Académique Documents

Professionnel Documents

Culture Documents

Sample Lending Agreement 2

Transféré par

cam8992Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sample Lending Agreement 2

Transféré par

cam8992Droits d'auteur :

Formats disponibles

3.

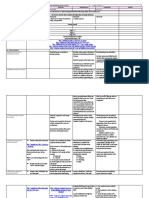

COMMENCEMENT OF LENDING TRANSACTION The BORROWER will sign this Agreement and within 5 banking days after signature, will transfer funds to the designated Clearing and Settlement account (Lending Manager) the amount ofXX% ; against invoice, to cover the call option expenses in order to reserve the bank instrument. At which point the loan procedure will commence. This amount will be refunded after successful completion of this transaction by the LENDER, as per article 5. The BORROWER has the right to deduct the above mentioned refund from the service total service fees associated with the successful completion of the transaction, as per article 7. After 30 calendar days of this agreement date, without the transfer as above mentioned, this agreement will expire and will be considered null and void. 4. DELIVERY OF DOCUMENTS After the signing of this agreement and the receipt of the wire transfer of the above mentioned call option guarantee, to the account of the Lending Manager, within 48 hours the LENDER will reserve the tranche of the above mentioned banking instrument by the Clearing and Settlement Company (Lending Manager). Following is a list of items that will be sent; I. Pre Advise of Invoice with all details of the Bank Instrument, II. Corporate Deed of Assignment, III. Bond Power if requested, IV. Bloomberg Printout or Security Card of the Stock Exchange Market where instrument is quoted, V. Permission for the designated BORROWERs Bank Officer to confirm and authenticate the instrument(s). (NOTE: Every instrument is on screen in Euroclear and Bloomberg systems) 5. REQUIREMENTS TO EFFECT THE DELIVERY OF THE BANK INSTRUMENT After the verification and authentication of the above mentioned documents, BORROWER must provide to the payment of service fees by payments made through, either of the following; I. Conditional ICPO (irrevocable corporate pay order) endorsed by an acceptable borrowers bank as per attachment 1. II. Bank backed Promissory Note(s), which expiring dates will be negotiated between the parties (per attch. 2) III. Conditional swift MT103-23 or MT700 as per attachments 3 and 4 NOTE: that if the payment will not take place within 20 calendar days from the pre advise of invoice issuing date (as per art.4) the contact will be considered null and void 6. DELIVERY OF THE BANK INSTRUMENT LENDER will confirm to the clearing operator the instrument to be purchased, after the Nominated LENDERs Compliance Officer has carried out the necessary due diligence. (Contacting the BORROWERs Bank Officer by certified email and the BORROWERs Bank will confirm RWA to receive the above mentioned instrument to close the transaction and their awareness/knowledge about the transaction. Once completed, the LENDER bank will deliver the Bank Instrument to which the Agreement relates, by Swift MT760, to the BORROWERs designated Bank. The Transaction will be closed on a Bank-To-Bank basis using the Swift system. 7. RATES APPLICABLE TO LOANED SECURITIES BORROWER shall pay to the LENDER,(in the manner prescribed in paragraph 5) the agreed service fee of XX%, of the face amount of the instrument for a period of One Year and One day. The BORROWER has the possibility to extend the lending period for up to 5 Years, paying the service fee yearly, 15 days prior to maturity date.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- KDIGO 2023 CKD Guideline Public Review Draft 5 July 2023Document339 pagesKDIGO 2023 CKD Guideline Public Review Draft 5 July 2023oscar coreaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Clinical Crown Lengthening in The Esthetic Zone2028Document12 pagesClinical Crown Lengthening in The Esthetic Zone2028AchyutSinhaPas encore d'évaluation

- Sample Lending AgreementDocument13 pagesSample Lending Agreementcam8992Pas encore d'évaluation

- Sample Lending Agreement 10Document1 pageSample Lending Agreement 10cam8992Pas encore d'évaluation

- Sample Lending Agreement 9Document1 pageSample Lending Agreement 9cam8992Pas encore d'évaluation

- Sample Lending Agreement 8Document1 pageSample Lending Agreement 8cam8992Pas encore d'évaluation

- Sample Lending Agreement 3Document1 pageSample Lending Agreement 3cam8992Pas encore d'évaluation

- Sample Lending Agreement 1Document1 pageSample Lending Agreement 1cam8992Pas encore d'évaluation

- Tests Conducted On Under Water Battery - YaduDocument15 pagesTests Conducted On Under Water Battery - YadushuklahousePas encore d'évaluation

- Chan vs. ChanDocument2 pagesChan vs. ChanMmm GggPas encore d'évaluation

- BÀI TẬP BUỔI SỐ 2 - VIẾT UNIT 1Document7 pagesBÀI TẬP BUỔI SỐ 2 - VIẾT UNIT 1Huy Trương GiaPas encore d'évaluation

- Modeling, Control and Simulation of A Chain Link Statcom in Emtp-RvDocument8 pagesModeling, Control and Simulation of A Chain Link Statcom in Emtp-RvBožidar Filipović-GrčićPas encore d'évaluation

- ES9-62 Ingestive Cleaning PDocument9 pagesES9-62 Ingestive Cleaning PIfran Sierra100% (1)

- Foundations of Group BehaviorDocument31 pagesFoundations of Group BehaviorRaunakPas encore d'évaluation

- Reading Comprehension MaterialsDocument6 pagesReading Comprehension MaterialsDiana PundavelaPas encore d'évaluation

- API 572 Practise QuestionDocument58 pagesAPI 572 Practise Questionbelonk_182100% (6)

- Blockchain Deck PDFDocument65 pagesBlockchain Deck PDFsankhaPas encore d'évaluation

- G1 CurvedDocument16 pagesG1 CurvedElbert Ryan OcampoPas encore d'évaluation

- Siremobil Compact MaintenanceDocument22 pagesSiremobil Compact MaintenanceRafael Tejeda100% (1)

- Leadership Roles and Management Functions in Nursing Theory and ApplicationDocument2 pagesLeadership Roles and Management Functions in Nursing Theory and Applicationivan0% (3)

- Improving Communication Skills of Pharmacy StudentDocument13 pagesImproving Communication Skills of Pharmacy StudentAbdul QadirPas encore d'évaluation

- 3.0.2 3.0.2 Thermax Inc.: Pressure Building Ambient Vaporizers For Bulk Storage TanksDocument2 pages3.0.2 3.0.2 Thermax Inc.: Pressure Building Ambient Vaporizers For Bulk Storage TanksSiDdu KalashettiPas encore d'évaluation

- Wound Dressing ChecklistDocument3 pagesWound Dressing ChecklistBUAHIN JANNA100% (1)

- ISBB CompilationDocument6 pagesISBB CompilationElla SalesPas encore d'évaluation

- Antibacterial Effects of Essential OilsDocument5 pagesAntibacterial Effects of Essential Oilsnightshade.lorna100% (1)

- Business Proposal New VentureDocument18 pagesBusiness Proposal New VentureBramhananda ReddyPas encore d'évaluation

- TDS-PE-102-UB5502H (Provisional) 2019Document2 pagesTDS-PE-102-UB5502H (Provisional) 2019Oktaviandri SaputraPas encore d'évaluation

- LUBRICANTCOOLANT Answer With ReflectionDocument5 pagesLUBRICANTCOOLANT Answer With ReflectionCharles Vincent PaniamoganPas encore d'évaluation

- Daily Lesson Log Personal Dev TDocument34 pagesDaily Lesson Log Personal Dev TRicky Canico ArotPas encore d'évaluation

- The Theory of Motivation in Dog Training: By: Ed FrawleyDocument30 pagesThe Theory of Motivation in Dog Training: By: Ed Frawleyrodrigue angbohPas encore d'évaluation

- Victron Orion-Tr - Smart - DC-DC - Charger-Manual Non IsolatedDocument19 pagesVictron Orion-Tr - Smart - DC-DC - Charger-Manual Non IsolatedThomist AquinasPas encore d'évaluation

- Tips To Diagnose & Address Common Horse AilmentsDocument6 pagesTips To Diagnose & Address Common Horse AilmentsMark GebhardPas encore d'évaluation

- Turbo Lab 1Document10 pagesTurbo Lab 1Seng SoonPas encore d'évaluation

- Applications Shaft SealDocument23 pagesApplications Shaft SealMandisa Sinenhlanhla NduliPas encore d'évaluation

- Materials Today: Proceedings: Ashish Malik, Shivam KohliDocument7 pagesMaterials Today: Proceedings: Ashish Malik, Shivam KohliSenthil KumarPas encore d'évaluation

- Lending Policies of Indian BanksDocument47 pagesLending Policies of Indian BanksProf Dr Chowdari Prasad80% (5)