staff could have

gotten the results of our ideas."

Siebert at first suggested that they submit

their views in writing. When the group rejected

that as inadequate, she consulted briefly with her

aides and said, "I see no problem. I will be de-

lighted to give you public hearings."

The hearing will be held at Union Temple,

17 Eastern Parkway near Grand Army Plaza in

Brooklyn, beginning at 6:30 p.m.

The proposed regulations concern interpreta-

tion of the "public convenience and advantage"

criteria that banks are supposed to satisfy in order

to merge, to open new branches or to close old

branches.

As drafted, the regulations would require the

Superintendent and the Banking Board to con-

sider "whether the applicant has taken steps to

ensure that all applications for credit received in

its existing facilities in this State, as well as in

the proposed facility, are considered on their

merits."

Anti-redlining community groups want

stronger regulations to require that banks show a

significant volume of investment and active ad-

vertising in older urban neighborhoods they are

supposed to be serviCing before being allowed to

open branches in newer suburban communities.

The meeting with Siebert was unexpected.

The entire State Banking Board was scheduled to

meet that day and a spokesman had already told

the coalition that the meeting would be closed.

The group planned to distribute leaflets.

When they arrived at the World Trade Center

they learned that the board meeting had been can-

celed due to an Upstate snowstorm. The group

then decided to demand a meeting with Siebert.

The request was denied at first, then granted when

the anti-redlining delegation made it clear they

were not gOing to leave the office without a

meeting.

In addition to South Brooklyn AID, organiza-

tions represented at the meeting included the

Greenpoint-Williamsburg Committee on Redlin-

ing, several Bank on Brooklyn groups and the

Reinvestment Committee of the Northwest Bronx

Community & Clergy Coalition. _

Members of the citywide anti-redJining coalition packed the confer- Herb Steiner, chairperson of South Brooklyn Against Investment

ence room of the New York State Banking Department. Standing is Discrimination.

s

C<O>IDl1IlImer"",f armer:

A 1HI <0> 1IlI i IDl g f <0> 1IlI IDl J aft i <0> IDl

by Bernard Cohen

Construction at the sweat equity project on East

11 th Street was at a standstill. The latest phase of work

was finished. Requisitions totalling $12,000 had been

submitted to the city. And meanwhile there was no

money to buy new materials. A day went by; two days,

a week. And still no check from the city.

Cash flow has not been an uncommon problem in

a city system where processing requisitions from sweat

equity sites has been slow and loan money paid only

after the job was finished. There was no telling how

much longer the wait for reimbursement would be.

Frustrated at the idleness of the project, Michael

Freedberg of the East 11 th Street Housing Movement

turned to a reliable source-the Consumer-Farmer

Foundation.

"So what's the problem? Meyer Parodneck, the

foundation's president, said he told Freedberg. "I said,

'Mike, what's the requisition for?'"

"$12,000."

"Come up and get a check. "

That is the kind of timely service that has made the

foundation a pivotal part of the self-help housing

rehabilitation movement in New York City. It has been

a unique resource for community-based housing organi-

zations, providing them with infusions of cash to tide

them over while they waited for other loans that move

through slower pipelines.

In four years, the Consumer-Farmer Foundation

has given loans totalling $200,000 to $300,000 for more

than 60 housing rehabilitation projects. It has backed

every single low-income sweat equity project in the city.

Interest-free foundation seed money loans have

enabled groups to purchase equipment and supplies,

pay architectural, legal, insurance and other preliminary

fees and begin actual work on a building even before

they can start drawing on construction loans.

As in the case of East 11 th Street, foundation loans

have also come to the rescue with financing so

that construction was not held up due to cash flow prob-

lems that result sometimes because of the city's slow

rate of processing expense vouchers.

There is widespread agreement among community

housing sponsors that without these loans, not only

would sweat equity and other forms of self-help housing

rehabilitation throughout New York City have sput-

tered, but the growth of many neighborhood-based

housing organizations would have been stunted.

"Their support has been extremely vital," said

Ramon Rueda, director of the People's Development

Corp., which has received seed money loans of $55,000

from the foundation for housing rehabilitation in the

e

Melrose-Morrisania area of the South Bronx. "Without

their assistance, the chances of our developing into the

organization we are is doubtful," Rueda said.

The Manhattan Valley Development Corp. bor-

rowed $1,300 to obtain insurance that was a prerequisite

for closing the mortgage loan on two buildings slated to

become low-income cooperatives. MVDC also borrowed

$5,000 to pay for architectural services prior to closing

the loan on a third building.

"We have received the most wonderful cooperation

and response from the foundation," said Leah Schneider

of MVDC. "I think they're the only place in the city we

can count on for an immediate response. "

If Consumer-Farmer is an unlikely name for an

organization dedicated to housing, it is because from

1937 until 1971 it functioned as a milk cooperative,

providing consumers with a saving of to a quart.

At the time the cooperative was organized, the

principal source of milk in the city was doorstep delivery

and "ma and pa" neighborhood stores. Because

mechanical cooling was in its infancy and transporta-

tion limited, dairy farmers had to do business with the

milk company with a nearby receiving station.

To liberate the farmer from the grip of the milk

monopoly, the Consumer-Farmer Milk Cooperative

Inc. was formed to process, market and distribute milk.

Farmers, many of them with small operations, became

the members. Processing plants were purchased in New

York and New Jersey. At its peak, the cooperative had

72 distributing stations, all located in New York City's

poorest neighborhoods.

By 1970, technology had so changed the dairy busi-

ness that the social purpose of the cooperative was no

longer relevant. Milk stored in bulk on the farm was

being pumped into tanks for easy transport. The farmer

now had a choice of markets. Neighborhood groceries

which had been responsive to local consumer groups

were displaced by large supermarkets owned by large

corporate chains. The number of distribution stations

was down to 32 and many were plagued by theft and

vandalism.

The economics of farming was changed as well.

The number of separate farms was declining but the

size of the remaining ones was growing.

"By 1970, we were dealing with a bunch of million-

aires," said Parodneck. While it took 90 farms to

produce 500 4O-quart cans in 1946, 15 farms were

producing the same amount in 1970, he added.

"It was getting to the point where all we were doing

was making money. It wasn't very inspiring," Parod-

neck said. "The social objective was frustrated so we

.j

.. '

;.

....

went back to our origins-serving the consumer at the

point of greatest need. "

If nutrition was a paramount consumer need of the

1930s, shelter was seen as the consumer issue of the

1970s.

"We felt that the poor could do more to supply

themselves and to influence the supply of shelter than

they had been doing," Parodneck said. "The practice

was always to have somebody doing things for people.

I never liked that. If you want to do something I'll help

you. I won't do it for you."

In 1971, the Consumer-Farmer Milk Cooperative,

Inc. terminatc::d its activities. Its assets were liquidated

and $1 million was turned over to the new Consumer-

Farmer Foundation Inc.

In addition to the East 11 th Street Housing Move-

ment and MVDC, Consumer-Farmer has also given

loans to the Oceanhill-Brownsville Tenants Association,

the Renigades Housing Movement, United Harlem

Growth and the Mosque of Islamic Brotherhood.

Philip St. Georges, director of the Urban Home-

steading Assistance Board, called the foundation

"totally essential" to the housing movement and said

its loans had smoked the city out on supporting self-

help housing efforts.

"The foundation was willing to take the risk with

money at a point where the government was wavering

and even negative about whether to do a project," St.

Georges said. The foundation's commitment, he added,

served as leverage to prod the city into approving loans

to community groups.

Getting a loan from the foundation means passing

the test of dedication.

"My standards are strictly subjective and per-

sonal, " Parodneck said. "What is the dedication of the

people to the project? What sacrifices are they prepared

to make to make the project succeed?

"If a group has lived without heat or hot water,

in a building with boarded-up windows, and withstood

the invasion of addicts-these people have a lot of

conviction. "

That is not to say that Parodneck, a lawyer who

knows real estate, or his longtime assistant, Martin

Young, are soft touches. By all accounts, their standards

of competence and fiscal responsibility are rigorous,

and a group whose other financing is not in place,

whose other legal obligations have not been met or

whose internal structure is shaky should not be opti-

mistic about getting a loan.

"He has taken me to the ropes twice as to the

wisdom of the economics of expanding and the impact

of the seed money," Rueda said. "He is very, very

tough. "

Jim Harris, who negotiated a loan for Los Sures in

Brooklyn, said Parodneck "brings a mature and experi-

enced business-like attitude" to the issue of financing

housing rehabilitation. He said the foundation turned

7

Meyer Parodneck

down Los Sures's first request for a loan because the

group had not gotten its other loan commitments. " He

is hard-nosed about money and hard-nosed about

personal honor," Harris said. "It is a refreshing

combination. "

Unlike most creditors, Parodneck seems to have

the genuine admiration and affection of those who have

borrowed money from him. It is a debt that appears to

go well beyond money.

Parodneck in turn gives the groups high marks for

fiscal integrity and honesty. "Oh, we've had some losses

(he estimated $80,000) and we have some loans on the

books I am quite sure will never be collected. But that's

all right. Those are risks we expect to take. "

One concern that he expressed was the slow rate at

which some of the interest-free loans are paid back.

"We have to find a better formula," he said, adding

that he was considering applying a penalty as an incen-

tive for more timely payments.

Parodneck was sharply critical of the city's housing

agency (Housing Preservation and Development), call-

ing it "an extremely incompetent" department. He also

disapproved of the city's participation loan program,

which carries a five to six per cent interest charge, but

admitted he may be a little old fashioned. '

"The trouble with me is I'm too old. To me five per

cent is a lot of money. It's a high interest rate and $40-a-

room is prohibitive, a luxury rent. .. "

He predicted that there will be a need for a long

time to come for the kind of service the Consumer-

Farmer Foundation supplies. "There's plenty of room

in this field that public funds will never supply," he

said. "The bureaucracy is slow moving. It has to creep.".

,

City-Owned Buildings:

The New Issue of 1978

by Philip St. Georges

With the many wishes of Happy New Year! only

recently fading, housing activists around the City are

returning from the holiday season to discover a grim

new issue in 1978: more City-owned buildings than

ever before. And more City-owned buildings than

imaginable.

Examine these facts:

No. of Current City-Owned Properties 6,000

No. of Properties Actually In Rem Tax

Foreclosure by the City of New York

(Staten Island, Bronx, Manhattan) 13,800

Upcoming Brooklyn In Rem

Foreclosure 12,000 - 15,000

Total Possible City-owned Property

in 1978 31,800 - 34,800

Approximate No. of Dwelling Units

(x7d.u. average) 222,600 -243,600

These figures have been supplied by the City's own

Corporation Counsel, In Rem Foreclosure unit. They

are the result of several years of maneuvering within

City Hall and the City Council over passage and imple-

mentation of the new In Rem tax foreclosure law.

The "old law" had enabled the City of New York

to foreclose upon any owner of private property who

was three years or more behind in the payment of real

estate taxes. The controversial "new law" changed this

allowable arrearage time period to one year or more

(excepting one- and two-family homes).

The rationale for this change had been that the

new law would enable the City to prosecute delinquent

property owners more rapidly, thereby insuring a timely

flow of needed tax revenues into a hard pressed City

treasury. The result appears to have been the opposite-

owners are throwing in the towel en masse and walking

away from properties already hard hit by the inflation

of oil, insurance and utilities costs and the disinvestment

of mortgage and insurance lenders. Inflation and red-

lining started abandonment. The new In Rem law

appears to have brought abandonment to newall-time

high levels, in more neighborhoods than ever before.

8

The unfortunate result for community organiza-

tions and housing activists all around the City is clear.

The greatest slumlord in the City of New York, The

Department of Real Property (formerly the Dept. of

Real Estate) will drastically increase its already secure

position as largest owner and worst maintainer of hous-

ing in New York City. The same 60 managers who are

now incapable of managing 6,000 properties (IOO prop-

erties per person) will now try their skills upon 534

properties per person, or nearly 3,800 units of housing

per manager!

This bleak pictur.e is made worse by the continuing

inability of the Department of Housing Preservation

and Development (HPD) to gear-up any effective pro-

grammatic or development alternatives utilizing Com-

munity Development Block Grant Funds. As of this

writing, only the Community Management Program,

managing approximately 2,000 units of currently city-

owned housing, shows any promise of coping with the

problems. Direct Sales (I-Title Transfer), Participation

Loans (6 buildings closed), receivership, et al. remain

ineffective and mired in bureaucratic quagmires.

So welcome to the New Year! Whole neighbor-

hoods are collapsing and coming up for auction by the

City. Rehabilitation mortgages and property insurance

of any sort are totally unavailable from the private

market. City programmatic alternatives seem not to

exist. And no one knows quite what to do.

Barring a sudden change in the In Rem foreclosure

law by the City Council liberalizing the ability of owners

to redeem their properties from tax foreclosure, 1978

will be the year of City-owned buildings. And while it is

still too early to determine the response of community

planning boards and community housing organizations,

the key new alternatives seem to be land banking and

Public Housing Authority intervention. And of course,

organizing. Because in the end, the City will always

find it easier to sell buildings for short term financial

gains than to deal effectively with the long term prob-

lems of community revitalization. So we must stop

them, again.

Philip St. Georges is director oj the Urban Homestead-

ing Assistance Board.

HPD continlled

Reached at his home on the weekend following his

appointment, Leventhal said he had never applied for

the HPD job nor submitted his resume to Koch. "I was

not in the job market," he asserted.

Leventhal went on, "Every four years I've had

feelings about getting involved in a city agency, and

sometimes this results in getting into hot water too."

As to the needs of the city's low income neigh-

borhoods, Leventhal said, "When I was Rent Commis-

sioner, I did as much as I could for low -income people.

I was familiar with the sweat equity program, and within

that context, we did as much as we could."

Natba. LenDthal

To many observers in the neighborhood housing

movement, their surprise that the choice was one whom

most "insiders" had not predicted was matched by their

relief that Leventhal has a reputation for being alert

to the housing needs of low and moderate income

people.

"It's a wonderful appointment," said Philip St.

Georges, director of the Urban Homesteading Assist-

ance Board (U-HAB). "I worked with him when he was

rent commissioner and found him to be a highly

competent administrator as well as sensitive to new ideas

and the potential of community organizations to build. "

Many others, however, said they did not know

Leventhal but that, on the surface,he sounded accept-

able. And several housing activists noted that it had

been four years since he played an active role in city

housing. One observer said Leventhal's current weak-

nesses lay in the areas of community development and

specific programs for low .. income housing, but added,

"I'm not worried."

Margaret McNeill, president of the Association of

Neighborhood Housing Developers (ANHD), said,

"Most people know very little about him," adding

that she would have preferred someone more familiar

with the housing programs of the neighborhood organi-

zations and someone who has a tie with the federal

government to get more funding for New York City.

McNeill was a member of a citizens' search com-

mittee co-chaired by Clara Fox, executive director of

United Neighborhood Houses, and architect David

Castro-Blanco. Early in December, this committee

submitted a long list of recommendations on the HPD

commissionership to the Koch transition team. This

list did not include Leventhal's name.

Commenting on Leventhal's appointment, Fox

said, "IL came as a total surprise to everyone in the

housing field. This name had never appeared on any

of the lists.

"Our committee," Fox continued, "was merely

a search and outreach committee. The Mayor-elect

made it very clear that he would make the final decision

himself. He did interview the people on our list and a

few others.

"To be perfectly honest, I don't know Leventhal,"

Fox added, "but, from those who knew him [in the

Lindsay administration], the reaction I got was fairly

positive. "

The new Commissioner will face several demands

from the housing movement. Among these are improve-

ments in the implementation of the participation loan

program; continuation and expansion of the community

management program; more equitable allocation and

speedier application of the Community Development

funds; an effective approach to the problems of emer-

gency repair, arson, building seal-up and demolition;

and a more effective bureaucracy at HPD.

A member of the Koch transition team who asked

not to be named told CITY LIMITS in the first week of

the new administration, "There are going to be hard

times ahead. The Mayor will not throw out money to

groups just because the community is screaming."

According to this adviser, "The Mayor expects all

groups to be realistic in their requests. Just as the Mayor

plans to be tough with the unions, the same applies

here," he predicted. "I think he means what he says.

He's going to be a tough Mayor."

The Koch administration has also indicated that no

single official in the Mayor's office will have authority

over housing . .

Alluding to this administrative decision, Leventhal

said, "I don't see any problem here. [Deputy Mayor]

Herman Badillo will be very active in this area of con-

cern, and already has been. We hope to show that this

concern is translated into action. . . I am sure that

[Deputy Mayor] David Brown will also have some hous-

ing positions to make known. "

Commissioner-designate Leventhal refused com-

ment on current HPD programs until his appointment

was cleared, but he did stress the importance to the

city's housing effort of making public specific, timely,

and accurate data on federally -assisted housing pro-

grams. "No one is ever sure of the numbers," he said.

"I ran into that problem in the Lindsay days, but I'm a

'numbers' man, and I don't like that kind of ambiguity.

I think there should be a clear accounting."

[See story on Section 8 Housing Assistance, Page 12 ]

Commissioner-designate Leventhal's appointment

met with wide approval from area housing officials.

Thomas Appleby, who resigned last September as

head of the city's Housing and Development Admini-

stration to become regional administratof of the federal

Department of Housing and Urban Development

(HUD), said of Leventhal, "I think it's a good appoint-

ment. He has background in the department. I'm sure

other officials will have something to say about the

office and the appointment. "

Daniel Joy heads HPD's Office of Rent and Hous-

ing Maintenance; the position Leventhal once held. Joy

said, "I worked with Leventhal in the Lindsay admini-

stration, and, during that period, I acquired a great deal

of respect for his administrative skills and abilities."

Another HPD official, Deputy Commissioner Carl

Callender of the Division of Evaluation and Compli-

ance, said of Leventhal's new job, "Sensitivity is the

key word, and I believe he will bring in people who are

sensitive to the needs of our communities.

" The best test of the new leadership," Callender

asserted, will be the people Leventhal puts around him

at HPD. "I think he'll be firm enough to fire me if I'm

not doing my job. Mayor Koch has said he expects his

commissioners to do a good job, and, if not, they'll

have to go. That's an incentive to do a good job. "

Referring to the new Commissioner-designate,

housing official Alexander Garvin said, "I feel Nat is

going to be an excellent Commissioner. He is energetic,

committed to getting things done, and interested in

seeing that the city's housing stock improves. He is

committed to rehabilitation. He always was, and that's

not going to be a battle. " Garvin, Deputy Commissioner

in charge of Rehabilitation and Neighborhood Preserva-

tion, also noted, "He is a bright, capable, shrewd man. "

Another view of the new Commissioner, as he

awaited word of his clearance, came from tenant leader

Jane Benedict of the Metropolitan Council on Housing.

"I'm hard boiled," she acknowledged, "and I

don't think the housing policies of the city are going to

be changed by Nat Leventhal. Housing should be for

10

people, rather than for the banking and real estate

interests. If Nat Leventhal can turn this around, that

will be fine, but I don't think he can. Housing policy is

not made by the Commissioner, but by the City Admini-

stration" she concluded, "and I haven't seen any policy

change in the new administration. "

Prior to his service as Rent and Housing Mainten-

ance Commissioner, Leventhal worked from 1967-69 on

the U.S. Equal Employment Opportunity Commission,

adjusting cases of alleged discrimination in employment.

From 1969-70, he was fiscal director of the City's

Human Resources Administration; from then until

1972, he was assistant to the mayor, acting as liaison to

City agencies.

When his service as Rent and Housing Maintenance

Commissioner ended in 1973, Leventhal served briefly

as special counsel to a U.S. Senate subcommittee on

administrative practice ~ n d procedure, and entered

private law practice in 1974. He is a public member of

the New York City Bar Association Committee on

Housing and Urban Development.

Leventhal was graduated in 1966 from Columbia

University Law School, where -he was editor-in-chief of

the Law Review from 1965-66.

Leventhal is single and lives in Manhattan. His

salary will be $54,000.

Last summer, Leventhal wrote a letter that was

helpful to a coalition of tenant groups who waged a

successful campaign to repeal a Beame administration

"labor cost pass-along" rent increase. The coalition

contended that the city was letting landlords use a con-

fusing section of the rent regulations (Section 33.8) to

demand exorbitant rent increases in the guise of mere

"pass-alongs" of higher labor costs.

Leventhal's letter, according to William Rowen,

treasurer of the Coalition Against Rent Increase Pass-

Alongs (CARIP), sided with the coalition's interpreta-

tion that Section 33.8 of the MBR (Maximum Base

Rent) law never intended rent - increases beyond the

yearly 7.5 per cent.

CARIP submitted the letter at a City Council hear-

ing on the pass-along issue last September. "It was

effective,"'Rowen said in helping to win the repeal.

~

JOBS PROGRAM FOR 38 NONPROFITS

GETTING UNDER WAY DESPITE SNAGS

The CET A Title VI contract, providing 375 jobs

for 38 community-based organizations, is moving

ahead with approval last month by the Board of

Est imate and a decision by the groups to sign it

despite serious problems with the recruitment

procedure.

Margaret McNeill, president of the Associa-

tion of Neighborhood Housing Developers, the

umbrella organization, signed the contract Jan. 19.

The Emergency Financial Control Board was ex-

pected to give its approval soon.

Passage of the $4.4 million program by the

Board of Estimate on Dec. 1 marked a major vic-

tory for the 38 organizations. The contract in-

includes more than $155,000 in administrative

funds budgeted for use by the local groups to

partially defray expenses of their one-year public

service contracts.

Interviews at the local organizations for the

375 jobs are set for the end of January.

One of the major controversies surrounding

the Title VI program has been the design of an

enrollee recruitment procedure. The city's original

plan was to fill all Title VI jobs by a citywide

referral process involving neighborhood man-

power service centers, the New York State Em-

ployment Service and the Department of Social

Services.

This system was strongly opposed by com-

munity-based organizations involved in the

11

program since it precluded the recruitment of

unemployed neighborhood residents by the local

groups. Since September, a citywide coalition of

Title VI nonprofit sponsors has been negotiating

with the city and federal officials for redesign of

the hiring system.

In December, the outgoing Beame admini-

stration issued a revised recruitment plan permit-

ting nonprofit Title VI organizations to fill 15 per

cent of their allotted jobs through local advertise-

ment, interviewing and hiring-bypassing the

established referral sources. The remaining 85 per

cent of the slots are to be filled through the

standard recruiting system. The city's Department

of Employment insists that its established referral

agencies are capable of locating well-qualified

individuals for the positions.

At a general meeting of ANHD umbrella parti-

cipants on Jan. 13, serious doubts were expressed

as to the capacity of the referral agencies to match

applicants to Title VI job descriptions.

However, in order to prevent further delay of

the program's implementation and in view of the

fact that the city has agreed to permit groups to

request neighborhood residents for all positions,

the Title VI groups voted to begin recruitment and

hiring under the city's conditions.

However, the groups also resolved to closely

monitor and evaluate their progress under this

system and halt its use by the ANHD umbrella if

serious problems arise. _

KTtlVin collJillued

Kravitz joined the faculty of SUNY -College of

Purchase in September, 1976. Prior to that he taught at

Ramapo College in New Jersey, New York University,

Hunter College, College of New Rochelle and the

University of North Carolina.

Between 1968 and 1976, he served as a housing and

planning consultant to the Coalition for Human Hous-

ing and Pueblo Nuevo Housing and Development

Association on the Lower East Side and the Clinton

Planning Council-Save Clinton Committee.

As consultant he conducted studies for these .

organizations and provided assistance for a wide range :

of projects from selection of public housing sites to

development of rehabilitation strategies to economic

development and building organizational bases.

He is currently a consultant for the Project on

Tenant Organization and Tenant Action at the Columbia

University Center for Policy Research.

Kravitz said strengthening the capability of com-

munity-based organizations and persuading policy

makers not to turn their backs on the city's poorest

neighborhoods were two critical issues of the moment.

"The groups that have been around for a while

have gotten a sense of how much they can get out of

the political process, what its limits are, how to play it,"

he said. "I think what they have to do now is really

strengthen their internal institutional capability and

they have to become to some extent financially inde-

pendent."

Convincing policy makers of the feasibility of

saving neighborhoods like Manhattan Valley, East

Harlem and the South Bronx will not be easy, he added,

because "there are a lot of people who are more pessi-

mistic about the city and therefore think it necessary to

write off those neighborhoods. "

An important role of ANHD, he continued, will be

"making it clear to policy makers that there is a viable

approach. . . that produces housing units, that begins

to stabilize things, that's appropriate to those neigh-

borhoods, and demonstrating the kinds of resources

that are required. It doesn't just happen. It happens

with a resource base. "

Calling himself a decentrist, Kravitz described the

efforts of community-based housing organizations as

"the cutting edge of change" and said, "I think that

the development of institutional capability at the neigh-

borhood level is the important thing. "

Kravitz is married and has two sons, Christopher,

8, and Matthew, 5. His wife Sara cooks parttime at the

Turning Point restaurant in Piermont, N. Y. and is the

food editor of the Rockland County magazine COll-

nection. They live in Nyack. _

12

SECTION 8:

THE NUMBERS GAME

Each y e a ~ at this time, people go looking for

specific information about the number of housing

units to be subsidized by Section 8 housing

assistance in the new year, only to find that these

figures are elusive. Getting them can make for the

most confusing "numbers game" in town.

CITY LIMITS spent the better part of a week

recently in calls and visits to the Department of

Housing Preservation and Development (HPD),

the Department of City Planning, and the area

office of the federal Department of Housing and

Urban Development (HUD), only to find that this

year's figures are still "tentative." According to

best estimates, however, New York City will be

allocated $66.5 million in Section 8 subsidies.

Section 8 wi II not apply to all of the 11,249

dwelling units (du's) that constitute the city's

housing program goals for fiscal 1978 (October 1,

1977 - September 30, 1978). Of this total, conven-

tional public housing financing (non-Section 8) is

planned for 1,059 du's of new construction and

850 du's of substantial rehabilitation.

Section 8 housing assistance will apply to

936 du's of new housing for the elderly (Sec. 202),

440 du's of new public housing, and 1,010 du's of

other government-financed and insured new con-

struction.

Substantial rehabilitation assisted by Section

8 will include 786 du's of housing for the elderly

(Sec. 202), 358 du's of public housing, and 1,300

du's of other government-financed and insured

rehabilitation.

In addition, the Housing Authority will certify

4,510 eligible families for Section 8 subsidies in

existing housing. _

With this issue, Susan Baldwin joins

CITY LIMITS as Assistant Editor. She has

covered housing, urban renewal, politics,

and education as a general assignment

reporter for the York (Pa.) Gazette and Daily,

the Quincy (Mass.) Patriot Ledger, the New

Haven (Conn.) Register, and the weekly West-

sider in Manhattan.

,

PHN AGAIN SPONSORS ORGANIZERS SCHOOL

The Peoples Housing Network will begin

another series of classes in its SCHOOL FOR

ORGANIZERS beginning Feb. 21.

Classes will be held every Tuesday evening

for 10 weeks.

Included among the topics offered will be:

starting a community organization, program

development, anti-redlining strategies, tenant

organizing, housing management and rehabilita-

tion programs and legislation dealing with neigh-

borhood issues.

Close to 200 people from more than 30 organi-

zations attended all or some of the classes at the

School last summer. These included staff and

leadership of community organizations, members

of tenant associations, students, members of

church groups, representatives from planning

boards, staff of service agencies, CET A workers

FACT BOOKS

"Fact Books" for each of New York City's

59 community districts are now available at the

Department of City Planning, Room 1616, 2 Lafa-

yette Street, Manhattan, Monday through Friday

from 9 a.m. until 5 p.m.

Each 12-page "Fact Book" contains census

data, a district map, names and telephone num-

bers of elected officials and .the representatives to

the district service cabinet, and titles of relevant

publications of the City Planning Department. The

pamphlets include such information as median

years of school completed in each district, per-

centage of overcrowded housing units, and char-

acteristics of district households.

The fee for each booklet is 25 cents, if picked

up at 2 Lafayette Street, and 50 cents if mailed.

According to Victor Marrero, former chairman

of the City Planning Commission who as Chair-

man introduced the "Fact Books" last fall , they

are "the first part of the Department of City Plan-

ning's massive Community Portfolio project, a

new state-financed computer information system

to provide data on land use and local characteris-

tics of the city's 59 community districts."

13

and interested individuals.

The cost of 10 classes is $25 per student.

Individual classes are $3.00. Limited scholarships

and group discounts are available. Classes will be

held at the offices of the Association of Neighbor-

hood Housing Developers, 29 E. 22nd St., 10th

floor. All classes will be from 6 p.m. to 8 p.m.

To enroll or for further information contact:

Roger Hayes

Peoples Housing Network

29 E. 22nd St.

New York, New York 10010

(212) 533-5650

Special longer training programs (Le., day-

long or week-long) for new staff, CETA workers

or other individuals can be arranged if enough

people are interested. -

BOILER COURSE

Housing Conservation Coordinators (HCC)

will sponsor a second course in boiler-burner

maintenance-repair and energy conservation,

beginning January 24, at HCC' s Clinton head-

quarters, 404 West 48th Street, Manhattan.

Enrollment fee for the course is $10, and

classes will be limited to 20 students. HCC' s first

course ended January 3rd.

The schedule for course II is as follows: Jan-

uary 24, 26, and 31; February 7, 9, 14, 16,21, 23, and

28; March 2, 7, and 9. Graduation will take place

March 14. Each session runs for two hours, from

7 until 9 p.m.

Areas of instruction will include types and

structures of boilers and burners, boiler cleaning,

oil filter replacement, relay replacement, safety

mechanisms, radiator repair, and weatherization

techniques.

Certificates will be awarded to t he partici-

pants who successfully complete the course.

Anyone interested in the program should

send a $10 check or money order to Housing Con-

servation Coordinators, Boiler Course, 777 10th

Avenue, New York, N.Y. 10019.

Stay Tuned to WVMV Radio

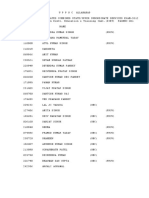

Celeste Morales and Reinaldo Pacheco getting ready to go on the air.

It is about 10 minutes before air time and Celeste

Morales, wearing a pair of powder blue headphones, is

leaning into microphone #1. "This is WVMV com-

munity radio in Manhattan Valley on the air again,"

she says in a soft but steady voice.

Sitting next to her, Reinaldo Pacheco flips a switch

and slowly turns a dial, testing his voice in the mike.

"It should read between 80 and zero," advises George

Ruiz, the engineer, looking over their shoulders at the

needle. "It also depends on the person talking," adds

Celeste.

After a few more t$, the sound level is set and

before long the teenagers, at this tiny community-run

radio station are a program of music, local

news items and public service announcements.

WVMV is the new voice of Manhattan Valley, a

4O-square block area between 100th and 110th Streets,

Central Park West and Broadway on the Upper West

Side of Manhattan.

Except for some high-rise luxury apartments along

Central Park West and some surviving once-elegant

townhouses, the area is characterized by deteriorating

old law and new law and a 3,OOO-unit public

housing project. It is predominantly Hispanic and low-

income.

14

The radio station went on the air Dec. 13 after

more than a year of planning and work. (Then mayor-

elect Koch called that night to offer congratulations.)

The station's range is still small but its unique potential

to entertain, inform, train and bring the Manhattan

Valley community together is enormous, according to its

sponsors.

"This is going to take off," said Dan Mack, a

young Fordham University communications professor

who helped set up the radio station. "Radio is so simple

that people should be able to do it for themselves," he

said.

Mack sees the community-controlled station as a

necessary alternative to the conventional media. Not

only is WVMV a source of information that Manhattan

Valley's population cannot get from the big radio sta-

tions, Mack says, but it also places a powerful com-

munications tool into the hands of people who normally

have no access to the major broadcast institutions that

shape everyone's life.

The station's 5-watt signal, which is transmitted

through existing power lines, now reaches about 600

people in a two block area. Once inside a building,

the signal radiates for about 250 feet so that it can be

picked up on a portable radio as well as plug-in radio.

r

Cars passing through the blocks can also tune in. The

frequency is 590 on the AM dial.

Because WVMV does not use the airwaves, it is not

regulated by the Federal Communications Commission.

Sponsors hope to expand the reach of the radio

station to up to one-half of Manhattan Valley. That will

mean either buying additional transmitters (at $300 to

$400 each) or finding a way to shift to the airwaves with-

out falling under FCC jurisdiction.

WVMV's current broadcast schedule is 4 p.m. to

7 p.m. on Tuesday and Friday. Programming is still

being developed, but the station's goal is to mix music

with about 15 minutes every hour of discussion of hous-

ing, health, welfare and other issues of importance to

the neighborhood. -

At the moment, most of the programming is in

English. Organizers of the station discovered that many

of the Spanish-speaking residents of the community

read and write only in English. Celeste is serving as

translator at the station and a format that will include

more Spanish is being worked out.

Ann Schwalbach, director of Parents for Improved

Playgrounds, a co-sponsor of WVMV, said the idea for

the station was an outgrowth of the after-school

program sponsored by PIP. The organization got a

federal grant in 1976 for the broadcast equipment,

which includes a mixing board, turntable and several

tape recorders in addition to the transmitter. A tele-

phone connection enables listeners to call the station

and speak on the air.

The station has had to overcome a number of tech-

nical and logistical problems. Early on, when the station

was located in a church, the engineer discovered during

tests that the signal was being absorbed into the copper

roof of the building and going nowhere. Space has been

a continuing worry. Right now the station is broadcast-

15

ing from a cramped control room at the Manhattan

Valley Development Corp. (also a co-sponsor) at 931

Columbus Ave. The station plans to move soon to space

a few doors away in a building being rehabilitated by

MVDC. Equipment trouble knocked the station off the

air for about three weeks.

One of the things he learned from putting the

station together, Mack said, was how slowly things

move in a situation that depends on voluntary efforts.

"I was sure we would be set up in six months," he said.

To prepare for the station, Schwalbach asked com-

munity organizations to participate in programs and

Mack taught classes on operating the equipment.

The technical training was easy, Mack said, com-

pared with overcoming the conventional model of how

a broadcaster should sound and getting people to be

themselves.

"Everyone has a style and a personality that comes

out and everyone has a lot to contribute," he said.

"Community radio is different. You don't have to

sound great. "

At first, people were very shy about going on the

air. "In general they were taught you had to be smart,

handsome, witty and very articulate. But that was not

the purpose of the Communications Act of 1934, which

said the airwaves belong to the people. It took convinc-

ing people that they were legitimate just because they

had never been on radio before. "

Before long, the stage fright had melted. "I'm

always on the air," said Reinaldo, who admitted he had

been nervous at first. "I didn't want to go on." But

after some practice, "I got used to it."

What happens if he suddenly runs out of things to

say on the air? No problem. "I just give the key to the

engineer and he plays a record. "

NEIGHBORHOODS & WASHINGTON

by Bernard Cohen

WASHINGTON-The voice of the nation's neighbor-

hoods is beginning to be heard in that part of the Wash-

ington bureaucracy that is concerned with urban policy

and programs. Traditionally, mayors have spoken for

the cities and there is little doubt that they are still

regarded as the "legitimate" ambassadors of the

nation's urban centers. But there are also some signs

that neighborhoods are beginning to carve out a place

in the scheme of federal urban policy.

A recent trip through the federal maze turned up a

number of programs that seem to be targeted more at

neighborhoods than at City Hall. There is a new

assistant-secretary level office of neighborhoods ' at

HUD. Neighborhood issues are a compooent of Presi-

dent Carter's soon-to-be-announced domestic policy.

And Congress, recognizing that city neighborhoods

"are a national resource to be conserved and revi-

talized, " has created a national neighborhood com-

mission to identify ways of promoting their survival.

Many observers in Washington say all this con-

stitutes a beachhead, the modest beginning of a neigh-

borhood consciousness at the federal level, which they

attribute to better organization of neighborhoods and to

politics.

"I think the neighborhood issue is joined into this

government for political reasons," said Milton Kotler,

head of the National Association of Neighborhoods.

"The President was elected by a lot of grassroots sup-

port, blacks, working people, neighborhood people.

"Being in for political reasons means that the

bureaucracy looks at the neighborhood section of

government or the neighborhood commission with

great skepticism. "

Kotler said neighborhoods must build a "legitimate

foundation" stressing citizen responsibility and account-

ability.

What follows is a bag of programs and policies

that form an outline of the emerging role of the neigh-

borhoods in federal urban policy.

HUD - Msgr. Geno Baroni is the assistant secre-

tary for the new office of neighborhoods, voluntary

associations and consumer protection. Baroni is said by

insiders to have led the battle to target 75 percent of

Community Development Block Grant funds to low and

moderate income people. (The results of that battle will

be known when HUD releases fmal CD r.,egulations.)

URPG - President Carter last year named an inter-

agency Cabinet-level task force, called the Urban and

Regional Policy Group, to formulate a new national

urban policy. URPG was divided into several task

1

us

forces, one of which was on neighborhoods. The initial

drafts of the URPG's report recommended $25 million

in direct funding for experienced neighborhood develop-

ment organizations; $100 million for mini -grants (' 1 ,000

to $40,(00) to community groups for a wide range of

revitalization efforts; $25 million of CDBG funds set

aside for awards to city governments with concurrence

of local groups; training of local government officials

to work with neighborhood groups and revision of citi-

zen participation standards. Neighborhood-oriented

critics of the report said its thrust was rapid economic

revitalization of cities without proper concern for its

potential effects (displacement) on many of the people

who l i v ~ there. President Carter has rejected the report

on the grounds that it is program-oriented rather than

policy-oriented. It is being revised and the program

expenditure figures ar(:; expected to be dropped.

NATIONAL COMMISSION ON NEIGHBOR-

HOODS - A brand new commission created by Congress

to examine the effect on neighborhoods of federal,

state and local policies, programs, laws, public and

private investment, poverty and citizen initiated revitali-

zation efforts. The commission, which plans hearings

around the country, is charged with recommending

new ways of facilitating neighborhood preservation and

revitalization. It will have 20 members, including two

senators, two members of the House of Representatives

and 16 public members.

ACTION - Action is a federal agency that includes

VISTA and the Peace Corps. In a new shift, VISTA

volunteers are being assigned to neighborhood-based

organizations as well as state government and old-line

agencies. National VISTA grants are going to some 12

broad-based umbrellas of grass roots organizations.

LABOR - A $115 million youth employment pro-

gram of the Labor Department is aimed specifically at

neighborhood-based organizations. Created last August,

the Youth Community Conservation and Improvement

Projects program seeks to employ 22,600 youths, ages

16 to 19, in community-improvement projects, including

rehabilitation of housing. New York City received $3.8

million for the program.

JUSTICE - The Law Enforcement Assistance

Administration has a $15 million program to sponsor

crime prevention programs at the community level.

CSA - Community groups that 'want to do their

own building weatherization can apply to Operation

Open City's Self-Help Volunteer Labor Program, which

will pay for materials up to $125 a unit. The money

comes from the federal Community Services Admini-

stration through the city's Community Development,

Agency to Operation Open City.

CENSUS - The Census Bureau is developing plans

to provide substantial census data by neighborhood, a

first. Under the proposed program, the Bureau would

prepare guidelines and hold workshops on the use of the

statistical data. The chief elected official of the munici-

pality or the "central council" of neighborhoods would

submit a request indicating the blocks making up the

neighborhood for which the census information is

sought.

COMMUNITY REINVESTMENT ACT OF 1977 -

The law contains a new provision that requires federal

supervisory agencies, such as the Home Loan Bank

Board and the Federal Deposit Insurance Corporation,

to "take into account" the lending records of banks

CAREY NAMES MARRERO

TO STATE HOUSING POST

Victor Marrero, former chairman of the New

York City Planning CommisSion, was sworn in

Jan. 9 as commissioner of the state's Division of

Housing and Community Renewal.

The $47,800-a-year state housing job had

been vacant since last spring.

Marrero served as chairman of the Planning

Commission for two years. Mayor Koch replaced

him with Robert Wagner Jr.

Marrero, 36, previously served as assistant

counsel to Governor Carey and before that as

executive director of the Planning Commission,

district manager of the South Bronx Office of

Neighborhood Government and neighborhood

director of the Model Cities program in the Bronx.

Considered a leading contender for the

Democratic nomination for the CongreSSional

seat vacated by Deputy Mayor Herman Badillo,

Marrero withdrew from the race, reportedly in the

face of opposition to him by Badillo and Bronx

Borough President Robert Abrams.

17

when evaluating whether to grant bank applications for

new branches, mergers and consolidations.

URBAN REINVESTMENT TASK FORCE - The

task force, created in 1970, provides technical assistance

(and sometimes grants) to neighborhood groups to

encourage urban revitalization. Its method is to encour-

age increased urban lending by the savings and loan

industry. The program, it should be noted, is designed

to help declining but not severely blighted neighbor-

hoods. The task force credits its programs with stimu-

lating approximately $30 million in urban reinvestment

through 1977. A bill to establish a Neighborhood Rein-

vestment Corp., which would institutionalize and

expand the program of the task force, passed the Senate

last September. The House is expected to take up the bill

in the current session. -

WAGNER APPOINTED

Robert F. Wagner Jr., 34, has been appointed

chairman of the City Planning CommisSion, effec-

tive January 1,1978. His annual salary is $47,093.

Elected Manhattan Councilman-at-Iarge in -

1973, Wagner, a Democrat, ran in the November

election as a Republican-Liberal for Manhattan

Borough President and was defeated by Andrew

Stein.

An advocate of City Council reform, Wagner

received a 100 per cent voting record from the

New Democratic Coalition (NDC). He was gradu-

ated magna cum laude with a B.A. degree in 1965

from Harvard College, studied history as a Mar-

shall Scholar from 1965-67 at the University of

Sussex, England, and received an M.A. degree

from the Woodrow Wilson School of Public Affairs

at Princeton University where he was a Public

Affairs Fellow.

1n another appointment, Jolie Hammer, a

former deputy Manhattan borough president, was

named director of local government and com-

munity relations at the Department of City Plan-

ning. Her yearly salary is $36,437.

Hammer was former Manhattan Borough

President Percy Sutton's representative on the

Board of Estimate. Her duties as deputy borough

president included serving as community liaison

for Sutton's office. _

Credit Unions continued

people do not overspend," Alayon concluded.

The neighborhood residents who make up the

membership of the three New York CDCU's are for

the most part the working poor, welfare recipients or

persons living on meager social security Most

of the CDCU savings accounts they keep are very small.

When they cash payor benefit checks at the CDCU,

members are urged to deposit a small amount-perhaps

the fee they would have had to pay a commercial check

cashing service.

"In addition to cashing checks and encouraging

people to save, we also sell food stamps and money

orders, and accept utility payments for the small fee of

35 cents, and do fmancial counseling," explains Ame-

rico Rodriguez, loan officer at CABS. According to

Rodriguez, CABS is the main distributor of food stamps

in Bedford-Stuyvesant and the parts of Williamsburg it

serves.

Despite substantial and constantly growing mem-

bership rolls, the New York CDCU' s count on the much

larger deposits that are provided by non-member

organizations and individuals-foundations, schools,

banks, insurance companies, other credit unions and

the like. These, like all deposits, are insured up to

$40,000 by the National Credit Union Administration

(NCUA), which regulates all federally chartered credit

unions.

How do the CDCU's in their low income neigh-

borhoods attract the non-member deposits? "It's very

simple," says Hector Figueroa of LESFCU. "We write

letters to these organizations explaining who we are,

stressing that any emergency money they want to keep

here will be available if they run into any fiscal trouble.

We tell them, that if they deposit this money with us,

they will be helping the people living here to have a

better life. "

Figueroa points out that non-member deposits in

his and the other CDCU's do not add up to huge sums

of money. There are typically from five to ten such

deposits ranging in size from $10,000 to $40,000, he

says.

Most of the CDCU credit currently extended to

residents of these low -income neighborhoods is in small

personal, or "signature" loans. CDCU's grailt loans of

any amount, no matter how small, while most banks

refuse to consider any loan for less than $750 or $800.

"If you go to a bank and ask for a $500 loan,"

says Alayon, "they tell you to go get Master Charge or

Visa. We make these smaller loans and charge 120/0 on

the unpaid balance, while the credit cards charge a flat

18%," he explains.

On automobile loans, the CDCU's offer 9%

interest rates, against the customary 12% on auto loans

obtained elsewhere.

What plans do the CDCU's have to put to work

their new power to make long-term mortgage loans?

Both Alayon, president, and Clark, as executive

18

director of the federation, agree on the importance of