Académique Documents

Professionnel Documents

Culture Documents

Abx Swot

Transféré par

tony3350Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Abx Swot

Transféré par

tony3350Droits d'auteur :

Formats disponibles

Barrick Gold Corporation

Barrick Gold Corporation - Financial and Strategic Analysis Review

Publication Date: 27-Sep-2011 Reference Code: GDMM27693FSA

Company Snapshot

Key Information

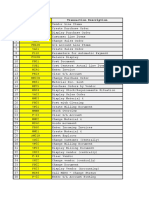

Barrick Gold Corporation, Key Information Web Address www.barrick.com Financial year-end December Number of Employees 16,000 TSE ABX

Source : GlobalData

Company Overview

Barrick Gold Corporation (Barrick) is an international gold mining company. It is engaged in the manufacturing and sale of gold, as well as related activities which includes exploration and mine development. In addition to this, the company also produces a substantial amount of copper, from the Zaldivar mine and holds interests in a nickel development project located in Africa, a copper-gold project in Pakistan and oil and gas properties located in Canada. The company has geographical presence in the North America, South America, Africa and Australia Pacific.

Key Ratios

Barrick Gold Corporation, Key Ratios P/E EV/EBITDA Return on Equity (%) Debt/Equity Operating profit margin (%) Dividend Yield

Note: Above ratios are based on share price as of 27-Oct-2011 Source : GlobalData

13.96.00 12.14 18.64 34.09 46.10 0.01

SWOT Analysis

Barrick Gold Corporation, SWOT Analysis Strengths Weaknesses Improved Financial Performance Strategic Divestiture Strong Reputation Litigations

Share Data

Barrick Gold Corporation, Share Data Price (CAD) as on 27-Oct-2011 EPS (USD) Book value per share (USD) Shares Outstanding (in million)

Source : GlobalData

Opportunities Rising Demand for Gold and Copper Exploration and Drilling Program Strategic Acquisitions

Threats Stringent Environmental Regulations Highly Competitive Market

48.61 3.52 19.50 997

Source : GlobalData

Performance Chart

Barrick Gold Corporation, Performance Chart (2006 2010)

Financial Performance

The company reported revenues of (U.S. Dollars) USD 11,001.00 million during the fiscal year ended December 2010, an increase of 35.21% over 2009. The operating profit of the company was USD 5,072.00 million during the fiscal year 2010, whereas the company reported an operating loss of USD 3,623.00 million during 2009. The net profit of the company was USD 3,630.00 million during the fiscal year 2010, whereas the company reported a net loss of USD 4,274.00 million during 2009.

Source : GlobalData

Barrick Gold Corporation- Financial and Strategic Analysis Review

Reference Code: GDMM27693FSA Page 1

Barrick Gold Corporation Barrick Gold Corporation - SWOT Analysis

SWOT Analysis - Overview Barrick Gold Corporation (Barrick) is one of the leading player in the gold industry. It has diversified global operations, strong reserves base and sound reputation, During 2010, it made strategic divestitures and enjoyed improved financial performance. Through its new projects, strategic acquisitions, and ambitious exploration program, it is expected to enjoy the rising demand of gold and copper during 2011. However, its involvement in various litigations could accentuate its exposure to risks involved by its competition and stringent regulations, present in the markets it operates in. Barrick Gold Corporation - Strengths Strength - Improved Financial Performance During 2010, Barrick enjoyed significant improvements in its financial performance over the previous fiscal year. For the year ended 2010, the total revenues rose by 35.21%, from $8,136m in 2009 to $11,001m in 2010, due to rising gold prices and volumes of sales. This led to the growth in operating and net margins to 46.11% and 33% in 2010, from -44.53% and -52.53% in 2009. The operating costs as a % of sales significantly fell from 144.53% in 2009 to 53.90% in 2010. The company enjoyed cash inflows from operating activities amounting to $4,127m, as against the cash used in operating activities at $2,322m in 2009. The company's strong financials indicate its ability to rise to the occasion after a disappointing 2009 performance. This will ensure investors' confidence in the company, and provide a strong foundation for further growth of the company. Strength - Strategic Divestiture Over the past two years 2009-11, Barrick has been involved in the divestiture of certain non-core assets. During 2010, it completed the divestiture of its Osborne copper mine. In February 2011, it agreed to the sale of its 10% interests in the Sedibelo platinum project, to the Bakgatla-Ba-Kgafela Tribe. It is also involved in the sale of long lead items to the Sedibelo to Newshelf 1101 (Proprietary) Limited. It is expected to gain an aggregate value of $65m from these transactions. These divestitures enable the company to focus on its core businesses, and consolidate its interests in the market. Strength - Strong Reputation Barrick is one of the leading players in the gold industry. Through its widespread global operations, it has enjoyed good reputation in the market. It is the only company in the gold industry with 'A' rated balance sheet. During the year 2010, it was added to the Dow Jones Sustainability Index World for the third consecutive year. It was also added to the NASDAQ Global Sustainability Index. It was the first Canadian mining company to join Voluntary Principles on Security and Human Rights in November 2010. A sound reputation enables it to secure external financing, and instil confidence in its investors. Strength - Diversified Geographical Operations Barrick has been focussed on the geographic diversification of its operations since its inception. It has over 26 operating mines and exploration and development projects across five continents. Prior to 1994, it was focussed on the consolidation of gold operating mines across North America. After 1994, it expanded its operations to Tanzania, Chile, Argentina, Pakistan, Peru, Papua New Guinea, Australia, and the Dominican Republic. During 2010, it successfully completed the construction of Cortez Hills mine in Nevada. This led to the addition of 1.1m oz of production during the year. Moreover, it spun off a separate entity, African Barrick Gold, for the management of its African operations, during 2010. The company's global presence enables it to mitigate the risks involved in the operation of a sole segment. It has enjoyed significant market recognition over the past decade, and is likely to grow further through its current projects and expansion plans. Strength - Significant Reserve Base Barrick is one of the leading gold companies with substantial gold and copper reserves. Its operating mines are located in some of the worlds most prospective gold districts in North America, South America, Australia Pacific and Africa. Along with gold, it operates mines containing silver and copper reserves. As of December 31, 2010, the total proved and probable (2P) gold reserves were 139.8m oz. It had measured and indicated gold resources at 76m oz, and inferred gold resources at 37m oz. During the year, it added 9m oz of gold reserves due to the acquisition of additional 25% shareholding in Cerro Casale. Moreover, it has 6.5 billion lbs of copper reserves, 9.1 billion lbs of inferred copper reserves, 13 billion lbs of measured and indicated copper reserves, and 1.1 billion oz of silver reserves contained within gold reserves. Barrick's reserve base grants it a significant competitive edge over its peers, and it has continued to focus on the successful building and replacement of its reserves. Barrick Gold Corporation - Weaknesses Weakness - Litigations During its normal course of business, Barrick has become embroiled in various disputes and litigations. Some of the major disputes are the Cortez Hills Complaint, Marinduque Complaint, Perilla Complaint, Calancan Bay (Philippines) Complaint,

Barrick Gold Corporation- Financial and Strategic Analysis Review

Reference Code: GDMM27693FSA Page 2

Barrick Gold Corporation

El Morro Claim, Pakistani Constitutional Litigation, Pueblo Viejo and the Argentine Glacier Legislation. In April 2010, an action was filed in the Dominican Republic, against the subsidiary, PDVC, alleging violations of fundamental rights. The action seeks injunctive relief, and is being contested in the Ninth Criminal Trial Court of Santo Domingo. In September 2010, the Argentine government had enacted the National Law on Minimum Requirements for the Protection of Glaciers. As per this legislation, legal action was taken against several companies including Barrick's subsidiaries in the Veladero and Pascua-Lama provinces. Currently, the constitutionality of legislation is being debated at the National Supreme Court of Justice of Argentina. All these litigations involve a lot of negative press, leading to doubts on the integrity and credibility of the company. Such disputes can hinder the development of Barrick's various projects. Moreover, Barrick can incur significant financial damage through cancellation of its contracts, in the scenario of unfavourable outcomes. Barrick Gold Corporation - Opportunities Opportunity - Rising Demand for Gold and Copper During 2011, the gold and copper prices are expected to reach new heights. According to industry estimates, the gold prices will rise to new levels due to the ongoing sovereign credit crunch in Europe, the US $13 trillion debt, lack of confidence in the dollar, and central banks low real interest rate policies aimed at kick-starting sluggish economies. Moreover, according to industry estimates, the demand for copper may exceed supply in 2011 for the first time in four years, which will provide the company tremendous growth opportunities. The world refined copper market is expected to record a deficit of 500,000 tons to 600,000 tons in 2011. In light of its financial performance in 2010, Barrick can be expected to record considerable growth in production and revenues during 2011. Opportunity - Exploration and Drilling Program Barrick has formulated an ambitious exploration and drilling program for 2011. It has increased its exploration budget by more than 50%, to $370-390 million. This program involves the upgradation of resources at Turquoise Ridge and Cortez properties, and the development of its brownfield projects in the underexplored areas of El Indio and Papua New Guinea. The program is expected to enhance the company's mineral reserves and resources by the end of 2011. Opportunity - Strategic Acquisitions Barrick has its strategic focus on the improvements in its production capacities, through strategic acquisitions. During 2010, it acquired an additional 25% interest in the Cerro Casale Project in Chile from Kinross Gold Corporation. During the first half of 2011, it acquired Equinox Minerals Limited, for a total consideration of CAD 7.3 billion. Through this agreement, it has acquired 5.7 billion lbs of copper reserves in Lumwana and Jabal Sayid, along with inferred copper resources of 5.5 billion lbs. These strategic acquisitions have enhanced Barrick's mineral reserves and resources, which could further lead to the increase in its production. Opportunity - Investment on New Projects Barrick is involved in seven advanced and early stage projects. These projects are being undertaken across different countries around the world. It has two advanced projects: Pueblo Veijo in the Dominican Republic and Pascua-Lama straddling the border of Chile and Argentina. It also has five early-stage projects, Cerro Casale in Chile, Donlin Creek in Alaska, Reko Diq in Pakistan, Jabal Sayid in Saudi Arabia, and Kabanga in Tanzania. The Pueblo Veijo project has been 70% completed with 75% of the capital committed, and is expected to yield first production during mid-2012. At the end of Q2-2011, 90% of the engineering design of the Pascua-Lama project was completed, and is expected to yield first production during mid-2013. During 2010, Barrick increased it shareholding in the Cerro Casale project to 75%. The company has planned exploration programs in collaboration with related parties, during 2011. Through the acquisition of Equinox in 2011, Barrick acquired the Jabal Sayid project, of which nearly 75% of the capital has been invested, and is expected to yield first production of copper in mid-2012. During the second half of 2011, the revision of feasibility studies are expected to be completed for the Donlin Creek project. Regarding the Reko Diq project, the Supreme Court has ruled in favour of the defendants including Barrick. The feasibility study of the Kabanga project is expected to be completed during the second half of 2011, which will lead to the commencement of the approval phase for the project. Such projects are expected to increase the production capacity of the company, and will enable it to access more international markets. Barrick Gold Corporation - Threats Threat - Stringent Environmental Regulations The mining and exploration operations of the company are subject to various government regulations including regulations pertaining to environmental protection. Further, the company also requires government approvals and permits to maintain mining and exploration activities. In September 2010, the Argentine government had enacted the National Law on Minimum Requirements for the Protection of Glaciers. As per this legislation, legal action was taken against several companies including Barrick's subsidiaries in the Veladero and Pascua-Lama provinces. Currently, the constitutionality of legislation is being debated at the National Supreme Court of Justice of Argentina. If the company fails to comply with all these national and international regulations, it may be imposed with hefty fines and penalties, which could have a material impact on the

Barrick Gold Corporation- Financial and Strategic Analysis Review

Reference Code: GDMM27693FSA Page 3

Barrick Gold Corporation

profitability of the company. The company may also be denied with new projects, which might hamper its business prospects. Threat - Highly Competitive Market The company operates in gold and copper industry which is highly competitive. It competes in terms of price, product differentiation and quality, delivery reliability, and customer service. To survive and succeed in a stiff competitive environment, it becomes very important for the company to distinguish its product and service offerings through a clear and unique value proposition. The company competes with Kinross Gold Corporation, Goldcorp Inc., New Gold Inc., Agnico-Eagle Mines Ltd., and Yamana Gold Inc. The highly competitive market, changes in market conditions, including customer demand and technological development, may affect the companys competitiveness, sales and profitability.

NOTE: * Sector average represents top companies within the specified sector The above strategic analysis is based on in-house research and reflects the publishers opinion only

Barrick Gold Corporation- Financial and Strategic Analysis Review

Reference Code: GDMM27693FSA Page 4

Vous aimerez peut-être aussi

- Cash Cost in MiningDocument7 pagesCash Cost in Miningbatman_Pas encore d'évaluation

- Focus On The Mining SectorDocument2 pagesFocus On The Mining Sectortami_abadiPas encore d'évaluation

- Iamgold 2006 Annual Report - FinalDocument113 pagesIamgold 2006 Annual Report - FinalJesus SalamancaPas encore d'évaluation

- Corporate PresentationDocument38 pagesCorporate PresentationAlejandro VillanuevaPas encore d'évaluation

- Golden Star 2003 Annual ReportDocument24 pagesGolden Star 2003 Annual Reportbarkerdesign100% (1)

- Enterprise Risk Management at BarrickDocument3 pagesEnterprise Risk Management at BarrickjoyabyssPas encore d'évaluation

- Vale - Stock Report - 04jan14 - S&P CapitalDocument11 pagesVale - Stock Report - 04jan14 - S&P Capitalbenjah2Pas encore d'évaluation

- Goliath Resources Wealth Letter Analyst Report February 25, 2021Document7 pagesGoliath Resources Wealth Letter Analyst Report February 25, 2021Chester Yukon GoldPas encore d'évaluation

- 1) CB - Gold - ProyectDocument19 pages1) CB - Gold - ProyectleonelgarciageoPas encore d'évaluation

- New Earth Mining Inc.Document16 pagesNew Earth Mining Inc.Asif Rahman100% (1)

- BUY Heritage Oil: Oil & Gas Fishing in Rich WatersDocument36 pagesBUY Heritage Oil: Oil & Gas Fishing in Rich Waterscanuck225Pas encore d'évaluation

- Vedanta ResourcesDocument6 pagesVedanta ResourcesKeokWee ChengPas encore d'évaluation

- EY Mining Eye Q2 2012Document14 pagesEY Mining Eye Q2 2012milistePas encore d'évaluation

- GOLD - Selected Specific Company TakeawaysDocument3 pagesGOLD - Selected Specific Company TakeawaysBlake WhealePas encore d'évaluation

- B2Gold Corp. and Volta Resources Inc. Complete Business CombinationDocument3 pagesB2Gold Corp. and Volta Resources Inc. Complete Business CombinationMa. Elizabeth ApolinarPas encore d'évaluation

- ASX Release: OZ Minerals To Defer Projects and Cut Operating CostsDocument6 pagesASX Release: OZ Minerals To Defer Projects and Cut Operating CostsJendayiPas encore d'évaluation

- AN C A E O: EW Ompany Dvancing Xisting PportunitiesDocument23 pagesAN C A E O: EW Ompany Dvancing Xisting PportunitiesIsmaelMinjarezSosaPas encore d'évaluation

- 18 Share Tips - 29 November 2021Document18 pages18 Share Tips - 29 November 2021FrankPas encore d'évaluation

- FCX - Annual Report 2010Document114 pagesFCX - Annual Report 2010dcpetersnPas encore d'évaluation

- Strategic Planning & The Business Environment Presented by Adams ErhuvwuDocument13 pagesStrategic Planning & The Business Environment Presented by Adams Erhuvwuadamssan2007100% (1)

- Transaction Highlights: Krugold Resources, IncDocument5 pagesTransaction Highlights: Krugold Resources, IncAamir AzizPas encore d'évaluation

- Minera IRL Provides Corporate Update Lima, 1 April 2015: Minera IRL Limited ("Minera IRL" or The "Company") (TSX:IRL)Document6 pagesMinera IRL Provides Corporate Update Lima, 1 April 2015: Minera IRL Limited ("Minera IRL" or The "Company") (TSX:IRL)IRL MiningPas encore d'évaluation

- WMC Official Case 2015Document33 pagesWMC Official Case 2015Nayaka AnggerPas encore d'évaluation

- October 2011: Corporate PresentationDocument23 pagesOctober 2011: Corporate PresentationarzoorathiPas encore d'évaluation

- Dynacor: Corporate Presentation April 2013Document27 pagesDynacor: Corporate Presentation April 2013Dynacor Gold Mines Inc.Pas encore d'évaluation

- Condor Resources Buy Note 9 Jan 2012Document4 pagesCondor Resources Buy Note 9 Jan 2012Anonymous 5aYupF1YXPas encore d'évaluation

- Assignment 1 - Pan American ResourcesDocument7 pagesAssignment 1 - Pan American ResourcesDhanpaul OodithPas encore d'évaluation

- HRA Journal: Bravo Ventures (BVG-V, B6I.F-Frnk)Document6 pagesHRA Journal: Bravo Ventures (BVG-V, B6I.F-Frnk)raiderrPas encore d'évaluation

- CAPEX 2013: Vale: Capital and R&D Expenditures Budget of Us$ 16.3 Billion For 2013Document7 pagesCAPEX 2013: Vale: Capital and R&D Expenditures Budget of Us$ 16.3 Billion For 2013Juanito GutierrezPas encore d'évaluation

- U S Report Freeport-Mcmoran IncDocument12 pagesU S Report Freeport-Mcmoran Incapi-676947142Pas encore d'évaluation

- B2Gold Corp Initation Raymend JamesDocument35 pagesB2Gold Corp Initation Raymend Jamesexaltedangel09Pas encore d'évaluation

- Rare Earth Report 1Document9 pagesRare Earth Report 1andre313Pas encore d'évaluation

- GK Executive Summary 1.2Document7 pagesGK Executive Summary 1.2kingdomtruck1Pas encore d'évaluation

- 2019.09.09 Tracking The Junior Miners - Valuations, Transactions, and Th...Document16 pages2019.09.09 Tracking The Junior Miners - Valuations, Transactions, and Th...AlanPas encore d'évaluation

- GGA PresentationDocument38 pagesGGA PresentationMaurits OvaaPas encore d'évaluation

- Vale Obtains Environmental License For Carajás Expansion - 27jun12 - BBDDocument5 pagesVale Obtains Environmental License For Carajás Expansion - 27jun12 - BBDbenjah2Pas encore d'évaluation

- Ascot Mining - Investor Communication - 8 - April 09, 2012Document5 pagesAscot Mining - Investor Communication - 8 - April 09, 2012atino_bannedPas encore d'évaluation

- WheatonPreciousMetals-AR 22Document136 pagesWheatonPreciousMetals-AR 22wigidas889Pas encore d'évaluation

- Orporate ResentationDocument25 pagesOrporate ResentationRayanPas encore d'évaluation

- The Story of OxyDocument47 pagesThe Story of OxyRicardo Gonzalez MazueraPas encore d'évaluation

- Swick Mining Services - Company Update: HighlightsDocument3 pagesSwick Mining Services - Company Update: HighlightssciomakoPas encore d'évaluation

- M&a Masterclass Presentation SlidesDocument52 pagesM&a Masterclass Presentation SlidesnebonlinePas encore d'évaluation

- The Mineral Exploration Business: Innovation Required: April 2006Document9 pagesThe Mineral Exploration Business: Innovation Required: April 2006Pat SimonPas encore d'évaluation

- Canadian Zinc Corp Media Release - 19 May 2009 - Option Agreement On Tuvatu Gold ProjDocument4 pagesCanadian Zinc Corp Media Release - 19 May 2009 - Option Agreement On Tuvatu Gold ProjIntelligentsiya HqPas encore d'évaluation

- De Beers Group 2013Document33 pagesDe Beers Group 2013Tess_UbervillePas encore d'évaluation

- Canadian Capital Providers Guide0415Document141 pagesCanadian Capital Providers Guide0415kohinoordas2007100% (1)

- News Release ELD No. 12-11 TSX: Eld Nyse: Ego Asx: Eau March 22, 2012Document4 pagesNews Release ELD No. 12-11 TSX: Eld Nyse: Ego Asx: Eau March 22, 2012Panos SkourasPas encore d'évaluation

- Highlights of Statement Accompanying The 2004 Report and AccountsDocument6 pagesHighlights of Statement Accompanying The 2004 Report and Accountsphilopatris909Pas encore d'évaluation

- Manica Gold Project Mozambique: April 2018Document21 pagesManica Gold Project Mozambique: April 2018dclayjutaPas encore d'évaluation

- Graphene Extracted From Flake Graphite Is Stronger Than DiamondDocument23 pagesGraphene Extracted From Flake Graphite Is Stronger Than DiamondRichard J MowatPas encore d'évaluation

- Oakdale Resources Limited and Its Controlled Entities Acn Annual ReportDocument72 pagesOakdale Resources Limited and Its Controlled Entities Acn Annual ReportAlexPas encore d'évaluation

- Mwana Africa PLC: Results For The Year Ended 31 March 2008Document42 pagesMwana Africa PLC: Results For The Year Ended 31 March 2008Kristi DuranPas encore d'évaluation

- Opportunity at RiskDocument88 pagesOpportunity at RiskABC News OnlinePas encore d'évaluation

- NML 2022 Annual Report To ShareholdersDocument112 pagesNML 2022 Annual Report To Shareholdersmontegue.sykesPas encore d'évaluation

- Company Overview: Spreading Operations Globally: Case of ValeDocument7 pagesCompany Overview: Spreading Operations Globally: Case of ValeYash AgarwalPas encore d'évaluation

- Sterlite PDFDocument4 pagesSterlite PDFrajaPas encore d'évaluation

- NAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New EliteD'EverandNAMA-Land: The Inside Story of Ireland's Property Sell-off and The Creation of a New ElitePas encore d'évaluation

- The Trader's Great Gold Rush: Must-Have Methods for Trading and Investing in the Gold MarketD'EverandThe Trader's Great Gold Rush: Must-Have Methods for Trading and Investing in the Gold MarketPas encore d'évaluation

- The Signs Were There: The clues for investors that a company is heading for a fallD'EverandThe Signs Were There: The clues for investors that a company is heading for a fallÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Takaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaD'EverandTakaful Investment Portfolios: A Study of the Composition of Takaful Funds in the GCC and MalaysiaPas encore d'évaluation

- TTC SystemMapDocument1 pageTTC SystemMapSalsa_Picante_BabyPas encore d'évaluation

- Forerunner 220: Owner's ManualDocument14 pagesForerunner 220: Owner's ManualIvanaPas encore d'évaluation

- Brunton Compass RC - USER - MANUAL - 8.8 - Update PDFDocument2 pagesBrunton Compass RC - USER - MANUAL - 8.8 - Update PDFBenjamin DoverPas encore d'évaluation

- Guide 1475809950Document87 pagesGuide 1475809950tony3350Pas encore d'évaluation

- Auto Insurance - Model FactorDocument107 pagesAuto Insurance - Model Factortony3350Pas encore d'évaluation

- Sharp 903 Phone ManualDocument134 pagesSharp 903 Phone Manualtony3350Pas encore d'évaluation

- Toll BridgesDocument9 pagesToll Bridgesapi-255693024Pas encore d'évaluation

- Shopping For A Surprise! - Barney Wiki - FandomDocument5 pagesShopping For A Surprise! - Barney Wiki - FandomchefchadsmithPas encore d'évaluation

- The Rise of Big Data Policing - Surveillance, Race, and The Future of Law Enforcement On JSTORDocument11 pagesThe Rise of Big Data Policing - Surveillance, Race, and The Future of Law Enforcement On JSTORFeroze KareemPas encore d'évaluation

- Basic Survival Student's BookDocument99 pagesBasic Survival Student's BookIgor Basquerotto de CarvalhoPas encore d'évaluation

- Shailendra Education Society's Arts, Commerce & Science College Shailendra Nagar, Dahisar (E), Mumbai-68Document3 pagesShailendra Education Society's Arts, Commerce & Science College Shailendra Nagar, Dahisar (E), Mumbai-68rupalPas encore d'évaluation

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsDocument10 pagesMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsPhạm Trần Gia HuyPas encore d'évaluation

- Seminar On HackingDocument21 pagesSeminar On Hackingpandu16550% (2)

- Hip Self Assessment Tool & Calculator For AnalysisDocument14 pagesHip Self Assessment Tool & Calculator For AnalysisNur Azreena Basir100% (9)

- Sunrisers HyderabadDocument22 pagesSunrisers Hyderabadsagar pajankarPas encore d'évaluation

- Govt Influence On Exchange RateDocument40 pagesGovt Influence On Exchange Rategautisingh100% (3)

- WhittardsDocument7 pagesWhittardsAaron ShermanPas encore d'évaluation

- Testimonies and PioneersDocument4 pagesTestimonies and Pioneerswally ziembickiPas encore d'évaluation

- Substituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019Document5 pagesSubstituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019dpfsopfopsfhopPas encore d'évaluation

- THE-CLAT POST-March 2023 Final5284208Document123 pagesTHE-CLAT POST-March 2023 Final5284208Vedangi JalanPas encore d'évaluation

- Read MeDocument21 pagesRead MeSyafaruddin BachrisyahPas encore d'évaluation

- Chit ChatDocument5 pagesChit ChatErmin KicoPas encore d'évaluation

- PAIN POINTS - Can Be Conscious (Actual Demand) or Unconscious (Latent Demand) That CanDocument8 pagesPAIN POINTS - Can Be Conscious (Actual Demand) or Unconscious (Latent Demand) That CanGeorge PaulPas encore d'évaluation

- Thought Expression Activity 1) Communication As Tool For Global Competitiveness Among Religion, Business, Social InteractionDocument2 pagesThought Expression Activity 1) Communication As Tool For Global Competitiveness Among Religion, Business, Social InteractionHover Olaso BonifacioPas encore d'évaluation

- Family Relations - San Luis v. San Luis (CJ CARABBACAN)Document2 pagesFamily Relations - San Luis v. San Luis (CJ CARABBACAN)juna luz latigayPas encore d'évaluation

- 131.3 Visa Requirements General 2016 10 PDFDocument2 pages131.3 Visa Requirements General 2016 10 PDFDilek YILMAZPas encore d'évaluation

- # Transaction Code Transaction DescriptionDocument6 pages# Transaction Code Transaction DescriptionVivek Shashikant SonawanePas encore d'évaluation

- FLEXI READING Implementing GuidelinesDocument94 pagesFLEXI READING Implementing GuidelinesMay L BulanPas encore d'évaluation

- Investing in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterDocument18 pagesInvesting in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterAtanu PaulPas encore d'évaluation

- Home / Publications / Questions and AnswersDocument81 pagesHome / Publications / Questions and AnswersMahmoudPas encore d'évaluation

- Charles Simics The World Doesnt End Prose PoemsDocument12 pagesCharles Simics The World Doesnt End Prose PoemsCarlos Cesar VallePas encore d'évaluation

- London To Delhi by Bus PDFDocument28 pagesLondon To Delhi by Bus PDFMPA76 Ravindra Kumar SahPas encore d'évaluation

- Concrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailDocument12 pagesConcrete Calculator Steel Calculator Brick Calculator: Atish Kumar EmailAnil sainiPas encore d'évaluation

- Historical Perspective of Financial Reporting Regulations in MalaysiaDocument2 pagesHistorical Perspective of Financial Reporting Regulations in Malaysiauglore100% (6)

- 5.2.1 List of Placed Students VESIT NAAC TPCDocument154 pages5.2.1 List of Placed Students VESIT NAAC TPCRashmi RanjanPas encore d'évaluation

- A Study On Bindal Group of IndustriesDocument100 pagesA Study On Bindal Group of IndustriesShivam RaiPas encore d'évaluation