Académique Documents

Professionnel Documents

Culture Documents

PFC Tax Free Bonds - Term Sheet

Transféré par

rohit_wade1579Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PFC Tax Free Bonds - Term Sheet

Transféré par

rohit_wade1579Droits d'auteur :

Formats disponibles

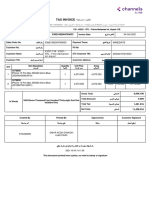

PFC Tax Free Secured Redeemable Non Convertible Debentures

(Term Sheet)

ISSUER Issue Structure Issue Opens Issue Closes Tenure Coupon Issue Size Credit Rating Face Value Minimum Application Interest on Refund Interest on application money on successful application Issuance Listing Trading Trading Lot Loan Against Bond Power Finance Corporation Ltd. Tax Free, Secured, Redeemable, Non Convertible Debentures th 28 December 2011 16th January 2012 10 Years 15 Years 8.20% p.a. 8.30% p.a. Shelf Limit of Rs.4033.12 crores AAA by CRISIL & ICRA Rs.1000/- per bond 10 Bonds i.e. Rs.10,000/- and in Multiples of Rs.5000 5 % p.a. Coupon Rate Both in physical as well as in demat mode Proposed to be listed on BSE Compulsorily in Demat Mode One Bond Can be Pledged or Hypothecated

HIGHLIGHTS OF TAX BENEFITS In exercise of the powers conferred by item (h) of sub-clause (iv) of clause (15) of Section 10 of the Income Tax Act, 1961 (43 of 1961) the Central Government authorizes PFC to issue during the FY 2011-12, Tax Free, Secured, Redeemable, Non-convertible Bonds. The income by way of interest on these Bonds is fully exempt from Income Tax and shall not form part of Total Income as per provisions under section 10 (15) (iv) (h) of I.T. Act, 1961. There will be no deduction of tax at source from the interest, which accrues to the bondholders in these bonds irrespective of the amount of the interest or the status of the investors. Wealth Tax is not levied on investment in Bond under section 2(ea) of the Wealth-tax Act, 1957.

Features

The interest on the bonds would be tax exempt Tenor shall be 10 & 15 years. Issue Size: Rs. 4033.12 Cr PAN is mandatory No Lock In period

NRIs can also invest

Who Can Apply

Category I Public Financial Institutions, Statutory Corporations, Scheduled Commercial Banks, Co-operative Banks and Regional Rural Banks, which are authorised to invest in the Bonds; Provident Funds, Pension Funds, Superannuation Funds and Gratuity Fund, which are authorised to invest in the Bonds; Insurance companies registered with the IRDA; National Investment Fund; Mutual Funds; Foreign Institutional Investors (including sub-accounts) Companies; bodies corporate and societies registered under the applicable laws in India and authorised to invest in the Bonds; Public/private charitable/religious trusts which are authorised to invest in the Bonds; Scientific and/or industrial research organisations, which are authorised to invest in the Bonds;

Category II

Partnership firms in the name of the partners; and Limited liability partnerships formed and registered under the provisions of the Limited Liability Partnership Act, 2008 (No. 6 of 2009) The following investors applying for an amount aggregating to above `5 lakhs across all Series in each tranche Resident Indian individuals;

Category III

Hindu Undivided Families through the Karta; and Non Resident Indians on repatriation as well as non-repatriation basis. The following investors applying for an amount aggregating to upto and including `5 lakhs across all Series in each tranche Resident Indian individuals; Hindu Undivided Families through the Karta; and Non Resident Indians on repatriation as well as non-repatriation basis.

Category Wise Breakup of the issue

Category I Upto 50% of Overall Issue Size Category II Upto 25% of Overall Issue Size Category III Upto 25% of Issue Size Overall

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Understanding The Effect of Domestic Resource Mobilisation On Real Aggregate Output in NigeriaDocument24 pagesUnderstanding The Effect of Domestic Resource Mobilisation On Real Aggregate Output in NigeriaOlusola Joel OyelekePas encore d'évaluation

- Khyber Pakhtunkhwa Local Government Act 2013 PDFDocument110 pagesKhyber Pakhtunkhwa Local Government Act 2013 PDFibrahim khanPas encore d'évaluation

- Online Business (E-Commerce) in Indonesia TaxationDocument12 pagesOnline Business (E-Commerce) in Indonesia TaxationIndah NovitasariPas encore d'évaluation

- Minimum Wages and Taxes Concerns of Filipino EntrepreneursDocument63 pagesMinimum Wages and Taxes Concerns of Filipino EntrepreneursMarie Nicole SalmasanPas encore d'évaluation

- FIDIC Comparison Between Red Book, Yellow Book, Silver BookDocument14 pagesFIDIC Comparison Between Red Book, Yellow Book, Silver BookZaid SuradiPas encore d'évaluation

- Ac2091 Za - 2019Document14 pagesAc2091 Za - 2019Isra WaheedPas encore d'évaluation

- Problem Set #5: Due Tuesday March 4, 2003Document3 pagesProblem Set #5: Due Tuesday March 4, 2003keyyongparkPas encore d'évaluation

- Rms IntegrationDocument30 pagesRms IntegrationMohammed ElabyadPas encore d'évaluation

- Homewood Suites Terms and ConditionsDocument4 pagesHomewood Suites Terms and ConditionsRyan LawlerPas encore d'évaluation

- Cases On Partnerships/ Co-Ownership/ Joint Venture: Tax 1 ReportDocument40 pagesCases On Partnerships/ Co-Ownership/ Joint Venture: Tax 1 ReportNaomi CorpuzPas encore d'évaluation

- Aefpm5487a 2023Document4 pagesAefpm5487a 2023enjoy enjoy enjoyPas encore d'évaluation

- The Power of Words PDFDocument11 pagesThe Power of Words PDFEli Ben APas encore d'évaluation

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, Bengaluruwar10ckjupiPas encore d'évaluation

- GST On Sale of New Residential PropertyDocument33 pagesGST On Sale of New Residential PropertytestnationPas encore d'évaluation

- Republic vs. Marsman Development CompanyDocument14 pagesRepublic vs. Marsman Development CompanyFbarrsPas encore d'évaluation

- SIPATHONDocument2 pagesSIPATHONnivethakarthikPas encore d'évaluation

- Technical Integration PaperDocument9 pagesTechnical Integration PaperjaimaakalikaPas encore d'évaluation

- Cash Management: Why Organisations Hold CashDocument15 pagesCash Management: Why Organisations Hold CashAjay Kumar TakiarPas encore d'évaluation

- Shreyash Retail Private Limited,: Grand TotalDocument2 pagesShreyash Retail Private Limited,: Grand TotalPavan Singh TomarPas encore d'évaluation

- Positive Money - Modernising Money by Andrew Jackson, Ben DysonDocument251 pagesPositive Money - Modernising Money by Andrew Jackson, Ben DysonHelyi Pénz100% (4)

- Taxation (Input Taxes)Document30 pagesTaxation (Input Taxes)Lara Joy Junio100% (4)

- E-Way BillDocument2 pagesE-Way BillNitin PanchalPas encore d'évaluation

- Qesco Online BillDocument2 pagesQesco Online BillFazal TanhaPas encore d'évaluation

- MBA-4th Sem. - 2013-14Document25 pagesMBA-4th Sem. - 2013-14archana_anuragiPas encore d'évaluation

- Times Leader 08-25-2011Document48 pagesTimes Leader 08-25-2011The Times LeaderPas encore d'évaluation

- Non-Lodgment Advice: Your Tax File Number (TFN)Document1 pageNon-Lodgment Advice: Your Tax File Number (TFN)Jonathan McDonaldPas encore d'évaluation

- Macroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)Document48 pagesMacroeconomics: PGDM: 2016 - 18 Term 2 (September - December, 2016) (Lecture 05)RohanPas encore d'évaluation

- TAXATION LAW Survival Kit by 4CDocument75 pagesTAXATION LAW Survival Kit by 4CMara Corteza San Pedro100% (2)

- Quiz #2 - BreakevenDocument1 pageQuiz #2 - BreakevenNelzen GarayPas encore d'évaluation

- OrderInvoice - 53821082004769033Document1 pageOrderInvoice - 53821082004769033Yoyo ToyoPas encore d'évaluation