Académique Documents

Professionnel Documents

Culture Documents

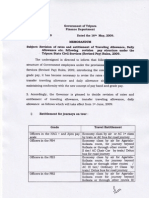

TA DA by Punjab Govt Under Pay Commission Notification by Vijay Kumar Heer

Transféré par

VIJAY KUMAR HEERDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

TA DA by Punjab Govt Under Pay Commission Notification by Vijay Kumar Heer

Transféré par

VIJAY KUMAR HEERDroits d'auteur :

Formats disponibles

No.

18/10/09-4FP2/ 440 GOVERNMENT OF PUNJAB DEPARTMENT OF FINANCE (FINANCE PERSONNEL BRANCH-1) Dated: Chandigarh the: 31 August , 2009 To All Heads of Departments, Commissioners of Divisions, Registrar High Court of Punjab and Haryana, District and Sessions Judges and Deputy Commissioners in the State. Subject: Sir, I am directed to refer to Punjab Government Circular No. 5/1/982FPIV/ 356 Dated 8th May, 1998 on the subject cited above and to say that after careful consideration of the recommendation of the Fifth Punjab Pay Commission, the Governor of Punjab is pleased to take the following decisions. 2. (i). Travelling Allowance (TA/DA) : For the purposes of T.A./D.A., Implementation of the recommendations of the Fifth Punjab Pay Commission T.A./ D.A.

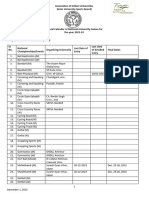

categorization of Punjab Government Employees on the basis of Grade Pay shall be as under: Category I II III IV V (ii). Grade Pay Rs. 10,000 and above Rs. 7,600 to Rs. 9,999 Rs. 5,000 to Rs. 7,599 Rs. 3,800 to Rs. 4,999 Below Rs. 3,800

The revised classification of cities within or outside the State for the grant

of T.A./D.A. shall be as under: (a) (b) (c) (d) Cities with population of 50 lakhs and above Cities with population of 20 lakhs and above but less than 50 lakhs Cities with population of 10 lakhs and above but less than 20 lakhs Cities with population of 5 lakhs but less than 10 lakhs A1 A2 B1 B2

(iii) Daily Allowance:- The revised rates of daily allowance shall be as under: Grade Pay Category A1 Hotel/Non-Hotel rates A2 Hotel/NonHotel rates B1 Hotel/NonHotel rates (In Rs.) B2/ Other Places Hotel/NonHotel rates 320 160 240 120 180 100

800 400 700 300 450 250

640 320 560 240 360 200

480 240 420 180 270 150

II

III

IV

380 200 300 150

300 160 240 120

230 120 180 90

150 80 120 60

The other conditions for daily allowance should remain in force: For example: a) No allowance should be permissible within a radius of 8 kms from the place of duty. Road mileage at fixed rates discussed subsequently should, however, continue to be paid for this journey except to employees who are in receipt of local travelling and conveyance allowance; b) Journey beyond 8 kms and within 25 kms of the place of duty should be treated as local journeys. Daily Allowance should be admissible for a calendar day at half the normal rate irrespective of the period of absence if the employee returns to headquarters the same day. But when such a journey involves night stay, an employee should be entitled to normal travelling allowance; c) A full Daily Allowance should be admissible for journeys beyond 25 kms from headquarters if the period of absence is six hours or more. If the period of absence is less than six hours, half Daily Allowance should be admissible; and d) No incidental charges should be payable in addition to the Daily Allowance/Half Daily Allowance. (iv). Travel Entitlement by Rail/ Air : The entitlement to travel

by Air & Rail shall be as under: Grade Pay Category I II III IV & V Entitlement by Rail Ist Class A.C./Executive Class Ist Class/A.C. Chair Car/A.C. Two tier sleeper Ist Class/A.C. Chair Car/A.C. Three Tier Second Class Sleeper

Other conditions for travel by train will remain the same. The entitlement to travel by Air within India shall be as under: Grade Pay Category I & II III Entitlement by Air Economy Class Economy Class (On the condition that the distance is more than 500 kms.)

In case of International travel, officers of and above the level of Secretaries in the State Government and the equivalent status would be entitled to travel by Business/Club Class in cases where the one-way flying time is more than 8 hours, & economy class for all other international flights. All other officers of the State

Government would be entitled to travel by Economy Class. (V) Journey by Road :

(a). The grade pay ranges for travel by public bus/ auto-rickshaw/ Scooter/ motor cycle, A.C. taxi/ taxi/ own car is revised as indicated below:Grade Pay Category (1) I & II Entitlement (2)

____

Actual fare by any type of public bus including air-conditioned bus. OR

At rates prescribed by the Transport Department of AC Taxi when the journey is actually performed by AC Taxi. OR Actual fare for journeys by autorickshaw. III Same as for (I & II) above with the exception that journeys by AC taxi will not be permissible. OR At prescribed rates for Taxi/ autorickshaw/ own scooter/ motorcycle/ moped etc. Actual fare by ordinary public bus only. OR At prescribed rates for autorickshaw/ own scooter/ motorcycle/ moped etc.

IV & V

(b ). The rate of Mileage Allowance for journeys on bicycle , on tour and transfer, will be Rs. 1.20 per kilometre. (Vi). Accommodation :-The maximum rates for hotel accommodation / Tourist Bungalows for tour outside Punjab & Chandigarh on the production of receipt shall be as under: Grade Pay Category I Accommodation Reimbursement of actual expenditure towards normal single room rent in a hotel of a category not above 5 star; and Reimbursement of actual expenditure incurred towards normal single room rent in a hotel of category not above 3 star. Classification of City A1 A2 B1 (Any hotel room upto rupees per day) III IV V 800 500 300 600 400 200 500 300 150 B2/ Other Places 400 200 100

II

At New Delhi and Shimla, the expenditure on hotel accommodation and Daily Allowance at hotel rates shall be reimbursed only if no accommodation is available in Punjab Bhawan/ Circuit Houses/ Rest Houses at these places. (vii). Travelling Allowance on Transfer : Transport charges for the carriage of their personal effects on transfer shall be as under :Grade Pay Category I & II III IV & V (a). Carriage Entitlement Two Trucks One Truck One Truck

The rates shall be fixed for carriage of personal effects by road only. The State transport Commissioner shall determine distance between two stations by road, by shortest route and shall also fix rates per truck per kilometer and revise them atleast annually, If necessary, he may fix separate rates for journey covering smaller distance.

(b).

If an employee transport his personal effects by rail, the existing rules and instructions shall apply. The time limit for the presentation of Travelling Allowance bill for shifting of personal effects on retirement will be two years.

(c).

3.

The decisions contained in this letter shall be effective from the First day of August, 2009. However, if the Travelling Allowance entitlements in terms of the revised entitlements now prescribed result in a lowering of the existing entitlements in the case of any individual, groups or classes of employees, the entitlements, particularly in respect of mode of travel, class of accommodation, etc., shall not be lowered. They will instead continue to be governed by the earlier orders on the subject till such time as they become eligible, in the normal course, for the higher entitlements. The instructions/ orders issued from time to time on the subject shall be treated to have been modified to the extent of the decisions contained in this letter. Yours faithfully,

4.

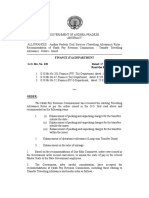

No. 18 /10 /09-4FP2/ 441

(Om Parkash Bhatia) Under Secretary Finance Dated the 31 August, 2009

(i) (ii)

A copy each along with a spare copy is forwarded to:The Accountant General (Audit) Punjab, Chandigarh; The Accountant General (Accounts and Entitlement), Punjab, Chandigarh.

Endst. No. 18 /10 /09-4FP2/ 442

(Om Parkash Bhatia) Under Secretary Finance Dated the 31 August, 2009

(i) (ii) (iii) (iv).

A copy each is forwarded to:The Secretary to Government of Himachal Pradesh, Department of Finance, Shimla; The Finance Secretary, Chandigarh Administration, Chandigarh; All the District Treasury Officers/Treasury Officers/ in the State for information and necessary action. The Director ( E & G) Ministry of Finance, Department of Expenditure, Pay Research Unit, New Delhi.

Superintendent I.D. No. 18 /10 /09-4FP2/ 443 Dated the 31 August, 2009

(i) (ii) (iii).

A copy is forwarded for information to:The Chief Secretary to Government of Punjab, Chandigarh; All the Financial Commissioners, Principal Secretaries and the Administrative Secretaries to Government of Punjab. The Resident Commissioner, Punjab, Punjab Bhawan,Copernicus Marg, New Delhi.

Superintendent

Endst. No. 18 /10 /09-4FP2/ 444

Dated the 31 August, 2009

(i) (ii) (iii). (iv). (v). (vi).

A copy each is forwarded to: The Registrar, Punjab Agriculture University, Ludhiana; The Registrar, Punjabi University, Patiala; The Registrar, Guru Nanak Dev University, Amritsar; The Registrar, Panjab University, Chandigarh; The Registrar, Dr. B.R. Ambedkar, Technical University, Jalandhar. The Registrar, Guru Angad Dev Veterinary and Animal Sciences University, Ludhiana.

Superintendent INTERNAL DISTRIBUTION: (i). (ii). Directorate of Financial Resources and Economic Intelligence; All Branches in the Department of Finance.

Vous aimerez peut-être aussi

- T.A. (Rules)Document71 pagesT.A. (Rules)rehmanPas encore d'évaluation

- TA DA RulesDocument54 pagesTA DA RulesSheikh InayatPas encore d'évaluation

- 182 Petroleum Platoon Army Service Corps Recruitment 2017Document2 pages182 Petroleum Platoon Army Service Corps Recruitment 2017Dmj Anbu RajPas encore d'évaluation

- Ssbdoc PDFDocument25 pagesSsbdoc PDFErr33Pas encore d'évaluation

- Interv Cwe AdvertiseDocument10 pagesInterv Cwe AdvertiseSumit GuptaPas encore d'évaluation

- 2014gad MS135Document4 pages2014gad MS135P. Balaji Chakravarthy100% (1)

- Officers Service RegulationsDocument78 pagesOfficers Service RegulationsSourav Chakraborty0% (1)

- Furnishing AllowanceDocument1 pageFurnishing AllowanceVijay KumarPas encore d'évaluation

- RTMC Form MCPS For New CandidatesDocument2 pagesRTMC Form MCPS For New CandidatesAsma SaleemPas encore d'évaluation

- Jto 2005Document21 pagesJto 2005api-26177876Pas encore d'évaluation

- Application Form For ASEAN Country Registered Buses To Operate Scheduled ServiceDocument4 pagesApplication Form For ASEAN Country Registered Buses To Operate Scheduled ServiceshujadamsPas encore d'évaluation

- Vistara JD For Groud Staff PDFDocument6 pagesVistara JD For Groud Staff PDFPrasad AcharyaPas encore d'évaluation

- Indian Navy Artificer Apprentice RecruitmentDocument1 pageIndian Navy Artificer Apprentice RecruitmentCareerNotifications.comPas encore d'évaluation

- New TA RulesDocument58 pagesNew TA Ruleschandrakant322Pas encore d'évaluation

- New Charges of Vehicle Registration in Sri LankaDocument12 pagesNew Charges of Vehicle Registration in Sri LankaPalinda WickramasinghePas encore d'évaluation

- TA DA Rules 2009 TRIPURADocument3 pagesTA DA Rules 2009 TRIPURAArup Debnath0% (2)

- J&K Services Selection Board: Government of Jammu and KashmirDocument32 pagesJ&K Services Selection Board: Government of Jammu and KashmirErr33Pas encore d'évaluation

- PG ProspectusDocument53 pagesPG ProspectusNizam Akbar AliPas encore d'évaluation

- LFAR-Ready Reckoner Audit Report SummaryDocument13 pagesLFAR-Ready Reckoner Audit Report SummaryJAY SHARMA100% (1)

- Punjab Govt Revises TA/DA Rates for EmployeesDocument5 pagesPunjab Govt Revises TA/DA Rates for EmployeesTannyCharayaPas encore d'évaluation

- PayCell 922 03-Oct-2012 268Document7 pagesPayCell 922 03-Oct-2012 268BMD DBMPas encore d'évaluation

- Hindi Version Will Follow.: Published On National Portal of India - Http://india - Gov.in/govt/paycommission - PHPDocument0 pageHindi Version Will Follow.: Published On National Portal of India - Http://india - Gov.in/govt/paycommission - PHPSandeep UndalePas encore d'évaluation

- Hindi Version Will Follow.: Published On National Portal of India - Http://india - Gov.in/govt/paycommission - PHPDocument8 pagesHindi Version Will Follow.: Published On National Portal of India - Http://india - Gov.in/govt/paycommission - PHPYadwinder SinghPas encore d'évaluation

- Finance Department GR For TA DA Dated 03-10-2012Document7 pagesFinance Department GR For TA DA Dated 03-10-2012Chintan iNDEXTbPas encore d'évaluation

- Chapter - I: Travelling AllowanceDocument55 pagesChapter - I: Travelling AllowancePan SmithPas encore d'évaluation

- Travelling Allowance RevisedDocument4 pagesTravelling Allowance RevisedvenkatasubramaniyanPas encore d'évaluation

- R Tio: Punjab Technical UniversityDocument2 pagesR Tio: Punjab Technical UniversityGurpreet Singh KambojPas encore d'évaluation

- Soft Copy of TaDocument6 pagesSoft Copy of TaRakesh KumarPas encore d'évaluation

- T A Rules and Reimbursement Allowance - May 2022Document7 pagesT A Rules and Reimbursement Allowance - May 2022J.SathishPas encore d'évaluation

- A.P Travelling Allowance RulesDocument61 pagesA.P Travelling Allowance RulesShashi KumarPas encore d'évaluation

- G.O.Ms - No.53 - Travelling AllowanceDocument7 pagesG.O.Ms - No.53 - Travelling AllowanceMahendar ErramPas encore d'évaluation

- Telangana Govt Updates Travel Allowance RulesDocument7 pagesTelangana Govt Updates Travel Allowance RulesDEE KulkacherlaPas encore d'évaluation

- TA DA Rules (Lecture)Document52 pagesTA DA Rules (Lecture)Muhammad AdnanPas encore d'évaluation

- Travel Rules GuideDocument22 pagesTravel Rules GuideMalvan HOPas encore d'évaluation

- 2010fin MS128Document5 pages2010fin MS128Anil KumarPas encore d'évaluation

- Final Ta RulesDocument7 pagesFinal Ta Rulessukantadeb65Pas encore d'évaluation

- TRG Material - T Wing - April 2010Document28 pagesTRG Material - T Wing - April 2010Mahender SinghPas encore d'évaluation

- Travelling AllowanceDocument10 pagesTravelling AllowancesoumenchaPas encore d'évaluation

- Domestic Travel HR PolicyDocument9 pagesDomestic Travel HR PolicyrahulvaliyaPas encore d'évaluation

- GO-Ms-No 101-Dt 11 05 2022Document16 pagesGO-Ms-No 101-Dt 11 05 2022Dummy ZonalPas encore d'évaluation

- TADALTCDocument11 pagesTADALTCKhaja Naseeruddin MuhammadPas encore d'évaluation

- Domestic TravelDocument4 pagesDomestic Travelsivakumar.tPas encore d'évaluation

- National Highways Authority of India - 127202112385428Document64 pagesNational Highways Authority of India - 127202112385428Vaibhav MittalPas encore d'évaluation

- DA RevisedDocument4 pagesDA RevisedArcGis TranscoPas encore d'évaluation

- TA Rules-1Document54 pagesTA Rules-1Crick CompactPas encore d'évaluation

- Travel Allowance RulesDocument10 pagesTravel Allowance RulesRupakDasPas encore d'évaluation

- SRO-458 TA RulesDocument13 pagesSRO-458 TA RulessaimajeednastiPas encore d'évaluation

- No. 4730-F Calcutta, The 25Th May, 1999, Sub: Travelling Allowance Rules-Implementation of The Recommendations of TheDocument19 pagesNo. 4730-F Calcutta, The 25Th May, 1999, Sub: Travelling Allowance Rules-Implementation of The Recommendations of TheI KanthPas encore d'évaluation

- APGVB NotificationDocument7 pagesAPGVB NotificationkdvprasadPas encore d'évaluation

- AP Govt Recruitment for 23 Assistant Motor Vehicle Inspector PostsDocument24 pagesAP Govt Recruitment for 23 Assistant Motor Vehicle Inspector PostsShahazad ShaikPas encore d'évaluation

- Advrtisement Dated 30.12Document7 pagesAdvrtisement Dated 30.12KunalPandeyPas encore d'évaluation

- UBGB AdvtDocument7 pagesUBGB AdvtRaveesh KumarPas encore d'évaluation

- Travel Allowance Policy SummaryDocument5 pagesTravel Allowance Policy SummaryMeem swapPas encore d'évaluation

- Guidelines To Statutory AuditorsDocument22 pagesGuidelines To Statutory AuditorsUttamJainPas encore d'évaluation

- Ta 11Document2 pagesTa 11samratgaikwadPas encore d'évaluation

- Rly Allowances BookDocument146 pagesRly Allowances Bookshivshanker tiwariPas encore d'évaluation

- Hand Book On Benefits To Serving EmployeesDocument98 pagesHand Book On Benefits To Serving Employeessiddharth pradhanPas encore d'évaluation

- Travel Policy - UsableDocument5 pagesTravel Policy - UsableSwati KumariPas encore d'évaluation

- Finance (Salaries) Department: G.O.Ms - No.27, Dated 20 January 2021Document2 pagesFinance (Salaries) Department: G.O.Ms - No.27, Dated 20 January 2021Amutha RajaramPas encore d'évaluation

- Travel PolicyDocument14 pagesTravel PolicySmith SivaPas encore d'évaluation

- New ACR Form For JBTs Serving in Himachal Pradesh by Vijay HeerDocument3 pagesNew ACR Form For JBTs Serving in Himachal Pradesh by Vijay HeerVIJAY KUMAR HEER79% (14)

- NCERT Lesson Plans Class 6th Honeysuckle 6th Eng by Vijay Kumar HeerDocument34 pagesNCERT Lesson Plans Class 6th Honeysuckle 6th Eng by Vijay Kumar HeerVIJAY KUMAR HEER85% (33)

- HP Panchayat Election Nomination Forms For Panch Pradhan Up-Pradhan BDCDocument5 pagesHP Panchayat Election Nomination Forms For Panch Pradhan Up-Pradhan BDCVIJAY KUMAR HEERPas encore d'évaluation

- Solved Term Exam Paper 10th Eng HP Dec 2020 by Vijay HeerDocument8 pagesSolved Term Exam Paper 10th Eng HP Dec 2020 by Vijay HeerVIJAY KUMAR HEERPas encore d'évaluation

- NCERT Lesson Plans Class 6th A Pact With Sun by Vijay Kumar HeerDocument23 pagesNCERT Lesson Plans Class 6th A Pact With Sun by Vijay Kumar HeerVIJAY KUMAR HEER75% (12)

- NCERT Lesson Plans Class 9th Beehive Lesson Plans by Vijay Kumar HeerDocument62 pagesNCERT Lesson Plans Class 9th Beehive Lesson Plans by Vijay Kumar HeerVIJAY KUMAR HEER85% (46)

- NCERT 9th Economics Lesson Plans by Vijay Kumar HeerDocument24 pagesNCERT 9th Economics Lesson Plans by Vijay Kumar HeerVIJAY KUMAR HEER100% (1)

- JBT To HT Promotion Proforma by Vijay HeerDocument7 pagesJBT To HT Promotion Proforma by Vijay HeerVIJAY KUMAR HEERPas encore d'évaluation

- NCERT 9th Geography Lesson Plans by Vijay Kumar HeerDocument48 pagesNCERT 9th Geography Lesson Plans by Vijay Kumar HeerVIJAY KUMAR HEER100% (1)

- NCERT Lesson Plans Class 8th Eng It So Happened by Vijay Kumar HeerDocument29 pagesNCERT Lesson Plans Class 8th Eng It So Happened by Vijay Kumar HeerVIJAY KUMAR HEER82% (17)

- NCERT Lesson Plans Class 10th First Flight by Vijay Kumar HeerDocument56 pagesNCERT Lesson Plans Class 10th First Flight by Vijay Kumar HeerVIJAY KUMAR HEER80% (70)

- JBT To TGT Non Medical Promotion Orders July 19 Upload by Vijay Kumar HeerDocument7 pagesJBT To TGT Non Medical Promotion Orders July 19 Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- NCERT Lesson Plans Class 10th Footprints Without Feet by Vijay Kumar HeerDocument24 pagesNCERT Lesson Plans Class 10th Footprints Without Feet by Vijay Kumar HeerVIJAY KUMAR HEER79% (14)

- NCERT Lesson Plans Class 9th Moments Lesson Plans by Vijay Kumar HeerDocument30 pagesNCERT Lesson Plans Class 9th Moments Lesson Plans by Vijay Kumar HeerVIJAY KUMAR HEER75% (12)

- NCERT Lesson Plans Class 8th Eng Honeydew by Vijay Kumar HeerDocument40 pagesNCERT Lesson Plans Class 8th Eng Honeydew by Vijay Kumar HeerVIJAY KUMAR HEER76% (41)

- NCERT Lesson Plans Class 7th Eng Honeycomb by Vijay Kumar HeerDocument49 pagesNCERT Lesson Plans Class 7th Eng Honeycomb by Vijay Kumar HeerVIJAY KUMAR HEER81% (43)

- Proforma JBT To TGT 2019 NM Med by Vijay Kumar HeerDocument5 pagesProforma JBT To TGT 2019 NM Med by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- NCERT Lesson Plans Class 7th Eng An Alien Hand by Vijay Kumar HeerDocument28 pagesNCERT Lesson Plans Class 7th Eng An Alien Hand by Vijay Kumar HeerVIJAY KUMAR HEER75% (12)

- Tentative Promotion Panel JBT To TGT (Non Medical) 2018-Upload by Vijay Kumar HeerDocument4 pagesTentative Promotion Panel JBT To TGT (Non Medical) 2018-Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Tentative Promotional Panel of C&V To TGT (A) 2018-Upload by Vijay Kumar HeerDocument2 pagesTentative Promotional Panel of C&V To TGT (A) 2018-Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- JBT To TGT Arts Promotion Orders July 19 Upload by Vijay Kumar HeerDocument14 pagesJBT To TGT Arts Promotion Orders July 19 Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- JBT To TGT (Med) Promotion Orders June 2018 by Vijay Kumar HeerDocument6 pagesJBT To TGT (Med) Promotion Orders June 2018 by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Panel JBT To TGT (Non Medical) 2019 Upload Vijay Kumar HeerDocument2 pagesPanel JBT To TGT (Non Medical) 2019 Upload Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Tentative Promotion Panel JBT To TGT (M) 2018-Upload by Vijay Kumar HeerDocument2 pagesTentative Promotion Panel JBT To TGT (M) 2018-Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Panel JBT To TGT (M) 2019 by Vijay Kumar HeerDocument2 pagesPanel JBT To TGT (M) 2019 by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Panel JBTs (Tet) To TGT (A) Mar 2019-Upload by Vijay Kumar HeerDocument16 pagesPanel JBTs (Tet) To TGT (A) Mar 2019-Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Panel JBT (Tet) To TGT Arts June 2018-Upload by Vijay Kumar HeerDocument12 pagesPanel JBT (Tet) To TGT Arts June 2018-Upload by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Extension in Joining Time To JBT To TGT PromoteesDocument1 pageExtension in Joining Time To JBT To TGT PromoteesVIJAY KUMAR HEERPas encore d'évaluation

- Left Out JBT To TGT Arts Promotion List June 2018 by Vijay Kumar HeerDocument6 pagesLeft Out JBT To TGT Arts Promotion List June 2018 by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- JBT To TGT Arts Promotion July 2018 Orders by Vijay Kumar HeerDocument13 pagesJBT To TGT Arts Promotion July 2018 Orders by Vijay Kumar HeerVIJAY KUMAR HEERPas encore d'évaluation

- Bajaj Allianz General Insurance Company Branch Offices List With AddressDocument38 pagesBajaj Allianz General Insurance Company Branch Offices List With AddressPraveen MadineniPas encore d'évaluation

- 2012 13Document66 pages2012 13Jasvinder SinghPas encore d'évaluation

- Sports Calendar 2023-24Document14 pagesSports Calendar 2023-24rishav rayPas encore d'évaluation

- Chandigarh University One of The Best University in ChandigarhDocument2 pagesChandigarh University One of The Best University in Chandigarhvikrant1912Pas encore d'évaluation

- ResultDocument8 pagesResultanon_981731217Pas encore d'évaluation

- A Deliberate Attempt by Jasbir Singh Mann To Denigrate The Members of The Sodhak CommitteeDocument5 pagesA Deliberate Attempt by Jasbir Singh Mann To Denigrate The Members of The Sodhak CommitteeasikhPas encore d'évaluation

- Candidate Hall TicketDocument3 pagesCandidate Hall TicketPrdeep SinghPas encore d'évaluation

- Profile DGDocument7 pagesProfile DGprateek siwachPas encore d'évaluation

- Karan Bir Singh Sidhu CbiDocument4 pagesKaran Bir Singh Sidhu Cbikbssidhu87Pas encore d'évaluation

- Sohni MahiwalDocument4 pagesSohni MahiwalMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaPas encore d'évaluation

- Revised Final Result Punjab Haryana High Court PCS JB 2019Document30 pagesRevised Final Result Punjab Haryana High Court PCS JB 2019Richa SharmaPas encore d'évaluation

- Punjab Development After 1947Document21 pagesPunjab Development After 1947lovleshrubyPas encore d'évaluation

- High Court of Punjab and Haryana at Chandigarh: January February MarchDocument1 pageHigh Court of Punjab and Haryana at Chandigarh: January February MarchsanjeevpunjPas encore d'évaluation

- Sukhmanpreet SinghDocument13 pagesSukhmanpreet Singhrachhpal singhPas encore d'évaluation

- Basic Punjabi - Lesson 2 - Common Useful PhrasesDocument37 pagesBasic Punjabi - Lesson 2 - Common Useful PhrasesCulture AlleyPas encore d'évaluation

- PAN India Empanelled Hospital ListDocument218 pagesPAN India Empanelled Hospital ListShamsuddin Hasnani50% (10)

- Basic Punjab GKDocument14 pagesBasic Punjab GKMohit Garg100% (2)

- PDFDocument18 pagesPDFKakaPas encore d'évaluation

- Gurdip Singh 1Document3 pagesGurdip Singh 1Gurdip SinghPas encore d'évaluation

- Nitnem Banis (Gurmukhi, Romanized, English)Document151 pagesNitnem Banis (Gurmukhi, Romanized, English)nss1234567890Pas encore d'évaluation

- Ajit Classified Ad Booking OnlineDocument3 pagesAjit Classified Ad Booking OnlineAds2PublishPas encore d'évaluation

- Operation Blue Star: True StoryDocument45 pagesOperation Blue Star: True StoryKiranpreet Singh63% (8)

- 2015 Guru Granth Sahib Desecration Controversy - WikipediaDocument40 pages2015 Guru Granth Sahib Desecration Controversy - WikipediaJaswant KaurPas encore d'évaluation

- Guru Nanak and His Mission - Principal Teja SinghDocument26 pagesGuru Nanak and His Mission - Principal Teja SinghSikhDigitalLibraryPas encore d'évaluation

- Dhaba CGDocument6 pagesDhaba CGVikas MishraPas encore d'évaluation

- Knowledge of Punjab's Geography, History, Culture & EconomyDocument4 pagesKnowledge of Punjab's Geography, History, Culture & EconomyAbhishek BawaPas encore d'évaluation

- ef8fd076328b42f3b49dd01da0e13df6Document176 pagesef8fd076328b42f3b49dd01da0e13df6moneythindPas encore d'évaluation

- Biomass ProjectsDocument3 pagesBiomass ProjectsSnehendu BiswasPas encore d'évaluation

- Missī Jātt Dī KartūtDocument20 pagesMissī Jātt Dī KartūtDr. Kamalroop Singh100% (3)

- Present Position: Name in FullDocument13 pagesPresent Position: Name in FullVivek SharmaPas encore d'évaluation