Académique Documents

Professionnel Documents

Culture Documents

Case Study

Transféré par

slassygetsamastersDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Case Study

Transféré par

slassygetsamastersDroits d'auteur :

Formats disponibles

Parsons: Overseas Training |1 Overseas Communication: Training techniques across borders Leah Beth Parsons Queens University of Charlotte

July 12, 2010 Need/Opportunity: We live in a global society in which, we have the ability to connect to multiple individuals in various regions of the world. How many times have you picked up a product and realized that its individual pieces were made in different countries and then assembled somewhere completely different. We are not an isolated work force; therefore we must understand the importance of overseas training. Even our banks utilize other countries to help support their product. Bank A and company B are two organizations, located in different areas of the world, that use overseas training in order to work together to supply an efficient and secure product. Bank A is a publicly traded, diversified financial institute based in Cincinnati, Ohio. It reaches across 18 different states and engages in five main lending and banking practices: branch banking, consumer lending, commercial banking, investment advisors and the Bank A Processing Solutions. The processing solutions division is responsible for handling all debit and credit transactions. Bank A employs over 22,000 individuals in the U.S. and has over $1.07 billion in net income. It also uses Company B to handle its offshore processing of credit and debit transactions. Company B was founded in 2000, and is headquartered in Bangalore, India. It focuses on providing solutions that leverage cutting-edge technologies and industry best practices (http://www.slk-soft.com/SLK_ITES/). Company B can provide companies with data enabled services, geographic information systems, and computer aided design and drafting. Offshore processing allows banks to utilize individuals living in other areas of the world, specifically India, to provide credit card processing assistance. While some individuals who disagree with global trading are wary of off-shore processing, however, many agree that offshore credit card processing services offer you reliable, secure and cost-effective payment procedures (http://www.merchantaccounts.cn/OffshoreMerchantAccounts/Offshore_Processing.h tml). One of the bankcard adjustments managers at Bank A stated that off shore processing allows consumers to have access to individuals and their credit information twenty-four hours a day, seven days a week. We live in a society that expects immediate results; this process allows this expectation to be met. Bank A and company B work together within Bank As processing solutions and company Bs data enabled services, to process credit and debit transactions and

Parsons: Overseas Training |2 verification of those transactions. Company B processes debit and credit transactions made by Bank As costumers, while Bank A oversees and verifies the process and information. In order for these two organizations to work together efficiently, cross cultural and overseas training is utilized. To train the processors, Bank A employees responsible for training use several means of communication. The question at hand is what is the best mix of communication techniques in order to train individuals in other parts of the world, securely and efficiently? Intended Audience: In order for overseas training to work the two teams, Company B and Bank A must work together. Middle management at Bank A will speak directly to general managers and supervisors at company B. Only on rare occasions will Bank A managers speak directly with the processors (the individuals responsible for processing the debit and credit transactions) at company B, mainly when new employees are hired or a new technique is developed. For the most part company B general management will speak on behalf of the processors and will then relay messages to the processors from the management team at Bank A. There is always a middle man which allows for mixed messages. Clarity and consistence of the message becomes an issue. Because company B is an India based group, the cast system plays a major role in determining who is in what position. The cast system is based on who you are when you were born. The poor can never hold a management position because they were born poor; sometimes they are not allowed to attend school and can only hold certain types of positions in the workforce (lower level). Whereas those who were born into wealth have the option to attend school and eventually work in management level. Caste barriers have mostly broken down in large cities, though they persist in rural areas of the country, where 72% of India's population resides the Indian Constitution has outlawed caste-based discrimination, in keeping with the secular, democratic principles that founded the nation. Nevertheless, the caste system, in various forms, continues to survive in modern India because of a combination of political factors and social perceptions and behavior. (http://en.wikipedia.org/wiki/Caste_system_in_India) Bank A and company B do not enforce the caste system; however it is still an issue because it is socially accepted. Similar to the lack of women leaders in America (women are still considered inferior to men within many organizations; however no one is allowed to say those exact words). This type of a system creates barriers during the training process. Many times the managers at company A have the same amount of knowledge as the lower lever processors at Bank A, where in a perfect world the mangers at company B should have knowledge that is consistent with the mangers, not the processors at Bank A. Because this is not the case Bank A managers must explain every detail, use

Parsons: Overseas Training |3 reiteration and make no assumptions when they speak with Company B managers and processors. During training periods Bank A managers will speak directly with the processors in a closely observed area with company B managers nearby in case an interpretation needs to be made or terminology needs to be clarified. The conversations are carried out through video feed, live meeting, or phone.

Goals and Objectives: The goal of distance training is to make sure that the employees in India as well as Cincinnati are completing the task in an efficient, correct and timely manner. Therefore open and clear communication is necessary. The communication objectives set by the managers are that all parties involved will have a clear understanding of the following: 1) All employees of Bank A and Company B should have an understanding of the cultural barriers (language and dialect differences, cast system, and so forth). 2) Employees of Bank A and Company B should have adequate knowledge of the required technology to complete their assigned task: instant messaging, e-mail, phone, and live meeting (Live meeting is a tool that allows one individual to oversee anothers computer desktop without being in the room. This allows trainers in Cincinnati to watch what the employees who are being trained in India are doing and then guide them through the steps). 3) All employees of Bank A and Company B have been given clear and succinct instructions on how to process debit and credit transactions. 4) All employees have the ability to ask questions and reiterate the process Each task and implementation of the task requires employees to be trained and a new contract between Bank A and company B must be create. If changes are made to the newly created process or old techniques are made then the implementation team at Bank A and Company B must hold a meeting to determine if this is a new implementation/task or just a minor change to a current process. Each change requires a change in the current contract or the creation of a new contract. This is a required contractual agreement between the two organizations and the mangers of both companies must be present. This process can be timely and costly; therefore each task must be thoroughly thought out and perfected before it is presented.

Parsons: Overseas Training |4 Solutions: A bankcard adjustments manager, who wishes not to be named, works closely with company Bs managers and supervisors to make sure the processors are completing the task (processing the debit and credit transactions) in an efficient, secure and timely manner. When implementing training David uses four forms of technologies: 1) Instant message: this is used to provide quick updates and to answer any small question that may occur after training 2) Phone: The phone is used mostly between managers to check on progress and to verify information. The phone can sometimes cause confusion due to the differences in dialects as well as the meanings of certain words. When the phone is used during training, repetition is crucial. 3) E-mail: when detail, graphs, charts, and other visuals are necessary this is the best form of communication. This is also a useful tool when documentation is necessary. 4) Live Video: This is the best and most efficient tool to use during training. Company B processors are not allowed to take notes, have pens, or paper (this is a security measure). Therefore everything they learn must happen on the computer and they must remember the steps. This training tool allows Company B members to have hands on training. It also allows the management and training team to see what mistakes are being made if an error occurs. While each issue requires a different form of technology, Bank A prefers to use live video and e-mail. Bank A believes these two technologies are best because information is passed from one person to another without a middle manner and it is communicated in a clear manner. By using these methods for training Bank A is also able to document the conversations and training sessions. . During the training process, each employee is given the opportunity to ask questions and a manager at Company B is at hand to help clarify. A managers onsite presence helps speed up the training time and make sure that each employee understand his or her job. Implementation and Challenges: In order for the training to occur a management team at Bank A and Company B must negotiate the contract, determine the task that will be accomplished, the method to complete that task, and the goals and measurements to determine success. This is the first group to be notified of a concern or if a problem should

Parsons: Overseas Training |5 arise. Because of this, the implementation team sees many of the challenges that come with overseas training and offshore processing. One of the challenges is the amount of red tape and bureaucracy that is necessary before a change can be made. Because of this, it is hard to change things that are not working and it is hard for some to have a voice. The processors, those completing the task, do not have a voice. If there is a problem with the process and they speak up, it takes a very long time for a solution to be found or for their concern to be recognized. This leads to another challenge, cultural differences. Because of the cast system in India, the processors are not considered valuable employees; therefore their opinion is taken lightly, without great consideration. Some of the problems could be found and solved in a quicker manner if management would listen to their opinion. The middle man sometimes gets in the way. The cultural differences also lead to a training problem. Because different words mean different things in different countries, each process needs to be clarified and reiterated. No assumptions can be made. Employees in India do not like to admit when they are wrong; therefore it is difficult to correct situations. If technology fails, then the training process cannot occur. Many times training will be postponed due to a technological difficulty. This leads to a postponement in production.

Measurement and Evaluation: 1) Turnaround Time: If a new process or goal is created then company Bs team must use that process or meet that goal within 48 hours. If they fail to do so then an error has occurred. If this occurs then management must meet to determine a more efficient process or the processors must go back through training. This is not good for either team, Company B or Bank A, because it is costly and slows down production. 2) Quality: A checklist is created with each process and goal. There is a quality control team located in Cincinnati that process three percent of the work, while Company B is responsible for processing the other 97 percent. If Company Bs team does not complete the checklist at the rate or efficiency as the hometown team, then the work is declared low quality. 3) Volume: This is the level at which Company B can process the work. There is a formula that determines how many credits and debits must be processed. This formula is based on number of credits and debits, time, and number of

Parsons: Overseas Training |6 processors. Payment is then made based on this formula. If the volume is low then the process will be reviewed and the contract will be re-negotiated.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Michael Waltrip Racing: A Look at Small Group Communication March, 2011 Davida Jackson Kenyon Stanley Kristen Bostedo-Conway Leah Beth ParsonsDocument12 pagesMichael Waltrip Racing: A Look at Small Group Communication March, 2011 Davida Jackson Kenyon Stanley Kristen Bostedo-Conway Leah Beth ParsonsKristen Bostedo-ConwayPas encore d'évaluation

- Reflection Journal 5Document4 pagesReflection Journal 5slassygetsamastersPas encore d'évaluation

- Final - Legally BlondeDocument9 pagesFinal - Legally BlondeslassygetsamastersPas encore d'évaluation

- Consulting Project - Cheer LeadingDocument15 pagesConsulting Project - Cheer LeadingslassygetsamastersPas encore d'évaluation

- QUEENS 7venth Comm Audit ReportDocument18 pagesQUEENS 7venth Comm Audit ReportslassygetsamastersPas encore d'évaluation

- Connection Paper 2Document3 pagesConnection Paper 2slassygetsamastersPas encore d'évaluation

- Leah's Final Paper - IdentityDocument18 pagesLeah's Final Paper - IdentityslassygetsamastersPas encore d'évaluation

- Cheer Leading Recruitment Strategic Communication PlanDocument10 pagesCheer Leading Recruitment Strategic Communication PlanslassygetsamastersPas encore d'évaluation

- Book Summary - Her Place at The TableDocument13 pagesBook Summary - Her Place at The TableslassygetsamastersPas encore d'évaluation

- Belk - IntroDocument14 pagesBelk - IntroslassygetsamastersPas encore d'évaluation

- Application Journal - 6Document7 pagesApplication Journal - 6slassygetsamastersPas encore d'évaluation

- Application Journal - 2Document5 pagesApplication Journal - 2slassygetsamastersPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- ID Model PDFDocument20 pagesID Model PDFAbbasPas encore d'évaluation

- Science 7 DLL J November 5 - 9Document3 pagesScience 7 DLL J November 5 - 9Jhaypee SorianoPas encore d'évaluation

- Discipline and Ideas in Applied Social SciencesDocument3 pagesDiscipline and Ideas in Applied Social SciencesJay Mark Blancada89% (9)

- I - CSCI - 2133 - 390 - 26585 - 201620 Introduction To JAVA - Online Spring 2016Document7 pagesI - CSCI - 2133 - 390 - 26585 - 201620 Introduction To JAVA - Online Spring 2016William SmithPas encore d'évaluation

- 115552r00ZB BoD-ZigBee Network Device - ZigBee Gateway Standard Version 1 PDFDocument301 pages115552r00ZB BoD-ZigBee Network Device - ZigBee Gateway Standard Version 1 PDFadryano85Pas encore d'évaluation

- 02 RA41562EN02GLA0 LTE Radio Interface Protocols and ProceduresDocument80 pages02 RA41562EN02GLA0 LTE Radio Interface Protocols and ProceduresesdrasferrazPas encore d'évaluation

- Dialnet ALearnerCentredApproachToTheTeachingOfEnglishAsAnL 2535996Document8 pagesDialnet ALearnerCentredApproachToTheTeachingOfEnglishAsAnL 2535996CintaPas encore d'évaluation

- 21PGDM177 - I&E AssignmentDocument6 pages21PGDM177 - I&E AssignmentShreya GuptaPas encore d'évaluation

- PEDMS User Guide - v5 - 8 1Document1 pagePEDMS User Guide - v5 - 8 1fandi_othmanPas encore d'évaluation

- English Language: Proper Usage and Its Vital RoleDocument13 pagesEnglish Language: Proper Usage and Its Vital RoleJackyline MagsinoPas encore d'évaluation

- B.E.S.T. Writing Argumentation Rubric: Grades 7-10Document3 pagesB.E.S.T. Writing Argumentation Rubric: Grades 7-10Wilson FerreiraPas encore d'évaluation

- Translating Cultural Identity in PoetryDocument15 pagesTranslating Cultural Identity in PoetryZubaida MhdPas encore d'évaluation

- Buzibr Ns Positions & Detailed Job DescriptionDocument4 pagesBuzibr Ns Positions & Detailed Job Descriptionvikas babuPas encore d'évaluation

- Topic: Move Analysis of Literature ReviewDocument12 pagesTopic: Move Analysis of Literature Reviewsafder aliPas encore d'évaluation

- Strategies For Reading Factual TextsDocument48 pagesStrategies For Reading Factual TextsLinette CabreraPas encore d'évaluation

- Ben Cotton CVDocument3 pagesBen Cotton CVashifPas encore d'évaluation

- Self-Learning Module Science3Document13 pagesSelf-Learning Module Science3Torres, Emery D.Pas encore d'évaluation

- Santana Et Al How To Practice Person Centred CareDocument12 pagesSantana Et Al How To Practice Person Centred CareShita DewiPas encore d'évaluation

- Baseband M Ary Transmission and Digital Subscriber LinesDocument17 pagesBaseband M Ary Transmission and Digital Subscriber LinesKoushik VemuriPas encore d'évaluation

- Activity 1. Language Analysis: Communication Setting and Communicators' RelationshipDocument3 pagesActivity 1. Language Analysis: Communication Setting and Communicators' RelationshipRichmond CubiloPas encore d'évaluation

- Final SlideDocument16 pagesFinal SlideHow to give a killer PresentationPas encore d'évaluation

- The Oxford Guide To Etymology, Edited by Philip DurkinDocument183 pagesThe Oxford Guide To Etymology, Edited by Philip DurkinRajua80% (5)

- JWagner ResumeDocument2 pagesJWagner ResumeAnkur MidhaPas encore d'évaluation

- Relationship Marketing: SHSMD Luncheon October 5, 2007 Leean Kravitz Mudhouse AdvertisingDocument27 pagesRelationship Marketing: SHSMD Luncheon October 5, 2007 Leean Kravitz Mudhouse AdvertisingVikalp TomarPas encore d'évaluation

- Marketing services challengesDocument15 pagesMarketing services challengesakhileshPas encore d'évaluation

- Mivoice Business GigDocument203 pagesMivoice Business GigyikchingPas encore d'évaluation

- TrendDocument35 pagesTrendEvelynPas encore d'évaluation

- Feedback MessageDocument1 pageFeedback Messageapi-530830965Pas encore d'évaluation

- Surat Perjanjian Sewa Menyewa RukoDocument3 pagesSurat Perjanjian Sewa Menyewa RukoMaamzkyPas encore d'évaluation

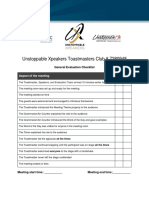

- Unstoppable Xpeakers Toastmasters Club EvaluationDocument3 pagesUnstoppable Xpeakers Toastmasters Club EvaluationJerry GreyPas encore d'évaluation