Académique Documents

Professionnel Documents

Culture Documents

LT Infrastructure FinanceLtd-2011B Series Tranche-1

Transféré par

Manish ChauhanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LT Infrastructure FinanceLtd-2011B Series Tranche-1

Transféré par

Manish ChauhanDroits d'auteur :

Formats disponibles

L&T Infrastructure Finance Company Ltd-Long Term Infrastructure Bonds 2011B Series (Tranche-1)

Tranche 1 Bond Series 1 2 Friday, November 25, 2011 Issue Opens Saturday, December 24, 2011* Issue Closes L&T Infrastructure Finance Company Limited Issuer Issue of Tranche 1 Bonds Public issue of long term infrastructure bonds of face value of Rs. 1,000 each, in the nature of secured, redeemable, non-convertible debentures, having benefits under section 80CCF of the Income Tax act, 1961 (the Tranche 1 Bonds), not exceeding Rs. 11,000.0 million for the FY 2012, to be issued at par on the terms contained in the Shelf Prospectus and this Prospectus Tranche 1. BSE Listing Dematerialized form only following expiry of Lock-in Period Trading (ICRA)AA+ from ICRA and CARE AA+ from CARE Rating 9.00% p.a. 9.00% p.a. compounded annually Interest Rate Rs. 1,000/Rs. 1,000/Face Value per Bond Annual Cumulative Frequency of Interest payment ICICI Securities, JM Financial & Karvy Investor Ser Ltd Lead Managers Bajaj Capital Ltd, RR Investor, SMC Capital, Integrated Enterprises Co-Lead Managers Sharepro Services (India) Private Limited. Registrar 5 Tranche 1 Bonds and in multiple of 1 Tranche 1 Bond thereafter. For the purpose of Minimum Application fulfilling the requirement of min subscription of 5 Tranche 1 bonds, an applicant may choose to apply for the Tranche 1 bonds across the same series or different series. Indian nationals resident in India, who are not minors, in single or joint names (not Who can apply? more than three); and Hindu Undivided Families or HUFs, in the individual name of the Karta. Debenture Trustee Lock in Period Issuance Buyback Facility Buyback Date Bank of Maharashtra 5 years from the deemed date of allotment Dematerialized form or Physical form as specified by an Applicant in the Application Form. Yes The first Working Day after the expiry of 5 years from the Deemed Date of Allotment and the first Working Day after the expiry of 7 years from the Deemed Date of Allotment. Rs. 1,000/- at the end of 5 years/ Rs. 1,538.62/- at the end of 5 years/ Rs. 1,000/- at the end of 7 years Rs. 1,828.04/- at the end of 7 years The period commencing from 6 months preceding the relevant Buyback Date and Ending 3 months prior to such Buyback Date. 10 years from the Deemed Date of 10 years from the Deemed Date of Allotment Allotment

Buyback Amount Buyback Intimation Period Maturity Date

Maturity Amount Yield on Maturity Yield on Buyback

Rs. 1,000/9.00% 9.00%

Rs. 2,367.36/9.00% compounded annually 9.00% compounded annually

Tax Benefit: THE TRANCHE 1 BONDS ARE CLASSIFIED AS LONG TERM INFRASTRUCTURE BONDS IN TERMS OF SECTION 80CCF OF THE INCOME TAX ACT AND THE NOTIFICATION. IN ACCORDANCE WITH SECTION 80CCF OF THE INCOME TAX ACT, THE AMOUNT, NOT EXCEEDING ` 20,000 PER ANNUM, PAID OR DEPOSITED AS SUBSCRIPTION TO LONG TERM INFRASTRUCTURE BONDS DURING THE PREVIOUS YEAR RELEVANT TO THE ASSESSMENT YEAR BEGINNING APRIL 01, 2012 SHALL BE DEDUCTED IN COMPUTING THE TAXABLE INCOME OF A RESIDENT INDIVIDUAL OR HUF. IN THE EVENT THAT ANY APPLICANT APPLIES FOR THE TRANCHE 1 BONDS IN EXCESS OF ` 20,000 PER ANNUM, (INCLUDING LONG TERM INFRASTRUCTURE BONDS ISSUED BY ANY OTHER ELIGIBLE ENTITY), THE AFORESTATED TAX BENEFIT SHALL BE AVAILABLE TO SUCH APPLICANT ONLY TO THE EXTENT OF ` 20,000 PER ANNUM.

* The Issue shall remain open for subscription during banking hours for the period indicated above, except that the Issue may close on such earlier date or extended date as may be decided by the Board subject to necessary approvals. In the event of an early closure or extension of the Issue, the Company shall ensure that notice of the same is provided to the prospective investors through newspaper advertisements on or before such earlier or extended date of Issue closure. Interest on Application and Refund Money The Company shall not pay any interest on the application monies collected pursuant to the Issue pending allotment of the Tranche 1 Bonds. The Company shall not pay any interest on refund of application monies on the amount not allotted. Bankers to the Issue Axis Bank Limited City Union Bank HDFC Bank Limited ICICI Bank Limited IDBI Bank Limited State Bank of India

Vous aimerez peut-être aussi

- Investment Agreement - 2Document3 pagesInvestment Agreement - 2patodi50% (2)

- IRS Form SS-4 Guide and InstructionsDocument7 pagesIRS Form SS-4 Guide and InstructionsChristopher WhoKnows100% (3)

- SREI Infrastructure Bond Application FormDocument8 pagesSREI Infrastructure Bond Application FormPrajna CapitalPas encore d'évaluation

- Chapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Document38 pagesChapter 11 Pfrs For Small and Medium-Sized Entities (Smes)Sarah G100% (1)

- Chapter 5 Question Answer KeyDocument83 pagesChapter 5 Question Answer KeyBrian Schweinsteiger FokPas encore d'évaluation

- Nedbank Pricing 2020Document55 pagesNedbank Pricing 2020BusinessTech100% (1)

- ContracrtDocument11 pagesContracrtroushan kumarPas encore d'évaluation

- L&T Infrastructure Bonds 2011B SeriesDocument2 pagesL&T Infrastructure Bonds 2011B Seriespriya thackerPas encore d'évaluation

- PFC Tax Free Bonds IssueDocument5 pagesPFC Tax Free Bonds IssueHimanshuPas encore d'évaluation

- L&T Long Term Infrastructure Bond Tranche 1 Application FormDocument8 pagesL&T Long Term Infrastructure Bond Tranche 1 Application FormPrajna CapitalPas encore d'évaluation

- LNT Bond FormDocument8 pagesLNT Bond FormsunajbaniPas encore d'évaluation

- L&T Infra BondsDocument6 pagesL&T Infra BondsPramod MorePas encore d'évaluation

- NTPCDocument19 pagesNTPCamritPas encore d'évaluation

- Investment Management Unit - Ii Investement AlternativesDocument57 pagesInvestment Management Unit - Ii Investement AlternativesmalavikaPas encore d'évaluation

- IDFC Infra Bond Tranche 1 Application DetailsDocument8 pagesIDFC Infra Bond Tranche 1 Application DetailsAjay KamatPas encore d'évaluation

- Ifci Infrastructure BondsDocument5 pagesIfci Infrastructure BondsAnirudh SharmaPas encore d'évaluation

- Rural Electrification Corporation LimitedDocument3 pagesRural Electrification Corporation LimitedanalystbankPas encore d'évaluation

- Government BusinessDocument17 pagesGovernment BusinessManish AroraPas encore d'évaluation

- SyllabusDocument24 pagesSyllabusRipon DebPas encore d'évaluation

- HUDCO - Term SheetDocument2 pagesHUDCO - Term SheetSandy DheerPas encore d'évaluation

- FAQs Redemption of Tranche 2 LTIBsDocument7 pagesFAQs Redemption of Tranche 2 LTIBsKaran KaranPas encore d'évaluation

- REC LONG TERM INFRASTRUCTURE BONDSDocument1 pageREC LONG TERM INFRASTRUCTURE BONDSAshish Kumar RathorePas encore d'évaluation

- NHAI ISSUE HighlightsDocument1 pageNHAI ISSUE HighlightsBal RajPas encore d'évaluation

- Presentation On Certificate of Deposits: Treasury ManagementDocument23 pagesPresentation On Certificate of Deposits: Treasury ManagementShankeyPas encore d'évaluation

- L&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Document8 pagesL&T Long Term Infrastructure Bond Tranche 2 Application Form 2012Prajna CapitalPas encore d'évaluation

- Money InstrumentsDocument14 pagesMoney InstrumentsSherin BabuPas encore d'évaluation

- FOREX Cir1684 12Document12 pagesFOREX Cir1684 12sunilPas encore d'évaluation

- Credit Monitoring Policy For 2020 ExamDocument8 pagesCredit Monitoring Policy For 2020 ExamSrikanth TanguturuPas encore d'évaluation

- Government SecuritiesDocument11 pagesGovernment Securitiesridhima57100% (2)

- Vallibel Finance PLC - Debenture Issue 2015 PROSPECTUSDocument64 pagesVallibel Finance PLC - Debenture Issue 2015 PROSPECTUSsampathmudalige23.promateworldPas encore d'évaluation

- 006eafd0-f2c2-4db1-8d18-872683c00b26Document14 pages006eafd0-f2c2-4db1-8d18-872683c00b26ShivamSinghPas encore d'évaluation

- Dewan Housing Finance Corporation LTD: Retail ResearchDocument4 pagesDewan Housing Finance Corporation LTD: Retail ResearchumaganPas encore d'évaluation

- EFDAIDocument5 pagesEFDAIJanardhana JaanuPas encore d'évaluation

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyPas encore d'évaluation

- Customers' Deposit Accounts: Unit IVDocument26 pagesCustomers' Deposit Accounts: Unit IVShaifaliChauhanPas encore d'évaluation

- Handbook On Govt Business Products 20210818174621Document9 pagesHandbook On Govt Business Products 20210818174621omvir singhPas encore d'évaluation

- Sample Eq2 Investment Agreement Statewide Loan FundDocument4 pagesSample Eq2 Investment Agreement Statewide Loan Fundtanzeel307Pas encore d'évaluation

- Assignment: Submitted ToDocument12 pagesAssignment: Submitted ToYadwinder SinghPas encore d'évaluation

- Invest in 7.75% RBI Savings BondsDocument2 pagesInvest in 7.75% RBI Savings BondsYash SoniPas encore d'évaluation

- Form 5196Document7 pagesForm 5196mittalharsh27Pas encore d'évaluation

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaPas encore d'évaluation

- BNK 632: International Finance &bankingDocument31 pagesBNK 632: International Finance &bankingShubham SrivastavaPas encore d'évaluation

- NHPC Application Form DetailsTNC PDFDocument47 pagesNHPC Application Form DetailsTNC PDFHariprasad ManchiPas encore d'évaluation

- Assignment: Investment ManagementDocument12 pagesAssignment: Investment ManagementYadwinder SinghPas encore d'évaluation

- CLERK Study Material-2017 Part 4Document7 pagesCLERK Study Material-2017 Part 4asdPas encore d'évaluation

- Circular For Interest PaymentDocument3 pagesCircular For Interest PaymentVibhu SinghPas encore d'évaluation

- FCNR Ac by Pranab NamchoomDocument18 pagesFCNR Ac by Pranab NamchoomPranab NamchoomPas encore d'évaluation

- RD THDocument4 pagesRD THRamakrishnan RamasamyPas encore d'évaluation

- Directive 2Document69 pagesDirective 2Manish BhandariPas encore d'évaluation

- General Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information MemorandumDocument8 pagesGeneral Information: Ifci Tax Exemption Long Term Infrastructre Bond SERIES II - Information Memorandumsiriasvs_bPas encore d'évaluation

- FINTELLIGENCE 6 12 March 2014 Step by Step Guide To NCD IssuanceDocument5 pagesFINTELLIGENCE 6 12 March 2014 Step by Step Guide To NCD IssuanceAnkit SharmaPas encore d'évaluation

- Scotts Garments Ltd.Document281 pagesScotts Garments Ltd.Ganesh100% (1)

- 12345Document8 pages12345induchellamPas encore d'évaluation

- Deduction Under Chapter VI-ADocument13 pagesDeduction Under Chapter VI-AVachanamrutha R.VPas encore d'évaluation

- Security Analysis 1 To 30 ConsolidatedDocument151 pagesSecurity Analysis 1 To 30 ConsolidatedPRACHI DASPas encore d'évaluation

- REC TAx Free Bond Application FormDocument8 pagesREC TAx Free Bond Application FormPrajna CapitalPas encore d'évaluation

- Term SheetDocument2 pagesTerm Sheetmayank04Pas encore d'évaluation

- Portfolio Management and Investment Alternatives: Shruti ChavarkarDocument17 pagesPortfolio Management and Investment Alternatives: Shruti ChavarkarShrikant SabatPas encore d'évaluation

- General Banking HeartDocument24 pagesGeneral Banking HeartMD. JAHIDPas encore d'évaluation

- SBI EMI Moratorium FAQsDocument4 pagesSBI EMI Moratorium FAQsCNBCTV18 DigitalPas encore d'évaluation

- Memorandum of Understanding (Mou)Document4 pagesMemorandum of Understanding (Mou)zil_bestPas encore d'évaluation

- FAQs On Sovereign Gold Bond SCHEME Annx1Document6 pagesFAQs On Sovereign Gold Bond SCHEME Annx1Alok Kr MishraPas encore d'évaluation

- Tgpala Aicte Income Tax Programme 2015 16 UPDATEDDocument27 pagesTgpala Aicte Income Tax Programme 2015 16 UPDATEDniranjannlgPas encore d'évaluation

- Thrift Savings Plan Investor's Handbook for Federal EmployeesD'EverandThrift Savings Plan Investor's Handbook for Federal EmployeesPas encore d'évaluation

- MCTax GuideDocument1 pageMCTax Guidekhageshcode89Pas encore d'évaluation

- Securities and Exchange Board of India: Master CircularDocument236 pagesSecurities and Exchange Board of India: Master CircularViral_v2inPas encore d'évaluation

- Renewal Premium Receipt - 00755988Document1 pageRenewal Premium Receipt - 00755988Tarun KushwahaPas encore d'évaluation

- A Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFDocument7 pagesA Case For Economic Democracy by Gary Dorrien - Tikkun Magazine PDFMegan Jane JohnsonPas encore d'évaluation

- Unit - Ii Entrepreneurial Idea and InnovationDocument49 pagesUnit - Ii Entrepreneurial Idea and InnovationAkriti Sonker0% (1)

- تجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكDocument11 pagesتجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكMortaza AlbadriPas encore d'évaluation

- CTRN Citi Trends Slides March 2017Document18 pagesCTRN Citi Trends Slides March 2017Ala BasterPas encore d'évaluation

- Ruchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesDocument3 pagesRuchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesHarshit GuptaPas encore d'évaluation

- GST Session 38Document20 pagesGST Session 38manjulaPas encore d'évaluation

- Notice of Annual General Meeting: Sunil Hitech Engineers LimitedDocument70 pagesNotice of Annual General Meeting: Sunil Hitech Engineers LimitedGaurang MehtaPas encore d'évaluation

- Analysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezosDocument37 pagesAnalysis and Interpretation of Financial Statements: Christine Talimongan ABM - BezostinePas encore d'évaluation

- The Accounting Cycle: 9-Step Accounting ProcessDocument3 pagesThe Accounting Cycle: 9-Step Accounting ProcessLala ArdilaPas encore d'évaluation

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocument11 pagesACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainPas encore d'évaluation

- Case Digest - OPT and DSTDocument30 pagesCase Digest - OPT and DSTGlargo GlargoPas encore d'évaluation

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesPas encore d'évaluation

- ACC 450 - Chapter No. 02 - Professional Standards - Auditing & Assurance Services - UpdatedDocument34 pagesACC 450 - Chapter No. 02 - Professional Standards - Auditing & Assurance Services - Updatedfrozan s naderiPas encore d'évaluation

- Christopher P. Mittleman's LetterDocument5 pagesChristopher P. Mittleman's LetterDealBook100% (2)

- Application For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1Document3 pagesApplication For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1shobsundar1Pas encore d'évaluation

- FDPP FormsDocument12 pagesFDPP FormsMay Joy Janapon Torquido-KunsoPas encore d'évaluation

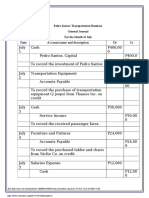

- Pedro Santos' Transportation Business General Journal For The Month of JulyDocument8 pagesPedro Santos' Transportation Business General Journal For The Month of Julyლ itsmooncakes ́ლPas encore d'évaluation

- Exercise 7.3Document5 pagesExercise 7.3Craig GrayPas encore d'évaluation

- PDF September Ict Notespdf - CompressDocument14 pagesPDF September Ict Notespdf - CompressSagar BhandariPas encore d'évaluation

- List of Mba Bba Projects-2017Document69 pagesList of Mba Bba Projects-2017Mukesh ChauhanPas encore d'évaluation

- Square Pharma Annual Report 2019-2020Document148 pagesSquare Pharma Annual Report 2019-2020Muktar HossainPas encore d'évaluation