Académique Documents

Professionnel Documents

Culture Documents

Project Rough

Transféré par

Raj GaneshDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Project Rough

Transféré par

Raj GaneshDroits d'auteur :

Formats disponibles

1

Chapter 1 Introduction

Introduction An investment is the choice by the individual, after thorough analysis, to place or lend money in a vehicle (e.g. property, stock securities, bonds etc.) that has sufficiently low risk and provides the possibility of generating returns over a period of time. Investing is the active redirection of resources: from being consumed today, to creating benefits in the future; the use of assets to earn income or profit. As stated earlier the main motive of investment is to earn profit which is also known as the return of investment. There are a large number of investment instruments available to the investors. These investment instruments perform different tasks. The insurance is mainly used to provide risk cover to the individuals; property investments are usually for long term gains; bank FDs and government securities are used mainly for secure returns on investments while equity investment and Mutual Funds are used for wealth creation as they give very high returns. Though they give very good returns to the investors the risk associated with these instruments is also higher. As a result it is likely that the investors also lose their money while investing in these instruments. Recently the stock markets all over the world had crashed. The investors had lost thousands of crores of rupees as the value of the stocks in their portfolio fell sharply. The world is facing a grave economic crisis. The financial markets the world over are in a downturn and this has resulted in a drop of investor confidence. This has led to a vicious cycle. The banks and the financial institutions are not lending money to the public and the industry fearing a slowdown. As the industries are not getting the money their profits are being reduced. These reduced profits directly affect the share prices of the company. The fall in the share prices leads to a loss for the investors who do not want to invest their money. This leads to further loss for the companies as they dont get money and this cycle continues. Now the world economy is showing signs of a recovery. The central banks of the various countries as well as the governments are taking steps to pump in more money into the economy so that the economy revives and the investors confidence is restored. The stock markets are slowly climbing up towards their peak level because of the measures that have been taken. The investors are slowly recovering from their losses. It is being increasingly clear that the recovery will be started from the markets of the developing nations like India and China. The government of India is being praised all over the world for its regulatory framework which enabled it to withstand the global financial crisis relatively unscathed. The general elections held

recently have given a majority to Dr. Manmohan Singh led U.P.A. government and the stock markets have reacted very positively to this development. The investor confidence has been restored due the possibility of a stable government under the leadership of the great economics who is the architect of the economic reforms in the country. This confidence is reflected in the stock markets which broke the upper circuit the day after the announcements of the results. The present scenario is a good time to study what the investors are expecting from their investments and how aware they are about the different modes of investments that are available to them. With the recovery of the stock markets the investors are also looking to get back to investing. The time is very good for marketing of various investment instruments as the investors want to put their idle money to some productive use.

INDUSTRYPROFILE:

The mutual fund industry is a lot like the film star of the finance business. Though it is perhaps the smallest segment of the industry, it is also the most glamorous in that it is a young industry where there are changes in the rules of the game every day, and there are constant shifts and upheavals. The mutual fund is structured around a fairly simple concept, the mitigation of risk through the spreading of investments across multiple entities, which is achieved by the pooling of a number of small investments into a large bucket. Yet it has been the subject of perhaps the most elaborate and prolonged regulatory effort in the history of the country.

A little history:

The mutual fund industry started in India in a small way with the UTI Act creating what was effectively a small savings division within the RBI. Over a period of 25 years this grew fairly successfully and gave investors a good return, and therefore in 1989, as the next logical step, public sector banks and financial institutions were allowed to float mutual funds and their success emboldened the government to allow the private sector to foray into this area. The initial years of the industry also saw the emerging years of the Indian equity market, when a number of mistakes were made and hence the mutual fund schemes, which invested in lesser-known stocks and at very high levels, became loss leaders for retail investors. From those days to today the retail investor, for whom the mutual fund is actually intended, has not yet returned to the industry in a big way. But to be fair, the industry too has focused on brining in the large investor, so that it can create a significant base corpus, which can make the retail investor feel more secure.

Company Profile: About the Royal Bank of Scotland Group In 300 years, The Royal Bank of Scotland Group has grown to become one of the largest financial services groups in the world. Our brands operate around the globe to provide banking services for individuals, businesses and institutions. Proud of our history, we remain committed to innovation and service. In 2007, the Group strengthened its presence across the globe through the purchase of several parts of the Dutch bank, ABN AMRO, including their businesses in India. The Group serves a variety of medium to large enterprises, including multi-national corporations (MNC) and financial institutions. We offer integrated consumer and business banking services such as transaction banking, risk management, investment banking, private banking and asset management. Our clients each have different aspirations, goals and needs. We work closely with and for them, providing solutions for their particular personal and business circumstances. About RBS India RBS India offers an unparalleled suite of client services in India. Using our global reach and drawing on the expertise of our team of research, sales and trading, equity capital market and mergers & acquisitions (M&A) advisory professionals, we have led many of the biggest and most innovative landmark transactions in India for our Corporate and Institutional Clients. We offer a broad range of transaction banking, fixed income and foreign exchange products and services, including sales and trading, fixed income origination, derivatives, structured lending and commodity financing. Additionally, we provide a diverse range of product offerings including personal loans, credit cards, savings accounts, financial planning, investment and insurance services, to meet the everyday financial needs of over a million Personal Banking clients in India.

Asset Management is among the fastest growing asset managers, with just two years of operations in the country. We have ever-increasing distribution and aim to emerge as a leading player in the Indian asset management industry. Leveraging the Group's comprehensive research and diverse range of investment products, we offer our clients investment options in fixed income, equities, money markets and structured products. Our Microfinance program, the largest amongst its peer foreign banks in India, is aimed at delivering credit to our target community of impoverished rural woman through intermediaries called microfinance institutions.

HISTORY OF MUTUAL FUND

The mutual fund industry in India started in 1963 with the formation of Unit Trust of India, at the initiative of the Government of India and Reserve Bank. The history of mutual funds in India can be broadly divided into four distinct phases: First Phase 1964-87 An Act of Parliament established Unit Trust of India (UTI) on 1963. It was set up by the Reserve Bank of India and functioned under the Regulatory and administrative control of the Reserve Bank of India. In 1978 UTI was delinked from the RBI and the Industrial Development Bank of India (IDBI) took over the regulatory and administrative control in place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of 1988 UTI had Rs.6,700 crores of assets under management.

Second Phase 1987-1993 (Entry of Public Sector Funds) 1987 marked the entry of non- UTI, public sector mutual funds set up by public sector banks and Life Insurance Corporation of India (LIC) and General Insurance Corporation of India (GIC). SBI Mutual Fund was the first non- UTI Mutual Fund established in June 1987 followed by Can bank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC established its mutual fund in June 1989 while GIC had set up its mutual fund in December 1990.At the end of 1993, the mutual fund industry had assets under management of Rs.47,004 crores. Third Phase 1993-2003 (Entry of Private Sector Funds) With the entry of private sector funds in 1993, a new era started in the Indian mutual fund industry, giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first Mutual Fund Regulations came into being, under which all mutual funds,except UTI were to be registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector mutual fund registered in July 1993.

Fourth Phase since February 2003 In February 2003, following the repeal of the Unit Trust of India Act 1963 UTI was bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust of India with assets under management of Rs.29,835 crores as at the end of January 2003, representing broadly, the assets of US 64 scheme, assured return and certain other schemes. The Specified Undertaking of Unit Trust of India, functioning under an administrator and under the rules framed by Government of India and does not come under the purview of the Mutual Fund Regulations. The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which had in March 2000 more than Rs.76,000 crores of assets under management and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking place among different private sector funds, the mutual fund industry has entered its current phase of consolidation and growth. As at the end of September, 2004, there were 29 funds, which manage assets of Rs.153108 crores under 421 schemes.

Chapter 2 Concepts and Review

10

Mutual Funds

Mutual fund is a professionally managed collective investment scheme where a number of investors pool their money and this money is turn invested in different instruments including equity, government bonds, commodities, debt market etc. The investors invest the money in various types of schemes brought by the AMCs or Asset Management Companies who in turn invest this money in various instrument to give the best possible returns of investment to the investors.

Structure of Mutual Funds In India the mutual funds are regulated by the guidelines of SEBI or Securities and Exchange Board of India. AMFI or Association of Mutual Funds in India also sets some rules governing the mutual fund companies in India. The structure of mutual fund is as shown below. A. Sponsor of the Mutual Fund is the promoter of the Mutual Fund. It establishes the Mutual Fund and registers the same with SEBI. The sponsor can be a bank like SBI, PNB ICICI etc., a financial institution like Fidelity, Franklin Templeton etc. or a corporate like Reliance, Tata, Birla etc. According to SEBI regulation the sponsor must have a 5 year experience in the financial services market and should have been profitable for at least 3 years. This is done to ensure that the fund is promoted by an experienced entity with which the public will have faith in handling their money. The sponsor appoints the AMC, trustees and the custodians with prior approval of SEBI. It also contributes at least 40% of the net worth of the AMC.

B. Trust According to SEBI regulation the Mutual Funds in India is a trust established under the Indian Trust Act 1982. The trust is managed by a board of trustees or by a trustee

11

company. There are at least 4 members in the board of trustees and 2/3rd of the board is independent. The trustees hold the unit holders money in a fiduciary capacity. The trustees also appoint the AMC in consultation with the sponsor and according to the SEBI regulation.

C. AMCs The Asset Management companies are the public face of the Mutual Fund. They are appointed by the sponsors and the trust under the guidelines of SEBI. The AMC should have the net worth of minimum Rs. 10 Crore. Half of the members of the board of the AMC should be independent. The main job of the AMC is to manage the funds of the investors. It researches the best investment options to put the money in so that the investors get the maximum return on their investment. There is a fund manager and his team which carries out the research. The AMC floats a number of schemes for the investors to invest their money based on their investment objectives and risk appetite. These varied schemes help attract the public to the company. Some of the AMCs in India are reliance Mutual Fund, HDFC Bank Mutual Fund, ICICI Prudential Mutual Fund etc.

D. Registrar The registrar processes the applications and records the details of the investors. They process the dividend payouts to the investors and send information to them. Thus they maintain the backend operations of the Mutual Fund

E. Custodian it is the guardian of the funds and the assets of the investor. It is appointed by the board of trustees and is responsible for the securities held in the Mutual Funds portfolio. It is also regulated by the SEBI.

12

CHARACTERISTICS OF MUTUAL FUNDS

The ownership is in the hands of the investors who have pooled in their funds. It is managed by a team of investment professionals and other service providers. The pool of funds is invested in a portfolio of marketable investments. The investors share is denominated by units whose value is called as Net Asset Value (NAV) which changes every day. The investment portfolio is created according to the stated investment objectives of the fund.

ADVANTAGES OF MUTUAL FUNDS The advantages of mutual funds are given below: -

Portfolio Diversification Mutual funds invest in a number of companies. This diversification reduces the risk because it happens very rarely that all the stocks decline at the same time and in the same proportion. So this is the main advantage of mutual funds.

Professional Management Mutual funds provide the services of experienced and skilled professionals, assisted by investment research team that analysis the performance and prospects of companies and select the suitable investments to achieve the objectives of the scheme.

Low Costs Mutual funds are a relatively less expensive way to invest as compare to directly investing in a capital markets because of less amount of brokerage and other fees.

Liquidity This is the main advantage of mutual fund that is whenever an investor needs money he can easily get redemption, which is not possible in most of other options of investment. In open-ended schemes of mutual fund, the investor gets the money back at net asset value and on the other hand in close-ended schemes the units can be sold in a stock exchange at a prevailing market price.

13

Transparency In mutual fund, investors get full information of the value of their investment, the proportion of money invested in each class of assets and the fund managers investment strategy

Flexibility Flexibility is also the main advantage of mutual fund. Through this investors can systematically invest or withdraw funds according to their needs and convenience like regular investment plans, regular withdrawal plans, dividend reinvestment plans etc.

Convenient Administration Investing in a mutual fund reduces paperwork and helps investors to avoid many problems like bad deliveries, delayed payments and follow up with brokers and companies. Mutual funds save time and make investing easy.

Affordability Investors individually may lack sufficient funds to invest in high-grade stocks. A mutual fund because of its large corpus allows even a small investor to take the benefit of its investment strategy.

Well Regulated All mutual funds are registered with SEBI and they function with in the provisions of strict regulations designed to protect the interest of investors. The operations of mutual funds are regularly monitored by SEBI.

DISADVANTAGES OF MUTUAL FUNDS Mutual funds have their following drawbacks:

No Guarantees No investment is risk free. If the entire stock market declines in value, the value of mutual fund shares will go down as well, no matter how balanced the portfolio. Investors encounter fewer risks when they invest in mutual funds than when they buy and sell stocks on

14

their own. However, anyone who invests through mutual fund runs the risk of losing the money.

Fees and Commissions All funds charge administrative fees to cover their day to day expenses. Some funds also charge sales commissions or loads to compensate brokers, financial consultants, or financial planners. Even if you dont use a broker or other financial advisor, you will pay a sales commission if you buy shares in a Load Fund.

Taxes During a typical year, most actively managed mutual funds sell anywhere from 20 to 70 percent of the securities in their portfolios. If your fund makes a profit on its sales, you will pay taxes on the income you receive, even you reinvest the money you made.

Management Risk When you invest in mutual fund, you depend on fund manager to make the right decisions regarding the funds portfolio. If the manager does not perform as well as you had hoped, you might not make as much money on your investment as you expected. Of course, if you invest in index funds, you forego management risk because these funds do not employ managers.

15

Types of Funds This section introduces some funds to the reader. The risk aspects underlying these funds, and their suitability for different kinds of investors are discussed in later units.

Open-Ended Funds, Close-Ended Funds and Interval Funds

Open-ended funds are open for investors to enter or exit at any time, even after the NFO.When existing investors buy additional units or new investors buy units of the open ended scheme, it is called a sale transaction. It happens at a sale price, which is equal to the NAV.When investors choose to return any of their units to the scheme and get back their equivalent value, it is called a re-purchase transaction. This happens at a repurchase price that is linked to the NAV.Although some unit-holders may exit from the scheme, wholly or partly, the scheme continues operations with the remaining investors. The scheme does not have any kind of time frame in which it is to be closed. The ongoing entry and exit of investors implies that the unit capital in an open-ended fund would keep changing on a regular basis.

Close-ended funds have a fixed maturity. Investors can buy units of a close-ended scheme, from the fund, only during its NFO. The fund makes arrangements for the units to be traded, post-NFO in a stock exchange. This is done through a listing of the scheme in a stock exchange. Such listing is com pulsory for close -ended schemes. Therefore, after the NFO, investors who want to buy Units will have to find a seller for those units in the stock exchange. Similarly, investors who want to sell Units will have to find a buyer for those units in the stock exchange. Since post- NFO, sale and purchase of units happen to or from a counter-party in the stock exchange and not to or from the mutual fund the unit capital of the scheme remains stable.

Interval funds combine features of both open-ended and close- ended schemes. They are largely close-ended, but become open- ended at pre-specified intervals. For instance, an interval scheme might become open-ended between January 1 to 15, and July 1 to15, each year. The benefit for investors is that, unlike in a purely close-ended scheme, they are not completely dependent on the stock exchange to be able to buy or sell units of the interval fund.

16

Actively Managed Funds and Passive Funds

Actively managed funds are funds where the fund manager has the flexibility to choose the investment portfolio, within the broad parameters of the investment objective of the scheme. Since this increases the role of the fund manager, the expenses for running the fund turn out to be higher. Investors expect actively managed funds to perform better than the market.

Passive funds invest on the basis of a specified index, whose performance it seeks to track. Thus, a passive fund tracking the BSE Sensex would buy only the shares that are part of the composition of the BSE Sensex. The proportion of each share in the schemes portfolio would also be the same as the weight age assigned to the share in the computation of the BSE Sensex. Thus, the performance of these funds tends to mirror the concerned index. They are not designed to perform better than the market. Such schemes are also called index schemes. Since the portfolio is determined by the index itself, the fund manager has no role in deciding on investments. Therefore, these schemes have low running costs.

Debt, Equity and Hybrid Funds A scheme might have an investment objective to invest largely in equity shares and equity-related investments like convertible debentures. Such schemes are called equity schemes. Schemes with an investment objective that limits them to investments in debt securities like Treasury Bills, Government Securities, Bonds and Debentures are called debt funds. Hybrid funds have an investment charter that provides for a reasonable level of investment in both debt and equity.

17

Types of Debt Funds

Gilt funds invest in only treasury bills and government securities, which do not have a credit risk (i.e. the risk that the issuer of the security defaults).

Diversified debt funds on the other hand, invest in a mix of government and nongovernment debt securities.

Junk bond schemes or high yield bond schemes invest in companies that are of poor credit quality. Such schemes operate on the premise that the attractive returns offered by the investee companies makes up for the losses arising out of a few companies defaulting.

Fixed maturity plans are a kind of debt fund where the investment portfolio is closely aligned to the maturity of the scheme. AMCs tend to structure the scheme around pre-identified investments. Further, like close-ended schemes, they do not accept moneys post-NFO. Thanks to these characteristics, the fund manager has little ongoing role in deciding on the investment options.

Floating rate funds invest largely in floating rate debt securities i.e. debt securities where the interest rate payable by the issuer changes in line with the market. For example, a debt security where interest payable is described as 5-year Government Security yield plus 1%, will pay interest rate of 7%, when the 5- year Government Security yield is 6%; if 5-year Government Security yield goes down to 3%, then only 4% interest will be payable on that debt security. The NAVs of such schemes

fluctuate lesser than debt funds that invest more in debt securities offering a fixed rate of interest.

Liquid schemes or money market schemes are a variant of debt schemes that invest only in debt securities where the moneys will be repaid within 91-days. As will be seen later in this Work Book, these are widely recognized to be the lowest in risk among all kinds of mutual fund schemes.

18

Types of Equity Funds

Diversified equity fund is a category of funds that invest in a diverse mix of securities that cut across sectors.

Sector funds however invest in only a specific sector.For example, a banking sector fund will invest in only shares of banking companies. Gold sector fund will invest in only shares of gold-related companies.

Thematic funds invest in line with an investment theme. For example, an infrastructure thematic fund might invest in shares of companies that are into infrastructure construction, infrastructure toll-collection, cement, steel, telecom, power etc. The

investment is thus more broad-based than a sector fund; but narrower than a diversified equity fund.

Equity Linked Savings Schemes (ELSS), as seen earlier, offer tax benefits to investors. However, the investor is expected to retain the Units for at least 3 years.

Equity Income / Dividend Yield Schemes invest in securities whose shares fluctuate less, and therefore, dividend represents a larger proportion of the returns on those shares. The NAV of such equity schemes are expected to fluctuate lesser than other categories of equity schemes.

Arbitrage Funds take contrary positions in different markets / securities, such that the risk is neutralized, but a return is earned. For instance, by buying a share in BSE, and simultaneously selling the same share in the NSE at a higher price. Most arbitrage funds take contrary positions between the equity market and the futures and options market. (Futures and Options are commonly referred to as derivatives. These are designed to help investors to take positions or protect their risk in some other security, such as an equity share. They are traded in exchanges like the NSE and the BSE. provides an example of futures contract that is linked to gold). Unit 10

19

Types of Hybrid Funds

Monthly Income Plan seeks to declare a dividend every month. It therefore invests largely in debt securities. However, a small percentage is invested in equity shares to improve the schemes yield. As will be discussed in Unit 8, the term Monthly Income is a bit of a misnomer and investor needs to study the scheme properly, before presuming that an income will be received every month.

Capital Protected Schemes are close-ended schemes, which are structured to ensure that investors get their principal back, irrespective of what happens to the market. This is ideally done by investing in Zero Coupon Government Securities whose maturity is aligned to the schemes maturity. (Zero coupon securities are securities that do not pay a regular interest, but accumulate the interest, and pay it along with the principal when the security matures). As detailed in the following example, the investment is structured, such that the principal amount invested in the zero-coupon security, together with the interest that accumulates during the period of the scheme would grow to the amount that the investor invested at the start. Suppose an investor invested Rs 10,000 in a capital protected scheme of 5 years. If 5-year government securities yield 7% at that time, then an amount of Rs 7,129.86 invested in 5-year zero- coupon government securities would mature to Rs 10,000 in 5 years. Thus, by investing Rs 7,129.86 in the 5-year zero-coupon government security, the scheme ensures that it will have Rs 10,000 to repay to the investor in 5 years. After investing in the government security, Rs 2,870.14 is left over (Rs 10,000 invested by the investor, less Rs 7129.86 invested in government securities). This a m o u n t i s invested in riskier securities like equities. Even if the risky investment becomes completely worthless (a rare possibility), the investor is assured of getting back the principal invested, out of the maturity moneys received on the government security. Some of these schemes are structured with a minor difference the investment is made in good quality debt securities issued by companies, rather than Central Government Securities. Since any borrower other than the government can default, it would be appropriate to view these alternate structures as Capital Protection Oriented Schemes rather than Capital Protected Schemes. It may be noted that capital protection

20

can also be offered through a guarantee from a guarantor, who has the financial strength to offer the guarantee. Such schemes are however not prevalent in the market.

Gold Funds These funds invest in gold and gold-related securities. They can be structured in either of the following formats:

Gold Exchange Traded Fund, which is like an index fund that invests in gold. The NAV of such funds moves in line with gold prices in the market.

Gold Sector Funds i.e. the fund will invest in shares of companies engaged in gold mining and processing. Though gold prices influence these shares, the prices of these shares are more closely linked to the profitability and gold reserves of the companies. Therefore, NAV of these funds do not closely mirror gold prices.(Gold Sector Fund is like any equity sector fund, which was discussed under Types of Equity Funds. It is discussed here to highlight the difference from a Gold ETF)

Real Estate Funds They take exposure to real estate. Such funds make it possible for small investors to take exposure to real estate as an asset class. Although permitted by law, real estate mutual funds are yet to hit the market in India.

Commodity Funds Commodities, as an asset class, include: food crops like wheat and chana spices like pepper and turmeric energy products like oil and natural gas precious metals (bullion) like gold and silver The investment objective of commodity funds would specify which of these commodities it proposes to invest in. As with gold, such funds can be structured as Commodity ETF or Commodity Sector Funds. In India, mutual fund schemes are not permitted to

invest in commodities. Therefore, the commodity funds in the market are in the nature of Commodity Sector Funds, i.e. funds that invest in shares of companies that are into

21

commodities. Like Gold Sector Funds, Commodity Sector Funds too are a kind of equity fund.

International Funds These are funds that invest outside the country. For instance, a mutual fund may offer a scheme to investors in India, with an investment objective to invest abroad. One way for the fund to manage the investment is to hire the requisite people who will manage the fund. Since their salaries would add to the fixed costs of managing the fund, it can be justified only if a large corpus of funds is available for such investment. An alternative route would be to tie up with a foreign fund (called the host fund). If an Indian mutual fund sees potential in China, it will tie up with a Chinese fund. In India, it will launch what is called a feeder fund. Investors in India will invest in the feeder fund. The moneys collected in the feeder fund would be invested in the Chinese host fund. Thus, when the Chinese market does well, the Chinese host fund would do well, and the feeder fund in India will follow suit. Such feeder funds can be used for any kind of international investment. The investment could be specific to a country (like the China fund) or diversified across countries. A feeder fund can be aligned to any host fund with any investment objective in any part of the world, subject to legal restrictions of India and the other country.

Fund of Funds The feeder fund was an example of a fund that invests in another fund. Similarly, funds can be structured to invest in various other funds, whether in India or abroad. Such funds are called fund of funds. These fund of funds pre-specify the mutual funds whose schemes they will buy and / or the kind of schemes they will invest in. They are designed to help investors get over the trouble of choosing between multiple schemes and their variants in the market. Thus, an investor invests in a fund of funds, which in turn will manage the investments in various schemes and options in the market.

Exchange Traded Funds Exchange Traded funds (ETF) are open-ended index funds that are traded in a stock exchange.

22

A feature of open-ended funds, which allows investors to buy and sell units from the mutual fund, is made available only to very large investors in an ETF. Other investors will have to buy and sell units of the ETF in the stock exchange. In order to

facilitate such transactions in the stock market, the mutual fund appoints some intermediaries as market makers, whose job is to offer a price quote for buying and selling units at all times. If more investors in the stock exchange want to buy units of the ETF, then their moneys would be due to the market maker. The market maker would use the moneys to buy a basket of securities that is in line with the investment objective of the scheme, and exchange the same for chapters of the scheme from the mutual fund. Thus, the market maker can offer the units to the investors. If there is more selling interest in the stock exchange, then the market maker will end up with units, against which he needs to make payment to the investors. When these units are offered to the mutual fund for extinguishment, corresponding securities will be released from the investment portfolio of the scheme. Sale of the released securities will generate the liquidity to pay the unit- holders for the units sold by them. In a regular open-ended mutual fund, all the purchases of units by investors on a day happen at a single price. Similarly, all the sales of units by investors on a day happen at a single price. The market however keeps fluctuating during the day. A key

benefit of an ETF is that investors can buy and sell their units in the stock exchange, at various prices during the day that closely track the market at that time. Further, the unique structure of ETFs, make them more cost-effective than normal index funds, although the investor would bear a brokerage cost when he transacts with the market maker.

23

Regulators in India

SEBI SEBI regulates mutual funds, depositories, custodians and registrars & transfer agents in the country. The applicable guidelines for mutual funds are set out in SEBI (Mutual Funds) Regulations, 1996, as amended till date. Some aspects of these regulations are discussed in various sections of this Workbook. An updated and comprehensive list of circulars

issued by SEBI can be found in the Mutual Funds section of SEBIs website www.sebi.gov.in. A useful download is a Master Circular, which captures the essence of various circulars issued upto January 1, 2010. Some segments of the financial markets have their own independent regulatory bodies. Wherever applicable, mutual funds need to comply with these other regulators also. For instance, RBI regulates the money market and foreign exchange market in the country. Therefore, mutual funds need to comply with RBIs regulations regarding investment in the money market, investments outside the country, investments from people other than Indians residents in India, remittances (inward and outward) of foreign currency etc. Stock Exchanges are regulated by SEBI. Every stock exchange has its own listing, trading and margining rules. Mutual Funds need to comply with the rules of

the exchanges with which they choose to have a business relationship.

Self Regulatory Organizations (SRO) In the developed world, it is common for market players to create Self Regulatory Organizations, whose prime responsibility is to regulate their own members. Wherever SROs exist, the statutory regulatory bodies set up by the

Government (like SEBI in India) only lay down the broad policy framework, and leave the micro- regulation to the SRO. For instance, the Institute of Chartered Accountants of India (ICAI) regulates its own members. Mutual Funds in India have not constituted any SRO for themselves. Therefore, they are directly regulated by SEBI.

24

AMFI Objectives AMCs in India are members of AMFI, an industry body that has been created to promote the interests of the mutual funds industry [like Confederation of Indian Industry (CII) for overall industry and NASSCOM for the IT/BPO industry]. AMFI is not an SRO.

The objectives of AMFI are as follows: To define and maintain high professional and ethical standards in all areas of operation of mutual fund industry To recommend and promote best business practices and code of conduct to be followed by members and others engaged in the activities of mutual fund and asset management including agencies connected or involved in the field of capital markets and financial services. To interact with the Securities and Exchange Board of India (SEBI) and to represent to SEBI on all matters concerning the mutual fund industry. To represent to the Government, Reserve Bank of India and other bodies on all matters relating to the Mutual Fund Industry. To develop a cadre of well trained Agent distributors and to implement a programme of training and certification for all intermediaries and others engaged in the industry. To undertake nationwide investor awareness programme so as to promote proper understanding of the concept and working of mutual funds. To disseminate information on Mutual Fund Industry and to undertake studies and research directly and/or in association with other bodies.

AMFI Code of Ethics (ACE) The AMFI Code of Ethics sets out the standards of good practices to be followed by the Asset Management Companies in their operations and in their dealings with investors, intermediaries and the public. SEBI (Mutual Funds) Regulation, 1996 requires all Asset Management Companies and Trustees to abide by the Code of Conduct as specified in the Fifth Schedule to the Regulation. The AMFI Code has been drawn up to supplement that schedule, to encourage standards higher than those prescribed by the Regulations for the

25

benefit of investors in the mutual fund industry. Appendix 1 has the details.

AMFI Guidelines & Norms for Intermediaries (AGNI) AMFI has also framed a set of guidelines and code of conduct for intermediaries, consisting of individual agents, brokers, distribution houses and banks engaged in selling of mutual fund products. The Code of Conduct is detailed in Appendix 2. SEBI has made it mandatory for intermediaries to follow the Code of Conduct. In the event of breach of the Code of Conduct by an intermediary, the following sequence of steps is provided for: Write to the intermediary (enclosing copies of the complaint and other documentary evidence) and ask for an explanation within 3 weeks. In case explanation is not received within 3 weeks, or if the explanation is not satisfactory, AMFI will issue a warning letter indicating that any subsequent violation will result in cancellation of AMFI registration. If there is a proved second violation by the intermediary, the registration will be cancelled, and intimation sent to all AMCs.

The intermediary has a right of appeal to AMFI.

26

Key Developments over the Years

The mutual fund industry in India has come a long way. Significant spurts in size were noticed in the late 80s, when public sector mutual funds were first permitted, and then in the mid-90s, when private sector mutual funds commenced operations. last few years, institutional distributors increased their focus on mutual funds. The emergence of stock exchange brokers as an additional channel of distribution, the continuing growth in convenience arising out of technological In the

developments, and higher financial literacy in the market should drive the growth of mutual funds in future.AUM of the industry, as of February 2010 has touched Rs 766,869 crore from 832 schemes offered by 38 mutual funds. In some advanced countries, mutual fund AUM is a multiple of bank deposits. In India, mutual fund AUM is hardly 10% of bank deposits. This is indicative of the immense potential for growth of the industry. The high proportion of AUM in debt, largely from institutional investors is not in line with the role of mutual funds, which is to channelize retail money into the capital market. Various regulatory measures to reduce the costs and increase the conveniences for investors are aimed at transforming mutual funds into a truly retail vehicle of capital mobilization for the larger benefit of the economy.

27

Chapter 3 Research Design

28

RESEARCH METHODOLOGY

NEED FOR THE STUDY To know the preferred kind of investment among the investors. Understand the perception of the investors regarding mutual fund investments. This study would helps to bring out the awareness level among investors about mutual funds. This would help the companies to know their weakness in promotions and help them to develop it.

SCOPE OF THE STUDY This study mainly focus on awareness level regarding mutual fund investment among investors To know perception of the investors about mutual fund industry. To know the drawbacks and the difficulties faced by the mutual fund investors. To understand the factors that determine the growth of the mutual fund investments among investors.

OBJECTIVES OF THE STUDY To examine the factors that the investors consider before investing in Mutual fund. To analyse what is the level of importance given to each factor by the investors. To help the investors to know more about mutual fund investments.

LIMITATIONS OF THE STUDY The sample units are confined to Salem. The sample size is limited to 100 respondents only. Biases in responses would also be due to the presence of the researcher. Hesitations on the part of respondent to express their views exactly on the questionnaire. The tools used to analyse the data are subject to their own assumptions and drawbacks.

29

TYPE OF RESEARCH DESIGN RESEARCH: Research in common parlance refers to search for knowledge. Research is also defined as scientific and systematic search for pertinent information on a scientific topic. Research is an art of scientific investigation. RESEARCH DESIGN: A research design is an arrangement of condition for collection and analysis of data in a manner that aims to combine relevance to the research purpose. Fundamental to the success of the research project work is the choice of research design. The main aim of this research project is to know the awareness level among investors about mutual fund investments. So the research design adopted in this research is Descriptive Research Design. Descriptive research involves studying about the actual facts. What, when, where and how are the questions answered by adopting this research design. Generation of suggestions and recommendations based on the data analyzed is the nature of descriptive research design POPULATION AND SAMPLE All items in any field of enquiry constitute the population. The population of the study comprises all the investors of mutual funds. A sample is a subset of the population. The population is taken among the people who have invested in mutual funds and hence a sample is selected for the study. The sampling technique used is convenience sampling. convenience sampling is the method of non-probabilistic sampling where the researcher selects the sample based on his convenience like place, time etc. DATA COLLECTION Primary data: It was collected by survey using questionnaire. Secondary data: It was collected from books, magazines and internet. Sample size is 100. Sample area is confined to Salem only.

30

TOOLS USED FOR DATA COLLECTION The tool used for the collection of primary data was questionnaire method with a set of pre-determined questions, The questionnaires are handed to the customers to fill in their answers. The questions are close-ended and the respondents are entitled to select their responses from the given options. TOOLS USED FOR DATA ANALYSIS PERCENTAGE METHOD In this project Percentage method test was used. The percentage method is used to know the accurate percentages of the data we took, it is easy to graph out through the percentages. The following are the formula

From the above formula, we can get percentages of the data given by the respondents. CHI-SQUARE ANALYSIS In this project chi-square test was used. This is an analysis of technique which analyzed the stated data in the project. It analysis the assumed data and calculated in the study. The Chi-square test is an important test amongst the several tests of significant developed by statistical. Chi-square, symbolically written as x2 (Pronounce as Ki-Spare), is a statistical measure used in the context of sampling analysis for comparing a variance to a theoretical variance.

where

O E

= =

Observed frequency Expected frequency

Weighted mean An average in which each quantity to be averaged is assigned a weight. These weightings determine the relative importance of each quantity on the average. Weightings are the equivalent of having that many like items with the same value involved in the average.

31

A weighted average is worked out by: Multiplying each number using a weight. Add the outcomes together. Divide the total by the sum of your weights.

By doing so you get an average that takes into account the proportional relevance of every element, as opposed to dealing with each element likewise. Any weighted average is definitely average, which modifies for any rate connected with individual numbers.

32

Chapter 4 Analysis and Interpretation

33

Analysis and Interpretation TABLE NO: 1 AGE

No. of respondents Below 20 20-30 30-40 Above 40 Total 7 21 46 24 100

Percentage 7 21 46 24 100

Age 50 40 30 20 10 0

Below 20 20-30 30-40 above 40

Age

INFERENCE: 7% of the total respondents are below 20 years of age, 21% belong to the age group of 20-30, 46% belong to the age group of 30-40 and 24% of the respondents are above 40 years of age. The majority (46%) of respondents are between 30-40 years of age.

34

TABLE NO: 2 OCCUPATION No.of respondents Government employee Private employee Business men Retired Total 16 45 28 11 100 Percentage 16 45 28 11 100

Occupation 50 45 40 35 30 25 20 15 10 5 0 Government INFERENCE: 16% of the total respondents are government employees,45% of the respondents are private employees,28% of the respondents are businessmen and 11% of the respondents are retired. The majority (45%) of respondents are private employees. Private Bussiness Retired Occupation

35

TABLE NO: 3 ANNUAL INCOME No.of respondents Less than 5 lakhs 5-10 lakhs 10-15 lakhs Above 15 lakhs Total 46 38 16 0 100 Percentage 46 38 16 0 100

Annual income 50 45 40 35 30 25 20 15 10 5 0 Less than 5 lakhs INFERENCE: 46% of the total respondents annual income is less than 5 lakhs,38% of the 5-10 lakhs 10-15 lakhs Above 15 lakhs

Annual income

respondents annual income is between 5-10 lakhs,16% of the respondents annual income is between 10-15 lakhs and none of the respondents have income over 15 lakhs.The

majority(46%) of respondents annual income is less than 5 lakhs.

36

TABLE NO: 4 INVESTORS PREFERENCE TOWARDS INVESTMENT No.of respondents Banks Insurance Mutual fund Shares Gold Real estate Total 32 13 16 20 11 8 100 Percentage 32 13 16 20 11 8 100

INVESTORS PREFERENCE TOWARDS INVESTMENT 16 14 12 10 8 6 4 Highly satisfied Satisfied Neutral

Dissatisfied

Highly dissatisfied

2

0 Bank Insurance Mutual funds INFERENCE: 32% of the total respondents prefer banks,13% of the respondents prefer insurance, 16% of the respondents prefer mutual funds,20% of the respondents prefer shares,11% of the respondents prefer and 8% of the respondents prefer gold. The majority (32%) of the respondents prefer to invest in banks. Shares Gold Real estate

37

TABLE NO: 5 FACTORS THEY CONSIDER BEFORE INVESTING Strongly agree Low risk High return Company reputation Maturity period Liquidity 12

34

Agree

Moderate

Disagree

Strongly disagree

19 5

22 17

26 23

25 32

8 23

14

27

19

30

10

27

27

24

11

28

22

9

6

FACTORS THEY CONSIDER BEFORE INVESTING

40 35 30 25 20 15 10 5 0 Low risk High return Company reputation Maturity period liquidity Strongly agree Agree Moderate Dis-agree Strongly disagree

INFERENCE: Most of the respondents consider liquidity factor before making their investment in mutual funds.

38

TABLE NO: 6 MINIMUM YEARS OF EXPERIENCE IN MUTUAL FUNDS No.of respondents 0-2years 2-4 years 4-6years above 6 Total 39 27 26 8 100 Percentage 39 27 26 8 100

Minimum years of experience

50 40 30 20 10 0 0-2 years 2-4 years 4-6 years Above 6 years Minimum years of experience

INFERENCE: 39% of the total respondents have 0-2 years of minimum experience, 27% of the respondents have 2-4 years of experience, 26% of the respondents have 4-6 years of experience and 8% of the respondents have above 6 years of experience. The Majority (39%) of the respondents have 0-2 years of minimum experience in mutual funds.

39

TABLE NO: 7 SIZE OF THE INVESTMENT No.of respondents Less than 1 lakh 2-4 lakhs 4-6 lakhs above 6 lakhs Total 56 24 16 4 100 Percentage 56 24 16 4 100

Size of the investment

60 50 40 30 20 10 0 Less than 1 lakh 2-4 lakhs 4-6 lakhs Above 6 lakhs Size of the investment

INFERENCE: 56% of the total respondents have invested less than 1 lakh in mutual funds, 24% of the respondents have 2-4 lakhs of investment, 16% of the respondents have 4-6 lakhs of investment and 4% of the respondents have above 6 lakhs of investment. The Majority (56%) of the respondents have less than 1 lakh investment in mutual funds.

40

TABLE NO: 8 FINDING YOURSELF HAS A INVESTOR No.of respondents Totally ignorant Partial knowledge Specific schemes Fully aware Which you invest Total 100 100 27 18 16 27 18 16 18 21 Percentage 18 21

Finding yourself has a investor

30 25 20 15 10 5 0

Finding yourself has a investor

INFERENCE: 18% of the total respondents are totally ignorant about mutual funds, 21% of the respondents have partial knowledge, 27% of the respondents have knowledge about specific schemes, 18% of the respondents are fully aware and 16% of the respondents only know the schemes which they invest in. The Majority (27%) of the respondents have knowledge about specific schemes only in mutual fund investments.

41

TABLE NO: 9 MUTUAL FUND SCHEME WHICH YOU HAVE USED No.of respondents Open-ended Close ended Liquid fund Mid-cap Growth fund Regular income Long cap Sector fund Total 12 11 18 13 17 16 1 12 100 Percentage 12 11 18 13 17 16 1 12 100

Used schemes

20 15 10 5 0 Used schemes

INFERENCE: 12% of the total respondents have used open-ended scheme, 11% of the respondents have used close-ended scheme, 18% of the respondents have used liquid funds, 13% of the respondents have used mid-cap, 17% of the respondents have used growth fund, 16% of the respondents have used Regular income fund, 1% of the respondents have used long-cap and 12% of the respondents have used sector fund. The Majority (18%) of the respondents have used Liquid fund schemes.

42

TABLE NO: 10 FEATURES WHICH ATTRACTS YOU No.of respondents Diversification Better return and safety Reduction in risk Regular income Tax benefit Total 20 20 19 100 20 20 19 100 24 17 Percentage 24 17

Features which attracts you

30 25 20 15 10 5 0

Features which attracts you

INFERENCE: 24% of the total respondents allure diversification feature, 17% of the respondents allure better return and safety feature, 20% of the respondents allure reduction in risk feature, 20% of the respondents allure regular income feature and 19% of the respondents allure tax benefit feature. The Majority (24%) of the respondents allure the diversification feature of mutual funds.

43

TABLE NO: 11 IN WHICH MUTUAL FUND YOU HAVE INVESTED No.of respondents HDFC SBI ICICI Sun life Others Total 22 17 16 20 25 100 Percentage 22 17 16 20 25 100

In which you have invested

30 25 20 15 10 5 0 HDFC SBI ICICI Sun life Others In which you have invested

INFERENCE: 22% of the total respondents have invested in HDFC, 17% of the respondents have invested in SBI, 16% of the respondents have invested in ICICI, 20% of the respondents have invested in Sun-life and 25% of the respondents have invested in other company. The Majority (22%) of the respondents have invested in HDFC mutual funds.

44

TABLE NO: 12 PERCENTAGE OF INCOME YOU HAVE INVESTED IN MUTUAL FUNDS No.of respondents 0-5% 5-10% 10-15% Above 15% Total 47 24 15 14 100 Percentage 47 24 15 14 100

Percentage of income you have invested

50 45 40 35 30 25 20 15 10 5 0 0-5% 5-10% 10-15% Above 15%

Percentage of income you have invested

INFERENCE: 47% of the total respondents have invested 0-5% of their income, 24% of the respondents have invested 5-10% of their income, 15% of the respondents have invested 1015% of their income and 14% of the respondents have invested above 15% of their income. The Majority (47%) of the respondents have invested 0-5% of their income in mutual funds.

45

TABLE NO: 13 PERCENTAGE OF RETURN YOU EXPECT FROM YOUR INVESTMENT No.of respondents 0-5% 5-10% 10-15% Above 15% Total 12 23 41 24 100 Percentage 12 23 41 24 100

PERCENTAGE OF RETURN YOU EXPECT FROM YOUR INVESTMENT

14 12 10 8 6 4 2 0 0-5% 5-10% 10-15% Above 15% Highly satisfied Satisfied Neutral Dissatisfied Highly Dissatisfied

INFERENCE: 12% of the total respondents expect 0-5% of return from their investment, 23% of the respondents expect 5-10% of return from their investment, 41% of the respondents expect 1015% of return from their investment and 24% of the respondents expect above 15% of return from their investment. The Majority (41%) of the respondents expect 10-15% of return from their investment in mutual funds.

46

TABLE NO: 14 HOW OFTEN YOU MAKE INVESTMENT DECISIONS AND EXECUTE THEM No.of respondents Once in 3 months Once in 6 months Once in a year More then a year Total 38 23 100 38 23 100 22 22 17 Percentage 17

How often you take investment decicion and execute them

40 35 30 25 20 15 10 5 0 Once in 3 months Once in 6 months Once in a year More then a year

How often you take investment decicion and execute them

INFERENCE: 17% of the total respondents take investment decisions once in 3 months and execute them, 22% of the respondents take investment decisions once in 6 months and execute them, 38% of the respondents take investment decisions once in a year and execute them and 23% of the respondents take investment decisions more then a year and execute them . The Majority (38%) of the respondents take investment decisions once in year and execute them.

47

TABLE NO: 15 NATURE OF RISK YOU PREFER No.of respondents High Medium Low No risk Total 21 9 24 46 100 Percentage 21 9 24 46 100

Nature of Risk

50 45 40 35 30 25 20 15 10 5 0 High Medium Low No risk

Nature of risk

INFERENCE: 21% of the total respondents prefer high risk, 9% of the respondents prefer medium risk, 24% of the respondents prefer low risk and 46% of the respondents prefer no risk . The Majority (46%) of the respondents prefer no risk appetite.

48

TABLE NO: 16 HOW WOULD A MARKET CHANGE AFFECT YOU No.of respondents Personally affect Disappointed Partially disappointed Not affect Total 13 100 13 100 13 44 30 Percentage 13 44 30

How would a market change affect you

50 40 30 20 10 0 Personally affect Disappointed Partially disappointed Not affect How would a market change affect you

INFERENCE: 13% of the total respondents will be personally affected by the sharp drop, 44% of the respondents will be disappointed with the drop, 30% of the respondents will be partially disappointed with the drop and 13% of the respondents will be not affected by the drop. The Majority (44%) of the respondents will be disappointed with the sharp drop in the investments.

49

TABLE NO: 17 ON AN AVERAGE HOW LONG WILL YOU STAY IN MUTUAL FUND INVESTMENTS No.of respondents 1 year 1-3 years 3-5 years More then 5 years Total 100 100 18 34 27 21 Percentage 18 34 27 21

On an average how long you will stay invested

40 35 30 25 20 15 10 5 0 1 year 1-3 years 3-5 years More then 5 years

On an average how long you will stay invested

INFERENCE: 18% of the total respondents will stay on for a year, 34% of the respondents will stay on for 1-3 years time, 27% of the respondents will stay on for 3-5 years and 21% of the respondents will stay on for more then 5 years. The Majority (34%) of the respondents will stay on investments with mutual funds for 1-3 years time.

50

TABLE NO: 18 AWARENESS ABOUT MUTUAL FUNDS No.of respondents Advertisement Newspapers Internet Friends and relatives Total 100 100 47 28 20 5 Percentage 47 28 20 5

Awareness about mutual funds

50 40 30 20 10 0 Advertisment Newspapers Internet Friends and relatives Awareness about mutual funds

INFERENCE: 47% of the total respondents came to know by advertisements, 28% of the respondents came to know by newspapers, 20% of the respondents came to know by internet and 5% of the respondents came to know by friends and relatives. The Majority (47%) of the respondents came to know about mutual funds by advertisement.

51

CHI SQUARE ANALYSIS Analysis on relationship between variables

Liquidity Age Below 20 20-30 30-40 Above 40 Strongly agree 4 6 12 12 Agree 2 5 12 8 Moderate 1 4 4 2 Disagree 2 4 15 1 Strongly disagree 0 2 3 1

From the data collected, analysis is made on whether there is any relation between the schedule differences Ho: There is no relation between Age and liquidity. H1 : There is relation between Age and liquidity.

Observed frequency Liquidity Moderate Disagree 1 4 4 2 11 2 4 15 1 22

Age Below 20 20-30 30-40 Above 40 TOTAL

Strongly agree 4 6 12 12 34

Agree 2 5 12 8 27

Strongly disagree 0 2 3 1 6

Total 9 21 46 24 100

Expected Frequency = (Row total * column total)/ grand total

52

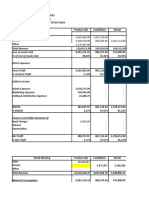

Calculation of value of chi-square Observed Expected Oi-Ei (Oi-Ei)2 (Oi-Ei)2 / frequency frequency Ei Oi Ei 4 3.06 0.94 0.8836 0.288758 2 2.43 -0.43 0.1849 0.076091 1 0.99 0.01 0.0001 0.000101 2 1.98 0.02 0.0004 0.000202 0 0.54 -0.54 0.2916 0.54 6 7.14 -1.14 1.2996 0.182017 5 5.67 -0.67 0.4489 0.079171 4 2.31 1.69 2.8561 1.236407 4 4.62 -0.62 0.3844 0.083203 2 1.26 0.74 0.5476 0.434603 12 15.64 -3.64 13.2496 0.847161 12 12.42 -0.42 0.1764 0.014203 4 5.06 -1.06 1.1236 0.222055 15 10.12 4.88 23.8144 2.353202 3 2.76 0.24 0.0576 0.02087 12 8.16 3.84 14.7456 1.807059 8 6.48 1.52 2.3104 0.356543 2 2.64 -0.64 0.4096 0.155152 1 5.28 -4.28 18.3184 3.469394 1 1.44 -0.44 0.1936 0.134444 Total 12.30064 (Oi-Ei)2 / Ei =12.30064 Degree of freedom= (c-1)(r-1) = (5-1)(4-1) = 12 Level of significance= 5% Table value= 21.026 Calculated value= 12.30064

INTERPRETATION

Since X2 table value> X2 Calculated value H0 is accepted Therefore, there is no relationship between age and liquidity.

53

CHI SQUARE ANALYSIS Analysis on relationship between variables Low risk Strongly Agre agree e 3 4 8 4 2 5 7 8

Age Below 20 20-30 30-40 Above 40

Moderate 1 8 15 2

Disagre e 1 4 14 6

Strongly disagree 2 0 2 4

From the data collected, analysis is made on whether there is any relation between the schedule differences Ho: There is no relation between Age and Low risk. H1 : There is relation between Age and Low risk.

Observed frequency Age Below 20 20-30 30-40 Above 40 TOTAL Strongly agree 3 4 8 4 19 Agree 2 5 7 8 22 Low risk Moderate Disagree 1 8 15 2 26 1 4 14 6 25 Strongly disagree 2 0 2 4 8 TOTAL 9 21 46 24 100

Expected Frequency = (Row total * column total)/ grand total

54

Calculation of value of chi-square

Observed Frequency Oi Expected frequency Ei (Oi-Ei) (Oi-Ei)2 (Oi-Ei)2 / Ei

3 2 1 1 2 4 5 8 4 0 8 7 15 14 2 4 8 2 6 4

1.71 1.98 2.34 2.25 0.72 3.99 4.62 5.46 5.25 1.68 8.74 10.12 11.96 11.5 3.68 4.56 5.28 6.24 6 1.92

1.29 0.02 -1.34 -1.25 1.28 0.01 0.38 2.54 -1.25 -1.68 -0.74 -3.12 3.04 2.5 -1.68 -0.56 2.72 -4.24 0 2.08 Total

1.6641 0.0004 1.7956 1.5625 1.6384 1E-04 0.1444 6.4516 1.5625 2.8224 0.5476 9.7344 9.2416 6.25 2.8224 0.3136 7.3984 17.9776 0 4.3264

0.973158 0.000202 0.76735 0.694444 2.275556 2.51E-05 0.031255 1.181612 0.297619 1.68 0.062654 0.961897 0.772709 0.543478 0.766957 0.068772 1.401212 2.881026 0 2.253333 17.6132

(Oi-Ei)2 / Ei =17.6132 Degree of freedom= (c-1)(r-1) = (5-1)(4-1) = 12 Level of significance= 5% Table value= 21.046 Calculated value= 17.6132

INTERPRETATION Since X2 table value> value X2 Calculated value

H0 is accepted

Therefore, there is no relationship between age and low risk.

55 CHI SQUARE ANALYSIS Analysis on relationship between variables

Age Below 20 20-30 30-40 Above 40

High return Strongly Agre agree e 2 0 2 1 2 6 5 4

Moderate 1 5 12 5

Disagre e 2 6 16 8

Strongly disagree 2 4 11 6

From the data collected, analysis is made on whether there is any relation between the schedule differences Ho: There is no relation between Age and high return. H1 : There is relation between Age and high return.

Observed frequency Age Below 20 20-30 30-40 Above 40 TOTAL Strongly agree 2 0 2 1 5 Agree 2 6 5 4 17 High return Moderate Disagree 1 5 12 5 23 2 6 16 8 32 Strongly disagree 2 4 11 6 23 TOTAL 9 21 46 24 100

Expected Frequency = (Row total * column total)/ grand total

56

Calculation of value of chi-square

Observed Frequency Oi

Expected frequency Ei

(Oi-Ei)

(Oi-Ei)2

(Oi-Ei)2 / Ei

2 2 1 2 2 0 6 5 6 4 1 4 5 8 6 1 4 5 8 6

0.45 1.53 2.07 2.88 2.07 1.05 3.57 4.83 6.72 4.83 2.3 7.82 10.58 14.72 10.58 1.2 4.08 5.52 7.68 5.52 Total

1.55 0.47 -1.07 -0.88 -0.07 -1.05 2.43 0.17 -0.72 -0.83 -1.3 -3.82 -5.58 -6.72 -4.58 -0.2 -0.08 -0.52 0.32 0.48

2.4025 0.2209 1.1449 0.7744 0.0049 1.1025 5.9049 0.0289 0.5184 0.6889 1.69 14.5924 31.1364 45.1584 20.9764 0.04 0.0064 0.2704 0.1024 0.2304

5.338889 0.144379 0.553092 0.268889 0.002367 1.05 1.654034 0.005983 0.077143 0.142629 0.734783 1.866036 2.942949 3.067826 1.982647 0.033333 0.001569 0.048986 0.013333 0.041739 19.9760

(Oi-Ei)2 / Ei =19.9760 Degree of freedom= (c-1)(r-1) = (5-1)(4-1) = 12 Level of significance= 5% Table value= 21.046 Calculated value= 19.9760

INTERPRETATION Since X2 table value> value X2 Calculated value H0 is accepted Therefore, there is no relationship between age and high return.

57

CHI SQUARE ANALYSIS Analysis on relationship between variables Company reputation Strongly Agre Moderate agree e 3 5 2 4 2 8 9 8 1 4 8 6

Age Below 20 20-30 30-40 Above 40

Disagre e 2 2 20 6

Strongly disagree 1 2 7 0

From the data collected, analysis is made on whether there is any relation between the schedule differences Ho: There is no relation between Age and company reputation. H1 : There is relation between Age and company reputation.

Observed frequency Age Below 20 20-30 30-40 Above 40 TOTAL Strongly agree 3 5 2 4 14 Company reputation Agree Moderate Disagree 2 8 9 8 27 1 4 8 6 19 2 2 20 6 30 Strongly disagree 1 2 7 0 10 TOTAL 9 21 46 24 100

Expected Frequency = (Row total * column total)/ grand total

58 Calculation of value of chi-square Observed Frequency Oi Expected frequency Ei (Oi-Ei) (Oi-Ei)2 (Oi-Ei)2 / Ei

3 2 1 2 1 5 8 4 2 2 2 9 8 20 7 4 8 6 6 0

1.26 2.43 1.71 2.7 0.9 2.94 5.67 3.99 6.3 2.1 6.44 12.42 8.74 13.8 4.6 3.36 6.48 4.56 7.2 2.4 Total

1.74 -0.43 -0.71 -0.7 0.1 2.06 2.33 0.01 -4.3 -0.1 -4.44 -3.42 -0.74 6.2 2.4 0.64 1.52 1.44 -1.2 -2.4

3.0276 0.1849 0.5041 0.49 0.01 4.2436 5.4289 0.0001 18.49 0.01 19.7136 11.6964 0.5476 38.44 5.76 0.4096 2.3104 2.0736 1.44 5.76

2.402857 0.076091 0.294795 0.181481 0.011111 1.443401 0.957478 0.002506 2.934921 0.004762 3.061118 0.941739 0.062654 2.785507 1.252174 0.121905 0.356543 0.454737 0.2 2.4 19.9457

(Oi-Ei)2 / Ei =19.9457 Degree of freedom= (c-1)(r-1) = (5-1)(4-1) = 12 Level of significance= 5% Table value= 21.046 Calculated value= 19.9457

INTERPRETATION Since X2 table value> value X2 Calculated value H0 is accepted Therefore, there is no relationship between age and Company reputation.

59

CHI SQUARE ANALYSIS Analysis on relationship between variables Maturity period Strongly Agre agree e 3 2 4 3 4 8 9 6

Age Below 20 20-30 30-40 Above 40

Moderate 0 5 11 8

Disagre e 1 5 15 7

Strongly disagree 1 1 7 0

From the data collected, analysis is made on whether there is any relation between the schedule differences Ho: There is no relation between Age and maturity period. H1 : There is relation between Age and maturity period. Observed frequency Age Below 20 20-30 30-40 Above 40 TOTAL Strongly agree 3 2 4 3 12 Agree 4 8 9 6 27 Maturity period Moderate Disagree 0 5 11 8 24 1 5 15 7 28 Strongly disagree 1 1 7 0 9 TOTAL 9 21 46 24 100

Expected Frequency = (Row total * column total)/ grand total

60

Calculation of value of chi-square

Observe d Frequen cy Oi Expected frequenc y Ei (OiEi) (Oi-Ei)2 (Oi-Ei)2 Ei /

3 4 0 1 1 2 8 5 5 1 4 9 11 15 7 3 6 8 7 0

1.08 2.43 2.16 2.52 0.81 2.52 5.67 5.04 5.88 1.89 5.52 12.42 11.04 12.88 4.14 2.88 6.48 5.76 6.72 2.16 Total

1.92 1.57 -2.16 -1.52 0.19 -0.52 2.33 -0.04 -0.88 -0.89 -1.52 -3.42 -0.04 2.12 2.86 0.12 -0.48 2.24 0.28 -2.16

3.6864 2.4649 4.6656 2.3104 0.0361 0.2704 5.4289 0.0016 0.7744 0.7921 2.3104 11.6964 0.0016 4.4944 8.1796 0.0144 0.2304 5.0176 0.0784 4.6656

3.413333 1.014362 2.16 0.916825 0.044568 0.107302 0.957478 0.000317 0.131701 0.419101 0.418551 0.941739 0.000145 0.348944 1.975749 0.005 0.035556 0.871111 0.011667 2.16 15.9334

(Oi-Ei)2 / Ei =15.9334 Degree of freedom= (c-1)(r-1) = (5-1)(4-1) = 12 Level of significance= 5% Table value= 21.046 Calculated value= 15.9334

INTERPRETATION Since X2 table value> value X2 Calculated value H0 is accepted Therefore, there is no relationship between age and maturity period.

61

WEIGHTED MEAN FACTORS THEY CONSIDERED BEFORE INVESTING Liquidity x 5 4 3 2 1 w 34 27 11 22 6 w=100 wx/w=371/100=3.71 INFERENCE Respondents have given agree for liquidity factor wx 170 108 33 44 6 wx=371

Strongly agree Agree Moderate Disagree Strongly disagree

Low risk x Strongly agree Agree Moderate Disagree Strongly disagree 5 4 3 2 1 w 19 22 26 25 8 w=100 wx/w=319/100=3.19 INFERENCE Respondents have given moderate rating for low risk factor Wx 95 88 78 50 8 wx=319

62

High return Strongly agree Agree Moderate Disagree Strongly disagree x 5 4 3 2 1 w 5 17 23 33 23 w=100 wx/w=251/100=2.51 INFERENCE Respondents have disagreed with High return factor wx 25 68 69 66 23 wx=251

Company reputation Strongly agree Agree Moderate Disagree Strongly disagree x 5 4 3 2 1 w 14 27 19 30 10 w=100 wx/w=305/100=3.05 INFERENCE Respondents have given moderate rating for company reputation factor wx 70 108 57 60 10 wx=305

63

Maturity period

Strongly agree Agree Moderate Disagree Strongly disagree

5 4 3 2 1

12 27 24 28 9 w=100

60 108 72 56 9 wx=305

wx/w=305/100=3.05

INFERENCE Respondents have given moderate rating for maturity period factor.

64

Chapter 5 Findings and Suggestion

65

Findings and Suggestion

FINDINGS: The majority (i.e.46 out of 100) of respondents are between 30-40 years of age. The majority (i.e.45 out of 100) of respondents are private employees. The majority (i.e.46 out of 100) of respondents annual income is less than 5 lakhs. The majority (i.e.32 out of 100) of the respondents prefer to invest in banks. Most of the respondents consider liquidity factor before making their investment in mutual funds. The Majority (i.e. 39 out of 100) of the respondents have 0-2 years of minimum experience in mutual funds. The Majority (i.e. 56 out of 100) of the respondents have less than 1 lakh investment in mutual funds. The Majority (i.e. 27 out of 100) of the respondents have knowledge about specific schemes only in mutual fund investments. The Majority (i.e. 18 out of 100) of the respondents have used Liquid fund schemes. The Majority (i.e. 24 out of 100) of the respondents allure the diversification feature of mutual funds. The Majority (i.e. 22 out of 100) of the respondents have invested in HDFC mutual funds. The Majority (i.e. 47 out of 100) of the respondents have invested 0-5% of their income in mutual funds. The Majority (i.e. 41 out of 100) of the respondents expect 10-15% of return from their investment in mutual funds. The Majority (i.e. 38 out of 100) of the respondents take investment decisions once in year and execute them. The Majority (i.e. 46 out of 100) of the respondents prefer no risk appetite. The Majority (i.e. 44 out of 100) of the respondents will be disappointed with the sharp drop in the investments. The Majority (i.e. 34 out of 100) of the respondents will stay on investments with mutual funds for 1-3 years time. The Majority (i.e. 47 out of 100) of the respondents came to know about mutual funds by advertisement.

66

SUGGESTIONS The most vital problem spotted is of ignorance. Investors should be made aware of the benefits and the current is status of

Economy. Nobody will invest until and unless he

fully convinced

of the future of ones Investments. Investors should be made to realize that ignorance is no longer bliss and what they are losing by not investing. Mutual funds offer a lot of benefit which no other single option could offer. But most of the people are not even aware of what actually a mutual fund is? They only see it as just another investment option. So the advisors should try to change their mindsets. The advisors should to highlight some of the value added benefits of MFs such as tax benefit, rupee cost averaging and systematic transfer plan, rebalancing etc.These benefits are not offered by other options single handedly. So these are enough to drive the investors towards mutual funds. Investors could also try to increase the spectrum of services offered.

67

CONCLUSION Has India is developing to a vast extent and more and more foreign investments are coming into India. And many foreign tie-ups are being made. People have lot of scope for their investments but most of the investors arent aware of the various investments that are available today. The investors have to be created awareness about the various instruments to the core so that it helps the development of our economy.

68

BIBLIOGRAPHY: http://www.moneycontrol.com http://www.scribd.com www.mutualfundsindia.com www.amfiindia.com www.investorsguide.com www.investopedia.com

BOOKS Business research methods - Donald R Cooper and Pamela S Schindler Operations research theory and applications- J K Sharma

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Full Download Test Bank For Foundations of Financial Management 17th Edition Stanley Block Geoffrey Hirt Bartley Danielsen PDF Full ChapterDocument34 pagesFull Download Test Bank For Foundations of Financial Management 17th Edition Stanley Block Geoffrey Hirt Bartley Danielsen PDF Full Chaptersacralpetrinevam6vu100% (16)

- AGPM Business PlanDocument10 pagesAGPM Business PlanOlome EmenikePas encore d'évaluation

- National Roads Authority: Project Appraisal GuidelinesDocument44 pagesNational Roads Authority: Project Appraisal GuidelinesPratish BalaPas encore d'évaluation

- Lecture 2a - Construction EquipmentDocument37 pagesLecture 2a - Construction EquipmentLouise Luy100% (1)

- Econ 202 Pre-Test 1 Chapters (4, 22-24)Document8 pagesEcon 202 Pre-Test 1 Chapters (4, 22-24)Amogh SharmaPas encore d'évaluation

- Due Diligence Studies - Alumina and Bauxite: Light MetalsDocument1 pageDue Diligence Studies - Alumina and Bauxite: Light MetalsEmílio LobatoPas encore d'évaluation

- Moroccan EconomyDocument16 pagesMoroccan EconomyAbderrahmane HajjamiPas encore d'évaluation

- Real Estate in India by AbhimanDocument24 pagesReal Estate in India by AbhimanabhimanbeheraPas encore d'évaluation

- Greenfield Airport PolicyDocument9 pagesGreenfield Airport Policyjim mehtaPas encore d'évaluation

- Brand Portfolio Strategy: Business Book ReviewDocument10 pagesBrand Portfolio Strategy: Business Book Reviewfreddlutz765Pas encore d'évaluation

- Introduction To AgribusinessDocument5 pagesIntroduction To AgribusinessEufemia GumbanPas encore d'évaluation

- Experienced CS Rohit Tyagi Seeks Finance RoleDocument3 pagesExperienced CS Rohit Tyagi Seeks Finance RolerosePas encore d'évaluation

- CPEC A Game ChangerDocument2 pagesCPEC A Game ChangerAnonymous MFumqOUvz6100% (1)

- Bεβαιωση ομολογωνDocument4 pagesBεβαιωση ομολογωνpolitisPas encore d'évaluation

- Greg Simon #1 v7Document9 pagesGreg Simon #1 v7ogangurelPas encore d'évaluation

- Lesson 19 - Preparation of Capital Statement and Balance SheetDocument6 pagesLesson 19 - Preparation of Capital Statement and Balance SheetMayeng MonayPas encore d'évaluation

- Bedford and Ziegler (1975Document6 pagesBedford and Ziegler (1975diva cahyaniPas encore d'évaluation

- A Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDocument11 pagesA Study On The Effect of Working Capital On The Firm'S Profitability of InfosysDr Abhijit ChakrabortyPas encore d'évaluation

- Chapter 7Document8 pagesChapter 7ne002Pas encore d'évaluation

- Banking: 1) in Calculations of Recurring Deposit Account, Time Is Always Taken inDocument5 pagesBanking: 1) in Calculations of Recurring Deposit Account, Time Is Always Taken inbjdevhervehroheghghbhbhotbhhortbhPas encore d'évaluation

- PI Final CombineDocument46 pagesPI Final CombineMonique LimPas encore d'évaluation

- 3 - Analysis of Financial Statements 2Document2 pages3 - Analysis of Financial Statements 2Axce1996Pas encore d'évaluation

- ListDocument4 pagesListrobbi ajaPas encore d'évaluation

- Financial InstitutionsDocument285 pagesFinancial Institutionsnadeem.aftab1177Pas encore d'évaluation

- Absa Personal Share Portfolio One PDFDocument2 pagesAbsa Personal Share Portfolio One PDFmarko joostePas encore d'évaluation

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhPas encore d'évaluation