Académique Documents

Professionnel Documents

Culture Documents

Accounting 2

Transféré par

Holabasayya ViraktamathDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting 2

Transféré par

Holabasayya ViraktamathDroits d'auteur :

Formats disponibles

1. What does the abbreviation GAAP stand for?

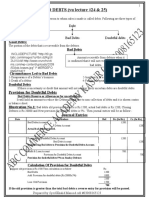

Your Answer: Generally Accepted Accounting Principles There are various generally accepted accounting principles that should always be followed by all businesses if they don't want the trouble of having auditors keep a close eye on their company. 87% of players have answered correctly. 2. What is the amount collected from the sale of goods and services called? Your Answer: Revenue When a company does a service or sells something revenue is recorded on an income statement and raises the overall equity of the owner. 81% of players have answered correctly. 3. What is it called when your expenses are greater than your revenues on an income statement? Your Answer: Net Loss You'd have a loss because you've lost money in that period of time and it would be a net meaning overall during the accounting period. 76% of players have answered correctly. 4. Which accounting principle states that the same amount of time must be used for each accounting period? Your Answer: Time Period Principle Accounting statements can be made on period of time such as monthly, annually, semi-annually etc. Every time a statement is made it should be made on the same duration of time each time to follow the time period principle. 37% of players have answered correctly. 5. What is the cash basis of accounting? Your Answer: Revenue and expenses are recognized as cash comes in or goes out. The cash basis of accounting is rarely used, however when it is used, it is recorded on an income statement when the owner of a company physically receives a payment for their goods or services or sends out a check for an expense they incurred. 58% of players have answered correctly. 6. This can be written either in an account form or a report form. Your Answer: Balance Sheet The account form balance sheet is divided into two columns assets and liabilities and equity. The report form balance sheet has assets, liabilities and equity all down a single column. 36% of players have answered correctly.

7. Which of the following is not considered a financial statement? Your Answer: Income Statement The correct answer was Trial Balance Financial statements are what the investors in the company can see. Balance Sheets and Income Statements show how a company is doing at a certain point in time. A trial balance is just a method of checking there are no errors in calculations. 57% of players have answered correctly. 8. When completing the financial statements, it is necessary to complete the income statement before the balance sheet. Your Answer: True The income statement must always be written before the balance sheet because the income statement generates a net income or loss which needs to be known so the owner equity on the balance sheet must be the same. 74% of players have answered correctly. 9. An income statement encompasses which of the following? Your Answer: Expenses, Revenues, Net Income or Net Loss The income statement shows expenses, and revenues for a specific period of time and the net income or loss are calculated by subtracting expenses from revenues. If the number is negative the company is experiencing a net loss, if it's positive it's a net income. 80% of players have answered correctly. 10. When an owner takes out money from the business for personal use, its impact on equity is recorded on the credit side. Your Answer: True The correct answer was f When cash is taken out, cash decreases on the credit side therefore the impact on the equity must occur on the opposite side, namely the debit side.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Ringkasan Saham-20201120Document64 pagesRingkasan Saham-2020112012gogPas encore d'évaluation

- Financial Analysis On Scooters India LimitedDocument9 pagesFinancial Analysis On Scooters India LimitedMohit KanjwaniPas encore d'évaluation

- ANMC 2021 Group2 UnlockedDocument145 pagesANMC 2021 Group2 UnlockedPragnesh PatilPas encore d'évaluation

- SCM Batch B - Group 3 - Madura Accessories LTDDocument35 pagesSCM Batch B - Group 3 - Madura Accessories LTDSHILPA GOPINATHAN100% (1)

- MGT 101 SampleDocument9 pagesMGT 101 SampleWaleed AbbasiPas encore d'évaluation

- Inventory Management and Cash BudgetDocument3 pagesInventory Management and Cash BudgetRashi MehtaPas encore d'évaluation

- GST Past Exam AnalysisDocument17 pagesGST Past Exam AnalysisSuraj PawarPas encore d'évaluation

- Pangan CompanyDocument18 pagesPangan CompanyWendy Lupaz80% (5)

- DLF Cost Sheet PlotsDocument6 pagesDLF Cost Sheet PlotsTobaPas encore d'évaluation

- Beaconhouse National University Fee Structure - Per Semester Year 2017-18Document1 pageBeaconhouse National University Fee Structure - Per Semester Year 2017-18usman ghaniPas encore d'évaluation

- Ch8 AR Test 9902Document7 pagesCh8 AR Test 9902ايهاب غزالةPas encore d'évaluation

- Buy Back Article PDFDocument12 pagesBuy Back Article PDFRavindra PoojaryPas encore d'évaluation

- Final accounts for year ending 1992Document50 pagesFinal accounts for year ending 1992kalyanikamineniPas encore d'évaluation

- Executive SummaryDocument7 pagesExecutive SummaryAshi GargPas encore d'évaluation

- Case Study: Buffett Invests in Nebraska Furniture MartDocument8 pagesCase Study: Buffett Invests in Nebraska Furniture MartceojiPas encore d'évaluation

- Government of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleDocument84 pagesGovernment of Ghana MLGRD A Operational Manual For Dpat 2016 A 1st CycleGifty BaidooPas encore d'évaluation

- Mba Interview QuestionsDocument3 pagesMba Interview QuestionsAxis BankPas encore d'évaluation

- Company Limited: Claim For Reimbursement of Motor Car Running ExpensesDocument1 pageCompany Limited: Claim For Reimbursement of Motor Car Running ExpensesRahul RawatPas encore d'évaluation

- NPC Vs Lucman IbrahimDocument2 pagesNPC Vs Lucman IbrahimNoelle Therese Gotidoc Vedad100% (1)

- Control Your Cash and Retirement With StocksDocument60 pagesControl Your Cash and Retirement With StocksLaurent DPas encore d'évaluation

- FI BankDocument34 pagesFI BankoptymPas encore d'évaluation

- Acquisition of Tetley by TataDocument3 pagesAcquisition of Tetley by TataANUSHRI MAYEKARPas encore d'évaluation

- Wa0022.Document37 pagesWa0022.karishmarakhi03Pas encore d'évaluation

- IFRIC 12 Service Concession AgreementDocument48 pagesIFRIC 12 Service Concession Agreementbheja2fryPas encore d'évaluation

- March PDFDocument4 pagesMarch PDFzaidaan khanPas encore d'évaluation

- SemesterDocument40 pagesSemestergokulsaravananPas encore d'évaluation

- Transfer AgreementDocument2 pagesTransfer AgreementHuntnPetePas encore d'évaluation

- Salary Slip MayDocument1 pageSalary Slip MayselvaPas encore d'évaluation

- Meralco Securities Pipeline Subject to Realty TaxDocument2 pagesMeralco Securities Pipeline Subject to Realty TaxMariano RentomesPas encore d'évaluation

- Soft Offer Iron Ore 64.5Document3 pagesSoft Offer Iron Ore 64.5BernhardPas encore d'évaluation