Académique Documents

Professionnel Documents

Culture Documents

USA v. Thomas Segner

Transféré par

Texas WatchdogCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

USA v. Thomas Segner

Transféré par

Texas WatchdogDroits d'auteur :

Formats disponibles

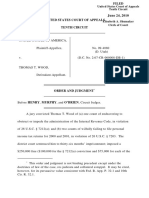

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 1 of 12

IN THE UNITED STATES DISTRICT COURT FOR THE WESTERN DISTRICT OF TEXAS AUSTIN DIVISION UNITED STATES OF AMERICA, Plaintiff, v. THOMAS W. SEGNER, BARBARA M. SEGNER, SOUND WAVE ELECTRONICS LLC, and GILLESPIE COUNTY Defendants. ) ) ) ) ) ) ) ) ) ) )

Civil No. 1:11-cv-932

UNITED STATES COMPLAINT Plaintiff, United States of America, pursuant to 26 U.S.C. 7401, at the direction of the Attorney General of the United States, or his delegate, and at the request of the Secretary of the Treasury, or his delegate, files this Complaint against Defendants, Thomas W. Segner, Sound Wave Electronics LLC, Barbara M. Segner, and the other named defendants and states as follows: NATURE OF ACTION 1. This is a civil action brought by the United States of America pursuant to 26

U.S.C. 7401, 7402 and 7403, to (1) reduce to judgment federal tax liabilities assessed against Thomas W. Segner, individually; against Sound Wave Electronics, LLC; and against Thomas W. Segner and Barbara M. Segner, jointly; (2) foreclose on certain real property of Thomas W. Segner and Barbara M. Segner; and (3) enjoin Thomas W. Segner and any and all entities under his control (including Sound Wave Electronics) from failing to timely file and/or pay federal employment and unemployment tax returns and deposits.

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 2 of 12

JURISDICTION AND VENUE 2. This Court has jurisdiction over this action pursuant to 26 U.S.C. Sections 7402

and 7403, and 28 U.S.C. Sections 1340 and 1345. 3. Venue of this action properly lies in this district pursuant to 28 U.S.C. Sections

1391(b) and 1396. THE PARTIES 4. 5. Plaintiff is the United States of America. Defendant, Thomas W. Segner (Mr. Segner), is a taxpayer in this action and can

be served at his residence in Fredericksberg, Texas. Mr. Segner owes delinquent income (1040), employment (941), and unemployment (940) taxes, penalties and interest. Mr. Segner further owes trust fund recovery penalties as he was the responsible person of Sound Wave Electronics, LLC, (pursuant to 26 U.S.C. 6672) who willfully failed to collect, truthfully account for, and/or pay over to the United States certain payroll trust funds. 6. Defendant, Barbara M. Segner (Ms. Segner), is a taxpayer in this action and can

be served at her residence in Fredericksberg, Texas. Barbara M. Segner is the wife of Thomas W. Segner (collectively, Mr. and Ms. Segner), and owes, jointly with Mr. Segner, delinquent income (1040) taxes, penalties and interest. Mr. and Ms. Segner own certain real property, more fully described below in paragraph 21, against which the United States seeks to foreclose its federal tax liens. 7. Defendant, Sound Wave Electronics, LLC (Sound Wave Electronics), is a

single-member, single-manager, limited liability company organized under the laws of Texas. Sound Wave Electronics is a taxpayer in this action, and owes delinquent employment (941)

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 3 of 12

taxes, penalties and interest. Sound Wave Electronics can be served by through its sole-member, sole-manager and registered agent, Thomas W. Segner. 8. Defendant, Gillespie County is a party to this action pursuant to 26 U.S.C.

7403(b) as it may claim an interest in the subject property through delinquent ad valorem tax liens. THE TAX LIABILITY History of Mr. Segners Businesses 9. Mr. Segner operated an electronics store, First Choice Enterprises, as a sole

proprietorship. From 2001 through 2009, Mr. Segner consistently and repeatedly neglected or refused to full pay federal employment (941) and unemployment (940) taxes as set forth in the table below in paragraph 12. As First Choice Enterprises was run as a sole proprietorship, Mr. Segner, himself, was the employer for purposes of payroll taxes, and personally incurred the 940 and 941 liability. 10. On March 25, 2009, Mr. Segner formed Sound Wave Electronics, LLC to operate

his electronics store in lieu of First Choice Enterprises. Mr. Segner is the sole member, sole manager, and the registered agent of Sound Wave Electronics. Sound Wave Electronics, since its inception and brief history, has also consistently and repeatedly neglected or refused to pay accruing federal employment (941) taxes as set forth below in paragraph 15. 11. Mr. Segner was a responsible person (within the meaning of 26 U.S.C. 6672) of

Sound Wave Electronics who willfully failed to withhold, truthfully account for, and/or pay over the funds withheld from his employees wages that were to be held in trust for the United States. As such, Mr. Segner incurred trust fund recovery penalty liabilities as set forth below in paragraph 12.

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 4 of 12

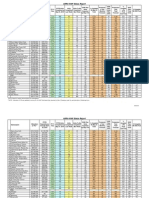

Assessments Against Mr. Segner, Individually 12. A duly-authorized delegate of the Secretary of the Treasury made timely and

proper assessments against, and gave notice and demand to Mr. Segner for unpaid federal employment (941) and unemployment (940) tax, penalties, statutory additions, and interest; and federal trust fund recovery penalties (pursuant to 26 U.S.C. 6672), statutory additions and interest for the tax periods set forth in the table below:

TYPE OF TAX TAX PERIOD DATE OF ASSESSMENTS AMOUNT DUE THROUGH July 20, 2011 DATE FEDERAL TAX LIEN RECORDED IN GILLESPIE COUNTY

941 941 941 941 941 941 941 941 941 941 941 941 941 941 941 941 941 941 941

09/30/2001 12/31/2001 12/31/2002 03/31/2003 12/31/2003 03/31/2004 06/30/2004 09/30/2004 12/31/2004 03/31/2005 06/30/2005 09/30/2005 12/31/2005 03/31/2006 06/30/2006 09/30/2006 12/31/2006 03/31/2007 06/30/2007

07/06/2009 07/06/2010 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 07/09/2007 01/05/2009 01/05/2009 01/05/2009 01/05/2009 10/01/2007 10/01/2007

$26,043.63 $27,803.18 $637.75 $32.21 $7,551.79 $9,072.87 $20,740.48 $20,535.40 $20,305.17 $19,664.53 $19,404.86 $19,135.86 $18,845.86 $18,564.52 $18,492.50 $16,711.59 $12,981.28 $1,341.04 $1,336.64

10/04/2010 10/04/2010 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 10/06/2008 03/04/2009 03/04/2009 03/04/2009 03/04/2009 10/06/2008 10/06/2008

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 5 of 12

TYPE OF TAX

TAX PERIOD

DATE OF ASSESSMENTS

AMOUNT DUE THROUGH July 20, 2011

DATE FEDERAL TAX LIEN RECORDED IN GILLESPIE COUNTY

941 941 941 941 940 6672 6672 6672

06/30/2008 09/30/2008 12/31/2008 03/31/2009 12/31/2009 12/31/2009 03/31/2010 06/30/2010

11/03/2008 12/29/2008 03/29/2009 06/29/2009 03/22/2010 05/02/2011 05/02/2011 05/02/2011

$14,959.89 $12,987.24 $9,292.29 $476.63 $310.71 $2,655.98 $3,296.69 $1,647.86 TOTAL $324,828.45

03/04/2009 03/04/2009 05/21/2009 02/23/2010 07/19/2010 08/03/2011 08/03/2011 08/03/2011

13.

Proper notice of and demand for payment of the assessments referred to above

was mailed to Mr. Segner on or about the date of the assessments. 14. The United States recorded a Notices of Federal Tax Lien against Mr. Segner in

the real property records of Gillespie County as shown in the chart above. Assessments Against Sound Wave Electronics 15. A duly-authorized delegate of the Secretary of the Treasury made timely and

proper assessments against, and gave notice and demand to Sound Wave Electronics for unpaid federal employment (941) tax, penalties, statutory additions, and interest for the tax periods set forth in the table below:

TYPE OF TAX TAX PERIOD DATE OF ASSESSMENTS AMOUNT DUE THROUGH July 20, 2011 DATE FEDERAL TAX LIEN RECORDED IN GILLESPIE COUNTY

941 941 941

12/31/2009 03/31/2010 06/30/2010

03/29/2010 06/14/2010 10/04/2010

$3,157.95 $6,702.05 $3,555.25

07/30/2010 09/29/2010 11/04/2010

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 6 of 12

TYPE OF TAX

TAX PERIOD

DATE OF ASSESSMENTS

AMOUNT DUE THROUGH July 20, 2011

DATE FEDERAL TAX LIEN RECORDED IN GILLESPIE COUNTY

941 941

03/31/2011 06/30/2011

07/04/2011 09/26/2011

$1,850.79 $2,518.551 TOTAL $17,784.59

08/01/2011 --

16.

Proper notice of and demand for payment of the assessments referred to above

was mailed to Sound Wave Electronics on or about the date of the assessments. 17. The United States recorded a Notices of Federal Tax Lien against Sound Wave

Electronics in the real property records of Gillespie County as shown in the chart above. Assessments Against Mr. and Ms. Segner, Jointly 18. A duly-authorized delegate of the Secretary of the Treasury made timely and

proper assessments against, and gave notice and demand to Mr. and Ms. Segner, jointly, for unpaid income (1040) tax, penalties, statutory additions, and interest for the tax periods set forth in the table below:

TYPE OF TAX TAX PERIOD DATE OF ASSESSMENTS AMOUNT DUE THROUGH July 20, 2011 DATE FEDERAL TAX LIEN RECORDED IN GILLESPIE COUNTY

1040 1040 1040 1040

2005 2006 2007 2008

08/11/2008 08/11/2008 04/13/2009 06/01/2009

$12,737.61 $15,122.25 $37,634.09 $12,399.91 TOTAL $77,893.86

06/01/2010 06/01/2010 06/01/2010 06/01/2010

The 06/30/2011 liability amount (of $2,518.55) is current through October 25, 2011 instead of July 20, 2011.

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 7 of 12

19.

Proper notice of and demand for payment of the assessments referred to above

was mailed to the Segners on or about the date of the assessments. 20. The United States recorded a Notices of Federal Tax Lien against Mr. and Ms.

Segner in the real property records of Gillespie County as shown in the chart above. THE SUBJECT PROPERTY 21. Through a Deed of Trust, dated July 23, 1990, and recorded in the real property

records of Gillespie County, Defendants Thomas W. Segner and Barbara M. Segner became the owner of certain real property located in Fredericksburg, Texas 78624 and legally described in Exhibit A, attached hereto (the subject property). COUNT I (Reduce Assessments to Judgment) 22. The United States is seeking a judgment that determines the parties tax indebtedness

to the United States as follows: a. that Mr. Segner, individually, is indebted to the United States in the amount of $324,828.45, plus interest to accrue from July 20, 2011, for federal employment (941), unemployment (940), and trust fund recovery (6672) liabilities, described above in paragraph 12; that Sound Wave Electronics is indebted to the United States in the amount of $17,784.59, plus interest to accrue from July 20, 2011, for federal employment (941) liabilities, described above in paragraph 15; and that Mr. and Ms. Segner, jointly, are indebted to the United States in the amount of $77,893.86, plus interest to accrue from July 20, 2011, for federal individual income (1040) liabilities, described above in paragraph 18.

b.

c.

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 8 of 12

COUNT II (Foreclose Federal Tax Liens) 23. The United States is seeking the enforcement of its federal tax liens, pursuant to 26

U.S.C. 7403(c), against the subject properties described above to pay the unpaid tax liabilities, penalties and interest of Mr. Segner, individually, and of Mr. and Mrs. Segner, jointly. 24. Pursuant to 26 U.S.C. 6321, a federal tax lien attached to Mr. and Ms. Segners

interest in the subject property upon the assessment of the taxes described in the charts above in paragraphs 12 and 18. This lien was perfected against third party creditors described in 26 U.S.C. 6323(a) when the notices of federal tax liens were filed. The United States seeks to foreclose the lien, sell the properties, and apply the proceeds to the above referenced tax liabilities. COUNT III (Request for Injunctive Relief) 25. As shown in the chart above in paragraphs 12 and 15, Mr. Segner has not full paid

his federal employment tax (941) or unemployment (940) tax liability for either First Choice Enterprises or Sound Wave Electronics. In fact, in the time period between the first quarter of 2001 and second quarter of 2011, Mr. Segner has assessed federal employment tax (941) delinquencies for 29 of the 42 quarters his businesses were in operation. 26. The United States thus seeks an injunction requiring Mr. Segner and any and all

entities controlled by him (including Sound Wave Electronics) do the following for all employment taxes falling due after the injunction date: a. Timely make federal tax deposits, according to federal deposit regulations, of FUTA, FICA, and withholding tax liabilities; Timely file all federal employment and unemployment tax returns (Forms 940 and 941); Timely pay all tax liabilities due on each 940 and 941 return;

b.

c.

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 9 of 12

d.

Be prohibited from paying other creditors or transferring funds to Mr. Segner directly, or to any third party at his request before paying federal employment tax liabilities; and Be required to file monthly reports with the Service attesting that all tax deposits have been made. 26 U.S.C. 7402(a) provides broad authority for the United States to seek and

e.

27.

obtain civil injunctions, so long as injunctive relief is generally necessary or appropriate for the enforcement of the internal revenue laws. U.S. v. Ernst & Whinney, 735 F.2d 1296, 1301 (11th Cir. 1984). Before issuing an injunction, district courts have traditionally required the party seeking an injunction to establish the following four factors: the party is substantially likely to prevail; the party faces a substantial threat of irreparable harm if the injunction is denied; the party faces a harm that outweighs any potential harm posed by the injunction to the defendant, and the injunction will not jeopardize the public interest. See United States v. Buttorff, 761 F.2d 1056, 1059 (5th Cir. 1985). However, where a statute explicitly authorizes an injunction, as does 26 U.S.C. 7402(a), the Fifth Circuit has modified the traditional factors, treating irreparable injury as presumed from the fact that the statute has been violated. See Buttorff, 761 F.2d at 1059 and 1063 (statutory injunction case involving section 7408). The existence of a remedy at law for the government through criminal prosecution does not prohibit the Court from issuing an injunction. See Buttorff, 761 F.2d at 1063. 28. The United States may appropriately seek injunctions under 26 U.S.C. 7402(a) to prohibit employers from future pyramiding of federal employment taxes when the employers and their responsible persons have demonstrated a history of pyramiding federal trust fund taxes and have proven impervious to the Services administrative collection remedies. 29. 26 U.S.C. 3102(a) and 3402(a) require employers to withhold federal income and Federal Insurance Contributions Act (FICA) taxes from their employees wages. Employers hold

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 10 of 12

these withheld taxes in trust for the United States and are generally required to deposit them on a regular basis, either monthly or semi-weekly. See 26 U.S.C. 6302 and 7501. Employers are also required to pay their own share of FICA taxes. See 26 U.S.C. 3111. As shown above, Mr. Segner has consistently failed as an employer to comply with these statutes, resulting in significant lost revenue to the United States. 30. The IRS has undertaken numerous administrative collection efforts, but have yielded little results. Furthermore, efforts to educate Mr. Segner as to the process and importance of these payroll tax statues have proved futile. Tax returns continue to be filed late, if at all, with little or no payments with them. The trust fund recovery penalty has proven an ineffective deterrent. Should the government foreclose and sell the subject property at issue in this suit, Mr. Segner will have even less of an incentive to comply with internal revenue laws, as he will have no other readily collectible assets. 31. The only harm posed by an injunction to Mr. Segner is that he must file tax returns and pay the taxes when due. Thus, Segner and his business will merely be required to follow the same federal tax laws every other employer must follow, not a harm for which he can justly complain. It is in the publics interest to order Mr. Segner to follow these laws because it is fundamentally unfair to other taxpayers that Mr. Senger may conduct business without doing so. Moreover, the public has a fundamental interest in stopping the drain on the Treasury caused by Mr. Segners pyramiding activities. 32. Therefore, the United States seeks an injunction to stop Mr. Segner, and any and all entities controlled by him, including Sound Wave Electronics, from their continued employment tax pyramiding activity. While an injunction is an extraordinary remedy, it is appropriate to prevent further pyramiding, as Mr. Segner has shown no intention of stopping.

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 11 of 12

COUNT III (Ten Percent Surcharge for Costs of Collection) 33. 28 U.S.C. section 3011 authorizes the United States to recover a surcharge of 10%

of the amount of the debt in the event that the United States avails itself of the pre-judgment or post judgment relief as set forth in Subchapter B or C of the Federal Debt Collection Procedure Act, 28 U.S.C. 3001 et. seq., in order to cover the cost of processing and handling the litigation and enforcement under this chapter of the claim for such debt. FOR THESE REASONS, the United States requests the Court to Order, A. That Mr. Segner, individually, is indebted to the United States for the amount of

$324,828.45, plus interest and any statutory additions as provided by law from July 20, 2011. B. That Sound Wave Electronics, LLC, is indebted to the United States for the amount

of $17,784.59, plus interest and any statutory additions as provided by law from July 20, 2011. C. That Mr. and Ms. Segner, jointly, are indebted to the United States for the amount

of $77,893.86 plus interest and any statutory additions as provided by law from July 20, 2011.. D. That the subject property described above in paragraph 21 is subject to the claim of

the United States; the Court determine the validity of the claims of the defendants named herein against the properties; and also determine the priority of all respective claims as against the claim of the United States; E. That the United States has valid liens against the properties, that said liens be

foreclosed and the property be sold in accordance with the law and practice of this Court, and that the proceeds of such sale be distributed in accordance with the findings of the Court and the rights of the parties;

Case 1:11-cv-00932-SS Document 1

Filed 10/28/11 Page 12 of 12

F.

That the Court enter a permanent injunction against Mr. Segner, and any and all

entities under his control, as set forth in paragraph 26, above; G. That the United States is entitled to the 10% litigation surcharge set forth in 28 U.S.C.

Section 3011; and, H. That the United States have such further relief as this Court may deem just and

proper, including its costs herein.

ROBERT PITMAN United States Attorney

/s/ Curtis C. Smith CURTIS C. SMITH Attorney, Tax Division State Bar No. Arizona 026374 Department of Justice 717 N. Harwood, Suite 400 Dallas, Texas 75201 (214) 880-9734 (214) 880-9742 (FAX) Curtis.C.Smith@USDOJ.gov ATTORNEYS FOR THE UNITED STATES

Vous aimerez peut-être aussi

- Trial Date Set in The Matter of State Vs Jacob Donald LawlerDocument23 pagesTrial Date Set in The Matter of State Vs Jacob Donald LawlerthesacnewsPas encore d'évaluation

- US Department of Justice Antitrust Case Brief - 01809-216649Document7 pagesUS Department of Justice Antitrust Case Brief - 01809-216649legalmattersPas encore d'évaluation

- MAREMONT CORPORATION v. ACE PROPERTY & CASUALTY INSURANCE COMPANY Et Al DocketDocument2 pagesMAREMONT CORPORATION v. ACE PROPERTY & CASUALTY INSURANCE COMPANY Et Al DocketACELitigationWatchPas encore d'évaluation

- State Vs Justin David Stork - Srcr012469Document33 pagesState Vs Justin David Stork - Srcr012469thesacnewsPas encore d'évaluation

- Guilty Plea and Judgment - State V Justin David Stork - Srcr012469Document37 pagesGuilty Plea and Judgment - State V Justin David Stork - Srcr012469thesacnewsPas encore d'évaluation

- State Vs Justin David Stork - Srcr012469Document24 pagesState Vs Justin David Stork - Srcr012469thesacnewsPas encore d'évaluation

- Vinick v. Commissioner, 110 F.3d 168, 1st Cir. (1997)Document9 pagesVinick v. Commissioner, 110 F.3d 168, 1st Cir. (1997)Scribd Government DocsPas encore d'évaluation

- Guilty Plea - State V Timothy Allen Kuhse - Early, Iowa - Agcr012349Document20 pagesGuilty Plea - State V Timothy Allen Kuhse - Early, Iowa - Agcr012349thesacnewsPas encore d'évaluation

- 2a Houston Division RecordDocument578 pages2a Houston Division RecordSue RhoadesPas encore d'évaluation

- Diver Justice ResponseDocument8 pagesDiver Justice ResponsecrazybuttfulPas encore d'évaluation

- State V Cody Anthony Dupre - Fecr012240Document65 pagesState V Cody Anthony Dupre - Fecr012240thesacnewsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument6 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- Sleater (Atlas Marketing) - 03 26 08 Motion For Relief From StayDocument5 pagesSleater (Atlas Marketing) - 03 26 08 Motion For Relief From StayCourtWatchPas encore d'évaluation

- United States Bankruptcy Court District of Delaware) in Re:) ) Mervyn's Holdings, LLC, Et - Al.,) ) Case No.:) Debtor(s) .) )Document2 pagesUnited States Bankruptcy Court District of Delaware) in Re:) ) Mervyn's Holdings, LLC, Et - Al.,) ) Case No.:) Debtor(s) .) )Chapter 11 DocketsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument5 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- Filed & Entered: United States Bankruptcy Court Central District of California (Santa Ana Division)Document6 pagesFiled & Entered: United States Bankruptcy Court Central District of California (Santa Ana Division)Chapter 11 DocketsPas encore d'évaluation

- Order Dismissing - State V Matthew Allen Summers - Fecr012351Document18 pagesOrder Dismissing - State V Matthew Allen Summers - Fecr012351thesacnewsPas encore d'évaluation

- United States Bankruptcy Court Central District of California Riverside DivisionDocument6 pagesUnited States Bankruptcy Court Central District of California Riverside DivisionChapter 11 DocketsPas encore d'évaluation

- Final JudgmentDocument6 pagesFinal JudgmentMichael LindenbergerPas encore d'évaluation

- Filed & Entered: United States Bankruptcy Court Central District of CaliforniaDocument5 pagesFiled & Entered: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsPas encore d'évaluation

- AGCR012597 - Sac City Man Convicted of Animal Abused Asks For New Trial PDFDocument74 pagesAGCR012597 - Sac City Man Convicted of Animal Abused Asks For New Trial PDFthesacnewsPas encore d'évaluation

- Ferguson Sisters Indicted For Identy Theft, Filing False Tax ReturnsDocument11 pagesFerguson Sisters Indicted For Identy Theft, Filing False Tax ReturnsJohn S KeppyPas encore d'évaluation

- ARENT FOX LLP, 1050 Connecticut Avenue NW, Washington, DC 20036-5339Document8 pagesARENT FOX LLP, 1050 Connecticut Avenue NW, Washington, DC 20036-5339Chapter 11 DocketsPas encore d'évaluation

- State V Matthew J. Wessels - Fecr012392Document34 pagesState V Matthew J. Wessels - Fecr012392thesacnewsPas encore d'évaluation

- Order Setting Trial - State V Matthew J. Wessels - Fecr012392Document22 pagesOrder Setting Trial - State V Matthew J. Wessels - Fecr012392thesacnewsPas encore d'évaluation

- Probation Violation Hearing Scheduled For Sac City Man Who Pleaded Guilty To Possesion and Driving While BarredDocument62 pagesProbation Violation Hearing Scheduled For Sac City Man Who Pleaded Guilty To Possesion and Driving While BarredthesacnewsPas encore d'évaluation

- Request For Service of Notice Pursuant To F.R.B.P. 2002 (G) : Authorized Agent For Litton Loan ServicingDocument2 pagesRequest For Service of Notice Pursuant To F.R.B.P. 2002 (G) : Authorized Agent For Litton Loan ServicingChapter 11 DocketsPas encore d'évaluation

- 1 6 13 Complaint NVD Klosowski V SBN ADA 023Document6 pages1 6 13 Complaint NVD Klosowski V SBN ADA 023NevadaGadflyPas encore d'évaluation

- Baker & McKenzie Attorney, Martin Weisberg, Who Was IEAM's Securities Counsel, Was Indicted 5/27/08Document7 pagesBaker & McKenzie Attorney, Martin Weisberg, Who Was IEAM's Securities Counsel, Was Indicted 5/27/08ValueSearcher70Pas encore d'évaluation

- Walter Anderson v. Commissioner of Internal Reven, 3rd Cir. (2012)Document15 pagesWalter Anderson v. Commissioner of Internal Reven, 3rd Cir. (2012)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- Full Details of What The Police Allege in The Koster MurderDocument15 pagesFull Details of What The Police Allege in The Koster MurderthesacnewsPas encore d'évaluation

- (Admitted Pro Vice) : - @A Tfox - Co .Mafk@areDocument10 pages(Admitted Pro Vice) : - @A Tfox - Co .Mafk@areChapter 11 DocketsPas encore d'évaluation

- Storm Lake Woman Found Guilty of Possession of A Controlled SubstanceDocument38 pagesStorm Lake Woman Found Guilty of Possession of A Controlled SubstancethesacnewsPas encore d'évaluation

- YoungThug LawsuitDocument35 pagesYoungThug Lawsuitmitchell6northamPas encore d'évaluation

- Defendants' Verified Motion To Stike Plaintiff's Motion To DefaultDocument18 pagesDefendants' Verified Motion To Stike Plaintiff's Motion To DefaultNeil GillespiePas encore d'évaluation

- 1 Winston Strawn LLP: CI'J UDocument8 pages1 Winston Strawn LLP: CI'J UChapter 11 DocketsPas encore d'évaluation

- Shelton Scanlon DocsDocument24 pagesShelton Scanlon DocsThe Valley Indy100% (1)

- HASHEMPOUR v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintDocument83 pagesHASHEMPOUR v. ACE AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchPas encore d'évaluation

- Filed & Entered: United States Bankruptcy Court Central District of CaliforniaDocument5 pagesFiled & Entered: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsPas encore d'évaluation

- United States v. Wood, 10th Cir. (2010)Document33 pagesUnited States v. Wood, 10th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- US Dept. of Labor v. A OK Walker AutoworksDocument8 pagesUS Dept. of Labor v. A OK Walker AutoworksNational Content DeskPas encore d'évaluation

- Glaski - Respondent's BriefDocument30 pagesGlaski - Respondent's Brief83jjmackPas encore d'évaluation

- Tavenner v. Smoot, 4th Cir. (2001)Document11 pagesTavenner v. Smoot, 4th Cir. (2001)Scribd Government DocsPas encore d'évaluation

- Ud Tenantanswer PDFDocument6 pagesUd Tenantanswer PDFMikePas encore d'évaluation

- FECR012629 - Scott Fister PDFDocument79 pagesFECR012629 - Scott Fister PDFthesacnewsPas encore d'évaluation

- Boone Man Accused of Possession of Stolen PropertyDocument20 pagesBoone Man Accused of Possession of Stolen PropertythesacnewsPas encore d'évaluation

- Felony Charge Against Denison Man DismissedDocument25 pagesFelony Charge Against Denison Man DismissedthesacnewsPas encore d'évaluation

- WESTCHESTER FIRE INSURANCE COMPANY v. BELLATOR SPORT WORLDWIDE, INC. Et Al DocketDocument2 pagesWESTCHESTER FIRE INSURANCE COMPANY v. BELLATOR SPORT WORLDWIDE, INC. Et Al DocketACELitigationWatchPas encore d'évaluation

- Response of Dallas County and Tarrant County To Debtors' Fourth Omnibus Objection To ClaimsDocument4 pagesResponse of Dallas County and Tarrant County To Debtors' Fourth Omnibus Objection To ClaimsChapter 11 DocketsPas encore d'évaluation

- Certificate of NoticeDocument4 pagesCertificate of NoticeChapter 11 DocketsPas encore d'évaluation

- Guilty Plea and Order Deferring Judgment State V Tamatha Lee Daniel - Carroll, Iowa - Owcr012330Document26 pagesGuilty Plea and Order Deferring Judgment State V Tamatha Lee Daniel - Carroll, Iowa - Owcr012330thesacnewsPas encore d'évaluation

- Ida Grove Man Convicted of Possession of Marijuana 1st OffenseDocument36 pagesIda Grove Man Convicted of Possession of Marijuana 1st OffensethesacnewsPas encore d'évaluation

- Prueba Contra Nelson Alonso VegaDocument4 pagesPrueba Contra Nelson Alonso VegaVictor Torres MontalvoPas encore d'évaluation

- Mark Sunik and Tamara Sunik v. Commissioner of Internal Revenue, 321 F.3d 335, 2d Cir. (2003)Document4 pagesMark Sunik and Tamara Sunik v. Commissioner of Internal Revenue, 321 F.3d 335, 2d Cir. (2003)Scribd Government DocsPas encore d'évaluation

- McNichols v. IRS, 13 F.3d 432, 1st Cir. (1993)Document8 pagesMcNichols v. IRS, 13 F.3d 432, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Sac City Man Convicted of Harassment in The Third DegreeDocument52 pagesSac City Man Convicted of Harassment in The Third DegreethesacnewsPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument16 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)D'EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Pas encore d'évaluation

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemD'EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemÉvaluation : 4 sur 5 étoiles4/5 (16)

- Kentucky Resources Council 990 (2008)Document12 pagesKentucky Resources Council 990 (2008)Texas WatchdogPas encore d'évaluation

- Hog Catcher Liberty County TexasDocument1 pageHog Catcher Liberty County TexasTexas WatchdogPas encore d'évaluation

- Drop Settlement AnnouncmentDocument2 pagesDrop Settlement AnnouncmentTexas WatchdogPas encore d'évaluation

- Kentucky Senate Bill 88Document5 pagesKentucky Senate Bill 88Texas WatchdogPas encore d'évaluation

- OIG Report On Homeland Security Spending by State of TexasDocument53 pagesOIG Report On Homeland Security Spending by State of TexasTexas WatchdogPas encore d'évaluation

- Road Map To RenewalDocument72 pagesRoad Map To RenewalTexas WatchdogPas encore d'évaluation

- Senate Bill 14Document24 pagesSenate Bill 14Texas WatchdogPas encore d'évaluation

- Kentucky Resources Council 990 (2009)Document12 pagesKentucky Resources Council 990 (2009)Texas WatchdogPas encore d'évaluation

- Kentucky Resources Council 990 (2010)Document27 pagesKentucky Resources Council 990 (2010)Texas WatchdogPas encore d'évaluation

- Economic Analysis of Critical Habitat Designation For Four Central Texas SalamandersDocument138 pagesEconomic Analysis of Critical Habitat Designation For Four Central Texas SalamandersTexas WatchdogPas encore d'évaluation

- Texans For Public Justice Lawsuit ReleaseDocument2 pagesTexans For Public Justice Lawsuit ReleaseTexas WatchdogPas encore d'évaluation

- Coburn Safety at Any PriceDocument55 pagesCoburn Safety at Any PriceAaron NobelPas encore d'évaluation

- Senate Bill 13Document6 pagesSenate Bill 13Texas WatchdogPas encore d'évaluation

- Project Connect/ Urban Rail ReportDocument22 pagesProject Connect/ Urban Rail ReportTexas WatchdogPas encore d'évaluation

- The Cost of The Production Tax Credit and Renewable Energy Subsidies in TexasDocument4 pagesThe Cost of The Production Tax Credit and Renewable Energy Subsidies in TexasTexas WatchdogPas encore d'évaluation

- Texas Revenue EstimateDocument100 pagesTexas Revenue EstimateTexas WatchdogPas encore d'évaluation

- School Finance 101 01142011Document50 pagesSchool Finance 101 01142011Texas WatchdogPas encore d'évaluation

- Preview of "Tex. Att'y Gen. Op. No. ... G Abbott Administration"Document4 pagesPreview of "Tex. Att'y Gen. Op. No. ... G Abbott Administration"Texas WatchdogPas encore d'évaluation

- Homeland Security BudgetDocument183 pagesHomeland Security BudgetTexas Watchdog100% (1)

- Alamo ReportDocument38 pagesAlamo ReportTexas WatchdogPas encore d'évaluation

- Weekly Weatherization ReportsDocument89 pagesWeekly Weatherization ReportsTexas WatchdogPas encore d'évaluation

- Your Money and Pension ObligationsDocument24 pagesYour Money and Pension ObligationsTexas Comptroller of Public AccountsPas encore d'évaluation

- Inspection ReportsDocument63 pagesInspection ReportsTexas Watchdog100% (1)

- Travis County BallotDocument2 pagesTravis County BallotTexas WatchdogPas encore d'évaluation

- Cityreferenda DownballotDocument2 pagesCityreferenda DownballotTexas WatchdogPas encore d'évaluation

- Travisco DownballotDocument3 pagesTravisco DownballotTexas WatchdogPas encore d'évaluation

- Nov 2012 Sample BallotDocument6 pagesNov 2012 Sample BallotMike MorrisPas encore d'évaluation

- Stateemployees PercentDocument1 pageStateemployees PercentTexas WatchdogPas encore d'évaluation

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogPas encore d'évaluation

- State Employees ChangeDocument2 pagesState Employees ChangeTexas WatchdogPas encore d'évaluation

- F4bwa 2010 Dec QDocument4 pagesF4bwa 2010 Dec QMuhammad Kashif RanaPas encore d'évaluation

- Publif Power: India and Other DemocraciesDocument36 pagesPublif Power: India and Other Democracieskalyanaraman7Pas encore d'évaluation

- KEY DEFINITIONS IN COMPANIES ORDINANCE 1984Document204 pagesKEY DEFINITIONS IN COMPANIES ORDINANCE 1984Muhammad KamranPas encore d'évaluation

- Republic Act No. 11463Document4 pagesRepublic Act No. 11463Arnan PanaliganPas encore d'évaluation

- Burma Will Remain Rich, Poor and Controversial': Published: 9 April 2010Document11 pagesBurma Will Remain Rich, Poor and Controversial': Published: 9 April 2010rheito6745Pas encore d'évaluation

- The Code of Civil Procedure, 1908 Non-Joinder and Misjoinder Parties To SuitsDocument13 pagesThe Code of Civil Procedure, 1908 Non-Joinder and Misjoinder Parties To Suitsnirav doshiPas encore d'évaluation

- Marriage False Affidavit On 5-Year Period of Cohabitation As If Marriage Celebrated Without A License VoidDocument4 pagesMarriage False Affidavit On 5-Year Period of Cohabitation As If Marriage Celebrated Without A License Voidguest1userPas encore d'évaluation

- Hernandez v. Andal G.R. No. L-273, March 29, 1947Document7 pagesHernandez v. Andal G.R. No. L-273, March 29, 1947Carla VirtucioPas encore d'évaluation

- Code of Conduct For Court PersonnelDocument6 pagesCode of Conduct For Court PersonnelJenelyn Bacay LegaspiPas encore d'évaluation

- Affidavit of Consent Exhumation 2 (BONG)Document3 pagesAffidavit of Consent Exhumation 2 (BONG)Tonton Reyes100% (1)

- Evolution of Judicial System in India During BritishDocument7 pagesEvolution of Judicial System in India During BritishJay DattaPas encore d'évaluation

- Remedial Law Review I: Civil Procedure OverviewDocument27 pagesRemedial Law Review I: Civil Procedure Overviewmelaniem_1100% (1)

- Guarin v. Limpin A.C. No. 10576Document5 pagesGuarin v. Limpin A.C. No. 10576fg0% (1)

- Home design ltd shareholders dispute resolutionDocument5 pagesHome design ltd shareholders dispute resolutionCarl MunnsPas encore d'évaluation

- FRIA LawDocument15 pagesFRIA LawDonnPas encore d'évaluation

- Umil v. Ramos PDFDocument3 pagesUmil v. Ramos PDFKJPL_1987Pas encore d'évaluation

- Sean Noonan ReportDocument10 pagesSean Noonan ReportDavid GiulianiPas encore d'évaluation

- Strict LiabilityDocument11 pagesStrict LiabilityMWAKISIKI MWAKISIKI EDWARDSPas encore d'évaluation

- (Art 163) Person Who Makes False or Counterfeit Coins and (Art 166) Forges Treasury orDocument4 pages(Art 163) Person Who Makes False or Counterfeit Coins and (Art 166) Forges Treasury orQuiquiPas encore d'évaluation

- Nism Series 8 Pay SlipDocument2 pagesNism Series 8 Pay SlipHritik SharmaPas encore d'évaluation

- TAXATION With ActivityDocument14 pagesTAXATION With ActivityAriel Rashid Castardo BalioPas encore d'évaluation

- Pak-US Relations 1947-1990Document13 pagesPak-US Relations 1947-1990Hassan Bin ShahbazPas encore d'évaluation

- Forms of Business OwnershipDocument26 pagesForms of Business OwnershipKCD MULTITRACKSPas encore d'évaluation

- Goals of Civil Justice and Civil Procedure in Contemporary Judicial SystemsDocument262 pagesGoals of Civil Justice and Civil Procedure in Contemporary Judicial Systems* BC *Pas encore d'évaluation

- P (TC 15B)Document29 pagesP (TC 15B)suruchi0901Pas encore d'évaluation

- Consti Citizenship Class NotesDocument4 pagesConsti Citizenship Class NotesIssah SamsonPas encore d'évaluation

- KP Law BROCHUREDocument7 pagesKP Law BROCHUREIvan_jaydee100% (1)

- Petitioners Respondent Atty. Noe Q. Laguindam Atty. Elpidio I. DigaumDocument11 pagesPetitioners Respondent Atty. Noe Q. Laguindam Atty. Elpidio I. DigaumRomy IanPas encore d'évaluation

- CSS22-28 of 2005Document35 pagesCSS22-28 of 2005Samastip SinghPas encore d'évaluation

- GR No. 189122: Leviste Vs CADocument11 pagesGR No. 189122: Leviste Vs CAteepeePas encore d'évaluation