Académique Documents

Professionnel Documents

Culture Documents

Capitalized Cost

Transféré par

Ariel PadinDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capitalized Cost

Transféré par

Ariel PadinDroits d'auteur :

Formats disponibles

capitalized cost

Definition

Expense recorded as the cost of a fixed asset. Such costs are written off as depreciation over several accounting periods, instead of being charged-off as an expense in the accounting period in which they are incurred. Read more: http://www.businessdictionary.com/definition/capitalized-cost.html#ixzz1l2Sm2Aor

Capital cost

From Wikipedia, the free encyclopedia Jump to: navigation, search Capital costs are costs incurred on the purchase of land, buildings, construction and equipment to be used in the production of goods or the rendering of services, in other words, the total cost needed to bring a project to a commercially operable status. However, capital costs are not limited to the initial construction of a factory or other business. For example, the purchase of a new machine that will increase production and last for years is a capital cost. Capital costs do not include labor costs except for the labor used for construction. Unlike operating costs, capital costs are one-time expenses, although payment may be spread out over many years in financial reports and tax returns. Capital costs are fixed and are therefore independent of the level of output. A fossil fuel power plant's capital costs include the purchase of the land the plant is built on, permitting and legal costs, the equipment needed to run the plant, the cost of the plant's construction, the cost of financing and the cost of commissioning the plant incurred prior to commercial operation of the plant. They do not include the cost of the natural gas, fuel oil or coal used to fire the plant once the plant enters commercial operation or any taxes on the electricity that is produced. They also do not include the labor used to run the plant or the labor and supplies needed for maintenance. Government generally provides subsidies through investments and partnerships in the initial capital costs of research and manufacturing infrastructure that cannot be matched by investorowned companies.

[edit] See also

y y

Capital recovery factor Capital Cost Allowance

y y y

Cost of capital Capital expenditure (capex) Cost overrun

Essentially Capital Cost is all the current / future cash outflows which are necessary to produce and sell goods or services. It can be towards tangible items like plant and machinery, buildings, structures etc. or it can be towards intangibles like acquisition of trademarks, development of software etc. Whether a particular cost is capital or not would be dependent on many factors like local accounting / taxation laws, materiality etc

Capitalized Cost

Accounting Print Email Meaning and definition of Capitalized Cost Capitalized cost can be defined as an expense that is added to the cost basis of a fixed asset on the balance sheet of a company. The capitalized costs are incurred while financing or building fixed assets. However, these costs are not expensed in the periods of being incurred, but identified over a time period through the way of amortization or depreciation. As explained by Investopedia, capitalized costs can be referred as an attempt to follow the Matching Principle of Accounting which seeks to match expenses with the revenues. Putting another way, match the cost of an item to period of being issued, as contrasted with those when the cost was actually incurred. Since some assets feature a long life and generate revenue during that functional life, their costs might be depreciated over a long time period. Example of Capitalized Cost The capitalized cost can be exemplified as the costs related to construction of a new factory. The costs related to building the asset, counting labor and other financing costs, can be added to the assets carrying value on the balance sheet. These capitalized costs are identified in prospective time periods. How to calculate Capitalized Cost One of the most effective ways of determining the true cost of an asset is calculating the capitalized cost. Besides, it is also helpful in evaluating the long-term overall cost of a product, service, or investment. The estimation of capitalized cost is helpful to consumers and businesses for projecting future costs and liabilities. However, the only drawback to this method is that it demands a lot of data collection for prediction of trends as well as long-term investment costs. The key steps involved in calculating the capitalized costs are:

1. Determine the time period as well as the duration of time to be used for calculation of capitalized cost. Collect all the data for the specified period, and you will get the concluding numbers readily available. 2. Sum up the concluding salvage value with the capital gains thus obtaining the final profit. 3. Sum up the straight costs, maintenance, and any total loan interest for the specific period thus obtaining the final cost. 4. Subtract the final profit from the final cost thus obtaining the capitalized cost for the particular transaction for the determined period.

Capitalized Cost

Capitalized Cost is a term used in car leasing that refers to the total amount of money to be financed over the term of the lease. Capitalized costs include the negotiated price of the car plus any fees or taxes that will be financed. Capitalized cost reduction payments will serve to reduce the monthly lease expenses by lowering the net capitalized costs, where: Net Capitalized Costs = Capitalized Costs - Capitalized Cost Reduction The difference between net capitalized cost and the residual value is used to calculate the monthly lease payments. In other words, the leasing company first calculates all of the costs of the car: the price of the car, licensing and lease initiation fees, taxes and interest. This is the capitalized cost. To make the monthly payments more affordable, the leaseholder may ask for a capitalized cost reduction payment. This is money upfront, such as a down payment. They payment is used to lower the capital, or money, the leasing company is lending the leaseholder. Since the car has residual, or terminal, value at the end of the lease, the monthly payment needs to cover the net capitalized costs minus the residual value.

apitalized Cost

Assets may have different original and/or maintenance costs, different useful lifetimes, different salvage values or produce revenue at different rates. All these differences make it very hard to choose between alternatives. Typical situations are:

y

you're considering whether to put aluminium siding on your house or to continue to have it painted every three years...

you need to choose between two machines, but find it very hard to choose between them because machine ABC lasts 8 years and produces 1,000 units per year, while the cheaper machine XYZ lasts only 5 years, produces less units and has a higher maintenance cost...

You could ask yourself the following question: How much money would I need now, to be able to purchase the asset, pay for annual maintenance, and replace it at the end of its useful lifetime by another one, forever? An asset's capitalized cost is the original cost of the asset, plus the present value of an infinite number of replacements, plus the present value of maintenance costs in perpetuity. The Capitalized Cost calculation enables you to choose rationally between alternatives. All you need to do is compare their capitalized costs: they represent the present value of all costs involved with purchasing, maintaining and replacing the assets. Input nominal annual rate (compounding frequency is assumed to be annually) cost useful life in years salvage value annual maintenance cost units produced per year Results capitalized cost capitalized cost per unit Examples Bart has to decide whether to install aluminium or wooden windows. Aluminium windows cost $5.000, have no maintenance cost and last 50 years. Wooden windows cost $2,500, last 25 years and have an annual maintenance cost of $150. What should he do when his savings earn interest at 6 % annually? Step 1: Calculate the capitalized cost for aluminium windows. Input Nominal annual rate: Cost: Useful lifetime: 6% 5,000 50

Salvage value: Annual maintenance cost: Units produced per year: Result Capitalized cost:

0 0 0 5,287.02

Step 2: Calculate the capitalized cost for wooden windows. Input Nominal annual rate: Cost: Useful lifetime: Salvage value: Annual maintenance cost: Units produced per year: Capitalized cost: 6% 2,500 25 0 150 0 5,759.45

Result

Answer: Bart should install aluminium windows. Machine A costs $30,000, lasts 15 years, and will have a salvage value of $4,500. Its annual maintenance cost is $3.500. Machine B costs $40,000, will last 20 years, and will have a salvage value of $2,000 after 20 years. The annual maintenance cost for this machine is $3.000. Both machines produce 10,000 units per year. If money is worth 10 % annually, which machine should be purchased? Step 1: Calculate the capitalized cost for machine A. Input Nominal annual rate: Cost: Useful lifetime: Salvage value: Annual maintenance cost: Units produced per year: Capitalized cost: Capitalized cost per unit: 10 % 30,000 15 4,500 3,500 10.000 73,025.81 7.30

Result

Step 2: Calculate the capitalized cost for machine B. Input Nominal annual rate: Cost: Useful lifetime: 10 % 40,000 20

Salvage value: Annual maintenance cost: Units produced per year: Result Capitalized cost: Capitalized cost per unit:

2,000 3,000 10,000 76,634.66 7.66

Answer: Machine A should be preferred because it has a lower capitalized cost. What if, in the above example, machine B produces 11.000 units per year? Input Nominal annual rate: Cost: Useful lifetime: Salvage value: Annual maintenance cost: Units produced per year: Capitalized cost: Capitalized cost per unit: 10 % 40,000 20 2,000 3,000 11,000 76,634.66 6.97

Result

Answer: Machine B should be preferred because it has a lower capitalized cost per unit.

1. Determine the time period as well as the duration of time to be used for calculation of capitalized cost. Collect all the data for the specified period, and you will get the concluding numbers readily available. 2. Sum up the concluding salvage value with the capital gains thus obtaining the final profit. 3. Sum up the straight costs, maintenance, and any total loan interest for the specific period thus obtaining the final cost. 4. Subtract the final profit from the final cost thus obtaining the capitalized cost for the particular transaction for the determined period.

Vous aimerez peut-être aussi

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageD'EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- MM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceDocument61 pagesMM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceOğulcan AytaçPas encore d'évaluation

- Chapter 1 - IntroductionDocument53 pagesChapter 1 - Introductionjeff leonenPas encore d'évaluation

- Fundamentals of Engineering Economics - Chapter 3 SlidesDocument57 pagesFundamentals of Engineering Economics - Chapter 3 SlidesMohammed Al-IsmailPas encore d'évaluation

- DepreciationDocument56 pagesDepreciationNasirPas encore d'évaluation

- Chapter 1 - Foundations of Engineering EconomyDocument28 pagesChapter 1 - Foundations of Engineering EconomyBich Lien PhamPas encore d'évaluation

- Chapter 2 Factors: How Time and Interest Affect MoneyDocument40 pagesChapter 2 Factors: How Time and Interest Affect Moneyaziziakira93Pas encore d'évaluation

- S PDFDocument90 pagesS PDFAmritha V100% (1)

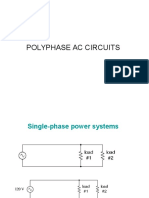

- Alternating Current)Document123 pagesAlternating Current)karlpo123Pas encore d'évaluation

- Present EconomyDocument21 pagesPresent EconomyKhryz Anne AvilaPas encore d'évaluation

- EC8553 Electron Devices and Circuits Question BankDocument24 pagesEC8553 Electron Devices and Circuits Question BankRaja PirianPas encore d'évaluation

- Present Economy AnalysisDocument7 pagesPresent Economy AnalysisIsiah Philip BersabalPas encore d'évaluation

- Polyphase Ac CircuitsDocument18 pagesPolyphase Ac CircuitsRay YudaPas encore d'évaluation

- Communicating, Controlling and LeadingDocument9 pagesCommunicating, Controlling and LeadingJannie Leila VergaraPas encore d'évaluation

- Unequal Lives DruryDocument3 pagesUnequal Lives DruryZahid HussainPas encore d'évaluation

- Microprocessors & Interfacing Techniques Assignment No. 2Document2 pagesMicroprocessors & Interfacing Techniques Assignment No. 2Abdullah Nasir100% (4)

- RLC Circuit Transfer Functions - KSB - 03 Aug 2020Document44 pagesRLC Circuit Transfer Functions - KSB - 03 Aug 2020Kì Hyö JüngPas encore d'évaluation

- Engineering Economy: Chapter 6: Comparison and Selection Among AlternativesDocument25 pagesEngineering Economy: Chapter 6: Comparison and Selection Among AlternativesBibhu R. TuladharPas encore d'évaluation

- Geometric SequenceDocument17 pagesGeometric Sequencerosette chantalPas encore d'évaluation

- Foundation of Engineering EconomyDocument27 pagesFoundation of Engineering EconomyKen Andrie Dungaran GuariñaPas encore d'évaluation

- Excel Reviewees-' Manual October 2011Document48 pagesExcel Reviewees-' Manual October 2011McNavy PAPas encore d'évaluation

- Detailed Estimation of Building With Plan PDFDocument21 pagesDetailed Estimation of Building With Plan PDFsqqpqq1Pas encore d'évaluation

- Unit-III (Fundamentals of Electrical Engg.) PDFDocument32 pagesUnit-III (Fundamentals of Electrical Engg.) PDFpramana_gmritPas encore d'évaluation

- Overspeeding Blind Curve Road Leads AccidentDocument2 pagesOverspeeding Blind Curve Road Leads AccidentRodenjade CadungogPas encore d'évaluation

- Solved Practice QuestionsDocument5 pagesSolved Practice QuestionsKwaku Frimpong GyauPas encore d'évaluation

- Comparison of AlternativesDocument26 pagesComparison of AlternativesMarielle CambaPas encore d'évaluation

- Chapter 2 Engineering EconomyDocument33 pagesChapter 2 Engineering Economymudassir ahmadPas encore d'évaluation

- Unit I Basic Circuits Analysis and Network TopologyDocument91 pagesUnit I Basic Circuits Analysis and Network TopologySaravana SelvanPas encore d'évaluation

- RSU Engineering Economics SyllabusDocument6 pagesRSU Engineering Economics Syllabuscharmaine fos100% (1)

- Dynamics of Rigid Bodies: Curvilinear Motion of ParticlesDocument17 pagesDynamics of Rigid Bodies: Curvilinear Motion of ParticlesJoshua AngelesPas encore d'évaluation

- Temperature Coefficient of ResistanceDocument2 pagesTemperature Coefficient of Resistancekali bangonPas encore d'évaluation

- Electric Circuits Interview Questions and Answers: by ManishDocument107 pagesElectric Circuits Interview Questions and Answers: by ManishSaitejaPas encore d'évaluation

- Wave Guids PDFDocument32 pagesWave Guids PDFlakshman donepudiPas encore d'évaluation

- MATRIX OPERATIONSDocument7 pagesMATRIX OPERATIONSneophymenPas encore d'évaluation

- Fourier Series ExercisesDocument1 pageFourier Series ExercisesKarim Karim100% (1)

- Chapter 3 Transformer Connections, Operation, and Specialty TransformersDocument38 pagesChapter 3 Transformer Connections, Operation, and Specialty TransformersSihamaSihamPas encore d'évaluation

- EEA126 - Module 2 - SWsDocument12 pagesEEA126 - Module 2 - SWsGabriel Carl Alpuerto100% (1)

- Impact of Electricity Theft On Power QualityDocument6 pagesImpact of Electricity Theft On Power QualitySachin Jose100% (1)

- Engineering Economics Chapter 1Document9 pagesEngineering Economics Chapter 1Allen Glen Gil100% (1)

- Instrumentation (Finale)Document20 pagesInstrumentation (Finale)Jonathan BacusPas encore d'évaluation

- Sensitivity Analysis InterpretationDocument8 pagesSensitivity Analysis Interpretationronit brahmaPas encore d'évaluation

- Engineering Economics Chapter 2 FactorsDocument25 pagesEngineering Economics Chapter 2 FactorsShanzeh DaudPas encore d'évaluation

- 1 1-1 3Document26 pages1 1-1 3Orlando Cruz SicoPas encore d'évaluation

- Republic Act No 7920Document17 pagesRepublic Act No 7920Drofer ConcepcionPas encore d'évaluation

- Ee0065 Module3 PDFDocument36 pagesEe0065 Module3 PDFMV5 ChannelPas encore d'évaluation

- EC Chapter 01Document39 pagesEC Chapter 01Muhammad qamar100% (1)

- Engineering EconomicsDocument28 pagesEngineering EconomicsTeeni AbeysekaraPas encore d'évaluation

- Transducer PDFDocument27 pagesTransducer PDFGAJANAN M NAIKPas encore d'évaluation

- Power Supply Filters and RegulatorsDocument13 pagesPower Supply Filters and RegulatorsYacine KhalidPas encore d'évaluation

- Method of DepreciationDocument17 pagesMethod of DepreciationAli ShehryarPas encore d'évaluation

- Engineering Economy QuizDocument6 pagesEngineering Economy QuizGretchel Diane Patlunag-EscabusaPas encore d'évaluation

- EN 206: Power Electronics and Machines: Direct Current (DC) MachinesDocument35 pagesEN 206: Power Electronics and Machines: Direct Current (DC) MachinesJaafar AbbakarPas encore d'évaluation

- PBR Implementation: Performance Based Regulation in the PhilippinesDocument32 pagesPBR Implementation: Performance Based Regulation in the PhilippinesBernie C. MagtalasPas encore d'évaluation

- Solar New SyllabusDocument4 pagesSolar New SyllabusM VetriselviPas encore d'évaluation

- ENGINEERING ECONOMICS COST STUDYDocument11 pagesENGINEERING ECONOMICS COST STUDYJuvina MagbanuaPas encore d'évaluation

- Course Syllabus Advance Engg MathDocument5 pagesCourse Syllabus Advance Engg Mathtirsollantada100% (1)

- COST ESTIMATION FOR FOOD ENGINEERING PROJECTSDocument53 pagesCOST ESTIMATION FOR FOOD ENGINEERING PROJECTSMohammad Reza AnghaeiPas encore d'évaluation

- More ConceptsDocument47 pagesMore ConceptsGurkirat Singh100% (1)

- Norhat1964 PDFDocument10 pagesNorhat1964 PDFNORHAT ABDULJALILPas encore d'évaluation

- Accounting For Managers - CH 3 - Recording Financial Transactions...Document14 pagesAccounting For Managers - CH 3 - Recording Financial Transactions...Fransisca Angelica Atika SisiliaPas encore d'évaluation

- Offer Letter HakkimDocument9 pagesOffer Letter Hakkimsenthil_kumaran_9100% (1)

- Uy Law Office Balance SheetDocument2 pagesUy Law Office Balance SheetA c100% (1)

- LK Juni 2017 Unaudited PDFDocument210 pagesLK Juni 2017 Unaudited PDFnandiwardhana aryagunaPas encore d'évaluation

- REALLY MODIFIED DU PONT ANALYSIS: FIVE WAYS TO IMPROVE RETURN ON EQUITYDocument5 pagesREALLY MODIFIED DU PONT ANALYSIS: FIVE WAYS TO IMPROVE RETURN ON EQUITYKhadija NalghatPas encore d'évaluation

- Financial Data Questionnaire Student Visa Application American Consulate GeneralDocument5 pagesFinancial Data Questionnaire Student Visa Application American Consulate Generalmuhyminul100% (3)

- Chapter 22 Fiscal Policy and Monetary PolicyDocument68 pagesChapter 22 Fiscal Policy and Monetary PolicyJason ChungPas encore d'évaluation

- Bir Form 2305Document1 pageBir Form 2305rbolandoPas encore d'évaluation

- Proposal Tanaman MelonDocument3 pagesProposal Tanaman Melondr walferPas encore d'évaluation

- Ms09 - Capital Budgeting (Reviewer's Copy)Document19 pagesMs09 - Capital Budgeting (Reviewer's Copy)Mikka Aira Sardeña100% (1)

- J. ALLEN JARBOE v. HUNTINGTON FOAM CORP. Et Al - Document No. 11Document12 pagesJ. ALLEN JARBOE v. HUNTINGTON FOAM CORP. Et Al - Document No. 11Justia.comPas encore d'évaluation

- Incorporating The Venture Backed LLCDocument30 pagesIncorporating The Venture Backed LLCRoger RoysePas encore d'évaluation

- Digitizing Cash Eco - After Demon - TrendsDocument126 pagesDigitizing Cash Eco - After Demon - Trendschimp64100% (1)

- Cash - TeachersDocument12 pagesCash - TeachersJustin ManaogPas encore d'évaluation

- Basics of Demand and SupplyDocument29 pagesBasics of Demand and SupplyNuahs Magahat100% (2)

- Alfredo Saad-Filho Inflation Theory A Critical Literature Review and A New Research AgendaDocument28 pagesAlfredo Saad-Filho Inflation Theory A Critical Literature Review and A New Research Agendakmbence83Pas encore d'évaluation

- CURRICULUM VITAE-FP SPV Tax Widasa Group Update 2Document11 pagesCURRICULUM VITAE-FP SPV Tax Widasa Group Update 2febrikafitriantiPas encore d'évaluation

- Investment Office ANRS: Project Profile On The Establishment of Banana PlantationDocument24 pagesInvestment Office ANRS: Project Profile On The Establishment of Banana Plantationbig john100% (3)

- Fci 132 Accounts - Finance PaperDocument15 pagesFci 132 Accounts - Finance PapersukanyaPas encore d'évaluation

- Jawaban Soal ExerciseDocument13 pagesJawaban Soal Exerciseqinthara alfarisiPas encore d'évaluation

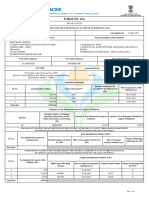

- TDS CertificateDocument2 pagesTDS Certificatetauqeer25Pas encore d'évaluation

- Batas Pambansa BLGDocument2 pagesBatas Pambansa BLGKevin Joe CuraPas encore d'évaluation

- After Tohoku: Do Investors Face Another Lost Decade From Japan?Document14 pagesAfter Tohoku: Do Investors Face Another Lost Decade From Japan?ideafix12Pas encore d'évaluation

- CH 12 ABC Costing ExampleDocument33 pagesCH 12 ABC Costing ExampleSweetu Nancy100% (1)

- Tax Rules For Domestic AirlinesDocument52 pagesTax Rules For Domestic AirlinesKath LeynesPas encore d'évaluation

- Playboy Enterprises's Strategic Management ReportDocument20 pagesPlayboy Enterprises's Strategic Management ReportLuiz Ricardo Machado CarreiroPas encore d'évaluation

- (B) Superannuation Standard Choice Form - ShortDocument2 pages(B) Superannuation Standard Choice Form - ShortAnonymous FsIAZZ9llxPas encore d'évaluation

- Duterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyDocument15 pagesDuterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyHannah SantosPas encore d'évaluation

- BSBFIA412 Formative AssessmentDocument13 pagesBSBFIA412 Formative AssessmentLAN L100% (1)

- Jenga Inc Solution Year 1 Year 2: © Corporate Finance InstituteDocument2 pagesJenga Inc Solution Year 1 Year 2: © Corporate Finance InstitutePirvuPas encore d'évaluation