Académique Documents

Professionnel Documents

Culture Documents

Dena Bank Result Updated

Transféré par

Angel BrokingDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dena Bank Result Updated

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

3QFY2012 Result Update | Banking

February 7, 2012

Dena Bank

Performance Highlights

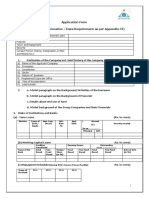

Particulars (` cr) NII Pre-prov. profit PAT

Source: Company, Angel Research

BUY

CMP Target Price

2QFY12 515 352 194 % chg (qoq) 5.1 11.7 (3.6) 3QFY11 466 316 155 % chg (yoy) 16.0 24.3 20.3

`79 `95

12 months

3QFY12 541 393 187

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Banking 2,662 1.2 115/48 329,313 10 17,707 5,362 DENA.BO DBNK@IN

For 3QFY2012, Dena Bank registered healthy 20.3% yoy growth to `187cr, above our estimates due to higher margin expansion and lower provisioning expenses than estimated by us. We recommend Buy on the stock.

Asset quality continues to impress: The pace of business picked up in 3QFY2012, with advances growing by 12.2% qoq (up 15.7% yoy) and deposits growing by 6.4% qoq (13.0% yoy). CASA deposits growth was relatively slower at 4.2% qoq (11.4% yoy), leading to a 72bp qoq (50bp yoy) decline in CASA ratio to 34.9%. Yield on advances for the bank increased by 22bp qoq to 12.2% in 3QFY2012, while cost of deposits increased by relatively lower 12bp, leading to a sequential improvement of 11bp in reported NIM to 3.3%. During 3QFY2012, non-interest income grew by 18.2% qoq to `134cr, mostly due to strong performance in fee income (aided by traction in LCs, guarantees and inflows from forex income), which grew by 13.3% qoq (up 9.7% yoy) to `124cr. Recoveries from written-off accounts were also strong at 19.6% qoq (down 44.2% yoy), while treasury income registered a strong sequential performance. Slippages (`173cr) for the bank were under control during 3QFY2012, with annualized slippage ratio standing at 1.5%. Gross NPA ratio as of 3QFY2012 stood at 1.85% (1.93% in 3QFY2012), while net NPA ratio stood at 1.10% (1.15% in 2QFY2012). NPA provision coverage ratio, including technical write-offs remained healthy at 76.6%. The banks outstanding restructured book as of 3QFY2012 stands at `1,800cr. Outlook and valuation: Dena Bank has structurally a strong CASA ratio of 35%, aiding better NIM than peers. We were cautious on the banks asset quality; however, so far, the banks asset quality has held up reasonably well compared to peers and now considering the improving macro environment, we upgrade the stock to Buy with a target price of `95.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 58.0 7.6 11.8 22.6

Abs. (%) Sensex Dena Bank

3m 0.7 (1.4)

1yr (1.8) (21.5)

3yr 90.1 120.0

Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

FY2010 1,100 3.3 511 21.0 2.1 17.8 4.4 0.9 1.0 23.5

FY2011 1,763 60.3 612 19.6 2.8 18.3 4.3 0.8 1.0 20.9

FY2012E 2,065 17.1 739 20.8 2.8 22.2 3.5 0.6 1.0 19.6

FY2013E 2,343 13.5 705 (4.6) 2.8 21.1 3.7 0.6 0.8 16.1

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Dena Bank | 3QFY2012 Result Update

Exhibit 1: 3QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income - Recov. from written off a/cs Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & Contingencies - Provisions for NPAs - Provisions for Investments - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) 1,676 1,293 375 9 1,135 541 134 124 109 10 15 675 282 171 111 393 124 69 21 35 269 82 187 30.6 1,634 1,226 397 11 0 1,119 515 113 109 97 4 13 628 276 163 114 352 81 65 11 5 271 77 194 28.5 2.6 5.5 (5.5) (23.8) (100.0) 1.4 5.1 18.2 13.3 12.5 151.0 19.6 7.5 2.1 5.0 (2.2) 11.7 52.9 5.3 84.9 587.1 (0.7) 6.6 (3.6) 208bp 1,290 986 300 4 823 466 127 113 86 14 27 593 277 181 96 316 86 50 20 15 231 76 155 32.7 30.0 31.1 25.0 140.0 NA 37.8 16.0 5.4 9.7 26.9 (28.6) (44.2) 13.8 1.8 (5.5) 15.5 24.3 45.1 36.4 1.4 132.1 16.5 8.8 20.3 (217)bp

Exhibit 2: 3QFY2012 Actual vs. Angel estimates

Particulars (` cr) Net interest income Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 541 134 675 282 393 124 269 82 187

Estimates 527 132 659 284 375 129 246 80 166

% chg 2.7 1.6 2.4 (0.8) 4.9 (3.8) 9.5 3.1 12.5

February 7, 2012

Dena Bank | 3QFY2012 Result Update

Exhibit 3: 3QFY2012 performance analysis

Particulars Balance sheet Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) CASA deposits (` cr) CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) Slippage ratio (%) Loan loss prov. to avg. assets (%)

Source: Company, Angel Research

3QFY12 2QFY12 % chg (qoq) 3QFY11 % chg (yoy) 47,928 68,339 70.1 23,848 34.9 11.6 8.5 7.1 12.2 3.3 41.8 885 1.9 524 1.1 76.6 1.5 0.4 42,723 64,236 66.5 22,879 35.6 12.6 9.3 7.0 12.0 3.2 44.0 830 1.9 491 1.2 77.1 1.4 0.4 12.2 6.4 362bp 4.2 (72)bp (97)bp (75)bp 12bp 22bp 11bp (220)bp 6.6 (8)bp 6.7 (5)bp (58)bp 16bp (0)bp 41,426 60,479 68.5 21,406 35.4 11.1 7.2 5.8 10.3 3.3 46.7 803 1.9 519 1.3 76.1 1.2 0.3 15.7 13.0 164bp 11.4 (50)bp 50bp 132bp 134bp 186bp 6bp (492)bp 10.2 (9)bp 0.9 (16)bp 47bp 35bp 5bp

Loan growth picks up after contraction in 1HFY2012

The pace of business picked up during 3QFY2012, with advances growing by 12.2% qoq (up 15.7% yoy) and deposits growing by 6.4% qoq (13.0% yoy). CASA deposits growth was relatively slower at 4.2% qoq (11.4% yoy), leading to a 72bp qoq (50bp yoy) decline in CASA ratio to 34.9%. Yield on advances for the bank increased by 22bp qoq to 12.2% in 3QFY2012, while cost of deposits increased by relatively lower 12bp, leading to a sequential improvement of 11bp in reported NIM to 3.3%. We have factored in loan growth of 13.2% and 14.1% for FY2013 and FY2013, respectively. Also, we expect calculated margins for the bank to sustain at 2.8% for FY2013.

February 7, 2012

Dena Bank | 3QFY2012 Result Update

Exhibit 4: Advances pick up in 3QFY2012

Adv. qoq chg (%) 20.0 15.0 10.0 5.0 68.5 69.8 Dep. qoq chg (%) CDR (%, RHS) 70.1 72.0 70.0 68.0 66.0 64.0 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Exhibit 5: CASA growth has moderated

CASA ratio 35.8 35.6 26.1 35.4 35.2 35.0 34.8 34.6 34.4 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 16.9 9.3 11.4 29.2 CASA yoy growth (%, RHS) 35.0 30.0 25.0 20.0 15.0 10.0 5.0 -

14.4 13.0

8.2 6.2

66.5

(4.4) (1.5)

(0.3)

1.6

12.2

67.8

6.4

35.4

35.4

35.2

35.6

(5.0) (10.0)

Source: Company, Angel Research

Exhibit 6: Yield on advances increase by 22bp

12.40 12.00 11.60 11.20 10.80 10.40 10.00 9.60 9.20 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 10.32 10.54 11.32 11.96 12.18

Exhibit 7: ...leading to sequential 11bp NIM expansion

(%) 3.50 3.27 3.20 2.90 2.60 2.30 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 3.09 2.90 3.22 3.33

Source: Company, Angel Research

Source: Company, Angel Research

Fee income drives non-interest income in 3QFY2012

During 3QFY2012, non-interest income grew by 18.2% qoq to `134cr, mostly due to strong performance in fee income (aided by traction in LCs, guarantees and inflows from forex income), which grew by 13.3% qoq (up 9.7% yoy) to `124cr. Recoveries from written-off accounts were also strong at 19.6% qoq (down 44.2% yoy), while treasury income registered a strong sequential performance.

Asset quality continues to impress

Slippages (`173cr) for the bank were under control during 3QFY2012, with annualized slippage ratio standing at 1.5%. Gross NPA ratio as of 3QFY2012 stood at 1.85% (1.93% in 3QFY2012), while net NPA ratio stood at 1.10% (1.15% in 2QFY2012). NPA provision coverage ratio including technical write-offs remained healthy at 76.6%. The banks outstanding restructured book as of 3QFY2012 stands at `1,800cr. The bank restructured Uttar Haryana SEB during 3QFY2012, while Rajasthan SEB (exposure of ~`1,100cr) and GTL (exposure of ~`400cr to the entire GTL group) will be restructured in 4QFY2012.

February 7, 2012

34.9

Dena Bank | 3QFY2012 Result Update

Exhibit 8: Slippage ratio at 1.5% for 3QFY2012

Slippages (%) 3.5 3.0 2.5 2.0 1.5 1.0 0.5 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 0.3 0.4 0.4 0.6 0.4 0.2 0.7 Credit cost (%, RHS) 0.8

Exhibit 9: Stable NPA ratios

Gross NPAs (` cr) Net NPAs (` cr)

1,200 900 600 300 -

76.1

74.6

77.9

77.1

76.6

90.0 70.0 50.0 30.0 10.0

803 519

842 549

797 458

830 491

ATMs (RHS) 520

1.2

3.0

1.3

1.4

1.5

0.1

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 10: Improvement in cost-to-income ratio

Cost-to-income ratio (%) 48.0 46.0 44.0 42.0 1.5 1.6 1.7 1.8 Opex to average assets (%, RHS) 1.9 1.8 1.7 1.6 1.5

Exhibit 11: Branch network expansion slow

Branches 1,310 1,300 1,290 1,280 1,270 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 473 507 496 535 540 520 500 480

1,284

1,291

1,297

1,298

46.7

47.4

46.1

44.0

41.8

40.0 38.0

1.5

1,307

885 524

1.4 1.3

460 440

3QFY11 4QFY11 1QFY12 2QFY12 3QFY12

Source: Company, Angel Research

Source: Company, Angel Research

February 7, 2012

Dena Bank | 3QFY2012 Result Update

Investment arguments

Structurally strong CASA

Dena Bank has maintained its CASA ratio at healthy 35%+ levels on account of having higher concentration of its branches in rural and semi-urban areas (mainly in Gujarat and Maharashtra). In the past two years, the bank has maintained a CASA market share of 1.1%, despite competition from private banks. This structural advantage is reflected in the bank's cost of funds at 5.5% in FY2011, which is one of the lowest amongst peers.

Capital infusion to enable further growth

Dena Bank has received ~`540cr in the form of equity share capital from the government. Post the capital infusion, Government of Indias holding has increased to 58.0% and the bank's tier-I ratio has improved by ~250bp to 9.7% (as of FY2011), which should enable it to grow its advances more-or-less in-line with peers in the medium term.

Outlook and valuation

Dena Bank has structurally a strong CASA ratio of 35%, aiding better NIM than peers. We were cautious on the banks asset quality; however, so far, the banks asset quality has held up reasonably well compared to peers and now considering the improving macro environment, we upgrade our rating on the stock to Buy with a target price of `95.

February 7, 2012

Dena Bank | 3QFY2012 Result Update

Exhibit 12: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Earlier estimates FY2012 12.0 8.0 36.7 2.8 1.9 (3.0) 16.0 2.4 77.0 FY2013 12.0 12.0 36.5 2.9 8.7 15.0 15.0 2.6 75.0 Revised estimates FY2012 14.0 12.0 35.4 2.8 2.1 (1.0) 14.0 2.0 76.0 FY2013 16.0 14.0 34.6 2.8 5.5 15.0 15.0 2.1 75.0

Coverage ratio

Source: Angel Research

Exhibit 13: Change in estimates

FY2012 Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

FY2013 Earlier estimates 2,281 591 2,872 1,282 1,590 641 949 308 641 Revised Var. (%) estimates 2,343 575 2,918 1,289 1,630 587 1,043 338 705 2.8 (2.7) 1.6 0.5 2.5 (8.4) 9.9 9.9 9.9

Earlier estimates 2,034 544 2,577 1,114 1,463 462 1,001 325 676

Revised Var. (%) estimates 2,065 545 2,610 1,120 1,490 396 1,094 355 739 1.6 0.2 1.3 0.5 1.8 (14.2) 9.2 9.2 9.2

Exhibit 14: P/ABV band

Price (`) 200 160 120 80 40 0 0.3x 0.6x 0.9x 1.2x 1.5x

Mar-03

Mar-04

Mar-05

Mar-06

Mar-07

Mar-08

Mar-09

Mar-10

Mar-11

Source: Company, Angel Research

February 7, 2012

Mar-12

Sep-03

Sep-04

Sep-05

Sep-06

Sep-07

Sep-08

Sep-09

Sep-10

Sep-11

Dena Bank | 3QFY2012 Result Update

Exhibit 15: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI BOM CanBk CentBk CorpBk DenaBk IDBI# IndBk IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk Reco. Buy Neutral Neutral Buy Neutral Buy Accumulate Neutral Buy Neutral Accumulate Accumulate Reduce Accumulate Buy Neutral Neutral Neutral Accumulate Neutral Accumulate Accumulate Accumulate Neutral Neutral Buy Reduce CMP (`) 1,114 416 510 937 25 337 175 114 784 341 50 511 99 472 79 106 233 96 827 298 984 2,152 107 74 238 71 59 Tgt. price (`) 1,392 1,104 398 186 907 53 553 84 510 95 877 1,079 2,364 114 83 54 Upside (%) 24.9 17.9 18.1 6.5 15.7 6.2 8.2 (14.7) 8.0 20.2 6.1 9.6 9.9 6.8 16.9 (9.0) FY2013E P/ABV (x) 1.8 1.1 3.5 1.7 1.2 2.1 0.8 0.8 1.1 1.1 0.7 1.0 0.9 0.8 0.6 0.7 0.9 0.6 0.8 0.8 1.1 1.7 0.7 0.9 1.0 0.6 0.8 FY2013E Tgt P/ABV (x) 2.3 2.0 2.5 0.9 1.3 0.8 1.1 0.8 0.9 0.7 0.9 1.3 1.9 0.8 0.7 0.8 FY2013E P/E (x) 9.7 9.0 17.8 14.7 7.6 11.2 4.9 5.3 6.0 7.2 5.1 6.6 6.4 5.1 3.7 5.3 5.6 5.0 4.8 6.5 6.2 10.4 4.5 4.8 6.0 4.0 6.6 FY11-12E EPS CAGR (%) 18.2 16.2 30.4 19.5 13.5 20.1 9.1 (2.9) 9.8 2.3 26.3 (7.4) (25.1) (1.8) 7.3 8.9 3.6 5.3 16.7 (5.9) 6.4 26.0 13.7 10.9 0.1 15.3 0.7 FY2013E RoA (%) 1.5 1.2 1.8 1.4 0.9 1.4 0.9 0.9 1.1 0.6 0.7 0.8 0.4 0.8 0.8 0.6 1.2 0.5 1.4 0.7 1.0 0.8 0.7 0.6 0.7 0.6 0.4 FY2013E RoE (%) 20.2 13.2 21.0 14.5 17.5 20.6 17.3 15.1 19.3 13.7 16.9 15.8 11.4 15.5 16.1 13.4 18.2 12.8 19.0 11.3 19.4 17.9 16.5 15.4 15.8 14.4 11.1

Source: Company, Angel Research; Note: *Target multiples=SOTP Target Price/ABV (including subsidiaries); #Without adjusting for SASF

February 7, 2012

Dena Bank | 3QFY2012 Result Update

Income statement

Y/E March (` cr) NII - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY07 855 18.4 422 (8.0) 1,278 8.1 612 8.9 666 7.4 433 (23.9) 233 352.5 31 13.5 202 176.1 FY08 859 0.4 478 13.2 1,337 4.6 650 6.4 686 3.1 369 (14.8) 318 36.3 (42) (13.3) 360 78.5 FY09 1,064 23.9 430 (10.0) 1,495 11.8 768 18.1 726 5.8 185 (49.9) 541 70.5 119 21.9 423 17.5 FY10 1,100 3.3 589 36.9 1,689 13.0 848 10.4 841 15.7 154 (16.8) 687 26.8 176 25.6 511 21.0 FY11 1,763 60.3 534 (9.3) 2,297 36.0 1,073 26.6 1,224 45.6 326 111.7 898 30.8 287 31.9 612 19.6 FY12E 2,065 17.1 545 2.1 2,610 13.6 1,120 4.4 1,490 21.7 396 21.6 1,094 21.8 355 32.4 739 20.8 FY13E 2,343 13.5 575 5.5 2,918 11.8 1,289 15.0 1,630 9.4 587 48.2 1,043 (4.6) 338 32.4 705 (4.6)

Balance Sheet

Y/E March (` cr) Share Capital Reserve & Surplus Deposits Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash balances Bank balances Investments Advances Growth (%) Fixed Assets Other Assets Total Assets Growth (%) FY07 287 1,210 27,690 17.2 451 535 1,278 31,451 1,957 861 9,235 18,303 28.6 442 652 31,451 18.5 FY08 287 1,514 33,943 22.6 395 1,066 1,437 38,642 3,533 505 10,283 23,024 25.8 412 885 38,642 22.9 FY09 287 1,884 43,051 26.8 52 1,391 1,796 48,461 4,982 875 12,473 28,878 25.4 405 847 48,461 25.4 FY10 287 2,315 51,344 19.3 46 1,516 2,079 57,587 4,355 759 15,694 35,462 22.8 407 908 57,587 18.8 FY11 333 3,323 64,210 25.1 176 1,516 1,281 70,838 4,721 687 18,769 44,828 26.4 404 1,429 70,838 23.0 FY12E 333 3,945 71,915 12.0 199 1,728 2,104 80,224 4,674 1,604 20,779 51,104 14.0 444 1,618 80,224 13.2 FY13E 333 4,534 81,983 14.0 227 2,005 2,425 91,507 5,329 1,830 22,730 59,281 16.0 491 1,846 91,507 14.1

February 7, 2012

Dena Bank | 3QFY2012 Result Update

Ratio Analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov./Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis (%) NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage (x) RoE 2.9 1.5 1.5 0.1 1.6 1.3 2.9 2.1 0.8 0.1 0.7 25.2 17.5 2.5 1.1 1.4 0.3 1.7 1.1 2.8 1.9 0.9 (0.1) 1.0 25.0 25.6 2.4 0.4 2.0 0.1 2.1 0.9 3.0 1.8 1.2 0.3 1.0 24.8 24.0 2.1 0.3 1.8 0.3 2.1 0.8 2.9 1.6 1.3 0.3 1.0 24.4 23.5 2.7 0.5 2.2 0.0 2.3 0.8 3.1 1.7 1.4 0.4 1.0 21.9 20.9 2.7 0.5 2.2 0.0 2.2 0.7 2.9 1.5 1.4 0.5 1.0 20.0 19.6 2.7 0.7 2.0 0.0 2.1 0.7 2.7 1.5 1.2 0.4 0.8 19.6 16.1 11.2 2.1 1.0 6.3 1.5 1.3 5.3 1.3 1.5 4.4 0.9 2.5 4.3 0.8 2.8 3.5 0.6 3.8 3.7 0.6 3.8 7.0 36.8 0.8 12.5 51.8 1.0 14.7 62.2 1.2 17.8 2.0 18.3 2.2 22.2 3.0 21.1 3.0 83.4 103.5 122.4 140.1 4.0 2.0 3.6 1.0 50.0 2.4 0.9 2.2 0.8 60.7 2.1 1.1 2.9 0.5 48.3 1.8 1.2 2.2 0.2 78.6 1.9 1.2 2.1 0.4 74.6 2.2 1.2 2.0 0.3 76.0 3.3 1.4 2.1 0.6 75.0 44.5 66.1 11.5 6.1 39.2 67.8 11.1 6.8 34.8 67.1 12.1 6.8 36.0 69.1 12.8 8.2 35.5 69.8 13.4 9.8 35.4 71.1 13.9 10.1 34.6 72.3 14.1 10.1 3.1 47.9 0.7 17.5 2.5 48.7 1.0 25.6 2.5 51.4 1.0 24.0 2.1 50.2 1.0 23.5 2.8 46.7 1.0 20.9 2.8 42.9 1.0 19.6 2.8 44.2 0.8 16.1 FY07 FY08 FY09 FY10 FY11 FY12E FY13E

February 7, 2012

10

Dena Bank | 3QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Dena Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

February 7, 2012

11

Vous aimerez peut-être aussi

- DL NewBusPermit-BACOORDocument2 pagesDL NewBusPermit-BACOOROlive Dago-oc100% (1)

- UGG PaperDocument10 pagesUGG Paperbudi adiPas encore d'évaluation

- IFRS US GAAP and Mexican FRS Similarities and DifferencesDocument196 pagesIFRS US GAAP and Mexican FRS Similarities and DifferencesArturo Vertti0% (1)

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingPas encore d'évaluation

- South Indian Bank Result UpdatedDocument12 pagesSouth Indian Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Dena Bank Result UpdatedDocument10 pagesDena Bank Result UpdatedAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- ICICI Bank Result UpdatedDocument16 pagesICICI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Vijaya Bank Result UpdatedDocument11 pagesVijaya Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Axis Bank Result UpdatedDocument13 pagesAxis Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Allahabad Bank Result UpdatedDocument11 pagesAllahabad Bank Result UpdatedAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Dena Bank: AccumulateDocument11 pagesDena Bank: AccumulateAngel BrokingPas encore d'évaluation

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Jammu and Kashmir Bank Result UpdatedDocument10 pagesJammu and Kashmir Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of Baroda, 7th February, 2013Document12 pagesBank of Baroda, 7th February, 2013Angel BrokingPas encore d'évaluation

- HDFC Bank Result UpdatedDocument13 pagesHDFC Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of IndiaDocument12 pagesBank of IndiaAngel BrokingPas encore d'évaluation

- Corporation Bank Result UpdatedDocument11 pagesCorporation Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- South Indian BankDocument11 pagesSouth Indian BankAngel BrokingPas encore d'évaluation

- Icici Bank: Performance HighlightsDocument15 pagesIcici Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Union Bank of India Result UpdatedDocument11 pagesUnion Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- South Indian Bank Result UpdatedDocument13 pagesSouth Indian Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Vijaya Bank, 1Q FY 2014Document11 pagesVijaya Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- State Bank of IndiaDocument16 pagesState Bank of IndiaAngel BrokingPas encore d'évaluation

- Oriental Bank of Commerce: Performance HighlightsDocument11 pagesOriental Bank of Commerce: Performance HighlightsAngel BrokingPas encore d'évaluation

- Bank of India Result UpdatedDocument12 pagesBank of India Result UpdatedAngel BrokingPas encore d'évaluation

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- South Indian Bank: Performance HighlightsDocument12 pagesSouth Indian Bank: Performance HighlightsPranay SinghPas encore d'évaluation

- State Bank of India: Performance HighlightsDocument14 pagesState Bank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Union Bank of India: Performance HighlightsDocument11 pagesUnion Bank of India: Performance HighlightsAngel BrokingPas encore d'évaluation

- Allahabad Bank: Performance HighlightsDocument12 pagesAllahabad Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Bank of Baroda: Performance HighlightsDocument12 pagesBank of Baroda: Performance HighlightsAngel BrokingPas encore d'évaluation

- Axis Bank: Performance HighlightsDocument13 pagesAxis Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- IDBI Bank Result UpdatedDocument13 pagesIDBI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Indian Bank: Performance HighlightsDocument11 pagesIndian Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Central Bank of India Result UpdatedDocument10 pagesCentral Bank of India Result UpdatedAngel BrokingPas encore d'évaluation

- HDFC Result UpdatedDocument12 pagesHDFC Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of BarodaDocument12 pagesBank of BarodaAngel BrokingPas encore d'évaluation

- UCO Bank: Performance HighlightsDocument11 pagesUCO Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- Bank of Baroda, 1Q FY 2014Document12 pagesBank of Baroda, 1Q FY 2014Angel BrokingPas encore d'évaluation

- Punjab National Bank Result UpdatedDocument12 pagesPunjab National Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Andhra Bank: Performance HighlightsDocument10 pagesAndhra Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- SouthIndianBank 2QFY2013RU NWDocument13 pagesSouthIndianBank 2QFY2013RU NWAngel BrokingPas encore d'évaluation

- IDBI Bank: Performance HighlightsDocument13 pagesIDBI Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- HDFC Bank Result UpdatedDocument13 pagesHDFC Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Bank of India, 4th February, 2013Document12 pagesBank of India, 4th February, 2013Angel BrokingPas encore d'évaluation

- State Bank of India: Performance HighlightsDocument15 pagesState Bank of India: Performance HighlightsRaaji BujjiPas encore d'évaluation

- Jammu and Kashmir Bank: Performance HighlightsDocument10 pagesJammu and Kashmir Bank: Performance HighlightsAngel BrokingPas encore d'évaluation

- ICICI Bank Result UpdatedDocument15 pagesICICI Bank Result UpdatedAngel BrokingPas encore d'évaluation

- Credit Union Revenues World Summary: Market Values & Financials by CountryD'EverandCredit Union Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- Currency Daily Report September 13 2013Document4 pagesCurrency Daily Report September 13 2013Angel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument12 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 12 2013Document2 pagesDaily Agri Tech Report September 12 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Currency Daily Report September 12 2013Document4 pagesCurrency Daily Report September 12 2013Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Daily Metals and Energy Report September 12 2013Document6 pagesDaily Metals and Energy Report September 12 2013Angel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 12Document2 pagesMetal and Energy Tech Report Sept 12Angel BrokingPas encore d'évaluation

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Document4 pagesDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingPas encore d'évaluation

- Unit I - Working Capital PolicyDocument16 pagesUnit I - Working Capital Policyjaskahlon92Pas encore d'évaluation

- Simplex PrismDocument3 pagesSimplex PrismxZeep DPas encore d'évaluation

- Credit FrameworkDocument10 pagesCredit Frameworkzubair1951Pas encore d'évaluation

- So What's The Deal With Gann and Gann AnalysisDocument12 pagesSo What's The Deal With Gann and Gann Analysissalima100% (1)

- Revival Letter: Indian Overseas Bank Branch Dear Sir(s)Document1 pageRevival Letter: Indian Overseas Bank Branch Dear Sir(s)sri_iasPas encore d'évaluation

- Soriano Shares, Inc., City of Davao and HON. RODRIGO S. RIOLA, in His o Cial Capacity As The City Treasurer of Davao CityDocument4 pagesSoriano Shares, Inc., City of Davao and HON. RODRIGO S. RIOLA, in His o Cial Capacity As The City Treasurer of Davao Cityrian.lee.b.tiangcoPas encore d'évaluation

- Legal Vocab (Version 1)Document157 pagesLegal Vocab (Version 1)Karina PramestiPas encore d'évaluation

- VLIS SelectionOpinion021916Document12 pagesVLIS SelectionOpinion021916Abdullah18Pas encore d'évaluation

- Social and Business Ethics1Document10 pagesSocial and Business Ethics1SjPas encore d'évaluation

- Loan Application FormDocument9 pagesLoan Application FormrohitPas encore d'évaluation

- WyckoffDocument1 pageWyckoffRatulPas encore d'évaluation

- HMC Annual StatementDocument65 pagesHMC Annual Statementৰিতুপর্ণ HazarikaPas encore d'évaluation

- Entrep ComputationDocument18 pagesEntrep ComputationEmman RevillaPas encore d'évaluation

- Uniform Loan and Mortgage Agreement (Real Estate) : Pangasinan Bank, IncDocument7 pagesUniform Loan and Mortgage Agreement (Real Estate) : Pangasinan Bank, IncCampbell HezekiahPas encore d'évaluation

- Rar HDFC Bank 2014Document32 pagesRar HDFC Bank 2014Moneylife Foundation100% (1)

- Libby Chap 5Document13 pagesLibby Chap 5hatanolove100% (1)

- Cost of CapitalDocument3 pagesCost of CapitalJohn Marthin ReformaPas encore d'évaluation

- Fairtrade Standard Cocoa Small Producer Organizations: Also Applicable To Contract Production in OceaniaDocument10 pagesFairtrade Standard Cocoa Small Producer Organizations: Also Applicable To Contract Production in OceaniaAfolabi OlaniyiPas encore d'évaluation

- Trend AnalysisDocument28 pagesTrend Analysisdiwakar0000000Pas encore d'évaluation

- APC Individual Assignment - CIC160097Document10 pagesAPC Individual Assignment - CIC160097Siti Nor Azliza AliPas encore d'évaluation

- Essentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Document3 pagesEssentials of Investments (BKM 5 Ed.) Answers To Selected Problems - Lecture 6Kunal KumudPas encore d'évaluation

- A Project Report On: A Study On Consumer Satisfaction of Payzapp Wallet With Refrence To City BhindDocument51 pagesA Project Report On: A Study On Consumer Satisfaction of Payzapp Wallet With Refrence To City Bhindnikhil jPas encore d'évaluation

- Economics AssignmentDocument8 pagesEconomics Assignmentchandanprakash30Pas encore d'évaluation

- JetBlue Airways IPO ValuationDocument15 pagesJetBlue Airways IPO ValuationThossapron Apinyapanja0% (2)

- Trading Hedging Risk ManagementDocument16 pagesTrading Hedging Risk ManagementManish AnandPas encore d'évaluation