Académique Documents

Professionnel Documents

Culture Documents

Receivable Management 1

Transféré par

Neeru SharmaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Receivable Management 1

Transféré par

Neeru SharmaDroits d'auteur :

Formats disponibles

Receivable Management Process

1. Credit Analysis 2. Credit Standards 3. Credit Terms 4. Credit Polices 5. Credit Control and Monitoring

1. Credit Analysis

I.

Collection of information about the customers: both financial as well as qualitative type of information is needed relating to customers:-

a) Financial statements: These are published accounts containing the profit and loss

account and balance sheet.

b) Trade references: Some enterprises may request the potential customers to furnish

them with references from other suppliers who have had dealings with them.

c) Bankers Enquiries: It is possible to ask the potential customer for a bank

references.

d) Credit Rating agencies: Specialists agencies now exist to provide information

which can be used to assess the creditworthiness of a potential customer.

e) Own experience of the concern: The enterprise may use its own experience in

collecting information about the potential customers.

II.

Analysis of collected information: This analysis attempts to measure the creditworthiness of the customers as well as risk involved. Normally, following six Cs are considered in analyzing the creditworthiness: Character Capacity Capital Conditions Cost Collateral 3. Credit Terms: After analyzing the customers creditworthiness and setting up enterprises credit standards, one has to determine the terms and condition s on which trade credit will be made available to the customers.

I.

Credit period: Credit period is the time for which an enterprise allows its customers not to pay their bills. It is length of credit period by the end of which enterprise expects that the customers would pay their bills.

II.

Cash Discount: An enterprise may decide to offer a cash discount in order to encourage prompt payment from its customers, particularly when it finds itself short of cash resources and is facing liquidity problem.

III.

Cash Discount Period: A cash discount period is the time period allowed to the debtors within whom the debtors are encouraged to pay their dues and to avail the cash discount.

4. Credit collection policies: Another aspect of receivables management is related to collection policy, which is basically concerned with the procedure to be followed in collecting the accounts not realized within the credit period allowed.

I.

Types of collection efforts: Some efforts are to be taken to collect payment from those customers who do not pay within the time given. Such efforts may include dunning letters, telephone, personal visit, help from collecting agencies and ultimately legal action.

II.

Degree of collection efforts: Degree of collection efforts in one sense refers to the policy which is being adopted in pursuing credit policy, i.e. whether conservative or aggressive which is already indicated with the concept of credit standards.

5. Control and Monitoring: Once the business concern has set credit standards, credit terms, collection policies, etc., it is important for the financial manager to control and monitor the effectiveness of the collections.

I.

Through aging schedule: This schedule provides the primary basis for controlling or monitoring accounts receivables. The age wise distribution of accounts receivables at a given moment of time is depicted in aging schedule.

II.

Through collection matrix: Sometimes, collection matrix may be prepared for correct study of the changes in the payment behavior of the customers. One can easily deduce from the collection pattern whether the collection is improving, stable or deteriorating.

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Fraternal Order of Leviathan - Leviathan SororitasDocument12 pagesFraternal Order of Leviathan - Leviathan SororitasBetson CajayonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Gfiles September 2016Document64 pagesGfiles September 2016Gfiles Mangazine IndiaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- IAS 10 Events After The Reporting Period-A Closer LookDocument7 pagesIAS 10 Events After The Reporting Period-A Closer LookFahmi AbdullaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Market-Tables (6) - Nov 29, 2018Document20 pagesMarket-Tables (6) - Nov 29, 2018allegrePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- PF I League Tables 2016Document40 pagesPF I League Tables 2016SuperstarVirgoPas encore d'évaluation

- Effects of Globalization On Indian Insurance SectorDocument21 pagesEffects of Globalization On Indian Insurance SectorArindam DeyPas encore d'évaluation

- Economic Value Added in ComDocument7 pagesEconomic Value Added in Comhareshsoni21Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- September 5 RulingsDocument32 pagesSeptember 5 RulingstaxcrunchPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- 2017 SSUG Attendee ListDocument4 pages2017 SSUG Attendee ListAntares SchachterPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- CIR Vs LedesmaDocument2 pagesCIR Vs LedesmaAnonymous wvx7n36Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Audit QuizDocument12 pagesAudit QuizKristine Astorga-NgPas encore d'évaluation

- Correction of ErrorsDocument5 pagesCorrection of ErrorsMikkaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- UBO Form PDFDocument2 pagesUBO Form PDFKevinPas encore d'évaluation

- ICF SEA ICF RegionalIslamic Crowdfunding in SEAArticle Islamic Crowd Funding in Singapore and IndonesiaDocument7 pagesICF SEA ICF RegionalIslamic Crowdfunding in SEAArticle Islamic Crowd Funding in Singapore and IndonesiaKetoisophorone WongPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Simulasi Rahan TasjilyDocument1 pageSimulasi Rahan TasjilyIqbal Rifay GSB100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- ARIIA 2019-20 ReportDocument22 pagesARIIA 2019-20 ReportJuberPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

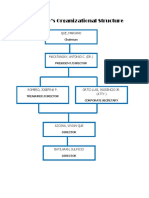

- Philusa Corporation Organizational StructureDocument2 pagesPhilusa Corporation Organizational StructureAlexiss Mace JuradoPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Undangan Klinik Jumat 15 Oktober 2021Document3 pagesUndangan Klinik Jumat 15 Oktober 2021Dwi Isti NadiarohPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- ch01 ProblemsDocument7 pagesch01 Problemsapi-274120622Pas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Promisory Note ExampleDocument1 pagePromisory Note Exampleapi-300362811Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Case UnileverDocument4 pagesCase UnileverLan AnhPas encore d'évaluation

- 03 FiatDocument238 pages03 FiatDeyvis UsandivaresPas encore d'évaluation

- Strategic Control and Corporate GovernanceDocument18 pagesStrategic Control and Corporate GovernanceDavid Ako100% (2)

- Pearson RetailDocument26 pagesPearson RetailDrRam Singh KambojPas encore d'évaluation

- Organizational Design and StructuresDocument77 pagesOrganizational Design and StructuresSreenath67% (3)

- Credit Management of NCC Bank Ltd.Document69 pagesCredit Management of NCC Bank Ltd.death_heaven100% (1)

- SFDocument1 pageSFEllen Zumba Pateros MpsPas encore d'évaluation

- Rural Godown SchemeDocument26 pagesRural Godown Schemelakshmi10110% (1)

- Saes-Z-002 Locked by BadrDocument8 pagesSaes-Z-002 Locked by Badrsalic2013Pas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Datatreasury v. Jack Henry & Associates Et. Al.Document39 pagesDatatreasury v. Jack Henry & Associates Et. Al.PriorSmartPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)