Académique Documents

Professionnel Documents

Culture Documents

Proposal

Transféré par

russ willisDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Proposal

Transféré par

russ willisDroits d'auteur :

Formats disponibles

Creating a Fund for Nonmotorists Injured or Killed by Uninsured/Underinsured Motorists

The problem: Nationwide, at least one out of every seven motorists, possibly as many as one in four, does not carry liability insurance. Sources: Insurance Research Council, Uninsured Motorists, 2011 ed. "Estimating the Uninsured Vehicle Rate from the Uninsured Motorist/Bodily Injury Ratio," NAIC Research Quarterly, Vol. V, issue 1 (January 1999) In Oregon, the rate is estimated to be a bit lower, perhaps one in ten, down slightly from a peak in 2008, during the early months of the current recession. In Idaho, the rate is one in twelve, and a handful of states have markedly lower rates. Source: Insurance Research Council news release dated April 21, 2011 In calendar 2010, there were 30,493 persons injured and 317 killed on the roads in Oregon. Of these, there were 772 pedestrians injured and 62 killed, and 877 bicyclists injured and 7 killed. While the numbers of fatalities have been declining in recent years, the numbers of injuries have been rising. Source: Oregon Department of Transportation, "2010 Oregon Motor Vehicle Traffic Crashes Quick Facts," dated July 27, 2011 In 2009, approximately 8.7 percent of American households did not own a private automobile. The figure is considerably higher in urban areas, in lower income ranges, and among households occupying rental properties. The numbers have been rising since the mid-90s. Sources: 2009 National Household Travel Survey http://www.census.gov/prod/cen2000/doc/sf3.pdf The proposal: To create a fund from which nonmotorists who are injured or killed by uninsured or underinsured motorists might recover. There is not at present a market for this kind of insurance coverage as a freestanding product for someone who does not own an automobile. And even if there were, the argument can certainly be made that it would be inequitable to impose the premium expense on nonmotorists, who after all do not participate in creating the risk.

Several states have had mechanisms in place for fifty or more years to compensate the claims. In New Jersey and in New York, the fund is created and managed by liability insurers as a condition of doing business in the state. The Oregon Insurance Guaranty Association, which manages claims against insolvent carriers, has already expressed an interest in managing a similar program in Oregon. We might also look at recruiting funding from traffic court costs, licensing and registration fees, and/or additional charges imposed on SR-22 policies and/or on relicensing after suspension. Other things we might look at: - Increasing the liability coverage minimum. It has been a very long time since $25k could have been considered even marginally adequate. - Increasing penalties for noncompliance. - SR22 should be forever, not just three years. - A thirty-day suspension for multiple moving violations is inadequate. - It should not require three convictions for driving under the influence or driving while suspended or negligent homicide to get a license revoked, and revocation should be for life, not just for five years. Obviously these are for the most part not politically feasible. But we might hold them out as the longer-term ask, in order to make the immediate ask more palatable.

Vous aimerez peut-être aussi

- CPC 1960492-1Document9 pagesCPC 1960492-1russ willisPas encore d'évaluation

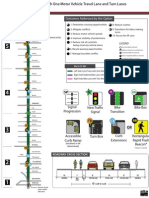

- Option 2ADocument1 pageOption 2Aruss willisPas encore d'évaluation

- Flyer 14Document1 pageFlyer 14russ willisPas encore d'évaluation

- Don't Try This at HomeDocument19 pagesDon't Try This at Homeruss willisPas encore d'évaluation

- Option 3Document1 pageOption 3russ willisPas encore d'évaluation

- Option 1ADocument1 pageOption 1Aruss willisPas encore d'évaluation

- Memorandum: Date: ToDocument17 pagesMemorandum: Date: Toruss willisPas encore d'évaluation

- 12th FinalDocument1 page12th Finalruss willisPas encore d'évaluation

- Senate Passes Extenders Bill: © 2006-2010, CPC Holdings, LLC Privacy Policy - Terms of Use & DisclaimerDocument1 pageSenate Passes Extenders Bill: © 2006-2010, CPC Holdings, LLC Privacy Policy - Terms of Use & Disclaimerruss willisPas encore d'évaluation

- In The Senate of The United States-111Th Cong., 2D Sess.: MCG10428 S.L.CDocument13 pagesIn The Senate of The United States-111Th Cong., 2D Sess.: MCG10428 S.L.Cruss willisPas encore d'évaluation

- BylawsDocument3 pagesBylawsruss willisPas encore d'évaluation

- Evaluation GoalsDocument3 pagesEvaluation Goalsruss willisPas encore d'évaluation

- Diversion Statement FinalDocument1 pageDiversion Statement Finalruss willisPas encore d'évaluation

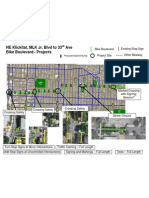

- Crosswalk 2Document1 pageCrosswalk 2russ willisPas encore d'évaluation

- Minutes 010808Document5 pagesMinutes 010808russ willisPas encore d'évaluation

- Section 9C.05 !"#"$%&'% (%" &+#,-) $: !"#$%&' 2009 EditionDocument1 pageSection 9C.05 !"#"$%&'% (%" &+#,-) $: !"#$%&' 2009 Editionruss willisPas encore d'évaluation

- Intersections 2Document1 pageIntersections 2russ willisPas encore d'évaluation

- MediansDocument1 pageMediansruss willisPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Location of AppendigealDocument8 pagesLocation of Appendigealasa.99Pas encore d'évaluation

- Child Abuse Paper Home VTFTDocument6 pagesChild Abuse Paper Home VTFTapi-410820359Pas encore d'évaluation

- Electolux EFLS617SIW 4.4 Cu. FTDocument32 pagesElectolux EFLS617SIW 4.4 Cu. FTpalkybdPas encore d'évaluation

- Fracture: Signs and SymptomsDocument6 pagesFracture: Signs and SymptomsKaran MauryaPas encore d'évaluation

- Trauma Informed CareDocument21 pagesTrauma Informed CareEry SuryatinPas encore d'évaluation

- Report On The Death of Taurean WilsonDocument8 pagesReport On The Death of Taurean WilsonFOX 61 WebstaffPas encore d'évaluation

- Future - d20 - Public - Gamma World ConversionDocument20 pagesFuture - d20 - Public - Gamma World ConversionVirtualWizard100% (2)

- Webinar: Bandaging (Group A2)Document15 pagesWebinar: Bandaging (Group A2)Josie GullasPas encore d'évaluation

- Physiotherapy Department: Anant HospitalDocument1 pagePhysiotherapy Department: Anant HospitalHbk RajneeshPas encore d'évaluation

- Fractures of The Upper Limb: Dr. Salman AbbasiDocument60 pagesFractures of The Upper Limb: Dr. Salman AbbasiSeimal MahmoodPas encore d'évaluation

- Trauma 1Document45 pagesTrauma 1Abdul HaiPas encore d'évaluation

- Compliance Policy Guides - CPG Sec. 555Document2 pagesCompliance Policy Guides - CPG Sec. 555diggerexePas encore d'évaluation

- The Nervous System: MC102 Nur - Human Anatomy and Physiology March 30 - April 4, 2020Document124 pagesThe Nervous System: MC102 Nur - Human Anatomy and Physiology March 30 - April 4, 2020imnasPas encore d'évaluation

- Intercostal DrainDocument44 pagesIntercostal Drainvamshidh100% (1)

- FujiFilm FinePix AX650Document112 pagesFujiFilm FinePix AX650mirtschaPas encore d'évaluation

- Musculoskeletal Assessment ChecklistDocument2 pagesMusculoskeletal Assessment ChecklistThe Blue and Gold RvdPas encore d'évaluation

- Eastern Shipping Lines, Inc. v. CA and The First Nationwide Assurance Corp. G.R. No. 97412 July 12, 1994Document4 pagesEastern Shipping Lines, Inc. v. CA and The First Nationwide Assurance Corp. G.R. No. 97412 July 12, 1994Cy PanganibanPas encore d'évaluation

- Muscle Study GuideDocument12 pagesMuscle Study GuideMitzi De Vera100% (1)

- Aos Warscroll Lordkroak enDocument1 pageAos Warscroll Lordkroak enasxPas encore d'évaluation

- LECT 1.anatomy and Physiology of Pregnancy 1.Document37 pagesLECT 1.anatomy and Physiology of Pregnancy 1.Umer RafiqPas encore d'évaluation

- Exercise 1 Language of AnatomyDocument4 pagesExercise 1 Language of Anatomymaniz44285% (27)

- Rachel Cade - Once Is Never EnoughDocument46 pagesRachel Cade - Once Is Never EnoughSaharsh Sharan100% (1)

- Sutures, Suture Characteristics and Suturing TechniquesDocument26 pagesSutures, Suture Characteristics and Suturing TechniquesNenette AlmarioPas encore d'évaluation

- Dyson Upright DC25 Vacuum User GuideDocument16 pagesDyson Upright DC25 Vacuum User Guidesteven dixonPas encore d'évaluation

- The IntruderDocument319 pagesThe Intruderjazz2jazz33% (6)

- DLP IN HEALTH-Gr.9Document7 pagesDLP IN HEALTH-Gr.9Aliah Mae MontanoPas encore d'évaluation

- Pediatric Sports InjuriesDocument54 pagesPediatric Sports InjuriesGopi KrishnaPas encore d'évaluation

- NR 509 Midterm PPDocument76 pagesNR 509 Midterm PPLou EscobarPas encore d'évaluation

- HNP CervicalDocument33 pagesHNP CervicalIndra RantePas encore d'évaluation