Académique Documents

Professionnel Documents

Culture Documents

Taxation Take Away

Transféré par

Vicky GoweDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Taxation Take Away

Transféré par

Vicky GoweDroits d'auteur :

Formats disponibles

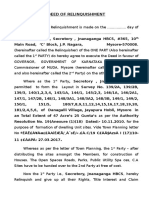

QUESTION ONE (a) Explain three circumstances under which: (i) The income of a taxable person is assessed on another

person

The income of an incapacitated person shall be assessed on, and the tax thereon charged on, that person in the name of his trustee, guardian, curator, committee or receiver appointed by a court, in the same manner and to the same amount as that incapacitated person would have been assessed and charged if he were not an incapacitated person. The master of a ship, or the captain of an aircraft, owned or chartered by a non-resident person who is chargeable to tax under section 9 shall (though not to the exclusion of any other agent) be deemed the agent of that nonresident person for the purposes of this section. The income accrued to, or received prior to the date of the death of a deceased person which would, but for his death, have been assessed and charged to tax on him for a year of income shall, subject to section 79(1)(d), be assessed on, and the tax charged on, his executors or administrators for that year of income. An amount received by the executors or administrators of a deceased person which would, but for his death, have been his income for a year of income shall be deemed to be income of his executors or administrators and shall be assessed on, and the tax charged on them for that year of income. Where executors or administrators distribute the estate of a deceased person before a change in the rate of tax at which they are liable in respect of a year of income, they shall not be liable in respect of any increased tax resultant from that change. A person in whose name the income of another person is assessable under this Act shall be responsible, in relation to the assessment of that income, for doing all things that are under this Act required to be done by a person whose income is chargeable to tax, and shall be responsible for the tax burden. A married woman living with her husband may be called upon to bear the burden of tax Employment income: The wife s employment income qualifies for separate assessment except: y y y y If the wife is employed by the husband Where the wife is employed in a company where wife and husband or both jointly controls 12.5% or more of the share capital If the wife is employed in a partnership where the husband is a partner If the wife is working in a trust created by her husband (ii)

Wife s Professional income: The gains of profits derived by the wife from the practice of the professions specified in the 5th schedule of the income tax act relevant to that profession. The professions are: y y y y y y y Medical profession Dental profession Legal profession Engineering under the engineering Act Accounting and auditors under the accountants Act Secretaries under the secretaries Act Surveyors under the surveyors Act

The professional income would not qualify for separate assessment if: -She is in partnership with her husband -She is a partner in a partnership where the husband is a partner Wife s Self Employment Income: The gains and profits arising from a business of a married woman are assessed separately from the husband. This is not so if she is providing services or goods to a business, partnership, or company owned by the husband. It entails business carried on by her on a fulltime basis without interferences or control by the husband and the business must have been registered under her own name. (b) I accordance to the tax act, write short notes on the following appellate bodies: (i) Local committee "The Minister may, by notice in the Gazette, establish a local committee for any area specified in the notice. A local committee shall consist of a chairman and not more than eight other members appointed by the Minister. A member of a local committee shall hold office for the period, not exceeding two years, specified in his appointment unless, prior to the expiration of that period (a) He resigns his office by written notification under his hand addressed to the Minister; or (b) The Minister, being satisfied that the member is unfit by reason of mental or physical infirmity to perform the duties of his office, or that the member has failed to attend at least three consecutive meetings of the committee, revokes his appointment.

The quorum for a meeting of a local committee shall be the chairman and two other members. The members of a local committee shall be entitled to receive such subsistence and travelling allowances as the Minister may determine. The members of a local committee shall not be personally liable for any act or default of the committee done or committed in good faith in the course of exercising the powers conferred by this Act. The Minister may make rules (a) Prescribing the manner in which an appeal under this Act may be made to a local committee and the fees to be paid in respect of an appeal; (b) Prescribing the procedure to be adopted by a local committee in hearing an appeal and the records to be kept by the committee; (c) Prescribing the manner in which a local committee shall be convened and the places where and the time at which it shall hold sittings; (d) Prescribing a scale of costs which may be awarded by a local committee; and (e) Generally for the better carrying out of the provisions of this Act relating to local committees and appeals thereto.

(ii) Tribunals The Minister may, by notice in the Gazette, establish a Tribunal to exercise the functions conferred upon it by this Act. The Tribunal shall consist of a chairman and not less than two and not more than four other members appointed by the Minister. A member of the Tribunal shall hold office for the period, not exceeding two years, specified in his appointment unless, prior to the expiration of that period (a) He resigns his office by written notification under his hand addressed to the Minister; or (b) The Minister, being satisfied that the member is unfit by reason of mental or physical infirmity to perform the duties of his office, or that the member has failed to attend at least three consecutive meetings of the Tribunal, revokes his appointment. The quorum for a meeting of the Tribunal shall be the chairman and two other members. The members of the Tribunal shall be entitled to receive such subsistence and travelling allowances as the Minister may determine.

The members of the Tribunal shall not be personally liable for any act or default of the Tribunal done or committed in good faith in the course of exercising the powers conferred by this Act. The Minister may make rules (a) Prescribing the manner in which an appeal shall be made to the Tribunal and the fees to be paid in respect of an appeal; (b) Prescribing the procedure to be adopted by the Tribunal in hearing an appeal and the records to be kept by the Tribunal; (c) Prescribing the manner in which the Tribunal shall be convened and the places where and the time at which sittings shall be held; (d) Prescribing a scale of costs which may be awarded by the Tribunal; and (e) Generally for the better carrying out of the provisions of this Act relating to the Tribunal and appeals thereto.

(iii)

High court

(c) The local committee may confirm, reduce, increase or annul the assessment or make such orders as may think fit. Explain seven circumstances under which a tax payer may be justified in making an appeal to the local committee.

(d) Explain four actions the commissioner of income tax can take upon the receipt of a notice of objection from the tax payer.

(e) Explain five requirements of a valid memorandum of appeal

(f) Explain two conditions under which the commissioner of income tax can accept a late notice of objection.

QUESTION TWO (a) Write notes on the following: (i) Excise duties This is a duty of excise imposed on goods manufactured in Kenya or imported into Kenya and specified in the fifth schedule. Examples are beer, beverages, textile etc. (ii) Custom duties

Customs duty is a kind of indirect tax which is realized on goods of international trade. Duties levied by the government in relation to imported items are referred to as import duty. In the same vein, duties realized on export consignments are called export duty. It is specified in the first schedule of the customs and excise act Cap 472.

(iii)

Clear report findings

(iv)

Bonded security

(v)

Import declaration form

An IDF must be applied for and obtained from the Kenya Revenue Authority for any Commercial Importation. The Importer is responsible for applying for the IDF but may consult us for purposes of Customs Classifications which form the backbone of the information drawn from the Pro-Forma Invoice. The IDF Fee is 2.75% of the CIF Value of the goods. A minimum payment of Ksh.5000/= is payable for the IDF to be issued, while the difference if any, will be paid alongside the Import Taxes. The IDF may set Conditions such as the following: Value - The IDF gives the indication as to whether the Values declared thereon are final. If not final, then an Appraisal of Value must be sort with the Valuation Section of the Customs Services Department. In this case, a complete set of the Shipping documents will be

attached to the Appraisal Of Value Request Form following which a Value Certificate is issued. The process could involve physical verification of the goods. Quality/Quantity Other control bodies such the Kenya Bureau of Standards, Public Health Department, Department of Agriculture (Kephis) and Mines & Geology Department may be asked to determine if the expected standards have been met. In case of suspicion, Tests may be carried out and Certificates/Permits issued. Under this criteria, test Certificates from accredited bodies may be required. Classification The Customs Services Department may be asked to determine the correctness of the classification for purposes of collection of the correct Taxes. This may involve Physical verification and/or Computer Scanning. Pre-Verification All Items originating from Dubai, Hong Kong and China including Textiles, Electronics, Motor Vehicles & Spares will be subjected to Pre-verification by the Customs Valuation Section who will accordingly issue a Certificate to the effect.

(vi)

Pre-shipment inspection

(vii)

Returns

(viii)

Assessment

An assessment is Computation of tax liability upon income earned. Section 73 states that the commissioner will assess any person who is chargeable as quickly as possible after the submission of return. If a person submits a provisional return of income, the commissioner will make a provisional assessment. The final return of income when submitted requires the issue of an assessment. If the commissioner feels that a person has been assessed at an income less than at which he ought to have been assessed, he may make an additional assessment. An assessment may be made any time before the expiry of seven years after the year of income to which the assessment relates except: -If fraud or willful negligence has been committed by the person submitting a return of income. In this case, an assessment can be made at any time -In the case of an assessment upon the executors, administrators of a deceased person, the period limit is three years after the year of income during which the person died.

The commissioner may assess a person on the basis of the return submitted. If he has a reason, however to believe that the return is not true or correct, he may determine to the best of his judgment the amount of the income of such person and assess him accordingly (S.73.2) Types of Assessment Estimated Assessment Where a person has not submitted a self assessment within four months after the end of the year of income and the commissioner has reason to believe that he is chargeable to tax, then he may issue an estimated assessment according to the best judgment. Failure to furnish a self-assessment return or notify chargeability is an offence which attracts a penalty of 5% p.m. on normal tax payable while failure continues.

Additional Assessment Where any person has been assessed, or charged

(b) In of the context of the Customs and Excise Act (Cap. 427) what is meant by the term dumping? Identify the measures that a government may put in place to discourage dumping. Dumping this is the case whereby goods are sold in the country at a price lower than the cost of importing. This happens where the cost in the country exporting the goods plus insurance, freight and duties. It also implies when the exports price of goods in the country of export is less than the fast market price. The government may put in place the following measures to discourage dumping: 1) Tariffs -the government may impose strict tariffs on imports so as to discourage importers. The tariffs will increase the cost of imports and increase the price of imported goods in the local market. 2) Import quotas- the government can impose quotas on imports so that to reduce quantities that are coming in a country thus discourage the amounts of imports coming in the country and as a result the imported goods will be expensive in the local market.

3) Anti-dumping legislation-the government can also formulate laws that discourage imports of cheap substandard goods. 4) The government can also give direct subsidies to local industries so as protect them against imports so that they can compete on equal or favorable grounds. 5) The government may manipulate foreign exchange rates to encourage export. 6) Administrative barriers-countries can are sometimes using administrative functions put barriers to imports. 7) Pre shipment and post shipment inspections-This normally happens when goods are inspected before or after shipment into the country

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Election OffencesDocument8 pagesElection OffencesVicky GowePas encore d'évaluation

- Portfolio & Investment Analysis Efficient-Market HypothesisDocument137 pagesPortfolio & Investment Analysis Efficient-Market HypothesisVicky GowePas encore d'évaluation

- Moi University Bachelor of Business Management BBM 351 Research MethodsDocument68 pagesMoi University Bachelor of Business Management BBM 351 Research MethodsVicky GowePas encore d'évaluation

- Gender and Climate ChangeDocument5 pagesGender and Climate ChangeVicky GowePas encore d'évaluation

- Gender and Climate ChangeDocument5 pagesGender and Climate ChangeVicky GowePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- BS023 Historical Books FR Joel Camaya SDBDocument4 pagesBS023 Historical Books FR Joel Camaya SDBJohn Quincy Almirante CaballosdbPas encore d'évaluation

- Correct AnswerDocument31 pagesCorrect AnswervijaykumarlambaPas encore d'évaluation

- Muster List Latest Dec 2021 - 074047Document12 pagesMuster List Latest Dec 2021 - 074047vikram raj100% (1)

- DeedDocument11 pagesDeedsunilkumar1988Pas encore d'évaluation

- Yale University Press History 2011 CatalogDocument36 pagesYale University Press History 2011 CatalogYale University Press100% (1)

- Principle of Natural Justice - Chapter 9Document34 pagesPrinciple of Natural Justice - Chapter 9Sujana Koirala60% (5)

- Putting The Word of God Into PracticeDocument2 pagesPutting The Word of God Into PracticeMaria Salee O. MoraPas encore d'évaluation

- Bible Quiz 1Document41 pagesBible Quiz 1MaribethMendozaPas encore d'évaluation

- Al-Masalih Al-MursalahDocument12 pagesAl-Masalih Al-MursalahYana ShazlinPas encore d'évaluation

- Academic - Garfinkel 2016 - Mavis Duncan Dyer EssayDocument5 pagesAcademic - Garfinkel 2016 - Mavis Duncan Dyer EssayumarPas encore d'évaluation

- Reading Test: 65 Minutes, 52 QuestionsDocument3 pagesReading Test: 65 Minutes, 52 QuestionsOma0% (1)

- Internal Security WorkbookDocument56 pagesInternal Security WorkbookSam PitraudaPas encore d'évaluation

- WW1 Battle Profile, Social Studies 10Document4 pagesWW1 Battle Profile, Social Studies 10mehtadhruv1325Pas encore d'évaluation

- Mayor Cranley's 2021 State of The CityDocument8 pagesMayor Cranley's 2021 State of The CityWCPO 9 NewsPas encore d'évaluation

- Brekoulakis Chapter 2Document27 pagesBrekoulakis Chapter 2Catalina HogasPas encore d'évaluation

- Agra Case DigestDocument10 pagesAgra Case Digestapplegee liboonPas encore d'évaluation

- Le Morte D ArhturDocument15 pagesLe Morte D ArhturKarl Michael RubinPas encore d'évaluation

- Associated Gun Clubs of Baltimore Candidate 2010 Election RecommendationsDocument1 pageAssociated Gun Clubs of Baltimore Candidate 2010 Election RecommendationsAmmoLand Shooting Sports NewsPas encore d'évaluation

- 42nd Amendment Act UPSC NotesDocument3 pages42nd Amendment Act UPSC NotesJyotishna MahantaPas encore d'évaluation

- Presentación Departamento de ValleDocument13 pagesPresentación Departamento de ValleMelissa MendozaPas encore d'évaluation

- Alcantara Vs NidoDocument7 pagesAlcantara Vs Nidobhieng062002Pas encore d'évaluation

- Brutus and Antonys SpeechesDocument10 pagesBrutus and Antonys SpeechesEmily CoppneyPas encore d'évaluation

- Topic and SourcesDocument2 pagesTopic and Sourcescarter.henmanPas encore d'évaluation

- Report Part 1 On TerrorismDocument23 pagesReport Part 1 On TerrorismBrianCarpioPas encore d'évaluation

- What Is The Purpose of This FormDocument2 pagesWhat Is The Purpose of This FormvictorPas encore d'évaluation

- WORKSHEET (Interstate 60)Document5 pagesWORKSHEET (Interstate 60)Bényi OlgaPas encore d'évaluation

- Psychiatric Times - Intermittent Explosive Disorder - 2015-03-25Document6 pagesPsychiatric Times - Intermittent Explosive Disorder - 2015-03-25Ruy AntonucciPas encore d'évaluation

- WWW - Csdaily.id UEFA Euro 2020 FinalsDocument1 pageWWW - Csdaily.id UEFA Euro 2020 FinalsLaso MandolaPas encore d'évaluation

- People vs. AlunanDocument1 pagePeople vs. AlunanRein GallardoPas encore d'évaluation

- Bose V Rhodes College: Bose' Final Title IX Investigation ReportDocument16 pagesBose V Rhodes College: Bose' Final Title IX Investigation ReportSouwesterdocsPas encore d'évaluation