Académique Documents

Professionnel Documents

Culture Documents

Technical Report 20th January 2012

Transféré par

Angel BrokingDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Technical Report 20th January 2012

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

Technical Research | January 20, 2012

Daily Technical Report Sensex (16633) / NIFTY (5018)

Yesterday, markets opened on a higher note in-line with strong positive cues from other Asian markets and then moved in a narrow range which led indices to give a close above the psychological level of 5000. On the sectoral front, Realty, Metal and Power sectors were among the major gainers, whereas IT and Teck ended marginally in the negative territory. The advance to decline ratio was in strongly favor of advancing counters. (A=1802 D=985) (Source www.bseindia.com)

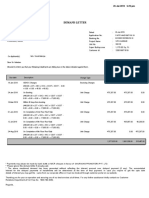

Exhibit 1: Nifty Daily Chart

Formation:

The 20-day EMA (Exponential Moving Average) has

Source: Falcon

now shifted to the 16050 / 4820 level.

Trading strategy:

After a gap up opening, indices traded in a narrow range during the first half and convincingly managed to sustain above 78.6% Fibonacci retracement resistance level of 16600 / 4976. Going forward, indices are likely to rally towards 16848 17004 / 5050 5100, if they sustain above yesterdays high of 16662 / 5024. On the downside, yesterdays upside gap area of 16517 to 16572 / 4980 to 4991. A sustainable move below 16517 / 4980 may lead to a minor correction towards next support levels of 16500 16384 / 4970 4931. Traders with are advised to lighten up positions and partial book profits as the markets edge higher towards the levels of 16848 - 17004 / 5050 5100.

Actionable points:

View Resistance levels Support levels Neutral 5024 5050 5100 4980 4970 4931

For Private Circulation Only |

Technical Research | January 20, 2012

Bank Nifty Outlook - (9199)

Yesterday, once again Bank Nifty opened with an upside gap, and gained momentum as the day progressed to close near days high. However, we are observing narrow range body formation on the hourly chart which suggests exhaustion. The momentum oscillator stochastic is currently placed in an overbought condition. Also on the hourly chart we are observing a bearish formation called Wolfe Wave This formation needs confirmation in the form of a move below 9130. In this case the Index is likely to correct towards 8900 8850 levels. On the other hand only if the index manages to sustain above yesterdays high of 9213 then it is likely to test the resistance zone of 9275 9323.

Exhibit 2: Bank Nifty Daily Chart

Actionable points:

Source: Falcon

View Sell Below Expected target Resistance level

Bearish 9130 8900 - 8850 9275 9323

For Private Circulation Only |

Technical Research | January 20, 2012

Positive Bias:

Expected Target 454

Stock Name Lupin

CMP 443.1

5 Day EMA 435.7

20 Day EMA 437.1

Remarks View will change below 432.5

Negative Bias:

Expected Target 640

Stock Name M&M

CMP 672.9

5 Day EMA 683.4

20 Day EMA 682.1

Remarks View will change above 697

For Private Circulation Only |

Technical Research | January 20, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM AXISBANK BAJAJ-AUTO BHARTIARTL BHEL BPCL CAIRN CIPLA DLF DRREDDY GAIL HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RCOM RELCAPITAL RELIANCE RELINFRA RPOWER SAIL SBIN SESAGOA SIEMENS STER SUNPHARMA SUZLON TATAMOTORS TATAPOWER TATASTEEL TCS WIPRO S2 16,536 4,979 9,067 1,109 156 935 1,401 332 254 524 340 325 201 1,638 363 412 681 476 1,841 140 384 772 117 2,552 207 503 62 461 1,233 654 1,096 162 261 901 98 454 88 317 774 431 90 89 1,853 183 729 107 508 22 215 96 424 1,053 394 S1 16,590 4,998 9,133 1,130 158 945 1,434 336 260 533 344 328 206 1,669 366 415 687 481 1,873 143 388 785 119 2,573 208 510 64 468 1,255 663 1,113 167 266 906 99 459 90 323 780 458 92 90 1,869 186 737 111 518 22 216 100 430 1,064 399 PIVOT 16,626 5,011 9,173 1,154 160 953 1,458 341 269 541 348 332 209 1,686 369 419 691 486 1,902 145 392 793 121 2,598 209 516 66 471 1,268 680 1,124 170 270 911 100 462 91 329 788 474 93 92 1,891 190 746 113 525 23 218 102 436 1,077 404 R1 16,680 5,031 9,239 1,175 162 963 1,492 345 275 550 352 336 213 1,718 372 423 697 491 1,935 148 395 806 123 2,619 211 523 68 478 1,290 690 1,141 174 276 917 101 467 93 336 794 501 95 93 1,906 193 754 118 534 23 220 106 442 1,088 409 R2 16,716 5,043 9,279 1,199 164 971 1,516 349 284 557 356 339 216 1,735 375 426 701 496 1,964 150 399 815 124 2,644 212 529 69 481 1,304 706 1,152 177 280 922 102 470 94 341 802 517 96 94 1,928 197 763 120 542 23 222 108 448 1,100 414

Technical Research Team

For Private Circulation Only |

Technical ResearchTechnical20, 2012 | January Report

RESEARCH TEAM

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head - Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com Research Team: 022-3952 6600 Website: www.angelbroking.com

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not

be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past.

Sebi Registration No : INB 010996539

For Private Circulation Only |

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingPas encore d'évaluation

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingPas encore d'évaluation

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingPas encore d'évaluation

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingPas encore d'évaluation

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingPas encore d'évaluation

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingPas encore d'évaluation

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- Demand LetterDocument2 pagesDemand LetterHimanshu RantiyaPas encore d'évaluation

- Credit Insurance AaaaaDocument21 pagesCredit Insurance AaaaaRohit GuptaPas encore d'évaluation

- Promissory NoteDocument10 pagesPromissory NoteIsh ChavanPas encore d'évaluation

- Chapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)Document53 pagesChapter 1 An Introduction To Accounting: Fundamental Financial Accounting Concepts, 10e (Edmonds)brockPas encore d'évaluation

- Offshore Banking - Definition, Advantages, DisadvantagesDocument1 pageOffshore Banking - Definition, Advantages, DisadvantagesCrEaTiVe MiNdPas encore d'évaluation

- The EXPLOITATION of Security Mispricing inDocument13 pagesThe EXPLOITATION of Security Mispricing inJorge J MoralesPas encore d'évaluation

- Bill Enquiries Branch Number Customer Number: Statement Month: OCTOBER 2021 Balance As At: 30/9/2021 $435.21Document2 pagesBill Enquiries Branch Number Customer Number: Statement Month: OCTOBER 2021 Balance As At: 30/9/2021 $435.21David JamiesonPas encore d'évaluation

- Wall StreetDocument9 pagesWall StreetmilosgojicPas encore d'évaluation

- Ratio Analysis ReportDocument121 pagesRatio Analysis ReportChandrakant ChopdePas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 546602010003219Document27 pages546602010003219PriyankaPas encore d'évaluation

- ICICI NEFT Application FormDocument1 pageICICI NEFT Application FormAtul Kawale100% (1)

- Vichitra StatementDocument3 pagesVichitra Statementsatyam dixitPas encore d'évaluation

- Dbfy2013 EntireDocument572 pagesDbfy2013 EntiremokilpoPas encore d'évaluation

- Chapter 15 Ppe Part 1Document28 pagesChapter 15 Ppe Part 1marianPas encore d'évaluation

- Case Study 1 Case Study 2Document3 pagesCase Study 1 Case Study 2MoatasemMadianPas encore d'évaluation

- Tax Planning & ManagementDocument7 pagesTax Planning & Managementoffer manPas encore d'évaluation

- Sample Letter To Activate Dormant AccountDocument9 pagesSample Letter To Activate Dormant AccountAshis MingalaPas encore d'évaluation

- Fresh IT 320206 Opening On 06-12-16Document21 pagesFresh IT 320206 Opening On 06-12-16maher0zainPas encore d'évaluation

- DDFDocument66 pagesDDFPankaj Kumar100% (2)

- Banking Law CasesDocument6 pagesBanking Law CasesCaesar Julius0% (1)

- Negotiable Instruments ActDocument23 pagesNegotiable Instruments ActNarendran Kamal'iyan100% (1)

- CalPERS Pension & Health Benefits Committee Agenda Item 4Document7 pagesCalPERS Pension & Health Benefits Committee Agenda Item 4jon_ortizPas encore d'évaluation

- When Are Personal Loans A Good Idea?Document2 pagesWhen Are Personal Loans A Good Idea?Sandeep KumarPas encore d'évaluation

- SAPMDocument194 pagesSAPMMujeeb Ur RahmanPas encore d'évaluation

- 1 Investment F PDFDocument35 pages1 Investment F PDFShrikant Mahajan100% (2)

- Basic Concepts of Open EconomyDocument44 pagesBasic Concepts of Open EconomyIvy Amistad Dela Cruz-CabalzaPas encore d'évaluation

- Account Titles UsedDocument40 pagesAccount Titles Usedmaria cacaoPas encore d'évaluation

- SHEKAR - Rural BankingDocument20 pagesSHEKAR - Rural BankingkiziePas encore d'évaluation

- A Study On The Role of Bajaj Finserv in Consumer Durable FinanceeDocument58 pagesA Study On The Role of Bajaj Finserv in Consumer Durable FinanceeSanjeeb DuttaPas encore d'évaluation

- Security Valuations - Stocks EZDocument9 pagesSecurity Valuations - Stocks EZAakash RegmiPas encore d'évaluation