Académique Documents

Professionnel Documents

Culture Documents

Accounting Rep

Transféré par

Safiya IqbalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting Rep

Transféré par

Safiya IqbalDroits d'auteur :

Formats disponibles

NIBM kurunegala.

Accounting process

Financial Accounting

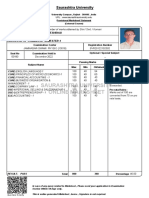

Bsc in Business Management (Special) Degree Safiya Iqbal Group no. 02

2010

Acknowledgement

I would like to thank our Financial Accounting lecturer and the course Director of Bsc in Business Management (special) Degree Miss. Harshani Piyumanthi for giving us this opportunity to take over this project and giving us the fullest support and cooperation to complete this project.

I also express our sincere gratitude to Mr. Chaminda Rathnayaka the Director of National Institute of Business Management (Kurunegala branch), Mr. Ravi Rajakaruna for providing all facilities ,And our special thanks goes to, Mr. M.S.M Iqbal the Deputy Director of RDA,Madawa Hearath Maduwalthana for providing information to make my assignment a great success. At the last, I would like to thank all the members in my group for the contribution given and all of them who helped us to make this assignment a successful one.

~ Thank you ~

Contents

Introduction What is accounting Introduction of HNB History About us Vision Mission Values Services providing Accounting process Source documents Journalizing Financial statements Definition income statement Balance sheet Earning forecast statement Accounting systems Typical manual accounting system Computerized accounting system Accounting package HNB using Benefits of computerized accounting Reference

04

05-13 05 06 07 07 07 08-13 14 15-19 20 21-24 21 22 23 24 25-31 25-26 27-28 29 30-31 32

Introduction

What is accounting?

Accounting is the language of business. It is a standard set of rules for measuring a firms financial performance. Accounting is the system a company uses to measure its finance by classifying all the transactions like sales, purchases, assets, and liabilities in a manner that adheres to certain accepted spandrel formats. Its helps to evaluate a companys past performance, present condition, and future prospects.

Definition of accounting; Accounting is the art of recording classifying, and summarizing in a significant manner and in terms of money, transaction and events which are , in part at least of a financial character and interpreting the results.

Introduction to HATTON NATIONAL BANK (HNB)

History ;

In 1888, Hatton Bank commenced business in Sri Lanka's hill country station of Hatton, to serve the flourishing tea industry that produced the country's most famous export. In 1948, with the independence of Ceylon, Brown & Company Ltd., a leader in the engineering business, bought over the interests of the original investors and fittingly restructured the bank with greater Sri Lankan participation. Thus began the voyage of what was to become a truly national bank that would grow to be recognized as Sri Lanka's Flagship among commercial banks.

About us;

Hatton National Bank PLC, together with its subsidiaries, provides banking and related services in Sri Lanka and internationally. The companys deposit products include non interest bearing deposits, savings deposits, term deposits, deposits redeemable at call, and certificates of deposit. Its loan portfolio comprises housing, personal, agricultural, animal produce, civil engineering, food processing, hotel and catering, light engineering, manufacturing, medical service, textile, short/medium and term, trading, and transport loans. The companys corporate banking services and products include working capital/operational finance, trade finance, project lending, lead financing for syndicate loans, standby letter of credit/bank guarantees, leasing, custodian services, and various forex/treasury products. Its activities also include offshore banking, mortgage financing, lease financing, corporate financing, dealing in government securities and quoted equities, pawn broking, stock broking, providing life and general insurance services, property development, credit card facilities, personal financial services, foreign currency operations, trade services, investment banking, development banking, rural finance, remittances and foreign currency related services, project finance, and other financial services. As of December 31, 2009, the company operated 186 customer centers and 310 automated teller machines in Sri Lanka. Hatton National Bank PLC was founded in 1888 and is headquartered in Colombo, Sri Lanka.

Vision, mission, and values of HNB;

Our Vision: To be the acknowledged leader and chosen partner in providing financial solutions through inspired people.

Our Mission: Combining entrepreneurial spirit with empowered people and leading edge technology to constantly exceed stakeholder expectations

Our Values: Treasure professional & personal integrity at all times Demonstrate mutual respect in all our interactions Passionate in everything we do Committed to being customer centric Courage to change, challenge and be different Demonstrate unity in diversity

Products and the services providing;

Personal banking

Overview

Expand your money

Savings accounts Pathum vimana Youth banking Kids banking Divi shakthi Saubhagya savings scheme Senior citizen scheme Certificate of deposits Capital savings

Control your finance Current accounts Share line current accounts Borrow funds Housing loans Shanthi housing loans Shanthi foreign currancy HNB pathum card HNB personal loans Education loans Graduate ship education loans

Credit card HNB royalty points Ranaviru Leasing Electronic banking HNB Virtual banking ATM Teleline HNB SMS banking

Saving accounts in HNB;

The HNB Singithi Lama Account is a account for children up to 12 years old. The HNB Singithi Lama Account can be opened at any HNB Customer Centre with an initial deposit of Rs 500/-. At the time of opening the account a copy of the child's birth certificate has to be submitted to your HNB customer Centre..Every child who opens a Singithi Lama Account is guaranteed of fabulous gifts. The value of the gifts offered will increase on reaching higher account balances. So all you have to do is save more and

HNB launches Singithi Kirikatiyo a Savings Scheme for New Born Babies HNB has reintroduced the new born baby scheme with a number of new value additions. The new scheme "Singithi Kirikatiyo" will be a savings scheme for new born babies. The official launch took place at the Appollo Hospitals on 19th March 2008. The bank intends to take this scheme island wide to include all key hospitals and nursing homes by 25th March 2008.Under the "Singithi Kirikatiyo" savings scheme parents of new born babies are given the opportunity to open a "Singithi Kirikatiyo" account by depositing Rs 1,000/-. When doing so the bank inturn also gifts another Rs 1,000/- to the account. The scheme offers a number of unique and attractive benefits. In addition to the gift of Rs 1,000/from the bank an attractive Baby Book is presented to the parents at the time of opening the account. In addition to this the baby will receive a complimentary gift pack from "Pears" at the time of opening the account. more and watch your child receive bigger and better gifts.

10

HNB current accounts;

Finances play a pivotal role in every persons life. HNBs Current Accounts simplifies daily hustle bustle of your finances. Making payments are not only convenient through HNB cheques, but you also get rewarded for doing so. HNB current account holders are now life insured through our lifeline scheme. Need you ask for more? Current Account Requirements An account could be opened at any of our branches. The requirement of a minimum deposit varies from branch to branch. Lifeline Current Account This is a scheme which offers personal current account holders free life insurance cover. Eligibility Age - Between 18 & 65 years old Minimum balance - 20,000/- continuously for 3 months in the C/A immediately preceding the contingency. (The minimum period will not apply if death or disability is caused by accident)

11

HNB housing loans ;

HNB Shanthi Home Loan

HNB Shanthi gives you the freedom to build or purchase a home of your own. Be it a basic house costing a couple of lakhs or a luxury mansion costing millions. We have a range of loans to suit a wide variety of budgets. HNB home loans are designed with our customers in mind. Whatever your decision may be, be it to acquire, build or refurbish your home, our loans will assist in achieving your objective. HNBs experienced financial advisers will assess your personal requirements and circumstances to provide affordable home loans for your convenience and flexibility.

Electronic banking

HNB Virtual Banking

Freedom, Convenience, Control

Sign up for Online Banking and you'll be able to manage your money when it suits you. You won't have to queue at a branch to pay bills, transfer money or check statements. You can still use your branch, the phone and cash machines. Business Online Banking puts you in control of your business finances day and night, seven days a week, 365 days a year. Log on and you can check your accounts, pay bills and suppliers and move funds between accounts with just a few clicks of the mouse.

12

Internet Banking Requirements Online banking service has user-friendly screens that are fast and easy to navigate. Internet Banking Functionality Balance Inquiry Cheque Status History Transactions Stop Payments Today's Transactions Bill Payments Fund Transfers - OWN Fund Transfers - Third Party Currency Exchange Rates Interest Rates view

13

Accounting process

The double entry accounting system provides a basic framework for the analysis of business activities, but when the business is expanding , its essential to go into greater detail about the accounting procedures used to account for the operation of a business during a specific period The accounting procedures of most business involve certain basic steps that are accomplished in a given order. This sequence of operation is known as the accounting cycle .

The steps of the accounting cycle

1. 2. 3. 4. 5. 6. 7. 8. 9.

Gather document and analyze transactions from source documents . Record transactions in journals Post journals entries to general ledger account Prepare a trial balance Prepare adjusting entries and adjust the general ledger accounts Prepare financial statements Journalized closing entries Prepare post closing trial balance Journalized reversing entries

14

Analyzing transactions from source documents

Source documents are printed or written forms that generate when the enterprise engages in business transactions.

Even a brief source document usually specifies the amount involved , the date of transaction , and possibly the party dealing with the enterprise. Ex: A purchase invoice ; Showing evidence of a purchase of merchandise (purchase invoice) A sellers invoice ; No suppliers Cash receipt ; Indicating funds received from a customer A payment slip ; A bank cheque ; Indicate the payment of obligation A deposit slip ; Showing the amount of funds turned over to the bank

15

Sales of service invoice

After the sales of goods of service has taken place a business form called invoice is prepared. The invoice shows the date of sales , services , rendered list of the articles sold or list of services rendered and other information. The original of the invoice is given to the buyer of goods or services. In a merchandising business, from the point of view of the seller, the invoice is called sales invoice; from the point of view of the buyer, it is a purchase invoice.

Official receipt

Official receipt are issued every time the business receives cash. The receipt shows the date on which the cash is received, the party from whom the cash is received, the amount of cash received, the explanation of the transaction, and signature of the person who issued the receipt .

Payment slip Ex ; Electricity bills, water bills, telephone bills and many others

Deposit slip

At present , many business have current account or checking accounts with the bank. They deposit their money in the bank and the payment from their deposit are made by means of issuing cheque.

16

Cash voucher The cash voucher is the document prepared every time payment of an obligation is made. The voucher is a business prep printed from .

Cash register slip

Strip of paper comes out as evidence of the money received by the cashier, the slip shows the date, items ordered amount paid, and other information.

17

The source documents that HNB using

Ex; 1. Cash withdrawal slip from current account/savings account

Front side;

Back side;

18

2. Deposit slip from a current account/savings account

19

Journalizing

Journalizing is the process of recording business transactions to the book of original entry called journals. Business activities are analyzed in terms of debit and credits and record in chronological order before they are entered in the general ledger. An accounting journal may be one of a group special journal, or it may be a general journal.

Chronological must record on the dates

A special journal is designed to record a specific type of frequently occurring business, transaction that do not occur often are recorded in the general journal.

20

Financial statements

Definition;

Summary report that shows how a firm has used the funds entrusted to it by its stockholders (shareholders) and lenders, and what is its current financial position. The three basic financial statements are the (1) balance sheet, which shows firm's assets, liabilities, and net worth on a stated date; (2) income statement (also called profit & loss account), which shows how the net income of the firm is arrived at over a stated period, and (3) cash flow statement, which shows the inflows and outflows of cash caused by the firm's activities during a stated period.

Financial statements in a typical business organization

a. b. c. d. e.

Trading account Profit and loss account Balance sheet Cash flow statement Changes of equity

21

The financial statement in HNB

Income statement ;

What is an income statement ? An Income Statement summarizes both income and expenses by category for an association. The categories represent each budget line item, or account, as well as a Net Profit or Loss. ...

22

Balance sheet ;

What is a blains sheet ? shows the financial position of a company at a particular time. It shows the physical resources (assets) of the business and, to match that, the sources from which finance has been raised both from shareholders and from borrowing.

23

earning forecast statement ;

what is earning forecast ? projection of earnings or Earnings Per Share (EPS) frequently made by management and independent security analysts

24

cashFlow

native

Accounting systems

Review of accounting systems in order to identify the weaknesses in the configuration and data capture resulting in inadequate financial reporting. We offer structured solutions in terms of improving the system configurations to ensure completeness of data capture and integrated financial reporting for external statutory compliances as well as internal Management Information System.

A typical manual accounting system A typical manual system consist of; 1.Separate books of prime ( not part of the double entry) 2. Subsidiary accounts receivable ledger and accounts payable (not part of the double entry )

3. General ledger ( the double entry system) containing accounts receivable and account payable control accounts 4.Separate cash book ( part of double entry)

25

A typical computerized accounting system

o This operates under the same principle as a manual system except that all the records will be stored in to one place. o The system will be broken down into sections in the same way as the manual system, so few people have access the complete system. o Instead of the general ledger being a collection of T accounts, it probably appear as a listing of debts and credits.

Task matching to computers

Manual

Exceptional/infrequent transaction Setting objectives and policy-making judgments Supervising employees Social communication

26

Computerized

Collecting and processing large volumes of routine transactions Storing large quantities of data and information Monitoring and controlling continues process Answering specific inquiries based on stored data Preparing complex analyses and extensive reports Helping gather data and understanding the relationships between all types of decisions.

Computerized accounting systems

Training modules can be customized according to the needs of the customer, to include basic or advanced accounting concepts to augment the understanding of the accounting process. The standard of the module maybe scaled up or down based on the level of knowledge and understanding of Accounting of the target employees of the customer. We also carry out need-based training of various modules of the Accounting Software Tally to enable the users to make full use of all the available facilities offered by the software. They are a number of integrated accounting packages which handle all parts the accounting system and ultimately produce the financial statements.

27

Computerized accounting systems

Examples; o o o o o o o Accpac Peachtree Premium Accounting 2010 Sage line 50/100 Quick book MYOB Lotus 123 Finacle

28

The accounting package that HNB using

HNB is using the latest accounting package mostly using in banking sector which called finacle , the 7.8 latest version.60 countries, and 161 companies using this computerized accounting package.

About FINACLE ; Finacle from Infosys partners with banks to power-up their innovation agenda, enabling them to differentiate their products and service, enhance customer experience and achieve greater operational efficiency.... Finacle solutions address the core banking, wealth management, CRM, Islamic banking and treasury requirements of retail, corporate and universal banks worldwide. Finacle solutions also empower banks with multiple sales, service and marketing channels including e-banking, mobile banking and call centers. These offerings make Finacle a strong innovation-facilitator enabling banks to accelerate growth, while maximizing value from their large scale business transformation

29

Benefits of computerization

1. Computerized accounting systems automate manual routine tasks such as; Book-keeping Bank reconciliations VAT returns Electronic banking Payroll

2. Computerized accounting systems provides a wide range of reports at the touch of a button Debtors and creditors statements Bank account balance VAT owed Balance sheet Profit and loss Stock values

30

3. Easier borrowing from banks 4. Detecting fraud or theft 5. Identification of source of profits and losses 6. More reliable data due to clearer policies 7. Financial planning and projections 8. Significant reduction in risk of penalties for tax evasion 9. Premium valuation 10. Less errors due to clear procedures 11. Concentrate on your core business

31

Reference

Web searches; http://www.infosys.com http://www.hnb.net http://www.businessdictionary.com http://tutor2u.net http://www.google.lk/images

The tutorials of financial accounting Miss. Harshani Piyumanthi The financial accounting lecher, course director of B sc in business management (special) degree kurunegala . Miss kayilashinie Thirangama B sc Accounting Sp (first class Honors) - University of Sri Jayewardenepura, passed finalist (institute of charted Accountants of Sri Lanka)

32

I declare all materials included in this report is the end result of my own and that due acknowledgement have been give in the bibliography and reference to all sources be they printed, electronic or personal

Thank you

Safiya iqbal Bsc in Business Management (special) degree Foundation year (1st semester) Financial Accounting

33

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Benefit Verification LetterDocument4 pagesBenefit Verification LetterDonna BridgesPas encore d'évaluation

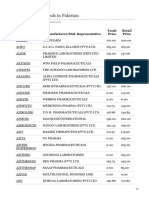

- Azithromycin Brands in Pakistan PDFDocument4 pagesAzithromycin Brands in Pakistan PDFibPas encore d'évaluation

- ProblemDocument3 pagesProblemazampec33% (3)

- A Call To Action: Helping Hospice Social Workers Embrace Evidence-Based Practice Improving Hospice DocumentationDocument7 pagesA Call To Action: Helping Hospice Social Workers Embrace Evidence-Based Practice Improving Hospice DocumentationSaab AeroPas encore d'évaluation

- Innovative Ideas To Remember The ActDocument23 pagesInnovative Ideas To Remember The Actsai sandeepPas encore d'évaluation

- Qarkullimi I Llogarisë Account TurnoverDocument7 pagesQarkullimi I Llogarisë Account TurnoverYllka HoxhaPas encore d'évaluation

- BIS Microsoft Dynamics NAV 2009 Vs NAV 2016Document20 pagesBIS Microsoft Dynamics NAV 2009 Vs NAV 2016mohit1990dodwalPas encore d'évaluation

- Business & Compliance ISO PCI Report: I.T. SecurityDocument11 pagesBusiness & Compliance ISO PCI Report: I.T. SecurityMohsin AliPas encore d'évaluation

- Marksheet PDFDocument1 pageMarksheet PDFD igg v D oh vPas encore d'évaluation

- ZFB01N TemplateDocument18 pagesZFB01N TemplatePrateek MohapatraPas encore d'évaluation

- Contentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFDocument4 pagesContentitemfile Clakzz57bxlrw0a21yjksjcx8 PDFJoseph OndariPas encore d'évaluation

- Cover PageDocument4 pagesCover PageDanielle MartinezPas encore d'évaluation

- Tutorial 10: Name: Riya Lashkary Roll No.: J219Document2 pagesTutorial 10: Name: Riya Lashkary Roll No.: J219Riya AgrawalPas encore d'évaluation

- Non-Marketable Financial Assets: Bank DepositsDocument8 pagesNon-Marketable Financial Assets: Bank DepositsDhruv MishraPas encore d'évaluation

- Research Paper - INWK 6111 - Ruchi Raghu BhattDocument16 pagesResearch Paper - INWK 6111 - Ruchi Raghu BhattruchibhattPas encore d'évaluation

- Warehousing and PurchasingDocument49 pagesWarehousing and PurchasingIrene100% (1)

- Country Specific Updates For Thailand AX2012Document66 pagesCountry Specific Updates For Thailand AX2012vanvic93Pas encore d'évaluation

- Hsa Compliant Gap Plan: Level-Funded Gap Coverage For Groups With High Deductible Health Insurance PlansDocument2 pagesHsa Compliant Gap Plan: Level-Funded Gap Coverage For Groups With High Deductible Health Insurance PlansamazonrecieptsPas encore d'évaluation

- Atp - Payment Gateway by G. JharbadeDocument9 pagesAtp - Payment Gateway by G. JharbadeGhaneshwer JharbadePas encore d'évaluation

- Sovereign Container Line, Inc: 10644481 SCLI40008202Document1 pageSovereign Container Line, Inc: 10644481 SCLI40008202ORLANDO GONZALEZPas encore d'évaluation

- Regulations For The Classification of Licenses For Telecommunications ServicesDocument19 pagesRegulations For The Classification of Licenses For Telecommunications ServicesfahadzekliasmPas encore d'évaluation

- Universiti Teknologi Mara Common Test: Confidential 1 AC/APR 2019/AIS205Document6 pagesUniversiti Teknologi Mara Common Test: Confidential 1 AC/APR 2019/AIS205ZilchPas encore d'évaluation

- Airbnb Travel Receipt, Confirmation Code HMAB5TZXYKDocument2 pagesAirbnb Travel Receipt, Confirmation Code HMAB5TZXYKAirbnb USPas encore d'évaluation

- PDIC NotesDocument5 pagesPDIC NotesRyDPas encore d'évaluation

- Fundamental Financial Accounting Concepts 8th Edition Edmonds Solutions ManualDocument11 pagesFundamental Financial Accounting Concepts 8th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- Class 6 InternetDocument13 pagesClass 6 InternetRahul SinghPas encore d'évaluation

- Reliance Mutual Funds ProjectDocument58 pagesReliance Mutual Funds ProjectShivangi SinghPas encore d'évaluation

- VoLTE BasicsDocument46 pagesVoLTE BasicsAdil Murad0% (1)

- Sample ResumeDocument4 pagesSample ResumeChris TinePas encore d'évaluation

- RNAM - Press Release - NLI Signs DA With RCLDocument2 pagesRNAM - Press Release - NLI Signs DA With RCLJayesh kurupPas encore d'évaluation