Académique Documents

Professionnel Documents

Culture Documents

Bharti Zain Online Info

Transféré par

Pratik KatariaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bharti Zain Online Info

Transféré par

Pratik KatariaDroits d'auteur :

Formats disponibles

Bharti-Zain Deal Analysis

The Bharti Zain deal is old news now. A quick look at the Zain September 2009 data nine months of the year only gives us a view of what Bharti is buying.

As you might notice, Nigeria is the bull in the room. Its still not profitable with a loss of $88m on revenues of $986m, and accounts for 1/3rd of Zain Africas revenues. (Zain does not classify Sudan or Morocco as Africa, and is not selling those to Bharti) Yet, Nigeria has hope; Zain has only 25% market share, and the market penetration is just 45% scope to grow. Average Revenue Per User (ARPU) in Africa ranges from $3 to $10, with Nigeria at $7. This compares favourably with India where Airtels ARPU is $5 (Rs. 230).

Powered by Tableau

If you cant see the above graphic(s), a snapshot image is below (Click for a larger picture):

The story from Mint is that Bharti is looking to finance the Zain deal from a $7 billion USD loan remaining $2bn will be from Indian rupee loans - at a rate of 300 bps (3.00%) over LIBOR. This is suspect they were offering to pay 320 points for the smaller $3 bn loan for MTN last year; still, LIBOR is at an all time low of about 0.88%.

The 10 year average of LIBOR is 3.75% and we shouldnt expect these low LIBOR rates to last too long. At even 2% of LIBOR and a 300 bps premium and 8% for the Indian bit , Bharti will pay $500m per year in interest. That means they have to improve EBIDTA by $500m just to pay for the deal; currently EBIDTA is $1.3bn, so its got to scale by 40% for Bharti to get a chunk. They can definitely improve some bits tower costs in Africa have been 4x more than India, which can be lowered and internal efficiencies can be improved. The local mafia in Africa will be tougher to handle (they take the lucrative deals and back-peddle commissions) where in India Mittals political connections would have helped in the early stages. Im not taking a short term call on this stock. If anything each person is supposed to make his own decisions; and Ill see what the market price has to say. If this deal is immensely profitable, Bharti should hit new highs; if its not and Africa is a laggard the prices wont move. It isnt a short right now, but it isnt a buy either; Theyre overpaying for the deal but money is cheap nowadays and expensive is more affordable than you think. Its a definite sign of desperation, but I wouldnt write off a juggernaut like Bharti just yet.

About Bharti:Founded in 1976, by Sunil Bharti Mittal, Bharti has grown from being a manufacturer of bicycle parts to one of the largest and most respected business groups in India. With its entrepreneurial spirit and passion to undertake business projects that are transformational in nature, Bharti has created world-class businesses in telecom, financial services, retail, and foods. Bharti started its telecom services business by launching mobile services in Delhi (India) in 1995. Since then there has been no looking back and Bharti Airtel, the groups flagship company, has emerged as one of top telecom companies in the world and is amongst the top five wireless operators in the world. Through its global telecom operations Bharti group operates under the Airtel brand in 19 countries across Asia and Africa India, Sri Lanka, Bangladesh, Seychelles, Burkina Faso, Chad, Congo Brazzaville, Democratic Republic of Congo, Gabon, Ghana, Kenya, Madagascar, Malawi, Niger, Nigeria, Sierra Leone, Tanzania, Uganda, and Zambia. In addition, the group also has mobile operations in Jersey, Guernsey. Over the past few years, the group has diversified into emerging business areas in the fast expanding Indian economy. With a vision to build Indias finest conglomerate by 2020 the group has forayed into the retail sector by opening retail stores in multiple formats small and medium - as well establishing large scale cash & carry stores to serve institutional customers and other retailers. The group offers a complete portfolio of financial services life insurance, general insurance and asset management to customers across India. Bharti also serves customers through its fresh and processed foods business. The group has growing interests in other areas such as telecom software, real estate, training and capacity building, and distribution of telecom/IT products. What sets Bharti apart from the rest is its ability to forge strong partnerships. Over the years some of biggest names in international business have partnered Bharti. Currently, Singtel, IBM, Ericsson, Nokia Siemens and Alcatel-Lucent are key partners in telecom. Walmart is Bhartis partner for its cash & carry venture. Axa Group is the partner for the financial service business and Del Monte Pacific for the processed foods division. Bharti strongly believes in giving back to the society and through its philanthropic arm the Bharti Foundation it is reaching out to over 30,000 underprivileged children and youth in India.

Milestone:1976-79

Bharti Enterprises founded by Sunil Bharti Mittal. Starts as a small scale manufacturing unit for bicycle components. Diversifies into production of yarn, stainless steel sheets for surgical utensils.

1980-84

Bharti Overseas Trading Corporation set up. Bharti imports and markets stainless steel products, brass and plastic products, and zip fastners etc. Bharti ties up with Suzuki, Japan to import and distribute portable gensets. By 1984 Bharti is the largest importer of portable gensets in India.

1985-88

Bharti makes it entry into the telecom sector with Bharti Telecom. Enters into a technical tie-up with Siemens AG of Germany and becomes the first company in India to manufacture electronic push button telephones in Gurgaon. Bharti Telecoms Ludhiana factory commences operations for manufacturing push button phones. Bharti also makes an entry into Indias pharma sector with Bharti Healthcare, which manufactures empty hard gelatin capsules.

1989

Bharti ties-up with Takacom Corporation, Japan to become the first company in India to manufacture telephone answering machines.

1990

Bharti ties-up with Lucky Gold Star, South Korea to become the first company in India to manufacture cordless telephones.

1992

Bharti Cellular Ltd. is born. Bharti forms a consortium with SFR-France, Emtel-Mauritius and MSI-UK, to bid for mobile service provider licenses in Indian metros.

1993

Bharti Telecoms Gurgaon factory becomes the first manufacturer of push button phones to be awarded ISO 9002 accreditation. Bharti provides technical assistance to Uganda for manufacture of push button phones.

1994

Bharti wins GSM mobile service provider licence for Delhi NCR. Bharti Telecoms Ludhiana factory gets ISO 9002 accreditation.

1995

Bharti launches Delhis first GSM mobile services under the Airtel brand. Forms consortium with Telecom Italia to bid for cellular and fixed-line services under Bharti Telenet. Bharti joins forces with Siemens to market telephone terminals under SIEMENS and BEETEL brand names. Bharti Tele-Ventures is incorporated.

1996

Airtel launched mobile services in the state of Himachal Pradesh, the first by any private telco. Telecom Italia acquires 20% equity interest in Bharti Tele-Ventures. Bharti Telenet bids for fixed line licence in the state of Madhya Pradesh. Bharti forays into manufacture of HDPE Silicore ducts. Forms a joint venture with Dura-Line Corp, USA.

2002

Bharti goes public, completes Indias first 100% book building issue and gets listed on the National stock Exchange, Bombay Stock Exchange and the Delhi Stock Exchange on February 18, 2002. Bharti launches mobile services in Gujarat, Haryana, Kerala, Madhya Pradesh circle, Maharashtra, Mumbai, Punjab, Tamil Nadu, Uttar Pradesh (West). Bharti enters into a license agreement with the DoT to provide International Long Distance services in India. Becomes Indias first private telecommunications services provider to launch International Long Distance services. Bharti launched fixed-line services in the Delhi, Haryana, Karnataka and Tamil Nadu.

2010

Bharti Airtel acquires 70% stake in Warid Telecom, Bangladesh.

Bharti Airtel enters into a legally binding definitive agreement with Zain Group to acquire Zain Africa.

Bharti Airtel acquires the mobile operations of Zain in 15 African countries. Becomes the fifth largest mobile operator in the world.

Vous aimerez peut-être aussi

- Sunil Mittala A EnterpreneurDocument9 pagesSunil Mittala A EnterpreneurDeepakdmimsPas encore d'évaluation

- Bharti Airtel LimitedDocument2 pagesBharti Airtel LimitedParminder KaurPas encore d'évaluation

- Bharti Zain DealDocument21 pagesBharti Zain DealPankaj Singh PariharPas encore d'évaluation

- Bharti Airtel and Zain: A Journey Into New Territories: Arindam Banik Tirthankar NagDocument6 pagesBharti Airtel and Zain: A Journey Into New Territories: Arindam Banik Tirthankar NagRAJAN SHAHIPas encore d'évaluation

- Bharti Airtel - Zain Acquisition: Presented By:-Vipin Shalini SonalDocument21 pagesBharti Airtel - Zain Acquisition: Presented By:-Vipin Shalini SonalSonal AroraPas encore d'évaluation

- SWOT Analysis Bharti AirtelDocument8 pagesSWOT Analysis Bharti Airtelsemin_sam100% (1)

- Bharti GroupDocument5 pagesBharti GroupashpikaPas encore d'évaluation

- amanKUMAR MARKET ST. AxaDocument60 pagesamanKUMAR MARKET ST. AxaAman Kumar RajpootPas encore d'évaluation

- Market Stragety of AirtelDocument54 pagesMarket Stragety of AirtelArpana GuptaPas encore d'évaluation

- GDIB AssignmentDocument39 pagesGDIB AssignmentBiniPas encore d'évaluation

- 5th Airtel's Acquisition of ZainDocument6 pages5th Airtel's Acquisition of ZainCupidd KaulPas encore d'évaluation

- "Bharti Airtel & Zain Africa Deal": An Assignment OnDocument9 pages"Bharti Airtel & Zain Africa Deal": An Assignment Onswatigupta88Pas encore d'évaluation

- Business Police and Strategic Management: Presentation On: Bharti AirtelDocument30 pagesBusiness Police and Strategic Management: Presentation On: Bharti AirtelPallavi PradeepkumarPas encore d'évaluation

- Project Report On AirtelDocument22 pagesProject Report On AirtelSidhant AirenPas encore d'évaluation

- Sunil Bharti Mittal-The Wireless WonderDocument4 pagesSunil Bharti Mittal-The Wireless WonderRenjith RameshPas encore d'évaluation

- AirtelDocument15 pagesAirtelDia LohiyaPas encore d'évaluation

- Bharti Airtel - SWAT and PESTAL AnalysisDocument7 pagesBharti Airtel - SWAT and PESTAL AnalysisArchu KamatPas encore d'évaluation

- Bharti Airtel - SWAT and PESTAL AnalysisDocument7 pagesBharti Airtel - SWAT and PESTAL AnalysisArchu KamatPas encore d'évaluation

- Bharti Airtel LTD.: Company OverviewDocument3 pagesBharti Airtel LTD.: Company OverviewavijeetboparaiPas encore d'évaluation

- Location and Branches: Headquarter New Delhi, India Branches in Every CityDocument4 pagesLocation and Branches: Headquarter New Delhi, India Branches in Every CitySolanki SolankiPas encore d'évaluation

- Bharti Airtel Limited AAAAAAAADocument13 pagesBharti Airtel Limited AAAAAAAAAashish Ritu GandhiPas encore d'évaluation

- Entrepreneur Sunil Bharti MittalDocument9 pagesEntrepreneur Sunil Bharti MittalDeep SutariaPas encore d'évaluation

- NikhilDocument5 pagesNikhilNikhill SinglaPas encore d'évaluation

- Bharti MTN FinalDocument13 pagesBharti MTN FinalAmol MoryePas encore d'évaluation

- SWOT Analysis Bharti AirtelDocument8 pagesSWOT Analysis Bharti AirtelKumboju ShashiPas encore d'évaluation

- The Bharti - Wal-Mart Retail Joint VentureDocument7 pagesThe Bharti - Wal-Mart Retail Joint VentureZoya Febina MuhammedPas encore d'évaluation

- Bharti Zain 2010 Case Study June 7 2010 Revision March222015Document19 pagesBharti Zain 2010 Case Study June 7 2010 Revision March222015swati.anand03Pas encore d'évaluation

- Airtel-Zain Deal ReportDocument12 pagesAirtel-Zain Deal Reportspab123100% (1)

- Bharti Airtel - Wikipedia, The Free EncyclopediaDocument17 pagesBharti Airtel - Wikipedia, The Free Encyclopedia16750Pas encore d'évaluation

- Bharti Airtel LimitedDocument16 pagesBharti Airtel LimitedsagarikabarpandaPas encore d'évaluation

- Lakshmi10 12 2013Document71 pagesLakshmi10 12 2013krazymottoPas encore d'évaluation

- Intro - /bharti Airtel, Formerly Known As Bharti Tele-Ventures LimitedDocument8 pagesIntro - /bharti Airtel, Formerly Known As Bharti Tele-Ventures Limitedaminiff100% (1)

- Airtel ProjectDocument70 pagesAirtel ProjectSanjay TulsankarPas encore d'évaluation

- An Assignment OF E-Business Bharti Airtel: S.A.N.Jain Model Senior Secondary SchoolDocument14 pagesAn Assignment OF E-Business Bharti Airtel: S.A.N.Jain Model Senior Secondary SchoolAnmol JainPas encore d'évaluation

- Airtel Comes To You From Bharti Airtel LimitedDocument3 pagesAirtel Comes To You From Bharti Airtel LimitedSagar SarangPas encore d'évaluation

- Bharti EnterpriseDocument25 pagesBharti EnterprisemayanksosPas encore d'évaluation

- Bharti Airtel HistoryDocument25 pagesBharti Airtel HistoryNiloy DasPas encore d'évaluation

- Group 5 - Bharti Airtel-Zain AfricaDocument10 pagesGroup 5 - Bharti Airtel-Zain AfricaabhishekPas encore d'évaluation

- Opportunities For Indian Telecommunication Sector in Africa: A Project Report OnDocument18 pagesOpportunities For Indian Telecommunication Sector in Africa: A Project Report OnGeorge PalathinkalPas encore d'évaluation

- Presentation: On EntrepreneurDocument14 pagesPresentation: On Entrepreneurmittal_anishPas encore d'évaluation

- Bharti AirtelDocument28 pagesBharti Airtelsoyabvahora47Pas encore d'évaluation

- INTRODUCTION of AirtelDocument3 pagesINTRODUCTION of AirtelVishal Chandak33% (3)

- Bharti Airtel LimitedDocument17 pagesBharti Airtel LimitedAmreshsingh SinghPas encore d'évaluation

- Assignment Description & ProspectDocument7 pagesAssignment Description & ProspectshwetasuranaPas encore d'évaluation

- SWOT Analysis Bharti AirtelDocument3 pagesSWOT Analysis Bharti Airtelrutvij7Pas encore d'évaluation

- Airtel Prokect For BBA Industry IntegratedDocument53 pagesAirtel Prokect For BBA Industry Integratedkabir070388Pas encore d'évaluation

- Bharti Airtel LimitedDocument31 pagesBharti Airtel LimitedNani SiraparapuPas encore d'évaluation

- BRM Interim ReportDocument11 pagesBRM Interim ReportVijeta BaruaPas encore d'évaluation

- SWOT Airtel, VodafoneDocument3 pagesSWOT Airtel, VodafoneHoney SaraoPas encore d'évaluation

- A Research On Airtel.Document10 pagesA Research On Airtel.AmyraPas encore d'évaluation

- Name:-Gourav Kumar Subject: Principles and Practices of ManagementDocument11 pagesName:-Gourav Kumar Subject: Principles and Practices of ManagementnepstorPas encore d'évaluation

- Airtel Connects With AfricaDocument2 pagesAirtel Connects With AfricaSaratou MaazouPas encore d'évaluation

- Bharti Airtel: Bharti Airtel Limited Is An Indian Global Telecommunications ServicesDocument4 pagesBharti Airtel: Bharti Airtel Limited Is An Indian Global Telecommunications ServicesRishab shahPas encore d'évaluation

- A Project Report ON: Piyush Garg MBA 1 Year Roll No: 089523Document30 pagesA Project Report ON: Piyush Garg MBA 1 Year Roll No: 089523Ribhanshu RajPas encore d'évaluation

- Sunil Bharti Mittal at The World Economic Forum In, 2007Document10 pagesSunil Bharti Mittal at The World Economic Forum In, 2007Akash RanaPas encore d'évaluation

- Finlatics-Bharti Airtel 1Document5 pagesFinlatics-Bharti Airtel 1KARAN NEMANIPas encore d'évaluation

- Outbound Hiring: How Innovative Companies are Winning the Global War for TalentD'EverandOutbound Hiring: How Innovative Companies are Winning the Global War for TalentPas encore d'évaluation

- IoT Machine Learning Applications in Telecom, Energy, and Agriculture: With Raspberry Pi and Arduino Using PythonD'EverandIoT Machine Learning Applications in Telecom, Energy, and Agriculture: With Raspberry Pi and Arduino Using PythonPas encore d'évaluation

- Building the Internet of Things: Implement New Business Models, Disrupt Competitors, Transform Your IndustryD'EverandBuilding the Internet of Things: Implement New Business Models, Disrupt Competitors, Transform Your IndustryÉvaluation : 3 sur 5 étoiles3/5 (1)

- How to Generate Money with ChatGPT: A Comprehensive GuideD'EverandHow to Generate Money with ChatGPT: A Comprehensive GuideÉvaluation : 3 sur 5 étoiles3/5 (1)

- Rules Cyber CafeDocument5 pagesRules Cyber Cafenik.narenPas encore d'évaluation

- Web Hancer Removal InstructionsDocument2 pagesWeb Hancer Removal Instructionstommyp100Pas encore d'évaluation

- Living in The It EraDocument8 pagesLiving in The It EraCherry KimPas encore d'évaluation

- CDM-625 ReleaseNotes v2.1.2Document6 pagesCDM-625 ReleaseNotes v2.1.2IvanStefanovichPas encore d'évaluation

- Configuring Site To Site IPSec VPN Tunnel Between Cisco RoutersDocument7 pagesConfiguring Site To Site IPSec VPN Tunnel Between Cisco RoutersIwatch YouPas encore d'évaluation

- 80ee SDDocument392 pages80ee SDsunnguyen100% (1)

- Assignment Dynamic RoutingDocument6 pagesAssignment Dynamic RoutingEdnis LordPas encore d'évaluation

- Configuring OAM 11g Server in CERT ModeDocument3 pagesConfiguring OAM 11g Server in CERT ModeDenem OrhunPas encore d'évaluation

- MAR Points List-1Document2 pagesMAR Points List-1Atanu Das100% (1)

- 1 How Many Bits Make Up An IPv4 Address CH6 Exams AnswersDocument7 pages1 How Many Bits Make Up An IPv4 Address CH6 Exams AnswersYolanda KondePas encore d'évaluation

- VersaLink C405 Service Manual PDFDocument862 pagesVersaLink C405 Service Manual PDFAbrahan Castro75% (4)

- Cisco SPA 502G 1-Line IP PhoneDocument5 pagesCisco SPA 502G 1-Line IP PhonemastrPas encore d'évaluation

- Echolife ws311Document24 pagesEcholife ws311Arley SepulvedaPas encore d'évaluation

- Networkings Asn 1Document9 pagesNetworkings Asn 1Brian Okoth OchiengPas encore d'évaluation

- Debug 1214Document17 pagesDebug 1214Massimo BeccariaPas encore d'évaluation

- Ukraine Press Room Media Discussion Report EngDocument12 pagesUkraine Press Room Media Discussion Report EngSilvio DemétrioPas encore d'évaluation

- Basic Computer Applications: LIFE SKILL COURSE-I Semester-IDocument6 pagesBasic Computer Applications: LIFE SKILL COURSE-I Semester-IComputers GCM KADAPAPas encore d'évaluation

- WhatsNewIn4 1Document276 pagesWhatsNewIn4 1bkbeltonPas encore d'évaluation

- Developing Webapps Faster With Appfuse: Matt RaibleDocument14 pagesDeveloping Webapps Faster With Appfuse: Matt RaibleKushan B GandhiPas encore d'évaluation

- Synthstatic: Lastgreywolf R/NorthernlionDocument6 pagesSynthstatic: Lastgreywolf R/NorthernlionDaniel KoroschetzPas encore d'évaluation

- 50 Daysof LulzDocument20 pages50 Daysof Lulzc2783088Pas encore d'évaluation

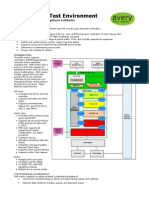

- Mipi Ds AveryDocument2 pagesMipi Ds AveryAkhilReddy SankatiPas encore d'évaluation

- Manual 315 PDFDocument155 pagesManual 315 PDFNikitsoPas encore d'évaluation

- Lesson Plan Ethical and Social Responsibility - 0Document8 pagesLesson Plan Ethical and Social Responsibility - 0nicodemus balasuelaPas encore d'évaluation

- SmartView For EssbaseDocument6 pagesSmartView For EssbaseAmit SharmaPas encore d'évaluation

- MCD 5000 Deskset User GuideDocument110 pagesMCD 5000 Deskset User GuideZeljko M BoskovicPas encore d'évaluation

- TXI2.Open Modbus Mbus XWP 6.1Document67 pagesTXI2.Open Modbus Mbus XWP 6.1Dylan AertgeertsPas encore d'évaluation

- United Patents - Winning Submissions For - US7299067 (Riggs Tech Holdings)Document6 pagesUnited Patents - Winning Submissions For - US7299067 (Riggs Tech Holdings)JGallagherPas encore d'évaluation

- B700 Error CodesDocument3 pagesB700 Error Codescastlelvania23Pas encore d'évaluation

- Using Google Sites To Create E-Portfolios For StudentsDocument5 pagesUsing Google Sites To Create E-Portfolios For StudentsVictor Manuel Enriquez GPas encore d'évaluation