Académique Documents

Professionnel Documents

Culture Documents

2010 CFA Level 2 Syllabus

Transféré par

Saurav NandiDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2010 CFA Level 2 Syllabus

Transféré par

Saurav NandiDroits d'auteur :

Formats disponibles

2010 CFA Level 2 Syllabus

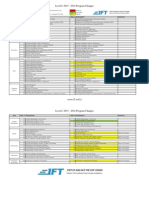

STUDY SESSION 1 ETHICAL AND PROFESSIONAL STANDARDS Reading 1: Code of Ethics and Standards of Professional Conduct Reading 2: Guidance for Standards I-VII Reading 3: CFA Institute Soft Dollar Standards Reading 4: CFA Institute Research Objectivity Standards STUDY SESSION 2 ETHICAL AND PROFESSIONAL STANDARDS: Reading 5 The Glenarm Company Reading 6 Preston Partners Reading 7 Super Selection Reading 8 Trade Allocation: Fair Dealing and Disclosure Reading 9 Changing Investment Objectives Reading 10 Prudence in Perspective STUDY SESSION 3 QUANTITATIVE METHODS FOR VALUATION Reading 11 Correlation and Regression Reading 12 Multiple Regression and Issues in Regression Analysis Reading 13: Time-Series Analysis STUDY SESSION 4 ECONOMICS FOR VALUATION Reading 14 Economic Growth Reading 15 Regulation and Antitrust Policy in a Globalized Economy Reading 16 Trading with the World Reading 17 The Exchange Rate and the Balance of Payments Reading 18 Currency Exchange Rates Reading 19 Foreign Exchange Parity Relations Reading 20 Measuring Economic Activity STUDY SESSION 5 FINANCIAL REPORTING AND ANALYSIS: Reading 21 Intercorporate Investments STUDY SESSION 6 FINANCIAL REPORTING AND ANALYSIS: Reading 22 Employee Compensation: Post-Employment and Share-Based Reading 23 Multinational Operations STUDY SESSION 7 FINANCIAL REPORTING AND ANALYSIS: Reading 24 The Lessons We Learn Reading 25 Evaluating Financial Reporting Quality Reading 26 Integration of Financial Statement Analysis Techniques STUDY SESSION 8 CORPORATE FINANCE Reading 27 Capital Budgeting

http://SreeniMeka.com

Reading 28 Capital Structure and Leverage Reading 29 Dividends and Dividend Policy STUDY SESSION 9 CORPORATE FINANCE: Reading 30 Corporate Governance Reading 31 Mergers and Acquisitions STUDY SESSION 10 EQUITY VALUATION: Reading 32 A Note on Asset Valuation Reading 33 Equity Valuation: Applications and Processes Reading 34 Equity: Markets and Instruments Reading 35 Return Concepts STUDY SESSION 11 EQUITY VALUATION: Reading 36 Equity: Concepts and Techniques Reading 37 The Five Competitive Forces that Shape Strategy Reading 38 Industry Analysis Reading 39 Valuation in Emerging Markets Reading 40 Discounted Dividend Valuation STUDY SESSION 12 EQUITY INVESTMENTS: Reading 41 Free Cash Flow Valuation Reading 42 Market-Based Valuation: Price and Enterprise Value Multiples Reading 43 Residual Income Valuation Reading 44 Private Company Valuation STUDY SESSION 13 ALTERNATIVE ASSET VALUATION Reading 45 Investment Analysis Reading 46 Income Property Analysis and Appraisal Reading 47 Private Equity Valuation Reading 48 Investing in Commodities Reading 49 Evaluating the Performance of Your Hedge Funds Reading 50 Buyers Beware: Evaluating and Managing the Many Facets of the Risks of Hedge Funds STUDY SESSION 14 FIXED INCOME: Reading 51 General Principles of Credit Analysis Reading 52 The Liquidity Conundrum Reading 53 Term Structure and Volatility of Interest Rates Reading 54 Valuing Bonds with Embedded Options STUDY SESSION 15 FIXED INCOME: Reading 55 Mortgage-Backed Sector of the Bond Market Reading 56 Asset-Backed Sector of the Bond Market Reading 57 Valuing Mortgage-Backed and Asset-Backed Securities

http://SreeniMeka.com

STUDY SESSION 16

DERIVATIVE INVESTMENTS: Reading 58: Forward Markets and Contracts Reading 59: Futures Markets and Contracts

STUDY SESSION 17

DERIVATIVE INVESTMENTS: Reading 60 Option Markets and Contracts Reading 61 Swap Markets and Contracts Reading 62 Interest Rate Derivative Instruments Reading 63 Using Credit Derivatives to Enhance Return and Manage Risk

STUDY SESSION 18

PORTFOLIO MANAGEMENT: Reading 64: Portfolio Concepts Reading 65: A Note on Harry M. Markowitzs Market Efficiency: Reading 66: International Asset Pricing Reading 67: The Theory of Active Portfolio Management Reading 68: The Portfolio Management Process and the Investment Policy Statement

Changes from 2009 syllabus Session 5: Variable Interest Entities, Intercompany Debt, Consolidated Cash Flows, and Other Issues ELIMINATED Study session 12 U.S. Portfolio Strategy: Seeking ValueAnatomy of Valuation Anatomy of Valuation replaced with Private Company Valuation Study session 15 Europes Whole Loan Sales Market Burgeoning as Mortgage Credit Market Comes of Age ELIMINATED Study session 18: Taxes and Private Wealth Management in a Global Context ELIMINATED

Three LOS were eliminated one was changed For accurate information check with CFA institute. Reference: CFA Institute.

http://SreeniMeka.com

Vous aimerez peut-être aussi

- A Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansD'EverandA Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Management Principles and PracticeDocument28 pagesFinancial Management Principles and PracticeAnnalyn Molina33% (3)

- Reilly Investment Analysis & Portfolio Management, 11 EdDocument7 pagesReilly Investment Analysis & Portfolio Management, 11 EdSabyasachi Mohapatra0% (1)

- Financial Management by Prasanna Chandra IndexDocument1 pageFinancial Management by Prasanna Chandra IndexBhanwar Hudda40% (5)

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and ExitsD'EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and ExitsPas encore d'évaluation

- Investment & Portfolio Mgt. SyllabusDocument7 pagesInvestment & Portfolio Mgt. SyllabusEmi YunzalPas encore d'évaluation

- Creating Value From Mergers and Acquisitions - ToCDocument7 pagesCreating Value From Mergers and Acquisitions - ToCredaek0% (1)

- CFA Level 2 - 2020 Curriculum Changes (300hours) PDFDocument1 pageCFA Level 2 - 2020 Curriculum Changes (300hours) PDFJOAOPas encore d'évaluation

- Time Warner, Inc., Is Playing Games With Stockholders.Document12 pagesTime Warner, Inc., Is Playing Games With Stockholders.WolfManPas encore d'évaluation

- Index For IAPMDocument1 pageIndex For IAPMRishi SonthaliaPas encore d'évaluation

- CFA level I Exam Companion: The Fitch Learning / Wiley Study Guide to Getting the Most Out of the CFA Institute CurriculumD'EverandCFA level I Exam Companion: The Fitch Learning / Wiley Study Guide to Getting the Most Out of the CFA Institute CurriculumPas encore d'évaluation

- CFA Level I Exam Companion: The 7city / Wiley Study Guide to Getting the Most Out of the CFA Institute CurriculumD'EverandCFA Level I Exam Companion: The 7city / Wiley Study Guide to Getting the Most Out of the CFA Institute CurriculumPas encore d'évaluation

- CFA TimelineDocument1 pageCFA Timelinenauli10Pas encore d'évaluation

- FInanceDocument11 pagesFInanceAtluri HaricharanPas encore d'évaluation

- Level II 2015 2016 Program ChangesDocument2 pagesLevel II 2015 2016 Program ChangessukeerrPas encore d'évaluation

- SAPM Course Outline - Subject To RevisionDocument4 pagesSAPM Course Outline - Subject To RevisionVinay KumarPas encore d'évaluation

- Final LIST OF SIP TOPICSDocument4 pagesFinal LIST OF SIP TOPICSrevati tapaskar100% (2)

- WWW - Simplil: 1 Module 1: Introduction To CFA® Level 1 2 Module 2: EthicsDocument4 pagesWWW - Simplil: 1 Module 1: Introduction To CFA® Level 1 2 Module 2: Ethicskhani.naser8834Pas encore d'évaluation

- CFA Level II 2014 2015 Program ChangesDocument2 pagesCFA Level II 2014 2015 Program ChangesJena KwanPas encore d'évaluation

- University of Gujrat Faculty of Management and Administrative SciencesDocument4 pagesUniversity of Gujrat Faculty of Management and Administrative SciencesObaidUllah ManzarPas encore d'évaluation

- Topics On FinanceDocument3 pagesTopics On FinancePintoo Kumar GuptaPas encore d'évaluation

- Elective Courses SyllabusDocument37 pagesElective Courses SyllabusAsif WarsiPas encore d'évaluation

- Study Planner L1 2023Document9 pagesStudy Planner L1 2023learningdemo211Pas encore d'évaluation

- Topic IdeasDocument14 pagesTopic IdeasAmanSethPas encore d'évaluation

- Finance Project TitlesDocument8 pagesFinance Project TitlesArjun Mv100% (1)

- S I O S T: Ukkur Nstitute F Cience EchnologyDocument11 pagesS I O S T: Ukkur Nstitute F Cience EchnologyMuhammad ShahidPas encore d'évaluation

- CFA Level 1 CourseDocument4 pagesCFA Level 1 CourseAbdulqayum SattigeriPas encore d'évaluation

- Valuation for M&A: Building and Measuring Private Company ValueD'EverandValuation for M&A: Building and Measuring Private Company ValuePas encore d'évaluation

- Financial Management & Int Finance Study Text P-12Document744 pagesFinancial Management & Int Finance Study Text P-12Saleem Ahmed100% (4)

- Security Analysis and Portfolio - S. KevinDocument595 pagesSecurity Analysis and Portfolio - S. KevinShubham Verma100% (1)

- Level I CurriculumDocument4 pagesLevel I CurriculumUtkarsh DalmiaPas encore d'évaluation

- FIN420 Scope of Work.Document2 pagesFIN420 Scope of Work.Nik HarithPas encore d'évaluation

- FinanceDocument7 pagesFinanceMohamed AliPas encore d'évaluation

- CFA Level 1 SyllabusDocument3 pagesCFA Level 1 Syllabusjohn ramboPas encore d'évaluation

- Trading System Development Final Report PDFDocument102 pagesTrading System Development Final Report PDFAditya Risqi Pratama100% (1)

- Sayllabus of Financial Advisors CertificationDocument6 pagesSayllabus of Financial Advisors Certificationrizwan matloobPas encore d'évaluation

- Papa Ki ReportDocument3 pagesPapa Ki ReportSougat SinghPas encore d'évaluation

- Financial Theory and Corporate Policy 3 EditionDocument7 pagesFinancial Theory and Corporate Policy 3 EditionkhanhchvPas encore d'évaluation

- SyllabusDocument3 pagesSyllabusArsalan LobaniyaPas encore d'évaluation

- Islamic Economic Finance Course OutlineDocument4 pagesIslamic Economic Finance Course OutlineLee WongPas encore d'évaluation

- CFA Level II 2017 Curriculum ChangesDocument1 pageCFA Level II 2017 Curriculum ChangeswwongvgPas encore d'évaluation

- Security AnalysisDocument5 pagesSecurity Analysistammy a. romuloPas encore d'évaluation

- Level I 2015 2016 Program ChangesDocument2 pagesLevel I 2015 2016 Program ChangesGuillano DorasamyPas encore d'évaluation

- THREE-5540-Investment and Securities ManagementDocument7 pagesTHREE-5540-Investment and Securities ManagementNabeel IftikharPas encore d'évaluation

- Financial Management: Partner in Driving Performance and ValueD'EverandFinancial Management: Partner in Driving Performance and ValuePas encore d'évaluation

- MMS III Finance SyllabusDocument30 pagesMMS III Finance SyllabusHardik ThakkarPas encore d'évaluation

- FINN 454-Portfolio Management-Salman KhanDocument5 pagesFINN 454-Portfolio Management-Salman KhanMalik AminPas encore d'évaluation

- 3rd Year SyllabusDocument9 pages3rd Year SyllabusFakhrul Islam RubelPas encore d'évaluation

- Master Forex TradingDocument51 pagesMaster Forex Tradingonly manager channel100% (1)

- CFA Level 2 Curriculum Changes 2021 (300hours)Document1 pageCFA Level 2 Curriculum Changes 2021 (300hours)rashedghanimPas encore d'évaluation

- Cipm Principles SyllabusDocument19 pagesCipm Principles Syllabustriptigupta25085232Pas encore d'évaluation

- How To Write Equity Resch RPRTDocument2 pagesHow To Write Equity Resch RPRTvishi123Pas encore d'évaluation

- Investments 11thDocument3 pagesInvestments 11thBellaaPas encore d'évaluation

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi67% (3)

- Financial Modelling Question BankDocument2 pagesFinancial Modelling Question BankPPTDATAPas encore d'évaluation

- Mutual Funds in India: Structure, Performance and UndercurrentsD'EverandMutual Funds in India: Structure, Performance and UndercurrentsPas encore d'évaluation

- Investments 12Th Edition Zvi Bodie Full ChapterDocument51 pagesInvestments 12Th Edition Zvi Bodie Full Chapterbob.purtell881Pas encore d'évaluation

- Investments 12Th Edition Zvi Bodie Full ChapterDocument67 pagesInvestments 12Th Edition Zvi Bodie Full Chapterangel.attaway709Pas encore d'évaluation

- Free Download Investments 12Th Edition Zvi Bodie Full Chapter PDFDocument51 pagesFree Download Investments 12Th Edition Zvi Bodie Full Chapter PDFcharles.stevens161100% (17)

- FM300 Syllabus Section A 2012-13Document5 pagesFM300 Syllabus Section A 2012-13dashapuskarjovaPas encore d'évaluation

- Ise Online Access For Essentials of Investments Bodie Full ChapterDocument67 pagesIse Online Access For Essentials of Investments Bodie Full Chapterera.gist400100% (4)

- FR MTP 2Document8 pagesFR MTP 2gaurav gargPas encore d'évaluation

- A Study On Financial Performance Analysis of The Sundaram Finance LTDDocument56 pagesA Study On Financial Performance Analysis of The Sundaram Finance LTDSindhuja Venkatapathy88% (8)

- ShareholderDocument8 pagesShareholderGanesh KalePas encore d'évaluation

- CH 10 Case StudiesDocument14 pagesCH 10 Case Studiesravideva84Pas encore d'évaluation

- 2020FORM GIS-StockDocument12 pages2020FORM GIS-StockSoo Hyuk LeePas encore d'évaluation

- ThesisDocument118 pagesThesisRoyalSthaPas encore d'évaluation

- CA IPCC Adv. Accounting Solution Nov 2015Document16 pagesCA IPCC Adv. Accounting Solution Nov 2015Siva Narayana Phani MouliPas encore d'évaluation

- Identifying Different Sources of Finance PDFDocument12 pagesIdentifying Different Sources of Finance PDFMzee KodiaPas encore d'évaluation

- Debenture and Debentures Holders: Law of Investment and SecuritiesDocument31 pagesDebenture and Debentures Holders: Law of Investment and SecuritiesVimal Singh100% (1)

- Overview of Financial MarketsDocument15 pagesOverview of Financial MarketsDavidPas encore d'évaluation

- QTTC 702021 TRACNGHIEM Giua-KyDocument31 pagesQTTC 702021 TRACNGHIEM Giua-Kymaingocquynhtrang120104Pas encore d'évaluation

- Dividend Policy of Nepal TelecomDocument9 pagesDividend Policy of Nepal TelecomGwacheePas encore d'évaluation

- SIP ReportDocument39 pagesSIP ReportAditya ShankarPas encore d'évaluation

- FINANCIAL MANAGEMENT For Agribusiness CPU 2nd Sem 2018-2019Document221 pagesFINANCIAL MANAGEMENT For Agribusiness CPU 2nd Sem 2018-2019Joyce Wendam100% (2)

- Chapter 2-Financial Statement AnalysisDocument45 pagesChapter 2-Financial Statement AnalysiswubePas encore d'évaluation

- Chapter 4Document14 pagesChapter 4Yosef KetemaPas encore d'évaluation

- An Overview of Indian Financial SystemDocument11 pagesAn Overview of Indian Financial SystemParul NigamPas encore d'évaluation

- Chubb Business Capabilities v2 - FINALDocument12 pagesChubb Business Capabilities v2 - FINALRoberto EnriquePas encore d'évaluation

- Cost of Capital PDFDocument37 pagesCost of Capital PDFBala RanganathPas encore d'évaluation

- Accounting For Corporations IIDocument25 pagesAccounting For Corporations IIibrahim mohamedPas encore d'évaluation

- 5011 Merchant Banking and Financial Services: Iii Semester/Ii Year BaDocument18 pages5011 Merchant Banking and Financial Services: Iii Semester/Ii Year Bas.muthuPas encore d'évaluation

- FRM Assgn Case StudyDocument16 pagesFRM Assgn Case StudyShravan Kumar100% (1)

- Unit - I: Section - ADocument22 pagesUnit - I: Section - AskirubaarunPas encore d'évaluation

- Venture CapitalDocument60 pagesVenture CapitalAdii AdityaPas encore d'évaluation

- W.C PPT by MeDocument70 pagesW.C PPT by Meramr9000Pas encore d'évaluation

- Cost of ProjectDocument10 pagesCost of ProjectGANESH RAPARTHIPas encore d'évaluation

- Class 12 Business Studies Chapter 10 - Revision NotesDocument9 pagesClass 12 Business Studies Chapter 10 - Revision NotesAyush ShahPas encore d'évaluation

- Article FMGGDocument17 pagesArticle FMGGErmi ManPas encore d'évaluation

- A Study On Role of Financial Planning in Investors Wealth Creation at EQII Logic Wealth Advisory Pvt. LTD, Bangalore PDFDocument83 pagesA Study On Role of Financial Planning in Investors Wealth Creation at EQII Logic Wealth Advisory Pvt. LTD, Bangalore PDFSapna JoshiPas encore d'évaluation