Académique Documents

Professionnel Documents

Culture Documents

Securities and Exchange Board of India

Transféré par

Kanna RajeshDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Securities and Exchange Board of India

Transféré par

Kanna RajeshDroits d'auteur :

Formats disponibles

Securities and Exchange Board of India

From Wikipedia, the free encyclopedia

Securities and Exchange Board of India

SEBI Bhavan, Mumbai headquarters

Agency overview

Formed

12 April 1992

Jurisdiction

Government of India

Headquarters

Mumbai, Maharashtra

Employees

525 (2009)[1]

Agency executive

U. K. Sinha, Chairman

Website

www.sebi.gov.in

The Securities and Exchange Board of India(frequently abbreviated SEBI) is the regulator for thesecurities market in India.

Contents

[hide]

1 History 2 Organization structure 3 Functions and responsibilities

3.1 Powers 3.2 SEBI Committees

4 See also 5 References 6 External links

[edit]History

It was formed officially by the Government of India in 1992 with SEBI Act 1992[2] being passed by the Indian Parliament. SEBI is headquartered in the business district of Bandra-Kurla complex in Mumbai, and has Northern, Eastern, Southern and Western regional offices in New Delhi, Kolkata, Chennai and Ahmedabad. Controller of Capital Issues was the regulatory authority before SEBI came into existence;[3] it derived authority from the Capital Issues (Control) Act, 1947. Initially SEBI was a non statutory body without any statutory power. However in 1995, the SEBI was given additional statutory power by the Government of India through an amendment to the securities and Exchange Board of India Act 1992. In April, 1998 the SEBI was constituted as the regulator of capital market in India under a resolution of the Government of India.

[edit]Organization

structure

Upendra Kumar Sinha was appointed chairman on 18 February 2011 replacing C. B. Bhave.[4]

The Board comprises[5]

Name

Designation

Upendra Kumar Sinha

Chairman

Prashant Saran

Whole Time Member

CA. T.V. Mohandas Pai Director, Infosys

Dr. Thomas Mathew

Joint Secretary, Ministry of Finance

V. K. Jairath

Member Appointed

Anand Sinha

Deputy Governor, Reserve Bank of India

List of former Chairmen[6]:

Name

From

To

C. B. Bhave

18 February 2008

18 February 2011

M. Damodaran

18 February 2005

18 February 2008

G. N. Bajpai

20 February 2002

18 February 2005

D. R. Mehta

21 February 1995

20 February 2002

S. S. Nadkarni

17 January 1994 31 January 1995

G. V. Ramakrishna 24 August 1990

17 January 1994

Dr. S. A. Dave

12 April 1988

23 August 1990

[edit]Functions

and responsibilities

SEBI has to be responsive to the needs of three groups, which constitute the market: the issuers of securities the investors the market intermediaries.

SEBI has three functions rolled into one body: quasi-legislative, quasi-judicial and quasi-executive. It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in its executive function and it passes rulings and orders in its judicial capacity. Though this makes it very powerful, there is an appeals process to create accountability. There is a Securities Appellate Tribunal which is a three-member tribunal and is presently headed by a former Chief Justice of a High court - Mr. Justice NK Sodhi. A second appeal lies directly to the Supreme Court. SEBI has enjoyed success as a regulator by pushing systemic reforms aggressively and successively (e.g. the quick movement towards making the markets electronic and paperless rolling settlement on T+2 basis). SEBI has been active in setting up the regulations as required under law. SEBI has also been instrumental in taking quick and effective steps in light of the global meltdown and the Satyam fiasco.[citation needed] It had[when?] increased the extent and quantity of disclosures to be made by Indian corporate promoters. More recently, in light of the global meltdown,it liberalised the takeover code to facilitate investments by removing regulatory structures. In one such move, SEBI has increased the application limit for retail investors to Rs 2 lakh, from Rs 1 lakh at present.[7]

[edit]Powers

For the discharge of its functions efficiently, SEBI has been invested with the necessary powers which are: 1. 2. 3. 4. 5. to approve bylaws of stock exchanges. to require the stock exchange to amend their bylaws. inspect the books of accounts and call for periodical returns from recognised stock exchanges. inspect the books of accounts of a financial intermediaries. compel certain companies to list their shares in one or more stock exchanges.

6. 7. 8. 9.

levy fees and other charges on the intermediaries for performing its functions. grant licence to any person for the purpose of dealing in certain areas. delegate powers exercisable by it. prosecute and judge directly the violation of certain provisions of the companies Act.

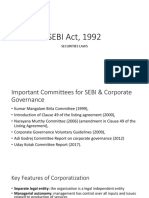

[edit]SEBI

1. 2. 3. 4. 5. 6. 7. 8. 9.

Committees

Technical Advisory Committee Committee for review of structure of market infrastructure institutions Members of the Advisory Committee for the SEBI Investor Protection and Education Fund Takeover Regulations Advisory Committee Primary Market Advisory Committee (PMAC) Secondary Market Advisory Committee (SMAC) Mutual Fund Advisory Committee Corporate Bonds & Securitization Advisory Committee Takeover Panel

10. SEBI Committee on Disclosures and Accounting Standards (SCODA) 11. High Powered Advisory Committee on consent orders and compounding of offences 12. Derivatives Market Review Committee 13. Committee on Infrastructure Funds

Vous aimerez peut-être aussi

- History: The Securities and Exchange Board of India Act, 1992Document4 pagesHistory: The Securities and Exchange Board of India Act, 1992Arulmani MurugesanPas encore d'évaluation

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanPas encore d'évaluation

- SEBI Regulates Indian Capital MarketsDocument7 pagesSEBI Regulates Indian Capital MarketsAshish ThengariPas encore d'évaluation

- SEBI India Regulator Securities MarketDocument6 pagesSEBI India Regulator Securities MarketSiddhi PatwaPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument73 pagesSecurities and Exchange Board of IndiaSurya ParkashPas encore d'évaluation

- SEBI India's Securities Market RegulatorDocument6 pagesSEBI India's Securities Market RegulatorPawan LohanaPas encore d'évaluation

- SEBI regulates India's securities marketDocument6 pagesSEBI regulates India's securities marketShashank HatlePas encore d'évaluation

- History and Functions of SEBIDocument2 pagesHistory and Functions of SEBIVishal SharmaPas encore d'évaluation

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaPas encore d'évaluation

- SEBIDocument2 pagesSEBIAkash ShrivastavaPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument21 pagesSecurities and Exchange Board of IndiaDeepa A PoojaryPas encore d'évaluation

- Securities and Exchange Board of India: Jump To Navigation Jump To SearchDocument8 pagesSecurities and Exchange Board of India: Jump To Navigation Jump To SearchShayan ZafarPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument32 pagesSecurities and Exchange Board of IndiaMohan kashyapPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument10 pagesSecurities and Exchange Board of IndiajaseelekaPas encore d'évaluation

- Sebi'S Background: Securities and Exchange Board of IndiaDocument15 pagesSebi'S Background: Securities and Exchange Board of IndiaAnjaliPas encore d'évaluation

- Introductio 1Document2 pagesIntroductio 1Anil ShelarPas encore d'évaluation

- SEBI: History, Establishment and OrganizationDocument55 pagesSEBI: History, Establishment and OrganizationSaurabh sarojPas encore d'évaluation

- SEBIDocument1 pageSEBIApurva DipnaikPas encore d'évaluation

- SEBI's functions and powers as market regulatorDocument10 pagesSEBI's functions and powers as market regulatorNavin PamnaniPas encore d'évaluation

- Sebi PresentatationDocument21 pagesSebi PresentatationDeepikaPas encore d'évaluation

- Difference Between Money Markets and Capital MarketsDocument4 pagesDifference Between Money Markets and Capital MarketsSachin TiwariPas encore d'évaluation

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanPas encore d'évaluation

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaPas encore d'évaluation

- SEBI as a regulator of the capital marketDocument25 pagesSEBI as a regulator of the capital marketraj vardhan agarwalPas encore d'évaluation

- Investment Law PresentationDocument11 pagesInvestment Law PresentationNanda SurajPas encore d'évaluation

- SEBI - Regulator of Indian securities marketsDocument37 pagesSEBI - Regulator of Indian securities marketsBhushan KharatPas encore d'évaluation

- Government of India Sebi Act 1992 Bandra-Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadDocument5 pagesGovernment of India Sebi Act 1992 Bandra-Kurla Complex Mumbai New Delhi Kolkata Chennai AhmedabadNeha SabooPas encore d'évaluation

- Security Exchange & Board of IndiaDocument11 pagesSecurity Exchange & Board of IndiaLyco BhardwajPas encore d'évaluation

- SEBI Act, 1992: Securities LawsDocument25 pagesSEBI Act, 1992: Securities LawsAlok KumarPas encore d'évaluation

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalPas encore d'évaluation

- BE 10 B SEBIDocument1 pageBE 10 B SEBIAnmol HuriyaPas encore d'évaluation

- SEBIDocument25 pagesSEBIsumant singhPas encore d'évaluation

- SEBIDocument3 pagesSEBIsruthi karthiPas encore d'évaluation

- SEBI: Regulations, Objectives and FunctionsDocument35 pagesSEBI: Regulations, Objectives and FunctionsRohan FodnaikPas encore d'évaluation

- Securities Exchange Board of IndiaDocument24 pagesSecurities Exchange Board of IndiaasdPas encore d'évaluation

- Module 04 Investment N Securities Law-6Document76 pagesModule 04 Investment N Securities Law-6Kirti DPas encore d'évaluation

- SEBI Introduction and RoleDocument3 pagesSEBI Introduction and RoleAnkush PoojaryPas encore d'évaluation

- SEBI IntroductionDocument48 pagesSEBI Introductiontanisq10100% (2)

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriPas encore d'évaluation

- SebiDocument26 pagesSebiHitesh MendirattaPas encore d'évaluation

- Investment and Securities AssignmentDocument16 pagesInvestment and Securities Assignmentkhusboo kharbandaPas encore d'évaluation

- Role of Sebi in Corporate GoveranceDocument13 pagesRole of Sebi in Corporate GoveranceTanima RoyPas encore d'évaluation

- Sebi LawDocument75 pagesSebi LawTUSHAR SHERMALEPas encore d'évaluation

- Assignment On SebiDocument17 pagesAssignment On SebiSUFIYAN SIDDIQUIPas encore d'évaluation

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- Anurag ProjectDocument3 pagesAnurag ProjectAnurag LahanePas encore d'évaluation

- Project On SebiDocument9 pagesProject On SebiAditya ChaulkarPas encore d'évaluation

- Ifm AssignmentDocument15 pagesIfm AssignmentRockstar KshitijPas encore d'évaluation

- Amity Law SchoolDocument12 pagesAmity Law SchoolIshaan TandonPas encore d'évaluation

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar86% (14)

- Corporate Law-Ii Important QuestionsDocument26 pagesCorporate Law-Ii Important QuestionsNishaath ShareefPas encore d'évaluation

- SebiDocument26 pagesSebikhilchiadilPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument57 pagesSecurities and Exchange Board of IndiaTanay Kumar SinghPas encore d'évaluation

- Project Name: Securities and Exchange Board of India (Sebi)Document24 pagesProject Name: Securities and Exchange Board of India (Sebi)Ronak DalmiaPas encore d'évaluation

- Arnav 245 (Sebi)Document14 pagesArnav 245 (Sebi)ArnavPas encore d'évaluation

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalPas encore d'évaluation

- Sebi Functional ReportDocument7 pagesSebi Functional ReportRohan Pawar61% (18)

- Corporate Governance: A practical guide for accountantsD'EverandCorporate Governance: A practical guide for accountantsÉvaluation : 5 sur 5 étoiles5/5 (1)

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersD'EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersPas encore d'évaluation

- 68.ramirez Telephone Corp. vs. Bank of AmericaDocument7 pages68.ramirez Telephone Corp. vs. Bank of Americavince005Pas encore d'évaluation

- PCGG v Senate: SC rules on limits of legislative inquiryDocument2 pagesPCGG v Senate: SC rules on limits of legislative inquiryBryanPas encore d'évaluation

- Case (Digests) in Credit TransactionsDocument31 pagesCase (Digests) in Credit TransactionsjafernandPas encore d'évaluation

- 098-Gochan vs. Young G.R. No. 131889 March 12, 2001Document8 pages098-Gochan vs. Young G.R. No. 131889 March 12, 2001wewPas encore d'évaluation

- Decision of A Lower Court: Appeal - Legal Definition. The Process To Seek and Obtain A Review and Reversal by ADocument11 pagesDecision of A Lower Court: Appeal - Legal Definition. The Process To Seek and Obtain A Review and Reversal by AShemoleth Magsino ReyesPas encore d'évaluation

- Client Confidentiality and Lawyer ClientDocument7 pagesClient Confidentiality and Lawyer ClientPriyal ShethPas encore d'évaluation

- Introduction To The Indian Legal System: Law After IndependenceDocument19 pagesIntroduction To The Indian Legal System: Law After IndependenceAbhijit KunduPas encore d'évaluation

- Press Release No 128/15: Court of Justice of The European UnionDocument2 pagesPress Release No 128/15: Court of Justice of The European UnionMirunaSavPas encore d'évaluation

- Sample Bar Exam QuestionsDocument3 pagesSample Bar Exam QuestionsslydogchuckPas encore d'évaluation

- Vol 3 P IIIDocument146 pagesVol 3 P IIIPramodKumarPas encore d'évaluation

- Gerochi vs. Department of EnergyDocument3 pagesGerochi vs. Department of EnergyRoss LynePas encore d'évaluation

- BBC Report On The Dutroux ScandalDocument3 pagesBBC Report On The Dutroux ScandalCazzac111Pas encore d'évaluation

- Ecumenical Prayer of The CourtDocument3 pagesEcumenical Prayer of The CourtSand FajutagPas encore d'évaluation

- ToC Repsonse ADA CadeDocument25 pagesToC Repsonse ADA CadeAnkur SinghPas encore d'évaluation

- Unlawful Detainer CaseDocument6 pagesUnlawful Detainer CaseDennis CosmodPas encore d'évaluation

- Digest Ortega Vs CADocument2 pagesDigest Ortega Vs CAOwen Buenaventura0% (1)

- Motion To Dismiss - Dremali Criminal No. 4:10-CR-059Document4 pagesMotion To Dismiss - Dremali Criminal No. 4:10-CR-059MLFAPas encore d'évaluation

- Chapter 19 - Government & LawDocument57 pagesChapter 19 - Government & Lawancaye1962Pas encore d'évaluation

- Appointment of An Arbitrator: Administrative or JudicialDocument4 pagesAppointment of An Arbitrator: Administrative or JudicialNiharikac1995Pas encore d'évaluation

- Digest-Rodriguez v. RodriguezDocument2 pagesDigest-Rodriguez v. RodriguezNamiel Maverick D. Balina100% (1)

- Reconsideration of Dismissal of Estafa, Falsification and Use of Falsified Documents CasesDocument3 pagesReconsideration of Dismissal of Estafa, Falsification and Use of Falsified Documents CasesPboy SolanPas encore d'évaluation

- PLD 2021 SC 639Document23 pagesPLD 2021 SC 639Usman Khan YousafzaiPas encore d'évaluation

- 300 Vocabulary Words PDFDocument52 pages300 Vocabulary Words PDFRocksa N RollPas encore d'évaluation

- DEMURRER - Marvin ClacioDocument14 pagesDEMURRER - Marvin ClacioDraei DumalantaPas encore d'évaluation

- Synopis Comparative ConstitutionDocument4 pagesSynopis Comparative ConstitutionHemantVermaPas encore d'évaluation

- Case SynthesisDocument2 pagesCase Synthesislexvinculum75% (4)

- Canton V. City of Cebu (2007)Document2 pagesCanton V. City of Cebu (2007)Genesis Leal100% (1)

- Complete - Substantive Due Process CasesDocument81 pagesComplete - Substantive Due Process CasesJP Ramos DatinguinooPas encore d'évaluation

- Sawyer County Case 2020CV000128 Tavern League of Wisconsin, Inc. Et Al vs. Andrea Palm Et AlDocument2 pagesSawyer County Case 2020CV000128 Tavern League of Wisconsin, Inc. Et Al vs. Andrea Palm Et AlTMJ4 NewsPas encore d'évaluation

- United States v. Kenneth Johnson, 199 F.3d 123, 3rd Cir. (1999)Document8 pagesUnited States v. Kenneth Johnson, 199 F.3d 123, 3rd Cir. (1999)Scribd Government DocsPas encore d'évaluation