Académique Documents

Professionnel Documents

Culture Documents

Application For Enrollment To Practice Before The Internal Revenue Service

Transféré par

lindale0Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Application For Enrollment To Practice Before The Internal Revenue Service

Transféré par

lindale0Droits d'auteur :

Formats disponibles

Form

23

(Rev. April 2011) Department of the Treasury Internal Revenue Service

Application for Enrollment to Practice Before the Internal Revenue Service

See Instructions on Page 3

OMB No. 1545-0950

Important things you need to know before you file this form: Take and Pass the Special Enrollment Examination Read Circular 230 The application fee is $30. Visit www.pay.gov to file and pay electronically or enclose a check or money order in the amount of $30.00 payable to the United States Treasury. This fee is non-refundable and applies regardless of your enrollment status. Check here if you are a former Internal Revenue Service Employee, and enter the date you separated from the Service . / /

For IRS use: Date Enrolled:

Enrollment Number:

Part 1. Tell Us About Yourself

Your Tax Identification Number (Social Security Number or Individual Tax Identification Number)

If you do not have an SSN or ITIN, please check this box.

Your Full Legal Name

Last First M

Your Current Address

Number Street Suite or Apt. Number

City

State

Zip Code

Country

Your email Address:

Your Contact Telephone Number:

4 5

Enter your PTIN number issued by the IRS or Candidate Number assigned by Prometric: Do you have an Employer Identification Number (EIN)? Yes No If Yes, enter all EINs, business names, and addresses below (attach additional pages, if necessary): EIN Business Name Business Address

For Privacy Act and Paperwork Reduction Act Notice, see page 3.

Cat. No. 16233B

Form 23 (Rev. 4-2011)

Form 23 (Rev. 4-2011)

Page 2

Do you have a Centralized Authorization File (CAF) number?

Yes

No

If Yes, enter all CAF numbers assigned to you (attach additional pages, if necessary):

7 8

Have you been sanctioned by a federal or state licensing authority? Has any application you filed with a court, government department, commission, or agency for admission to practice ever been denied? Have you been convicted of a tax crime or any felony? Have you been permanently enjoined from preparing tax returns, or representing others before the IRS?

Yes

No

Yes Yes

No No

9 10

Yes

No

NOTE: If you answered Yes to question 7, 8, 9 or 10, please describe on a separate page, the matter, including the date of when the matter occurred, and provide any additional information about the matter that you would like us to consider. 10a Are you a CPA? Yes No If Yes, enter the states where you are licensed to practice.

10b Are you an Attorney?

Yes

No

If Yes, enter the states where you are licensed to practice.

Part 2. Sign here

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief, it is true, correct, and complete.

Signature

Date

Form 23 (Rev. 4-2011)

Filling out this form: It is important to answer all questions on the form. Failure to answer any questions or sign the form could result in processing delays. An intentionally false statement or omission identified with your application is a violation of Circular 230 10.51(a)(4) and 18 U.S.C. 1001 and may be grounds for suspension or disbarment from practice.

Form 23 (Rev. 4-2011)

Page 3

Instructions:

You must obtain a PTIN before completing this form. You must take and pass the Special Enrollment Examination (SEE) before you can apply. You may register for the examination at www.Prometric.com/irs.

Former IRS Employees:

Please Note: Your eligibility to practice may be limited based upon your work experience. You may request a waiver to take the SEE through the submission of an application within three (3) years from the date of your separation with the Internal Revenue Service (IRS). Please check the box at the top of the form which indicates you are requesting a waiver from taking the SEE. See Circular 230 Section 10.4(c)(3) for more information. To gain full enrollment status you must take and pass the SEE before you can apply. You may register for the examination at www.prometric/irs.

What if I don't have a Social Security Number?

If you are employed in the United States (U.S.), you are required to have a Social Security Number (SSN). If you are working outside of the U.S. and you do not have an SSN or an ITIN check the box on line 1.

Privacy Act and Paperwork Reduction Act Notice. Section 330 of title 31 of the United States Code authorizes us to collect this information. We ask for this information to administer the program of enrollment to practice before the IRS. Applying for renewal of enrollment is voluntary; however, if you apply you must provide the information requested on this form. Failure to provide this information may delay or prevent processing your application; providing false or fraudulent information may subject you to penalties. Generally, this information is confidential pursuant to the Privacy Act. However, certain disclosures are authorized under the Act, including disclosure to: the Department of Justice, and courts and other adjudicative bodies, with respect to civil or criminal proceedings; public authorities and professional organizations for their use in connection with employment, licensing, disciplinary, regulatory, and enforcement responsibilities; contractors as needed to perform the contract; third parties as needed in an investigation; the general public to assist them in identifying enrolled individuals; state tax agencies for tax administration purposes; appropriate persons when the security of information may have been compromised for their use to prevent, mitigate or remedy harm. You are not required to provide the information requested on a form that is subject to the requirements of the Paperwork Reduction Act unless the form displays a valid OMB control number. Books and records relating to a form or its instructions should be retained as long as their contents may become material in the administration of the law. The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is 30 minutes, including recordkeeping, learning about the law or the form, preparing the form, and copying and sending the form to the IRS. If you have comments concerning the accuracy of this time estimate or suggestions for making this form simpler, we would be happy to hear from you. You can write to IRS/Office of Professional Responsibility; SE:OPR; 1111 Constitution Avenue, NW; Washington, DC 20224. Do not send this form to this address; instead see the Where to send this form section of the instructions.

Electronic Application and Payments:

You can pay electronically by visiting www.pay.gov/paygov/.

Where to send this form:

You can use overnight mail or regular mail to send us this form. If you want to use regular mail: U.S. Treasury/Enrollment PO Box 301510 Los Angeles, CA 90030-1510 If you want to use overnight mail: Internal Revenue Service Attn: Box 301510 5860 Uplander Way Culver City, CA 90230

How long will it take to process your application for enrollment?

The application processing cycle generally takes about 60 days to process applications. Your enrollment status is not effective until we approve your request. You are not authorized to practice before the IRS as an EA until enrollment has been granted.

Who do I call if I have questions?

Please allow 60 days for processing before calling to check on the status of your application. To check on the status of your application please call 1-313-234-1280.

Vous aimerez peut-être aussi

- 4th MAILING - Validation Letter - SampleDocument6 pages4th MAILING - Validation Letter - SampleJeromeKmt100% (20)

- Adverse Action LettersDocument7 pagesAdverse Action LettersRobat Kooc100% (2)

- Trustee Address Change IRSDocument2 pagesTrustee Address Change IRS25sparrow100% (5)

- Ssa 7050Document4 pagesSsa 7050tobehode100% (1)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreD'EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MorePas encore d'évaluation

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returndavis_dion22Pas encore d'évaluation

- How Did The Income Tax Start?: Irs - GovDocument6 pagesHow Did The Income Tax Start?: Irs - GovApurva BhargavaPas encore d'évaluation

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!D'EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Évaluation : 1 sur 5 étoiles1/5 (1)

- F 211Document2 pagesF 211Bogdan PraščevićPas encore d'évaluation

- Judicial Affidavit For Unlawful DetainerDocument2 pagesJudicial Affidavit For Unlawful DetainerHannief Ampa21Pas encore d'évaluation

- RN Exam ApplicationDocument7 pagesRN Exam ApplicationNursePoorPas encore d'évaluation

- TCF-ICEE Credit Application 11 081Document1 pageTCF-ICEE Credit Application 11 081jasonparker80Pas encore d'évaluation

- F 3949 ADocument3 pagesF 3949 Aiamsomedude100% (3)

- US Social Security Form (Ssa-7050) : Wage Earnings CorrectionDocument4 pagesUS Social Security Form (Ssa-7050) : Wage Earnings CorrectionMax PowerPas encore d'évaluation

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!D'EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!Pas encore d'évaluation

- Https WWW - Dol.state - Ga.us WS4-MW5 CicsDocument4 pagesHttps WWW - Dol.state - Ga.us WS4-MW5 CicsDaniel MinnickPas encore d'évaluation

- I-94 W FormDocument5 pagesI-94 W Formapi-6921411Pas encore d'évaluation

- NEW Engagement Policy StatementDocument3 pagesNEW Engagement Policy StatementRenelito Dichos Tangkay100% (1)

- The New IRS Form 3949 A Revised in March 2014Document3 pagesThe New IRS Form 3949 A Revised in March 2014Freeman Lawyer100% (1)

- 1040 Engagement LetterDocument2 pages1040 Engagement LetterAshru AshrafPas encore d'évaluation

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptAmber CarterPas encore d'évaluation

- 4506 TDocument3 pages4506 Tteddy rooseveltPas encore d'évaluation

- Sample IRS Penalty Abatement Request LetterDocument4 pagesSample IRS Penalty Abatement Request LetterMichelle MachadoPas encore d'évaluation

- F 9465Document3 pagesF 9465Pat PlantePas encore d'évaluation

- Candlestick Charting: Quick Reference GuideDocument24 pagesCandlestick Charting: Quick Reference GuideelisaPas encore d'évaluation

- Full Download Test Bank For Cognitive Psychology 6th Edition Sternberg PDF Full ChapterDocument31 pagesFull Download Test Bank For Cognitive Psychology 6th Edition Sternberg PDF Full Chaptercadie.tutressrwwsn100% (16)

- An Expert Guide To SQL Server Performance Tuning PDFDocument10 pagesAn Expert Guide To SQL Server Performance Tuning PDFMarioPas encore d'évaluation

- Digest NegoDocument9 pagesDigest NegoMichael RentozaPas encore d'évaluation

- Computer Networks Notes (17CS52) PDFDocument174 pagesComputer Networks Notes (17CS52) PDFKeerthiPas encore d'évaluation

- New Vendor Info FormDocument11 pagesNew Vendor Info FormRoseNPrincePas encore d'évaluation

- Non Banking Financial CompanyDocument39 pagesNon Banking Financial Companymanoj phadtarePas encore d'évaluation

- Status FormDocument3 pagesStatus FormAbdul Latief FaqihPas encore d'évaluation

- California Excise Taxes Permit Application: Boe 400 Eti Rev. 7 (1 10)Document8 pagesCalifornia Excise Taxes Permit Application: Boe 400 Eti Rev. 7 (1 10)Anonymous UUUcrNPas encore d'évaluation

- Confirmation PageDocument4 pagesConfirmation PageNakia Freeman-AlvinPas encore d'évaluation

- QC 16161Document12 pagesQC 16161john englishPas encore d'évaluation

- Suitability and Declarations FormDocument5 pagesSuitability and Declarations FormMansoor MalikPas encore d'évaluation

- A. General Guidance About The PTIN Application ProcessDocument7 pagesA. General Guidance About The PTIN Application ProcessYanjing LiuPas encore d'évaluation

- F4506tez 2011Document2 pagesF4506tez 2011Arash Refael BaradarianPas encore d'évaluation

- TSTIW4Document4 pagesTSTIW4abhinavanupamPas encore d'évaluation

- Support Payment Credit Information Sheet: Return Completed Form (S) ToDocument6 pagesSupport Payment Credit Information Sheet: Return Completed Form (S) ToMaria EPas encore d'évaluation

- An IRS Audit Is A ReviewDocument4 pagesAn IRS Audit Is A ReviewRohit BajpaiPas encore d'évaluation

- Government Form 1310Document3 pagesGovernment Form 1310EmilyPas encore d'évaluation

- Reed Application FormDocument6 pagesReed Application FormCalvin Leo 'Carter' SamkangePas encore d'évaluation

- 2013 Partnership Eng Letter WebsiteDocument6 pages2013 Partnership Eng Letter WebsiteClarisse30Pas encore d'évaluation

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1Pas encore d'évaluation

- Tax Return Acceptance Receipt 2016Document2 pagesTax Return Acceptance Receipt 2016anandrapakaPas encore d'évaluation

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printrobertledoux2Pas encore d'évaluation

- Application To Participate in Selection Process - Adviser Acquisition - Online4 - Feb 2022Document16 pagesApplication To Participate in Selection Process - Adviser Acquisition - Online4 - Feb 2022anelisampande8Pas encore d'évaluation

- FL Voluntary Disclosure ProgramDocument3 pagesFL Voluntary Disclosure Programmcampo7Pas encore d'évaluation

- Application For Release From Prohibition or Removal OrderDocument13 pagesApplication For Release From Prohibition or Removal OrderMark ReinhardtPas encore d'évaluation

- 4506T EzDocument2 pages4506T EzIvellisse AyusoPas encore d'évaluation

- IRS Publication 1Document2 pagesIRS Publication 1Francis Wolfgang UrbanPas encore d'évaluation

- Form 4506 TDocument2 pagesForm 4506 Tbhill07Pas encore d'évaluation

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetPas encore d'évaluation

- Universal Member Application: Personal InformationDocument2 pagesUniversal Member Application: Personal InformationHunter GrayPas encore d'évaluation

- Golden Hope Care LTD Job Application Form For International Staff 2Document11 pagesGolden Hope Care LTD Job Application Form For International Staff 2Oscar ChitatePas encore d'évaluation

- How To Apply For Snap-Tanf InstructionsDocument2 pagesHow To Apply For Snap-Tanf InstructionsLamario StillwellPas encore d'évaluation

- NM Self/Participant Direction Employee Employment PacketDocument34 pagesNM Self/Participant Direction Employee Employment PacketShellyJacksonPas encore d'évaluation

- Dealing With An Income Tax Dispute?: Your Rights Asa TaxpayerDocument5 pagesDealing With An Income Tax Dispute?: Your Rights Asa TaxpayergodardsfanPas encore d'évaluation

- Income Tax Act - 1961: Penalties For Non-Payments of TaxesDocument3 pagesIncome Tax Act - 1961: Penalties For Non-Payments of TaxesTejas GujjarPas encore d'évaluation

- std686 PDFDocument2 pagesstd686 PDFnmkeatonPas encore d'évaluation

- Pplication OR Mployment: MR / Mrs / Miss / Ms / OtherDocument9 pagesPplication OR Mployment: MR / Mrs / Miss / Ms / OtherIonut DumitrescuPas encore d'évaluation

- Instructions For Form 940: Future DevelopmentsDocument12 pagesInstructions For Form 940: Future DevelopmentsAldrianPas encore d'évaluation

- Building International Bridges BIB Articles of Incorporation Page 19 BY LAWSDocument32 pagesBuilding International Bridges BIB Articles of Incorporation Page 19 BY LAWSJk McCreaPas encore d'évaluation

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalPas encore d'évaluation

- Electronic Funds Transfer (Eft) Authorization Agreement: Page 1 of 3Document3 pagesElectronic Funds Transfer (Eft) Authorization Agreement: Page 1 of 3JayPas encore d'évaluation

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnmarlygradePas encore d'évaluation

- Ficha Tecnica Gato Big Red 30tonDocument16 pagesFicha Tecnica Gato Big Red 30tonCesar Augusto Arias CastroPas encore d'évaluation

- DENTAL JURIS - Dental Legislation PDFDocument2 pagesDENTAL JURIS - Dental Legislation PDFIsabelle TanPas encore d'évaluation

- Accounting SyllabiDocument2 pagesAccounting SyllabiJyotirmaya MaharanaPas encore d'évaluation

- Chordu Piano Chords Ede Lobas Chordsheet Id - JBQiUlO0NDU PDFDocument3 pagesChordu Piano Chords Ede Lobas Chordsheet Id - JBQiUlO0NDU PDFKaren RochaPas encore d'évaluation

- K-8 March 2014 Lunch MenuDocument1 pageK-8 March 2014 Lunch MenuMedford Public Schools and City of Medford, MAPas encore d'évaluation

- Ethics in Marketing - UNIT-2Document27 pagesEthics in Marketing - UNIT-2kush mandaliaPas encore d'évaluation

- Create An Informational Flyer AssignmentDocument4 pagesCreate An Informational Flyer AssignmentALEEHA BUTTPas encore d'évaluation

- HHI Elite Club - Summary of Benefits 3Document3 pagesHHI Elite Club - Summary of Benefits 3ghosh_prosenjitPas encore d'évaluation

- 2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsDocument6 pages2022 NPC Circular No. 02 Amending NPC Circular 2020-01 Guidelines On Loan Related TransactionsWilliam SantosPas encore d'évaluation

- Request For Inspection: Ain Tsila Development Main EPC Contract A-CNT-CON-000-00282Document1 pageRequest For Inspection: Ain Tsila Development Main EPC Contract A-CNT-CON-000-00282ZaidiPas encore d'évaluation

- TaclobanCity2017 Audit Report PDFDocument170 pagesTaclobanCity2017 Audit Report PDFJulPadayaoPas encore d'évaluation

- China Signposts: A Practical Guide For Multinationals in 2022Document16 pagesChina Signposts: A Practical Guide For Multinationals in 2022APCO WorldwidePas encore d'évaluation

- Math Worksheets For Kids (Count The Animals)Document9 pagesMath Worksheets For Kids (Count The Animals)Zêd Ha FådēdPas encore d'évaluation

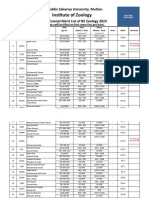

- 5953-6th Merit List BS Zool 31-8-2023Document22 pages5953-6th Merit List BS Zool 31-8-2023Muhammad AttiqPas encore d'évaluation

- Ideological Differences - Communism V CapitalismDocument11 pagesIdeological Differences - Communism V CapitalismElvira ToktasinovaPas encore d'évaluation

- ARLANXEO EPDM at A GlanceDocument6 pagesARLANXEO EPDM at A GlanceErwin ErwinPas encore d'évaluation

- Davao October 2014 Criminologist Board Exam Room AssignmentsDocument113 pagesDavao October 2014 Criminologist Board Exam Room AssignmentsPRC Board0% (1)

- Shooting An Elephant Marxist Criticism PDFDocument5 pagesShooting An Elephant Marxist Criticism PDFapi-247731762Pas encore d'évaluation

- SBI's Microfinance InitiativesDocument3 pagesSBI's Microfinance InitiativesSandeep MishraPas encore d'évaluation

- Chapter Eight Cross-National Cooperation and Agreements: ObjectivesDocument13 pagesChapter Eight Cross-National Cooperation and Agreements: ObjectivesSohni HeerPas encore d'évaluation

- Last Two Verse of Surah AlDocument5 pagesLast Two Verse of Surah AlMhonly MamangcaoPas encore d'évaluation

- JF 2 7 ProjectSolution Functions 8pDocument8 pagesJF 2 7 ProjectSolution Functions 8pNikos Papadoulopoulos0% (1)