Académique Documents

Professionnel Documents

Culture Documents

Section A (20 Marks)

Transféré par

Taha NasirDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Section A (20 Marks)

Transféré par

Taha NasirDroits d'auteur :

Formats disponibles

GAB 1013 / SAB 1013 SECTION A [20 Marks] Answer ALL questions. 1.

In the charts of accounts, assets accounts generally begin with the digit ___________ and liabilities with a ___________. A. B. C. D. 2. 1, 2 2, 3 3, 4 4, 5

What is the meaning of fraud? A. B. C. D. Separation of duties Transactions that make up net income Assessment of financial statements to determine if they are fairly determined. Deceit or trickery that causes financial harm to a business or its stakeholders.

3.

Three factors must be present in a fraud triangle EXCEPT ____________. A. B. C. D. perceived pressure perceived risk perceived opportunity rationalization

GAB 1013 / SAB 1013 4. Misappropriation or theft of business assets is a type of ____________. A. B. C. D. 5. employee embezzlement management fraud financial fraud reporting fraud

Which of the following is NOT a purpose of preparing the statement of cash flow? A. B. C. D. To predict future cash flows To evaluate management decisions To predict ability to pay debts and to pay dividends To compute net profit or net loss Which of the following is NOT one of the types of business activities in the statement of cash flow? A. B. C. D. Operating Investing Financing Reporting

6.

7.

Purchase of equity investments will be reported in the _______________ activities section in the statement of cash flow. A. B. C. D. operating investing financing reporting

GAB 1013 / SAB 1013 8. Transactions that increase and decrease long-term assets refer to ______________ activities. A. B. C. D. 9. operating reporting investing manufacturing Financial statement analysis is generally based on the following comparative financial data EXCEPT _____________. A. B. C. D. 10. A. B. C. D. 11. A. users. B. C. information. Management accounting help investors and creditors make investment and credit decisions. Management accounting focuses on future with different items in the financial statements from one year to the next with another company with the industry Current ratio = _____________. Current assets / Current liabilities Total assets / Total liabilities Current liabilities / Current assets Total liabilities / Total assets Which of the following statements is TRUE? Financial accounting report is prepared for internal

GAB 1013 / SAB 1013 D. CPAs. 12. A. B. C. D. 13. All costs in a service company are ______________ costs. period perpetual product periodic Management reports are audited by independent

All other manufacturing costs other than direct materials and direct labor refer to ___________costs. A. B. C. D. marketing operating manufacturing overhead indirect materials Gross profit minus operating expenses equals ____________. A. B. C. D. operating income cost of goods available for sale cost of goods sold cost of goods manufactured The following are examples of indirect materials used in manufacturing a chair EXCEPT _____________. A. B. C. glue nails bolts

14.

15.

GAB 1013 / SAB 1013 D. woods

16.

How do variable costs behave? A. volume. B. C. D. volume. They remain constant for a given time period despite fluctuations in volume. They have both fixed and variable components. They change indirectly in proportion to changes in They change directly in proportion to changes in

17. A. B. C. D. 18.

As activity increases, variable costs per unit ___________________. also increase decrease do not change None of the above

Building rent is an example of _____________ cost. A. B. C. D. fixed variable mixed perpetual

19.

How costs change in response to changes in a cost driver refers to cost ____________. A. attitude

GAB 1013 / SAB 1013 B. C. D. behavior pool driver

20.

Contribution

margin

ratio

Contribution

margin

divides

by

______________. A. B. C. D. Operating income Sales revenue Fixed costs Variable costs

GAB 1013 / SAB 1013

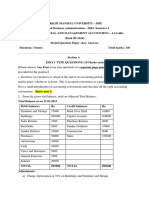

SECTION B [80 marks] Answer ALL questions 1. Fern Company has the following comparative financial statements: FERN COMPANY Comparative Income Statements For Years Ended December 31, 2008 and 2007(in RM) 2008 Sales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income taxes Net income 444,000 267,288 176,712 62,694 40,137 102,831 73,881 13,764 60,117 2007 340,000 212,500 127,500 46,920 29,920 76,840 50,660 10,370 40,290

GAB 1013 / SAB 1013

FERN COMPANY Balance Sheet For Years Ended December 31, 2008 (in RM) 2008 Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other contributed capital Retained earnings Total liabilities and equity Prepare the following: a. Horizontal analysis for the income statement. [10 marks] b. Vertical analysis for the balance sheet for both years. [10 marks] 20,200 72,000 9,000 37,280 138,480 19,960 72,000 9,000 33,464 134,424 48,480 0 90,000 138,480 37,924 500 96,000 134,424 2007

GAB 1013 / SAB 1013

2.

a. What is the difference between the accrual basis and the cash basis of accounting? [4 marks] b. Give ONE (1) example of accrued revenue. [1 mark] c. For each of the following separate cases, prepare adjusting entries required for preparation of financial statements for the year ended December 31, 2008. i. Wages of RM10,000 are earned by workers but not paid as of December 31, 2008. [3 marks] ii. Depreciation on the companys equipment for 2008 is RM20,000. [3 marks] iii. The Office Supplies account had a RM500 debit balance on December 31, 2007. During 2008, RM5,000 of office supplies was purchased. A physical count of supplies at December 31, 2008 shows RM1,000 of supplies available. [3 marks] iv. An analysis of the insurance policies in effect on December 31 shows that RM300 of insurance coverage had expired.

10

GAB 1013 / SAB 1013 [3 marks] v. The total amount of accrued interest expense at year-end is RM1,000. [3 marks] 3. a. Give TWO (2) examples of investing activities and TWO (2) of operating activities on the statement of cash flows. [4 marks] b. Use the following information to prepare a statement of cash flow (direct method) for Pine Company for 2008: Cash paid for merchandise inventory Cash paid to purchase machinery Cash paid for interest Cash paid for operating expense Cash proceeds from sale of land Cash received for interest Cash balance at the beginning of the year Cash balance at the end of the year Cash dividends paid Cash borrowed on a short-term note Cash received from stock issuance Cash collections from customers RM 100,000 150,000 5,000 200,000 200,000 10,000 15,000 50,000 24,000 25,000 50,000 500,000 [16 marks]

11

GAB 1013 / SAB 1013

4.

a. Management

accountability

is

the

managers

responsibility to the various stakeholders of the company. List FIVE (5) stakeholders of a company. [5 marks] b. There are six differences between management accounting and financial accounting. Discuss any FIVE (5) of them. [10 marks] c. In manufacturing companies, materials can be classified into direct and indirect materials. State THREE (3) examples of direct materials and TWO (2) examples of indirect materials. [5 marks]

-END OF PAPER-

12

Vous aimerez peut-être aussi

- MB0041 MQP Answer KeysDocument21 pagesMB0041 MQP Answer Keysajeet100% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Tutorial 4Document6 pagesTutorial 4Amirul Noris0% (1)

- 0452 s10 QP 11Document16 pages0452 s10 QP 11ATEF0% (1)

- Assignment 14 Ok TDocument10 pagesAssignment 14 Ok TJu RaizahPas encore d'évaluation

- AC 201 UE 2010 - 11 With SolutionDocument12 pagesAC 201 UE 2010 - 11 With Solutionrashidmdumuka0Pas encore d'évaluation

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoPas encore d'évaluation

- Afin 210 Assignment PDFDocument8 pagesAfin 210 Assignment PDFGeorge MandaPas encore d'évaluation

- Accounting Quiz YP 51 BDocument4 pagesAccounting Quiz YP 51 Bnicasavio2725Pas encore d'évaluation

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- FND - Pilot Question & AnswerDocument118 pagesFND - Pilot Question & AnswerSunday OluwolePas encore d'évaluation

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDocument18 pagesCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelsagarnitishpirtheePas encore d'évaluation

- Gls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking CompaniesDocument11 pagesGls University Faculty of Commerce Sub: Advanced Corporate Account - 2 Objective Questions (17-18) Unit:-Accounts of Banking Companiessumathi psgcas0% (1)

- Chapter 4Document52 pagesChapter 4XI MIPA 1 BILLY SURYAJAYAPas encore d'évaluation

- 9706 Y16 SP 2Document18 pages9706 Y16 SP 2Wi Mae RiPas encore d'évaluation

- 0452 s14 QP 11Document20 pages0452 s14 QP 11ATEFPas encore d'évaluation

- FSA1Document16 pagesFSA1sanucwa6932Pas encore d'évaluation

- 9706 s21 in 33-Pages-2Document4 pages9706 s21 in 33-Pages-2KaashifPas encore d'évaluation

- Kumpulan Kuis AKM 3 UASDocument12 pagesKumpulan Kuis AKM 3 UASAlya Sufi IkrimaPas encore d'évaluation

- 9706 s16 QP 22 PDFDocument16 pages9706 s16 QP 22 PDFFarrukhsgPas encore d'évaluation

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonPas encore d'évaluation

- CH 4 - Intermediate Accounting Test BankDocument51 pagesCH 4 - Intermediate Accounting Test BankCorliss Ko100% (11)

- 0452 s11 QP 13Document16 pages0452 s11 QP 13Athul TomyPas encore d'évaluation

- Accounting For ManagersDocument14 pagesAccounting For ManagersKabo Lucas67% (3)

- MC Questions CH 24-1Document19 pagesMC Questions CH 24-1lynn_mach_1Pas encore d'évaluation

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenPas encore d'évaluation

- ComprehensiveexamDocument14 pagesComprehensiveexamLeah BakerPas encore d'évaluation

- MCQ in Bca-Accounting & CobolDocument20 pagesMCQ in Bca-Accounting & CobolSagar KansalPas encore d'évaluation

- A142 - BKAL1013 - Tut 5 - CH 6 7Document8 pagesA142 - BKAL1013 - Tut 5 - CH 6 7Thavanniswaran VijayakumarPas encore d'évaluation

- A162 Tutorial 4Document6 pagesA162 Tutorial 4Danny SeePas encore d'évaluation

- A161 Tutorial 4 - Annual Report Fin AnalysisDocument10 pagesA161 Tutorial 4 - Annual Report Fin AnalysisAmeer Al-asyraf MuhamadPas encore d'évaluation

- Accounting For Managers Sample PaperDocument10 pagesAccounting For Managers Sample Paperghogharivipul0% (1)

- IandF CT2 201709 Exam 0Document8 pagesIandF CT2 201709 Exam 0Dhruvi SharmaPas encore d'évaluation

- Conceptual FrameworkDocument65 pagesConceptual FrameworkKatKat OlartePas encore d'évaluation

- At 7Document7 pagesAt 7Joshua GibsonPas encore d'évaluation

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghPas encore d'évaluation

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Income Statement and Related Information: Chapter Learning ObjectivesDocument53 pagesIncome Statement and Related Information: Chapter Learning Objectivesheyhey100% (1)

- 0452 w13 QP 11Document20 pages0452 w13 QP 11Naðooshii AbdallahPas encore d'évaluation

- 0452 w11 QP 13Document16 pages0452 w11 QP 13Faisal RaoPas encore d'évaluation

- Real Estate Principles A Value Approach 3Rd Edition Ling Test Bank Full Chapter PDFDocument36 pagesReal Estate Principles A Value Approach 3Rd Edition Ling Test Bank Full Chapter PDFoctogamyveerbxtl100% (7)

- Real Estate Principles A Value Approach 3rd Edition Ling Test BankDocument15 pagesReal Estate Principles A Value Approach 3rd Edition Ling Test Bankkietermintrudegjd100% (29)

- Cash Flow StatementDocument5 pagesCash Flow StatementSai Phanindra Kumar MuddamPas encore d'évaluation

- Income Statement and Related Information: Chapter Learning ObjectivesDocument52 pagesIncome Statement and Related Information: Chapter Learning ObjectivesIvern BautistaPas encore d'évaluation

- MACTG01 Prelim ExaminationDocument3 pagesMACTG01 Prelim ExaminationBliPas encore d'évaluation

- Chap 4Document52 pagesChap 4Ella Mae LayarPas encore d'évaluation

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (B)Document10 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (B)ahmedPas encore d'évaluation

- ch03 Part1Document6 pagesch03 Part1Sergio HoffmanPas encore d'évaluation

- Documents - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFDocument96 pagesDocuments - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFSatyabrataNayak100% (1)

- Commerce and Accountancy Mcqs-3: Ans. (B) ExplanationDocument4 pagesCommerce and Accountancy Mcqs-3: Ans. (B) ExplanationGaurav Chandra DasPas encore d'évaluation

- Advanced AccountingDocument13 pagesAdvanced AccountingprateekfreezerPas encore d'évaluation

- Institute and Faculty of Actuaries: Subject CT2 - Finance and Financial Reporting Core TechnicalDocument34 pagesInstitute and Faculty of Actuaries: Subject CT2 - Finance and Financial Reporting Core TechnicalSarthak GargPas encore d'évaluation

- ACYFAR1 CE On PAS1 (IAS1) Presentation of FSDocument4 pagesACYFAR1 CE On PAS1 (IAS1) Presentation of FSElle KongPas encore d'évaluation

- Chapter 1 Test QuestionsDocument3 pagesChapter 1 Test QuestionsRocel NavajaPas encore d'évaluation

- Chapter 03 Brief ThirdDocument11 pagesChapter 03 Brief Thirdjorge AlvaradoPas encore d'évaluation

- Report Dairy Milk Management SystemDocument44 pagesReport Dairy Milk Management SystemSathishPas encore d'évaluation

- Financial Accounting II: 2 Year ExaminationDocument32 pagesFinancial Accounting II: 2 Year ExaminationGeneGrace Zolina TasicPas encore d'évaluation

- Statement of Cash Flows Quiz Set ADocument5 pagesStatement of Cash Flows Quiz Set AImelda lee0% (1)

- 9706 s12 QP 42Document8 pages9706 s12 QP 42Adrian JosephianPas encore d'évaluation

- PDFDocument9 pagesPDFyamadaPas encore d'évaluation

- IB FinaleeeeDocument37 pagesIB FinaleeeeTaha NasirPas encore d'évaluation

- Pillar Event Planning Guide 2008Document25 pagesPillar Event Planning Guide 2008Taha NasirPas encore d'évaluation

- Lazy User ModelDocument2 pagesLazy User ModelTaha NasirPas encore d'évaluation

- Toa 38 40Document17 pagesToa 38 40Mary Joy AlbandiaPas encore d'évaluation

- Man Sci CompreDocument9 pagesMan Sci CompreJessa Mae CacPas encore d'évaluation

- KMC Balance Sheet Stand Alone NewDocument2 pagesKMC Balance Sheet Stand Alone NewOmkar GadePas encore d'évaluation

- Financial Accounting 9th Edition by Libby Chapter 1Document3 pagesFinancial Accounting 9th Edition by Libby Chapter 1Bernadette ConcepcionPas encore d'évaluation

- Finance Chapter 9 PDFDocument36 pagesFinance Chapter 9 PDFRonalyn BeleganioPas encore d'évaluation

- DA4675 CFA Level II SmartSheet 2020Document10 pagesDA4675 CFA Level II SmartSheet 2020Navnath MaharajPas encore d'évaluation

- ZagroDocument2 pagesZagropamela_medici_1Pas encore d'évaluation

- Introduction To Equity Market - CrosswordDocument3 pagesIntroduction To Equity Market - Crosswordamit kumarPas encore d'évaluation

- HSC Business Studies Syllabus AcronymsDocument9 pagesHSC Business Studies Syllabus AcronymsmissgroganPas encore d'évaluation

- Fund Flow Statement 2Document13 pagesFund Flow Statement 2Rajendra GawatePas encore d'évaluation

- The Little Book of Valuation: Cash FlowsDocument5 pagesThe Little Book of Valuation: Cash FlowsSangram PandaPas encore d'évaluation

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap007 PDFDocument77 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap007 PDFYopie ChandraPas encore d'évaluation

- ICRA Research MFIDocument8 pagesICRA Research MFIJaiganesh M SPas encore d'évaluation

- Nism Ii B - Registrar - Practice Test 4Document19 pagesNism Ii B - Registrar - Practice Test 4HEMANSH vPas encore d'évaluation

- Full Download Fundamentals of Corporate Finance Asia Global 2nd Edition Ross Solutions ManualDocument36 pagesFull Download Fundamentals of Corporate Finance Asia Global 2nd Edition Ross Solutions Manualempiercefibberucql19100% (36)

- PFRS 9 &PAS 32 Financial Instrument: Conceptual Framework and Reporting StandardDocument7 pagesPFRS 9 &PAS 32 Financial Instrument: Conceptual Framework and Reporting StandardMeg sharkPas encore d'évaluation

- Financial Ratio AnalyzesDocument11 pagesFinancial Ratio AnalyzesNardsdel RiveraPas encore d'évaluation

- ACCT5001 - Semester 2, 2021Document11 pagesACCT5001 - Semester 2, 2021Zhang RickPas encore d'évaluation

- CoverDocument11 pagesCoverGangapurna Multipurpose Cooperative Ltd.Pas encore d'évaluation

- Lesson #1 FabmDocument32 pagesLesson #1 FabmCZARINA ROSEANNE M. GIMENEZPas encore d'évaluation

- Financial Statement Analysis of Jollibee Food Corporation and Max's Group IncDocument17 pagesFinancial Statement Analysis of Jollibee Food Corporation and Max's Group IncRem100% (1)

- Balance Sheet of Adani Power: - in Rs. Cr.Document7 pagesBalance Sheet of Adani Power: - in Rs. Cr.bpn89Pas encore d'évaluation

- FS Analysis Ans KeyDocument5 pagesFS Analysis Ans KeyTeofel John Alvizo PantaleonPas encore d'évaluation

- Template - Acctg. Major 3 Module 2Document7 pagesTemplate - Acctg. Major 3 Module 2Ryan PatitoPas encore d'évaluation

- Exercises Corpo and Inst. SalesDocument1 pageExercises Corpo and Inst. SalesGanda MoPas encore d'évaluation

- Coetsee Meditari Vol 18 No 1 2010Document16 pagesCoetsee Meditari Vol 18 No 1 2010HientnPas encore d'évaluation

- CH 3 - Lap Konsolidasi PengantarDocument45 pagesCH 3 - Lap Konsolidasi PengantarJulia Pratiwi ParhusipPas encore d'évaluation

- TLV 20221111164418 2022-Q3-ReportDocument84 pagesTLV 20221111164418 2022-Q3-Reportafrodita99977Pas encore d'évaluation

- KKR Private Equity Investors, L.P. Annual Report 2007Document133 pagesKKR Private Equity Investors, L.P. Annual Report 2007AsiaBuyouts100% (1)

- Mis207 ShostaDocument29 pagesMis207 ShostaRafid ChyPas encore d'évaluation

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyD'EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditD'EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditÉvaluation : 5 sur 5 étoiles5/5 (1)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceD'EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidencePas encore d'évaluation

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageD'EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageÉvaluation : 4.5 sur 5 étoiles4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)D'EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)D'EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Évaluation : 4.5 sur 5 étoiles4.5/5 (24)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsD'EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsÉvaluation : 4 sur 5 étoiles4/5 (7)

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)