Académique Documents

Professionnel Documents

Culture Documents

PressAdd 230509

Transféré par

Rekha BaiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PressAdd 230509

Transféré par

Rekha BaiDroits d'auteur :

Formats disponibles

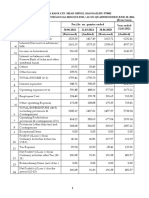

STATE BANK OF INDIA

STATE BANK OF INDIA

Central Office, Mumbai - 400 021

Central Office, Mumbai - 400 001.

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31st MARCH 2009

Rs. in crores

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED 31ST MARCH 2009

Segment-wise Revenue, Results and Capital Employed

Consolidated

Particulars

Quarter ended

31.03.2009

Year ended

31.03.2009

31.03.2008

Part A : Primary Segments

Year Ended

31.03.2008

31.03.2009

Rs.in.crores

Year ended

31.03.2008

Particulars

1 Interest Earned (a)+(b)+(c)+(d)

(a) Interest/discount on advances/bills

(b) Income on Investments

(c)

Interest on balances with Reserve Bank of India and other interbank

funds

(d) Others

17342.39

12083.61

4230.89

13576.73

9603.47

3211.76

63788.43

46404.71

15574.11

48950.31

35228.11

11944.16

91667.01

67285.12

22079.30

71495.82

51920.07

17406.32

880.15

218.80

1474.38

1200.08

1783.50

1442.55

147.74

542.70

335.23

577.96

519.09

726.88

31.03.2009

Segment Revenue (income)

a Treasury

19838.88

13982.33

b Corporate / Wholesale Banking

24241.41

15662.77

c Retail Banking

32398.93

-

27654.45

345.69

76479.22

57645.24

3744.64

5071.12

7222.86

16038.62

-1857.96

14180.66

5059.42

1230.76

4961.26

5617.52

11809.54

-1370.64

10438.90

3709.78

9121.24

6729.12

19303.77

15672.85

22971.07

13166.77

29478.56

6387.33

d Unallocated

2 Other Income

3

TOTAL INCOME (1+2)

4 Interest Expended

4718.22

22060.61

12500.45

2817.20

16393.93

8776.14

12690.79

76479.22

42915.29

8694.93

57645.24

31929.08

21426.08

113093.09

62626.46

18722.99

90218.81

47944.04

4283.11

2349.60

1933.51

16783.56

3244.66

1569.60

1675.06

12020.80

15648.70

9747.31

5901.39

58563.99

12608.61

7785.87

4822.74

44537.69

26201.15

12626.62

13574.53

88827.61

23943.23

10457.51

13485.72

71887.27

5277.05

4373.13

17915.23

13107.55

24265.48

18331.54

1377.66

1296.25

1619.14

1066.98

3734.57

2474.97

3899.39

1157.08

2753.99

870.74

14180.66

5059.42

2668.65

2000.94

0.00

10438.90

3709.78

6000.08

3616.30

370.57

17894.83

6721.77

4340.97

2804.05

0.00

13990.57

4777.73

2742.31

9121.24

2742.31

1883.25

0.00

1883.25

9121.24

6729.12

0.00

6729.12

634.88

631.47

634.88

631.47

11173.06

0.00

11173.06

217.78

10955.28

634.88

Less Inter Segmental Revenue

Total

Segment Results (Profit before tax)

a Treasury

5 Operating Expenses (i) + (ii)

(i)

Employee cost

(ii) Other Operating Expenses

TOTAL EXPENDITURE (4) + (5)

b Corporate / Wholesale Banking

c Retail Banking

Total

Add / (Less) : Unallocated

Operating Profit

(excluding Provisions and Contingencies)

OPERATING PROFIT (3 - 6)

Less : Tax

Less : Extraordinary Profit / Loss

(before Provisions and Contingencies)

Provisions (other than tax) and Contingenecies

--- of which provisions for Non-performing assets

9

10

11

12

13

14

Exceptional Items

PROFIT FROM ORDINARY ACTIVITIES BEFORE TAX (7-8-9)

Tax expense

NET PROFIT FROM ORDINARY ACTIVITIES AFTER TAX (10-11)

Extraordinary items (net of tax expense)

NET PROFIT FOR THE PERIOD (12-13)

Share of Minority

NET PROFIT AFTER MINORITY INTEREST

15

16 Paid-up equity Share Capital

57312.81

48401.19

57312.81

48401.19

71755.51

Basel II

(iii) Earnings Per Share (EPS) (in Rs.)

(a) Basic and diluted EPS before Extraordinary items (net of tax

expenses)

(b) Basic and diluted EPS after Extraordinary items

(iv) NPA Ratios

(a) Amount of gross non-performing assets

(b) Amount of net non-performing assets

(c) % of gross NPAs

(d) % of net NPAs

(v) Return on Assets (Annualised)

19 Public Shareholding

.. .. .. No. of shares

.. .. .. Percentage of Shareholding

20 Promotors and Promotor Group Shareholding

(a) Pledged/Encumbered

a Treasury

b Corporate / Wholesale Banking

c Retail Banking

60604.91

(as per balance sheet of previous accounting year)

Basel I

Capital Employed

Geographic

Segments

Particulars

18 Analytical Ratios

(i ) Percentage of shares held by Government of India

(ii) Capital Adequacy Ratio

Net Profit

Total

9212.84

57947.69 49032.66

0.00

9212.84

252.23 * Equity Capital is allocated between segments in proportion of the Assets of respective segments

8960.61

Rs.in.crores

631.47 Part B : Secondary Segments

(Face Value of Rs.10 per share)

17 Reserves excluding Revaluation Reserves

31.03.2008

Revenue

59.41%

59.73%

59.41%

59.73%

12.97%

14.25%

13.54%

12.97%

14.25%

13.54%

143.77

126.62

172.68 168.61/168.45

143.77

126.62

172.68 168.61/168.45

43.23

34.65/34.62

(not annualised)

(not annualised)

43.23

34.65/34.62

15588.60

9552.02

2.84%

1.76%

1.10%

12837.34

7424.33

3.04%

1.78%

1.10%

15588.60

9552.02

2.84%

1.76%

1.04%

12837.34

7424.33

3.04%

1.78%

1.01%

257673022

254263176

257673022

254263176

40.59%

40.27%

40.59%

40.27%

377207200

59.41%

59.73%

Assets

Domestic Operation

Foreign Operation

Total

Year ended

Year ended

Year ended

31.03.2009

31.03.2008

31.03.2009

31.03.2008

31.03.2009

31.03.2008

71563.34

856147.58

51493.43

632865.94

4915.88

108284.50

6151.81

88660.37

76479.22

964432.08

57645.24

721526.31

1. The Central Board have declared a dividend of Rs. 29 per share (290%) for the year ended 31st March 2009.

2. During the year State Bank of Saurashtra (SBS) was acquired by the Bank.

3. During the year the Bank has issued 3409846 equity shares of Rs. 10 each for cash at a premium of Rs. 1580/ per

equity share aggregating to Rs. 542.17 crores to its employees under SBI Employees Share Purchase Scheme.

4. Number of investors complaints received and disposed off during the quarter ended 31.03.2009:

(i) pending at the beginning of the quarter-03 (ii) received during the quarter-76

(iii) disposed off during the quarter 79 (iv) outstanding at the end of the quarter- Nil.

Number of Shares

Percentage of Shares (as a percentage of the total shareholding of

promoter

and promotor group)

Percentage of Shares (as a percentage of the total share capital of

the company)

(b) Non-encumbered

Number of Shares

Percentage of Shares (as a percentage of the total shareholding of

promoter and promotor group)

Percentage of Shares (as a percentage of the total share capital of

the company)

NIL

377207200

377207200

377207200

100%

100%

100%

100%

59.41%

59.73%

59.41%

59.73%

The above results have been approved by the Central Board of the Bank on the 9th May 2009.

Date 09.05.2009

Kolkata

R. SRIDHARAN

MD & GE (A&S)

S. K. BHATTACHARYYA

MD & CCRO

O. P. BHATT

CHAIRMAN

Vous aimerez peut-être aussi

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Q1 FY09 TablesDocument3 pagesQ1 FY09 TablesPerminder Singh KhalsaPas encore d'évaluation

- SIDBI Financial Result DEC 2010 EnglishDocument2 pagesSIDBI Financial Result DEC 2010 EnglishSunil GuptaPas encore d'évaluation

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkPas encore d'évaluation

- Particulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDocument5 pagesParticulars 3 Months Ended 31.03.2009 3 Months Ended 31.03.2008 Year Ended 31.03.2009 Audited Year Ended 31.03.2008 AuditedDhanya R KarthaPas encore d'évaluation

- Axis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006Document3 pagesAxis Bank: Regd. Office: Trishul', 3 Floor, Opp. Samartheshwar Temple, Law Garden, Ellisbridge, Ahmedabad - 380 006alayprajapatiPas encore d'évaluation

- Audited Results 31.3.2012 TVSMDocument2 pagesAudited Results 31.3.2012 TVSMKrishna KrishnaPas encore d'évaluation

- State Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008Document1 pageState Bank of India: Unaudited Financial Results For The Period Ended 30Th June 2008Rajat PaniPas encore d'évaluation

- Result Q-1-11 For PrintDocument1 pageResult Q-1-11 For PrintSagar KadamPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Indiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010Document1 pageIndiabulls Securities Limited (As Standalone Entity) : Unaudited Financial Results For The Quarter Ended December 31, 2010hk_warriorsPas encore d'évaluation

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyPas encore d'évaluation

- Segment Reporting (Rs. in Crore)Document8 pagesSegment Reporting (Rs. in Crore)Tushar PanhalePas encore d'évaluation

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariPas encore d'évaluation

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document7 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Sintex Industries LimitedDocument14 pagesSintex Industries Limitednaresh kayadPas encore d'évaluation

- OutcomeofBoardMeeting 1Document14 pagesOutcomeofBoardMeeting 1abhishektheonePas encore d'évaluation

- Abc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesDocument24 pagesAbc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesSharbani ChowdhuryPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- GTL Fin Q4 FY 10-11MDocument4 pagesGTL Fin Q4 FY 10-11MAnantmmPas encore d'évaluation

- Q3 Results 201112Document3 pagesQ3 Results 201112Bishwajeet Pratap SinghPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Userfiles Financial 6fDocument2 pagesUserfiles Financial 6fTejaswini SkumarPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Audited Result 2010 11Document2 pagesAudited Result 2010 11Priya SharmaPas encore d'évaluation

- Part - I - Standalone Balance Sheet As at 31 March, 2016: ST STDocument2 pagesPart - I - Standalone Balance Sheet As at 31 March, 2016: ST STDeepak AryaPas encore d'évaluation

- Havells Annual ReportDocument1 pageHavells Annual ReportSatyaki DeyPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianPas encore d'évaluation

- Financial ResultsDocument1 pageFinancial Resultsgtnjlsngh338Pas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document6 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Document3 pagesReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiPas encore d'évaluation

- Consolidated Financial HighlightsDocument1 pageConsolidated Financial HighlightsMuvin KoshtiPas encore d'évaluation

- SEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FDocument20 pagesSEBI PAPER PUB 30 06 2021 FINAL (27 07 2021) FYathish Us ThodaskarPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Kotak Mahindra 2011Document55 pagesKotak Mahindra 2011Pdr RaooPas encore d'évaluation

- Fin ResultsDocument2 pagesFin Resultsparimal2010Pas encore d'évaluation

- 2008 2009 - 31 Mar 2009Document3 pages2008 2009 - 31 Mar 2009Nishit PatelPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document1 pageStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Segment Report Dec07 QTRDocument1 pageSegment Report Dec07 QTRChetan KanetkarPas encore d'évaluation

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelPas encore d'évaluation

- Financial Results For The Half Year Ended 30 SEPTEMBER 2009Document27 pagesFinancial Results For The Half Year Ended 30 SEPTEMBER 2009amritabhoslePas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Results Dec 2018Document4 pagesResults Dec 2018Mukesh PadwalPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- New Listing For PublicationDocument2 pagesNew Listing For PublicationAathira VenadPas encore d'évaluation

- V-Guard Industries LTD 150513 RSTDocument4 pagesV-Guard Industries LTD 150513 RSTSwamiPas encore d'évaluation

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750Pas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Document8 pagesPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaPas encore d'évaluation

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargPas encore d'évaluation