Académique Documents

Professionnel Documents

Culture Documents

Annuity

Transféré par

Ahad Zaman Rony0 évaluation0% ont trouvé ce document utile (0 vote)

37 vues2 pagesProfit maximization refers to how much dollar profit the company makes. Shareholder wealth means maximization of the market value of the existing shareholders common stock price +because the effects of all financial decisions are included. The major factors assumed away by the profit maximization goal are uncertainty and the timing of the profits.

Description originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentProfit maximization refers to how much dollar profit the company makes. Shareholder wealth means maximization of the market value of the existing shareholders common stock price +because the effects of all financial decisions are included. The major factors assumed away by the profit maximization goal are uncertainty and the timing of the profits.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

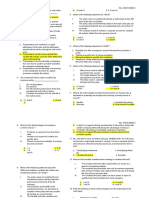

37 vues2 pagesAnnuity

Transféré par

Ahad Zaman RonyProfit maximization refers to how much dollar profit the company makes. Shareholder wealth means maximization of the market value of the existing shareholders common stock price +because the effects of all financial decisions are included. The major factors assumed away by the profit maximization goal are uncertainty and the timing of the profits.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Annuity : Series of payments at fixed intervals, guaranteed for a fixed number of years or the lifetime of one or more individuals.

Profit maximization

Profit maximization refers to how much dollar profit the company makes. Profit maximization stresses the efficient use of capital resources, but it is not specific(or ignore) with respect to the time frame over which the profits are to be measured. In business life there is a very definite relationship between risk and expected return - that isprivate investors demand a higher expected return for taking on the investment projects additional risk. To ignore this relationship leads to improper decision making to allocate the capital which could lead to long-term conflict between existing investors and management.

Maximization Shareholder wealth

means maximization of the market value of the existing shareholders common stock price because the effects of all financial decisions are included. Shareholder wealth is talking about the value of the company generally expressed in the value of the stock. The shareholders react to poor investment or dividend decisions by causing the total value of the firm's stock to fall and react to good decisions by pushing the price of the stock upward. In this way all financial decisions are evaluated, and all financial decisions affect shareholder wealth. The objective of maximizing stockholder wealth can be narrowed to maximizing stock price

difference between Profit Maximization & Maximization of the Shareholders Wealth :

The major difference between the profit maximization goal and the goal of shareholder wealth maximization is that the latter goal deals with all the complexities of the operating environment, while the profit maximization goal does not. The major factors assumed away by the profit maximization goal are uncertainty and the timing of the returns.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Project Proposal: Marketing Strategies Imposed by Banking Companies of BangladeshDocument2 pagesProject Proposal: Marketing Strategies Imposed by Banking Companies of BangladeshAhad Zaman RonyPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Rony Performance AppraisalDocument4 pagesRony Performance AppraisalAhad Zaman RonyPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- HRM Dessler Chapter 1 & 2 CaseDocument6 pagesHRM Dessler Chapter 1 & 2 CaseAhad Zaman RonyPas encore d'évaluation

- Marketing Assignment FinalDocument16 pagesMarketing Assignment FinalAhad Zaman RonyPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Case Burke RonyDocument2 pagesCase Burke RonyAhad Zaman Rony100% (2)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Assignment On BanglalinkDocument16 pagesAssignment On BanglalinkAhad Zaman RonyPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Case Study On Bangladesh RailwayDocument14 pagesA Case Study On Bangladesh RailwayAhad Zaman Rony0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Formula For Definite IntegralsDocument4 pagesFormula For Definite IntegralsAhad Zaman RonyPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Assignment On Pollution Is SylhetDocument17 pagesAssignment On Pollution Is SylhetAhad Zaman RonyPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Assignment For Asad Zaman 01731030419Document2 pagesAssignment For Asad Zaman 01731030419Ahad Zaman RonyPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- VUL Mock ExamDocument5 pagesVUL Mock ExamMillet Plaza Abrigo100% (2)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Nature and Scope of Managerial EconomicsDocument19 pagesNature and Scope of Managerial EconomicsBedria NariPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Levis Swot AnalysisDocument9 pagesLevis Swot AnalysisShady YounesPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Chapter Three: Channels of Distribution ManagementDocument20 pagesChapter Three: Channels of Distribution ManagementmuhdfirdausPas encore d'évaluation

- Managerial Economics: - Fairness Prof. Thiagu RanganathanDocument12 pagesManagerial Economics: - Fairness Prof. Thiagu RanganathanAshishKushwahaPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Demand Schedule and Demand Curve Supply Schedule and The Supply Curve Elasticity of Demand and SupplyDocument31 pagesDemand Schedule and Demand Curve Supply Schedule and The Supply Curve Elasticity of Demand and SupplyBhavana ChavanPas encore d'évaluation

- Presentation On Bata Case StudyDocument18 pagesPresentation On Bata Case StudyLeon Varghese100% (5)

- ME Ebay Case Study Notes by Renu & AvaniDocument4 pagesME Ebay Case Study Notes by Renu & AvaniNawazish KhanPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Class 11 Economics Answer KeyDocument9 pagesClass 11 Economics Answer Keyu0911588Pas encore d'évaluation

- AcknowledgementDocument9 pagesAcknowledgementsyahiir syauqiiPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Ankita Bhuniya (DM22215) Aditya Sattiraju (DM22206) Jonadab Theodore (DM22232) Rahul Basu (DM22256) Tanish Jhaveri (DM22279)Document4 pagesAnkita Bhuniya (DM22215) Aditya Sattiraju (DM22206) Jonadab Theodore (DM22232) Rahul Basu (DM22256) Tanish Jhaveri (DM22279)Ankita BhuniyaPas encore d'évaluation

- Project Report OF: Capital Market in India With Respect To Mumbai. Submitted byDocument74 pagesProject Report OF: Capital Market in India With Respect To Mumbai. Submitted byAli Ahmed KhanPas encore d'évaluation

- Chapter 4 Demand AnalysisDocument19 pagesChapter 4 Demand AnalysisabcPas encore d'évaluation

- Porter's Five ForcesDocument3 pagesPorter's Five ForcesDEVINA GURRIAHPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- II PUC EconomicsDocument137 pagesII PUC EconomicsSpoorthi JPas encore d'évaluation

- Chapter No. 2Document46 pagesChapter No. 2Muhammad SalmanPas encore d'évaluation

- Regtllating A Monopoly: Microeconomics Activity 3-14Document3 pagesRegtllating A Monopoly: Microeconomics Activity 3-14Changuoi YOtoPas encore d'évaluation

- International Business 7th Edition Wild Test BankDocument40 pagesInternational Business 7th Edition Wild Test Banklegacycoupablemf2100% (30)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Phillip Kevin Lane: Kotler - KellerDocument42 pagesPhillip Kevin Lane: Kotler - KellerMohammad FaridPas encore d'évaluation

- 508-Financial Institutions and MarketsDocument2 pages508-Financial Institutions and MarketsIrfan0% (1)

- Tut - Week 3.v2Document16 pagesTut - Week 3.v2peter kongPas encore d'évaluation

- Pricing Strategies For Popsicles Business IdeaDocument3 pagesPricing Strategies For Popsicles Business IdeaAlishbah MehreenPas encore d'évaluation

- Chapter 1 - The Ten Principles of MicroeconomicsDocument9 pagesChapter 1 - The Ten Principles of MicroeconomicsGinev Andrya Lei SencioPas encore d'évaluation

- Ross 12e PPT Ch17Document25 pagesRoss 12e PPT Ch17jl123123Pas encore d'évaluation

- Business EnvironmentDocument25 pagesBusiness EnvironmentION GĂNGUȚPas encore d'évaluation

- Task 1 LO1: P1: Product and Services Development ProcessDocument6 pagesTask 1 LO1: P1: Product and Services Development ProcessTayyab Hassan ButtPas encore d'évaluation

- MbaDocument45 pagesMbaSreedhar KonduruPas encore d'évaluation

- Managerial 1Document88 pagesManagerial 1Mary Kris CaparosoPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- FentimansDocument0 pageFentimanszhenglin0620_2205311Pas encore d'évaluation

- Starbucks Corporation's Marketing Mix (4Ps) AnalysisDocument3 pagesStarbucks Corporation's Marketing Mix (4Ps) AnalysisFaiz RezalPas encore d'évaluation