Académique Documents

Professionnel Documents

Culture Documents

This Case Presents Confounding Question: Who Will Guard The Guardians?

Transféré par

Investor ProtectionTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

This Case Presents Confounding Question: Who Will Guard The Guardians?

Transféré par

Investor ProtectionDroits d'auteur :

Formats disponibles

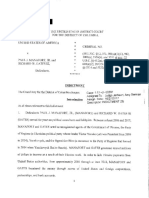

UNITED STATES DISTRICT COURT

SOUTHERN DISTRICT OF NEW YORK -X SECURITKS AND EXCHANGE COMMISSION,: Plaintiff, -against ZURICH FINANCIAL SERVICES, Defendant.

08 Civ. 10760 (WHP)

MEMORANDUM 2 ORDER

I USDC SDNY I DOCUMENT I Et FCTRONtCALLY FILED

i DOC,'i:

j~,DATE Ftt ED: / S O l< >

~

WILLIAM H. PAULEY III, District Judge: This case presents yet again the confounding question: who will guard the guardians? On December 11, 2008, the United States Securities Exchange Commission ("SEC") filed this action against Zurich Financial Services (" Zurich" ) for its alleged role in inflating the financial performance of Converium Holding AG ("Converium") in connection with Converium's initial public offering on December 11, 2001 (the "SEC Action" ). It followed on the heels of a settlement of a private class action brought by investors against both Converium and Zurich in this district (the "Private Class Action" ). See In re: SCOR Holdin Switzerland AG Liti ., No. 04 Civ. 7897 (DLC). As part of the Private Class Action settlement, Converium and Zurich agreed to pay $84.6 million to a fund to be distributed to a certified class of Converium shareholders. See In re: SCOR Holdin S w i t zerland AG Liti .,

No. 04 Civ. 7897 (DLC) (ECF Nos. 251, 264).

Both the SEC and Zurich proposed to end the adversarial pr ocess i t SEC n he Action the very day this lawsuit was filed. They simultaneously presented a proposed final

judgment requiring that Zurich pay $1 in disgorgement and $25 million in civil penalties. This Court entered the Judgment as a matter of routine. (ECF No. 2.) The Judgment provided that the SEC "may by motion propose a plan to distribute the Fund." On February 4, 2009, Zurich deposited $25,000,001 in a Court Registry Investment System account. Six months elapsed without any communication from the SEC. By Order dated August 7, 2009, this Court directed the SEC to shake off its lethargy and provide a status report regarding plans for distribution of the Fund. (ECF No. 4.) When the SEC failed to provide any report, this Court scheduled a conference to provoke some activity by the agency.

(ECF No. 7.)

In September 2009, the SEC presented a plan of distribution to the Court. The SEC's pro forma motion papers in support of the plan summarized the background of the SEC Action and proposed the creation of a fund pursuant to the Fair Fund provisions of Section 308(a) of the Sarbanes-Oxley Act of 2002 (" Distribution Plan" ). (ECF No. 11-4.) As part of its motion, the SEC nominated Garden City Group, Inc. ("GCG") as Claims Administrator and Damasco Associates as Tax Administrator. Aside from Zurich's objection to a characterization of its conduct in the SEC's memorandum, no interested person submitted an opposition. Thereafter, this Court approved the Distribution Plan. (ECF No. 18.) During the ensuing eighteen months, GCG implemented the Distribution Plan. GCG moves for payment of its fees, expenses, and costs totaling $1,083,911.88 before distributing the balance of the Fair Fund to aggrieved investors. Specifically, GCG seeks $455,471.35in f ees,$99,766.656 in expenses, and $528,673.88 in publication costs. The invoice dated October 1, 2010, is the only support for this application. It does not describe who

provided the services, when those services were provided, or what hourly rates were charged. (ECF No. 27-1.) It also purports to include fees and expenses for services rendered prior to this Court's appointment of GCG as Claims Administrator in February 2010. Finally, the invoice totals $870,070.01, while GCG's latest application seeks $1,083,911.88. The additional $213,841.87 sum is not supported by anything. This Court has cautioned the SEC about its responsibility to review and audit fees and expenses submitted by its nominees. See SEC v. Northshore Asset M t . ,No. 05 Civ. 2192 (WHP), 2009 WL 3122608 (S.D.N.Y. Sept. 29,

2009) (ordering the SEC to audit all fees and expenses paid to a receiver without meaningful review, resulting in disgorgement of $4,960,000.) GCG's application brings into focus the perils of judicial oversight of SEC settlements after the adversarial process has melted away. This Court previously commented on that peculiar conundrum in the context of the Research Analyst settlements. See SEC v. Bear Stearns & Co. Inc., 626 F. Supp. 2d 402 (S.D.N.Y. 2009). Once again, the SEC "pass[es] to the Court responsibility for freighting this substantial consignment... without any navigational aids."Bear Stearns,626 F. Supp. 2d at405. To better understand the concerns of t C ourt,a he brief recapitulation may be helpful. On August 11, 2008, GCG was appointed claims administrator in the Private Class Action and tasked with notifying class members, processing claims, and distributing the settlement fund. See In re: SCOR Holdin S w i t zerland AG Liti ., No. 04 Civ. 7897 (DLC) (ECF No. 251.). The Private class was defined as "all persons or entities who, during the [period of Dec. 11, 2001 through Sept. 2, 2004], (i) were U.S. residents and purchased Converium Common Stock on the SWX Swiss Exchange and/or (ii) purchased Converium

American Depository Shares ("ADS") on the New York Stock Exchange." In re: SCOR Holdin S w i tzerland AG Liti ., No. 04 Civ. 7897 (DLC) (ECF Nos. 251, 264). As of

November 30, 2008, GCG had mailed a total of 14,154 Claim Packets. (Declaration of Stephen J. Cirami, dated Dec. 5, 2008 ("Cirami I") $ 4.) By September 30, 2010, GCG had received and processed 1,636 Proofs of Claim and accepted 589. (Declaration of Stephen J. Cirami, dated Sept. 30, 2010 ("Cirami II") $$ 5, 36.) In processing the claims, GCG reported that it had (i) defined project guidelines, (ii) created a unique database to store claim information and documentation, (iii) trained staff to process claims, (iv) formulated telephone and e-mail systems to respond to inquiries, (v) developed computer programs to enter claim data, and (vi) developed a program to calculate loss amounts. (Cirami II $ 6.) GCG charged a total of $357,378.19 in fees and expenses for its administration of the Private Class Action fund.

(Cirami II f[ 37.)

The SEC recommended GCG as claims administrator to this Court because both the Private Class Action and the SEC Action "involve identifying and locating Converium shareholders, and the work GCG has done on the Class Action distribution will help it perform the [Fair Fund] distribution in a more efficient and cost effective manner." (SeeDeclaration of James McGovern, dated Sept. 15, 2009 (" McGovern Decl.") $ 9.) Under the SEC's Distribution Plan, an investor was eligible for distribution if he "held Converium Common Stock as of the open of the Swiss markets on November 4, 2005 and/or Converium ADSs as of the open of the U.S. markets on November 4, 2005." (ECF No. 11-4.) To solicit claims from investors in foreign countries with the highest percentage of Converium shareholders, the SEC plan required GCG to publish notice in six nations at an estimated cost of $520,000. (McGovern Decl. $ 20.)

In addition, GCG agreed to cap its fees at $375,000, not including expenses, publication costs, or audit costs, assuming that GCG mailed 30,000 Claim Packets and processed 6,000 claims.

(McGovern Decl. f[ 19.)

In its fifth progress report docketed April 4, 2011, GCG reported mailing approximately 55,000 Claim Packets, processing 4,342 claims, and determining that 1,383 claims were eligible, with a total eligible loss amount of $40,021,834.11. (ECF No. 36.) GCG's most recent progress report docketed July 20, 2011, reported receiving twelve additional claims, only one of which may be eligible for an inconsequential sum. (ECF No. 37.) While GCG's request for $528,673.88 in publication costs is in line with the estimate in the Distribution Plan, the question that occurs to this Court, but apparently not to the SEC, is, was such an expensive notice program effective? Of course, neither the SEC nor GCG provide any information to answer that question. Astonishingly, the SEC never informed this Court that GCG undertook a significant advertising campaign in connection with the Private Class Action. In fact, GCG billed the Class Action fund $58,908.39 to publish notices in The

Wall Street Journal (Global), The Economist (Europe), Neue Zucker Zeitung ((Switzerland

German), Le Temps (Switzerland French), and PR Newswire (US and Europe). Nor did the SEC inform this Court that GCG mailed individual notices and proofs of claim to potential class members, including class members residing in Switzerland. Had this Court been apprised of the notice and publication efforts in the Private Class Action, it would have questioned the SEC closely about the utility of an enormously expensive publication program in the SEC Action. Certainly, the incremental value of such a notice program is an open question.

While the SEC and GCG undoubtedly have more expertise than this Court in reaching out to aggrieved investors, it would seem that one of the most effective ways to reach Zurich and Converium investors would be to put a notice concerning the SEC Action and a link to the Fair Fund website on the Zurich and Converium websites. Apparently, GCG contacted Zurich and Converium to do just that. But both expressly declined to post any link or notice on their respective websites. While that development was relegated to a footnote in GCG's first progress report, (seeECF No. 23, 3, n.2), the SEC neither raised it with this Court nor made any application. In ostrich-like fashion, the SEC does not even bother to submit a single piece of paper on GCG's cumulative motions for payment of fees and expenses totaling $1,083,911.88. Instead, the SEC apparently permitted an officer of GCG to make the following representation to this Court in the November 3, 2010 motion: GCG has been advised that the staff of [sic] United States Securities and Exchange Commission has reviewed GCG's invoice and has no objection

to payment of the invoice in full. (ECF Nos. 26, 27.)

Then, GCG's April 4, 2011 motion for authority to distribute the Fair Fund to eligible claimants, was even bolder, styling itself as an "Unopposed Motion of the Claims Administrator," and asserting that "the [SEC] concurs with the Claims Administrator's Motion." (ECF No. 35.) The SEC's laissez-faire attitude is remarkable and wholly unacceptable. An agency of the United States Government, especially one charged with enforcing the securities laws, should speak for itself when it is a litigant. But in this Court's experience, the SEC's natural, bureaucratic proclivity is to avoid responsibility. Indeed, no SEC attorney is identified in the pending motions as binding the

Commission to the position staked out by GCG, a private, for-profit claims administrator. Such administrative acquiescence is unseemly. Because the SEC has failed to provide any information about the effectiveness of the advertising campaign, this Court cannot assess it. And if that expensive campaign turned out to be a mistake, the SEC is likely doomed to repeat it. Neither the SEC nor this Court will know whether it was a mistake unless the SEC makes some sort of inquiry. As such, this Court directs the SEC to perform its duty and evaluate the effectiveness of the advertising program it proposed by, among other things, comparing the investors identified in the Class Action with the investors identified in the SEC Action and reporting how many claimants learned of the Fair Fund through the publication program. The SEC is also directed to compare the claims approved in the Private Class Action with the claims approved in the SEC Action. Further, among other matters, the SEC needs to explain why the procedures used to identify U.S. investors in the Private Class Action were not adequate to identify foreign investors in the SEC Action. GCG's remaining fees and expenses are, as yet, unjustified in view of the work it has already done administering the Private Class Action fund. To justify its fees, GCG states that the work administering the fund "included the construction of a database to administer the Distribution Fund,... building a calculation module to compute the Recognized Losses of each claimant, setting up and maintaining a toll-free number for claimant communications, handling claimant communications by phone, email, and post, creating a case-specific website where claimants were able to file claims electronically, and other tasks that were described and approved in the Distribution Plan." (Declaration of Stephen J. Cerami, dated Oct. 29, 2010

("Cerami III") $ 4.) This formulaic recital is strikingly similar to GCG's recital in support of its fee application in the Private Class Action. On their face, these tasks appear largely duplicative of the work done administering the Private Class Action fund, (see Cerami II $ 6), and are fees and expenses the SEC represented would be avoided if this Court appointed GCG as Claims Administrator in the SEC Action. For example, GCG seeks fees for the development of a procedure to calculate the Recognized Losses of the claimants. There should have been significant overlap with the work done in calculating the Recognized Losses of the Private Class Action. But there is no accounting or explanation for what was done. And this is not an academic exercise the eligible loss amount of $40,021,834.11 substantially exceeds the fund available for distribution to aggrieved investors. In another vein, GCG reported in the Private Class Action that class members would receive approximately 55% of their Recognized Losses. In the SEC Action, GCG reports that claimants will receive nearly 59% of losses. Without a proper accounting, it is impossible to ascertain whether any investor is receiving a payment that exceeds his loss. Here again, the SEC's Distribution Plan provided for an independent outside accounting firm EisnerAmper LLP t o audit the claims processed by GCG. But the audit report is singularly unhelpful. And this Court wonders why the SEC decided in this case that an outside accounting firm was necessary to check GCG's homework. To be clear, this Cont understands that the number of claims in the SEC Action is higher than the number of claims in the Private Class Action. Yet, GCG provides little basis for this Court, the SEC, claimants, or anyone else to conclude that GCG took full advantage of the work already done in the Private Class Action. At best, GCG states generically that it compiled

names and addresses of potential claimants from, among other sources, "the database compiled in connection with the Class Action." (See Affirmation of Stephen J. Cirami, dated Apr. 4, 2011 ("Cirami IV") $ 7.) Nor does GCG even bother to justify why its fees of $455,471.35 should exceed the agreed cap of $375,000. See Nortel Networks Co . Sec. Liti ., No. 01 Civ. 1855 (RMB), 2010 WL 3431152, at *3 (S.D.N.Y. Aug. 20, 2010) (reducing GCG's fees for, inter alia, failing to explain why its fees in a period in which it made no distributions exceeded fees in a period in which it did). And in the Private Class Action involving distribution of $84.6 million, GCG soughtfees and expenses of $357,378.19, j f t ust our enths of one percent of t f ui But he i d. in the SEC Action, GCG seeks $1,083,911.88, or more than 4.3% of the $25 million to be distributed. It is time for the SEC to explain why it believes that the cost of distributing a Fair Fund dollar should be nearly ten times higher than the cost of distributing a Private Class Action dollar. Accordingly, because GCG fails to justify its requested fees and expenses, and the SEC appears to have conducted no meaningful oversight, GCG's request is denied without prejudice. The SEC is directed to respond to the issues raised in this Memorandum & Order by October 28, 2011. The Clerk of the Court is directed to terminate the motions pending at Docket Entry Nos. 26 and 35. Dated: September 30, 2011 New York, New York SO ORDERED:

WILLIAM H. PAULEY III U.S.D.J.

Counsel of Record: Andrew M. Calamari, Esq. Securities and Exchange Commission Northeast Regional Office 3 World Financial Center, Room 400 New York, NY 10281 Counsel for Plaintiff Ralph C. Ferrara, Esq. Dewey k LeBoeuf LLP 1101 New York Avenue, NW Washington, DC 20005 Attorney for Defendant

Also copied to: The Garden City Group, Inc. Claims Administrator 105 Maxess Road Melville, New York 11747

-10

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Grubhub Delivery Partner AgreementDocument18 pagesGrubhub Delivery Partner AgreementKemet JusticePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Mcgahn Interview TranscriptDocument241 pagesMcgahn Interview Transcriptacohnthehill100% (1)

- Class Action Lawsuit Against Eagle Web Assets, Ryan Eagle, Harrison Gevirtz & Others in Cook County Circuit Court, ChicagoDocument39 pagesClass Action Lawsuit Against Eagle Web Assets, Ryan Eagle, Harrison Gevirtz & Others in Cook County Circuit Court, ChicagoJennifer SelleckPas encore d'évaluation

- Soccer Class-Action Complaint - Aug. 27, 2014Document138 pagesSoccer Class-Action Complaint - Aug. 27, 2014Evan Buxbaum, CircaPas encore d'évaluation

- Lieu-Rice Letter To Wray On Potential Federal Election Law Violations by Trump CampaignDocument3 pagesLieu-Rice Letter To Wray On Potential Federal Election Law Violations by Trump CampaignInvestor ProtectionPas encore d'évaluation

- Plea Agreement As To Jon Ryan SchafferDocument13 pagesPlea Agreement As To Jon Ryan SchafferInvestor ProtectionPas encore d'évaluation

- Stone Indictment 012419Document24 pagesStone Indictment 012419Olivia Alabaster100% (2)

- House Intel Transcript Carter Page TestimonyDocument243 pagesHouse Intel Transcript Carter Page TestimonyInvestor ProtectionPas encore d'évaluation

- 2017 10 05 Papadopoulos IndictmentDocument14 pages2017 10 05 Papadopoulos IndictmentEvan100% (2)

- Democratic House Intelligence FISA MemoDocument10 pagesDemocratic House Intelligence FISA MemoInvestor ProtectionPas encore d'évaluation

- Hawaii TRO Halting Trump 2nd Immigration Executive OrderDocument43 pagesHawaii TRO Halting Trump 2nd Immigration Executive OrderLegal InsurrectionPas encore d'évaluation

- Al Franken Letter To SessionsDocument3 pagesAl Franken Letter To SessionsInvestor ProtectionPas encore d'évaluation

- Transcript - Jeff Flake's Speech On The Senate FloorDocument27 pagesTranscript - Jeff Flake's Speech On The Senate FloorInvestor ProtectionPas encore d'évaluation

- Pei CletterDocument2 pagesPei Cletterdailykos100% (1)

- FEC Complaint Donald Trump JRDocument20 pagesFEC Complaint Donald Trump JRInvestor ProtectionPas encore d'évaluation

- Manafort Gates IndictmentDocument31 pagesManafort Gates IndictmentInvestor ProtectionPas encore d'évaluation

- Ica 2017 01Document25 pagesIca 2017 01Yahoo NewsPas encore d'évaluation

- James B. Comey StatementDocument7 pagesJames B. Comey StatementYahoo News100% (6)

- Trump & His Team's Ties To RussiaDocument1 pageTrump & His Team's Ties To RussiaInvestor ProtectionPas encore d'évaluation

- Trump 2005 TaxDocument2 pagesTrump 2005 TaxMediaite100% (1)

- The Attorney General: WashingtonDocument3 pagesThe Attorney General: WashingtonInvestor ProtectionPas encore d'évaluation

- Alabama State Bar Complaint Against A Lawyer AG Jeff SessionsDocument3 pagesAlabama State Bar Complaint Against A Lawyer AG Jeff SessionsInvestor ProtectionPas encore d'évaluation

- Joint Declaration of National Security OfficialsDocument6 pagesJoint Declaration of National Security OfficialsInvestor ProtectionPas encore d'évaluation

- Lindsey Graham Wire Tap Letter To FBIDocument1 pageLindsey Graham Wire Tap Letter To FBIInvestor ProtectionPas encore d'évaluation

- #Kremlin KlanDocument1 page#Kremlin KlanInvestor ProtectionPas encore d'évaluation

- Ninth Circuit Court of Appeals Ruling On Trump's Travel BanDocument29 pagesNinth Circuit Court of Appeals Ruling On Trump's Travel BanKatie DowdPas encore d'évaluation

- Nyt Trump PDFDocument2 pagesNyt Trump PDFJennifer VanascoPas encore d'évaluation

- Donald Trump National Security LetterDocument8 pagesDonald Trump National Security LetterGerman Lopez33% (3)

- 1986 Letter Coretta Scott KingDocument10 pages1986 Letter Coretta Scott KingInvestor ProtectionPas encore d'évaluation

- World Relief LetterDocument1 pageWorld Relief LetterLancasterOnlinePas encore d'évaluation

- Ica 2017 01Document25 pagesIca 2017 01Yahoo NewsPas encore d'évaluation

- Nyt Trump PDFDocument2 pagesNyt Trump PDFJennifer VanascoPas encore d'évaluation

- Senator Warrens Letter To SEC Chair Mary Jo WhiteDocument13 pagesSenator Warrens Letter To SEC Chair Mary Jo WhiteInvestor ProtectionPas encore d'évaluation

- Judge King Rules Against NewsCorp & Sets January 12, 2012 Hearing - Federal Brown v. Brewer Securities Fraud & Antitrust Class ActionDocument128 pagesJudge King Rules Against NewsCorp & Sets January 12, 2012 Hearing - Federal Brown v. Brewer Securities Fraud & Antitrust Class Actionlen_starnPas encore d'évaluation

- Hilao v. Estate of Ferdinand Marcos 103 F.3d 767 (9th Cir. 1996)Document38 pagesHilao v. Estate of Ferdinand Marcos 103 F.3d 767 (9th Cir. 1996)Legal KidPas encore d'évaluation

- Lawsuit Filed Against DisneyDocument30 pagesLawsuit Filed Against DisneyNews 6 WKMG-TV100% (2)

- Alicea v. Circuit City Stores, Inc. - Document No. 29Document13 pagesAlicea v. Circuit City Stores, Inc. - Document No. 29Justia.comPas encore d'évaluation

- Horry County, Myrtle Beach Hospitality SettlementDocument14 pagesHorry County, Myrtle Beach Hospitality SettlementWMBF NewsPas encore d'évaluation

- LINNINS Et Al v. HAECO AMERICAS, LLC Et Al: Complaint Filed On 5/17/2016Document27 pagesLINNINS Et Al v. HAECO AMERICAS, LLC Et Al: Complaint Filed On 5/17/2016Jeff PetersPas encore d'évaluation

- Greenwald V Ripple, 9/7/18, Motion To RemandDocument106 pagesGreenwald V Ripple, 9/7/18, Motion To RemandcryptosweepPas encore d'évaluation

- Spectrum ComplaintDocument13 pagesSpectrum ComplaintABC Action NewsPas encore d'évaluation

- Good Morning To You Productions Corp. v. Warner/Chappell Music, Inc.Document9 pagesGood Morning To You Productions Corp. v. Warner/Chappell Music, Inc.abbbbblPas encore d'évaluation

- United States Court of Appeals, Second Circuit.: No. 1391, Docket 85-5040Document9 pagesUnited States Court of Appeals, Second Circuit.: No. 1391, Docket 85-5040Scribd Government DocsPas encore d'évaluation

- T-Mobile Data Breach SettlementDocument43 pagesT-Mobile Data Breach Settlementmichaelkan1Pas encore d'évaluation

- 01 Banda Vs ErmitaDocument38 pages01 Banda Vs ErmitaHerzl Hali V. HermosaPas encore d'évaluation

- Lowe's+Hourly+Offer+ +Stores+and+Supply+Chain+2024!01!22Document5 pagesLowe's+Hourly+Offer+ +Stores+and+Supply+Chain+2024!01!22niklaskiddPas encore d'évaluation

- Fumiko Lopez V Apple Inc - Class ActionDocument20 pagesFumiko Lopez V Apple Inc - Class ActionJack PurcherPas encore d'évaluation

- Matera Google SettlementDocument26 pagesMatera Google SettlementRussell BrandomPas encore d'évaluation

- Alexa Brenneman v. Cincinnati Bengals, Class Action Complaint and Jury Demand, Filed 2/11/14Document28 pagesAlexa Brenneman v. Cincinnati Bengals, Class Action Complaint and Jury Demand, Filed 2/11/14Josh CorriveauPas encore d'évaluation

- Lawyer Barons by Lester BrickmanDocument524 pagesLawyer Barons by Lester BrickmanADPas encore d'évaluation

- Order On MotionDocument69 pagesOrder On MotionHonolulu Star-Advertiser100% (1)

- Trump Letter Motion For Stay Pending AppealDocument5 pagesTrump Letter Motion For Stay Pending AppealLaw&CrimePas encore d'évaluation

- Etta Calhoun v. InventHelp Et Al, Class Action Lawsuit Complaint, Eastern District of Pennsylvania (6/1/8)Document44 pagesEtta Calhoun v. InventHelp Et Al, Class Action Lawsuit Complaint, Eastern District of Pennsylvania (6/1/8)Peter M. HeimlichPas encore d'évaluation

- Chavez V Illinois State Police - Abridged by SRGDocument13 pagesChavez V Illinois State Police - Abridged by SRGSarah_GadPas encore d'évaluation

- 5 Steps To Ensure Compliance With The FCRADocument22 pages5 Steps To Ensure Compliance With The FCRAsethPas encore d'évaluation

- Showtime Class ActionDocument18 pagesShowtime Class ActionTHROnlinePas encore d'évaluation

- U.S. Court of Appeals, Eighth CircuitDocument11 pagesU.S. Court of Appeals, Eighth CircuitScribd Government DocsPas encore d'évaluation

- The Law and Business Administration in Canada: Fifteenth Canadian EditionDocument21 pagesThe Law and Business Administration in Canada: Fifteenth Canadian EditionPotatoPas encore d'évaluation

- Corbarruviaz v. Maplebear, Inc.Document38 pagesCorbarruviaz v. Maplebear, Inc.KatySteinmetzTIMEPas encore d'évaluation

- Jacobson v. Bassett ComplaintDocument9 pagesJacobson v. Bassett ComplaintWashington Free BeaconPas encore d'évaluation