Académique Documents

Professionnel Documents

Culture Documents

Asia Equity Insights-HSBC

Transféré par

tinylittleworldDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Asia Equity Insights-HSBC

Transféré par

tinylittleworldDroits d'auteur :

Formats disponibles

Equity Strategy Asia ex Japan

abc

Global Research

We examine fund positions across Asia and equity market data on net flows following the sell-down in Sept/Oct Most Asian portfolios are underweight TW and KR. These markets have seen relatively low inflows in Oct/Nov and thus could see further inflows in the next months Conversely, TH and IN face the risk of a slowdown of inflows

A total of USD20bn left Asian markets in August and September. Most of this came from Taiwan and Korea, which combined accounted for 73% of the total sell-down. Only a third of this money has returned in October, again mostly in Taiwan and Korea. Current portfolio cash levels are elevated (c2%). Combining data on portfolio positions and recent equity flows, we examine markets which have seen inflows and where portfolios have high portfolio weights. We conclude that Thailand and India are the markets most at risk of a slowdown in further buying. Taiwan and Korea markets are now underweight in fund portfolios where little money has returned in October. They could see continued inflows in the coming months.

Asia Equity Insights

Equity flows: What did you buy?

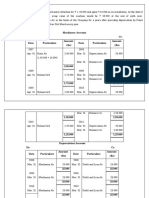

Fund flows and fund weights EPFR data on Asian portfolios Funds vs MSCI (current weight vs long-term) Malaysia Korea Singapore Taiwan HK Indonesia China Thailand India Philippines -20% -7% -18% -5% -4% -15% 7% 6% 14% -3% Average position in EPFR Underweight Underweight Underweight Underweight Underweight Underweight Overweight Overweight Overweight Underweight Equity flows (USDbn) Aug/Sept (a) -0.5 -5.4 -0.3 -9.2 -0.5 -0.8 -2.1 -1.9 -2.4 -0.2 Oct/Nov (b) Na 1.5 Na 1.6 Na 0.5 Na 1.0 0.6 0.1 Return ratio (a)/(b) Na 27% Na 18% Na 62% Na 50% 24% 30%

Notes: 1. Fund weights at end-September. The column Funds vs MSCI shows the relative position of the current UW or OW position versus a long-term average OW or UW position. Fund flow data up to 3 November 2. Na indicates that data on foreign equity flows is not available for this market 3. EPFR = Emerging Portfolio Fund Research, Inc. Source: Bloomberg, EPFR, HSBC

11 November 2011

Herald van der Linde* Strategist The Hongkong and Shanghai Banking Corporation Limited + 852 2996 6575 heraldvanderlinde@hsbc.com.hk Devendra Joshi* Associate Bangalore

To establish our HSBC strategy view, we also examine factors such as valuations, yield, earnings risk and monetary policies. From a fundamental perspective, we are overweight Taiwan, Singapore and Hong Kong and underweight Korea and Thailand.

View HSBC Global Research at: http://www.research.hsbc.com *Employed by a non-US affiliate of HSBC Securities (USA) Inc, and is not registered/qualified pursuant to FINRA regulations Issuer of report: The Hongkong and Shanghai Banking Corporation Limited

Disclaimer & Disclosures This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it

Equity Strategy Asia ex Japan 11 November 2011

abc

What have you been buying?

We examine fund positions across Asia and equity market data on

net flows following the sell-down in September and October

Taiwan and Korea are generally underweight in Asian portfolios,

and they saw relatively low inflows in October. They could see continued inflows in the coming months

Conversely, Thailand and India face risk of a slowdown of inflows

Stocks and flows

Portfolio positions and fund flows

Given the strong volatility in the markets in recent months, we have examined how funds have repositioned their investments in recent months. Recent conversations with investors in Asian equities suggest that many funds, especially those

located in Asia, are anticipating redemptions in October. For this, they have raised their cash positions. In the past, when redemptions have been much lower than initially anticipated, this cash needed to be redeployed in markets. The question is in how far money has returned and whether some markets are more at risk of fund outflows or inflows than other markets.

Foreign investors net investments in Asian equity markets (USDbn) Total 2005 Total 2006 Total 2007 Total 2008 Total 2009 Total 2010 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 2011 to date

Source: Bloomberg, HSBC

TW 22.2 17.4 2.1 -14.7 14.8 9.2 3.4 -3.3 -1.2 3.4 -0.6 -0.8 -2.1 -6.6 -2.6 1.7 -0.1 -8.8

KR -4.0 -12.1 -29.4 -33.3 24.8 19.0 0.3 -3.1 1.0 2.9 -2.3 -0.7 1.3 -4.3 -1.2 1.5 0.0 -4.5

TH 2.9 2.1 1.6 -4.8 1.1 2.7 -0.9 0.3 0.6 1.0 -0.6 -0.9 1.3 -1.4 -0.5 1.0 0.0 -0.2

ID 2.3 1.9 3.2 1.7 1.4 2.3 -0.3 0.1 -0.3 2.0 0.0 0.5 0.6 -1.0 0.2 0.3 0.2 2.4

PH 0.4 0.9 1.4 -1.1 0.4 1.2 -0.1 -0.1 0.1 0.4 0.1 0.0 0.2 -0.1 -0.1 0.0 0.0 0.5

IN 10.8 8.1 17.8 -12.9 17.6 29.3 -1.4 -0.8 1.6 1.6 -1.2 0.7 1.7 -2.1 -0.3 0.5 0.1 0.4

AEJ 34.7 18.3 -3.4 -65.1 60.1 63.8 1.0 -6.9 1.8 11.2 -4.6 -1.1 3.0 -15.5 -4.5 5.1 0.2 -10.3

Equity Strategy Asia ex Japan 11 November 2011

abc

Asia ex-Japan funds Current fund weighting Malaysia Korea (South) Singapore Taiwan Hong Kong Indonesia China Thailand India Philippines

Source: HSBC

Current LT average MSCI fund weighting weighting 4.7 20.9 7.1 15.5 11.2 4.1 23.0 2.5 10.1 0.9 3.9 19.6 7.7 14.9 15.1 3.2 16.8 3.8 5.9 0.9

LT MSCI Current LT avg Current LT avg Current vs weighting over/under over/under over/under over/under LT position (ppt) (ppt) (%) (%) (%) 4.3 22.0 7.4 17.2 13.6 2.6 19.9 2.4 9.8 0.7 -1.8 -3.0 -1.0 -2.4 0.9 0.4 -2.0 1.6 -2.4 0.2 -0.5 -2.4 0.3 -2.3 1.5 0.6 -3.1 1.4 -3.9 0.2 -38.4 -14.2 -13.6 -15.6 7.7 10.8 -8.8 62.8 -24.1 19.8 -11 -11 4 -14 11 22 -15 57 -40 24 -27 -3 -18 -2 -4 -11 7 6 16 -4

2.9 17.9 6.1 13.0 12.1 4.5 20.9 4.1 7.7 1.1

In this report we compare two sets of data:

1

Equity flows in selected Asian equity markets for which data is available; and Portfolio positions derived from Emerging Portfolio Fund Research, Inc. (EPFR) data.

the equation indicates that current cash positions are elevated. It is also interesting to note that Indonesia and Thailand have seen continued inflows after August. Investors have been sticky in these markets. In India, investors have been selling equities and, although some of the outflows witnessed in August and September returned in subsequent weeks, flows into India are still below levels seen in the middle of the year. There is no readily available source of data for flows in China (H-shares) and Hong Kong. Therefore, we use EPFR data as a proxy.

China and Hong Kong flows

The table above looks at data from stock exchanges on flows in and out of equity markets. Note that this collection of data is not available for all markets. Year to date, it appears that most equity inflows have been towards Indonesia and most selling was done in Taiwan. The body of data also suggests that USD15.5bn left this group markets in August, followed by another USD4.5bn in September. The majority of this sale of USD20bn came from sales of equities in Taiwan and Korea these two markets accounted for 73% of the total sell-down. Only a third of this money has returned into the markets in October, again most of it in Taiwan and Korea. Indeed, Asia ex-Japan funds average cash level for last 12 months was 1.6%. Currently it is 2.1%. This 2.1% is also the long-term average cash position, but this would include 2008-09, when cash levels were elevated and reached as much as 4.3% of total funds. Removing that period from

30 25 20 USD bn 15 10 5 0 Jun-03 Jan-04 Aug-04 Mar-05 Oct-05 May-06 Dec-06 Jul-07 Feb-08 Sep-08 Apr-09 Nov-09 Jun-10 Jan-11 Aug-11

Source: EPFR, HSBC

As the chart indicates, China and Hong Kong have, meanwhile, also seen considerable outflows

Equity Strategy Asia ex Japan 11 November 2011

abc

since early 2011, with little sign of a turnaround in September.

Portfolio positions

We have also examined portfolio positions in recent months. There are three broad sets of data (from EPFR) portfolio weights for funds that focus on global emerging markets, Asia ex-Japan funds, and Pacific funds. The last set of funds is rather small compared with the first two (it makes up only c5% of total funds) and we therefore excluded it from our analysis. The factor to consider is the current portfolio weight versus the benchmark compared with the long-term weight versus the benchmark. Here is why: Looking at current weightings versus the benchmark might give a misleading picture. As Taiwan investors have traditionally been underweight Taiwan equities, it is important to know whether investors are now more or less underweight than what they have been in the last few years. In Taiwan, it works out that they are currently more underweight than usual. On this measure, it works out that Malaysia and Indonesia show up as two markets where funds remain underweight. Asia ex-Japan funds are currently also underweight Singapore while GEM funds are underweight Taiwan and Korea. Markets where portfolios are currently overweight include China, India, and Thailand.

Also, because we use different sources of information in equity flows, the data sets are not always comparable. Still, they enable us to look at various trends. The table shows that there are markets that are currently overweight in GEM and Asia ex-Japan portfolios where a large part of the outflows witnessed in August and September have returned. Based on this analysis, we conclude that these markets are most likely to see a slowdown in further buying. Examples of these markets are Thailand and, to a lesser extent, India. There are also markets that are currently underweight in portfolios (compared with the long-term average weight of these markets in portfolios) and where little money has returned. These markets are, based on this analysis, more likely to see inflows. Examples of these markets are Taiwan and, to a lesser extent, Korea. For China and Hong Kong, there is little in the way of fund flow data available, but we have already noted that funds are overweight China.

Fund flows and fund weights Funds vs Weighting Aug/Sept Oct/Nov MSCI Malaysia Korea Singapore Taiwan HK Indonesia China Thailand India Philippines -20% -7% -18% -5% -4% -15% 7% 6% 14% -3% UW UW UW UW UW UW OW OW OW UW -0.5 -5.4 -0.3 -9.2 -0.5 -0.8 -2.1 -1.9 -2.4 -0.2 Na 1.5 Na 1.6 Na 0.5 Na 1.0 0.6 0.1 Return Na 27% Na 18% Na 62% Na 50% 24% 30%

Implications

It is now possible to compare fund weights with flow data in various markets. This is summarized in the table below. Note that there is no accurate flow data for all markets, explaining some of the gaps in this analysis.

Note: Na indicates that data on foreign equity flows is not available for this market Source: Bloomberg, EPFR, HSBC

Equity Strategy Asia ex Japan 11 November 2011

abc

GEM funds Current fund weighting Malaysia Korea (South) Taiwan Thailand Indonesia China India Philippines

Source: HSBC

Current MSCI weighting 3.3 15.2 11.1 1.8 2.9 16.7 7.1 0.6

LT avg fund weighting 2.3 13.3 9.4 2.7 2.3 11.0 6.9 0.6

LT MSCI weighting 3.0 15.2 11.9 1.7 1.8 13.7 6.7 0.5

Current Over/under -1.2 -3.4 -3.2 1.1 0.3 -2.1 1.1 0.2

Average over/under -0.7 -1.9 -2.5 1.0 0.5 -2.7 0.2 0.1

Over/under to current -35.6% -22.3% -28.8% 62.4% 8.9% -12.7% 15.3% 28.1%

Over/under to average -24% -13% -21% 56% 27% -20% 3% 29%

Current vs LT position -12% -10% -7% 6% -18% 7% 13% -1%

2.1 11.8 7.9 2.9 3.2 14.6 8.2 0.8

HSBC Strategy view

Lastly, we would like to compare and contrast this with our overall view on markets. Fund flow and fund positioning is one factor on which we base our country selection, with factors such as valuations, yields, monetary policies and earnings risk taken into consideration as well. A scorecard that summarizes our views is presented below. This is our country selection as presented in our latest quarterly (Anaerobic growth and deflated equity valuations, 7 October): Taiwan. We are overweight this market given its low valuations, its high yields (highest in Asia), and the general underweight position of funds. Hong Kong. We are overweight this market given low valuations, low risk to earnings forecast and funds underweight positions.

Singapore. As with Hong Kong, we are overweight this market given low valuations, low risk to earnings forecasts, and funds underweight positions. Thailand. We are underweight this market. Its valuations are on a par with the rest of the region, and the recent floods are a risk to growth. Meanwhile, funds are generally already overweight this market. Korea. We are underweight this market. Valuations are now far from their historical low levels and there remains risk to analysts earnings forecasts, which have hardly changed in recent months. China. We are neutral on this market. Valuations are low, but funds are generally already overweight Chinese equities. India. We are neutral on India. Valuations are on a par with the rest of the region.

HSBC Strategy market scorecard Monetary policy Taiwan Singapore Hong Kong China Malaysia India Philippines Indonesia Thailand Korea 10% 0 0 2 0 0 -1 0 0 -1 0 Growth surprise 20% -2 1 -1 0 -1 -1 -1 0 0 -2 Loved/unloved 15% 2 1 1 -3 1 1 1 -2 -3 0 Newsflow/shocks 15% 1 0 -1 -1 -1 -2 0 -1 -1 -2 Valuation 10% 2 2 2 3 1 1 0 0 1 1 Dividend yield 10% 3 2 2 2 2 0 1 1 2 0 Long-term story 20% 2 1 1 2 1 3 1 2 1 1 Weighting Overweight Overweight Overweight Neutral Neutral Neutral Neutral Neutral Underweight Underweight

Note: for a full description of the score card, please refer to our latest Asia Equity Insights Quarterly, Anaerobic Growth and deflated equity valuations, published 7 October 2011. Scores fall between -3 (low) and +3 (high) Source: HSBC

Equity Strategy Asia ex Japan 11 November 2011

abc

Indonesia. This market offers excellent growth prospects the highest in the region, but now sufficiently priced into market valuations, which are also the highest across the region. Philippines. Similar to Indonesia, this market offers good growth prospects, but these are now sufficiently priced into market valuations. Malaysia. This is a very defensive market given its high exposure to consumer staples and utilities within the market. We are neutral on Malaysia.

Equity Strategy Asia ex Japan 11 November 2011

abc

Disclosure appendix

Analyst Certification

The following analyst(s), economist(s), and/or strategist(s) who is(are) primarily responsible for this report, certifies(y) that the opinion(s) on the subject security(ies) or issuer(s) and/or any other views or forecasts expressed herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Herald van der Linde

Important disclosures

Stock ratings and basis for financial analysis

HSBC believes that investors utilise various disciplines and investment horizons when making investment decisions, which depend largely on individual circumstances such as the investors existing holdings, risk tolerance and other considerations. Given these differences, HSBC has two principal aims in its equity research: (1) to identify long-term investment opportunities based on particular themes or ideas that may affect the future earnings or cash flows of companies on a 12-month horizon; and (2) from time to time to identify short-term investment opportunities that are derived from fundamental, quantitative, technical or event-driven techniques on a 0- to 3-month horizon and which may differ from our long-term investment rating. HSBC has assigned ratings for its long-term investment opportunities as described below. This report addresses only the long-term investment opportunities of the companies referred to in the report. As and when HSBC publishes a short-term trading idea the stocks to which these relate are identified on the website at www.hsbcnet.com/research. Details of these short-term investment opportunities can be found under the Reports section of this website. HSBC believes an investors decision to buy or sell a stock should depend on individual circumstances such as the investors existing holdings and other considerations. Different securities firms use a variety of ratings terms as well as different rating systems to describe their recommendations. Investors should carefully read the definitions of the ratings used in each research report. In addition, because research reports contain more complete information concerning the analysts views, investors should carefully read the entire research report and should not infer its contents from the rating. In any case, ratings should not be used or relied on in isolation as investment advice.

Rating definitions for long-term investment opportunities

Stock ratings

HSBC assigns ratings to its stocks in this sector on the following basis: For each stock we set a required rate of return calculated from the cost of equity for that stocks domestic or, as appropriate, regional market established by our strategy team. The price target for a stock represents the value the analyst expects the stock to reach over our performance horizon. The performance horizon is 12 months. For a stock to be classified as Overweight, the potential return, which equals the percentage difference between the current share price and the target price, including the forecast dividend yield when indicated, must exceed the required return by at least 5ppt over the next 12 months (or 10ppt for a stock classified as Volatile*). For a stock to be classified as Underweight, the stock must be expected to underperform its required return by at least 5ppt over the next 12 months (or 10ppt for a stock classified as Volatile*). Stocks between these bands are classified as Neutral. Our ratings are re-calibrated against these bands at the time of any material change (initiation of coverage, change of volatility status or change in price target). Notwithstanding this, and although ratings are subject to ongoing management review, expected returns will be permitted to move outside the bands as a result of normal share price fluctuations without necessarily triggering a rating change. *A stock will be classified as volatile if its historical volatility has exceeded 40%, if the stock has been listed for less than 12 months (unless it is in an industry or sector where volatility is low) or if the analyst expects significant volatility. However, stocks which we do not consider volatile may in fact also behave in such a way. Historical volatility is defined as the past months average of the daily 365-day moving average volatilities. In order to avoid misleadingly frequent changes in rating, however, volatility has to move 2.5ppt past the 40% benchmark in either direction for a stocks status to change.

Equity Strategy Asia ex Japan 11 November 2011

abc

Rating distribution for long-term investment opportunities

As of 9 November 2011, the distribution of all ratings published is as follows: Overweight (Buy) 54% (26% of these provided with Investment Banking Services) Neutral (Hold) Underweight (Sell) 35% 11% (22% of these provided with Investment Banking Services) (13% of these provided with Investment Banking Services)

Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC* which includes investment banking revenue. For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. *HSBC Legal Entities are listed in the Disclaimer below.

Additional disclosures

1 2 3 This report is dated as at 11 November 2011. All market data included in this report are dated as at close 8 November 2011, unless otherwise indicated in the report. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBCs analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBCs Investment Banking business. Information Barrier procedures are in place between the Investment Banking and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

Equity Strategy Asia ex Japan 11 November 2011

abc

Disclaimer

*Legal entities as at 4 March 2011 Issuer of report UAE HSBC Bank Middle East Limited, Dubai; HK The Hongkong and Shanghai Banking The Hongkong and Shanghai Banking Corporation Limited, Hong Kong; TW HSBC Securities (Taiwan) Corporation Limited; CA HSBC Corporation Limited Securities (Canada) Inc, Toronto; HSBC Bank, Paris Branch; HSBC France; DE HSBC Trinkaus & Level 19, 1 Queens Road Central Burkhardt AG, Dsseldorf; 000 HSBC Bank (RR), Moscow; IN HSBC Securities and Capital Markets Hong Kong SAR (India) Private Limited, Mumbai; JP HSBC Securities (Japan) Limited, Tokyo; EG HSBC Securities Egypt SAE, Cairo; CN HSBC Investment Bank Asia Limited, Beijing Representative Telephone: +852 2843 9111 Office; The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch; The Hongkong Telex: 75100 CAPEL HX and Shanghai Banking Corporation Limited, Seoul Securities Branch; The Hongkong and Shanghai Fax: +852 2596 0200 Banking Corporation Limited, Seoul Branch; HSBC Securities (South Africa) (Pty) Ltd, Johannesburg; Website: www.research.hsbc.com GR HSBC Securities SA, Athens; HSBC Bank plc, London, Madrid, Milan, Stockholm, Tel Aviv; US HSBC Securities (USA) Inc, New York; HSBC Yatirim Menkul Degerler AS, Istanbul; HSBC Mxico, SA, Institucin de Banca Mltiple, Grupo Financiero HSBC; HSBC Bank Brasil SA Banco Mltiplo; HSBC Bank Australia Limited; HSBC Bank Argentina SA; HSBC Saudi Arabia Limited; The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch This document has been issued by The Hongkong and Shanghai Banking Corporation Limited (HSBC) in the conduct of its Hong Kong regulated business for the information of its institutional and professional customers; it is not intended for and should not be distributed to retail customers in Hong Kong. The Hongkong and Shanghai Banking Corporation Limited is regulated by the Securities and Futures Commission. All enquires by recipients in Hong Kong must be directed to your HSBC contact in Hong Kong. If it is received by a customer of an affiliate of HSBC, its provision to the recipient is subject to the terms of business in place between the recipient and such affiliate. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. HSBC has based this document on information obtained from sources it believes to be reliable but which it has not independently verified; HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the Research Division of HSBC only and are subject to change without notice. HSBC and its affiliates and/or their officers, directors and employees may have positions in any securities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such securities (or investment). HSBC and its affiliates may act as market maker or have assumed an underwriting commitment in the securities of companies discussed in this document (or in related investments), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform investment banking or underwriting services for or relating to those companies. HSBC Securities (USA) Inc. accepts responsibility for the content of this research report prepared by its non-US foreign affiliate. All U.S. persons receiving and/or accessing this report and wishing to effect transactions in any security discussed herein should do so with HSBC Securities (USA) Inc. in the United States and not with its non-US foreign affiliate, the issuer of this report. In the UK this report may only be distributed to persons of a kind described in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001. The protections afforded by the UK regulatory regime are available only to those dealing with a representative of HSBC Bank plc in the UK. In Singapore, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch for the general information of institutional investors or other persons specified in Sections 274 and 304 of the Securities and Futures Act (Chapter 289) (SFA) and accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the SFA. This publication is not a prospectus as defined in the SFA. It may not be further distributed in whole or in part for any purpose. The Hongkong and Shanghai Banking Corporation Limited Singapore Branch is regulated by the Monetary Authority of Singapore. Recipients in Singapore should contact a Hongkong and Shanghai Banking Corporation Limited, Singapore Branch representative in respect of any matters arising from, or in connection with this report. In Australia, this publication has been distributed by The Hongkong and Shanghai Banking Corporation Limited (ABN 65 117 925 970, AFSL 301737) for the general information of its wholesale customers (as defined in the Corporations Act 2001). Where distributed to retail customers, this research is distributed by HSBC Bank Australia Limited (AFSL No. 232595). These respective entities make no representations that the products or services mentioned in this document are available to persons in Australia or are necessarily suitable for any particular person or appropriate in accordance with local law. No consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. This publication is distributed in New Zealand by The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch. In Japan, this publication has been distributed by HSBC Securities (Japan) Limited. It may not be further distributed in whole or in part for any purpose. In Korea, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited, Seoul Securities Branch (HBAP SLS) for the general information of professional investors specified in Article 9 of the Financial Investment Services and Capital Markets Act (FSCMA). This publication is not a prospectus as defined in the FSCMA. It may not be further distributed in whole or in part for any purpose. HBAP SLS is regulated by the Financial Services Commission and the Financial Supervisory Service of Korea. Copyright 2011, The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited. MICA (P) 208/04/2011 and MICA (P) 040/04/2011

abc

Global Equity Strategy Research Team

Global

Garry Evans Global Head of Equity Strategy +852 2996 6916 garryevans@hsbc.com.hk Daniel Grosvenor +852 2996 6592 daniel.grosvenor@hsbc.com.hk

Asia

Herald van der Linde Deputy Head of Research and Head of Equity Strategy, Asia-Pacific +852 2996 6575 heraldvanderlinde@hsbc.com.hk Steven Sun +852 2822 4298 Roger Xie +852 2822 4297 Vivek Misra +91 80 3001 3699 stevensun@hsbc.com.hk rogerpxie@hsbc.com.hk vivekmisra@hsbc.co.in

EU and US

Peter Sullivan Head of Equity Strategy, EU and US +44 20 7991 6702 peter.sullivan@hsbcib.com

Europe

Robert Parkes +44 20 7991 6716 robert.parkes@hsbcib.com

Taiwan

Jenny Lai Head of Taiwan Research +886 2 8725 6020 jennylai@hsbc.com.tw

CEEMEA

John Lomax +44 20 7992 3712 Wietse Nijenhuis +44 20 7992 3680 john.lomax@hsbcib.com wietse.nijenhuis@hsbcib.com

South East Asia

Neel Sinha Head of Equity Research, South East Asia +65 6239 0658 neelsinha@hsbc.com.sg

Vous aimerez peut-être aussi

- Delta Hedging PDFDocument29 pagesDelta Hedging PDFLê AnhPas encore d'évaluation

- INSEAD CasebookDocument96 pagesINSEAD Casebooktinylittleworld100% (9)

- 10 Things We Didn't Know - Charts of The Day 16MAYDocument13 pages10 Things We Didn't Know - Charts of The Day 16MAYLuis DutraPas encore d'évaluation

- RA 8799 Securities and Regulation CodeDocument24 pagesRA 8799 Securities and Regulation CodeShalom May Catedrilla0% (1)

- Accenture Tying The Knot Between Risk and Performance ManagementDocument16 pagesAccenture Tying The Knot Between Risk and Performance Managementkinky72100% (1)

- SeasonalDocument15 pagesSeasonalPericleanu AndreeaPas encore d'évaluation

- Case Book Harvard HBS 2004Document114 pagesCase Book Harvard HBS 2004zeronomity94% (35)

- Comparative Analysis of Stock MarketsDocument35 pagesComparative Analysis of Stock MarketsDivya PadmanabhanPas encore d'évaluation

- Columbia Casebook 2006Document89 pagesColumbia Casebook 2006simplythecase100% (4)

- Nomura Strategy 03 11Document106 pagesNomura Strategy 03 11Thiago PalaiaPas encore d'évaluation

- Predictive Power of Weekly Fund Flows: Equity StrategyDocument32 pagesPredictive Power of Weekly Fund Flows: Equity StrategyCoolidgeLowPas encore d'évaluation

- Business Statistics Project 2010Document21 pagesBusiness Statistics Project 2010Aayush AkhauriPas encore d'évaluation

- Trade Surveillance PDFDocument2 pagesTrade Surveillance PDFBaluPas encore d'évaluation

- Fuqua CaseBook 2010-2011Document146 pagesFuqua CaseBook 2010-2011tinylittleworld100% (1)

- Case Book Wharton 2006Document43 pagesCase Book Wharton 2006zeronomity100% (9)

- Case Prep 2Document69 pagesCase Prep 2Blake Toll100% (1)

- Research On LiptonDocument14 pagesResearch On LiptonFAIZAN AHMED SUHAILPas encore d'évaluation

- Performance Appraisal of Gold ETFS in India: Finance ManagementDocument4 pagesPerformance Appraisal of Gold ETFS in India: Finance ManagementpatelaxayPas encore d'évaluation

- India Infoline Weekly WrapDocument8 pagesIndia Infoline Weekly WrappasamvPas encore d'évaluation

- Marc Faber May 5Document3 pagesMarc Faber May 5variantperception100% (1)

- Financial Anomalies Evidence From Chinese A-Share MarketsDocument13 pagesFinancial Anomalies Evidence From Chinese A-Share MarketsSounay PhothisanePas encore d'évaluation

- EVS Article Indian Stock Market USDocument13 pagesEVS Article Indian Stock Market USMayank AgrawalPas encore d'évaluation

- HSBC Asia-Pacific Rates Guide 2011Document116 pagesHSBC Asia-Pacific Rates Guide 2011Enlin JinPas encore d'évaluation

- Synopsis: A Study On Alumini Response Towards The Management Programe Offered by Colleges in DehradunDocument12 pagesSynopsis: A Study On Alumini Response Towards The Management Programe Offered by Colleges in DehradunTazeen FatimaPas encore d'évaluation

- Market Wrap 010612 (MG)Document4 pagesMarket Wrap 010612 (MG)Jason KhooPas encore d'évaluation

- Volatality in Stock MarketDocument16 pagesVolatality in Stock Marketpratik tanna0% (1)

- Nuances of The Reserve Banks Exchange Rate and Reserves ManagementDocument3 pagesNuances of The Reserve Banks Exchange Rate and Reserves ManagementselvamuthukumarPas encore d'évaluation

- Financial Analysis On Indian Stock Market Volatility During RecessionDocument7 pagesFinancial Analysis On Indian Stock Market Volatility During RecessionManjrekar RohanPas encore d'évaluation

- Inflation Dynamics in Asia: Causes, Changes, and Spillovers From ChinaDocument21 pagesInflation Dynamics in Asia: Causes, Changes, and Spillovers From ChinaVinod JoshiPas encore d'évaluation

- Will The Renminbi Eventually Rival The Dollar?: Economics GroupDocument6 pagesWill The Renminbi Eventually Rival The Dollar?: Economics GroupirishhokiePas encore d'évaluation

- Market Commentary 12-03-12Document3 pagesMarket Commentary 12-03-12CLORIS4Pas encore d'évaluation

- Market Update As of 31 Aug (Eng)Document10 pagesMarket Update As of 31 Aug (Eng)Alex KwokPas encore d'évaluation

- Analyzing The Outperforming Sector in The Volatile Market: Malu - Sandeep@yahoo - inDocument12 pagesAnalyzing The Outperforming Sector in The Volatile Market: Malu - Sandeep@yahoo - insivi_425898823Pas encore d'évaluation

- Ebbs & Flows: EM Maiden Funds Outflow in 15 WeeksDocument9 pagesEbbs & Flows: EM Maiden Funds Outflow in 15 WeeksNgọcThủy100% (1)

- ETF Landscape: STOXX Europe 600 Sector ETF Net FlowsDocument10 pagesETF Landscape: STOXX Europe 600 Sector ETF Net FlowsRichard GregorPas encore d'évaluation

- Weekly Flow Report Informa2010Q4Document22 pagesWeekly Flow Report Informa2010Q4Vincent DeluardPas encore d'évaluation

- Nov-11 HSBC Asian FX Focus - Rupee Into Thin AirDocument11 pagesNov-11 HSBC Asian FX Focus - Rupee Into Thin AirmaksambhaPas encore d'évaluation

- Korean HF ResearchDocument9 pagesKorean HF ResearchKim JungsunPas encore d'évaluation

- Investor Sentiment in The ChineseDocument5 pagesInvestor Sentiment in The ChineseTruc PhanPas encore d'évaluation

- Literature ReviewDocument13 pagesLiterature Reviewpyj3003Pas encore d'évaluation

- US Equity Strategy Q2 11Document8 pagesUS Equity Strategy Q2 11dpbasicPas encore d'évaluation

- Asia Bonds - Debt Highlights - August 08, 2011Document12 pagesAsia Bonds - Debt Highlights - August 08, 2011rryan123123Pas encore d'évaluation

- RREEF Global Investment Outlook Market Perspective 2011Document32 pagesRREEF Global Investment Outlook Market Perspective 2011robri0Pas encore d'évaluation

- A Comparative Interrelationship Study of Indian Stock Market With Global Stock MarketsDocument23 pagesA Comparative Interrelationship Study of Indian Stock Market With Global Stock MarketsNandita IyerPas encore d'évaluation

- 1/6/15 Macro Trading SimulationDocument18 pages1/6/15 Macro Trading SimulationPaul KimPas encore d'évaluation

- Bits & Pieces 17 June 2016 - Off-PisteDocument37 pagesBits & Pieces 17 June 2016 - Off-PisteTash KentPas encore d'évaluation

- The Co-Movement of U.S. Equity Returns With The Developed and Emerging Markets of Australasia and AsiaDocument16 pagesThe Co-Movement of U.S. Equity Returns With The Developed and Emerging Markets of Australasia and AsiaAri Samuel Corcia BritoPas encore d'évaluation

- Weekly OverviewDocument4 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- 20081111-12 Masahiro Kawai PDFDocument33 pages20081111-12 Masahiro Kawai PDFMarch EllenePas encore d'évaluation

- 1/15/15 Macro Trading SimulationDocument21 pages1/15/15 Macro Trading SimulationPaul KimPas encore d'évaluation

- 2015 Apr EH21Document32 pages2015 Apr EH21kinjal23585Pas encore d'évaluation

- Eurekahedge Index Flash - December 2011Document3 pagesEurekahedge Index Flash - December 2011EurekahedgePas encore d'évaluation

- 9162-Article Text-35363-1-10-20150304Document12 pages9162-Article Text-35363-1-10-20150304Anonymous OGqJJKPas encore d'évaluation

- Foreign Exchange Reserve and Its Impact On Stock Market Capitalization: Evidence From IndiaDocument15 pagesForeign Exchange Reserve and Its Impact On Stock Market Capitalization: Evidence From IndiaKarangwa Jean PaulPas encore d'évaluation

- Hao Et Al-2016-Asia-Pacific Journal of Financial StudiesDocument36 pagesHao Et Al-2016-Asia-Pacific Journal of Financial StudiesabhinavatripathiPas encore d'évaluation

- 12/9/14 Global-Macro Trading SimulationDocument15 pages12/9/14 Global-Macro Trading SimulationPaul KimPas encore d'évaluation

- Thesis On Currency DevaluationDocument5 pagesThesis On Currency Devaluationchristinavaladeznewyork100% (2)

- Paci Fic-Basin Finance Journal: Xuanjuan Chen, Kenneth A. Kim, Tong Yao, Tong YuDocument23 pagesPaci Fic-Basin Finance Journal: Xuanjuan Chen, Kenneth A. Kim, Tong Yao, Tong Yupham_1706Pas encore d'évaluation

- Lane Asset Management Stock Market Commentary October 2011Document9 pagesLane Asset Management Stock Market Commentary October 2011Edward C LanePas encore d'évaluation

- Comparative Study of Distribution of Indian Stock Market With Other Asian MarketsDocument20 pagesComparative Study of Distribution of Indian Stock Market With Other Asian Marketsadmin2146Pas encore d'évaluation

- 2008 Vs 2011 Stock SaleDocument7 pages2008 Vs 2011 Stock Salevjignesh1Pas encore d'évaluation

- Weekly OverviewDocument3 pagesWeekly Overviewapi-150779697Pas encore d'évaluation

- 1362-Article Text-4617-1-10-20201204Document22 pages1362-Article Text-4617-1-10-20201204azertyPas encore d'évaluation

- Asia Pacific Vision Q4 2012 ABRIDGEDDocument32 pagesAsia Pacific Vision Q4 2012 ABRIDGEDKw LohPas encore d'évaluation

- Dynamic Linkages Between Exchange Rates and Stock Prices: Evidence From East Asian MarketsDocument18 pagesDynamic Linkages Between Exchange Rates and Stock Prices: Evidence From East Asian MarketsSuleman MehmoodPas encore d'évaluation

- An Impact of Currency Fluctuations On Indian Stock MarketDocument6 pagesAn Impact of Currency Fluctuations On Indian Stock MarketInternational Journal of Application or Innovation in Engineering & ManagementPas encore d'évaluation

- 5 Asia MicrostrategyDocument28 pages5 Asia MicrostrategygirishrajsPas encore d'évaluation

- China Medical Device MarketDocument20 pagesChina Medical Device Marketkrrishshrish14Pas encore d'évaluation

- Facebook IPO ProspectusDocument148 pagesFacebook IPO ProspectustinylittleworldPas encore d'évaluation

- 2004-2005 Michigan Ross CC Interview Case BookDocument116 pages2004-2005 Michigan Ross CC Interview Case Bookr_okoPas encore d'évaluation

- Lek Case StudyDocument8 pagesLek Case StudysahaiakkiPas encore d'évaluation

- 2001-2002 Michigan Ross Case BookDocument50 pages2001-2002 Michigan Ross Case Bookr_okoPas encore d'évaluation

- Relationship Marketing WEEK3Document11 pagesRelationship Marketing WEEK3Vince CastilloPas encore d'évaluation

- PACC Offshore Services IPO ProspectusDocument516 pagesPACC Offshore Services IPO ProspectusJame ColesPas encore d'évaluation

- Future GroupDocument7 pagesFuture GroupAbhay Pratap SinghPas encore d'évaluation

- Unit 10 Brand Equity: Product PositioningDocument11 pagesUnit 10 Brand Equity: Product Positioningsabyasachi samalPas encore d'évaluation

- Competition Law and Consumer InterestDocument58 pagesCompetition Law and Consumer InterestAishwarya SudhirPas encore d'évaluation

- Factors Affecting Promotion Mix - Top 10 Factors Affecting Promotion MixDocument49 pagesFactors Affecting Promotion Mix - Top 10 Factors Affecting Promotion MixJoyjit SanyalPas encore d'évaluation

- International RetailingDocument13 pagesInternational RetailingAbhi SinghPas encore d'évaluation

- QFIP-159-F23 Private Debt Fund Returns, Persistence, and Market ConditionsDocument54 pagesQFIP-159-F23 Private Debt Fund Returns, Persistence, and Market ConditionsNoodles FSA100% (1)

- Chapter 2: Manufacturing Cost: Concept and ComponentsDocument5 pagesChapter 2: Manufacturing Cost: Concept and ComponentsNur Batrisyia KhiriPas encore d'évaluation

- Jet Airways ProjectDocument28 pagesJet Airways ProjectAmit SinghPas encore d'évaluation

- Strategic Analysis of Onida: Assignment For Strategic MarketingDocument13 pagesStrategic Analysis of Onida: Assignment For Strategic MarketingVikas NigamPas encore d'évaluation

- Questionnaire - Yash PareekDocument4 pagesQuestionnaire - Yash PareekYash PareekPas encore d'évaluation

- About LazadaDocument2 pagesAbout LazadaIffah NabilahPas encore d'évaluation

- Invisible HandDocument12 pagesInvisible HanddebangeesahooPas encore d'évaluation

- Strama Quiz 4Document5 pagesStrama Quiz 4Norhel FangedPas encore d'évaluation

- DepreciationDocument84 pagesDepreciationDubai SheikhPas encore d'évaluation

- Profit Centre PDFDocument12 pagesProfit Centre PDFalvickyPas encore d'évaluation

- InvoiceDocument1 pageInvoicejadav karmakarPas encore d'évaluation

- SVB Crisis - O3 SecuritiesDocument7 pagesSVB Crisis - O3 SecuritiesAnkit PandePas encore d'évaluation

- Corporate AccountingDocument8 pagesCorporate AccountingAiDLoPas encore d'évaluation

- Vice President Marketing in Los Angeles CA Resume Mitch PerlissDocument2 pagesVice President Marketing in Los Angeles CA Resume Mitch PerlissMitchPerlissPas encore d'évaluation

- NYKAADocument9 pagesNYKAAdevanshiPas encore d'évaluation

- How To Start An Online School in 10 StepsDocument2 pagesHow To Start An Online School in 10 StepsKiambisPas encore d'évaluation

- IA1 Cash and Cash EquivalentsDocument20 pagesIA1 Cash and Cash EquivalentsJohn Rainier QuijadaPas encore d'évaluation

- Case Study Market LeadershipDocument5 pagesCase Study Market LeadershipDanish RehmanPas encore d'évaluation