Académique Documents

Professionnel Documents

Culture Documents

RFP

Transféré par

Sazzad WahidDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RFP

Transféré par

Sazzad WahidDroits d'auteur :

Formats disponibles

1

Operation Analysis 1.1 Bangladesh Krishi Bank Bangladesh Krishi Bank, is a non-commercial scheduled bank of Central Bank. It has around one thousand branches around Bangladesh divided into 10 divisions and 56 regions. Most of the purposes of this bank to finance into agriculture and agricultural development. Some more details . . from their documents. 1.2 IBTA IBTA or in other word Reconciliation division, is a department in Krishi bank Head office, Dhaka which deal with all kind of Inter Branch Transaction reconciliations. All transactions come from branches to head office in hard copy log format, and officers in this department have to reconcile these transactions, store and report to higher authority of the bank and other stake holders, like board of the bank and central bank. 1.3 User analysis

Users of the proposed IBTA Reconciliation System are very much familiar with the whole reconciliation process and moderate computer knowledge. 1.4 Number of system users Around 15/20 man/officer are available to use, administer, enter data, process and generate reports. 1.5 Present Reconciliation system A semi automatic reconciliation system was existing before this proposed system which was majorly used to enter the raw transaction data from the hard copy into soft data format. It was Oracle based system and CGI based front end system. Proposed system has to migrate the outstanding data from that system in to this. 1.6 Future Reconciliation system

Proposed reconciliation system will have SQL server as database server and ASP .NET as front end. It will be able to enter data, reconcile, revision & correction of outstanding data and generate following reports. Also there will be interface to access control of the users and add/edit new users and add new branches. List of reports: 1. Branch List 2. Branch List Alphabatically

3.

Overview - Reconciliation System Entities & Functions

2.1

Common functional requirements

Following are broadly the functions of the proposed reconciliation system i. Transaction Data Entry. ii. Validity of data while data entry. iii. Modification/Delete transaction data.

iv. v. vi. vii.

Finding and marking syntax and semantic mistakes. Finding and marking settled data according to settle criterions. Reporting on the settled and unsettled data. Summarizing reconciliation report on month-wise branch-wise basis. viii. Outstanding correction.

2.2 System wide functions Following are broadly the system wide functions of the proposed reconciliation system i. Authentication. ii. Add/Edit/Delete User information. iii. Access Control of the users. iv. Report exporting into Excel/PDF format. v. Web based system access.

2.3 Advanced analytics and Process intelligence Following are the major process intelligence i. Reconciliation logic based data validation. ii. ENTER key based text field switching. iii. Asynchronous data posting while data entry for faster interaction with server. iv. Syntax and semantic error analysis in data. v. Batch query for faster settle finding. vi. Predictive searching for interactive errors. vii. Generation of IDSL for correcting outstanding data. 2.4 Transaction Month

Transaction month refer to the month in which the transaction has been occurred. All monthly reports are based on this transaction month. 2.5 Transaction Date Transaction date refer to the date in which the transaction has been occurred. It can be equal or greater than date of origin of the transaction, not less than that. In responding transaction it is very common for a long gap from transaction date and date of origin. 2.6 Transaction Codes Transaction code refers to the type of transaction. There are 36 types of transaction in Krishi bank. A brief list of all kind of transaction has been given below. 00:UNKNOWN 01:D.D. 02:T.T 03:M.T. 04:TT. Disc. 05:Fund Tr. 06:Coll/Clrng 07:Othr Bank 08:Stff Recov 09:CR Adv(HO) 10:Stff paymt 11:Loan Trans 12:Fund (Corpn) 13:Pr. & Loss 14:Print Stn. 15:Inc. Bonus

16:Army Pensn 17:F.Ex. Tr. 18:Haji Dep. 19:P. Bnd/S.P. 20:P. Fund 21:Sup.Fund 22:Bnv. Fund 23:Lttry Tick 24:Fld.Off. Exp 25:Pens./Grty 26:CBA Cont. 27:Gen A/C Int. 28:Loan Recov. 29:Levy/S.chrg 30:Food Proc. 31:PF. Adv 32:RAKUB 33:DD/MT Cancl 34:DAIBB Hon. 35:TA/DA Adv. 36:Misc. Theoretically in settling condition the transaction code should be included. But from branch delivered hard copies many times the transaction code are not available and thus bank system asked to discard transaction code from the settle criterions. 2.7 SL No It is the serial number that is available in the transaction log hard copies from the branches. Generally it is in number format and always ascending order depending on transaction date. Generally serial restarts on each month. 2.8 Despatch Code / Number Despatch Code is the code give to each transaction while originating from a branch. It is a unique number for each originating and responding branch and each date of origin. Generally this is a number but practically anomalies found in the hard copies given from branches, like, there are non numeric character in the dispatch code, there is an empty dispatch code etc. Despatch code has to be same in settle criterions. 2.9 Despatch Date / Date of original Despatch date or date of original refers to the date when the actual transaction was received in the branch in vouchers of the bank. Date of original should be same in settling condition. Transaction date can be equal or greater than date of origin of the transaction, not less than that. In responding Transaction it is very common for a long gap from transaction date and date of origin. But it is found that in hard copies some entries erroneously have date of original is greater than transaction date. 2.10 Branch Code Branch code means the branchs unique code. It refers to branch of which the transaction is. 2.11 Originating Branch Code

Originating branch code refers to the branch of which the transaction originates. Originating Branch Code has to be same in settle criterions for two transactions. 2.12 Responding Branch Code Responding branch code refers to the branch of which the transaction should respond. Responding Branch Code has to be same in settle criterions for two transactions.

2.13

Amount Dr/Cr

This field refers to the amount of the transaction. 2.14 Branches / Division There are 986 branches in 54 regions and 10 divisions. 2.15 Transactions Entry This function enables user to enter new transaction data while validating each data upon above cited criterions. After successful insertion, this function gives messages to user, shows transaction data in the list according to transaction date and serial and generates monthly debit-credit summation. More over it gives user search facilities according to serial number and transaction date. 2.16 Opening balance/ Closing Balance This function generates opening and closing balance for all branches for each month consecutively and cumulatively adding up monthly transactions summation. 2.17 Finding Settled Data This function is the most critical part of the whole system. It is a sequence of several error-markings, preparing raw data table and putting settled data in a separate table for further reconciling reports.

2.18

Reconciliation

This function generates branch-wise, month-wise reconciliation report consecutively and cumulatively. This report shows all monthly settled, monthly settled up-to, outstanding transaction data up-to, Balance etc on each branches, regions and divisions basis. 2.19 Outstanding Correction This functionality gives user ability to revise the outstanding data. For this an special IDSL is generated on outstanding data for each branch according to transaction date and serial order. User can search for errors in the printed outstanding data, check with the hardcopy provided from the branch and correct it in the system. 2.20 Reporting There is 16 types of report, stated above the Reconciliation department needs. System requires a system to generate and browse all those reports easily.

DETAILED FUNCTIONALITY: SYSTEM WIDE

3 3.1 3.2 3.3 3.4

System Wide Functions* Platform Networked user support ESS (employee self service) MSS (manager self service)

3.5 3.6 3.7 3.8 3.9 3.10 3.11 3.18

Employee portal Workflow Messages System / software quality accreditations Security Compliance - Reconciliation Standards Portability Reporting

DETAILED RECONCILIATION SYSTEM FUNCTIONALITY

4 4.1 4.2 5 5.1 5.2 6 6.1 6.2 7 7.1 7.2

Basic global variables Department Setup Designation Setup User Data Entry User name, details, password etc setup User list User Access control User privileges setup on subsystems Privileged user, options list Transactions Data entry Branch name validation Transaction month set

7.3 7.4 7.5 7.6 7.7 7.8 7.9 7.10 7.11 7.12 7.13 7.14 7.15 7.16

Get the month transactions and show in list Generate monthly debit-credit summation Show monthly Opening/Closing balance with debit-credit Transaction date set & validate Transaction code set & validate Despatch code set & validate Originating branch code set, validate & selection option Responding branch code set, validate & selection option Transaction Amount Dr/Cr set & validate Transaction data Insert, validate, show message & show in list Duplicate Transaction data Insert by force, validate, show message & show in list Transaction data Update, validate, show message & show in list Transaction data Delete, validate, show message & show in list Transaction data searching by slno and transaction date, generate Dr/Cr summation, validate & show in list

7.17

Transaction data selection in the list by slno by mouse clicking, showing in text fields for modification

8 8.1 8.1.1 8.1.2 9 9.1

Opening-Closing balance generation Generation of debit/credit summation for each Generation of opening and closing balance cumulatively Store opening and closing balance for Entry window use. Settled data finding & Reconciliation Previous and current outstanding data Syntax & semantic error marking

9.1.1 9.1.2 9.1.3 9.1.4 10 7.1 7.2 7.3 7.4 7.5 7.6 7.7 7.8 7.9 7.10 7.11 7.12 7.13 7.14 7.15 7.16

Settled data finding & marking Outstanding data finding & marking Reconciling on settled data Re-generating IDSL for the outstanding data. Outstanding Data Modification Branch name validation IDSL set Get the IDSLs and show in list Generate monthly debit-credit summation Show monthly Opening/Closing balance with debit-credit Transaction date set & validate Transaction code set & validate Despatch code set & validate Originating branch code set, validate & selection option Responding branch code set, validate & selection option Outstanding Amount Dr/Cr set & validate Outstanding data Insert, validate, show message & show in list Duplicate Transaction data Insert by force, validate, show message & show in list Outstanding data Update, validate, show message & show in list Outstanding data Delete, validate, show message & show in list Outstanding data searching by slno and transaction date, generate Dr/Cr summation, validate & show in list

7.17

Outstanding data selection in the list by slno by mouse clicking, showing in text fields for modification

OPERATIONS, TECHNOLOGY AND SUPPORT 11.1 11.2 11.3 11.4 11.5 11.6 11.7 11.8 System reliability Operational efficiency System performance User productivity assistance Data processing and systems control Data volumes and quality Security Backup and recovery

TECHNOLOGY REQUIREMENTS

12.1 12.2 12.3 12.4 12.5 12.6 12.7 12.8 12.9 12.10 12.11

Application server: IIS-7 Databases-SQL server 2005 Express edition Database administration and monitoring tools Operating systems for Database server Windows2003 Operating systems for Application server Windows2003 Operating systems - clients (Any with JavaScript enabled Web Browser) XML: Embedded XBRL (eXtensible Process Reporting Language)- Microsoft Report Viewer Operating systems networks TCP/IP backbone Network types Local Intranet Network configuration Topology: Star Protocol: TCP/IP

12.12 12.13 12.14 12.15 12.16 12.17 12.18 12.19

Cloud services: SaaS (Software as a Service) ASP (Application Service Provider) / Hosted Internet access For remote backup and remote administering Internet hosting Intranet Hardware platforms - mainframe / mid range / server Hardware platforms - workstation / client Hardware - wireless / portable devices Hardware - other requirements

13

Software / System Support

13.1 13.2 13.3 13.4

Sources of support: Consultant Implementation assistance: IT department of the bank Training: Consultant will arrange Maintenance and support: After implementation support agreement required.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- CMP6221: Computing For AI Lab Session 4: Object Oriented Programming Relationships Between Objects & InheritanceDocument6 pagesCMP6221: Computing For AI Lab Session 4: Object Oriented Programming Relationships Between Objects & InheritanceYasir MehmoodPas encore d'évaluation

- Using The Borland 5.5 Compiler and Command-Line ToolsDocument2 pagesUsing The Borland 5.5 Compiler and Command-Line Toolsarief prasetyoPas encore d'évaluation

- Lions - Unix Operating System Source Code Level Six 197711Document110 pagesLions - Unix Operating System Source Code Level Six 197711abigarxesPas encore d'évaluation

- Using Node-RED Platform in An Industrial Environment: February 2020Document13 pagesUsing Node-RED Platform in An Industrial Environment: February 2020Ankit JhaPas encore d'évaluation

- UNIT 4 - SOFTWARE TestingDocument15 pagesUNIT 4 - SOFTWARE Testingsuthakarsutha1996Pas encore d'évaluation

- M Alekya: Phone # 7036899945 104 Java Full Stack Developer Career ObjectiveDocument4 pagesM Alekya: Phone # 7036899945 104 Java Full Stack Developer Career ObjectiveNuclear WifePas encore d'évaluation

- JSPDocument250 pagesJSPSiwa Karthikeya AmbatiPas encore d'évaluation

- Step-By-Step Guide For LSMW Using ALE/IDOC Method: Business CaseDocument15 pagesStep-By-Step Guide For LSMW Using ALE/IDOC Method: Business Casedaisy.ngPas encore d'évaluation

- Library ManagementDocument33 pagesLibrary Managementrakshitha s0% (1)

- 17.set in PythonDocument6 pages17.set in Pythondnyaneshwar patilPas encore d'évaluation

- BO InfoView User GuideDocument240 pagesBO InfoView User GuideKofi AmoakoPas encore d'évaluation

- SystemVerilog VeriflcationDocument68 pagesSystemVerilog VeriflcationDrBhoopal RaoPas encore d'évaluation

- Solaris Cheat Sheet: SmitDocument6 pagesSolaris Cheat Sheet: SmitKevinNilsson100% (2)

- PracticalsDocument88 pagesPracticalsAdeeb Mehmood50% (2)

- Information Security CS 526: Topic 9Document13 pagesInformation Security CS 526: Topic 9Morrow LongPas encore d'évaluation

- Isc2 CCDocument68 pagesIsc2 CCDamian LewisPas encore d'évaluation

- Case 3Document3 pagesCase 3Riki Alvarez Indo100% (2)

- Mba 546Document2 pagesMba 546api-3782519Pas encore d'évaluation

- Exam Questions AWS-Solution-Architect-AssociateDocument6 pagesExam Questions AWS-Solution-Architect-AssociatetestPas encore d'évaluation

- Oracle Fusion OTBI Reports by Ravinder Reddy: Udem yDocument7 pagesOracle Fusion OTBI Reports by Ravinder Reddy: Udem yKasiviswanathan MuthiahPas encore d'évaluation

- SyllabusDocument9 pagesSyllabusAkinsunmiPas encore d'évaluation

- FURPS - WikipediaDocument2 pagesFURPS - WikipediaJOHN CHARLASPas encore d'évaluation

- Task SchedulerDocument1 pageTask SchedulerPedro AlexandrePas encore d'évaluation

- BhaskarDocument5 pagesBhaskarDonakanti BhaskarPas encore d'évaluation

- AEM 6 Archtecture E0 BeginnersDocument24 pagesAEM 6 Archtecture E0 Beginnersravi9inPas encore d'évaluation

- Fortiweb v5.8.5 Administration GuideDocument833 pagesFortiweb v5.8.5 Administration GuideabaheabaheabahePas encore d'évaluation

- Payroll Table Descriptions Hand BookDocument251 pagesPayroll Table Descriptions Hand Bookbalasuk0% (2)

- ACT 14 07 Sky Robo Data Sheet Short Version 140430e PDFDocument2 pagesACT 14 07 Sky Robo Data Sheet Short Version 140430e PDFhotfuryPas encore d'évaluation

- Backup, Recovery, and Media Services For IseriesDocument370 pagesBackup, Recovery, and Media Services For IseriesAndreas Scherer100% (2)

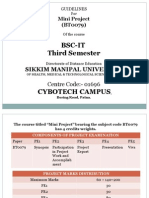

- Mini Project For BSCIT 3rdDocument9 pagesMini Project For BSCIT 3rdMani ManuPas encore d'évaluation