Académique Documents

Professionnel Documents

Culture Documents

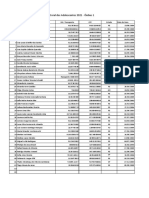

Valuation of Imported Goods For Customs Purposes, VAT and Trade Statistics

Transféré par

Kuo Hsiung ChongDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Valuation of Imported Goods For Customs Purposes, VAT and Trade Statistics

Transféré par

Kuo Hsiung ChongDroits d'auteur :

Formats disponibles

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

Foreword

This notice cancels and replaces Notice 252 (June 2006).

Further help and advice

If you need general advice or more copies of HM Revenue & Customs notices, please phone the Helpline on 0845 010 9000. You can call between 8.00 am and 8.00 pm, Monday to Friday. If you have hearing difficulties, please phone the Textphone service on 0845 000 0200. If you would like to speak to someone in Welsh, please phone 0845 010 0300, between 8.00 am and 6.00 pm, Monday to Friday. All calls are charged at the local rate within the UK. Charges may differ for mobile phones.

Other notices on this or related subjects

702 VAT: Imports

1. Introduction 1.1 What this notice is about

There are a number of Methods for establishing the value on which customs duty and import VAT is calculated. The same value is also used for trade statistics. This notice explains what the Methods are and when they may be used. You can also access details of any changes to this notice since June 2009 on our website at www.hmrc.gov.uk This notice explains our view of the law, and nothing in it overrides the law.

1.2 Who should read this notice?

It is mainly for importers and their clearing agents. The notice is written as though you are the importer unless otherwise stated. Our notices and other information are available on our website at www.hmrc.gov.uk

Page 1 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

1.3 Why do I need a value for customs duty?

We often charge customs duty as a percentage of the value of your goods we call this ad valorem duty. The amount of duty you must pay depends on the customs value of your goods. The rules for arriving at the customs value are based on the WTO Valuation Agreement (previously known as the GATT Agreement).

1.4 What law covers customs valuation?

These rules are set out in EC Regulations which are listed in Section 26. All EC legislation is available on the Internet (http://europa.eu/index_en.htm).

1.5 What is import VAT?

VAT due at import is treated like a customs duty. The amount of VAT you must pay depends on the value of the goods. The rules for arriving at this value are set out in the VAT Act 1994, Section 21.

1.6 What are trade statistics?

We have to collect and compile trade statistics for UK (the balance of payments) and EC purposes. You must always declare a value for trade statistics on the import entry or removal document from Customs warehousing. This value must be declared in the value for duty box whether or not ad valorem duty is to be paid or the goods are to be entered to a Customs warehouse.

2. Customs duty 2.1 Where can I find out if I have to pay ad valorem customs duty?

In the Customs Tariff. This lists all the customs duty rates, commodity codes and procedures relating to imported goods. You can ask for details from our Helpline.

2.2 How do I arrive at the value for customs duty?

You do this by using one of 6 ways or Methods. You must try Method 1 before going on to Method 2 and so on. We may ask you to explain why an earlier Method cannot be used. The only exception to the order of trying the Methods is that you may try Method 5 before Method 4 if you wish. You can use the SPV (for goods imported on consignment) or SIV systems (see Sections 9 and 10) if you import the fresh fruit and vegetables.

Page 2 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

Sections 3 to 8 explain the 6 Methods. However, the normal Method of valuation is Method 1 (the transaction value Method). You must use this Method wherever possible and in fact it is used for over 90% of importations liable to ad valorem customs duty.

2.3 Must I produce evidence to support the value for customs duty?

Yes. The evidence for each Method is described in the relevant Sections. You must produce any documents and information about an importation which one of our officers requires. You may also be required to allow officers to inspect or take extracts from any relevant document.

2.4 How long must I keep customs records?

You must keep them for a period of at least four years.

2.5 What if I cannot arrive at the value for customs duty?

You can ask for release of your goods by paying the undisputed charges outright and securing the balance by cash or cheque we call this a deposit. When the value is agreed you may be asked to pay more duty or you may get a refund we call this adjusting the deposit. If the deposit equals the amount of duty due you will be told we call this bringing the deposit to account. As an alternative to a cash deposit, you may be able to use a guarantee, underwritten by a bank. The Helpline will be able to advise you further.

2.6 What do I do if I disagree with a Customs decision?

If you do not agree with any decision issued to you there are three options available. Within 30 days of the date of the decision you can either: send new information or arguments to the decision maker request a review of the decision by someone not involved in making the disputed decision. Your request must be in writing and should set out the reasons why you do not agree with the decision. Please write to:

Page 3 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

Customs and International Review and Appeals Team 7th Floor South West Alexander House 21 Victoria Avenue Essex SS99 1AA, or appeal direct to the Tribunal who are independent of HMRC.

If you opt to have your case reviewed you will still be able to appeal to the tribunal if you disagree with the outcome. Further information relating to reviews and appeals is contained in factsheet HMRC1 which can be obtained from our website or by phoning 0845 900 0404.

3. Method 1 3.1 What is Method 1?

It is the first Method you must try. It is called the transaction value. It is the normal Method of valuation which applies to over 90% of importations liable to ad valorem customs duty.

3.2 What is meant by transaction value?

This is the price paid or payable by the buyer to the seller for the goods when sold for export to the EC adjusted in accordance with specific rules explained in detail in the following paragraphs. This may also cover situations where goods are imported from a processor. The transaction value may be built up or constructed by reference to the cost of processing plus any items to be added in accordance with paragraph 3.15 below particularly sub-paragraph (d). Such items are commonly referred to as assists.

3.3 What if there is no sale?

This rules out Method 1. You must try Method 2. Ignore the rest of this Section and go direct to Section 4. Examples of situations where there is no sale are given in Section 27.

Page 4 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

3.4 How do I arrive at the customs value?

You base it on the price actually paid or payable by the buyer to the seller for the goods. This means the total payment made or to be made by the buyer to or for the benefit of the seller for the imported goods. It includes all payments made or to be made as a condition of sale of the imported goods by the buyer to the seller or by the buyer to a third party to satisfy an obligation of the seller. Thus periodic payments (such as monthly, quarterly, annually) or one off payments by the buyer to the seller for the imported goods must be taken into account (for example tooling charges, engineering fees, development costs). The buyer of the imported goods need not necessarily be established in the country of importation.

3.5 What happens if there is an earlier sale where the imported goods have been sold more than once prior to entry to free circulation?

Where goods are sold only once, the fact that they are declared for free circulation in the Community can be taken as confirming that the goods were sold for export to the Community. Where the goods are sold to one or more subsequent buyers before entry into free circulation, this also applies to the last sale in the commercial chain prior to the introduction of the goods into the customs territory of the Community.

3.6 What other information and documentary evidence is required?

Where an earlier sale has taken place involving the imported goods, you may declare the earlier sale as the basis for the customs value. NOTE. An earlier sale may not be used as the basis for import VAT where the import declaration is made in the name of a final consumer or retail customer. Remember you can only use an earlier sale where it can be demonstrated that there are specific and relevant circumstances which led to export of the goods to the customs territory of the Community. Ways in which you can do this include the following: the goods are manufactured according to EC specifications, or are identified (according to, for example, the marks they bear) as having no other use or destination the goods in question were manufactured or produced specifically for a buyer in the EC, or

Page 5 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

specific goods are ordered from an intermediary who sources the goods from a manufacturer and the goods are shipped directly to the EC from that manufacturer.

Examples illustrating case situations are given in Section 28. The term earlier sale may also apply to built up or constructed values (see paragraph 3.2). NOTE. The person completing and signing the valuation declaration, form C109A (see paragraph 19.6) must be in possession of all the facts relating to the sale upon which the declared customs value is based (see paragraph 19.7). This includes having access to the relevant accounting records kept in third countries in order to provide documentary evidence of settlement between the relevant buyer and seller to our satisfaction. Also, having declared a sale, which is accepted by us as the basis for the transaction value, you cannot subsequently amend the original declaration to another sale if the goods have been released into free circulation.

3.7 What evidence of the price paid or payable must I produce?

A copy of the sellers invoice or other document against which payment will be made. This will include telex or similar messages used instead of invoices. (See also paragraph 2.3).

3.8 What if Customs has doubts about the transaction value?

Where we have doubts that the declared transaction value represents the total amount paid or payable, we will ask you for more information. If those doubts continue we shall notify you (in writing if you request) of the grounds for those doubts before making a final decision about the acceptability of the declared value. You will be given a reasonable opportunity to respond. Then we will make a final decision and notify you of it in writing. (See paragraph 2.6 if you disagree with a customs decision.)

3.9 What if the sale is subject to any restrictions?

If the sale is subject to conditions which restrict your freedom to dispose of or sell the goods as you wish you may not be able to use Method 1 (see Section 29).

Page 6 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

3.10 What if I am related to the seller of the goods?

The fact that you are related to the seller of the goods does not mean that Method 1 cannot be used. The price paid or payable is still acceptable unless as a result of the relationship you get a reduced price (see Section 30).

3.11

What does related to the seller mean?

they are officers or directors of one anothers businesses they are legally recognised partners in business they are employer and employee any person directly or indirectly owns, controls or holds 5% or more of the outstanding voting stock or shares of both of them one of them directly or indirectly controls the other both of them are directly or indirectly controlled by a third person together they directly or indirectly control a third person, or they are members of the same family (see Section 31).

Persons (natural or legal) are related if:

But if you act as the sellers agent, distributor or concessionaire you are related only if one of the above categories also applies.

3.12 If Im an intermediary (such as a selling agent) or branch office can I use Method 1?

You may be able to use Method 1. Section 32 for selling agents or 33 for branch offices give further information.

3.13 Does it matter whether I pay the seller direct?

No. You can pay a third party if the seller says so.

3.14

Does it matter whether I pay in cash?

No. You can also pay by letters of credit or negotiable instrument.

Page 7 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

3.15 What items must I add to the price paid or payable?

You must add the following to the price you pay (unless they are already included): (a) Delivery costs. The costs of transport, insurance, loading or handling connected with delivering the goods to the EC border must be included. Section 17 gives further details. (b) Commissions. Certain payments of commission and brokerage, including selling commission, must be included. Section 32 gives more details about selling agents. But you can exclude buying commission if it is shown separately from the price paid or payable for the goods (see paragraph 3.16(f) and Section 34). (c) Royalties and licence fees. You must include these payments when they relate to the imported goods and are paid by you as a condition of the sale to you of those goods. You can find further information in Section 35. (d) Goods and services provided free of charge or at reduced cost by the buyer. If you provide, directly or indirectly, any of the following, you must include in the customs value any part of the cost or value not included in the price charged to you by the seller: (i) materials, components, parts and similar items incorporated in the imported goods including price tags, kimball tags, labels (ii) tools, dies, moulds and similar items used in producing the imported goods, for example, tooling charges. There are various ways of apportioning these charges (iii) materials consumed in producing the imported goods, for example, abrasives, lubricants, catalysts, reagents etc which are used up in the manufacture of the goods but are not incorporated in them, or (iv) engineering, development, artwork, design work and plans and sketches carried out outside the EC and necessary for producing the imported goods. The cost of research and preliminary design sketches is not to be included. NOTE. If you make any payments (periodically or one off) to the seller for any of the above goods and services, you must include the amounts in the customs value (see paragraph 3.4). (e) Containers and packing. Include: the cost of containers which are treated for customs purposes as being one with the goods being valued (that is not freight containers the hire-cost of which forms part of the transport costs), and

Page 8 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

the cost of packing whether for labour or materials.

Where containers are for repeated use, for example, reusable bottles, you can spread their cost over the expected number of imports. If a number of the containers may not be re-exported, this must be allowed for. (f) Proceeds of resale. If you are to share with the seller (whether directly or indirectly) the profit on resale, use or disposal of the imported goods you must add the sellers share to the price paid (but see paragraph 3.16(d) as regards dividends). For example, if the seller is to have 30% of the profit which you receive, this is to be added to the price paid or payable. If at the time of importation the amount of profit is not known, you must request release of the goods against a deposit or guarantee (see paragraph 2.5). (g) Export duty & taxes paid in the country of origin or export. When these taxes are incurred by the buyer they are dutiable. However, if you benefit from tax relief or repayment of these taxes they may be left out of the customs value.

3.16 Can I leave out any items from the customs value?

Yes. The following items may be left out of the customs value: (a) Delivery costs within the EC. If the sellers or carriers charge covers delivery beyond the EC border you may deduct the additional charges for such delivery, providing they are shown separately from the price paid or payable for the goods. Section 17 gives more details. (b) EC duties or taxes. You can deduct from the price you pay any included customs duty or other taxes which are payable in the EC because of the importation or sale of the goods. To find the amount of duty included in the invoice price, use the formula:

For example, if the duty inclusive invoice price is 1100 and the rate of duty is 10% the duty included in that invoice price is:

Therefore the included duty is 100. NOTE. The included duty is the last item to be deducted.

Page 9 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

(c) Discounts. These can only be left out where they relate to the imported goods being valued and there is a valid contractual entitlement to the discount at the material time for valuation. Discounts (such as contingency or retroactive discounts) related to previous importations cannot be claimed in full on the current importation. (i) Quantity or trade discounts. You can leave out these discounts where earned. In other words the price paid or payable net of these discounts is acceptable. If you are related to the seller the discounts will also be allowed if that relationship has not affected the price of the goods (see paragraph 30.1). (ii) Cash and early settlement discounts. You can also leave out these discounts on the following basis: when the payment reflecting the discount has been made at the time of entry to free circulation if the payment has not been made at the time of entry to free circulation, it will be allowed at the level declared provided it is a discount generally accepted within the trade sector concerned if the discount is higher than is generally accepted within the trade sector concerned it will only be accepted if you can demonstrate, where required, that the goods are actually sold at the price declared as the price actually paid or payable and the discount is still available at the time of entry to free circulation.

NOTE. If you never take advantage of a cash discount and always pay the gross contract price for the goods, the discount may become liable for inclusion in the customs value at the time of entry to free circulation. For further information you should contact our Helpline. (d) Dividends. You can leave out dividend payments you make to the seller.

(e) Marketing activities related to the imported goods. You are not required to include in the customs value the cost of the following activities which you carry out at your own expense: advertising promotion, or guarantee or warranty services.

In addition any payments that you make towards general marketing support which are not related to imported goods, should not be included. NOTE. The cost of marketing activities borne by the seller are to be included in the customs value even if they are charged separately from the invoice price for the goods.

Page 10 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

(f) Buying commission. You may leave out fees or brokerage paid to your agent for representing you outside the EC in buying imported goods, providing the commission is shown separately from the price paid or payable for the goods. See Section 34 for further details. NOTE. Buying commission is to be included in the value for VAT. Paragraph 24.2 refers. (g) Export quota and licence payments. You may leave out payments for buying export quotas and licences. But you must include payments for certificates of authenticity for meat. See Section 36 for further details. (h) Interest charges. These may be left out if they are payable under a financing arrangement for buying the imported goods, providing the charges are shown separately from the price paid or payable for the goods. See Section 37 for further details. (i) Rights of reproduction. Payments for these rights may be left out if they are shown separately from the price paid or payable for the goods. (j) Post-importation work. You may leave out charges for: construction work erecting assembling maintaining, or giving technical help

for goods such as industrial plant, machinery or heavy equipment. The work may be carried out before or after importation so long as it is carried out as part of the installation of the imported goods and the charge must be shown separately from the price paid or payable for the goods. (k) Management fees. You can leave out management fees that you pay to the seller. This would include general service fees for administration, marketing, accounting, etc., that are not related to the imported goods. NOTE. You may need to produce evidence to support any claim to leave any of the items mentioned in this paragraph out of the customs value.

Page 11 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

3.17 What can I do if, at the time of entry, I cannot arrive at a value for an item that:

(a) (b) I must add to the price paid or payable, or I may leave out of the customs value?

You can ask us to agree to a Method for arriving at an appropriate amount to add or exclude at the time of entry. This could involve the use of average values or a percentage addition or deduction and be subject to periodic reviews.

4. Method 2 4.1 What is Method 2?

It is the second Method you must try. It is based on the customs value of identical goods exported to the EC at or about the same time as the goods to be valued.

4.2 What is meant by identical goods?

These are goods produced in the same country as those being valued. They must also be the same in all respects, such as physical characteristics, quality and reputation. Minor differences in appearance do not matter. If the producer of the Method 2 goods does not produce Method 1 goods, another producers goods may be used for comparison.

4.3 What if there are no identical goods?

This rules out Method 2. You must try Method 3. Ignore the rest of this Section and go direct to Section 5.

4.4 How do I arrive at the customs value?

You base it on a customs value of identical goods already accepted by EC Customs under Method 1. Where there is a sale at the same commercial level and in the same quantity this must be used. If more than one value is available use the lowest.

Page 12 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

4.5 What if there are no sales at the same level or in the same quantity?

You may use sales at a different commercial level or in different quantities. But when arriving at the customs value you must take into account any effect these differences have on the price. There are examples in Section 38.

4.6 Are there any other differences I must take into account?

Yes. You must take account of differences between the costs of delivering the identical goods and delivering the goods to be valued.

4.7 What evidence must I produce?

A copy of, or the necessary data to enable us to trace, an import entry (with supporting documents) for identical goods where Method 1 has been accepted by us or another EC Customs administration. This entry must relate to identical goods exported at or about the same time as the goods to be valued. This is to ensure that the goods to be valued and the identical imported goods will have been exported within a timescale in which the price of the goods would not have changed.

4.8 What if identical goods are to be valued under both Method 1 and Method 2?

If some of the goods are sent free of charge, (see Section 12) and they are entered on the same import entry, the evidence provided with that entry can be used to establish both the customs values. We may need a copy of the producers price list where differences for level or quantity have to be taken into account (see paragraph 4.5 and Section 38).

5. Method 3 5.1 What is Method 3?

It is the third Method you must try. It is based on the customs value of similar goods exported to the EC at or about the same time as the goods to be valued.

5.2 What is meant by similar goods?

These are goods which differ in some respects from the goods being valued but they: are produced in the same country

Page 13 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

can carry out the same tasks, and are commercially interchangeable.

Where similar goods are not made by the producer of the goods to be valued, you can use similar goods produced by a different person.

5.3 What if there are no similar goods?

This rules out Method 3. You now have a choice to either try Method 4 (explained in Section 6) or Method 5 (explained in Section 7).

5.4 What are the conditions for using Method 3?

The conditions are the same as for Method 2; see Section 4.

6. Method 4 6.1 What is Method 4?

It is the fourth Method you can try. It is based on the selling price of the goods in the EC. Remember that Method 5 can be tried before Method 4 if you wish.

6.2 How do I arrive at the customs value?

The customs value is based on the price of each item (unit price) at which: the imported goods identical imported goods (see paragraph 4.2), or similar imported goods (see paragraph 5.2),

are sold in the EC in the condition as imported to customers unrelated to the seller. The unit price must relate to sales in the greatest aggregate quantity (see paragraph 6.6) at or about the time of the importation of the goods to be valued. You must be able to produce details of the sales in the greatest aggregate quantity at the time of entry into free circulation. In the UK this is known as Method 4(a).

Page 14 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

6.3 What if there is no sale at or about the time of importation?

You can base the customs value on the unit price of the actual sales of the imported goods that take place up to 90 days after importation. As you cannot establish the customs value until the goods have been sold you must request release against a deposit (see paragraph 2.5). In the UK this is known as Method 4(b).

6.4 What if the goods are not sold in the EC in the condition as imported?

If you want to, you can base the customs value on the price at which the goods are sold after processing. But you cannot do this if the goods: lose their identity (unless you can accurately and easily establish the value added by the processing), or keep their identity but form a minor part of the goods sold.

6.5 What if there are no sales to unrelated persons in the EC?

This rules out Method 4. You must try Method 5 (explained in Section 7) if you have not already considered it. Otherwise go to Section 8.

6.6 How do I arrive at the sale in the greatest aggregate quantity?

You add together the number of items sold at each price. The largest number of items sold at one price is the greatest aggregate quantity. See Section 39 for examples.

6.7 What deductions must I make from the unit price?

You must deduct the following:

Page 15 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

either the commissions usually paid or agreed to be paid or the addition usually made for profit and general expenses in connection with sales in the EC of imported goods of the same class or kind the usual costs of transport, insurance and associated costs incurred within the EC, and EC customs duties and internal taxes payable in the country of importation.

Also if the goods are sold after processing (see paragraph 6.4) deduct the value added by the processing carried out in the EC.

6.8 Can I deduct my actual profit and general expenses?

Yes unless your figures are out of line with those usual for sales in the EC of imported goods of the same class or kind.

6.9 What if Customs challenge the deduction I have made?

We will produce other relevant information relating to additions for profit and general expenses made by importers of goods identical or similar to those to be valued. Therefore you should have available information to show that the deduction you have made is usual by comparison with importers within your trade sector. Because this is a complex subject we recommend that you contact the Helpline to agree a deduction before you begin importing the goods concerned.

6.10 What is meant by goods of the same class or kind?

This term means goods which fall within a group or range of goods produced by a particular industry or sector of industry. It includes identical (see paragraph 4.2) and similar (see paragraph 5.2) goods. The goods need not have been imported from the same country as the goods being valued.

Page 16 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

6.11

What evidence must I produce?

Method 4(a). You must produce with the import entry one of the following showing the unit price in the greatest aggregate quantity: a sales invoice a price list current at the time of importation (for importations of sheepmeat carcases from Australia and New Zealand see Section 40), or other evidence as agreed with us.

Unless an overall percentage deduction has been agreed with us, we also need details of the actual deductions claimed. Method 4(b). At the time of importation. You must give a reasonable estimate of the final sales value for deposit purposes (see paragraph 2.5). This estimate must be supported by a pro-forma invoice, statement of value or other evidence. For importations of fresh fruit and vegetables and cut flowers see Section 41. Adjusting the deposit. You do not have to wait until all the goods are sold to establish the customs value. Once you have sold enough to arrive at the unit price you must send copies of the sales invoices and a copy of your calculations to NIDAC. Unless an overall percentage deduction has been agreed with us, we will also need details of the actual deductions claimed. Duty will either be taken to account, refunded or called for (see paragraph 2.5).

In the fresh fruit and vegetable and cut flowers trade the account sales procedure may be used as a basis for arriving at the duty payable (see Section 41 for more information).

7. Method 5 7.1 What is Method 5?

It is the fifth Method you can try. It is based on the costs of production of the goods. Usually it can only be used where the importer and supplier are related (see paragraph 3.10). Remember you can try this Method before Method 4 if you wish.

7.2 How do I arrive at the customs value?

The customs value is a built-up value. It is based on the sum of the following:

Page 17 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

the cost or value of materials and fabrication or other processing used in producing the imported goods including: the items detailed in paragraph 3.15(d) if supplied by the buyer, directly or indirectly. Even if the work listed in paragraph 3.15(d)(iv) is carried out in the EC you must include the value of the work in the customs value if you charge the producer of the goods to be valued for that work; and containers and packing (see paragraph 3.15(e)) an amount for the producers profit and general expense, plus the cost of transport, insurance and loading or handling connected with delivering the goods to the EC border.

7.3 What evidence must I produce?

You must be able to get information about the cost or value of the items in paragraph 7.2. This information must be based on the producers commercial accounts. These accounts must follow the general principles of accounting, which apply in the country where the goods are produced.

7.4 What other evidence is required?

You must also be able to get information about the producers profit and general expenses. The amount to be added must be in line with the usual figures for profit and general expenses for producers in the country of exportation of the goods: of the same class or kind (see paragraph 6.10), and for export to the EC.

7.5 What if Customs challenge the producers figures for profit and general expenses?

We will produce other relevant information relating to figures for profit and general expenses reflected in sales by other producers who export to the EC. Such figures will relate to producers of identical or similar goods in the same country of export as the goods to be valued.

7.6 What if I cannot get this information?

This rules out Method 5. If you have already unsuccessfully tried Method 4 (explained in Section 6) you must now use Method 6 (explained in Section 8).

Page 18 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

7.7 Can I get help to work out this Method?

Yes, but we know from experience that this Method is difficult and therefore is rarely used. For further advice you should contact the Helpline.

8. Method 6 8.1 What is Method 6?

It is the final Method and is called the fall-back Method.

8.2 How do I arrive at the customs value?

You must arrive at the customs value by using reasonable means consistent with the WTO Valuation principles. You do this where possible by adapting Methods 1 5 flexibly to fit unusual circumstances: Examples Methods 2 or 3. The customs value could be based on the transaction value of identical or similar imported goods produced in a country other than the country of exportation of the goods being valued. Method 4(b). The 90 days limit for sales could be extended. The customs value could be based on the price that would have been paid for the goods if they had been purchased (perhaps by reference to the export price list for sales to the EC issued by the supplier). This approach would be consistent with WTO valuation principles.

8.3 What evidence must I produce?

This depends on which Method is being flexibly used. For further advice you should contact the Helpline.

9. Simplified Procedure Values (SPVs) 9.1 What are SPVs?

They are customs values derived from prices realised on sales in specified marketing centres within the EC. A variety of deductions are made from these prices to arrive at an average sterling value per 100kg net for each product covered by the scheme.

Page 19 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

9.2 What fruit and vegetables does the scheme cover?

A list is given in Section 42. Importers connected to CHIEF can obtain these details from the relevant data files.

9.3 When can I use SPVs?

You can only use the SPV scheme for whole fruit and vegetable produce, of a single kind, imported on a consignment basis. Excluded from the scheme are fruit or vegetable products that have undergone a cut & dicing process prior to importation. You can not use the SPV system if there is a transaction value. The goods must be valued using Method 1.

9.4 Can I change my mind about using the SPV scheme during a calendar year?

Yes, there are no restrictions on changing between SPVs and other valuation Methods during that year. Remember that if there is a transaction value, Method 1 must always be used. NOTE. Once the goods have been entered to SPVs you can never have the entry amended to, for example, Method 4(b) nor may goods be entered against security pending a choice between SPVs and any other Method.

9.5 How often do the SPVs change?

Fortnightly, starting midnight Thursday/Friday.

9.6 How can I find out the current SPVs?

A list of the values is available on the CHIEF Noticeboard. The Fresh Produce Consortium (UK) is also told the values for the benefit of their members. The SPV to be used is the value applying when the import entry is accepted by us. NOTE. When a SPV rate is not available to use as the basis of value you must use Method 4(b) to value goods imported on consignment.

Page 20 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

9.7 Can I get a refund of duty on goods which are received in a state unfit for human consumption or have to be destroyed?

Yes, if you can show that 5% or more of the consignment was unfit for human consumption (before entry into free circulation). Duty will be refunded on that part of the consignment which is unfit for human consumption. Section 8 of Notice 199 Imported goods: Customs procedures and Customs debt, gives you advice on repayments.

9.8 What if the goods are received in a damaged state?

If you can show that the damage occurred before entry into free circulation and the value of the consignment has decreased by at least 20% the SPV rate will be apportioned accordingly. Example If the value of the consignment has decreased by 40%, the customs value will be based on 60% of the SPV.

9.9 What evidence must I produce?

You must show by what percentage the goods were damaged or unfit for human consumption before they were released from our control. This must be done by producing a statement from: our officer who examined the goods the Port Health Official, or an independent expert such as an insurance assessor or a surveyor who is acceptable to us.

10. Entry price system - Standard Import Values (SIVs) 10.1 What is the entry price system?

The entry price system applies to the fruit and vegetables. The periods of application are listed in the Annex to Commission Regulation 1580/2007. Further details can be found in the Customs Tariff, Volume 2, Section 11.

Page 21 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

For each product covered by the system the Tariff indicates a scale of entry prices per 100 Kg net. At the highest point on the scale the Tariff indicates an ad valorem rate of duty only. As you proceed down the scale specific charges are introduced. Thus the lowest entry price generates the highest specific charge in addition to the ad valorem duty.

10.2 How do I decide which entry price applies?

You have a choice of the following: (a) the FOB price of the products in their county of origin plus delivery costs (freight and insurance) to the EC border, where that price and those costs are known at the time the customs declaration is made NOTE. For goods listed in the Annex, where the FOB price, (plus the costs at 10.2(a)), is greater by more than 8% of the SIV price (see (c) below) applicable at the time of entry to free circulation for the product being valued, you must lodge security. The amount of the security is the additional duty due if the SIV had been used. This will only apply if the SIV is below the threshold entry price. (b) the customs value calculated in accordance with Method 4(b) (see paragraph 6.3). The value declared for deposit purpose must be a reasonable estimate of the final value NOTE. At the time of importation you must lodge security equal to the amount of duty that would have been paid if you had chosen the SIV (see (c) below). (c) the Standard Import Value (SIV). SIVs are arrived at by the EC Commission in exactly the same way as SPVs and are per 100 Kg net. SIVs change daily at midnight. If you are connected to CHIEF you can obtain details from the relevant Notice Board. NOTE. When an entry price is in force for particular types of fresh fruit and vegetables, the SPV for those products is suspended and not available as the basis of value.

10.3 What value do I use to calculate the duty payable?

You must use the same value as you chose to determine the entry price (see paragraph 10.2). NOTE. When you have made your choice at the time of entry to free circulation, you cannot change your mind and request that the entry is amended.

Page 22 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

10.4 Where security is required, how do I obtain release of that security?

You have one month from the sale of the products to prove that they were disposed of under conditions which confirm the price (in accordance with paragraph 10.2(a)) or the customs value (in accordance with paragraph 10.2 (b)). This is subject to a limit of four months from the date of acceptance of the entry to free circulation. However, you may ask Customs (NIDAC) for an extension of up to three months to this limit. Failure to meet one or other of these deadlines will result in the loss of the security. The security lodged will be released to the extent that proof of the conditions of disposal is provided to the satisfaction of Customs (NIDAC). Otherwise the security will be forfeit to pay the duties.

11. Frozen meats in round sets 11.1 What is frozen meat in round sets?

Frozen meat is often imported in what is commercially described as frozen round sets. These consist of several different cuts of meat invoiced at a unit price per ton. The cuts differ in value, but this may not be shown on the invoice.

11.2

Which valuation Method do I use?

You must try Method 1, based on the alternatives outlined in Section 43.

11.3 What if there is no price paid or payable?

For further advice you should contact the Helpline if you are unable to use Method 1.

12. Valuing free of charge goods 12.1 Can I use Method 1?

Not normally, because there is no price paid or payable by you to the supplier. But you may be able to use Method 1 where: the goods have been the subject of an earlier sale (perhaps to the supplier), or you are importing the goods pre-sold; and you can produce evidence of that sale.

Page 23 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

See paragraph 19. 4 about completing and signing valuation declarations.

12.2 If I cannot use Method 1, how else can I arrive at the customs value?

You can try: Methods 2 or 3 (see Sections 4 or 5) if you import or have knowledge of imports of identical or similar goods under Method 1 Method 4 (see Section 6) if you sell the goods or identical or similar goods to unrelated customers in the EC, or Method 5 (see Section 7) if you can get the detailed costings.

12.3 What if I cannot use any of these Methods?

You must use Method 6 (see Section 8). The customs value can be based, for example, on the price you would have paid the supplier if you had bought the goods. You must add or leave out the items detailed in paragraphs 3.15 and 3.16 as appropriate.

12.4 What evidence must I produce under Method 6?

A copy of the suppliers current export price list for goods sold to the EC a statement from the supplier of the value of the goods, or other evidence as agreed with us.

13. Valuing free of charge replacement goods 13.1 Replacement goods in the same shipment

If the supplier includes in the shipment a quantity of items free of charge as replacements for goods likely to be defective or damaged in transit, the contracted sale price is regarded as covering the total quantity of items shipped.

Page 24 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

13.2 Replacement goods in a subsequent shipment

The customs value is determined in accordance with paragraphs 12.1 and 12.2. However, you can ask Customs to amend the customs value of the original shipment in accordance with the contractual arrangements.

14. Valuing used goods 14.1 Second-hand goods which were not used by you before entry into free circulation

You have to follow the rules set out in Sections 3 8. No special treatment is necessary.

14.2 Goods acquired new or used and used or further used in a third country before entry into free circulation

Where the period and extent of use between being acquired and entry into free circulation results in the goods being worth less at time of entry into free circulation than when acquired, you need not use Method 1. You can try: Methods 2 or 3 (see Sections 4 or 5) if you import identical or similar goods of the same age and in the same condition under Method 1, or Method 4 (see Section 6) if you sell the goods or identical or similar goods to unrelated customers in the EC.

If you cannot use any of these Methods you must use Method 6. The customs value can be based on the value of the goods when acquired less an amount for loss of value due to the usage.

Page 25 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

15. Valuing rented or leased goods 15.1 How do I arrive at the Customs value?

When you import goods that you have rented or leased, there will be no sale between the supplier and yourself. However, prior to being rented or leased, the goods may have been subject to a sale. Thus it may be possible to use Method 1 (see paragraph 3.5). Otherwise Methods 2 to 5 (see Sections 4 7) should be tried. Nevertheless, in most cases, Method 6 will be appropriate (see paragraph 15.3).

15.2

Can I use a cash price?

Sometimes a cash price is quoted in the rental or leasing agreement in case you wish to purchase the goods at a later date. However, this cash price may be artificially high to encourage the renting or leasing of the goods. Alternatively it may be an option to buy when the goods are effectively second hand. Thus such a cash price does not constitute a sale and cannot be used under Method 1.

15.3 6?

How do I arrive at a value using Method

You multiply the annual rental or leasing cost by the expected economic life of the imported goods. Where the rental or leasing cost includes interest it is necessary to calculate the cash price of the goods. This is done by using a formula. There are two formulae which can be used, depending on whether payment is made in advance or arrears. Further information about the formulae is provided in Section 44. For further advice you should contact the Helpline where it is difficult to determine the expected economic life of the imported goods.

16. Goods lost, damaged or defective 16.1 What this Section covers

Notice 266 Rejected imports: repayment or remission of duty and VAT gives details of the duty relief provisions. This Section is intended to cover the cases when those provisions cannot be used.

16.2 What if I do not receive all of my goods?

No duty is due on any goods shown to have been short-shipped or lost in transit before release from customs charge into free circulation.

Page 26 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

16.3

What if the goods are damaged?

If you can prove to us that damage occurred before the goods were released from customs charge into free circulation, you can ask for the customs value to be amended. See paragraph 9.8 for goods entered under the SPV scheme.

16.4

What evidence must I produce?

a credit note from the seller a statement from the Customs officer who examined the goods a certificate of condemnation a statement from the Port Health official a statement from an independent expert such as a surveyor, or details of settlement of claim against insurer or carrier.

We cannot list all acceptable forms of evidence but some examples are:

But see paragraph 9.8 for goods entered under the SPV scheme.

16.5

How do I arrive at the customs value?

apportioning the original price paid or payable to take account of partial loss or damage using the revised price paid or payable where the seller reduces the price as a result of the loss or damage, or comparing the price at which you sell the damaged goods with the published average market values for the same type of goods at the time of sale, and using the ratio to apportion the invoice price.

Depending on the evidence you can produce you can do this by for example:

16.6 What if the goods are found to be defective after importation?

If the defects are repaired, and the seller reimburses you under warranty for the cost of the warranty work carried out by you or on your behalf, you can submit a claim for repayment of duty to Customs National Duty Repayments Centre.

Page 27 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

16.7

You must:

What evidence must I produce?

(a) provide full details of the contractual arrangements covering the warranty work that have been agreed between you and the seller of the imported goods (b) show that the seller has accepted responsibility under the warranty for the defects in respect of the particular goods in question and agreed to make the reimbursement for the warranty work (c) provide a clear audit trail to show that you have been reimbursed for the postimportation warranty work required on the imported goods which evidences and links: the discovery and nature of the defect (including sufficient details to identify the goods concerned) the repair work undertaken and the cost the reimbursement of the repair cost by the seller in accordance with the terms of the warranty, (if details are not available demonstrate how the precise amount for the repair cost has been calculated and that the seller or warrantor has accepted liability for that amount), and

(d)

provide details of the customs entry for the goods in question.

16.8

How do I calculate the amount I claim?

You must calculate the amount of customs duty that would have been paid if the customs value of the imported goods had been reduced by the amount of the reimbursement you receive from the seller of the goods and deduct this amount from the duty that was actually paid. You can claim the difference.

16.9

Are there any time limits?

Yes. There are two time limits which must both be met if you are to make a claim. You must ensure that: the amount of the reimbursement is adjusted within 12 months from the date of acceptance of the customs entry that resulted in the duty being paid on the goods being repaired, and the claim is submitted within 3 years of the date of the acceptance of the customs entry that resulted in the duty being paid on the goods being repaired.

For example, where a consignment was imported on 1 June 2007 and an adjustment was made on 1 April 2008, a claim can be made to cover the cost of repairs reimbursed under warranty if submitted before 1 June 2010.

Page 28 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

16.10

Are there any other conditions?

Yes, the amount claimed under these arrangements for any specific imported item may not exceed the original declared value of that item resulting in a negative value. NOTE. Customs reserves the right to carry out any appropriate verification enquiries and to request access to any relevant documentation before claims are processed.

17. Delivery costs 17.1

These are: the cost of transport the cost of insurance (including global or blanket policies) loading and handling charges container charges (for example when hired for transportation of the imported goods) terminal charges (charges for a variety of services in connection with the handling/storage of freight containers at container depots), and any other charges involved in carrying the goods from one place to another.

What are delivery costs?

17.2 Are all of the costs to be included in the customs value?

No. Only costs up to the place of introduction of the imported goods into the customs territory of the EC are to be included. Remember you must include in the customs value all inland transport and associated costs in the country of export.

Page 29 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

17.3

Where is the place of introduction?

Sea If the goods are delivered direct to the UK the place of introduction is the port of importation into the UK. If the goods are delivered to another member state before being sent to the UK the place of introduction is the port of unloading in that member state. If the goods are transhipped within the EC the place of introduction is the port of transhipment. (This is subject to transhipment being certified by Customs at that port). Air The place of introduction is the point where the EC border is first crossed during the air journey. Road, Rail or Inland Waterway The place of introduction is the point where the goods first pass a Customs office on EC territory.

This is usually the point when the goods cross the EC border. Post The place of introduction is the address for delivery, for example your office or home.

17.4 Can I deduct EC transport costs where they are included in the total freight charge?

Yes. If the freight is charged separately and distinguished, the freight charge can be apportioned to arrive at the value for the journey after the EC border. For goods transported by sea the freight charge that would have been paid to the place of introduction is to be included in the customs value. Rates shown in rate books or otherwise advertised by the shipping line or other carrier are usually acceptable. For goods transported by rail or road the freight charge is to be apportioned using reasonable means for example by distance covered outside and inside the EC. Section 45 gives other examples. The percentage of the air transport costs shown on the air waybill to be included in the customs value is set out in an EC Regulation. The percentages are listed in Section 46. Importers connected to CHIEF can obtain details from the relevant data files. Remember locally agreed rates for EC transport costs for VAT purposes must not be used for ad valorem customs duty calculations.

Page 30 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

17.5 Can I deduct EC transport costs where they are included in the price I pay for the goods?

Yes, a deduction for these charges may be made from the price you pay, provided they can be distinguished and evidence can be produced to support them. Section 45 gives examples. The following would be acceptable as evidence: the amount shown separately on the sellers invoice a certified statement or telex from the supplier an invoice or certified statement of the actual freight amount charged by the carrier to the buyer, seller or agent an invoice or certified statement establishing the total cost of transport, split to show the proportion of actual distance inside and outside the community a statement from the buyer referring to a schedule of freight rates normally applied for the same mode of transport, or in the case of goods imported by air, a statement on the invoice confirming that the cost of freight included in the price is the same as that stated on the air waybill.

17.6 What if the transport is free or I provide my own transport?

You must include in the customs value an amount for transport costs to the EC border. You can calculate this amount by using the freight rates tariff for the type of transport used, for example IATA rates for air transport costs, or conference rates for sea.

Page 31 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

17.7 Is the cost of insuring the goods against loss or damage in transit to be included in the customs value?

Yes. You must include the cost of insurance for the goods up to the place of introduction into the Customs Territory of the EC. However, if you pay a premium which covers the whole journey, the cost of insurance after the EC border does not have to be included in the customs value provided you separately distinguish this element. Also, where there is separate cover for the journey after the EC border, the cost of this separate insurance cover does not have to be included in the customs value. Remember if your insurance covers more than one importation, or relates to other items as well as the imported goods, the cost of that insurance must be apportioned and the appropriate amount included in the customs value. An example of how to apportion a periodic insurance premium to individual consignments is provided in Section 45.

17.8 Can I leave out container terminal costs?

Yes, if they are separately charged and are for a container terminal in the EC.

17.9

Can I leave out demurrage charges?

Yes, if the charge is made as a result of delay after arrival of the goods at the place of introduction. But charges for delay before arrival of the goods at the place of introduction are to be included in the customs value.

17.10 Can I use surface freight costs when goods are sent by air?

In normal circumstances, no. However, where the contractual arrangements between buyer and seller: (a) are in force at the time of entry of the goods concerned to free circulation

(b) require the seller to have the goods transported by air to ensure agreed delivery deadlines are met, and (c) the seller has to bear the additional costs, the following treatment will apply:

Page 32 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

if the terms of the original order were CIF or post CIF, then the terms change to CIP (Carriage & Insurance Paid To) and the air transport cost is considered to be included in the CIP price. No further addition for transport and associated costs is required if the terms of the original order were FOB, those terms change to CIP or CPT (Carriage Paid To). The CIP or CPT price is considered to include the air transport cost. No further addition for transport and associated costs is required unless any further costs are incurred by the buyer, for example, for insurance or if the buyer makes a contribution towards the additional air transport costs (for example by paying an amount equal to what it would have cost to transport the goods by sea). In which case those costs have to be included in the customs value.

In either case, the cost of transport within the EU can be excluded from the customs value in accordance with Article 166 and Annexe 25 of Commission Regulation 2454/93 (apportionment of airfreight costs), provided the airfreight costs are shown separately on the invoice, or can be evidenced by alternative satisfactory means. NOTE. You should contact our Helpline for further information if consignments are shipped late on a regular basis.

17.11 Can I leave out a currency adjustment factor?

Where an additional charge is billed by an agent, rather than the shipping line/carrier of the goods, it may be left out of the customs value, subject to evidence being produced to substantiate the actual total cost of transporting the goods. In all other situations the charge is dutiable.

17.12 Can I leave out a bunker adjustment factor?

No. This surcharge is raised by shipping lines to take account of fluctuations in the price of marine fuel. A similar fuel surcharge is applied where goods are transported by air to compensate for fluctuations in the price of aviation fuel.

17.13 Should any other transport surcharges be included in the customs value?

Yes, the following surcharges are considered to be part of the cost of transporting the goods to the place of introduction in the EU and must be included in the customs value: Peak season surcharge

Page 33 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

Security surcharge War risk surcharge UK Port Congestion charge.

In addition any other payment or surcharge charged by the shipping line, airline or carrier of the goods, which does not relate to a cost incurred, or an activity or operation taking place after the arrival of the goods at the place of introduction must be included in the customs value of the goods. NOTE: Where the surcharge is made in connection with transport by air, it may be included in the total air transport costs declared for apportionment purposes.

18. Rates of exchange conversion of foreign currency 18.1 What must I do if all or part of any amount to be taken into account in arriving at the customs value is shown in a foreign currency?

You must convert to sterling any foreign currency amount which needs to be taken into account in arriving at the customs value. Also you must convert to sterling any other part of the customs value shown in foreign currency, for example, freight or insurance.

18.2 Can I use the rate of exchange at which I make settlement?

No. Unless paragraphs 18.3 or 18.5 apply.

18.3

Can I use a fixed rate of exchange?

the contract of sale specifies that a fixed rate of exchange is to be used to convert a foreign currency amount to sterling, and the seller is to receive payment in sterling.

You should use the fixed rate when:

Page 34 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

18.4 What if the supplier requires payment in a foreign currency?

If the invoices are in sterling at a fixed rate of exchange quoted in the contract of sale, that rate of exchange must be used to convert the sterling amount into the foreign currency. The resulting foreign currency amount must be reconverted to sterling at the customs rate of exchange applicable at the time of importation (see paragraph 18.5).

18.5

Which rate of exchange must I use?

If paragraph 18.3 does not apply you must use the rate of exchange published by us for use at the time the entry to free circulation is accepted. However, for periodic declarations, you may ask us to accept a single exchange rate based on the rate applicable on the first day of the period covered by the declaration in question.

18.6

How are the customs rates designated?

The monthly rates are fixed under provisions set out in EC legislation. (See the correlation table at paragraph 26.5).

18.7

When are the rates published?

At the end of every month we publish the rates on the Internet and on the CHIEF Noticeboard. These give the rates of exchange to be used during the next month for converting foreign currencies for duty and import VAT purposes.

18.8

What period do the rates cover?

From the first to the last day of the next calendar month.

18.9 What happens when there are sudden currency fluctuations?

Once a week we check the monthly rates issued against the commercial selling rates on the London Exchange Market. If the commercial rate for a currency differs by more than 5% from the last published customs rate, the customs rate is amended from midnight on Tuesday/Wednesday of the following week.

Page 35 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

18.10 Where can I get details of Customs rates of exchange?

From our Helpline. Current and historical exchange rates are available on our website Importers connected to CHIEF can obtain details of Customs rates from the relevant data files.

19. Valuation declarations and statements 19.1 What is a valuation declaration?

It is a form that gives information to us about the value declared on the import entry. There are two forms: form C105A to be completed when using Method 1 (see Section 3), and form C105B to be completed when using Methods 2 6 (see Sections 48).

19.2 Must I complete a valuation declaration?

No, not unless we ask you to.

19.3 When will I be asked to complete a valuation declaration?

We may ask you to complete a form C105A or C105B for import declarations we examine on a post importation audit.

19.4 Who can sign the valuation declaration?

Forms C105A and B can be signed by any person (natural or legal): residing or having a place of business in the EC, and who has the information needed to answer the questions on the forms.

Where the forms are completed for a company, the person signing must be a responsible representative of the company, for example: Director

Page 36 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

Company Secretary, or Manager.

One of these persons may authorise an employee to sign for the company. Clearing agents may also sign these forms on behalf of the importer when authorised to do so. NOTE. The person signing a declaration is responsible for the accuracy and completeness of the particulars given on the form and must be in possession of all the facts relating to the sale upon which the declared customs value is based .

19.5

What is a general valuation statement?

It is a season ticket valuation declaration, form C109A, which is normally valid for three years (but see paragraph 19.9).

19.6 When will a general valuation statement be required?

We require you to complete form C109A only when using Method 1 and the value is based on an earlier sale (see paragraph 3.5). The form can be obtained from our Helpline.

19.7 Who can sign the general valuation statement?

Form C109A must be signed by the importer not by an agent or other representative. The signatory must be a responsible representative of the company such as: Director Company Secretary Manager Partner, or Sole Proprietor.

A form signed by an employee authorised to sign on behalf of the company must be accompanied by a letter of authority signed by one of the accepted signatories.

Page 37 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

19.8

How do I register a form C109A?

Send the completed form C109A, with a copy, to the General Valuation Registration Unit at the address shown in the Notes at the head of the form. When the form has been registered, a copy will be returned to you, together with your reference number. You or your clearing agent may put this reference number in box 44 of the import entry when the terms of your general valuation statement apply to the relevant consignment.

19.9 When must the general valuation statement be renewed?

If there are any changes to your registration details or terms of trading, you must notify the General Valuation Registration Unit. We will advise you if a new application form is required. Otherwise, a reminder will be issued to you three years after the date of registration.

19.10 Where can I find out more about valuation declarations and statements?

Contact the Helpline.

20. Customs warehousing 20.1 What value must I declare at the time of importation?

You must declare a value for statistical purposes (see Section 25). This value will also be used for warehouse stock control purposes.

20.2 How do I arrive at the customs value when the goods are removed to free circulation?

You do this by using one of the 6 Methods set out in Sections 3 8 or SPVs and SIVs (Section 9) for fresh fruit and vegetables.

Page 38 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

20.3 When using Method 1 must I base the customs value on the last sale before removal?

No. It may be based on any of the prices paid by any buyer in a series of sales before entry of the goods into free circulation. This includes any sales in the warehouse. The buyer may be outside the EC. (See paragraph 3.4). But see paragraph 19. 4 about completing and signing valuation declarations.

20.4 When must I establish the customs value of goods removed from warehouse to free circulation?

At the time the goods are removed from the Customs warehouse. This means that any elements making up the value for duty (for example price, freight and insurance charges) which are invoiced in a foreign currency will have to be converted to sterling at the customs period rate of exchange (see paragraph 18.4) in force at the time the goods are entered for removal from the warehouse. (Exception: In the case of goods entered to type D Customs warehouses the customs value is established at the time of entry of the goods to the warehouse. However, you have the option of using the rate of exchange applicable when the goods are removed from the Customs warehouse at the time when the customs debt is incurred.)

20.5 Can I leave out of the customs value the cost of warehousing and/or preserving the goods?

Yes, providing it is shown separately from the price of the goods.

20.6 Where can I find out more about Customs warehousing?

In Notice 232 Customs Warehousing.

Page 39 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

21. Outward Processing Relief (OPR) 21.1 How do I arrive at the customs value of goods reimported after process outside the EC?

(a) The processor charges you for the cost of the process. You must try Method 1 (see Section 3 particularly paragraph 3.15(d)). The customs value will be based on the cost of the process. All of the following items must be included in the customs value if not already in the processors charge: the value of the exported goods (where the goods are purchased from an unrelated person, the cost of acquisition is to be used. Where the goods are produced by yourself or a related person, the cost of production is to be used) the value of any material rejected, lost or wasted before, during or after the process, and any third country customs duty or similar levy.

Outward freight and insurance are not to be included in the built-up value. The exception to this is when the temporarily exported goods are invoiced CIF and the outward freight and insurance is not separately distinguishable. Then the outward freight and insurance is includible in the built-up value. (b) The processor does not charge you for the cost of the process.

As no payment is made Method 1 cannot be used. You must try either: Methods 2 or 3 (see Sections 4 or 5) if you import identical or similar processed goods under Method 1 Method 4 (see Section 6) if you sell the processed goods or identical or similar processed goods to unrelated customers in the EC Method 5 (see Section 7) if you can get the detailed costings of the processed goods, or Method 6 (see Section 8) if you cannot use any of these Methods. The customs value can be based on the charge that would have been made for the process. Additions have to be made as detailed in (a) above.

Page 40 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

21.2

Where can I find out about this relief?

In Notice 235 Outward processing relief (OPR).

22. Standard Exchange System (SES) 22.1 How do I arrive at the customs value of the imported replacement products?

Charge made for the replacement products. You must try Method 1 (see Section 3). The customs value will be based on the charge made for the replacement products. If this charge has been reduced to take account of the value of the exported goods, you must add back the amount of the reduction to arrive at the customs value. If you do not know the amount of the reduction you must include in the customs value the FOB export value of the exported goods. No charge made for the replacement products. No duty is due on goods which have been repaired or replaced free of charge under warranty or similar arrangement. Relief is allowed on all costs involved including outward and return freight and insurance.

22.2

Where can I find out about this system?

In Notice 235 Outward processing relief (OPR).

23. Inward Processing Relief (IPR) 23.1 How do I arrive at the customs value of the goods?

You do this at the time the goods are entered to the relief by using one of the 6 Methods set out in Sections 3 8.

23.2

Where can I find out about this relief?

In Notice 221 Inward processing relief (IPR).

Page 41 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

24. Valuation for VAT 24.1 What is the basis of the value for VAT?

You must base it on the value for duty even if no duty is payable.

24.2 What items must I add to the value for duty to arrive at the value for VAT?

You must add all of the following unless they are already included: all incidental expenses such as commission, packing, transport and insurance costs incurred up to the goods first destination in the UK all such incidental expenses where they result from transport to a further place of destination in the EC if that place is known at the time of importation any customs duty or levy payable on importation into the UK, plus any excise duty or other charges payable on importation into the UK (except the VAT itself).

NOTE. Buying commission has to be included in the value for VAT.

24.3

Must I include royalty or licence fees?

No. These are regarded as charges for services received from outside the EC. VAT is due on such payments at a later stage. Notice 741 VAT: Place of supply of services, gives you information on how to account for such supplies.

24.4 Must I include a discount for prompt payment?

No. Provided at the time of import a discount for early payment is still available.

24.5 What must I do if the price of the goods is in foreign currency?

You have to convert the foreign currency into sterling. Also you must convert to sterling any other part of the value shown in foreign currency for example transport, insurance etc. You must use the rules set out in Section 18.

Page 42 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

24.6 Are there any special arrangements for certain goods?

Yes. Hydrocarbon oils and certain racehorses Standard values have been agreed for certain goods, such as racehorses imported for auction and hydrocarbon oils. You can get details from your Trade Associations. Certain imported works of art, antiques and collectors items These are entitled to a reduced valuation at importation, giving an effective VAT rate of 5%. Details of how to calculate the reduced valuation are given in Notice 702 VAT: Imports. Computer software Details of how to value computer software is given in Notice 702 VAT: Imports. Goods reimported after process or repair abroad Details are given in Notice 702 VAT: Imports.

24.7 How do I arrive at the value for VAT when imported goods are removed from a Customs warehouse?

You follow the procedures for customs value set out in Section 19.11 and the value rules set out in this Section. NOTE. The treatment of services performed in a Customs warehouse or an Excise or Customs and Excise warehouse (see paragraph 24.9) may affect the declared VAT value.

24.8 How do I arrive at the value for VAT when imported goods are removed from an Excise or Customs and Excise warehouse?

Details are given in Notice 179 Mineral (hydrocarbon) oils: Duty and VAT: Warehousing and related procedures for hydrocarbon oils, and Notice 197 Excise goods: Holding and movement for other Excise goods.

Do not forget you have to include excise duty in the value.

Page 43 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

24.9 VAT?

What if I cannot arrive at the value for

You can ask for release of your goods against a security, that is to say a deposit or a guarantee (see paragraph 2.5).

24.10 Where can I find out more about valuation for VAT on imports and warehoused goods?

In Notice 702: VAT: Imports and Notice 702/9 VAT: Warehouses and free zones.

25. Value for trade statistics 25.1 What value must I show for goods on which ad valorem duty or levy is charged?

The customs value arrived at by using the rules set out in Sections 3 8.

25.2 What value must I show for other goods?

The price paid or payable for the goods (see Section 3). You may need to add or deduct certain costs (see paragraphs 25.3 and 25.4).

25.3 What items must I add to the price paid or payable?

You must add all of the following to the price you pay unless they are already included: freight insurance all other costs, charges and expenses connected with the sale and delivery of the goods to the port or place of importation in the UK, and selling commission.

Page 44 of 9998

Notice 252 Valuation of imported goods for customs purposes, VAT and trade statistics June 2009

25.4 Must I leave out any items from the value for trade statistics?

Yes. The all of the following must be left out: buying commission selling commission incurred within the UK cost of transport within the UK, and duty or tax chargeable in the UK.