Académique Documents

Professionnel Documents

Culture Documents

Checklist Accreditation First Timer

Transféré par

Jerry Bantilan JrDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Checklist Accreditation First Timer

Transféré par

Jerry Bantilan JrDroits d'auteur :

Formats disponibles

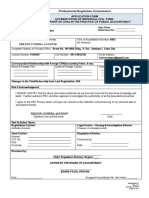

Republic of the Philippines Professional Regulation Commission Manila

FOR FIRST-TIME APPLICANT ONLY

BOARD OF ACCOUNTANCY CHECKLIST OF REQUIREMENTS FOR ACCREDITATION OF INDIVIDUAL CPA / FIRMS / PARTNERSHIPS IN ACCORDANCE WITH IMPLEMENTING RULES AND REGULATIONS (RES. NO. 71) REPUBLIC ACT NO. 9298 OTHERWISE KNOWN AS THE PHILIPPINE ACCOUNTANCY ACT OF 2004 _______ 1. BACC Form No. 02, duly accomplished in three (3) copies and properly notarized (Please affix metered documentary stamp in the original copy) _______ 2. Photocopy of CPA Board Certificate(s) of individual CPA, sole proprietor, Partners and staff member(s). _______ 3. Photo copy of current of professional identification card(s) of individual CPA, sole proprietor, partners and staff member(s). _______ 4. Code of Good Governance of the Individual CPA, Firm or Partnerships (signed by the Individual CPA, sole proprietor of the Firms and managing partner of the Partnership). _______ 5. Copy of internal quality review procedures being implemented to ensure compliance with the professional ethical and technical standards required of the practice of public accountancy. _______ 6. Certified copies of all business permits/current PTR issued by the local and/or national government. _______ 7. Sworn statement by the Individual CPA, sole proprietor of the Firm and managing partner of the Partnership stating that the Individual CPA and staff member(s), the sole proprietor and staff member(s) of the Firm, and all the partners and staff member(s) of the Partnership, as the case maybe,: (Please notarize and affix metered documentary stamp to the original copy). _______ a. had a meaningful participation of their respective internal quality review process _______ b. had undergone adequate and effective training (from organizations duly accredited by the Board or by its duly authorized representatives) on all the current accounting and auditing standards, code of ethics, laws and their implementing rules and regulations, circulars, memoranda, their respective codes of good governance and other related documents that are required in the practice of public accountancy to ensure professional, ethical and technical standards _______ c. are all of good moral character _______ d. he/she or they had not been found guilty by a competent court and/or administrative body of any case involving moral turpitude and/or unethical practices and that neither any of them is a defendant in any case of similar nature pending before any competent court and/or administrative agencies. _______ e. has (have) at least three (3) years meaningful experience in any of the areas of public practice including taxation as defined in Section 4 Rule 4 of the IRR. _______ 8. For government employee only: Original copy of authority to practice profession issued by employer, printed in the official letter head of the institution/agency.

3

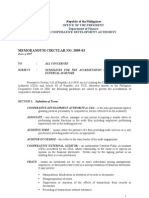

Supporting documents to be attached to the sworn statements: _______ 9. Certified copies of accredited certificate(s) of attendance or any proof of meaningful participation in, and proof of adequacy and effectiveness of such training for the immediate past three years. For year 2008 Seminar/trainings from 2005 onwards 2009 2006 onwards thereafter

Required Credit Units 15 10 4 4 27 60 CU

Topics Updates on Philippine Financial Reporting Standards (PFRS) including interpretations thereof/Philippine Accounting Standards (PSA) Updates on Philippine Standards on Auditing (PSA) Taxation Professional Ethics Relevant laws recently issued affecting business including recent SEC rulings, or other subject areas relevant to the practice of accountancy or as provided for in the IRR to R.A. 9298 Annex C. TOTAL

Credit Units Earned

Total

_______ 10. Current certificate of clearance issued by the proper court and/or National Bureau of Investigation (NBI) clearance for the individual CPA, sole practitioner & the partners/principals of the partnerships. _______ 11. Detailed description of such work experience of the individual CPA, sole proprietorship of the Firm and all the partners of the Partnership (data should include name of company, position, duties and responsibilities and date of employment). Additional requirements for Partnerships: _______ _______ _______ 12. Certified copy of the Certificate of Registration issued by the SEC 13. Certified copy of current Articles of Partnership (Should tally with the application from (BACC Form No. 02) 14. Certified copy of the documents showing the correspondent relationship, membership or business dealings with foreign CPA firm(s) if any, including complete address & postal address, telephone number and facsimile numbers, e-mail address and website. 15. Sworn statement stating that: (Please notarize and affix metered documentary to the original copy) _______ a. the copy of the document showing the correspondent relationship membership, or business dealings with the foreign CPA, is the faithful reproduction of its original copy. _______ b. the foreign CPA is not directly or indirectly (through the Filipino CPA) engaged in the practice of public accountancy in the Philippines, except the authorized CPAs under Sections 34 and 35 of R.A. No. 9298 _______ c. the rights and obligations of the parties are in specific terms.

_______

Other Requirements: _______ 16. Payment of accreditation fee (in Cash, Postal Money Order, Managers Check or Bank Draft payable to the Professional Regulation Commission) a. b. Single Proprietorship P1,500.00 Partnership P2,000.00

_______ 17. Short Brown Envelope for the Certificate of Accreditation. _______ 18. One set of metered documentary stamp worth Twenty-One Pesos (P21.00) to be affixed to the Certificate of Registration. ALL NOTARIZED DOCUMENTS SHOULD HAVE METERED DOCUMENTARY STAMPS WORTH TWENTY-ONE PESOS (P21.00) APPLICATIONS WITH INCOMPLETE DOCUMENTS WILL NOT BE ACCEPTED METERED DOCUMENTARY STAMP IS AVAILABLE AT PRC COSTUMER SERVICE COUNTERS AND PRC REGIONAL OFFICES Note: Representative/s filling and claiming the Certificate of Registration/Accreditation in behalf of the professional must present Special Power of Attorney and valid identification of the professional and the representative.

Page 2 of 2

Vous aimerez peut-être aussi

- PRC Accrediation of Cpa Partners StaffDocument2 pagesPRC Accrediation of Cpa Partners StaffJulienne PelayoPas encore d'évaluation

- BACC Resolution Renewal CPA AccreditationDocument4 pagesBACC Resolution Renewal CPA AccreditationDarlon B. SerenioPas encore d'évaluation

- Boa ReqtsDocument2 pagesBoa ReqtsCyril Alto TyPas encore d'évaluation

- Accreditation Public PracticeDocument36 pagesAccreditation Public Practicejanpeters0n100% (1)

- Requirement For Accreditation CPAs in Public Practice PDFDocument2 pagesRequirement For Accreditation CPAs in Public Practice PDFRicalyn E. SumpayPas encore d'évaluation

- PRC Application for CPA AccreditationDocument3 pagesPRC Application for CPA AccreditationCIM Imperial MacatangayPas encore d'évaluation

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyErlene CompraPas encore d'évaluation

- BOA RequirementsDocument1 pageBOA RequirementsRey Lim CabungcagPas encore d'évaluation

- MODULE 2 The Professional Practice of AccountingDocument21 pagesMODULE 2 The Professional Practice of AccountingMary Grace Dela CruzPas encore d'évaluation

- BOA RegistrationDocument9 pagesBOA RegistrationGreg AustralPas encore d'évaluation

- Registration Requirements Accounting Firms CPAsDocument2 pagesRegistration Requirements Accounting Firms CPAsDaniel GalzotePas encore d'évaluation

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public Accountancyhannah100% (1)

- Tips in Tax FilingDocument30 pagesTips in Tax FilingNIcey NiceyPas encore d'évaluation

- Requirements For BOA AccreditationDocument2 pagesRequirements For BOA AccreditationJem VadilPas encore d'évaluation

- PRC Application for CPA Firm AccreditationDocument3 pagesPRC Application for CPA Firm AccreditationJun Guerzon PaneloPas encore d'évaluation

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyJoel RazPas encore d'évaluation

- Villanueva - Taxation and Regulatory ComplianceDocument8 pagesVillanueva - Taxation and Regulatory ComplianceEDRICK ESPARRAGUERRAPas encore d'évaluation

- 132.tax On Dividends - FDD.02.25.10Document1 page132.tax On Dividends - FDD.02.25.10GeeAgayamPastorPas encore d'évaluation

- SD-SCD-QF01 Application For PS (FORM) - 19june2014Document4 pagesSD-SCD-QF01 Application For PS (FORM) - 19june2014Mitch EspirituPas encore d'évaluation

- Salient Features of Ra 11032: "Responsibilities of Lgus and Ngas"Document29 pagesSalient Features of Ra 11032: "Responsibilities of Lgus and Ngas"Mike MikePas encore d'évaluation

- Non-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Document2 pagesNon-Members With Accumulated Reserves and Undivided Net Savings of Not More Than Ten Million Pesos (P10,000,000.00)Fairy Ann PeñanoPas encore d'évaluation

- DILG Joint Circulars 20100813 JMCNo01 Seriesof2010Document21 pagesDILG Joint Circulars 20100813 JMCNo01 Seriesof2010mackoypogiPas encore d'évaluation

- AT Lecture 2 Professional Practice of Accounting - (1SAY2021)Document7 pagesAT Lecture 2 Professional Practice of Accounting - (1SAY2021)Jan Mouie LucidoPas encore d'évaluation

- 55026RR 14-2010 Accreditation PDFDocument5 pages55026RR 14-2010 Accreditation PDFlmin34Pas encore d'évaluation

- CASE1Document141 pagesCASE1Mikaela CorderoPas encore d'évaluation

- Ra 9298Document6 pagesRa 9298Jane Michelle EmanPas encore d'évaluation

- Accounting Alert Guidelines On Compliance With Boa Resolution 3 2016Document4 pagesAccounting Alert Guidelines On Compliance With Boa Resolution 3 2016Anonymous EHOOxR3upPas encore d'évaluation

- Public Practice of AccountancyDocument7 pagesPublic Practice of AccountancyJohn Kenneth BentirPas encore d'évaluation

- Professional Regulatory Board of Accountancy Accreditation: Public Practice of AccountancyDocument3 pagesProfessional Regulatory Board of Accountancy Accreditation: Public Practice of AccountancyChelsy SantosPas encore d'évaluation

- Registration Requirements for Architectural FirmsDocument5 pagesRegistration Requirements for Architectural Firmsg0% (1)

- CHAPTER 5 (Quality Control)Document25 pagesCHAPTER 5 (Quality Control)rogealynPas encore d'évaluation

- Bidding Documents For New BOC Systems & National Single WindowDocument39 pagesBidding Documents For New BOC Systems & National Single WindowPortCallsPas encore d'évaluation

- CDA guidelines for cooperative external auditor accreditationDocument11 pagesCDA guidelines for cooperative external auditor accreditationAndres Lorenzo III50% (2)

- Annex A & BDocument13 pagesAnnex A & BChelsy SantosPas encore d'évaluation

- FEU Mkti - at Lecture 2 Professional Practice of AccountingDocument10 pagesFEU Mkti - at Lecture 2 Professional Practice of AccountingmarkPas encore d'évaluation

- 02-Annex C - Sworn StatementDocument2 pages02-Annex C - Sworn Statementrenzoc.helixPas encore d'évaluation

- PRC CPA Accreditation Form (39Document3 pagesPRC CPA Accreditation Form (39veraPas encore d'évaluation

- Auditing Theory Schoology Quiz 01 AnswersDocument11 pagesAuditing Theory Schoology Quiz 01 AnswersMin Yoongi100% (3)

- Accreditation of PractitionersDocument9 pagesAccreditation of PractitionersSeth RavenPas encore d'évaluation

- Contractor's License Application ChecklistDocument11 pagesContractor's License Application ChecklistAngelo Pura0% (1)

- Checklist Issuance New License LBDocument3 pagesChecklist Issuance New License LBRodneyAcePas encore d'évaluation

- Tax Brief August 2010Document10 pagesTax Brief August 2010jae123Pas encore d'évaluation

- RA 9178 BMBE ActDocument69 pagesRA 9178 BMBE Actinvictusinc100% (1)

- Rmo 20-2013Document7 pagesRmo 20-2013Carlos105Pas encore d'évaluation

- 1ADocument8 pages1APaula Mae DacanayPas encore d'évaluation

- Contractor's License Amnesty Application RequirementsDocument11 pagesContractor's License Amnesty Application RequirementsArlyn JarabePas encore d'évaluation

- PWC Frcn-Rules On Reporting PDFDocument7 pagesPWC Frcn-Rules On Reporting PDFamandaPas encore d'évaluation

- PRBoA Resolution 2022-53Document15 pagesPRBoA Resolution 2022-53Maenelle ColobongPas encore d'évaluation

- LCC - Renewal of Contractor's LicenseDocument23 pagesLCC - Renewal of Contractor's LicenseJason LucasPas encore d'évaluation

- Journal 5Document3 pagesJournal 5not youPas encore d'évaluation

- Change of Authorized Managing Officer Application: Philippine Contractors Accreditation BoardDocument5 pagesChange of Authorized Managing Officer Application: Philippine Contractors Accreditation BoardAugust Ponge100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4D'EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Pas encore d'évaluation

- Case Studies in Not-for-Profit Accounting and AuditingD'EverandCase Studies in Not-for-Profit Accounting and AuditingPas encore d'évaluation

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsD'EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsPas encore d'évaluation

- 1040 Exam Prep Module XI: Circular 230 and AMTD'Everand1040 Exam Prep Module XI: Circular 230 and AMTÉvaluation : 1 sur 5 étoiles1/5 (1)

- RETRAK and the Ministry of Trade Advocacy PartnershipD'EverandRETRAK and the Ministry of Trade Advocacy PartnershipPas encore d'évaluation

- Deluxe Murphy Bed Plan FullDocument22 pagesDeluxe Murphy Bed Plan Fullperffecto100% (3)

- 10 Day Pre Conference DevotionalDocument11 pages10 Day Pre Conference DevotionalReggie de CastroPas encore d'évaluation

- Vertical DIY InstructionsDocument20 pagesVertical DIY InstructionsDangheliz Tobar UrzúaPas encore d'évaluation

- The Ombudsman ActDocument10 pagesThe Ombudsman ActJerry Bantilan JrPas encore d'évaluation

- 267692551M FinalDocument3 pages267692551M FinalLycel Nna OrazlanPas encore d'évaluation

- 2551QDocument3 pages2551QJerry Bantilan JrPas encore d'évaluation

- 267692551M FinalDocument3 pages267692551M FinalLycel Nna OrazlanPas encore d'évaluation

- 267692551M FinalDocument3 pages267692551M FinalLycel Nna OrazlanPas encore d'évaluation

- John Paultan AssignmentDocument5 pagesJohn Paultan AssignmentJerry Bantilan JrPas encore d'évaluation

- UP08 Tax 01 & 02Document163 pagesUP08 Tax 01 & 02jojitusPas encore d'évaluation

- 1987 ConstitutionDocument29 pages1987 ConstitutionJerry Bantilan JrPas encore d'évaluation

- Application For A Certified Copy of A Death RecordDocument1 pageApplication For A Certified Copy of A Death RecordkinyPas encore d'évaluation

- Authorised Third Party Representative FormDocument6 pagesAuthorised Third Party Representative FormJimPas encore d'évaluation

- UK Sponsorship Undertaking FormDocument2 pagesUK Sponsorship Undertaking FormTruc TranPas encore d'évaluation

- Sample Marriage Certificate ApplicationDocument3 pagesSample Marriage Certificate ApplicationKristen HammerPas encore d'évaluation

- Nit No.: Mcl/Sbp/Mmd/Sec-Iii/Dte/2.5Fel/ Dated: .08.2018Document65 pagesNit No.: Mcl/Sbp/Mmd/Sec-Iii/Dte/2.5Fel/ Dated: .08.2018PradeepPas encore d'évaluation

- CITATION Ann11 /L 1033Document24 pagesCITATION Ann11 /L 1033Sayid 0ali Cadceed FiidowPas encore d'évaluation

- DENR CENR, PENR AND REGIONAL OFFICES ACCEPT AND VERIFY WATER PERMIT APPLICATIONSDocument11 pagesDENR CENR, PENR AND REGIONAL OFFICES ACCEPT AND VERIFY WATER PERMIT APPLICATIONScenro staritaPas encore d'évaluation

- Procedure For Passport, Citizenship and Visa Applications - Jamaican NationalsDocument4 pagesProcedure For Passport, Citizenship and Visa Applications - Jamaican NationalsJamaican Association of Barbados (JAMBAR)Pas encore d'évaluation

- Apply Irish Citizenship Naturalisation Form 8Document14 pagesApply Irish Citizenship Naturalisation Form 8Фенамин НорадреналиновичPas encore d'évaluation

- Omnibus Certification and VeracityDocument2 pagesOmnibus Certification and VeracityAlpher Bacor100% (4)

- SEC Form F-103Document4 pagesSEC Form F-103Argie Capuli Rapisura0% (1)

- AO - 2004-019.PDF Minors Travelling AbroadDocument10 pagesAO - 2004-019.PDF Minors Travelling Abroaddempe24Pas encore d'évaluation

- Final Field ReportDocument23 pagesFinal Field ReportVũ NinhPas encore d'évaluation

- LBU F DL DL26 DuplicateLicenceDocument2 pagesLBU F DL DL26 DuplicateLicenceMatthew Leatt-HayterPas encore d'évaluation

- Omnibus Certification of Authenticity and Veracity of DocumentsDocument1 pageOmnibus Certification of Authenticity and Veracity of DocumentsT'JoyCie LptPas encore d'évaluation

- 2004 Rules on Notarial Practice approved by Supreme CourtDocument17 pages2004 Rules on Notarial Practice approved by Supreme CourtErwin James Badayos FabrigaPas encore d'évaluation

- PEBC - Credentials Evaluation ProcedureDocument5 pagesPEBC - Credentials Evaluation ProcedureGaurav Rooprai100% (1)

- Notarial RegisterDocument105 pagesNotarial RegisterAnonymous 03JIPKRk100% (3)

- Guide to Overseas Nursing RegistrationDocument30 pagesGuide to Overseas Nursing RegistrationAlex PiecesPas encore d'évaluation

- Advt No 17 2021 Engl 261121Document18 pagesAdvt No 17 2021 Engl 261121RajaPas encore d'évaluation

- NPS-103 - Death Withdrawal FormDocument5 pagesNPS-103 - Death Withdrawal FormSubahan ShaikPas encore d'évaluation

- CarerDocument6 pagesCarercdxasifPas encore d'évaluation

- Notarial Practice RuleDocument15 pagesNotarial Practice RuleCarmela LopezPas encore d'évaluation

- Srg1 Application VetassessDocument28 pagesSrg1 Application VetassessAlexis ColinaPas encore d'évaluation

- 1300T FormDocument30 pages1300T FormNeamat AliPas encore d'évaluation

- O o o o o O: Judicial AssistanceDocument9 pagesO o o o o O: Judicial AssistanceMarisol Valbuena100% (2)

- ORE Application Form (1.2MB, PDFDocument24 pagesORE Application Form (1.2MB, PDFkhanaslam0% (1)

- Nnas Applicant Handbook EnglishDocument17 pagesNnas Applicant Handbook EnglishCharlemagne C. Marban IVPas encore d'évaluation