Académique Documents

Professionnel Documents

Culture Documents

Barcap Emerging Markets Weekly

Transféré par

shiyee_gohDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Barcap Emerging Markets Weekly

Transféré par

shiyee_gohDroits d'auteur :

Formats disponibles

EMERGING MARKETS RESEARCH

5 May 2011

THE EMERGING MARKETS WEEKLY De-risked, but not distressed

The agreement on Portugals bailout package and a generally healthy set of PMI data this week should encourage investors to view EM assets positively. The de-risking this week was probably more technical in nature, namely profit-taking ahead of the ECB/BoE and payrolls data.

EM Views on a Page EM Dashboard EM FX Views on a Page EM Credit Portfolio Data Review & Preview FX Forecasts and Forwards Official Interest Rates What we like FX FX Long 9m CNY NDFs Short EUR/Long PLN 2 21 22 24 25 31 32

Macro Outlooks

Emerging Asia: An exception that proves the rule 6 The Reserve Bank of India increased the speed of tightening to 50bp as it delivered its ninth rate hike since March 2010 to counter rising inflation expectations. We expect central banks in China, India, Korea, Malaysia, Philippines, Thailand and Taiwan to hike policy rates in the next three months as they maintain a front-loading bias. Similarly, we expect the Bank of Korea to hike 25bp next week to anchor inflation expectations. EEMEA: Still room for expansion 8 Although growth has improved, we believe there is still room for further expansion, as GDP output gaps remain in many countries. We expect Q1 11 GDP figures to improve and IP to stay high but flatten. Next week, we expect Poland and South Africa to hold and Serbia to continue hiking. Latin America: Taking stock of growth and inflation trends 10 Inflation-targeting economies are split in two groups according to GDP gaps. Brazil and Peru have had positive gaps since 2010, while Mexico, Colombia and Chile will likely close them in H2 11. Inflation poses a larger risk for Brazil, while Chile, Colombia and Peru have a more comfortable position. The bulk of the Mexican disinflation reflects base effects and is expected to reverse. Other demand indicators in the region confirm a gradual convergence towards potential this year.

Credit Long PDVSA 17 New Weekly EM Asset Performance

TWD/USD RUB/USD INR/USD KRW/USD MXN/USD TRY/USD CLP/USD ZAR/USD BRL/USD -2.4% -2.8% -1.7% -1.7% EM FX -1.4% -0.9% -0.3% -0.7% 0.3%

Strategy Focus

EEMEA FX: Moving mainstream 12 Since the publication of The Emerging Markets Quarterly, 22 March 2011, the beta backdrop for EM currencies has turned more bullish. To position for this view, we recommend closing our CZK long and moving into a PLN long, albeit with a tail-risk hedge. Elsewhere, we tweak our other EEMEA FX trade recommendations. Singapore: Updating our SGD NEER model 15 We have recalibrated our SGD NEER model in light of the release of updated historical data from the MAS. We expect the SGD NEER to remain above the midpoint of the index through to year-end and now forecast USD/SGD to fall to 1.19 in 12m. Chile: Fine-tuning our monetary policy call 18 Marginally more dovish communication from Chiles policymakers leads us to now expect the central bank to deliver a 25bp hike on 12 May (previously 50bp) and pencil in a pause at 5.0% (previously a steady normalization to 5.5%).

India 2yr IRS Indo 5yr Gov Kor 2yr IRS CLP 2yr IRS -1 bp Braz Jan 12 SA 2yr IRS -2 bp CZK 5yr IRS -3 bp Hun 5yr IRS -4 bp Pol 5yr IRS -10 bp Mex TIIE 5yr -13 bp Mex 5yr CDS EM Credit Rus 5yr CDS Turk 5yr CDS Phils 5yr CDS SA 5yr CDS Braz 5yr CDS Indo 5yr CDS Hun 5yr CDS Arg 5yr CDS Veni 5yr CDS -25 bp

22 bp 8 bp 2 bp 0 bp

EM Rates 0 bp -1 bp -1 bp -2 bp -3 bp -3 bp -4 bp -10 bp -13 bp

Turkey Shanghai -0.5% Kospi -1.3% S&P -1.9% JSE All -3.3% Bovespa -3.6% FTSE JSE -3.7% Bolsa -3.8% Russia -5.6% Sensex -5.6%

1.4%

EM Equity

Note: EM Assets Performance charts as of 5 May2011 except CDS spreads, which are as of 4 May 2011. Source: Bloomberg, Markit, Barclays Capital

PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES STARTING AFTER PAGE 33

Barclays Capital | The Emerging Markets Weekly

EM VIEWS ON A PAGE

What happened Markets Risk markets took profits, with the S&P down nearly 1.8% on the week. US Treasuries extended their advance, and the yen was the top-performing currency against the USD this week. In EM FX, most currencies sold off this week, with the exception of the TWD and the PEN. After a large widening over the past few weeks, Perus credit rallied (Peru 50 bonds were up 2.5pts) in response to a poll conducted by Ipsos-Apoyo, which showed that Humala's lead over Fujimori declined to just 1 pp. April manufacturing PMI prints for all of the countries in the emerging EMEA region were generally robust, though they were somewhat more diverse on a country level. Employment conditions seem to be continuing to improve. The results were broadly consistent, with the German and euro area PMI still holding up at very strong levels. The Reserve Bank of India hiked the key policy rates 50bp, against expectations and our call for a 25bp hike. With the current hike, the repo and reverse repo rates stand at 7.25% and 6.25%, respectively. Malaysia initiated its rate hike cycle, raising its overnight policy rate 25bp, to 3.0%, in line with our expectations; consensus expectations were for the BNM to remain on hold. We expect it to hike again in July, by another 25bp. Bangko Sentral ng Pilipinas also hiked its policy rate 25bp, to 4.5%, in line with our and market expectations. Russia also raised its policy rates across the board by 25bp; the refinancing rate is now 8.25%. We expect another 25bp hike in May. In Colombia, Banrep announced a 25bp hike of the reference rate, to 3.75%, on Friday, in line with our and the market's expectations. We continue to expect the central bank to raise the overnight rate to 5.0% this year with a 25bp hike per meeting.

Global macro Monetary policy

What we think EM assets The agreement on Portugals bailout package and a generally healthy set of PMI data this week should encourage investors to view EM assets positively. The de-risking this week was probably more technical in nature, namely profit-taking ahead of the ECB/BoE and payrolls data.

What we like Asset class Trade FX Short EUR/long PLN Long CNY 9m NDFs Long PDVSA 17N Rationale The improved positioning outlook in EM and the continued strength of the German economy all argue for switching into more mainstream, higher beta EEMEA FX. We recommend a tactical PLN cash long vs. the EUR (target 3.85), hedged with a EUR/PLN put digital option (strike 4.08) based on our concerns about the medium-term risks (fiscal concerns, C/A and monetary policy credibility). In the context of this weekends Strategic and Economic Dialogue, we look for USD/Asia to continue to drift lower, although we envisage a slower pace of appreciation, given recent performance. We highlight our long CNY 9m NDF ahead of the SED meetings 9-10 May in Washington, DC. We think that that PDVSA 17s new are attractive, given the change in their technicals. For the past three months, the central bank has been selling the new PDVSA 17 at USD120mn per week. Given that PDVSA previously allocated USD2.6bn of these bonds, and average sales of approximately USD 30mn per week, there are only seven weeks of additional selling. Investors concerned about the current market volatility can hedge market risks buying protection (5y CDS in Venezuela is the ideal candidate).

FX

Credit

Figure 1: Oil prices have tumbled this week

Figure 2: Peru vs. Brazil 5y CDS: protection against politically driven volatility in Peru, election uncertainty remains

180 170 160 150 140 130 120 110 100 90 1-Jan 125 120 115 110 105 100 95 31-Jan 2-Mar 1-Apr Brazil 5Y CDS 90 1-May

130 125 120 115 110 105 100 95 90 1-Jan 31-Jan 2-Mar 1-Apr 1-May

Brent Oil Price

Source: Bloomberg Source: Bloomberg

Peru 5Y CDS

5 May 2011

Barclays Capital | The Emerging Markets Weekly

EMERGING MARKETS OUTLOOK

De-risked but not distressed

Koon Chow +44 (0) 20 7773 7572 koon.chow@barcap.com George Christou +44 (0) 20 7773 1472 george.christou@barcap.com

The agreement on Portugals bailout package and a generally healthy set of PMI data this week should encourage investors to view EM assets positively. The de-risking we have seen this week was probably more technical in nature, namely profit-taking ahead of the ECB/BoE and payrolls data.

Downplay the de-risking

Notwithstanding the results of the US payrolls data due for release later today, the key developments this week should result in investors looking positively towards EM assets. The agreement on Portugals bailout package was reached quickly and in line with political consensus (in Lisbon). The size of the package (EUR78bn, the equivalent of 45% of the countrys 2010 GDP), in our European economists view, reflects the determination of the EU authorities to ring-fence problems in the periphery. On the data front, this week has seen a generally healthy set of PMI data releases both in developed markets (DM) and in EM. Also, even though EEMEA PMI saw a slight setback and US non-manufacturing ISM surprised to the downside, our economists see little to worry about in either of these regions, for now. The de-risking that we have seen in global equities and, to some degree, in currency space in EM has been rightly modest and we think, mainly technical in nature (eg, profit-taking ahead of ECB/BoE and payrolls data). We believe overall EM positioning by real money investors is helpful (figure 2), and with trading in recent weeks punctuated by public holidays, it seems unlikely that speculative positions in EM local or external markets are extensive. We think key beta factors for EM assets are still pointing in a positive direction: US rates and Treasury yields remain contained; and our FX analysts believe that EUR/USD, in spite of a recent correction, is likely to head higher. The uptrend on EUR/USD should offer some positive pull for EM currencies. Figure 3 shows the spot FX performance of the major EM currencies versus the performance suggested by the EUR/USD move on its own (EUR/USD change * historical beta of EM FX to EUR/USD). With the exception of RUB and MXN, EM currencies have not overstretched themselves given where EUR/USD has already moved to. If there is a common restraint on EM FX, it is probably the temporary break for payers that we currently see, with lower carry providing a little less appeal for yield-focused currency longs.

Agreement on Portugals bailout package and a healthy set of PMI is positive for EM assets

The de-risking this week has largely been technical in nature

Figure 1: A healthy set of data should keep investor risk appetite firm

PMI (SA, 50+=Expansion) 60 56 52 48 44 40 36 32 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 Dec-10 EMEA EM Asia LatAm US EU Area

Figure 2: Positioning in EM equities and bonds (local and external) is not currently a problem

2.5% 2.0% 1.5% 1.0% 0.5% 0.0% -0.5% -1.0% -1.5% -2.0% -2.5% -3.0% 2008 Mutual fund OW/UW in EM space (ppt)

overweight

underweight

2009 EM bonds

2010

2011 EM equities

Source: National Statistics Sources, Barclays Capital

Source: EPFR Global, Barclays Capital

5 May 2011

Barclays Capital | The Emerging Markets Weekly

Payers can take a break but should be vigilant on commodity prices

An easing in commodity prices may, in the very near term, cap the performance of payer trades

However, our EM inflation surprise index is still in positive territory

and supply- and demand-side pressures should still push commodity prices higher

Global oil and food prices have recently moderated, which may contribute to some erosion in the amount of hikes priced in the near term and therefore, the potential for payers to perform. However, we believe this is unlikely to last long for several reasons. First, our EM inflation surprise index (updated for the March inflation prints) was still positive; that is, inflation has still been surprising to the upside (though the index has recently come down off its highs). In addition, policy surprises are still occurring (India surprised with a larger hike than we and the market expected this week). This is generally symptomatic of narrowing output gaps in EM as a whole (certainly when compared with DM) which should continue to support our long FX and payer recommendations in the medium term. Second, our commodity research colleagues still strongly emphasize the role of both demand and supply fundamentals in keeping commodity prices high and skewing the risk outlook, The correlation coefficient between commodity prices and EM equities has returned to positive territory since March, suggesting a good scenario for risk taking. To put another way, commodity prices and equities confirm the same thing - strong global demand. We note, however, that while demand-driven commodity price increases are less worrying for EM (as it is likely to be supplying most of the demand), our commodities team does not rule out the return of supplyside concerns in the coming months, particularly for oil given the potential for a further deterioration in Yemen and Bahrain. On the food side, supply shocks have already taken their toll on grain prices and should continue to pressure food prices higher. The risk is that if supply-side pressure re-asserts itself, EM assets may see a repeat of Februarys price action. We believe that a positive message should be conveyed on EM assets and that, despite our concerns on EM inflation, it should also encompass some relief for EM fixed income in the near term. The latter should not last, hence our characterisation of a break for payers. More seriously, we remain sensitive to an inflection point in terms of EM assets reactions to rising commodity prices. Specifically, we are sensitive to the point where rises are not viewed as confirmed strong global demand, but a challenge to it. We do not see the market being at that inflection point in the next few weeks but it joins our list of tail risks that we highlighted in our recent publications (notably The EM Quarterly, 22 March 2011).

Figure 3: EM FX is up ytd but compared with the EUR/USD moves and historical betas, have not punched their weight

12% 10% 8% 6% 4% 2% 0% RUB MXN HUF* IDR KRW SGD BRL MYR TWD PHP CNY CLP INR PLN* TRY HKD THB ZAR PEN -2% Outperforming what the beta to EUR would imply Underperforming

Figure 4: Commodity and risky asset correlations (MSCI EM) are positive

1.0 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 break down in relationship during MENA related commodity supply jitters and rotation out of EM equities Apr-10 Jul-10 Oct-10 Jan-11 Apr-11

-1.0 Jan-10

Eur contribution**

Spot performance

CRB Commod index

Source: Bloomberg, Barclays Capital

Avg correl since 2010

Note: * Versus EUR, ** beta to EUR/USD times by EUR/USD change. Source: Barclays Capital

5 May 2011

Barclays Capital | The Emerging Markets Weekly

Peru - election watch

Asset market volatility as investors follow the opinion polls closely

Peruvian assets remain in the spotlight following the volatility created by the uncertain political situation (Peru: Electoral riddle, 26 April 2011). A May 4 poll conducted by IpsosApoyo showed that Humala's lead over Keiko Fujimori declined to just 1pp. The credit, after a large widening over the past few weeks, rallied in response (Peru 50 bonds were up 2.5pts) and the PEN appreciated 0.28%. Peruvian equity markets have also rallied on the news (the Peru Lima General Index was up 6.12% on the week). However, with the candidates technically tied at the moment, and an important portion of the electorate still undecided, the final result remains uncertain. Nonetheless, the market has reacted optimistically and is positioning ahead for a potentially positive result on May 8th when the next Ipsos-Apoyo poll will be release.

What we like

Some room for tactical receivers, but our higher confidence trades are still on the bearish side

We like paying TRY 1y1y and KRW 1y. We also recommend adding to INR OIS 1y payers

Rates: There is probably some room for tactical receivers (ie, PLN, to 2y, given our view of no change at the May meeting). However the emphasis is tactical. Our structural/higher confidence trades are still on the bearish side. Investors may get some attractive opportunities to add or scale into these trades in the coming days/weeks. In EEMEA our high confidence payer is Turkey (1y/1y) while elsewhere we highlight a KRW (1y) payer as well. For Turkey, the widening C/A deficit necessitates a more aggressive tightening of liquidity conditions with an impact on rates. In Korea, inflation is becoming a little more problematic even though headline CPI recently surprised to the downside at 4.6% y/y. Core inflation is rising and we look for the BoK to hike the policy rate by 25bp in May. We would advise investors to add to pay INR OIS 1y positions, based on our view on policy and the inflation risks in India. Credit: We maintain our strategic Overweight in higher yielding credits, particularly Venezuela and Ukraine. Positioning is not as supportive as previously for Ukraine and Argentina, but investors have maintained a cautious stance on Venezuela. On a more granular level, we have recently highlighted the PDVSA 17N as our instrument of choice to express our constructive view on Venezuela (Venezuela: Manna from heaven, 28 ,April 2011). In the low beta space in LatAm, we still like Brazil 10y CDS versus Mexico 10y CDS. Mexico's has outperformed on the back of higher-than-expected growth. The medium-term trend in Brazil's creditworthiness indicators, largely thanks to higher potential growth, is more encouraging than that of Mexico. Hence, we think that Brazil should be trading tighter than Mexico. FX: The improved positioning outlook in EM and the continued strength of the German economy all argue for switching into more mainstream, higher beta EEMEA FX (See EEMEA Focus piece in this publication). Therefore, we close our CZK long vs EUR and open a tactical PLN cash long vs the EUR (target 3.85, stop 4.00), given near-term FX appreciation pressures, hedged with a EUR/PLN put digital option (strike 4.08) based on our concerns about medium-term risks (eg, fiscal, C/A and monetary policy credibility). In EM Asia, central banks still remain comfortable with the idea that currency appreciation can be used to lean against inflation. In the context of this weekends Strategic and Economic Dialogue, we look for USD/Asia to continue to drift lower, although we envisage a slower pace of appreciation from here given recent performance. We highlight our long CNY 9m NDF ahead of the SED meetings. We also like our MYR seagull trade; while it has recently moved in the money, we see potential for USD/MYR to reach 2.94 over the next 2.5 months.

We maintain our strategic Overweight in higher yielding credits

In low beta credit space we still like Brazil vs Mexico 10y CDS

Improved beta and positioning argues for more mainstream and higher beta EMEA FX longs

We continue to look for USD/Asia to drift lower in the context of the SED this weekend

5 May 2011

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: EMERGING ASIA

An exception that proves the rule

Rahul Bajoria +65 6308 3511 rahul.bajoria@barcap.com Prakriti Sofat +65 6308 3201 prakriti.sofat@barcap.com

The Reserve Bank of India increased the speed of tightening to 50bp as it delivered its ninth rate hike since March 2010 to counter rising inflation expectations. We expect central banks in China, India, Korea, Malaysia, Philippines, Thailand and Taiwan to hike policy rates in the next three months as they maintain a front-loading bias. Similarly, we expect the Bank of Korea to hike 25bp next week to anchor inflation expectations.

Monetary policy: 50bp hike from RBI is an exception

RBI increases the size of rate increases to 50bp

The Reserve Bank of India (RBI) hiked its key policy rates the repo and reverse repo - by 50bp each earlier this week, to 7.25% and 6.25%, respectively. This was the ninth hike by the RBI since March 2010, with a cumulative 250bp rise in the repo rate since then. The RBIs policy stance remains markedly hawkish, with the central bank now almost exclusively focussed on containing inflation, even at the expense of growth. But inflation is unlikely to be influenced meaningfully by this rate increase alone. We see the possibility that the RBI may want to stay ultra-cautious and quash the chance of being perceived as falling behind the curve. We factor in another 50bp of hikes in the next two policy announcements (16 June and 21 July). Given the current level of systemic pressure on liquidity and interest rates, policy rate hikes are no longer costless in terms of future growth. But, we think the RBI is not in a position to give that consideration anything more than a distant second priority for the time being. The RBI also noted the risks of higher fiscal spending and/or higher inflation if oil prices are sustained at elevated levels. In the coming weeks, we believe higher inflation prints could prompt the RBI to hike by more than what the market is pricing in. Going into the next mid-quarter policy review on 16 June, the trend of large upside surprises in headline inflation, along with rising core inflation, point towards to further tightening, in our view.

and likely to remain extra cautious to avoid being perceived as behind the curve

We expect another 50bp of hikes in the next three months

Figure 1: Core prices rising quickly in India

Figure 2: Leading to more decisive rate hikes

10% 9% 8% 7% 6% 5%

12 10 8 6 4 2 0 -2 -4 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11

IN: Headline WPI (% y/y) Non-food manufacturing inflation

Source: CEIC, Barclays Capital

4% Apr-08

Apr-09

Apr-10 India: Policy rate (%)

Apr-11

Source: Bloomberg, Barclays Capital

5 May 2011

Barclays Capital | The Emerging Markets Weekly

but the region will continue to follow the front-loading rule

BSP and BNM deliver 25bp hike to take its policy rate to 4.50% and 3.00% respectively; we expect both central banks to hike again in July

Risks of acceleration in policy tightening elsewhere appear limited for now. In the Philippines, against a backdrop of higher core prices the central bank delivered its second rate hike of 25bp in less than two months. The BSP has stated that the rate hike was to contain second-round effects and reign in inflation expectations. The central bank, which has raised rates by 50bp in the current hiking cycle, also clearly indicated that its 2011 inflation target of 3-5% remains at risk. The deputy governor also noted that the Philippines economy can accommodate the 50bp of hikes already delivered, adding that the BSP is not ruling out future rate hikes. Our base case is for the BSP to stand pat in June to gauge developments on inflation expectations, and then deliver another 25bp hike in July. Bank Negara Malaysia (BNM) also hiked the overnight policy rate by 25bp to take the policy rate to 3.00%. This was the first rate hike by BNM since July 2010, and the fourth 25bp rate hike since the start of 2010. It also left the door open for further rate action based on its assessment of growth and inflation prospects. We expect BNM to hike the policy rate by 25bp again at the next MPC in July. We expect the front-loading of monetary policy tightening to continue across the region, given the combination of rising inflation and high growth in most Asian economies. With demand-pull pressures rising across the board, we believe that central banks in China, India, Korea, Malaysia, Thailand and Taiwan will again hike policy rates in Q2.

Front-loading of rate hikes is likely to remain the rule within the region

The week ahead: Bank of Korea, Bank Indonesia MPC

Next week: Bank of Korea expected to deliver a 25bp hike

Next week the focus will shift to MPC meetings in Korea and Indonesia. We expect the Bank of Korea (BoK) to hike its policy rate by 25bp, as it appears clear that core price pressures remain elevated. We expect the BoK to deliver two further 25bp rate hikes in July and September taking the policy rate to 3.75%. We expect Bank Indonesia to stand pat at 6.75% next week, on the back of the downside inflation surprise. However, with core price pressures rising, we believe that Indonesian rates remain on an uptrend. In China, we forecast export and import growth to have moderated but to have remained strong, and a small surplus in the trade balance. We see a broad moderation in April activity, with IP slowing to 14.5% y/y from 14.8% previously. On the inflation side, we forecast April CPI to have edged lower to 5.2% y/y on declines in some food prices, but price pressures remain elevated. We estimate new loans in April of CNY700-750bn and M2 growth at a moderate 16.5%.

Figure 3: Front-loading of rate hikes likely to continue

10% 9% 8% 7% 6% 5% 4% 3% 2% 1% 0% Apr-08 Apr-09 China Korea

Source: Bloomberg, Barclays Capital

Figure 4: Food inflation prices on the decline in China

180 160 140 120 100 80 Sep-09 Dec-09 Mar-10 Jun-10 Grain Chicken

Source: CEIC, Barclays Capital

06 Sep 09=100

Apr-10 Indonesia Taiwan

Apr-11 India

Oct-10

Jan-11

Apr-11

Edible Oil Egg

Meat Vegetable

5 May 2011

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: EASTERN EUROPE, MIDDLE EAST, AND AFRICA

Still room for expansion

Daniel Hewitt +44 (0) 20 3134 3522 daniel.hewitt@barcap.com Vladimir Pantyushin +7 495 786 8450 vladimir.pantyushin@barcap.com

Although growth has improved, we believe there is still room for further expansion as GDP output gaps remain in many countries. We expect Q1 11 GDP figures to improve and IP to stay high but flatten out. Russia raised rates and Romania and Czech Republic kept rates unchanged this week. Next week we expect Poland and South Africa to hold and Serbia to continue hiking. The EEMEA region output gap has risen from its lows, but it appears to have left room in most countries for further expansion before overheating sets in. On average, the output gap

Output gap remains for most countries; however, excess productive capacity seems to be disappearing in several countries

rose to +5% at the height in 2008, declined to -3.5% at end-2009, and climbed back to -1% at end-2010, with most countries remaining in negative territory (Figure 1). The pattern was somewhat different for capacity utilization, where the trough occurred earlier and recovery progressed farther, pushing capacity utilization above average for most countries. This seems to reflect manufacturing leading other sectors in an unbalanced recovery. Additionally, countries with large output gaps tend to be experiencing lower inflationary pressures, leading to a nearly linear inverse relationship between output gap and inflation momentum (Figure 2). The countries with apparent risks of overheating are Turkey, South Africa, and Israel. In contrast, Romania, Czech, and Russia still have large output gaps. We are expecting GDP growth in Q1 11 to accelerate because of the buoyancy of exports, IP, and employment gains (Figures 3 and 4). IP is already high and will likely remain strong, but probably not accelerate. In Poland, we expect the NBP to keep its policy rate on hold next week at 4.0%, notwithstanding accelerating inflation. March inflation surprised on the upside at 4.3% y/y from 3.6% the previous month. We forecast April inflation (released next week) to decline slightly, to 4.2% y/y, on lower food inflation. According to statements from MPC members, the dovish voting block will reject a rate increase this month. One argument is that core inflation remains low at 1.9% y/y, so inflation is mostly externally driven by commodity prices. Additionally, some board members are uneasy about the sustainability of growth. Finally, the NBP and MinFin announced that EU transfers will be sold in the market this year

Poland NBP expected to keep policy rate on hold next week

Figure 1: Capacity utilization has recovered more than the output gap

6 5 4 3 2 1 0 -1 -2 -3 -4 07 76 74 72 70 68 66 64 62 08 09 10 Output Gap: (GDP weighted average of 6 countries) Capacity Utilization (GDP weighted average)

Source: National sources, EU, Haver Analytics, Barclays Capital

Figure 2: Expected inflationary pressures are higher in countries where the output gap has closed

Inflation Momentum (CPI 2011F - CPI 2010), ppt 3.0 South Africa 2.0 Turkey Ukraine 1.0 Israel Poland 0.0 Russia Czech -1.0 Hungary Republic -2.0 -3.0 -4.0 -5.0 Romania -4.0 -3.0 -2.0 -1.0 0.0 1.0 2.0

Ouput gap (% GDP), Q4 2010

Source: National sources, Haver Analytics, Barclays Capital

5 May 2011

Barclays Capital | The Emerging Markets Weekly

(up to 12.5bn), instead of being retained by the NBP as FX reserves. This is expected to lead to currency appreciation that will help hold back imported inflation. Having raised rates in each of January and April by 25bp, dovish voters appear reluctant to raise rates in consecutive meetings. We expect a resumption of hikes next month.

South Africa is expected to keep rates on hold, while Serbia is likely to continue raising rates on rising inflation

We expect South Africa to keep its policy rate on hold. Inflation has turned the corner, rising to 4.1% y/y. However, with the policy rate at 5.5%, there is no need to rush into hikes. We believe that continued economic expansion and higher global commodity prices will continue to push inflation up gradually and lead to policy hikes early in 2012. Serbia also has a rate decision next week and we expect a 50bp rate hike to 13.0%. While the NBS has increased rates a cumulative 450bp over the last nine months, inflation has outpaced this, rising to 14.0% y/y in March, and we estimate April inflation (released next week) at 16.2% y/y due to electricity price hikes. In data released last week, growth was favourable with flash Q1 11 GDP up 3% y/y and IP up 7.1% y/y in March. As expected, in Czech Republic the CNB kept its policy rate at 0.75%. Inflation remains low at 1.7% y/y in March, and we expect further moderation to 1.5% in April (data to be released next week) and core inflation remains even lower. We foresee some improvement in growth. PMI was high in April at 59.0 and we expect March IP (released next week) to be up 10% y/y. More importantly, our GDP growth proxy indicates that GDP accelerated in Q1 11 (data released next week), we expect growth of 3.0% y/y from 2.6% in Q4 10 and see upside risks to our forecast. Based on the strength of this growth, we predict the CNB will begin hiking in August. In Romania, the NBR kept its policy rate on hold at 6.25%, as expected. Inflation remained high at 8.0% y/y in March and we predict next weeks April release will be 8.2% y/y due to unfavourable base effects. We expect Q1 11 GDP growth (released next week) to move into a positive range, up 0.3% y/y, marking the beginning of a likely sustained but gradual recovery. Turkey CPI accelerated to 4.3% y/y in April from 4.0% in March. More significantly, core inflation expanded to 4.4% y/y, so that inflation has become more broad-based. Even though PMI dropped in April, at 52.7 it remains in expansionary territory and we expect the April IP release next week to continue to show economic expansion. Hungary PMI was very strong in April, at 56. Accordingly we expect IP to continue its brisk pace rising in March. Given the rapid increase in PMI, IP and exports in Q1, we anticipate GDP growth rose to 2.8% y/y in Q1 11 (data released next week) from 1.9% y/y in Q4 10. We expect inflation (data released next week) to have remained unchanged at 4.5% y/y in April.

Czech central bank held policy rate unchanged at 0.75%, as expected

Romania central bank also kept rates unchanged

Turkey inflation rose and growth remains strong

Hungarys growth prospects appear to be improving

Figure 3: Indicators imply acceleration of Q1 GDP growth

15% 10% 5% 0% -5% -10% -15% -30% -50% 50% 30% 10% -10%

Figure 4: Employment is starting to improve

18 16 14 12 10 8 6 4 2005 2006 CE-3 2007 2008 2009 CIS-3 2010 2011

Average unemployment (%)

-70% -20% Feb-08 Aug-08 Feb-09 Aug-09 Feb-10 Aug-10 Feb-11 EMEA IP growth (PPP weighted), % y/y EMEA GDP growth (PPP weighted), % y/y EMEA exports (PPP weighted), % y/y RHS

Source: National sources, Haver Analytics, Barclays Capital

Balkans

Baltics

Source: National sources, Haver Analytics, Barclays Capital

5 May 2011

Barclays Capital | The Emerging Markets Weekly

MACRO OUTLOOK: LATIN AMERICA

Taking stock of growth and inflation trends

Alejandro Arreaza +1 212 412 3021 Alejandro.Arreaza@barcap.com Marcelo Salomon +1 212 412 5717 marcelo.salomon@barcap.com

Inflation-targeting economies are split in two groups according to GDP gaps. Brazil and Peru have had positive gaps since 2010, while Mexico, Colombia and Chile will likely close them in H2 11. Inflation poses a larger risk for Brazil, while Chile, Colombia and Peru have a more comfortable position. The bulk of the Mexican disinflation reflects base effects and is expected to reverse. Other demand indicators in the region confirm a gradual convergence towards potential this year.

The region is split between economies that have closed their GDP gaps in 2010 and those that should see this happening sometime between Q2 and Q3 11.

Latin America continues to experience solid growth momentum. The region is split between economies that have closed their GDP gaps in 2010 (Brazil and Peru) and those that should see this happening sometime between Q2 and Q3 11 (Chile, Mexico and Colombia). Figure 1 shows the GDP gap in these five economies since Q4 08, along with our estimates for Q1 11, which is due out in the coming weeks for most of the region. While growth should be moderating towards potential during the course of this year, Q1 releases are unlikely to show that this convergence is happening swiftly. To be sure, Chilean monthly growth (Imacec) points to a 6.5% q/q saar rise in 1Q. Hence, we continue to see GDP gaps trending north across these countries. Inflation remains a risk in the region. The most extreme case is Brazil, where inflation should already breach the 6.5% upper bound of the target in April and remain above this threshold level until January 2012, after peaking at the high 7.7% level in August. Core inflation also corroborates our view, showing that domestic demand pressures are at work and there is a material risk that the upper limit of the target could be reached in 2012 if the economic activity does not slow. Chile, Colombia and Peru are feeling a more moderate build-up in core inflation and are at still-comfortable levels. Meanwhile, base effects have helped the year-on-year trend in Mexico, though to be sure, there was some good news in March, with core and headline surprising on the downside. This combination of factors resulted in inflation going back to target for the first time since 2006. Unfortunately, we expect this trend to reverse, pushing headline inflation back up to 4.0% by yearend. Figure 2: Core inflation

10 8 6 4 2 0 -2 % y/y

Inflation remains a risk, with Brazil facing most problems

Figure 1: Output gaps

4.0 2.0 0.0 -2.0 -4.0 -6.0 -8.0 Q4 08 Q2 09 Brazil Mexico Q4 09 Chile Peru Q2 10 Q4 10 Colombia Output gap (%)

Jan-05

Jan-06

Jan-07

Jan-08 Chile Peru

Jan-09

Jan-10

Jan-11

Brazil Mexico

Colombia

Source:: Haver Statistics, Barclays Capital

Source: Haver Statistics, Barclays Capital

5 May 2011

10

Barclays Capital | The Emerging Markets Weekly

The pace at which retail sales surpasses IP growth appears to be moderating

Other indicators of domestic demand across the region are also showing strength, but with a consolidation trend taking place. Excess growth of retail sales above industrial production is softening. This has been the case since the beginning of the year in Brazil and Colombia, after being in place in Venezuela since October last year. Meanwhile, Chilean domestic demand continues to fire ahead of IP, and the difference is well above that observed in the pre-crisis periods. Mexico also sticks out, as the momentum of domestic demand remains below that of industrial activity. Import growth continues to soften gradually, but remains at strong levels across the region. The overall pattern is much more uniform than for other activity indicators, and with the exception of Colombia and Venezuela, which continue to show an upward trend of import growth, the data corroborate our view that growth moderation is taking place. On this front, the only exception will probably be Venezuela, the only economy that still contracted last year and should benefit this year from rising oil-driven public expenditures. This backdrop helps us sort the main sources of pressure building up behind the monetary policy normalization process in the region. The strongest inflation and growth pressures felt in Brazil are leading to a prolonged period of tighter monetary conditions, despite the clear pro-growth bias endorsed by the governments. Meanwhile, the output gap and observed inflation outlook in Mexico are giving a dovish Banxico the ammunition to remain on hold, and even though inflation should have seen its trough in March, we believe policy normalization is due to begin next year. Finally, we see the Chilean authorities probably ready to start softening its tightening cycle (see Chile: Fine-tuning our monetary policy call, May 4, 2011).

while import growth is strong and gradually softening at the margin

Figure 3: Excess retail sales growth vs. IP

25 20 15 10 5 0 -5 -10 Jan-07 Oct-07 Jul-08 BR Apr-09 CL Jan-10 CO Oct-10 MX % y/y 3mma

Figure 4: Import growth consolidation

80 60 40 20 0 -20 -40 -60 Jan-05 Jan-06 AR Jan-07 BZ Jan-08 CL Jan-09 CO Jan-10 MX Jan-11 PE % y/y 3mma

Source: Haver Analytics, Barclays Capital

Source: Haver Analytics, Barclays Capital

5 May 2011

11

Barclays Capital | The Emerging Markets Weekly

STRATEGY FOCUS: EEMEA FX

Moving mainstream

This is an extract of a report published on 4 May 2011.

Koon Chow +44 (0) 20 7773 7572 koon.chow@barcap.com George Christou +44 (0) 20 7773 1472 george.christou@barcap.com

Since the publication of The Emerging Markets Quarterly, 22 March 2011, the beta backdrop for EM currencies has turned more bullish. To position accordingly for this view, we recommend closing our CZK-long and moving into a PLN-long, albeit with a tail-risk hedge. Elsewhere, we tweak our other EEMEA FX trade recommendations. Helpful beta factors and a healthy pull for EM European economies (from robust German growth) argue for being long on aggregate EEMEA currencies. At the time we published The Emerging Markets Quarterly, 22 March 2011, we were constructive EM currencies but did not foresee major gains from being long EEMEA FX. Most of our EEMEA FX recommendations were longs focused on idiosyncratic factors and with few pure longs in the most liquid currencies. Since publication, the beta backdrop has turned more bullish with the helpful adjustment (weaker) in the USD against major currencies. This has, to varying degrees, washed into EM currencies against their base currencies. We still see room for further dollar weakness and, with generally constructive positioning technicals and the return of EM fund inflows, we can see more room for gains in EEMEA FX longs. To position accordingly for this view, we recommend closing our CZK-long and moving into a PLN-long, albeit with a tail risk hedge. Elsewhere, we tweak our other EEMEA FX trade recommendations as set out in Figure 1. Below we outline the key themes that have been (and are likely to continue to be) more helpful for EEMEA currencies.

Tweaking our EEMEA FX recommendations and adding a mainstream long in the form of the zloty

Figure 1: EEMEA FX trade ideas

Recommendations published in EM Quarterly, 22 March 2011 Czech Republic Hungary Israel Kazakhstan Poland Short EUR/long CZK cash Short TRY/long HUF cash Short EUR/long ILS. Buy USD/ILS butterfly Short USD/KZT 6m NDF None Latest Close Hold Close butterfly. Hold short EUR/ long ILS Hold Short EUR/long PLN cash. Buy EUR/PLN put digital as hedge (4.08 strike, 1m, 12% cost) Hold Hold Hold short TRY / HUF. Adjust put sprd strikes (1.60, 1.70, 3m)

Romania Serbia Turkey

Source: Barclays Capital

Long 6m T-bill, FX unhedged Short EUR/long RSD NDF (6m) Short TRY/HUF. Buy USD call/TRY put sprd (1.65, 1.75, 3m)

CE currency trades in EEMEA Moving into the main stream

We close our long CZK vs EUR trade due to downside risks in the near term

In light of the above, as well as the shifts that have occurred in CEE idiosyncratic factors since publication of The Emerging Markets Quarterly, we have decided to tweak our CEE FX trades to better reflect the current themes at play. We switch from lower-beta peripheral CEE currencies into more mainstream, higher-beta CEE currencies. More specifically, we take profits on our long CZK versus EUR trade at 24.18 (we entered at 24.49). While we remain bullish the CZK in the medium run, we see limited scope for any significant appreciation over the coming months given the potential for the CNB to disappoint the

12

5 May 2011

Barclays Capital | The Emerging Markets Weekly

markets with regard to rate hikes (we look for the first hike in August of 25bp). In addition, and against this backdrop, the currencys negative carry and lower beta will further deter investors to scale up CZK exposure from these levels, we think.

Catch-up potential, IPO/privatization flows and onmarket EU transfer conversions are positive PLN in the near term

We enter into 1m tactical long PLN vs EUR cash position hedged with a digital option given Polands challenges

In place of our CZK trade we enter into a tactical long PLN versus EUR cash position (target 3.85, stop 4.00). Several factors should offer the PLN some support in the coming weeks, we think. First, there is plenty of catch-up potential when comparing PLN YTD performance versus other CEE currencies. In addition, we expect privatisation/IPO flows to pick up in Q2 relative to Q1. One transaction that stands out is the sale of Polkomtel, which could be worth up to $6.7bn and is expected to close before June (final bids are due on 6 May). This could offer PLN significant support in the near term given that four out of the five bidders are foreign private equity funds or telecoms companies that would need to exchange FX into PLN (Reuters reports). Furthermore, the announcement that the MinFin will start to regularly exchange EU related proceeds (in the range of EUR12-13bn) into local currency on the market should also increase PLN appreciation pressures, we think. That said, we continue to remain concerned about Polands medium-term challenges (fiscal risks, overall BoP health and the ongoing credibility issues of the MPC in the face of increasing inflation). These challenges, combined with the currencys high beta, will likely lead to a significant underperformance relative to other EEMEA currencies in a tail-risk event or in an environment of general risk aversion. We therefore prefer to hedge our long PLN cash trade with a call/PLN put digital option (strike 4.08, cost of 12%). As a worked example, if we assume a notional of EUR20mn on the cash side and EUR1mn on the option notional, we earn a net profit of c.EUR0.4mn in a scenario in which our 3.85 target is hit (spot profit of 0.5mn minus option cost of 0.12mn). Assuming our more bearish scenario materialises, our ITM digital option earns a net profit of c.EUR0.6mn (assuming a stop of 4.00 on the cash side). Our maximum loss occurs at our cash stop of 4.00 (c.EUR0.4mn). Elsewhere in CEE FX space we remain happy to hold our existing trades documented in The Emerging Markets Quarterly, 22 March 2011. Hungarys solid BoP numbers combined should offer further support in the near term for the HUF, we think. We continue to prefer to express our bullishness through an RV trade versus the TRY (see below). In addition, we still like our two carry trades - long RSD versus EUR 6M NDF trade (currently 10% NDF implied yield) and our long RON carry trade (via 6M T-bills FX unhedged, currently 6%). In Serbias case the likely continuation of the central banks aggressive rate hiking cycle in the context of rising inflation should be supportive of further appreciation, while for Romania, a shrinking current account deficit and the reserves buffer of a precautionary SBA should all help to exert further gradual appreciation pressure. We look for EUR/RON to reach 4.00 by year-end. Intervention risks due to competitiveness concerns remain a key risk for both our carry trades, however.

We remain happy with our relative value bullish HUF trade vs TRY

We also continue to hold our RON and RSD carry trades

Oil currency trades in EEMEA the haves and have nots

Elevated spec positioning and structural private outflows make us sceptical about RUB as an oil beta trade

The Barclays Capital view is that Brent prices will average $112 this year, which means that, with current prices at $122, the remainder of 2011 is likely to see a softening in prices. However, our commodity research colleagues warn of near-term upside risks to prices related to possible supply disruptions and investment inflows to energy instruments. From an FX perspective the most obvious implications are for the floating/managed currencies of oil producers Russia and Kazakhstan. Although RUB has been the better performer YTD and CBR is significantly more acquiescent towards currency flexibility than the National Bank of Kazakhstan, we feel more comfortable sticking with a KZT long rather than getting into RUB longs at this late stage. Speculative positioning in RUB is a challenge and structural private capital outflows from Russia remain sizeable and could unseat the rouble if oil prices were to ease back (not our baseline scenario). The KZT, by contrast, has marginally fewer

13

5 May 2011

Barclays Capital | The Emerging Markets Weekly

We stick with our long KZT trade recommendation

positioning risks and the overall BoP is in stronger shape. The relatively cheap level of the KZT versus RUB (a key trading partner currency for Kazakhstan) supports our view of a 35% annualised appreciation rate of KZT appreciation against the dollar and importantly, with low downside risks if oil prices correct. Turkey remains the most vulnerable to further oil price increases given the high level already reached on the current account balance (see Figure 2). On a 12-month rolling basis the deficit is nearly the equivalent of 7.9% of GDP and the deterioration is in contrast to the rest of EEMEA where the pull of demand for exports has offset the higher oil import bill. The size of Turkeys C/A and the reliance of financing on portfolio flows, offshore borrowing and asset repatriation flows make us nervous on TRY (see Figure 3). Granted, the positive beta backdrop will likely continue to offer up capital inflows to finance this C/A deficit, hence, our early forecasts of a sharp fall (by mid-year) in the lira seem inappropriate. But the negative tail risks on the lira remain meaningful and as a result, we wish to keep our hedged bearish trades, albeit with some slight modifications. We stick with short TRY versus HUF given the contrasting BoP health of Turkey versus Hungary. We modify our USD call/TRY put to less ambitious strikes (1.60 and 1.70 for 3m against our previous strikes of 1.65 and 1.75. The new structure has a max net payout-to-cost ratio of 5:1).

Turkeys C/A deficit and reliance on portfolio flows, offshore borrowing and asset repatriation make us nervous on the lira

We keep our short TRY vs HUF trade and adjust the strikes on our TRY put spread

What if we are wrong about these beta factors?

Peripheral Europe risks have not gone away

While our liquid cash longs may suffer in a tail-risk event our TRY/HUF and PLN digital option hedges are likely to perform

We are turning more constructive on EEMEA currencies; however, peripheral European risks are likely to continue to linger with investors periodically nervous about the possibility of deleveraging flows from the Emerging Europe banking system. In a scenario of a flare up in contagion something more akin to the experience in May 2010 than this year our CE currency cash longs (PLN, RSD and, to a lesser degree, RON) are likely to come under depreciation pressure, especially the more liquid ones, given the ease of portfolio outflows there. However, while our bullish recommendations would come under pressure and maybe stopped out, some of our hedges could do very well (TRY/HUF, given the challenging C/A financing metrics in Turkey and our PLN option digital hedge). Our short EUR/long ILS recommendation would probably do even better in this scenario. Our baseline view is that the convergence of a structural C/A surplus and an aggressive hiking cycle in Israel should be pushing ILS higher anyway against the EUR. Although the ILS has done well against the USD, it is still at competitive/cheap levels versus the EUR. A serious flare-up in peripheral European risks would probably hit EUR a lot more than ILS. Figure 3: but Turkeys deficit is still large and the source of financing in the BoP is risky

10 8 % GDP

Figure 2: Strong external demand trumps oil so far in terms of the C/A balances

10 5 0 -5 -10 2007 % GDP

6 4 2 0 -2 2008 CE Israel 2009 Russia S.Africa 2010 Turkey Net FDI Net portfolio Net other Assets & liab. Hungary

14

Turkey

SA

Source: National Statistics Offices, Barclays Capital

Source: IMF, Haver Analytics

5 May 2011

Czech R.

Poland

Russia

Israel

Barclays Capital | The Emerging Markets Weekly

STRATEGY FOCUS: SINGAPORE

Updating our SGD NEER model

Wai Ho Leong +65 6308 3292 waiho.leong@barcap.com Rahul Bajoria +65 6308 3511 rahul.bajoria@barcap.com Nick Verdi +65 6308 3093 nick.verdi@barcap.com

This is an excerpt from Singapore: Updating our SGD NEER model, 5 May 2011. We have recalibrated our SGD NEER model in light of the release of updated historical data from the MAS. We expect the SGD NEER to remain above the midpoint of the index through to year-end and now forecast USD/SGD to fall to 1.19 in 12m. Our in-house SGD NEER model has been updated following the release of the SGD NEER weekly data up to 8 April 2011 by the Monetary Authority of Singapore (MAS). The modified weights inferred econometrically from the official data are shown in Figure 1. Based on this analysis, we estimate that the SGD NEER was re-centred by 150bp, consistent with the MASs message that: The exchange rate policy band will be re-centred below the prevailing level of the SGD NEER. Our analysis suggests that the slope was left unchanged at 3.5%, maintaining the steepening from the 2.5% applied in October 2010. We also estimate that the policy band was left unchanged at +/-2.0%. After the update, we have reduced the average deviation between our NEER model and the MASs data to close to 2bp for the past six months. Refreshing our econometric analysis entails changes to some of the weights in our SGD NEER model. We estimate that the USD weight has fallen by 0.9pp to 27.9%. The largest change was the TWD weighting, which we estimate rose by 1.6pp to 4.5%. Other notable changes included the INR (-0.7pp to 0.4%), MYR (-0.4pp to 13.4%) and KRW (+0.2pp to 3.5%).

Figure 1: Updated SGD NEER model weightings largely unchanged

Versus SGD New weights USD MYR EUR CNY JPY THB IDR KRW AUD TWD GBP INR PHP 27.9% 13.4% 11.0% 9.7% 9.4% 5.6% 5.6% 3.5% 3.8% 4.5% 3.3% 0.4% 2.0% Broad 13-currency index Old 28.8% 13.8% 11.2% 9.4% 9.3% 5.5% 5.8% 3.3% 3.6% 2.9% 3.3% 1.0% 2.0% Net change (pp) -0.9 -0.4 -0.2 0.3 0.1 0.1 -0.2 0.2 0.2 1.6 0.0 -0.7 0.0

Note: 1) we use principal-components analysis to determine the weights for each currency in the SGD NEER basket. Source: Bloomberg, Barclays Capital

5 May 2011

15

Barclays Capital | The Emerging Markets Weekly

SGD to remain above the midpoint of the band

We expect upward pressure on the SGD NEER to continue

Between now and the October 2011 MAS policy meeting, we expect upward pressure on the SGD to continue with the NEER remaining above its midpoint. This is consistent with our view of generalised USD weakness through the remainder of the year. Our USD view is predicated on our expectation of no policy tightening in the US before Q3 12, in contrast to rate hikes elsewhere. In the run-up to the April MPC, we think the MAS intervened frequently in the market as the SGD NEER skirted the upper part of its band. This is supported by data on FX reserves and the forward book, with intervention heaviest in March and April, when FX reserves rose by USD16bn and USD22.7bn, respectively, to an estimated USD356.8bn (see Figures 3 and 4). We expect the SGD NEER to drift 75-100bp above the midpoint over the next three months. In 6m, we expect the NEER to trade 100-125bp above the midpoint as markets price in further currency appreciation. At the October monetary policy meeting, we expect MAS to narrow the band back to +/1.5% as it becomes increasingly confident in the pace of currency appreciation without requiring the insurance of a wider band. Based on our forecasts for other currencies and assuming that the 3.5% slope in the SGD NEER remains in place, we look for USD/SGD to drift lower to 1.19/USD in 12m, within an estimated range of 1.177-1.213. Figure 2: USD/SGD exchange rate forecasts

Spot SGD NEER Mid Implied forecast mid Implied forecast bottom Implied forecast Top Forecast

Source: Barclays Capital

USD/SGD to maintain its downward trajectory; we now expect the SGD to appreciate to 1.19/USD in 12m

1m 116.77 1.23 1.26 1.21 1.225

3m 117.46 1.23 1.25 1.20 1.215

6m 118.49 1.21 1.23 1.20 1.200

12m 120.51 1.19 1.21 1.17 1.190

116.43

Figure 3: SGD NEER likely to trade in top half of the band

120 118 116 114 112 110 108 106 104 102 Apr-07 Apr-08 Apr-09 Apr-10 Apr-11

Figure 4: Strong reserve accumulation in the near term

350 300 250 200

USDbn

118 116 114 112 110

MAS official NEER

Source: MAS, Bloomberg, Barclays Capital

Updated Barclays Broad index

108 106 104 150 102 100 100 98 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Net fwd position Foreign reserves Monthly Average SGD NEER (Index, RHS)

Source: MAS, CEIC, Barclays Capital

5 May 2011

16

Barclays Capital | The Emerging Markets Weekly

A relatively measured response from MAS in April MPC

A measured response from MAS in April policy should help to anchor inflation expectations For now, we see the balance of risks as still tilted towards inflation, albeit slightly. The recent MAS statement was interesting for two reasons. First, the re-centring suggests that the MASs assessment of inflation risks is more immediate than we had expected MAS noted in its policy statement that: "factor markets are tight, domestic cost and price pressures will remain firm". We estimate the re-centring to be about 1.5%. While MAS has acknowledged that the increase in inflation in Q1 was largely due to a sharp rise in COE premiums, this distortion will fade as base effects dissipate. It expects wage pressures to build up amid a tight labour market, and the pass-through into services costs and core could intensify in the months ahead. For the whole year, the MAS continues to expect inflation to be in the upper half of its 3-4% forecast range and core inflation to be 2-3%. Second, the re-centring to a level below the prevailing level of the midpoint was an unprecedented step. We believe this reflects a greater sense of caution over the tail risks to growth and a desire to avoid excessive strength in the SGD. Even as the government has expressed greater comfort with the present path of growth, we believe this reflects the robust expansion in Q1. A factor of comfort was the stronger performance of Q1 GDP which grew 23.5% at an annualised q/q pace (up from 3.9% in Q4 last year). We think this likely contributed to the central bank's expectation that momentum will remain strong in the coming quarters, even as headline readings moderate. We see a possible contraction in output in Q2, on a likely downside surprise in pharmaceutical output. The abnormally high base in the pharmaceutical IP index over Q2 10 is likely to depress headline IP this year.

A re-centring below the prevailing level reflects caution over tail risks to growth

Figure 5: Pass-through into services costs accelerating

8% 6% 4% 2% 0% -2% Mar-08

Figure 6: Core price pressures rising

8 6 4 2 0 -2 Mar-05 10 8 6 4 2 0 -2 -4 Mar-11

Mar-09

Mar-10 Transport

Mar-11 Food

Domestic oriented services

Source: CEIC, Barclays Capital

Mar-07 Mar-09 Core inflation (% y/y Core inflation (% 3m/3m, saar, RHS)

Source: CEIC, Barclays Capital

5 May 2011

17

Barclays Capital | The Emerging Markets Weekly

STRATEGY FOCUS: CHILE

Fine-tuning our monetary policy call

This is an excerpt from Chile: Fine-tuning our monetary policy call, 4 May 2011.

Jimena Zuniga +1 212 412 5361 jimena.zuniga@barcap.com Recent communication points to a more dovish stance

Marginally more dovish communication from Chiles policymakers leads us to now expect the central bank to deliver a 25bp hike on 12 May (previously 50bp) and pencil in a pause at 5.0% (previously a steady normalization to 5.5%). In the past few days, communication from fiscal and monetary authorities has been turning marginally away from the free-floating, inflation-focused tone prevailing since early February. Last week, Minister of Finance Felipe Larrain said the government was not going to sit idly by during FX appreciation. This morning, the Central Bank Chief Economist Luis Herrera said lower global rates may push down neutral Latin rates. This followed minutes from the 12 April monetary policy meeting, published on 28 April, that carried a relatively more dovish tone, in our view. We think that with the Chilean peso having appreciated significantly and after 125bp of progress in the normalization process, the sense of urgency inspiring monetary policy decisions since February has seemingly begun to fade. Concerns about FX strength, in turn, appear to have ticked up. In the most recent minutes, one board member said it was evident that, as the normalization proceeded, the remaining required adjustments of the policy rate would be lower. The minutes also concluded with the notion that the neutral policy rate (estimated to be 5.1-6.5% for Chile) reflected a condition of internal equilibrium but could imply an external disequilibrium when international rates were not near their neutral levels. This notion alludes to the paradigm outlined last year (Chile: All Doves Day, 2 November 2010), which was eventually followed by the announcement of an FX-intervention package and a pause in the tightening cycle in January. Although we suspect the central bank will take care to avoid the sort of market punishment endured after its intervention-pause combo, its most recent language suggests a less aggressive normalization pace in the near term and possibly a terminal rate on the lower end of the range considered neutral. Accordingly, we now expect the central bank to deliver a 25bp hike on 12 May instead of the 50bp we expected previously. Moreover, we now pencil in a pause at 5.0% instead of the steady normalization to 5.5% we expected before. Although we think the central bank will eventually bring the policy rate more clearly within its neutral range (we pencil in finetuning 25bp hikes in September and December), this updated near-term outlook suggests some tactical value in the very front end of the curve. In contrast, it caps the upside potential of our recommendation to sell 5y breakeven inflation, which we had based on the decisiveness of the central bank to control inflation (Chile: Dont stop believin, 8 March 2011); we recommend investors reduce or take profits on the position.

showing less sense of urgency on the inflation front and higher FX concerns

This resembles the situation in late 2010

leading us to expect a less aggressive monetary policy path

Would less urgency be justified?

We assess Chiles stance against a Taylor rule

Following the methodology outlined in Mexico: Taylor (does not) rule, 28 April 2011, we assess the current monetary policy stance against the prescriptions of a Taylor rule. As a reminder, in that report we estimated a Taylor rule equation using actual inflation in one specification and expected inflation in another. Here we consider a third specification incorporating FX changes. Figure 1 shows the results of the estimated parameters.

5 May 2011

18

Barclays Capital | The Emerging Markets Weekly

The main messages of these results are the following: 1. A Taylor rule provides a pretty good fit for the policy rate in Chile. As recommended by the Taylor rule, the central bank is responsive to both the output gap and deviations of inflation from the target. 2. The central bank is forward looking, responding more to deviations in inflation expectations from the target than to deviations of actual inflation from the target. 3. The central bank is about as responsive to the output gap and to deviations in inflation expectations from the target as a Taylor rule recommends. 4. The central bank is somewhat responsive to FX changes, though adding FX changes to the expectations-based specification does not increase the explanatory power of the regressor group significantly. 5. The implied value for the neutral policy rate in Chile seems too low, highlighting that even if the central bank has been about as responsive to the Taylor rule inputs as the rule would indicate, it has not necessarily been as hawkish.

Figure 1: Taylor rule estimates for Chile

Specification 1: Using actual inflation Variables Real rate + target Output gap Inflation gap FX ann. change (lagged) Adjusted R2 Observations Coef. 3.49 0.27 0.55 --0.81 99 p value 0.000 0.000 0.000 --Specification 2: Using inflation expected in 12 mth Coef. 3.42 0.40 1.54 --0.69 100 p value 0.000 0.000 0.000 --Specification 3: Using expected inflation and FX Coef. 3.63 0.47 1.38 0.05 0.76 100 p value 0.000 0.000 0.000 0.000

Note: Sample period: January 2003-present. Source: Barclays Capital

Figure 2: Policy rate versus Taylor implied (using the parameters estimated for Chile)

10 8 6 4 2 0 -2 Jan-03 Jul-04 Jan-06 Policy rate Taylor-implied** Jul-07 Jan-09 Jul-10 Taylor-implied* Taylor-implied*** 5.0 4.6 4.5 3.6 %

Figure 3: Policy rate versus Taylor implied (using Taylors recommended parameters)

12 10 8 6 4 2 0 Jan-03 5.5 5.2 4.5 %

Jul-04

Jan-06

Jul-07

Jan-09

Jul-10

Policy rate

Taylor-implied*

Taylor-implied**

Note: *using actual inflation; **using expected inflation; ***using expected inflation and FX changes. Source: Barclays Capital

Note: We assume a conservative neutral real rate of 2%; *using actual inflation; **using expected inflation. Source: Barclays Capital

5 May 2011

19

Barclays Capital | The Emerging Markets Weekly

Figure 4: BCCh could justify a relatively low terminal rate

6 5 4 3 2 1 0 -1 Jan-10 Based on BarCap forecasts 4.50 % 5.2 5.2

Figure 5: Taylor inputs

5% 3% 1% -1% -3% -5% Jan-03 % BarCap forecasts 11 9 7 5 3 1 -1 -3

May-10

Sep-10

Jan-11

May-11

Sep-11

-5 Jul-04 Jan-06 Output gap Jul-07 Jan-09 Jul-10

Policy rate Taylor-implied***

Taylor-implied**

Inflation, R HS

Note: Based on Chiles estimated parameters; **using expected inflation; ***using expected inflation and FX changes. Source: Barclays Capital

Source: Haver Analytics, Barclays Capital

Measured against a Taylor rule, the policy stance seems adequate to a little dovish

The results also indicate that, at 4.5%, the policy rate is broadly in line with what a Taylor rule would indicate, at least when relying on the parameters estimated for the Chilean economy (Figure 2), if not the ones recommended by Taylor (Figure 3). In particular, the current monetary policy stance seems a little dovish relative to the prescriptions of an expectations-based Taylor rule, yet adequate relative to the prescriptions of an FXaugmented rule. By contrast, just after the central banks January pause, the policy stance seemed to unambiguously lag what a Taylor rule recommended. This supports our view that the central banks sense of urgency vis vis the normalization of the policy stance has probably diminished. Interestingly, incorporating our real GDP growth forecast for this year (6.4%), our neutral view on the USD/CLP at 460, and assuming no further deterioration in inflation expectations, the Taylor-implied policy rate would not increase tremendously in the coming months (Figure 4.) This suggests that, even though we view our revised monetary policy path as potentially risky for the inflation outlook, such a path would be defensible.

and suggests our revised monetary policy path, while potentially risky, could be defensible

5 May 2011

20

Barclays Capital | The Emerging Markets Weekly

EM DASHBOARD

George Christou Alanna Gregory +44 (0)20 777 31472 212 412 5938 george.christou@barcap.com alanna.gregory@barcap.com

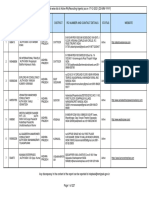

P&L to target/ P&L to stop Analyst 2.4 1.75 0.34 0.56 0.43 2.08 0.59 1.88 6.5 2.33 0.33 0.56 0.23 8.6 0.14 1.67 14.63 11.12 1.68 0.71 0.89 1.83 0.14 2.2 2 0.67 1 3.29 0.75 1.15 0.15 4 0.29 1.5 0.67 0.9 1.42 0.58 1.14 05-May-11 05-May-11 05-May-11 05-May-11 04-May-11 04-May-11 02-May-11 28-Apr-11 28-Apr-11 Hegde, Save Arreaza, Cruz, Grisanti, Guarino Guarino, Zuniga Kolbe Kolbe, Hewitt Kolbe, Moubayed Guarino Guarino Kolbe, Markus Kolbe Melzi, Guarino Kolbe Guarino, Mondino Chow Chow Chow Verdi Verdi Verdi Verdi Verdi Loureiro, Melzi, Salomon Verdi Chow, Chwiejczak Chow Chow Chow Chow Melzi,Grisanti Markus Rachapudi Chwiejczak Rachapudi Chwiejczak Chwiejczak Rachapudi Melzi Melzi Chwiejczak Chow Chow Cruz, Grisanti, Guarino, Arreaza Guarino Melzi,Zuniga Chow Verdi Melzi Melzi, Zuniga

Description Credit (13) Buy Philippines 5 Yr CDS Long PDVSA 17 New Sell Brazil Buy Mexico 10yr CDS Hungary 2s7s CDS steepener (DV01-neutral) Buy Poland 5y CDS vs CEEMEA SovX index Buy Tunisia 5y CDS/Sell Morocco 5y CDS Long Boden 15 Long Boden 15 Buy 5yr CDS Long Ghana 17s Buy Russia 5y CDS Buy Peru 5yr CDS Sell Brazil 5yr CDS Long Ukraine 13s Long Argentina EUR Warrant FX (17) Buy 1M EUR call/PLN put digital (strike 4.08) Buy 3M USD call/TRY put spread (1.60, 1.70) Sell EUR/PLN Buy 1m one-touch USD/INR option with a trigger at Buy 2m USD/IDR calls with an 8950/USD strike Buy 1x1.5 USD/TWD put spread (strikes 28.85 and 28 Sell 9m CNY NDF Buy USD/MYR put spread (strikes 3.0237 (ATM) and 2 Sell USD/BRL Buy SGD vs EUR(60%)-USD(40%) basket Long RON via 6M Tbills FX unhedged Sell EUR/ILS Sell EUR/RSD 6M NDF sell TRY/HUF Sell USD/KZT 6M NDF Long USD/PEN Long Ghana 3y bond (FX unhedged) Rates (9) Indonesia 5x20 flattener CZK 2s10s IRS dv01 flattener Pay 1y KRW IRS Pay TRY CCS 1y1y FWD Receive ZAR 1y1y fwd Pay 1y INR OIS Long Jul20 local TES Receive Jan15 Pre-Di Pay 5y PLN IRS Closed Trades (9) Buy USD put/ILS call Bfly (3.70,3.60,3.55 strikes) Buy USD/TRY put spread (1.60, 1.70 strikes) Long PDVSA 14 Sell 10yr Brazil Basis (BR2021 vs 10yr CDS) Sell 5y BEI Chile Sell EUR/CZK Buy 3m atmf USD/KRW put with RKO at 1070 Pay 1y1y Fwd TIIE Short USD/CLP

Entry date 28-Apr-11 28-Apr-11 04-Apr-11 28-Mar-11 22-Mar-11 22-Mar-11 22-Mar-11 22-Mar-11 22-Mar-11 16-Mar-11 04-Mar-11 07-Dec-10 06-Jun-10 04-May-11 04-May-11 04-May-11 28-Apr-11 28-Apr-11 26-Apr-11 26-Apr-11 11-Apr-11 07-Apr-11 22-Mar-11 22-Mar-11 22-Mar-11 22-Mar-11 22-Mar-11 22-Mar-11 18-Mar-11 07-Dec-10

Entry 128bp 72 15bp 68bp 60bp 5bp 700bp 110bp 427bp 138bp -5bp 525bp 6.05 3.95 1.55 3.95 9% 0.42% 0.14% 6.37% 0.22% 1.6 100 4.16 5.01 103 121 146 2.78 13%

Current Target 128bp 71 3.8bp 91bp 42bp -4bp 673.9bp 88.8bp 365bp 128bp 37.9bp 336bp 14 1.54 3.95 6.4% 0.33% 0.41% 6.35% 1.27% 1.61 101.4 4.11 5 99 117 145.6 2.82 12.4% 191bp 110bp 3.79% 8.4% 7.4% 7.81% 8.19% 12.62% 5.61% 3.4 1.54 75.08 17.8bp 3.53% 24.2 0.25% 6.22% 460.82 140bp 78 -5bp 100bp 30bp 50bp 600bp 30bp 300bp 170bp 100bp 300bp 16 4.08 1.75 3.85 100% 4% 1.1% 6.25% 2.4% 1.5 101.8 4 4.8 95 107 141 2.85 9%

Stop 123bp 67 30bp 75bp 70bp -30bp 800bp 120bp 375bp 110bp 26bp 400bp 9 4 0% 0% 0% 6.5% 0% 1.67 98.5 4.16 5.1 105 127 147 2.78 16%

14-Apr-11 235bp 22-Mar-11 105bp 22-Mar-11 3.68% 22-Mar-11 8.34% 22-Mar-11 7.6% 20-Mar-11 7.4% 18-Mar-11 8.15% 18-Mar-11 12.79% 07-Dec-10 5.4% 22-Mar-11 3.53 21-Apr-11 1.52 14-Mar-11 70 16-Feb-11 45bp 08-Mar-11 3.88% 22-Mar-11 24.49 22-Mar-11 0.75% 18-Mar-11 6.54% 18-Mar-11 481.35

180bp 265bp 70bp 120bp 3.85% 3.58% 9% 8% 7% 8% 8% 7.6% 7.75% 8.5% 12.2% 13.35% 5.85% 5.4% 80 25bp 3.35% 23.9 5.39% 6.9% 460 65 55bp 4% 24.6 0% 6.2% 487

Note: As of 04-05 May 2011 (trades are updated regionally). Methodology: P&L to target/P&L to stop is a measure of how much can be gained relative to how much can be lost. Both are calculated from the current value and reported in dollars. This measure does not take probabilities into account. Source: Barclays Capital

5 May 2011

21

Barclays Capital | The Emerging Markets Weekly

FX VIEWS ON A PAGE

Currency Tactical bias Strategic directional view Current strategy/ trades we like Vol adj 6m returns Score (1-5)

Emerging Asia MYR Bullish Stronger growth, rising commodity prices, a healthy fiscal position, and improved equity flows should lend support to the currency. We expect the THBs recent underperformance to reverse. A robust economy and a strong external position are likely to support modest THB appreciation. We believe still-sizeable current account surpluses and a preference to contain imported inflationary pressures will see USD/KRW move towards 1025 by year-end. We expect the USD/CNY to move lower as the authorities react to elevated inflation. We have slightly lowered our BoP surplus forecast. In addition, the central bank likely believes the REER is close to fair value. We expect a modest move lower in USD/PHP towards 41.5 by year-end. The INR remains fairly well supported near term in the context of wider currency appreciation in the region, despite medium-term issues related to weak BoP dynamics. Increasing CNY deposits onshore may result in the RMB-isation of the economy. The MASs concern relating to near-term inflation pressures is likely to support the SGD NEER. USD/TWD has moved sharply lower in recent weeks. We think the currency will drift towards the 28.5/USD level over the next 1m. A shrinking current account surplus and high valuation on a REER basis point to IDR underperformance. Buy USD-EUR basket (60%40%) versus SGD outright Buy 1x1.5 USD/TWD put spread (strikes 28.85 and 28.45) and sell a USD call/TWD put (strike 29.5) Buy 2m USD/IDR calls with an 8950/USD strike Buy 1m one-touch USD/INR option with a trigger at 42.85/USD Sell 9m CNY NDF Buy 3m USD/MYR put spread with strikes 3.0237 (ATM) and 2.94 and sell 3m USD/MYR calls (strike: 3.07)

0.41

4.10

THB

Bullish

0.32

3.90

KRW

Bullish

0.29

3.55

CNY PHP

Bullish Bullish

0.19

3.35

0.24

3.20

INR

Bullish

0.14

3.15

HKD SGD TWD

Neutral Bullish Bullish

-0.06 0.14

3.00 2.80

-0.08

2.60

IDR

Bearish

-0.08

2.35

Latin America PEN Bearish Politically related volatility is likely to continue during the next few weeks. The final outcome of elections is still unclear. We target 1.50 in 3m as fundamentals are supportive and the government acknowledges limitations of FX intervention. Supportive fundamentals: strong domestic demand, hawkish monetary policy and bright outlook for copper prices. Government has increased FX intervention rhetoric. Improving domestic demand and US activity are supportive, but it is hard to see a shift lower in USD/MXN unless Banxico signals a more aggressive monetary policy stance than what is priced in. Positioning is overextended, in our opinion. Supportive fundamentals (oil prices and monetary policy normalization), but FX intervention limits downside for USD/COP. Buy 1m USD/PEN NDF 0.19 Sell USD/BRL 0.42 3.35 3.60

BRL

Bullish

CLP

Neutral

0.23

3.10

MXN

Neutral

0.12

2.50

COP

Neutral

0.10

2.05

5 May 2011

22

Barclays Capital | The Emerging Markets Weekly

Currency

Tactical bias

Strategic directional view

Current strategy/ trades we like

Vol adj 6m returns

Score (1-5)

Emerging EMEA RON* Bullish Improving C/A deficit plus prospects of further FX sale argue for, at worse, a stable RON. However, yields have, fallen due to capital inflows. Less uncertainty about the transition process may limit capital flight, but the challenge facing the economy leaves no room for a stronger EGP. M/t challenges remain in the Polish BoP but near-term technical positives (sale of EUR by the ministry of finance and privatisation flows) can trigger near-term zloty gains A C/A surplus and a credible central bank stance continue to offset investor uncertainty on fiscal policy. Potential asset repatriation flows and the resumption of euro-linked lending are positive flows risks. The terminal level for policy rates in the Israel hiking cycle has likely risen. This, together with a structurally robust Israeli BoP, should keep investors engaged in long ILS. Historically low nominal yields are likely to feed the already-large C/A deficit, making external funding harder as well. We expect a difficult Q2, with relief likely only towards year-end after a policy adjustment. The solid macro balances and tightening rate cycle should eventually push CZK higher. But with rising risk appetite, other higher beta currencies are likely to outperform Oil windfall is likely to keep the RUB well bid. However, structural capital outflows and the election cycle argue for more challenging times later this year. High commodity prices and a likely return of some portfolio flows on high real/nominal yields should provide enough capital inflows to fund the (modest) C/A deficit. Depressed yields leave the UAH more exposed, particularly as the best of the capital inflows/ de-dollarisation process are behind us. Kazakhstan benefits hugely from high oil prices, and the central bank has said it expects some appreciation, suggesting continued managed appreciation. Sell USD/buy KZT through 6m NDF Short EUR/PLN, Buy as a tailrisk hedge, 1m 4.08 digitial Sell TRY/HUF 0.16 3.05 Buy 6m T-bills (6.7% indicative yield) FX unhedged 0.32 3.80

EGP

Neutral

0.60

3.55

PLN*

Bullish

0.29

3.15

HUF*

Bullish

ILS

Bullish

Short EUR/ILS 0.13 Buy USD call/TRY put spread, 3m, 1.60-1.70 strikes, sell TRY/HUF 2.65

TRY

Bearish

-0.18

2.40

CZK*

Neutral

0.12

2.20

RUB

Bullish

-0.08

2.05

ZAR

Neutral

-0.17

1.70

UAH

Neutral

KZT

Bullish

Note: * Versus EUR. The variable score is an index that ranks EM currencies according to the vol-adjusted returns, PPP valuation, carry, systemic risk, basic balance/GDP and reserves accumulated over the past 5y/GDP. For more details on the trade recommendations, please see the EM Dashboard. Source: Barclays Capital

5 May 2011

23

Barclays Capital | The Emerging Markets Weekly

EM CREDIT PORTFOLIO

OAS (bp) 31-Dec-10 EM Portfolio Arg, Ven, Ukr Other EM Asia Philippines Indonesia Vietnam Pakistan Sri Lanka EEMEA Turkey Russia Lebanon South Africa Ukraine Hungary Lithuania Bulgaria Egypt Croatia Tunisia Qatar Abu Dhabi Latin America Brazil Mexico Venezuela Argentina Colombia Peru Panama Uruguay El Salvador Dominican Republic 271 752 192 175 139 166 359 727 304 243 168 197 303 152 444 416 259 221 197 311 170 152 130 327 136 146 1065 571 169 162 158 173 303 372 4-May-11 257 734 179 186 154 177 319 739 308 220 177 190 357 148 397 270 195 174 324 255 294 138 126 313 114 129 1012 598 130 187 151 162 326 395 3mF 238 651 170 179 150 165 300 750 300 214 170 170 360 135 360 280 190 190 375 300 300 125 130 278 100 110 900 525 125 160 145 120 390 350 OAD 6.9 6.3 6.9 7.3 8.0 7.1 5.4 4.3 4.6 5.9 6.8 6.1 3.8 5.9 4.8 5.5 4.7 2.4 8.4 5.9 5.5 6.4 3.8 7.6 7.2 7.7 5.4 7.9 7.4 10.3 9.1 10.0 8.4 5.1 Bench 100 14 86 14 7.3 5.8 0.5 0.3 0.5 41 12.8 9.3 2.1 2.7 2.4 5.5 2.6 0.7 0.4 1.6 0.7 0.0 0.0 45 12.1 10.1 5.8 5.9 3.2 2.5 2.2 1.5 1.0 0.4 Weights (%) Model 100 22 78 13 3.5 7.0 1.0 0.3 1.1 39 12.3 9.0 1.0 3.3 3.2 5.3 2.8 0.7 0.1 0.5 0.1 0.5 0.0 48 11.1 8.3 10.7 8.0 2.5 2.1 1.4 1.6 0.5 1.8 over under under under over over neutral over under neutral neutral under over over neutral neutral neutral under under under over neutral over under under over over under under under neutral under over Returns (%) 2011 2011 QTD YTD 1w 1.2 1.4 1.2 1.3 1.4 1.5 0.1 1.5 0.5 1.1 1.1 0.6 0.7 1.2 0.9 1.7 1.5 1.1 0.5 1.5 1.4 0.9 0.3 1.3 1.0 0.9 1.6 1.5 1.1 4.6 0.8 0.2 0.2 0.1 2.4 2.5 2.4 2.2 1.8 2.4 2.4 7.4 2.9 2.9 3.5 0.9 1.9 2.3 2.2 5.3 4.3 3.1 0.0 4.0 3.5 2.7 1.2 2.0 2.0 2.0 2.7 2.4 2.5 -0.1 1.3 2.0 1.3 2.8 4.3 5.8 4.1 1.9 1.6 2.0 5.3 3.7 2.1 5.5 3.3 3.0 1.1 4.3 5.9 15.3 9.5 6.9 -7.8 8.3 1.2 2.4 1.7 4.1 3.5 4.4 7.4 4.3 4.7 0.0 2.9 3.8 1.0 2.1 Bonds we recommend 3mF* 1.4 7.0 0.5 0.5 0.1 1.0 0.7 2.0 0.7 0.4 0.4 0.8 0.5 0.9 2.5 0.2 0.1 0.1 -4.7 -2.0 -0.8 0.9 -0.2 2.7 0.7 0.8 9.0 6.9 0.0 5.6 -0.4 2.4 -6.2 2.3 Buying Selling

RoP 14s, 15s, 16s Indo 20s Vietnam 20s Sri Lanka 12, 15s Turkey 25s Russia 28s Turkey 21s Russia 15, 20s SoAf EUR13s, 14s EUR16s Hungary 20s