Académique Documents

Professionnel Documents

Culture Documents

December 20, 2011 - The Federal Crimes Watch Daily

Transféré par

Douglas McNabbCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

December 20, 2011 - The Federal Crimes Watch Daily

Transféré par

Douglas McNabbDroits d'auteur :

Formats disponibles

Federal Criminal Defense Lawyers

Tuesday, December 20, 2011

www.McNabbAssociates.com

Florida Loan Officer Sentenced in Connection with $2.5 Million Reverse Mortgage and Loan Modification Scheme

McNabb Associates, P.C. (Federal Criminal Defense Lawyers)

Submitted at 8:33 AM December 20, 2011

The Federal Bureau of Investigation (FBI) on December 19, 2011 released the following: Wifredo A. Ferrer, United States Attorney for the Southern District of Florida, Tony West, Assistant Attorney General for the Civil Division of the U.S. Department of Justice, Timothy A. Mowery, Special Agent in Charge, U.S. Department of Housing and Urban Development, Office of Inspector General (HUD-OIG), Jose A. Gonzalez, Special Agent in Charge, Internal Revenue Service, Criminal Investigation Division (IRS-CID), Henry Gutierrez, Inspector in Charge, U.S. Postal Inspection Service, John V. Gillies, Special Agent in Charge, Federal Bureau of Investigation (FBI), Miami Field Office, and Tom Grady, Commissioner, State of Floridas Office of Financial Regulation, announce that a Florida loan officer was sentenced today by U.S. District Court Judge William P. Dimitrouleas in Ft. Lauderdale, Fla., for his participation in a nationwide $2.5 million reverse mortgage fraud scheme. John Incandela, 25, of Palm Beach, Fla., was sentenced to 41 months in prison, three years of supervised release and ordered to pay over $1.9 million in restitution. Louis Gendason, 42, of Delray Beach, Fla., is scheduled to be sentenced on Jan. 20, 2012. A reverse mortgage, also known as a Home Equity Conversion Mortgage, allows borrowers who are at least 62 years of age to convert the equity in their homes into a monthly stream of income, or a line of credit. Unlike the traditional mortgage loan scenario, in which borrowers make monthly payments to a mortgage lender in satisfaction of their outstanding loan, in a reverse mortgage loan scenario, the mortgage lender purchases borrowers equity and makes installment payments to the borrower. According to the information and statements made during the August 2011 hearing in the case, from May 2009

through November 2010, the defendants engaged in a reverse mortgage scheme that defrauded unwitting borrowers, Genworth Financial Home Equity Access Inc. and the Federal Housing Administration (FHA). Working as a loan officer, Incandela, along with codefendant Marcos Echevarria, 29, of Palm Beach, solicited seniors to refinance their existing mortgages with a reverse mortgage loan financed by Genworth. To qualify the borrowers for these loans, codefendant Gendason altered real estate appraisals to fraudulently inflate the value of the borrowers properties. In fact, however, none of the borrowers had sufficient equity in their properties to qualify for a reverse mortgage. The defendants then submitted the fraudulently inflated appraisals to Genworth. Based on the false documentation, Genworth approved and the FHA insured more than $2.5 million in reverse mortgage loans. As part of the scheme, co-defendant Kimberly Mackey, 47, of Pittsburgh, a licensed title agent, fraudulently closed the Genworth loans and did not pay off the borrowers existing mortgage loans. Mackey attempted to conceal the fraudulent loan closings by preparing false settlement documents that showed that the existing mortgages had, in fact, been paid off. The defendants divided up the loan proceeds and used the money for their personal benefit. On Nov. 3, 2011, Mackey and Echevarria received prison sentences of 60 and 24 months, respectively, for their roles in the scheme. The defendants further engaged in a loan modification scheme to conceal the existence of the Genworth reverse mortgage transactions from the original mortgage lenders, whose loans remained unpaid. To this end, Gendason, Incandela and Mackey conspired to create fictitious offers to buy some of the borrowers properties, in the form of short sales. A short sale is a sale of real estate in which the sale proceeds are less than the balance owed on the loan to the mortgage lender, but avoids foreclosure and related costs. In other instances, to hide the existence of

the Genworth reverse mortgage loan from the original lenders, the defendants made monthly mortgage payments to the borrowers original lenders. The case was investigated by the U.S. Department of Housing and Urban Development Office of Inspector General, the U.S. Postal Inspection Service, the FBI and the Floridas Office of Financial Regulation, with assistance from the U.S. Secret Service and Genworth Financial Home Equity Access. The case was prosecuted by Kevin J. Larsen, a Trial Attorney in the Justice Departments Consumer Protection Branch, and Assistant U.S. Attorneys Jeffrey H. Kay and Thomas Lanigan of the Southern District of Florida. A copy of this press release may be found on the website of the United States Attorneys Office for the Southern District of Florida at http://www.usdoj.gov/usao/ fls. Related court documents and information may be found on the website of the District Court for the Southern District of Florida at http:// www.flsd.uscourts.gov or on http:// pacer.flsd.uscourts.gov. Douglas McNabb McNabb Associates, P.C.s Federal Criminal Defense Attorneys Videos: Federal Crimes Appeal To find additional federal criminal news, please read Federal Crimes Watch Daily. Douglas McNabb and other members of the U.S. law firm practice and write and/ or report extensively on matters involving Federal Criminal Defense, INTERPOL Red Notice Removal, International Extradition and OFAC SDN Sanctions Removal. The author of this blog is Douglas McNabb. Please feel free to contact him directly at mcnabb@mcnabbassociates.com or at one of the offices listed above.

Federal Criminal Justice

Federal Criminal Defense Lawyers

Manhattan U.S. Attorney Announces Guilty Plea of Former Controller at Bernard L. Madoff Investment Securities LLC

McNabb Associates, P.C. (Federal Criminal Defense Lawyers)

Submitted at 9:27 AM December 20, 2011

The Federal Bureau of Investigation (FBI) on December 19, 2011 released the following: Preet Bharara, the United States Attorney for the Southern District of New York, announced today that ENRICA COTELLESSA-PITZ, the former Controller at Bernard L. Madoff Investment Securities LLC (BLMIS), pled guilty in Manhattan federal court to a fourcount Superseding Information charging her with conspiracy, as well as substantive counts of falsifying books and records of a broker-dealer, falsifying books and records of an investment adviser, and making false filings to the Securities and Exchange Commission (SEC). COTELLESSA-PITZ pled guilty before U.S. District Judge Laura Taylor Swain. As part of her guilty plea, COTELLESSA-PITZ has agreed to cooperate with the Government in its ongoing investigation of the fraud that occurred at BLMIS. According to the Superseding Information, plea agreement and other documents filed in connection with the case: COTELLESSA-PITZ was employed at BLMIS from 1978 through December 11, 2008. In 1998, COTELLESSA-PITZ became the Controller of BLMIS. Beginning in the late 1990s until the collapse of BLMIS in 2008, COTELLESSA-PITZ, allegedly along with other coconspirators, created false and misleading entries in the books and records of BLMIS and in reports filed with the SEC. The false and misleading entries were used to disguise transfers of funds from the BLMIS Investment Advisory (IA) business to BLMISs Market Making and Proprietary Trading operations. The transfers made the Market Making and Proprietary Trading operations of BLMIS appear profitable when they were not. In addition, COTELLESSA-PITZ,

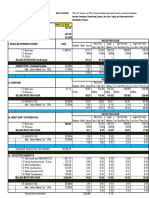

allegedly along with other coconspirators, created false and fraudulent documents that were given to the SEC in connection with its audit of BLMIS. COTELLESSA-PITZ, and allegedly other co-conspirators, also created false and fraudulent documents in connection with tax audits of Bernard L. Madoff. *** COTELLESSA-PITZ, 53, faces a statutory maximum sentence of 50 years in prison. The statutory maximum sentences for each of the charged offenses are set forth in the attached chart. COTELLESSA-PITZ is also subject to mandatory restitution and criminal forfeiture and faces criminal fines up to twice the gross gain or loss derived from the offense. Pursuant to the agreements entered into with the Government, COTELLESSA-PITZ has agreed to forfeiture of more than $97 billion. The net proceeds from the sale of the forfeited property will be used to compensate victims of the fraud, consistent with applicable Department of Justice regulations. Following the guilty plea, Judge SWAIN released COTELLESSA-PITZ on a $2.5 million bond on the condition that the bond be co-signed by eight financially responsible individuals and secured by $800,000 in cash and property. In addition, COTELLSSA-PITZs travel is restricted to the Southern and Eastern Districts of New York. COTELLESSAPITZ has surrendered her passport. Judge Swain set a sentencing date for COTELLESSA-PITZ of June 22, 2012. Mr. Bharara praised the investigative work of the Federal Bureau of Investigation. He also thanked the U.S. Securities and Exchange Commission and the Internal Revenue Service, Criminal Investigations Division for their assistance. These cases were brought in coordination with President Barack Obamas Financial Fraud Enforcement Task Force, on which Mr. Bharara serves as a Co-Chair of the Securities and Commodities Fraud

Working Group. President Obama established the interagency Financial Fraud Enforcement Task Force to wage an aggressive, coordinated, and proactive effort to investigate and prosecute financial crimes. The task force includes representatives from a broad range of federal agencies, regulatory authorities, inspectors general, and state and local law enforcement who, working together, bring to bear a powerful array of criminal and civil enforcement resources. The task force is working to improve efforts across the federal executive branch, and with state and local partners, to investigate and prosecute significant financial crimes, ensure just and effective punishment for those who perpetrate financial crimes, combat discrimination in the lending and financial markets, and recover proceeds for victims of financial crimes. The case is being handled by the Offices Securities and Commodities Fraud Task Force. Assistant United States Attorneys Lisa A. Baroni, Julian J. Moore, Arlo Devlin-Brown, Barbara A. Ward, and Matthew L. Schwartz are in charge of the prosecution. Douglas McNabb McNabb Associates, P.C.s Federal Criminal Defense Attorneys Videos: Federal Crimes Appeal To find additional federal criminal news, please read Federal Crimes Watch Daily. Douglas McNabb and other members of the U.S. law firm practice and write and/ or report extensively on matters involving Federal Criminal Defense, INTERPOL Red Notice Removal, International Extradition and OFAC SDN Sanctions Removal. The author of this blog is Douglas McNabb. Please feel free to contact him directly at mcnabb@mcnabbassociates.com or at one of the offices listed above.

Three Operators of Miami Home Health Company Plead Guilty in $60 Million Health Care Fraud Scheme

(USDOJ: Justice News)

Submitted at 9:49 AM December 20, 2011

Roberto Gonzalez, 61, Olga Gonzalez, 57, and their son, Fabian Gonzalez, 39,

each pleaded guilty before U.S. District Judge Ursula Ungaro in the Southern District of Florida to one count of conspiracy to commit health care fraud.

Federal Criminal Defense Lawyers

Justice

Deputy Assistant Attorney General Roy L. Austin Jr. Speaks at the East Haven Police Department Investigative Findings Announcement

(USDOJ: Justice News)

Submitted at 10:34 AM December 20, 2011

"Based on our investigation, we find that the East Haven Police Department engages in discriminatory policing against Latinos," said Deputy Assistant Attorney General Austin.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument8 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Syllabus CFA Level 1Document2 pagesSyllabus CFA Level 1Phi AnhPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Ong v. Tiu Case DigestDocument3 pagesOng v. Tiu Case DigestNa-eehs Noicpecnoc Namzug0% (1)

- Urban DesignDocument22 pagesUrban DesignAbegail CaisedoPas encore d'évaluation

- LC Draft Raw Cashew NutDocument5 pagesLC Draft Raw Cashew NutUDAYPas encore d'évaluation

- Bot ContractDocument18 pagesBot ContractideyPas encore d'évaluation

- BembosBurger PDFDocument34 pagesBembosBurger PDFcreynosocPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument3 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current International Criminal CasesDocument7 pagesInternational Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current International Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDocument3 pagesInternational Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument3 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument7 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDocument3 pagesInternational Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDocument7 pagesInternational Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDocument2 pagesInternational Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument1 pageFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument4 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDocument7 pagesInternational Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument2 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument9 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument8 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDocument4 pagesInternational Criminal Defense Lawyer Douglas McNabb of McNabb Associates - News On Current International - Transnational Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument4 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument4 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- International Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current International Criminal CasesDocument7 pagesInternational Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current International Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument2 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument3 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- USA v. Fishenko Et Al., Case No. 1:12-cr-00626-SJ - Letter To The Court Moving For A Permanent Order of DetentionDocument15 pagesUSA v. Fishenko Et Al., Case No. 1:12-cr-00626-SJ - Letter To The Court Moving For A Permanent Order of DetentionDouglas McNabbPas encore d'évaluation

- USA v. Fishenko Et Al., Case No. 1:12-cr-00626-SJ - Federal Criminal IndictmentDocument32 pagesUSA v. Fishenko Et Al., Case No. 1:12-cr-00626-SJ - Federal Criminal IndictmentDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument5 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument2 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument3 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument1 pageFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument1 pageFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument2 pagesFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Federal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDocument1 pageFederal Criminal Lawyer Douglas McNabb of McNabb Associates - News On Current Federal Criminal CasesDouglas McNabbPas encore d'évaluation

- Overview of Persuasive Advertising-R8-N8.2.2014Document52 pagesOverview of Persuasive Advertising-R8-N8.2.2014Tawfik EwedaPas encore d'évaluation

- Wilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Document140 pagesWilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Mantenimiento CoinogasPas encore d'évaluation

- Capital Reduction MergedDocument33 pagesCapital Reduction MergedWhalienPas encore d'évaluation

- JollibeeDocument5 pagesJollibeeDaphane Kate AureadaPas encore d'évaluation

- Crs Report For Congress: Worldcom: The Accounting ScandalDocument6 pagesCrs Report For Congress: Worldcom: The Accounting ScandalMarc Eric RedondoPas encore d'évaluation

- Union BankDocument7 pagesUnion BankChoice MyPas encore d'évaluation

- Catálogo de Bandejas Cablofood BTICINODocument6 pagesCatálogo de Bandejas Cablofood BTICINOEdgar RequenaPas encore d'évaluation

- Dwnload Full Retailing 8th Edition Dunne Test Bank PDFDocument35 pagesDwnload Full Retailing 8th Edition Dunne Test Bank PDFjayden4r4xarnold100% (14)

- Using Oracle Business Intelligence Cloud Service PDFDocument274 pagesUsing Oracle Business Intelligence Cloud Service PDFDilip Kumar AluguPas encore d'évaluation

- Masters 2017 PDFDocument28 pagesMasters 2017 PDFGCMediaPas encore d'évaluation

- ENSP - Tender No.0056 - ENSP - DPE - AE - INV - 19 - Supply of A Truck Mounted Bundle ExtractorDocument2 pagesENSP - Tender No.0056 - ENSP - DPE - AE - INV - 19 - Supply of A Truck Mounted Bundle ExtractorOussama AmaraPas encore d'évaluation

- Company Profile of FlipkartDocument54 pagesCompany Profile of FlipkartPurnima SidhwaniPas encore d'évaluation

- Walmart Research PlanDocument7 pagesWalmart Research PlanErin TurnerPas encore d'évaluation

- Marketing Domain ...........................Document79 pagesMarketing Domain ...........................Manish SharmaPas encore d'évaluation

- SPANISH AMERICAN SKIN COMPANY, Libelant-Appellee, v. THE FERNGULF, Her Engines, Boilers, Tackle, Etc., and THE A/S GLITTRE, Respondent-AppellantDocument5 pagesSPANISH AMERICAN SKIN COMPANY, Libelant-Appellee, v. THE FERNGULF, Her Engines, Boilers, Tackle, Etc., and THE A/S GLITTRE, Respondent-AppellantScribd Government DocsPas encore d'évaluation

- Security agency cost report for NCRDocument25 pagesSecurity agency cost report for NCRRicardo DelacruzPas encore d'évaluation

- MFRS11 Joint Arrangements MFRS12 Disclosure of Interests in Other Entities MFRS5 Non-Current Assets Held For Sale &Document20 pagesMFRS11 Joint Arrangements MFRS12 Disclosure of Interests in Other Entities MFRS5 Non-Current Assets Held For Sale &cynthiama7777Pas encore d'évaluation

- Centum Rakon India CSR Report FY 2020-21Document14 pagesCentum Rakon India CSR Report FY 2020-21Prashant YadavPas encore d'évaluation

- PD Mitra Jurnal Penerimaan Kas: Bulan: Desember 2016Document36 pagesPD Mitra Jurnal Penerimaan Kas: Bulan: Desember 2016DaraPas encore d'évaluation

- Shareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaDocument3 pagesShareholder Vs Stakeholder Approach - RSM South Africa Shareholders Vs Stakeholders - Legal Insights - RSM South AfricaCasper MaungaPas encore d'évaluation

- Chapter-I: Customer Service and Loan Activities of Nepal Bank LimitedDocument48 pagesChapter-I: Customer Service and Loan Activities of Nepal Bank Limitedram binod yadavPas encore d'évaluation

- Claims Software: Integrated InsuranceDocument2 pagesClaims Software: Integrated InsurancespucilbrozPas encore d'évaluation

- Richard ADocument2 pagesRichard AsubtoPas encore d'évaluation

- Tally PPT For Counselling1Document11 pagesTally PPT For Counselling1lekhraj sahuPas encore d'évaluation