Académique Documents

Professionnel Documents

Culture Documents

Form ST-3 (Return Under Section 70 of The Finance Act, 1994)

Transféré par

Samir SalunkheDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form ST-3 (Return Under Section 70 of The Finance Act, 1994)

Transféré par

Samir SalunkheDroits d'auteur :

Formats disponibles

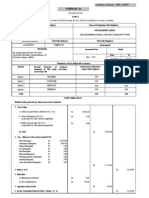

Form ST-3 (Return under Section 70 of the Finance Act, 1994)

Registration Number : Return Number : Address of Registered Unit : Commissionerate : Financial Year : Single Return :

AAACJ4952HST001

Assessee's Name :

AAACJ4952HST001_SG0 Status : 2060001_ST3_042011 - R-627 MIDC TTC IND AREA, RABALE THANE GHANSOLI SERVICE TAX-II MUMBAI 2011-2012 Yes Division : SERVICE TAX DIVISION-V Return for the period :

JOGLEKAR REFRACTORIES & CERAMICS PVT LTD., FILED

Range :

GROUP-VI

April-September

Category of Service : TRANSPORT OF GOODS BY ROAD

COMPUTATION OF SERVICE TAX(TO BE FILLED BY A PERSON LIABLE TO PAY SERVICE/NOT TO BE FILLED BY INPUT SERVICE DISTRIBUTOR) A2 Assessee is liable to pay service tax on this taxable service as (i) (ii) B C1 C2 A2 1 a Service Provider : No a Service Receiver liable to make payment of service tax : Yes Sub-clause No. of clause(105) of section 65 : (zzp) Has the assessee availed benefit of any exemption notification : No If reply to above is yes, please furnish Notification Nos. : Notification No.

D E1 E2

Sr.No in the Notification (If Abatement is claimed as per Notification No. 1/2006-ST) : Whether provisionally assessed : No Provisional Assessment Order No.(If Any) :

F. VALUE OF TAXABLE SERVICE,SERVICE TAX PAYABLE AND GROSS AMOUNT CHARGED (ALL FIGURES IN RUPEES) FOR SERVICE RECEPIENT Sl.n o (I) SERVICE TAX PAYABLE (a) Gross Amount paid in money (i) Against service received : (ii) 41522 91970 167470 0 0 112981 0 0 69441 0 0 162960 0 0 646344 0 0 Apr May June July Aug Sept Total

In advance for service to 0 0 be received : (b) Money equivalent of con0 0 siderations paid in form other than money : (c) Value on which Service Tax is exempt/not payable (i) Amount paid against export of service^ : 0 0

Page 1 of 9

Amount paid towards ex0 0 empted service(other than export of service) : (iii) Amount paid to pure agent 0 0 : (d) Abatement amount claimed 0 0 : (e) Taxable value = (a+b) 41522 91970 (c+d) : Service Tax rate wise break-up of taxable value = (e) Sl.n o Taxable Rate % Service Tax Rate @ :10 Education Cess Rate @ :2 Secondary and Higher Education Cess Rate @ :1 Service tax payable = : Education cess payable : Secondary and higher education cess payable : (II) TAXABLE AMOUNT PAID Gross amount for which bills/invoices/challans are issued relating to service received/to be received (including export of service and exempted service) : Money equivalent of other considerations paid,if any,in a form other than money : Amount paid for exported service received/to be received^ : Amount paid for exempted service received/to be received (other than export of service) : Amount paid as pure agent : Amount claimed as abatement : Net taxable amount paid = (j+k) - (l+m+n+o) : Apr 41522 May 91970

(ii)

0 0 167470

0 0 112981

0 0 69441

0 0 162960

0 0 646344

Taxable Value June 167470 July 112981 Aug 69441 Sept 162960 Total 646344

4152 83 42

9197 184 92

16747 335 167

11298 226 113

6944 139 69

16296 326 163

64634 1293 646

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

Category of Service : CONSULTING ENGINEER

COMPUTATION OF SERVICE TAX(TO BE FILLED BY A PERSON LIABLE TO PAY SERVICE/NOT TO BE FILLED BY INPUT SERVICE DISTRIBUTOR) A2 Assessee is liable to pay service tax on this taxable service as (i) (ii) B C1 C2 A2 1 Page 2 of 9 a Service Provider : No a Service Receiver liable to make payment of service tax : Yes Sub-clause No. of clause(105) of section 65 : (g) Has the assessee availed benefit of any exemption notification : No If reply to above is yes, please furnish Notification Nos. : Notification No.

D E1 E2

Sr.No in the Notification (If Abatement is claimed as per Notification No. 1/2006-ST) : Whether provisionally assessed : No Provisional Assessment Order No.(If Any) :

F. VALUE OF TAXABLE SERVICE,SERVICE TAX PAYABLE AND GROSS AMOUNT CHARGED (ALL FIGURES IN RUPEES) FOR SERVICE RECEPIENT Sl.n o (I) SERVICE TAX PAYABLE (a) Gross Amount paid in money (i) Against service received : (ii) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Apr May June July Aug Sept Total

In advance for service to 0 0 be received : (b) Money equivalent of con0 0 siderations paid in form other than money : (c) Value on which Service Tax is exempt/not payable (i) Amount paid against export 0 0 of service^ : (ii) Amount paid towards ex0 0 empted service(other than export of service) : (iii) Amount paid to pure agent 0 0 : (d) Abatement amount claimed 0 0 : (e) Taxable value = (a+b) 0 0 (c+d) : Service Tax rate wise break-up of taxable value = (e) Sl.n o Taxable Rate % Service Tax Rate @ :0 Education Cess Rate @ :0 Secondary and Higher Education Cess Rate @ :0 Service tax payable = : Education cess payable : Secondary and higher education cess payable : (II) TAXABLE AMOUNT PAID Gross amount for which bills/invoices/challans are issued relating to service received/to be received (including export of service and exempted service) : Money equivalent of other considerations paid,if any,in a form other than money : Amount paid for exported service received/to be received^ : Amount paid for exempted service received/to be received (other than export of service) : Amount paid as pure agent Apr 0 May 0

0 0

0 0

0 0

0 0

0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

Taxable Value June 0 July 0 Aug 0 Sept 0 Total 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 Page 3 of 9

: Amount claimed as abatement : Net taxable amount paid = (j+k) - (l+m+n+o) : 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Category of Service : BUSINESS AUXILIARY SERVICES

COMPUTATION OF SERVICE TAX(TO BE FILLED BY A PERSON LIABLE TO PAY SERVICE/NOT TO BE FILLED BY INPUT SERVICE DISTRIBUTOR) A2 Assessee is liable to pay service tax on this taxable service as (i) (ii) B C1 C2 A2 1 a Service Provider : No a Service Receiver liable to make payment of service tax : Yes Sub-clause No. of clause(105) of section 65 : (zzb) Has the assessee availed benefit of any exemption notification : No If reply to above is yes, please furnish Notification Nos. : Notification No.

D E1 E2

Sr.No in the Notification (If Abatement is claimed as per Notification No. 1/2006-ST) : Whether provisionally assessed : No Provisional Assessment Order No.(If Any) :

F. VALUE OF TAXABLE SERVICE,SERVICE TAX PAYABLE AND GROSS AMOUNT CHARGED (ALL FIGURES IN RUPEES) FOR SERVICE RECEPIENT Sl.n o (I) SERVICE TAX PAYABLE (a) Gross Amount paid in money (i) Against service received : (ii) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Apr May June July Aug Sept Total

In advance for service to 0 0 be received : (b) Money equivalent of con0 0 siderations paid in form other than money : (c) Value on which Service Tax is exempt/not payable (i) Amount paid against export 0 0 of service^ : (ii) Amount paid towards ex0 0 empted service(other than export of service) : (iii) Amount paid to pure agent 0 0 : (d) Abatement amount claimed 0 0 : (e) Taxable value = (a+b) 0 0 (c+d) : Service Tax rate wise break-up of taxable value = (e) Sl.n o Taxable Rate % Apr May

0 0

0 0

0 0

0 0

0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

Taxable Value June July Aug Sept Total

Page 4 of 9

Service Tax Rate @ :0 Education Cess Rate @ :0 Secondary and Higher Education Cess Rate @ :0 Service tax payable = : Education cess payable : Secondary and higher education cess payable : (II) TAXABLE AMOUNT PAID Gross amount for which bills/invoices/challans are issued relating to service received/to be received (including export of service and exempted service) : Money equivalent of other considerations paid,if any,in a form other than money : Amount paid for exported service received/to be received^ : Amount paid for exempted service received/to be received (other than export of service) : Amount paid as pure agent : Amount claimed as abatement : Net taxable amount paid = (j+k) - (l+m+n+o) :

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

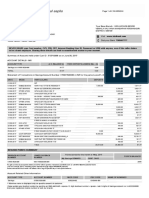

4. AMOUNT OF SERVICE TAX PAID IN ADVANCE UNDER SUB-RULE(1A) OF RULE 6 Sl.n o Amount paid in Advance : (ii) Apr 0 May 0 June 0 July 0 Aug 0 Sept 0 Total 0

Challan Details for Advance Payment Month Apr May Jun Jul Aug Sept GAR-7 Challan

4A. SERVICE TAX,EDUCATIONAL CESS AND OTHER AMOUNTS PAID(TO BE FILLED BY A PERSON LIABLE TO PAY SERVICE TAX/NOT TO BE FILLED BY INPUT SERVICE DISTRIBUTOR) Sl.n Apr May June July Aug Sept Total o (I) SERVICE TAX ,EDUCATION CESS,SECONDARY AND HIGHER EDUCATION CESS PAID (a) SERVICE TAX PAID In cash : By CENVAT Credit ^ : Advance Service Tax utilized [Rule 6(1A)] : Service Tax paid [Rule 6(3)] : 4152 0 0 0 9197 0 0 0 16747 0 0 0 11298 0 0 0 6944 0 0 0 16296 0 0 0 64634 0 0 0

Page 5 of 9

Service Tax paid [Rule 6(4A)] : (b) EDUCATION CESS PAID In cash : By CENVAT Credit ^ : Advance Educess utilized [Rule 6(1A)] : Educess paid [Rule 6(3)] : Educess paid [Rule 6(4A)] :

83 0 0 0 0

184 0 0 0 0

335 0 0 0 0

226 0 0 0 0

139 0 0 0 0

326 0 0 0 0

1293 0 0 0 0

(c) SECONDARY AND HIGHER EDUCATION CESS PAID In cash : By CENVAT Credit ^ : Advance Sec.& High. Educess utilized [Rule 6(1A)] : Sec.& High. Educess paid [Rule 6(3)] : Sec.& High. Educess paid [Rule6(4A)] : (d) OTHER AMOUNTS PAID 42 0 0 0 0 92 0 0 0 0 167 0 0 0 0 113 0 0 0 0 69 0 0 0 0 163 0 0 0 0 646 0 0 0 0

Other amounts paid - Ar0 0 0 0 0 0 0 rears Cash : Other amounts paid - Ar0 0 0 0 0 0 0 rears Credit : Other amounts paid - Ar0 0 0 0 0 0 0 rears (Educess) Cash : Other amounts paid - Ar0 0 0 0 0 0 0 rears (Educess) Credit : Other amounts paid - Ar0 0 0 0 0 0 0 rears (Sec & Higher Educess) Cash : Other amounts paid - Ar0 0 0 0 0 0 0 rears (Sec & Higher Educess) Credit : Other amounts paid - In0 0 0 0 0 0 0 terest : Other amounts paid - Pen0 0 0 0 0 0 0 alty : Section 73A Amount Paid ^ 0 0 0 0 0 0 0 : Any Other Amount (Please 0 0 0 0 0 0 0 specify) : (II) DETAILS OF CHALLAN (VIDE WHICH SERVICE TAX EDUCATION CESS, SECONDARY AND HIGHER EDUCATION CESS AND OTHER AMOUNTS PAID IN CASH) Month GAR-7 Challan Apr May Jun Jul Aug Sept 00033750405201100014 00031090306201100028 00033750507201100022 00033750308201100017 00033750309201100002 00031090410201100011

4B. SOURCE DOCUMENT DETAILS FOR ENTRIES AT COLUMN 4A(I)(a)(iii), 4A(I)(a)(iv), 4A(I)(b)(iii), 4A(I)(b)(iv), 4A(I)(c)(iii), 4A(I)(c)(iv), 4A(I)(d)(i) to (vii) Sl Entry in table Service tax,educational cess,secondary and higher education cess paid Source document No. Source Document Type Month No./ Period Date

Page 6 of 9

4C. DETAILS OF AMOUNT OF SERVICE TAX PAYABLE BUT NOT PAID AS ON THE LAST DAY OF THE PERIOD FOR WHICH RETURN IS FILED :

5. DETAILS OF INPUT STAGE CENVAT CREDIT(TO BE FILED BY A TAXABLE SERVICE PROVIDER ONLY/NOT TO BE FILLED BY SERVICE RECEIVER LIABLE TO PAY SERVICE TAX OR INPUT SERVICE DISTRIBUTOR) 5A. WHETHER THE ASSESSEE PROVIDING EXEMPTED/NON TAXABLE SERVICE OR EXEMPTED GOODS (a)Whether providing any exempted or non taxable service No (b)Whether manufacturing any exempted goods No

(c) If any one of the above is yes, whether maintaining separate account for receipt or consumption of No input service and input goods(refer to rule 6(2) of CENVAT credit Rule,2004) (d) If any one of the (a) and (b) is 'Yes' and (c) is 'No',which option is being availed under rule 6 (3) of the Cenvat Credit Rules,2004 (i) Opted to pay an amount equal to 10% of the value of exempted goods and 8% of the No value of exempted service (Y/N) or (ii) Opted to pay an amount equivalent to CENVAT Credit attributable to inputs and input No services used in or in relation to manufacture of exempted goods or provision of exempted service(Y/N)

5AA AMOUNT PAYABLE UNDER RULE 6 (3) OF THE CENVAT CREDIT RULES,2004 Sl MONTH No (a) Value of Exempted good cleared : (b) Value of exempted services provided : (c) Amount paid under rule 6(3) of Cenvat Credit Rules,2004 by CENVAT Credit : (d) Amount paid under rile 6(3) of Cenvat Credit Rules,2004 by cash : (e) Total Amount paid for Cenvat : Apr 0 0 0 May 0 0 0 June 0 0 0 July 0 0 0 Aug 0 0 0 Sept 0 0 0

(f)

Challan Nos,vide which amount mentioned in (d) is paid Month Apr May Jun Jul Aug Sept GAR-7 Challan

CREDIT DETAILS FOR SERVICE TAX PROVIDER / RECEIPIENT (A) CENVAT CREDIT DETAILS (all figures in rupees) Details of Credit Opening Balance : Credit taken on inputs : Credit taken on capital goods : Credit taken on input services received directly : Credit taken as received from input service distributor : Credit taken from inter unit transfer by a LTU : Total credit availed : Credit utilized for payment of service Apr 0 0 0 0 0 0 0 0 May 0 0 0 0 0 0 0 0 June 0 0 0 0 0 0 0 0 July 0 0 0 0 0 0 0 0 Aug 0 0 0 0 0 0 0 0 Sept 0 0 0 0 0 0 0 0 Page 7 of 9

tax : Credit utilized for payment of educational cess on taxable service : Credit utilized for payment of excise or any other duty : Credit utilized towards clearance of input goods and capital goods removed as such : Credit utilized towards inter unit transfer of LTU : Credit of education cess and secondary and higher education cess utilized for Payment under rule 6(3) of the Cenvat Credit Rules,2004 : Total credit utilized : Closing Balance of CENVAT credit : 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

(B) EDUCATION CESS CREDIT DETAILS (all figures in rupees) Details of Credit Opening Balance : Credit of education cess and secondary and higher education cess taken on inputs : Credit of education cess and secondary and higher education cess taken on capital goods : Credit of education cess and secondary and higher education cess taken on input services received directly : Credit of education cess and secondary and higher education cess taken as received from input service distributor : Credit of education cess and secondary and higher education cess taken from inter unit transfer by a LTU : Total credit of education cess and secondary and higher education cess taken : Credit of education cess and secondary and higher education cess utilized for payment of education cess and secondary and higher education cess on services : Credit of education cess and secondary and higher education cess utilized for payment of education cess and secondary and higher education cess on goods : Credit of education cess and secondary and higher education cess utilized towards payment of education cess and secondary and higher education cess on clearance of input goods and capital goods removed as such : Credit of education cess and secondary and higher education cess utilized towards inter unit transfer of LTU : Total credit of education cess and secondary and higher education cess utilized : Closing Balance of Education cess and secondary and higher education cess : Apr 0 0 May 0 0 June 0 0 July 0 0 Aug 0 0 Sept 0 0

Page 8 of 9

CREDIT DETAILS FOR INPUT SERVICE DISTRIBUTOR (A) DETAILS OF CENVAT CREDIT RECEIVED AND DISTRIBUTED (all figures in rupees) Details of Credit Apr May June July Aug Sept

(B) DETAILS OF EDUCATION CESS RECEIVED AND DISTRIBUTED (all figures in rupees) Details of Credit Apr May June July Aug Sept

7. SELF-ASSESSMENT MEMORANDUM (a) I/We declare that the above particulars are in accordance with the records and books maintained by me/us and are correctly stated. (b) I/We have assessed and paid the service tax and/or availed and distributed CENVAT credit correctly as per the provisions of the Finance Act, 1994 and the rules made thereunder. (c)I/We have paid duty within the specified time limit and in case of delay, I/We have deposited the interest leviable thereon.

8. IF THE RETURN HAS BEEN PREPARED BY A SERVICE TAX RETURN PREPARER (STRP), FURNISH FURTHER DETAILS AS BELOW: (a) Identification No. of STRP : (b) Name of STRP :

Name : Place : Revised Date :

JOGALEKAR REFRACTORIES PVT. LTD. RABALE, NAVI MUMBAI Date : 18/10/2011

Page 9 of 9

Vous aimerez peut-être aussi

- Leelavati Service Tax ReturnDocument6 pagesLeelavati Service Tax Returnphani raja kumarPas encore d'évaluation

- Service Tax Return 3in Excel Format-1Document8 pagesService Tax Return 3in Excel Format-1priyaradhiPas encore d'évaluation

- Instruction To Fill Form St3Document9 pagesInstruction To Fill Form St3Dhanush GokulPas encore d'évaluation

- ServiceTaxobjective QuestionsDocument14 pagesServiceTaxobjective QuestionsJitendra VernekarPas encore d'évaluation

- Direct Tax Summary Notes For IPCC JKQK1AK0Document24 pagesDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaPas encore d'évaluation

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespiePas encore d'évaluation

- MR - Vageesh ShuklaDocument8 pagesMR - Vageesh ShuklakittushuklaPas encore d'évaluation

- VATReturn All Annexs 6402227Document6 pagesVATReturn All Annexs 6402227muhammad saadPas encore d'évaluation

- Service Tax and Vat Problems By-BharathDocument3 pagesService Tax and Vat Problems By-BharathrajdeeppawarPas encore d'évaluation

- Supllimentary Duty, Submission of Vat ReturnDocument51 pagesSupllimentary Duty, Submission of Vat ReturnKhadeeza ShammeePas encore d'évaluation

- (With Solution) Ipcc A.Y.2013-14: Mock Test Category-C Full SyllabusDocument25 pages(With Solution) Ipcc A.Y.2013-14: Mock Test Category-C Full SyllabusTushar BhattacharyyaPas encore d'évaluation

- IT Return IndividualDocument42 pagesIT Return IndividualAllanPas encore d'évaluation

- Suggested Tax Paper May 2011Document11 pagesSuggested Tax Paper May 2011Sudhir PanigrahiPas encore d'évaluation

- Proposed Corrected Return - Muhammad Zai BuildersDocument4 pagesProposed Corrected Return - Muhammad Zai BuildersHaroon ButtPas encore d'évaluation

- Re: Service Tax-Change in CENVAT Credit Rules 2004Document7 pagesRe: Service Tax-Change in CENVAT Credit Rules 2004Prakash BatwalPas encore d'évaluation

- 103497Document5 pages103497Ashok PuttaparthyPas encore d'évaluation

- (Please See The Instruction Carefully Before Filling The Form) (ORIGINAL / REVISED RETURN (Strike Whichever Is NOT Applicable) ) Financial YearDocument10 pages(Please See The Instruction Carefully Before Filling The Form) (ORIGINAL / REVISED RETURN (Strike Whichever Is NOT Applicable) ) Financial Yearharjeet54Pas encore d'évaluation

- Submitted Status:: CNIC in Case of Individual Coy/Aop/Ind Service Category Tax OfficeDocument5 pagesSubmitted Status:: CNIC in Case of Individual Coy/Aop/Ind Service Category Tax OfficeAbbas AliPas encore d'évaluation

- VATReturn All Annexs 3033229Document3 pagesVATReturn All Annexs 3033229Faiza MinhasPas encore d'évaluation

- 1 Budget Impact 2012-13Document5 pages1 Budget Impact 2012-13Rajkamal TiwariPas encore d'évaluation

- Bundled Service ValuationDocument7 pagesBundled Service ValuationSushant SaxenaPas encore d'évaluation

- Sales Tax Return 16353854Document1 pageSales Tax Return 163538547799349Pas encore d'évaluation

- Monthly VAT ReturnDocument34 pagesMonthly VAT ReturnEdris MatovuPas encore d'évaluation

- Submitted Status:: Tax Period KNTN Name Submission Date Normal AmendedDocument2 pagesSubmitted Status:: Tax Period KNTN Name Submission Date Normal AmendedEntertaining VideosPas encore d'évaluation

- Following Issues Have Been Found in Your Return:: Form - Er1Document9 pagesFollowing Issues Have Been Found in Your Return:: Form - Er1Mrinal SinghPas encore d'évaluation

- 031508996Document2 pages031508996Lokesh KumarPas encore d'évaluation

- Questionnaire ObjectiveDocument9 pagesQuestionnaire Objectiveprasadzinjurde100% (3)

- ST RKBDocument14 pagesST RKBanon-849760Pas encore d'évaluation

- 14 - Guidance Note - Service TaxDocument3 pages14 - Guidance Note - Service Taxgaurav_99961Pas encore d'évaluation

- 2015 VAT in Cambodia Sesion II 22aug 2015Document27 pages2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangPas encore d'évaluation

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilPas encore d'évaluation

- Ipc, Taxation Indirect Taxes - Suggested Answers For May, 2016 ExamDocument8 pagesIpc, Taxation Indirect Taxes - Suggested Answers For May, 2016 ExamAnuj Harshwardhan SharmaPas encore d'évaluation

- Form16Document10 pagesForm16anon-263698Pas encore d'évaluation

- "Form St-3: (Please See The Instructions Carefully Before Filling The Form)Document8 pages"Form St-3: (Please See The Instructions Carefully Before Filling The Form)lbajaj_3Pas encore d'évaluation

- Scanner Ipcc Paper 4Document34 pagesScanner Ipcc Paper 4Meet GargPas encore d'évaluation

- Charging Section of SalaryDocument5 pagesCharging Section of SalaryPrashant singhPas encore d'évaluation

- Examples On Taxable Services A To L (Chapter 59)Document6 pagesExamples On Taxable Services A To L (Chapter 59)kapilchandanPas encore d'évaluation

- Summary of Tax Deducted at Source: Part-ADocument5 pagesSummary of Tax Deducted at Source: Part-Achakrala_sirishPas encore d'évaluation

- Hemendra CorpDocument3 pagesHemendra Corphem2_3Pas encore d'évaluation

- 1 - Form 16Document5 pages1 - Form 16premsccPas encore d'évaluation

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaPas encore d'évaluation

- Form 16 For AY 2015-16 CAknowledge - inDocument16 pagesForm 16 For AY 2015-16 CAknowledge - inKiranPas encore d'évaluation

- Final Tax Sem 4PAYMENT, REGISTRATION AND RETURNS OF SERVICE TAXDocument32 pagesFinal Tax Sem 4PAYMENT, REGISTRATION AND RETURNS OF SERVICE TAXkarthika kounderPas encore d'évaluation

- Far 811S Test 2 2023Document7 pagesFar 811S Test 2 2023Grechen UdigengPas encore d'évaluation

- Chapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document71 pagesChapter 6 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarPas encore d'évaluation

- Chapter 3-GSTDocument14 pagesChapter 3-GSTPooja D AcharyaPas encore d'évaluation

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluPas encore d'évaluation

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976Pas encore d'évaluation

- Mock E Exam Pap ERDocument19 pagesMock E Exam Pap ERtim_rattanaPas encore d'évaluation

- Excise Summary 09 10Document4 pagesExcise Summary 09 10KoolmindPas encore d'évaluation

- ST 3 Revised For 2nd QuarterDocument16 pagesST 3 Revised For 2nd QuarterSam SmartPas encore d'évaluation

- Form 16Document1 pageForm 16Manish Varghese MathewPas encore d'évaluation

- Form 16Document3 pagesForm 16Yashika ChoudharyPas encore d'évaluation

- 01 VatDocument29 pages01 VatNaimul KaderPas encore d'évaluation

- Value of SupplyDocument36 pagesValue of SupplyTreesa Mary RejiPas encore d'évaluation

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickPas encore d'évaluation

- Sales Tax3650193129439Document12 pagesSales Tax3650193129439tayyabPas encore d'évaluation

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDocument5 pagesNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Pas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionPas encore d'évaluation

- ackReceiptN - 050769700461395Document1 pageackReceiptN - 050769700461395jvmuruganPas encore d'évaluation

- PNB MetLife Super Saver Plan - Brochure - tcm47-69396Document15 pagesPNB MetLife Super Saver Plan - Brochure - tcm47-69396Aditya MehtaPas encore d'évaluation

- GTCPhase4 - Terms N ConditionDocument28 pagesGTCPhase4 - Terms N ConditionMitraPas encore d'évaluation

- BGM ST Trans SecDocument235 pagesBGM ST Trans SecrajuwithualwaysPas encore d'évaluation

- Taxable ServicesDocument19 pagesTaxable ServicesYaman SalujaPas encore d'évaluation

- MR - Gundhi Raza: Page 1 of 2 M-6454244Document2 pagesMR - Gundhi Raza: Page 1 of 2 M-6454244mageshminiPas encore d'évaluation

- GST Notes For Vi SemesterDocument55 pagesGST Notes For Vi SemesterNagashree RAPas encore d'évaluation

- Zepto - Feb 1Document2 pagesZepto - Feb 1priyankPas encore d'évaluation

- Ola Cabs DataDocument1 pageOla Cabs DataNeelabh Mishra100% (1)

- HDFC Life ProGrowth Plus IllustrationDocument3 pagesHDFC Life ProGrowth Plus IllustrationSrikanth DornaluPas encore d'évaluation

- Jeevan Ankur Ppt-Eng - LIC - 9884635430 - Child PlanDocument17 pagesJeevan Ankur Ppt-Eng - LIC - 9884635430 - Child PlanBabujee K.NPas encore d'évaluation

- Amendments - For A.Y. 2011-12Document49 pagesAmendments - For A.Y. 2011-12Arun BansalPas encore d'évaluation

- Revision Questions 2020 Part VDocument18 pagesRevision Questions 2020 Part VJeffrey KamPas encore d'évaluation

- Cenvat Credit Rules, 2004Document21 pagesCenvat Credit Rules, 2004Himanshu SawPas encore d'évaluation

- Hand Book - SAP-Taxation IndiaDocument116 pagesHand Book - SAP-Taxation IndiaNpsw Social-workers100% (5)

- Lrde 13ATT194 12MAR13Document8 pagesLrde 13ATT194 12MAR13Rishi KeshPas encore d'évaluation

- 8 Section 8 SCCDocument29 pages8 Section 8 SCCTRANSIT STRPas encore d'évaluation

- Preventive Officer (Customs Officer) : OthersDocument22 pagesPreventive Officer (Customs Officer) : OthersR K MeenaPas encore d'évaluation

- Model Form of Agreement To Be Entered Into Between Promoter and Alottees Annexure ADocument21 pagesModel Form of Agreement To Be Entered Into Between Promoter and Alottees Annexure AAamina KhanPas encore d'évaluation

- ERP PresentationDocument24 pagesERP PresentationThe BigBradPas encore d'évaluation

- 01 Single File DSR 2015-16Document432 pages01 Single File DSR 2015-16chetansshindePas encore d'évaluation

- AC CodesDocument296 pagesAC CodessvramanaPas encore d'évaluation

- Super Endowment BrochureDocument13 pagesSuper Endowment BrochuremiteshtakePas encore d'évaluation

- Excise DutyDocument4 pagesExcise DutySwapnil BhalaPas encore d'évaluation

- Hand BookDocument82 pagesHand Booknmshamim7750Pas encore d'évaluation

- Goods and Services Tax: B2B - Invoice DetailsDocument1 pageGoods and Services Tax: B2B - Invoice DetailsSOURAV GUPTAPas encore d'évaluation

- Pre-Tender Tie-Up Agreement - VENDORDocument11 pagesPre-Tender Tie-Up Agreement - VENDORArun MuthuramanPas encore d'évaluation

- Exide Life InsuranceDocument26 pagesExide Life InsuranceMaheshPas encore d'évaluation

- 750 HP Rig SpecificationDocument230 pages750 HP Rig SpecificationPrakhar SarkarPas encore d'évaluation

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentDebabrata PaulPas encore d'évaluation