Académique Documents

Professionnel Documents

Culture Documents

NMMP Apr10

Transféré par

Andrew T. BermanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NMMP Apr10

Transféré par

Andrew T. BermanDroits d'auteur :

Formats disponibles

5

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

P R E S O R T E D S T A N D A R D

U . S . P O S T A G E P A I D

N M P M E D I A C O R P .

N M P M E D I A C O R P .

1 2 2 0 W A N T A G H A V E N U E

W A N T A G H , N E W Y O R K 1 1 7 9 3

46

A

P

R

IL

2

0

1

0

O

N

A

T

I

O

N

A

L

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

Ours are 35% LESS.

All title insurance premiums

ARE NOT EQUAL.

It's simple. Get title insurance through ENTITLE DIRECT. It costs less.

We offer direct rates that are up to 35% or more below the competition.

Save your borrowers hundreds, even thousands of dollars in closing

costs and watch your referrals multiply. And we offer reissue and

refinance discounts on top of our already lower rates, so you can

save your borrowers even more.

Besides industry-leading low rates, with ENTITLE DIRECT you can count on:

PROVEN EXPERIENCE - EnTitle Insurance Company has been under-

writing and issuing title insurance policies for more than 30 years. Our

Demotech Financial Stability Rating

is A' Prime, so you can be confi-

dent in our financial strength. We're members of both ALTA and CLTA.

APPROVED RATES - EnTitles low direct rates have been approved by

each states department of insurance and our policies are accepted by

major lenders, Fannie Mae, Freddie Mac and the FHA.

COMPLIANCE Our Guaranteed Settlement Fees mean you wont have to

worry whether your HUD-1s will match your GFEs, and risk not meeting

tolerance levels.

EXCELLENT SERVICE Our customer service and turn times cannot be beat.

A dedicated closing specialist will coordinate the title and closing process to

assure a trouble-free experience for you and your borrowers.

We do business where you need us -- we currently offer our lower rates in

more than 30 states, soon to be 40.

Discover how offering the lowest title insurance rates in the industry can help

you increase referrals and close more loans. Call ENTITLE DIRECT today at

877-936-8485 for a quote or visit us at www.EntitleDirect.com/mortgage.

All title insurance policies are being underwritten and issued by EnTitle Insurance Company, 4600 Rockside Road,

Independence, OH 44131. EnTitle Insurance Company is regulated by the Ohio Department of Insurance.

* Except in NM where rates are set by statute.

OUR RATES THEIR RATES

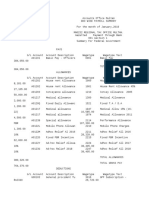

OFFICERS

Phone # E-mail

Frank Sena President (505) 474-6864 swhomeloans@yahoo.com

Wes Moore President-Elect (505) 275-0200 wes@superiormortgage-nm.com

Heidi Snow Vice President (505) 888-9500 hsnow@perennial-mortgage.com

Dennis Blomberg Treasurer (505) 896-4663 dennis@anothermortgageco.com

DIRECTORS

Brian Bagon (505) 221-6933 bbagon@lgmortgagebanc.com

Jenifer Duarte (505) 830-5085 jduarte@cltic.com

Kim Molina-Marquez (505) 998-5363 kim@trinitymtg.biz

STAFF

Theresa Castellano Executive Director (505) 480-8514 ceomom@spinn.net

Mike Walker Lobbyist (505) 250-3688 mwlobbyist@msn.com

NM 1

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

Mortgage

PROFESSIONAL

N E W M E X I C O

M A G A Z I N E

Your source for the latest on originations, settlement, and servicing

New Mexico Association of Mortgage Professionals

P.O. Box 3967 O Albuquerque, NM 87190

Phone #: (505) 480-8514 O Fax #: (505) 994-0658

Web site: www.nmamp.org

Advisor Asset Protection Management Bank President Branch Manager Business Analyst

Business Development Manager

Client Relationship Manager Client Relationship Specialist Collateral Asset Manager

Commercial Loan Officer Corporate Sales Credit Analyst Inside Sales Legal

Assistant Licensing Assistant Loan Administration Manager Loan Originator

Mortgage Loan Processor Mortgage Originator National Account

Manager National Sales Rep PC Support Admin

Post Closing QC Expert Processor Regional Vice President REO Closer

Retail Branch Manager Retirement Planner Reverse Mortgage Specialist

Sales Manager Secondary Marketing Analyst Senior Loan Officer Senior Underwriter

Senior Vice President Software Engineer Underwriter Vice President

Wholesale Account Executive

Job Seekers

Post your anonymous resume free

Sign-up for free job alerts

Free career management tools

Geographical and job type searches

Employers

Responses from highly-qualified candidates

Your ad can also be posted on Indeed and Sim-

plyHired as a Featured Job, on Craigslist (most

cities), Googlebase, Oodle, Juju, Career-

MetaSearch, TopUSAJobs, Jobalot, and more!

Pay-per-use resume bank

Post your resume. Find a job. Be happy.

Use

coupon code

NMP0551

to take advantage

of this special

offer!

40% Discount on Job Postings and

Subscriptions for all National Mortgage

Professional Magazine Readers

This offer expires July 30, 2010.

MAY 2010

Thursday-Friday, May 6-7

NMLS-Approved Pre-Licensing Education: 20 Hours (Two-Day Course) SAFE Comprehensive:

Mortgagee Essentials (ID#: 1146)

New Mexico Association of Mortgage Professionals Presents Mortgage Education Foundation

NMLS-Approved Pre-Licensing Education

Instructor: To be determined

New Mexico Association of Mortgage Professionals EXPO 2010

Albuquerque, New Mexico

8:00 a.m.-6:00 p.m. each day

For more information on all NMAMP events, call (505) 480-8514

or visit www.nmamp.org.

NMAMP

Daily updated mortgage industry news

Industry blogs

Write your own blog

Find loan programs

Discover local and national events

Get access to video

NM 2

A

P

R

IL

2

0

1

0

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

Thursday, June 24, 2010

Friday, June 25, 2010

AAMB welcomes NAMB to beautiful Phoenix!

Come see the new NAMB President and the new NAMB Board installation, while

participating in some great networking opportunities. State delegates can also

participate in the NAMB Delegate Council Meeting.

Phoenix Airport Marriott

1101 North 44th Street Phoenix, Arizona 85008 USA

Rooms are $99 per night, and will be honored at the same rate if you wish to extend your stay.

Hotel Toll-Free: 1-800-228-9290

Visit www.NAMB.orgfor details.

1

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

NMP

EXPLORER

P

A

G

E

#

O

R

I

G

I

N

A

T

I

O

N

S

S

E

C

O

N

D

A

R

Y

S

E

R

V

I

C

I

N

G

C

O

M

P

L

I

A

N

C

E

M

A

R

K

E

T

I

N

G

/

S

A

L

E

S

S

E

T

T

L

E

M

E

N

T

S

E

R

V

I

C

E

S

T

R

E

N

D

S

T

E

C

H

N

O

L

O

G

Y

R

E

S

I

D

E

N

T

I

A

L

C

O

M

M

E

R

C

I

A

L

R

E

V

E

R

S

E

M

O

R

T

G

A

G

E

S

Value Nation: The Mortgage Meltdown and Appraiser

Selection By Charlie W. Elliott Jr., MAI, SRA

Regulatory Compliance Outlook: April 2010Escrow

Requirements for Higher-Priced Mortgage Loans

By Jonathan Foxx

SAFE Smart Testing, Education and Licensing: The Test

in the Bar By Paul Donohue, CRMS

The Secondary Market Overview: Predictions

By Dave Hershman

The NAMB Perspective

NMP Mortgage Professional of the Month: Steven A.

Milner, President and Chief Executive Officer of Mortgage

Concepts

FDIC Finds Fair Lending Violations Under ECOA for Credit

Reporting Fees By Terry W. Clemans

Trend Spotter: Why Tax Knowledge Matters

By Gibran Nicholas

Half-Empty? Half-Full By Donald E. Fader, CRMS

Ask Tommy: Your QC Expert By Tommy A. Duncan, CMT

Forward on Reverse: Reverse Mortgages for First-Time

Homebuyers By Atare E. Agbamu, CRMS

A View From the C-Suite: Redefining Going Green

By David Lykken

Will the Mortgage Industry Witness Another Influx of Non-

Traditional Lenders By Ed F. Wallace Jr., Ph.D.

Going Green and Stamping Out Fraud

By Tommy A. Duncan, CMT

Paperless Lending Offers Fraud Risk Mitigation

By Sharon Matthews

Paperless or Just Less Paper? By Erik Wind

Pieces of the P.I.e: Paper, Imaged and e-Documents

By Greg Smith

Eight Reasons Why E-mail Marketing Works for Mortgage

Brokers By Wendy Lowe

4

6

7

8

10

13

18

27

27

28

33

34

38

38

39

40

42

5

MAIN STREET

62+

2

A

P

R

IL

2

0

1

0

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

April 2010

Volume 2 Number 4

1220 Wantagh Avenue Wantagh, NY 11793-2202

Phone: (516) 409-5555 / (888) 409-9770

Fax: (516) 409-4600

Web site: www.nationalmortgageprofessional.com

Mortgage

PROFESSIONAL

N A T I O N A L

M A G A Z I N E

Your source for the latest on originations, settlement, and servicing

STAFF

Eric C. Peck

Editor-in-Chief

(516) 409-5555, ext. 312

ericp@nmpmediacorp.com

Andrew T. Berman

Executive Vice President

(516) 409-5555, ext. 333

andrew@nmpmediacorp.com

Domenica Trafficanda

Art Director

domenicat@nmpmediacorp.com

Karen Krizman

Senior National Account Executive

(516) 409-5555, ext. 326

karenk@nmpmediacorp.com

Jennifer Moeller

Billing Coordinator

(516) 409-5555, ext. 324

jenniferm@nmpmediacorp.com

ADVERTISING

To receive any information regarding advertising rates,

deadlines and requirements, please contact Senior

National Account Executive Karen Krizman at (516) 409-

5555, ext. 326 or e-mail karenk@nmpmediacorp.com.

ARTICLE SUBMISSIONS/

PRESS RELEASES

To submit any material, including articles and press

releases, please contact Editor-in-Chief Eric C. Peck at

(516) 409-5555, ext. 312 or e-mail ericp@nmpmedia-

corp.com. The deadline for submissions is the first of the

month prior to the target issue.

SUBSCRIPTIONS

To receive subscription information, please call (516)

409-5555, ext. 301; e-mail orders@nmpmediacorp.com

or visit www.nationalmortgageprofessional.com. Any

subscription changes may be made to the attention of

Circulation via fax to (516) 409-4600.

Statements of fact and opinion in National Mortgage

Professional Magazine are the responsibility of the

authors alone and do not imply an opinion on the

part of NMP Media Corp. National Mortgage

Professional Magazine reserves the right to edit, reject

and/or postpone the publication of any articles, infor-

mation or data.

National Mortgage Professional Magazine is

published monthly by NMP Media Corp.

Copyright 2010 NMP Media Corp.

N

A

T

IO

N

A

L

M

O

RTGAGE PR

O

F

E

S

S

IO

N

A

L

M

AGAZI N

E

N

M

P N

M

P

A Message From NMP Media Corp.

Executive Vice President Andrew T. Berman

Going green? Paperless?

So when we thought of doing a special section on Going Green/Paperless, I assumed

wed be reporting on some great companies that have gone green and have experi-

enced great savings and an increase in productivity. Instead, I have been hearing night-

marish scenarios about $50 million-per-month mortgage operations spending in

upwards of five figures on paper and related dead-tree technology expenses. I am even

hearing stories about so-called paperless offices, where specific employees insist on

printing out PDFs so they can view their documents offline. However, most compa-

nies are trying to make the push towards paperless. It seems that the benefits, such as

savings, the ability to market yourself as a green company, increased productivity, better control over

your processes and document management, far outweigh the negatives.

In our Going Green/Paperless section, you will learn from Tommy Duncan, CMT that going paperless

is of great concern when it comes to fraud detection. The loss of wet signatures leaves room for would-

be fraudsters to take advantage of the system. Sharon Matthews shows how lenders are using technolo-

gy to analyze the data behind what you and I see on the screen to mitigate fraud. In the contribution by

Erik Wind, he shares with us how many are finding that while paperless might not be possible, there

are a great many benefits of just less paper. The section wraps up with a piece from Greg Smith of Xerox

where he shares information on his companys P.I.e (Paper, imaged documents and electronic documents)

program.

What business does a print publication like National Mortgage

Professional Magazine have featuring a section on going green? Are

we hypocritical?

Lets face the facts, while we are all getting more and more news from the Internet, the magazine format

still provides a medium that educates us about areas that we didnt know we should be in the know

about. This is evident by our increasing paid subscriber base (thats you and thank you!). Furthermore,

more than 70 percent of our readers choose to read our publication online (yes, even though 25 percent

of those choose to print it out).

On the road again

My first conference of this year was the recent Regional Conference of Mortgage Bankers Associations in

Atlantic City, N.J. and all I can say is, Wow! What a turnout! More than 1,400 attendees were on hand to

share in this magical experience. I am not talking about the plastic-fabricated magic that we were sur-

rounded by at The Trump Taj Mahal, but an organic magic created from the collaboration and networking

going on with the industrys best. The mortgage industry has filtered out the garbage and is left with the

proverbial cream of the industrys crop. And they were all there at The Trump Taj. Heres a shocker new

wholesale lenders! Overall, it was a great event that gave the feeling of a renewed sense of pride about

being a mortgage professional in 2010.

I hope you enjoy yet another edition of National Mortgage Professional Magazine. We are on the verge

of the one-year anniversary of this undertaking, and so far, have received nothing short of rave reviews.

The proof is in you, our readership, who turns to us for the latest in industry news, through both our

monthly print edition and our daily updated Web site, NationalMortgageProfessional.com. Im happy to

report that our blogger community is growing, as is the number of registered users on our site each day.

Again, I thank you for your support of our publication over the past year, and I raise my glass to toast

many more years to come.

Sincerely,

Andrew T. Berman, Executive Vice President

NMP Media Corp.

National Credit Reporting Association Inc.

125 East Lake Street, Suite 200 O Bloomingdale, IL 60108

Phone #: (630) 539-1525 O Fax #: (630) 539-1526

Web site: www.ncrainc.org

3

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

The National Association of

Mortgage Brokers

7900 Westpark Drive, Suite T-309 O McLean, VA 22102

Phone: (703) 342-5900 O Fax: (703) 342-5905

Web site: www.namb.org

PresidentJim Pair, CMC

Mortgage Associates Corpus Christi

6262 Weber Road, Suite 208

Corpus Christi, TX 78413

(361) 853-9987

jimpair@namb.org

President-ElectWilliam Howe, CMC, CRMS

Howe Mortgage Corporation

9414 E. San Salvador Drive, #236

Scottsdale, AZ 85258

(602) 200-8100

billhowe@namb.org

Vice PresidentMichael DAlonzo, CMC

Creative Mortgage Group

1126 Horsham Road, Suite D

Maple Glen, PA 19002

(215) 657-9600

michaeldalonzo@namb.org

SecretaryGinny Ferguson, CMC

Heritage Valley Mortgage Inc.

5700 Stoneridge Mall Road, Suite 150

Pleasanton, CA 94588

(925) 469-0100

ginnyferguson@namb.org

TreasurerDon Frommeyer, CRMS

Amtrust Mortgage Funding Inc.

200 Medical Drive, Suite D

Carmel, IN 46032

(317) 575-4355

donfrommeyer@namb.org

Joe Camarena

The Mortgage Source

10120 Southwest Nimbus Avenue, Suite C-7

Portland, OR 97223

(503) 443-1060 O joecamarena@namb.org

John Councilman, CMC, CRMS

AMC Mortgage Corporation

2613 Fallston Road O Fallston, MD 21047

(410) 557-6400 O jlc@amcmortgage.com

Olga Kucerak

Crown Lending

8700 Crown Hill Boulevard, Suite 804 O San Antonio, TX 78209

(210) 828-3384 O olga@crownlending.com

Walt Scott

Excalibur Financial Inc.

175 Strafford Avenue, Suite 1 O Wayne, PA 19087

(215) 669-3273 O waltscott@namb.org

Don Starks

D.C. Starks Mortgage Associates Inc.

141 South Main Street O Bourbonnais, IL 60914

(815) 935-0710 O donstarks@namb.org

Marty FlynnPresident

(925) 831-3520, ext. 224

marty@ccireports.com

Tom ConwellVice President

(248) 473-7400

tconwell@credittechnologies.com

Daphne LargeTreasurer

(901) 259-5105

daphnel@datafacts.com

William BowerDirector

(800) 288-4757

wbower@confinfo.com

Mike BrownDirector

(800) 285-6691

mike.brown@ncogroup.com

Susan CataldoDirector

(404) 303-8656, ext. 204

susancds@cdsusa.net

Nancy FedichDirector

(908) 813-8555, ext. 3010

nancy@cisinfo.net

Sanford (Sandy) LubinDirector

(805) 481-3155

slubin@cbslo.com

Judy RyanDirector

(800) 929-3400, ext. 201

jryan@kroll.com

Tom SwiderDirector

(856) 787-9005, ext. 1201

tswider@creditlenders.com

Donald J. UngerDirector

(303) 670-7993, ext. 222

don@advcredit.com

NCRA Staff

Terry ClemansExecutive Director

(630) 539-1525

tclemans@ncrainc.org

Jan GerberOffice

Manager/Membership Services

(630) 539-1525

jgerber@ncrainc.org

President

Liz Roberts-Fajardo, GML

(702) 498-8020

lvlizrf@aol.com

President-Elect

Gary Tumbiolo, CMI

(919) 452-1529

garytumbiolo@aol.com

Senior Vice President

Sharon Patrick, MML, CMI

(386) 985-1620

howell@cfl.rr.com

Vice President/Northwestern Region

Jill M. Kinsman

(206) 344-7827

jill.kinsman@usbank.com

Vice President/Western Region

Tim Courtney

(760) 792-5620

desertranchrealty@hotmail.com

Vice President/Central Region

Candace Smith, CMI

(512) 329-9040

csmith@wrstarkey.com

Vice President/Greater Northeast

Region

Colleen-Therese McKeever, CMI

(646) 584-8332

colleenmckeever@aol.com

Vice President/Southeastern Region

Jessica Edmonston

(919) 414-3028

jedmon3601@yahoo.com

Secretary

Laurie Abisher, GML, CMI

(661) 283-1262

lauriea@gemcorp.com

Treasurer

Kay Talley, MML

(919) 846-4294

kay.talley@genworth.com

Parliamentarian

Hulene Bridgman-Works

(972) 494-2788

hulene137@yahoo.com

NAMB Board of Directors

National Association of Professional

Mortgage Women

P.O. Box 140218 O Irving, TX 75014-0218

Phone: (800) 827-3034 O Fax: (469) 524-5121

Web site: www.napmw.org

Officers

Directors

2010 Board of Directors

National Board of Directors

4

A

P

R

IL

2

0

1

0

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

The Mortgage Meltdown and

Appraiser Selection

Within the past couple of years, we have

experienced a complete meltdown of

our economy, the mortgage industry

and our banking system. As a result, we

have witnessed wholesale changes in the

way appraisals are purchased. Mortgage

brokers, loan officers and anyone else

with a financial interest in a transaction

are unable to purchase appraisals.

This requirement has

been imposed by Fannie

Mae, Freddie Mac and

the Federal Housing

Administration (FHA) on

all loans, either pur-

chased or made by them.

In todays market, that

represents most, if not

all, of the mortgage loan

market. In the past, Wall

Street was buying loans,

but that practice has

ground to a halt due to

all of the bad loans. As a

result, federally-backed

mortgages are practically

the only game in town.

There has been much

complaining by mortgage

brokers, loan officers

and even Realtors and

appraisers over this new

practice. Unfortunately, the change

comes at a time when loan volumes are

in the gutter, property values are in the

tank, home foreclosures are at an all-

time high, and the overall economy is

on the ropes. When we combine all of

these factors, it makes the origination of

a marginal loan difficult, to say the

least. Some say that these marginal

loans should not be made; others say

that these circumstances make apprais-

ers less accountable.

Many have complained about this

new process and the new rules. Is it

likely to change, or are we stuck with a

system where lenders and Realtors are

not going to be able to select and or

communicate with appraisers in the

future?

Before determining the answer, we

must consider the fact that our entire

financial system was in danger of going

down the tubes as a result of the mort-

gage meltdown. Practically everyone in

our society was damaged in one way or

another by the collapse of the system,

and, like it or not, most of the problem

stemmed from toxic mortgages. Due to

this catastrophic failure

of the system, our politi-

cal leadership cannot and

will not take this problem

lightly. While there is suf-

ficient blame to go

around, the consensus of

opinion is that inflated

appraisals were largely to

blame for the crack in the

monetary system. It will

not be easy going forward

for regulators and politi-

cians to relax appraisal

procurement rules set in

place by Fannie, Freddie

and the FHA. Specifically,

what may we expect in

this regard?

For starters, there is

likely to be a tightening

of the mortgage system in

months to come like we

have never seen. Interest rates are

going to increase, mortgage qualifica-

tion requirements will continue to be

rigid for many would-be borrowers,

and appraisal scrutiny will be tougher,

not lighter.

The powers that be are currently say-

ing that the root of the problem is

appraiser pressure being imposed by

those selecting appraisers, purchasing

appraisals and reviewing appraisals

and that these are the very people

standing to gain by collecting fees from

the closing of the loan transaction.

Further, appraisers, in some cases, are

accused of collecting fees on appraisals,

which they inflate just to insure that

continued on page 7 continued on page 6

While there is

sufficient blame to go

around, the consensus

of opinion is that

inflated appraisals

were largely to blame

for the crack in the

monetary system.

By Charlie W. Elliott Jr., MAI, SRA

Columbia Law School

study finds: Federal action

resulted in more defaults

and riskier lending

Federal action to exempt national

banks from state anti-predatory lend-

ing laws resulted in more defaults and

riskier lending compared to other

banks, found a study funded by the

National State Attorneys General

Program at Columbia Law School. At

the same time, the study found anti-

predatory lending laws enacted by

some to protect consumers from abu-

sive and unfair mortgage practices

saved many people from losing their

homes to foreclosure.

The implications of these results are

extraordinarily important, said James

Tierney, director of the National State

Attorneys General Program. This

report proves that that vigorous state

consumer protection laws make a posi-

tive difference for consumers through-

out the country. The federal govern-

ment must respect that clear fact.

The study, titled The Preemption

Effect: The Impact of Federal

Preemption of State Anti-Predatory

Lending Laws on the Foreclosure Crisis,

was conducted by researchers at the

UNC Center for Community Capital. It

found foreclosures and risky lending

increased as a direct result of the pre-

emption order enacted by the Office of

the Comptroller of the Currency (OCC)

in 2004.

Our research confirms that state

consumer protection laws worked, but

that when one group of lenders is

handed a regulatory free pass, they are

going to take advantage of it, said

Center for Community Capital Director

Roberto G. Quercia. In this scenario,

unfortunately, we see preemption shift-

ing the activities of federally insured

banks to riskier activities than they

would otherwise have pursued.

The research findings are the result

of two companion reports that offer the

first comprehensive look at loan quali-

ty and performance following the fed-

eral preemption of state laws in states

with and without strong anti-predatory

lending laws.

This research shows the need for

strong, consistent mortgage laws in

North Carolina and across the country,

said North Carolina Attorney General

Roy Cooper, who wrote the nations first

comprehensive state law combating

predatory lending as a state senator.

While our laws kept more homeowners

from risky loans than other states, our

communities are still suffering from too

many foreclosures. Washington needs to

let states set high standards and hold

unfair lenders accountable.

The order exempted nationally char-

tered banks and their subsidiaries from

most state laws regulating mortgage

lending, including stricter laws that had

been passed by some states to curb

abusive, predatory mortgage lending.

The center analyzed data from 2.5

million mortgages before and after fed-

eral preemption in states with and

without anti-predatory lending laws.

The mortgages examined were issued

from 2002-2006, and represent about

30 percent of U.S. mortgages rated sub-

prime or Alt-A and about five percent of

all U.S. mortgages during the period.

We believe these results provide

strong support for policy proposals that

will prevent regulatory loopholes, so

that borrowers can rely on the full pro-

tection that state laws afford them,

said Quercia.

For more information, visit

www.ccc.unc.edu/preemptioneffect.

California tops Interthinx

mortgage fraud risk

index for Q4 of 2009

Interthinx has released its quarterly

Mortgage Fraud Risk Report, covering

data collected during the fourth quar-

ter of 2009. The report includes an

analysis of national mortgage fraud

and indices for the four most common

types of mortgage fraud. It indicates

that most fraud types are on the rise,

with increases in the risk index for

occupancy fraud, employment/income

fraud, and property valuation. The lat-

ter is up more than 100 percent from

two years ago.

The study finds that California now

has the highest mortgage fraud risk,

5

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

Rapid Rescore (NO DOC)

Score Increasing Tools

Monthly Credit Score Monitoring

(SCORE WATCH)

Instant Credit Reports

Same Day Credit Supplements

Learn more about our services by calling,

Lorenzo Pugliano, President and CEO

at 631-299-2084.

www.platinumcreditservices.com

Heres what our customers are saying:

My loan ofcers have been closing more loans

by running credit reports through PCSs credit

scoring services

In July 2008, the Federal Reserve Board approved a final rule, which amends

Regulation Z (the Truth-in-Lending Act) and was adopted under the

Homeownership and Equity Protection Act (HOEPA). The new rule addressed and

defined higher-priced mortgage loans (HPML), a new category of mortgage

loans, while also providing additional protection to consumers.

1

Most require-

ments of the rule were to be implemented on Oct. 1, 2009.

Four key protections were provided to consumers:

O Borrower Ability: Lenders must take a borrowers ability to repay the loan from

income and assets other than the homes value into account when making the loan.

O Verification of Income/Assets: Lenders must verify the income and assets

they rely upon to determine repayment ability.

O Prepayment Penalty: Prepayment penalties are prohibited if the mortgage

payments can change in the first four years; and, for other higher-priced loans,

a prepayment penalty period cannot last for more than two years.

O Escrow Accounts: Lenders must establish escrow accounts for property taxes

and homeowners insurance for all first-lien mortgage loans.

HPML calculation

Determining if a loan is an HPML origination requires a calculation using a spe-

cific survey-based index, as follows:

The rules definition of an HPML origination captures virtually all loans in the

sub-prime market, but generally excludes loans in the prime market.

Effective date: April 1, 2010

The escrow account requirement must be implemented on April 1, 2010. This

deferral of the requirement until April 1, 2010 was given in order to provide orig-

inators sufficient time to set up escrow account procedures. Lenders must become

familiar with federal and state escrow account requirements.

Implementation dates

O Effective April 1, 2010, the lender will be required to set up an escrow account

for residential real estate-secured HPMLs.

O Effective Oct. 1, 2010, the lender will be required to set up an escrow account for

non-real estate-secured (principal dwelling) HPMLs (i.e., manufactured homes).

Escrow requirements

Effective with the dates indicated above for the respective types of HPMLs, the

Escrow Requirements for

Higher-Priced Mortgage Loans

lender must set up an escrow account for loans subject to the HPML escrow

requirements. Escrow mandates only affect first lien transactions. (Exception:

Escrow is not required for a condominium, if the condominium association main-

tains a master policy that covers the individual condominium units for items such

as homeowners insurance and property taxes.)

The HPML originations escrow account must be set up to pay items such as

property taxes and premiums for mortgage-related insurance (such as homeown-

ers insurance) that the lender has required.

RESPA requirements

Escrow requirements under federal law, such as under the Real Estate Settlement

Procedures Act (RESPA), must be implemented. RESPA provides detailed escrow require-

ments, escrow account calculation methodologies, and also some model forms.

2

Some salient RESPA requirements for escrow accounts

O Disclosure of the initial escrow account statement at the time an escrow

account is established.

O Annual escrow account disclosure.

O Certain limitations on how the escrow account is funded, ensuring that the

account is not overfunded with the borrowers money.

State requirements

State law places further requirements on escrow accounts. Some states exceed

RESPAs mandates in limiting the amount of the escrow cushion. Additionally, state

law might require the lender to pay interest on the amount in the escrow account.

Submit your questions

Do you have a regulatory compliance issue that youd like to see addressed in the

Regulatory Compliance Outlook Column? If so, e-mail your issue or concern to

Jonathan Foxx at jfoxx@lenderscompliancegroup.com.

Jonathan Foxx, former chief compliance officer for two of the countrys top publicly-

traded residential mortgage loan originators, is the president and managing director

of Lenders Compliance Group, a mortgage risk management firm devoted to provid-

ing regulatory compliance advice and counsel to the mortgage industry. He may be

contacted at (516) 442-3456 or by e-mail at jfoxx@lenderscompliancegroup.com.

Footnotes

1Compliance with the new rules, other than the escrow requirement, is manda-

tory for all applications received on or after Oct. 1, 2009. The escrow requirement

has an effective date of April 1, 2010 for site-built homes, and Oct. 1, 2010 for

manufactured homes

2See 24 CFR 3500.17, RESPAs Escrow Requirements section, for further informa-

tion on RESPA escrow requirements. The U.S. Department of Housing & Urban

Development (HUD) publishes a number of Public Guidance Documents that illus-

trate the proper way to fund and manage an escrow account.

Survey-Based Index

The rule establishes a category of higher-priced mortgage loans secured by a

consumers principal dwelling, defined as a first lien mortgage that has an

annual percentage rate (APR) that is 1.5 percentage points or more above the

average prime offer rate, or, if the loan is a subordinate lien loan, 3.5 per-

centage points above this Survey-Based Index.

The average prime offer rate index is based on a survey published by

Freddie Mac, and can be found on Freddie Macs website at the following tab:

Weekly Primary Mortgage Market Survey.

Daily updated mortgage

industry news

Industry blogs

Write your own blog

Find loan programs

Discover local and

national events

Get access to video

6

A

P

R

IL

2

0

1

0

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

CSBS and AARMR reach

settlement agreement

with CitiFinancial

The Conference

of State Bank

Supervisors (CSBS)

and the American

Association of

R e s i d e n t i a l

Mortgage Regulators (AARMR) have

announced a 35-state settlement, in which

CitiFinancial agreed to remit a $1.25 million

penalty. The agreement between state

mortgage regulators and CitiFinancial

was executed following an examination

conducted by the Massachusetts Division

of Banks to determine compliance with

state and federal consumer protection

laws. The examination found that

CitiFinancial had failed to report 91,127

residential mortgage loans to the federal

government as required by the Home

Mortgage Disclosure Act (HMDA). The res-

idential mortgage loans that were omit-

ted from CitiFinancials HMDA Loan

Application Register were originated

between 2004 and 2007. The failure to

report the loans was apparently caused

by an internal systems error at

CitiFinancial that went undetected until

the Massachusetts Division of Banks

examination.

HMDA remains the primary tool we

utilize to ensure compliance with fair

lending laws and regulations, said

Steven L. Antonakes, Massachusetts

Commissioner of Banks. By failing to

accurately report all required transac-

tions, CitiFinancial hampered our ability

to complete that assessment. Therefore,

this agreement will ensure that the sys-

tems, training, and appropriate over-

sight and controls are in place to avoid a

similar occurrence in the future.

Major terms of the agreement

include:

O CitiFinancial already resubmitting

corrected and complete HMDA

reports to the Federal Reserve

System for the years 2004-2007;

O CitiFinancial engaging an independ-

ent consultant to conduct a thor-

ough fair lending review to ensure

the data from the previously unre-

ported 91,127 mortgage transac-

tions does not in any way demon-

strate a pattern or practice of dis-

criminatory lending practices;

O CitiFinancial will thoroughly review

and substantially modify its internal

control procedures to ensure all

reportable HMDA transactions are

accurately compiled and reported; and

O CitiFinancial will remit a penalty

totaling $1.25 million to the 35 states

that are party to this agreement.

This settlement highlights the value

of state enforcement of federal con-

sumer protection laws, said Mark

with an index value of 222. Nevada,

which had the highest index for the

previous five consecutive quarters,

drops to second place with an index of

220, and is closely followed by Arizona

with an index of 211. Florida remains

in fourth place with an index of 179,

while Colorado is in fifth place at 153.

The occupancy fraud risk index

rose 16 percent since last quarter

the first significant increase in the

index since the fourth quarter of

2006. The magnitude of the quarter-

on-quarter increase suggests that

occupancy fraud risk will be a seri-

ous issue going forward, as continu-

ing price declines and get-rich-quick

schemes lure investors back into the

market and as builders face continu-

ing difficulty in moving unsold

inventory.

Despite a slight (four percent) quar-

ter-on-quarter decrease, the property

valuation fraud risk index is up 40 per-

cent over last year and up more than

100 percent from two years ago.

Schemes involving short sales, real

estate-owned (REO) inventories, whole-

sale flipping, and refinancing by bor-

rowers whose equity has been

impaired by falling real estate values

continue to drive this index.

Interthinx analysts expect lenders

to focus more closely on fraud risk mit-

igation as they work to emerge from

the downturn. This will help guard

against the potential for fraud as a

large number of adjustable rate mort-

gage loansespecially option ARMs

with negative amortization features

reset between now and the first quar-

ter of 2012.

Lenders have expressed their

appreciation for our investment to pro-

vide a more detailed analysis of the

data weve been collecting, said Kevin

Coop, president of Interthinx. Our

most recent report provides data that

lenders can use to anticipate and pre-

pare for trends that will impact their

risk mitigation strategies. The report

can ultimately make them more suc-

cessful at identifying fraud before loans

are funded.

The Interthinx Mortgage Fraud Risk

Report is fast becoming the primary

source of information about fraud risk

in the mortgage industry, and with

good reason, added Mike Zwerner,

senior vice president for Interthinx.

Interthinx has the depth of data to

identify, categorize, and help lenders

effectively mitigate mortgage fraud

risk. Using our own proprietary data

along with outside public data

resources, the quarterly report reveals

where mortgage fraud risk is occurring,

where it is migrating, and how

schemes are changing. Were pleased

that more institutions are relying on

our reports.

For more information, visit

www.interthinx.com.

news flash continued from page 4

The Test is the Bar

It made no sense to me. When I heard you could take the national test before sit-

ting for the 20 hours of pre-license education (PE), Im thinking what a regulatory

boondoggle. How could they draft up something this illogical? Then I learned it was-

nt a mistake; this disconnect was quite purposeful.

Rich Madison, the NMLS Director of Education Programs explained to our educa-

tion working group that, it is not pre-testing education, it is pre-licensing education.

He added, there is no connection between the education requirements of the SAFE

Act and the national test. This seemed curious to me. I knew it needed further ex-

ploration. What were they up to?

Education Minimized, the Test Emphasized

The twenty hours of required PE is designed to satisfy a bare minimum of MLO

competency requirements. The twenty hours only requires 8 hours of core education;

the remaining twelve hours is elective. Each state is allowed to use as many of these

elective hours for any state education it deems appropriate. It began to dawn on me

that education, though important, was not the focus of MLO competency validation.

Clearly, the bar of entry is the national test. It supplies the true capability meas-

urement for MLOs. The national test is designed to be both broad and deep. The test

covers 146 different areas of study. The test questions are interpretive in nature, re-

quiring a firm conceptual understanding of these subjects in order to score well. The

test is the bar and it is set quite high.

Test Break Down

The national test component entails 100 questions that include 10 un-scored questions

used for developmental purposes. The questions are all multiple choice and you will have

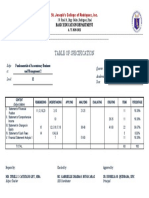

150 minutes for completion. The test is broken down into the following four categories.

O Federal mortgage related laws (35%)

O General mortgage knowledge (25%)

O Mortgage loan origination activities (25%)

O Ethics (15%)

My concern for brand new students of the mortgage industry is the MLO activities

section, which covers more that 62 separate subjects. A new person with no contex-

tual understanding of the business will naturally struggle in this area.

My concern for an experienced mortgage veteran is the federal law and the ethics sec-

tions, which explore 14 different federal laws and consumer protections. How long has

it been since you studied the HOEPA prohibitions? Do you understand the difference be-

tween providing ECOA based adverse action vs. FCRA based adverse action notices?

A SAFE Smart Approach

Dont think you are going to waltz into this test and ace it. The questions are filled

with double negatives and trip words designed to throw you off. This is first a read-

ing test and second, a knowledge bar.

The industrys new bar of entry is the 100-question national test. My SAFE Smart

advice to you is take a test specific 20-hour PE course first, then get a good exam prep

tool and buckle down to study.

Paul Donohue, CRMS is a 23-year industry professional and founder of Abacus Mortgage

Training and Education. Paul served on two NMLS working groups, establishing the new

national education protocols. Go to AbacusMortgageTraining.com to find out more about

your obligations for testing, education and licensure, or call (888) 341-7767.

continued on page 9

7

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

Tax Return Verication (4506 tax transcript done

in less than 24 hours in most cases)

Flood Certication Report

Automated Valuation Model (AVM) Reports

Verication of Employment (VOE)

Learn more about our services by calling,

Lorenzo Pugliano, President and CEO

at 631-299-2084.

www.platinumcreditservices.com

Heres what our customers are saying:

By using PCSs VOE service, I was able to move the

cost onto the HUD1 and virtually get the VOEs done at

no cost to my company

PCSs high level of customer service ensures that my

loans close on TIME!

the loan closes and of continuing to get

business from the people who hired

them. Even when it is not true, the per-

ception is there, and, because of this, it

will be hard for regulators and legisla-

tors to allow business as usual.

In conclusion, it is not fair to any of

the self-respecting professionals con-

cerned, including lenders, appraisers

and Realtors, to be subjected to the

temptation to commit fraud or to be

positioned where the perception would

be that they are acting in a less-than-pro-

fessional manner. Neither is it fair to the

taxpayer for there to be a door for indus-

try participants to practice business in

such a way that the taxpayer is on the

hook to cover the cost of avoidable bad

loans. Nor is it fair to the borrower to pay

for an appraisal and a loan whereby he

or she is exposed to foreclosure due to

unscrupulous business practices.

Finally, it is not fair to the regulators,

who must enforce rules, to be put in a

position where there is opportunity for

fraud on their watch. Given all of the rea-

sons above, stricter rules are not only like-

ly to be implemented, but they are also

necessary to protect a system from which

we all benefit from as professionals.

value nation continued from page 4

If these rules eliminate a few bad

apples, so be it. In the past, the bad

apples had the advantage of siphoning

off business from those who follow the

rules. Under todays new system, the

playing field is level and the ethical pro-

fessionals will enjoy the business pro-

vided by our industry, without being

put in a position of their having to sub-

scribe to the same underhanded tactics

of the less-than-ethical practitioners in

order to earn a living.

Yes, stricter rules will come at a

price, but it is worth the investment. It

is a necessary cost of doing business

and it will serve to protect all of society

from the type of catastrophic events

that we have experienced and are expe-

riencing. Going forward, appraisers

must continue to be insulated from the

pressure of those having a financial

interest in loan transactions.

Charlie W. Elliott Jr., MAI, SRA, is presi-

dent of Elliott & Company Appraisers, a

national real estate appraisal company.

He can be reached at (800) 854-5889, e-

mail charlie@elliottco.com or visit his

companys Web site, www.appraisalsany-

where.com.

So whats the answer? Be knowl-

edgeable. That is why we teach the sec-

ondary markets as part of the Certified

Mortgage Advisor Program. Hedge your

bets. Make sure your business model is

diversified. Putting all your eggs in one

basket is never a good idea.

I asked Eric Holloman, our secondary

expert and the chief executive officer of

RateLink, about his view of the future.

He says that it is important to watch the

national news. For example, many loan

officers are trying to figure out why

their loans are getting underwritten to

death right now when the crisis should

be easing. Yet, if you read about Fannie

Mae repurchases and what lenders are

going through in this regard, it makes

perfect sense. If the loan is not perfect,

when something goes wrong, it is being

thrown back in their face. It is not only

about rates, it is about how someone

will have to navigate the process to

achieve the American dream of home-

ownership.

Dave Hershman is a leading author for

the mortgage industry with eight books

and several hundred articles to his credit.

He is also head of OriginationPro

Mortgage School and a top industry

speaker. Daves Certified Mortgage Advisor

Program can be found at www.webina-

rs.originationpro.com. If you would like

to stay ahead of what is happening in the

markets, visit ratelink.originationpro.com

for a free trial or e-mail success@hersh-

mangroup.com.

One word that says it all. We are con-

stantly trying to predict the future.

When you go on the street and meet

with real estate agents, they ask you,

What do you think will happen with

rates? When you set up your business

plan, it is all about know what will hap-

pen within several areas of the mar-

kets, such as refinances versus purchas-

es. Consider this prediction released

recently:

Refinances in 2010 will be down 52

percent and purchase mortgage vol-

ume will be down five percent from

2009, according to the latest projec-

tions from iEmergent, a Des Moines,

Iowa-based market research firm.

Others have predicted rising rates

this year and cite the following factors:

O The Federal Reserve Board with-

drawing from the mortgage-backed

securities (MBS) markets

O The Fed also starting to tighten

monetary policy as the economy

recovers. The Fed has already

increased the Discount Rate as a

symbolic gesture.

O The markets getting spooked by

large government deficits which will

fuel the threat of inflation. As the

government borrows more, this

forces rates up because of increased

supply in the bond markets.

Here is the problem. We cannot pre-

dict the future. One event tomorrow

could change everything. That is why I

have never been a believer in technical

charts. It is the fundamentals which are

important. Fundamentally, we are

heading into an economic recovery,

and if all goes well, rates will rise, but

not drastically. If the economy gets too

strong too quickly or steps back into a

recession, all bets are off. These factors

are so entwined that we never know

how they will come out. For example, if

the recovery is stronger, that means

higher rates because of the risk of infla-

tion. But a stronger recovery also

means that the deficit will start to

diminish more quickly and that could

translate into lower rates. Finally, if the

recovery is stronger, people will have

more jobs and buy more houses, which

makes it more likely that housing prices

are not falling and mortgages become a

favored investment again. Confused

yet?

Your job as an originator is to stay on

top of what is happening. Today, that

means every hour. You need not be

able to predict the future. However, you

should know what factors are in play

and what events are on the horizon that

could impact the markets. For example,

if you dont know that the employment

report is being released the first Friday

of every month, you cannot stay on

top of the markets. I get a text mes-

sage on my phone from RateLink

(www.RateLink.com) that provides

upcoming events, as well as changes

in the markets.

Once again, predictions are not only

about rates. The economy itself pro-

vides much suspense for us. For exam-

ple, I am surprised at how many origi-

nators are starting loan modification

efforts now. I have often said that loan

mods might be a great service from one

to four years. It is now almost two years

after I started saying that. Some see pre-

dictions of five million foreclosures to

come on a market and predict that loan

mods will be going strong five years

from now. But the fact is that a stronger

economy, along with low rates and a tax

credit, could shorten this period to 18

months. And that would be good for all

of us. Do I know the answer? No.

However, I do know the factors in play

that could change the time frame sig-

nificantly. Even the value of the dollar

becomes important because if the dol-

lar stays weak, this increases demand

from foreign investors. Basically,

American real estate is on sale. And the

sale is really great if you are from a

country with a strong currency.

Predictions

Refinances in 2010 will be down

52 percent and purchase mortgage

volume will be down five percent

from 2009, according to the latest

projections from iEmergent, a Des

Moines, Iowa-based market

research firm.

8

A

P

R

IL

2

0

1

0

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

NAMB Setting the Bar on

Professionalism in the

Mortgage Industry

A Message From NAMB President Jim Pair, CMC

If you did not attend the 2010 National Association of Mortgage

Brokers Legislative & Regulatory Conference in February, you missed

one of the very best conferences NAMB has sponsored that I have

ever attended. Every panel covered a topic that was crucial to our

industry, and the panelists were experts on the topics presented.

There was plenty of time for the attendees to address the panelists

with questions that were answered in a straightforward manner. The highlight of

the event was the luncheon where Federal

Housing Administration (FHA) Commissioner

David H. Stevens spoke to us. He provided us with

some important information, including discussing

the important role the mortgage broker plays in

the mortgage distribution channel.

Many of the attendees came up to me or

expressed in e-mails, the same impressions I had

of the conference. Much of the credit for such a

successful conference must be given to Jon Otto,

NAMBs director of government affairs. Jon and

the staff of NAMB were responsible for the organ-

ization of the conference, selecting the topics for

the various panels, arranging for the panelists to

speak and locking up Commissioner Stevens as our luncheon speaker. Many

thanks to Jon and his team for a conference that was well-planned, well-coordi-

nated, and as I said previously, one that was very informational on all the current

issues impacting our industry.

The Legislative & Regulatory Conference is just one of the many benefits for NAMB

members. It is the only conference NAMB holds that is restricted to NAMB members

only. As a member attending the conference, you are receiving information before

anyone else, as evidenced by Commissioner Stevens announcement at our luncheon.

In the current market environment, there are two more very important bene-

fits for NAMB members.

The Lending Integrity Seal of Approval sets you apart

from all the other loan originators. As a NAMB member

licensed under the SAFE Act and certified by your state asso-

ciation, you are qualified to use the Seal. By using the Seal,

you have pledged to abide by a strict Code of Ethics,

Professional Standards and Best Lending Practices, and a

NAMB grievance review process.

The Seal should be used in all in your advertising, busi-

ness cards, stationery, etc. You can go to www.lendingin-

tegrity.org and learn how to download the Seal for use in radio ads, print ads,

press releases and letters to your customers and prospects. There is even a video

that you can use in presentations to Realtors, business groups or other groups that

tells the story of the Lending Integrity Seal of Approval. The Seal will truly set you

apart from loan originators who do not qualify.

Besides qualifying for the Lending Integrity Seal of Approval, a NAMB member

may go one step further and obtain a designation. NAMB offers the Certified

Mortgage Consultant (CMC), the Certified Residential Mortgage Specialist (CRMS)

and the General Mortgage Associate (GMA) designations. Anyone receiving their

designation has distinguished themselves from other originators, even those

qualified to use the Lending Integrity Seal of Approval. Obtaining a NAMB-certi-

fied designation means you have passed a rigorous test, have experience in the

industry and met the necessary qualifying points to earn the designation. Go to

www.namb.org and click on the Certification tab and learn more about how you

can achieve the highest level of professionalism and really set yourself apart from

all other loan originators.

These are only a few of the benefits available to you when you become a NAMB

member. To learn more on how to become a member, go to www.namb.org and

click on the Membership button, scroll down to Join Now and click to join. You

will find all the information needed to join the only association working to pro-

tect our industry and the consumer.

Jim Pair, CMC is with Mortgage Associates Corpus Christi and is president of the National

Association of Mortgage Brokers. He may be reached by e-mail at jimpair@namb.org.

Certification? Certainly!

How Do You Know?

A Message From NAMB Certifications

Committee Chair Pava J. Leyrer, CMC, CRMS

I am sure everyone is buzzing with licensing requirements that all

loan originators for non-depositories have to complete in the next

two to four months. Whether we agree or not, it is the law and we

must comply with it to be licensed. The reason I bring this up is

because of standards and a basic thought process.

Do you know just the basics to do your job, or are you above the

curve and make it part of your profession to excel? To be licensed, you have the

required minimum in each state and must follow those. To receive a certification,

it is now your choice and opportunity to excel above the basics to a higher level

and set yourself apart from everyone else.

How do you know though which to choose? I have personally seen different

offerings for distinction and there are even more coming out now for various

topics. When I was reviewing those options and trying to decide, I looked at what

credentials and knowledge was needed. As I reviewed the NAMB certifications

and the goals set for them, I realized that this was more than just a pay for

paper certification. I was not buying the right to have the CMC (Certified

Mortgage Consultant) or CRMS (Certified Residential Mortgage Specialist) titles. I

had to work for them and know my profession and then prove it through a test

to gain those honors.

I have always been passionate about my industry and profession. It has been

an area that the experienced train and share with those wanting to break into our

industry. I believe that those of us still fighting for what we believe in and what

we have to offer our valued customers and communities, can also recognize the

importance of defining our knowledge and taking the next step to becoming cer-

tified and maintaining these certifications.

Take time today to know where you want to stand in this industry and how

becoming NAMB-certified can benefit you and your business.

Pava J. Leyrer, CMC, CRMS, is president and owner of Heritage National Mortgage

Corporation in Grandville, Mich., and Certifications Committee chair for the

National Association of Mortgage Brokers. She may be reached by phone at (616)

534-4993 or e-mail pava@heritagenational.com.

For more information on the National Association of Mortgage Brokers, visit www.namb.org.

9

w

w

w

.

N

a

t

i

o

n

a

l

M

o

r

t

g

a

g

e

P

r

o

f

e

s

s

i

o

n

a

l

.

c

o

m

O

N

E

W

M

E

X

I

C

O

M

O

R

T

G

A

G

E

P

R

O

F

E

S

S

I

O

N

A

L

M

A

G

A

Z

I

N

E

O

A

P

R

IL

2

0

1

0

We make FHA and HVCC compliance easy

with our tools built around your business

We work with YOUR appraisers

Online automated appraisal ordering

Learn more about our services by calling,

Lorenzo Pugliano, President and CEO

at 631-299-2084.

www.platinumcreditservices.com

Heres what our customers are saying:

PCS appraisal management services allowed

me to create a virtual firewall between the loan

officers and the appraisers, yet still maintain

a high level of quality, fast, and accurate

appraisals

Bank of America is a strong propo-

nent of the home retention goals of the

Making Home Affordable program, and

we have placed HAMP at the center of

our broad-based mortgage modifica-

tion efforts, said Schakett. Recently,

we became the first servicer to formal-

ly agree to participate in the HAMP sec-

ond-lien modification program, further

demonstrating our commitment to

putting as many financially struggling

homeowners as possible into a more

affordable and sustainable situation.

Bank of America is also a leading

lender-participant in the Home

Affordable Refinance Program (HARP).

Nearly 152,000 Bank of America cus-

tomers have benefitted through the

enhanced loan-to-value and stream-

lined provisions of that prong of the

Making Home Affordable initiative. In

total, Bank of America helped more

than 1.1 million customers refinance

their home in 2009.

For more information, visit www.banko-

famerica.com.

NAHB poll shows

Americans firmly

support government

housing initiatives

Americans remain strong-

ly committed to federal

support for homebuyers,

according to a recent

survey of U.S. house-

holds conducted by the

National Association of Home Builders

(NAHB) by RT Strategies. Roughly 68 per-

cent of those polled said the government

should continue to support housing,

and 65 percent believe the govern-

ment should be doing more to keep

families from losing their homes to

foreclosure.

RT Strategies, is a non-partisan pub-

lic opinion polling firm based in

Washington, D.C. RT Strategies inter-

viewed a representative sample of

1,000 adults nationwide by telephone

using live interviewers on Jan. 29-31,

2010. The sample included 170 inter-

views with respondents from cell-

phone-only households.

Among those polled, some key

groups said the government should

continue to play a vital role in main-

taining a healthy housing market. For

example, 78 percent of all potential

homebuyers, including 81 percent of

renters intending to buy a home in the

near future, said the government

should continue to support housing.

Roughly 65 percent of homeowners

said the government also needs to do

more to keep families from losing their

homes. Support for more foreclosure

protection was not confined merely to

current homeowners. Among renters,

84 percent said the government needs

to do more to helped strapped borrow-

ers. This issue is particularly important

to women, with 71 percent supporting

Pearce, president of AARMR and Chief

Deputy Commissioner of the North

Carolina Office of Commissioner of

Banks. State regulators supplement

existing federal efforts and help ensure

consumer protections are rigorously

enforced. This settlement demon-

strates the ability of state regulators to

work together effectively to address

our systemic compliance concerns with

a large national lender.

State regulators have significantly

enhanced multistate cooperation in

recent years through projects such as

the development and launch of the

CSBS/AARMR Nationwide Mortgage

Licensing System (NMLS) and the cre-

ation of the Multi-State Mortgage

Committee to provide seamless super-

vision of mortgage companies operat-

ing in more than one state.

For more information, visit

www.csbs.org or www.aarmr.org.

Bank of America com-

pletes 12,700 permanent

HAMP modifications

Bank of America

has realized sig-

nificant gains

modifying mort-

gages through the governments Home

Affordable Modification Program

(HAMP). At the reporting deadline for the

U.S. Department of Treasurys February

2009 monthly servicer progress report,

Bank of America had quadrupled the

number of completed modifications for

its customers since the previous months

report.

More than 12,700 Bank of America

customers now have a permanent

Home Affordable modification, up

from nearly 3,200 a month earlier.

Another 13,700 permanent modifica-

tions are pending, meaning final

modified loan terms have been

approved and documents have been

sent for the customers signatures,

which will be their final step to a

completed modification.

In the past month, our concerted

customer outreach initiative has driven

a substantial increase in the rate of

conversions from trial to permanent

modifications, as we anticipated in our

recent reports of HAMP progress, said

Jack Schakett, credit loss mitigation

strategies executive for Bank of

America Home Loans. These results

are attributable to the resources

including expansion of our default

management staffing to more than

15,000and focus we have placed in

support of this and other homeowner-

ship retention programs.

Since January 2008, Bank of

America has helped 700,000 customers

with a loan modification through our

own programs and with trial and com-

pleted modifications through the

Administrations Home Affordable

Modification Program (HAMP).

news flash continued from page 6

greater foreclosure protection, com-

pared to 58 percent of men.

Keeping families in their homes is

also particularly important to first-time

homebuyers, as 78 percent of young

adults under age 30 support greater

foreclosure protection. And 69 percent

of adults who are 30-44, the prime age

range for move-up buyers, said they

support more foreclosure protection.

Overall, roughly two-in-three respon-

dents said they own their home. Among

renters, about two-in-three intend to

buy a home in the near future. In addi-

tion, 15 percent of current home own-

ers intend to buy a home in the near

future.

The poll asked respondents for their views

regarding the Worker, Homeownership, and

Business Assistance Act of 2009 that

extended a tax credit of up to $8,000 for

qualified first-time homebuyers purchas-

ing a principal residence. The legislation,

which was signed into law by President

Obama in November 2009, also author-

ized a tax credit of up to $6,500 for quali-

fied repeat homebuyers.

Overall, eight percent of those sur-

veyed said they intend to take advan-

tage of that credit, while another 24

percent who might have been interest-

ed in using the tax credit said they can-

not afford to purchase a home at this

time. Of the 33 percent of respondents

who said they are planning to buy a

home (both renters and current home