Académique Documents

Professionnel Documents

Culture Documents

NPV Essay

Transféré par

Fatima Al SharifDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

NPV Essay

Transféré par

Fatima Al SharifDroits d'auteur :

Formats disponibles

There are six projects which Cheltenham Races LTD aims to undertake and for this purpose the

company is using investment appraisal methods. Investment appraisal procedure is the technique of evaluation of different projects to choose the best projects which maximise the companys profit.

THE INVESTMENT DECISION MAKING PROCESS:

There are number of stages to be followed in the investment decision making process. Origination of proposals;

It is very important at this stage that organisations have free friendly atmosphere for the staff/participants in decision making, as new ideas are expected to develop at this stage, thus rejecting some alternatives projects early. Project screening;

At this stage qualitative factors should be considered before undertaking any financial measures. Such evaluation will include asking questions whether the project fits with the long-term objectives of the organisations .Only those projects will be further evaluated which passed this initial screening. Analysis and acceptance;

At this stage, the organisation undertakes financial analysis using its preferred method of investment appraisal. Monitoring and review;

Once the decision made and project is implemented, then it is necessary to ensure that the expected benefits are obtained and that authorised capital spending was not exceeded. Investment appraisal method; There are four methods which we can use to evaluate the investments. 1) 2) 3) 4) The Payback period The accounting rate of return The net present value method The internal rate of return method

A. The Payback period; The payback period is the number of years it takes to recover its initial investment. This method assists with the project risk and liquidity. The projects with the less payback period consider less risky than the projects with greater payback period.

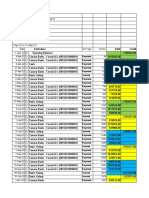

Payback period = initial investment Annual cash flow B. The Accounting rate of return; The accounting rate of return is also known as the Return on capital Employed. It can also be used to evaluate the different projects to make the best choice. It is differ from other techniques due to accounting profit rather than cash flow used. Accounting rate of return= average annual profits Annual investment Its results are expressed in percentage %. AVERAGE INVETMENT 50,000 50,000 100,000 100,000 75,000 25,000

RANK 3 6 5 1 2 4

PROJECT A B C D E F

AVERAGE CASH-FLOW 13333 8667 20667 37333 20000 5333

AROR/ROCE % 26.7 17.3 20.7 37.3 26.7 21.3

Higher the percentage preferable the project and ranked accordingly.

C. Internal rate of return; IRR is the discount rate at which the NPV of all the cash flows are zero. IRR= 5% + (NPV@5% ) * (15 5)

NPV@5% - NPV@15% The IRR take account of the time value of the money but doesnt indicate the money made by the project. It claims that shorter the investment period for the profitable investment, the higher the IRR.

D. Net Present Value; For the evaluation of these six projects the Cheltenham Races LTD did not use the proper investment decision making process. The company should have used the project screening first for all these projects to identify incompatible projects to its long-term objectives and had eliminated

those which contradict the objectives. There are no details provided for Cheltenham Races LTD or for its next year festivals and of the projects, so it is difficult to comment on the harmony between projects and companys objectives. Cheltenham Races LTD has chosen NET PRESENT VALUE. The Net present value is the difference between the present value of cash inflows and present value of cash outflows. The company has calculated NPVs of all six projects and ranked according to highest NPV. In this method the following factors have much importance and that they affect the results of the NPV. Such factors are; a) b) c) d) Time value of money Inflation Depreciation Taxation / Written down allowance

Time value of the money is based on the concept that the value of the money increases over time, e.g. 1 earned or spent sooner is worth more than 1 earned or spent later. There are many reasons for this rise in worth of present value of 1 in the future. Uncertainty The business world is considered full of risk and uncertainty. It is believed that in practise the business get promise of cash in future, it can never be certain until it is actually received. Inflation Inflation is the decline in purchasing power of the monetary unit. It is a common sense that moneys worth changes over time due to inflation. If there is an element of inflation then it is necessary to adjust the values by the given rates for inflation. Inflation is not considered important in the decision making process when it is low but it is important to include the factor when it rises let say 10 %.

Factors influencing Ranking NPV vs. PI

If we take an approach of Net present value (NPV) and Profit index (PI) to rank these 6 projects without setting any constraints then the simple raking would be below showing projects in the following sequence. RANK (NPV) 4 3 6 2 1 PROJECT A B C D E INVESTMENT 100,000 100,000 200,000 200,000 150,000 NPV 4158 8435 -31403 39230 293700 PI 1.04 1.08 0.84 1.2 2.96 RANK (PI) 5 3 6 2 1

50,000

3027

1.06

You can see, it is very obvious that ranking sequence differ somehow so would affect cash flow generating from the projects if undertaken with one of the ranking approach. NPV = SUM OF PRESENT VALUES INITIAL INVESTMENT PI = (INVESTMENT + NPV)/ INVESTMENT

Discounted payback method

Discounted payback period method can be combined with NPV approach and usually used in the screening stage to eliminate alternative projects at early stage. This can be done by calculating discounted present values and cumulative DPVs to work out the payback period, lesser the payback period better the project.

RANK 4 1 5 2 3

PROJECT A B C D E F

INVESTMENT 100,000 100,000 200,000 200,000 150,000 50,000

NPV 4158 8435 -31403 39230 293700 3027

DISCOUNTED PAYBACK PERIOD 13YRS 9 MONTHS 4 YRS 7 MONTHS N/A 14YRS 2 MONTHS 8 YRS 8 MONTHS 12 YRS 3 MONTHS

Discount Rate

The discount can be one of the factors which influence the project ranking by affecting NPV calculation. It has been assumed in this question that the company cost of capital will remain over the life the project (15yrs) and it is chosen as 7%. But in practical life this is not a case, as the factors such as interest rates and inflation can change the cost of capital over a short period of time so the company may have to use different rate of discount factor to cover this change. If different rates being used, this will change the present values throughout the project life and ultimately produce different NPVs of each project, which would be the cause of different ranking.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- (Feb19 & 20) - Urgent and Sensitive - Formal Notice From The Board and Shareholders - Redacted PDFDocument5 pages(Feb19 & 20) - Urgent and Sensitive - Formal Notice From The Board and Shareholders - Redacted PDFDavid HundeyinPas encore d'évaluation

- Taxguru - In-Depreciation As Per Schedule II of Companies Act 2013Document3 pagesTaxguru - In-Depreciation As Per Schedule II of Companies Act 2013Ravi SharmaPas encore d'évaluation

- AUDIT OF SHAREHOLDERS-discussionDocument2 pagesAUDIT OF SHAREHOLDERS-discussionadrian eboraPas encore d'évaluation

- AAAA Final ProgramDocument10 pagesAAAA Final ProgramShahifol Arbi IsmailPas encore d'évaluation

- 2012 CA ATC ListDocument26 pages2012 CA ATC Listardhipratomo4390Pas encore d'évaluation

- PRELIMSDocument4 pagesPRELIMSJadon MejiaPas encore d'évaluation

- Massage Addict Financing Package - RBC 2023Document2 pagesMassage Addict Financing Package - RBC 2023lageishon.mPas encore d'évaluation

- MBA Exam 1 Spring 2009Document12 pagesMBA Exam 1 Spring 2009Kamal AssafPas encore d'évaluation

- Salary Sheet 22 23 (Audited)Document72 pagesSalary Sheet 22 23 (Audited)Manojit GamingPas encore d'évaluation

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelPas encore d'évaluation

- Supply-Chain Management FutureDocument71 pagesSupply-Chain Management FutureAhmed HajaliPas encore d'évaluation

- Auditing and Assurance Concept and Applicatiosn 1 - SyllabusDocument2 pagesAuditing and Assurance Concept and Applicatiosn 1 - SyllabusMARIA THERESA ABRIOPas encore d'évaluation

- Future of PE and VCDocument14 pagesFuture of PE and VCReaderPas encore d'évaluation

- MMPC 04 PDF EBOOK Merged SECUREDocument74 pagesMMPC 04 PDF EBOOK Merged SECURERakesh dahiyaPas encore d'évaluation

- CON 2103 Construction Project Cost Control and Accounting - CalendarDocument3 pagesCON 2103 Construction Project Cost Control and Accounting - CalendarTaher KaukawalaPas encore d'évaluation

- Finc361 - Lecture - 10 - Project Cost of Capital PDFDocument36 pagesFinc361 - Lecture - 10 - Project Cost of Capital PDFLondonFencer2012Pas encore d'évaluation

- Indian Accounting Standards An Overview (Revised 2019)Document15 pagesIndian Accounting Standards An Overview (Revised 2019)Pooja GuptaPas encore d'évaluation

- Configure and Apply Accrual Schemes - Learn - Microsoft DocsDocument4 pagesConfigure and Apply Accrual Schemes - Learn - Microsoft DocsAndrew PackPas encore d'évaluation

- Bond Markets in The MENA RegionDocument59 pagesBond Markets in The MENA RegionstephaniPas encore d'évaluation

- Module 7Document5 pagesModule 7trixie maePas encore d'évaluation

- Chapter 8 Risk and Return PresentationDocument29 pagesChapter 8 Risk and Return PresentationsarmadPas encore d'évaluation

- Investment in Equity and Debt SecuritiesDocument3 pagesInvestment in Equity and Debt SecuritiesBryan ReyesPas encore d'évaluation

- Running Head: SEGMENT REPORTINGDocument6 pagesRunning Head: SEGMENT REPORTINGRajshekhar BosePas encore d'évaluation

- AKD cpt03Document91 pagesAKD cpt03Anisha RosevitaPas encore d'évaluation

- Osdl - GistDocument7 pagesOsdl - Gistsandeep raj (RA1861001010024)Pas encore d'évaluation

- Student SpreadsheetDocument14 pagesStudent SpreadsheetPriyanka Agarwal0% (1)

- Business Combination Quiz Final. Todo Na ToDocument10 pagesBusiness Combination Quiz Final. Todo Na ToKristelDeniseTansiongcoMindoro100% (1)

- Cse Letter - 21ST June - 8490987741051167Document1 pageCse Letter - 21ST June - 8490987741051167Sujith Sanjeewa SamaranayakePas encore d'évaluation

- IRC AAA Notes (Clean) - Kindly Print This OutDocument101 pagesIRC AAA Notes (Clean) - Kindly Print This OutAhmad Rizal100% (1)

- STRATEGIC COST MANAGEMENT - Week 12Document46 pagesSTRATEGIC COST MANAGEMENT - Week 12Losel CebedaPas encore d'évaluation