Académique Documents

Professionnel Documents

Culture Documents

Karpoor Gauram Karunnaavataram Sansaar Saaram Bhujgendra Haaram. Sadaa Vasantam Hridyaarvrinde Bhavam Bhavaani Sahitam Namaami

Transféré par

Vinutha VinuDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Karpoor Gauram Karunnaavataram Sansaar Saaram Bhujgendra Haaram. Sadaa Vasantam Hridyaarvrinde Bhavam Bhavaani Sahitam Namaami

Transféré par

Vinutha VinuDroits d'auteur :

Formats disponibles

Karpoor Gauram Karunnaavataram Sansaar Saaram Bhujgendra Haaram. Sadaa Vasantam Hridyaarvrinde Bhavam Bhavaani Sahitam Namaami.

Ya devi sarvabhuteshu Vishnu-mayeti sadbita Namas tasyai, Namas tasyai, Namas tasyai namo namah. Ya devi sarvabhuteshu buddhi - rupena samsthita, namas tasyai Ya devi sarvabhuteshu nidra - rupena samsthita, namas tasyai Ya devi sarvabhuteshu ksudha - rupena samsthita, namas tasyai Ya devi sarvabhuteshu chhaya - rupena samsthita, namas tasyai Ya devi sarvabhuteshu sakti - rupena samsthita, namas tasyai Ya devi sarvabhuteshu trisna - rupena samsthita, namas tasyai Ya devi sarvabhuteshu ksanti - rupena samsthita, namas tasyai

Ya devi sarvabhuteshu lajja - rupena samsthita, namas tasyai Ya devi sarvabhuteshu shanti - rupena samsthita, namas tasyai Ya devi sarvabhuteshu Sraddha - rupena samsthita, namas tasyai Ya devi sarvabhuteshu kanti - rupena samsthita, namas tasyai Ya devi sarvabhuteshu lakshmi - rupena samsthita, namas tasyai Ya devi sarvabhuteshu vritti - rupena samsthita, namas tasyai Ya devi sarvabhuteshu smriti - rupena samsthita, namas tasyai Ya devi sarvabhuteshu daya - rupena samsthita, namas tasyai Ya devi sarvabhuteshu tusti - rupena samsthita, namas tasyai Ya devi sarvabhuteshu matri - rupena samsthita, namas tasyai To that goddess who in all beings is called Visnumaya Salutations, Salutations, Salutations to Thee, again, and again.

SHARNAAGAT DEENAART PARITRAAN PARAAYANEY, SERVASYARTI HAREY DEVI NAARAAYANI NAMOSTUTEY.

Filling e-TDS return is compulsorily for company and government deductors as per section 206 of Income tax law. So, it is the need of time to learn how to fill e-TDS return, if you are interested to work as accountant in company or government sector.

Before learning simple steps, you should know, what is e-TDS? E-TDS means electronic tax deducted at source. It is duty of above mentioned deductors to deduct the amount income tax when they pay to others and prepare return in form No.24, 26 or 27 or 24Q, 25Q or 26Q in electronic media as per prescribed data structure in either a floppy or a CD ROM. The floppy or CD ROM prepared should be accompanied by a signed verification in Form No.27A.

Central

Board

of

Direct

Taxes

(CBDT) as

has

appointed

National

Securities

Depository

Ltd.(NSDL), Mumbai 5 Ist Choose the format or Simple Steps

e-TDS filling eTDS

Intermediary. Return Step

for

data

structure

for

preparing

e-TDS

return

Income tax department and NSDL have made different format according to nature of payments. So, accountant should choose any one from following format.

1. o o o (b) o (c) o File o o o Data 2nd E-TDS File File File structure File File File File

(a)

Annual Format Format Format Annual Format Quarterly Format Format Format Format for Form 24Q of for for for for the for for for for e-TCS

e-TDS Form Form Form

return: 24 26 27 return: Form 27E return:

Form Form Form Form quarter ending

24Q 26Q 27Q 27EQ 31-March Step

return

for

successful

acceptance

1. E-TDS clean text ASCII format: You can use any software like ms excel, compu tax or Tally.ERP or NSDLs software Return Preparation Utility (e-TDS RPU-Light) for making e-TDS return but E-TDS file formats must be in clean text ASCII format with 'txt' as filename extension. 2. Correct Tax deduction Account Number (TAN) of the Deductor is clearly mentioned in Form No.27A as also in the e-TDS return, as required by sub-section (2) of section 203A of the Income-tax Act. 3. The particulars relating to deposit of tax deducted at source in the bank are correctly and properly filled in the table at item No.6 of Form No.24 or item No.4 of Form No.26 or item No.4 of Form No.27, as Administrator. 5. The Control Chart in Form 27A is duly filled in all columns and verified and as enclosed in paper form with the e-TDS return on computer media. 6. The Control totals of the amount paid and the tax deducted at source as mentioned at item No.4 of Form No.27A tally with the corresponding totals in the e-TDS return in Form No. 24 or Form No. 26 or Form No.27, as the case may be. 7. Bank Branch code or BSR code is a 7 digit code allotted to banks by RBI. This is different from the branch code which is used for bank drafts etc. This no. is given in the OLTAS challan or can be obtained from the bank branch or from www.tin-nsdl.com. It is mandatory to quote BST code both in challan details and deductee details. Hence, this field cannot be left blank. Government deductors transfer tax by book entry, in which case the BSR code can be left blank. the case may be. 4. The data structure of the e-TDS return is as per the structure prescribed by the e-Filing

3rd Validate or verify your prepared e-TDS

Step return

After the file has been set as per the file format, it should be verified using the File Validation Utility(FVU) (download here ) provided by NSDL.

4th Rectify the errors and verify the

Step file

In case file has any errors the FVU will give a report of the errors. Rectify the errors and verify the file again through the FVU.

5th Filling A ) Go to TIN of FC ( e-TDS center) near to your

Step Return office

e-TDS returns can be filed at any of the TIN-FC opened by the e-TDS Intermediary for this purpose. Addresses of these TIN-FCs are available at the website onhttp://www.incometaxindia.gov.in/ or at http://www.tin-nsdl.com/ .

B)

Filling

of

e-TDS

Return

Online

Now, you have also facility to file your e-TDS return online for this you have to register to NSDL.

Vous aimerez peut-être aussi

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesD'EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesPas encore d'évaluation

- 5 Steps For Filing E-TDS ReturnDocument6 pages5 Steps For Filing E-TDS Returnk gowtham kumar100% (1)

- E Tax ManualDocument46 pagesE Tax ManualAbhai AgarwalPas encore d'évaluation

- Statement of Cash Flows: Preparation, Presentation, and UseD'EverandStatement of Cash Flows: Preparation, Presentation, and UsePas encore d'évaluation

- 6 Month JST Programme VmeDocument8 pages6 Month JST Programme VmeHemanth Krishna RavipatiPas encore d'évaluation

- q4 Etds Process Fy 2022-2023Document39 pagesq4 Etds Process Fy 2022-2023Puneet RhodePas encore d'évaluation

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)D'EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Évaluation : 3 sur 5 étoiles3/5 (1)

- Tds TcsDocument20 pagesTds TcsnaysarPas encore d'évaluation

- E-Filing of TDS ReturnsDocument10 pagesE-Filing of TDS ReturnsMayur KundarPas encore d'évaluation

- Tax. 23Document18 pagesTax. 23RahulPas encore d'évaluation

- Quarterly TDS ReturnsDocument4 pagesQuarterly TDS ReturnsAjeet SinghPas encore d'évaluation

- E TDS ManualDocument30 pagesE TDS ManualJeetendra ShresthaPas encore d'évaluation

- Laran BSA 3 B Transaction Payroll System 1Document2 pagesLaran BSA 3 B Transaction Payroll System 1Vencint LaranPas encore d'évaluation

- Re Rffoedi1Document6 pagesRe Rffoedi1nayak07Pas encore d'évaluation

- RMC 2010 No. 51 Clarification and Questions On Use of eDST SystemDocument26 pagesRMC 2010 No. 51 Clarification and Questions On Use of eDST SystemBien Bowie A. CortezPas encore d'évaluation

- Theorypresentation 170218171210Document66 pagesTheorypresentation 170218171210SumitPas encore d'évaluation

- Disburse Process OverviewDocument3 pagesDisburse Process OverviewAnonymous CuUAaRSNPas encore d'évaluation

- FAQsDocument10 pagesFAQsrajdeeppawarPas encore d'évaluation

- Etds Software EasyofficeDocument63 pagesEtds Software EasyofficeetilahdPas encore d'évaluation

- eBIR FormsDocument31 pageseBIR FormsAibo GacuLa71% (7)

- ContractPayInformation 011110Document42 pagesContractPayInformation 011110Franseh MuyaPas encore d'évaluation

- Subsequent Activities in SAP HR PayrollDocument7 pagesSubsequent Activities in SAP HR PayrollclaokerPas encore d'évaluation

- Welcome To Tds Awareness / E-Filing of TDS Returns PROGRAMMEDocument60 pagesWelcome To Tds Awareness / E-Filing of TDS Returns PROGRAMMEmahadevavrPas encore d'évaluation

- Rmo 28-07Document31 pagesRmo 28-07nathalie velasquezPas encore d'évaluation

- Payroll ObjectivesDocument9 pagesPayroll ObjectivesfiredevilPas encore d'évaluation

- E InvoicingDocument24 pagesE InvoicingBrijPas encore d'évaluation

- TDS Return FilingDocument34 pagesTDS Return FilingCABRAJJHAPas encore d'évaluation

- DME Process in APDocument23 pagesDME Process in APNaveen KumarPas encore d'évaluation

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiPas encore d'évaluation

- Tds TutorialsDocument25 pagesTds TutorialsdagliamitPas encore d'évaluation

- Efrs Manual Acctg ProcessDocument57 pagesEfrs Manual Acctg ProcessShobi Dionela100% (2)

- SECP Form FillingDocument22 pagesSECP Form FillingKhuram Shehzad JafriPas encore d'évaluation

- KiranDocument3 pagesKiransuneetbansalPas encore d'évaluation

- Functional Steps To Use Efiling &epaymentDocument66 pagesFunctional Steps To Use Efiling &epaymentAmanuelPas encore d'évaluation

- Not Configuration in SAPDocument6 pagesNot Configuration in SAPVenkat Ram NarasimhaPas encore d'évaluation

- Slna Govt. of Andhra PradeshDocument24 pagesSlna Govt. of Andhra Pradeshk_sateeshPas encore d'évaluation

- IRD - PAYE Annual ReturnDocument4 pagesIRD - PAYE Annual ReturnVarina HassanaliPas encore d'évaluation

- TdsDocument22 pagesTdsFRANCIS JOSEPHPas encore d'évaluation

- 2Document3 pages2hidden heroPas encore d'évaluation

- TDS Manual 2007 BDocument51 pagesTDS Manual 2007 BVijaysreeram TalluruPas encore d'évaluation

- Cashbook For Sage 300 ERP PDFDocument3 pagesCashbook For Sage 300 ERP PDFisako88Pas encore d'évaluation

- E-Invoice (Electronic Invoice) : List of AbbreviationsDocument5 pagesE-Invoice (Electronic Invoice) : List of AbbreviationsChirag SolankiPas encore d'évaluation

- State VAT Registration VAT Return CS T Efilin G Audi T Entry TaxDocument3 pagesState VAT Registration VAT Return CS T Efilin G Audi T Entry TaxdvikramsinghPas encore d'évaluation

- Power Point Presentation On ACES For AssessesDocument45 pagesPower Point Presentation On ACES For Assessesharishnttf8346Pas encore d'évaluation

- Vertex How To GuideDocument9 pagesVertex How To Guidesap_lm6663Pas encore d'évaluation

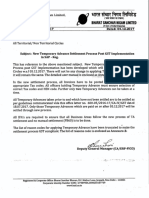

- Er Pty AdvanceDocument5 pagesEr Pty AdvanceRaghavan KPas encore d'évaluation

- SAP-TO BE Process: New Allenberrry Works Fico Naw Finance and ControllingDocument15 pagesSAP-TO BE Process: New Allenberrry Works Fico Naw Finance and ControllingsivasivasapPas encore d'évaluation

- IT-AE-41-G02 - Guide To Complete The Tax Directive Application Forms - External GuideDocument50 pagesIT-AE-41-G02 - Guide To Complete The Tax Directive Application Forms - External GuidercpretoriusPas encore d'évaluation

- All About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDocument4 pagesAll About E-Ledgers Under GST - E-Cash Ledger, E-Credit Ledger & E-Liability LedgerDINESH CHANCHALANIPas encore d'évaluation

- Interview Questions and TipsDocument45 pagesInterview Questions and TipsSoumava BasuPas encore d'évaluation

- Harmony 1111Document36 pagesHarmony 1111arvind-khanna-2954Pas encore d'évaluation

- GST Invoice Details I Essential InformationDocument7 pagesGST Invoice Details I Essential InformationShaik MastanvaliPas encore d'évaluation

- 24/7 On-Line Bookkeeping Because You Deserve A Prompt Service"Document21 pages24/7 On-Line Bookkeeping Because You Deserve A Prompt Service"HarryPas encore d'évaluation

- Tax Assessment ManualDocument294 pagesTax Assessment ManualPrudvi RajPas encore d'évaluation

- SAP Financials - Tax Collected at Source ManualDocument5 pagesSAP Financials - Tax Collected at Source ManualSurya Pratap Shingh RajputPas encore d'évaluation

- EBACS User GuideDocument24 pagesEBACS User GuideAi AizatPas encore d'évaluation

- SAT - TCS - Einvoice & Ewaybill Solution PDFDocument10 pagesSAT - TCS - Einvoice & Ewaybill Solution PDFvenkatPas encore d'évaluation

- SAT - TCS - Einvoice & Ewaybill Solution PDFDocument10 pagesSAT - TCS - Einvoice & Ewaybill Solution PDFvenkatPas encore d'évaluation

- TTPQDocument2 pagesTTPQchrystal85Pas encore d'évaluation

- VIII and IXDocument56 pagesVIII and IXTinn ApPas encore d'évaluation

- Finding Neverland Study GuideDocument7 pagesFinding Neverland Study GuideDean MoranPas encore d'évaluation

- LBST 2102 Final EssayDocument9 pagesLBST 2102 Final Essayapi-318174977Pas encore d'évaluation

- Elements of PoetryDocument5 pagesElements of PoetryChristian ParkPas encore d'évaluation

- Iii. The Impact of Information Technology: Successful Communication - Key Points To RememberDocument7 pagesIii. The Impact of Information Technology: Successful Communication - Key Points To Remembermariami bubuPas encore d'évaluation

- Management of Graves Disease 2015 JAMA ADocument11 pagesManagement of Graves Disease 2015 JAMA AMade ChandraPas encore d'évaluation

- Kozier Erbs Fundamentals of Nursing 8E Berman TBDocument4 pagesKozier Erbs Fundamentals of Nursing 8E Berman TBdanie_pojPas encore d'évaluation

- Designing HPE Server Solutions: Supporting ResourcesDocument3 pagesDesigning HPE Server Solutions: Supporting ResourcesKARTHIK KARTHIKPas encore d'évaluation

- 5f Time of Legends Joan of Arc RulebookDocument36 pages5f Time of Legends Joan of Arc Rulebookpierre borget100% (1)

- The Eaglet - Vol. 31, No. 3 - September 2019Document8 pagesThe Eaglet - Vol. 31, No. 3 - September 2019Rebecca LovettPas encore d'évaluation

- Landslide Hazard Manual: Trainer S HandbookDocument32 pagesLandslide Hazard Manual: Trainer S HandbookMouhammed AbdallahPas encore d'évaluation

- Jewish Standard, September 16, 2016Document72 pagesJewish Standard, September 16, 2016New Jersey Jewish StandardPas encore d'évaluation

- Unit 7Document10 pagesUnit 7Christopher EddyPas encore d'évaluation

- Picc Lite ManualDocument366 pagesPicc Lite Manualtanny_03Pas encore d'évaluation

- Literatures of The World: Readings For Week 4 in LIT 121Document11 pagesLiteratures of The World: Readings For Week 4 in LIT 121April AcompaniadoPas encore d'évaluation

- Dye-Sensitized Solar CellDocument7 pagesDye-Sensitized Solar CellFaez Ahammad MazumderPas encore d'évaluation

- Symptoms: Generalized Anxiety Disorder (GAD)Document3 pagesSymptoms: Generalized Anxiety Disorder (GAD)Nur WahyudiantoPas encore d'évaluation

- Cat Hydo 10wDocument4 pagesCat Hydo 10wWilbort Encomenderos RuizPas encore d'évaluation

- CS 124/LINGUIST 180 From Languages To Information: Conversational AgentsDocument58 pagesCS 124/LINGUIST 180 From Languages To Information: Conversational AgentsamanPas encore d'évaluation

- Pda Teachers GuideDocument2 pagesPda Teachers Guidepeasyeasy100% (2)

- Marriot CaseDocument15 pagesMarriot CaseArsh00100% (7)

- Review Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Document11 pagesReview Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Ulaş GüllenoğluPas encore d'évaluation

- Economics and Agricultural EconomicsDocument28 pagesEconomics and Agricultural EconomicsM Hossain AliPas encore d'évaluation

- FCAPSDocument5 pagesFCAPSPablo ParreñoPas encore d'évaluation

- MagmatismDocument12 pagesMagmatismVea Patricia Angelo100% (1)

- Damodaram Sanjivayya National Law University VisakhapatnamDocument6 pagesDamodaram Sanjivayya National Law University VisakhapatnamSuvedhya ReddyPas encore d'évaluation

- Georgia Jean Weckler 070217Document223 pagesGeorgia Jean Weckler 070217api-290747380Pas encore d'évaluation

- Research PaperDocument9 pagesResearch PaperMegha BoranaPas encore d'évaluation

- Newspaper OrganisationDocument20 pagesNewspaper OrganisationKcite91100% (5)