Académique Documents

Professionnel Documents

Culture Documents

Us Debt Crisis

Transféré par

Shailja MudgalDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Us Debt Crisis

Transféré par

Shailja MudgalDroits d'auteur :

Formats disponibles

Explained: The US downgrade, double-dip and other related concepts

The last week was action-packed. First the US debt ceiling was raised, which was considered good news (at least compared to what could have happened). But a couple of days later, the US stock markets plunged 500 points in a single day, the biggest single day fall since the 2008 financial and credit crisis. The week ended with rating agency S&P downgrading the US debt rating from the highest AAA to AA+; the first rating downgrade for the US in its entire history. Now there are reports on the US going into another recession, called a double-dip recession. Meanwhile, in Europe, countries like Italy, Greece and Spain are seeing severe debt crisis. Common questions people may have: - Is this recession related to the 2008 crisis or another one? - Are the crises in US and Europe related? - Why is the downgrade such a big deal? - Why is the dollar depreciating? - Why should I care? Lets try to understand all of this. Is this recession related to the 2008 crisis or another one? Lets revisit history. 2001 to 2008 We all know what happened in 2008. But heres a quick recap anyway. Between 2001 and 2005, a bubble was being formed in the US housing market with real estate prices going up rapidly. Banks too started lending aggressively to the housing market and in doing that they created, what is now famous as the sub-prime industry. Sub-prime lending refers to lending to people who may not be eligible for a loan under normal circumstances. Maybe they dont have a regular job or income, or have defaulted in the past. Banks traditionally did not lend to such people due to high risk of default. But since these loans were mortgaged against property and property prices were rising continuously, ban ks started doing so. If customers defaulted, they could sell the mortgaged property. But banks did not factor in the possibility of a fall in property prices. When the Federal Bank (the US equivalent of RBI) started increasing interest rates, the sub-prime borrowers who couldnt afford higher EMIs started defaulting and banks started selling off the mortgaged properties. The more properties that got sold, the faster property rates started falling. Now these banks were faced with another problem, another animal. During the same time between 2001 and 2005, the US financial markets had developed a new product a bond securitised against the mortgages. In simple terms it means that the mortgage banks borrowed money against the mortgages on the condition that they would repay to lenders as soon as they recovered their mortgages. The lenders in this case were financial institutions ( like Bear Sterns, Lehman and Merril Lynch) who in turn sold retail bonds to individuals. Sadly, the repayment never happened. And institutions like Bear Sterns, Lehman, Merrill Lynch and AIG were the casualties. Since the mortgages were not honoured, the banks could not repay these financial institutions who in turn could not repay retail investors. The same thing was happening across Europe too who were holding these bad bonds. This is what caused the crisis of 2008. Banks are the financial backbone of an economy and a run on a bank is like a run on an economy. And we are talking hundreds of banks here. 2008-2010 In order to prevent a run on the large banks, the US Government started to bail out the failed financial institutions so that they didnt go bankrupt. They decided to dole out funds to these banks (the large ones) to the extent of loss they faced. The important question: Where did they get the money from? As it is, the people in the country were in bad shape. People were sitting on houses worth far less than their mortgages. They had accumulated huge debts with little savings. People stopped spending and unfortunately in the US, when people stopped spending, the companies (dominated by processed and fast food, car makers and petrol companies, retail) stop making money and send the econ omy into recession. Jobs were starting to go. At this point, the Government could not raise money from taxes. In fact, it had to cut taxes. Moreover, the country had fought two expensive wars which had dipped heavily into Government surplus. The amount for bailout required was so huge that borrowing from other countries would have been expensive. So the Fed decided to print money to dole out in fiscal packages, called stimulus packages; trillions of US dollars. Failing companies were given money to survive; people were given money to spend. (There is a fear that printing money causes inflation but that didnt happen because firstly demand was low and secondly costs were kept low in the US by cheap purchases from countries like China) For the time being, the crisis was controlled. During this time, smaller countries in Europe started facing trouble as their banks held a lot of the bad mortgage backed securities. Iceland went bankrupt. Ireland and Greece were running out of money. 2011 But the doling out of money was just a temporary solution. It only prevented a further fall. It only prevented the loss of more jobs. In the long-term, in order to keep the economy sustainable, in order to reduce the deficit (the gap between Government spending and earning) the US had to do something to create jobs within the country, to promote sectors that created these jobs. And that of course is something that will take time, especially with emerging countries like China and India becoming strong hubs of manufacturing, service and job creation. The fiscal stimulus did not help promote industry, did not help create jobs. All this while, while the US Government did not earn much by way of income, it still had the same level of spending to do to keep up the peoples standard of living. This led to a widening deficit. So in reality, the US never recovered from the blow of 2008. A double dip recession is explained as follows: A double dip recession occurs when the economy has a recession, emerges from the recession with a short period of growth, but quickly falls back into recession.This is what everyone fears will happen in the US now. Are the crises in Europe and US related? Yes. As we saw earlier, the credit crisis of 2008 had spread to Europe where many banks were holding the bad assets of US banks. As a result, many smaller European countries starting going down. Now, even the bigger economies like Portugal, Italy and Spain are feeling the heat. The problem across is universal: too much Government spending compared to too little Government earnings. If the European countries and people start spending less, this will impact the US economy. The US exports a lot of things like software, video games and all kinds of intellectual property to Europe. In this global world, its all related. Why is the US debt downgrade such a big issue? How did the US Government fund the widening deficit? It borrowed more. It borrowed so much that it hit the debt ceiling. The debt ceiling is a self imposed limit for US Government borrowing. Increasing the debt ceiling was not by itself a difficult task because it was up to the Government to decide. But increasing the debt ceiling would send a signal to the rest of the world about a weakening US economy. So far, the US economy and therefore the US dollar was the single strongest currency in the world. The US Government had a great credit rating (AAA) so it could raise money from other countries at very low interest rates. Raising the debt ceiling would hamper its credit worthiness. And thats exactly what happened. On Friday, the S&P downgraded the US long-term debt to AA+. This would mean higher borrowing costs for the US which in turn will affect the deficit or slow growth. Why is the dollar depreciating? The currency is a reflection of the strength of an economy. It shows the credit worthiness of the country. If I hold dollars, it means that I believe I will always be able to sell it at a certain price. There will always be a buyer for my dollar. I will invest in US treasury bonds because I believe the US will never default. I will always get my money back. The dollar has been, for the longest time, the single strongest currency in the world. But the crisis over the last few years has shaken that confidence. People have been selling dollars that they hold and buying gold (that is why gold prices are going up). People believe they will no longer get what they expect from the dollar. When people, institutions, countries start selling dollars in the open market, there is an excess supply of dollars. This brings down the value of the dollar. Why should I care? Its important to understand all these things, not only to improve knowledge but also to be prepared. A US crisis will likely impact India too; our IT exports will be affected. Foreign investments that we need for our infrastructure development will reduce. While our domestic economy is strong and has a large consumption base, we will still see some slowdown in growth. This is just a broad overview of the current crisis, put as simply as possible. I am sure there are a lot more questions left unanswered or perhaps new questions in your mind. Do share your thoughts and questions. Looking forward to hearing from you. Till then, Money Happy Returns!

Vous aimerez peut-être aussi

- Arithmetic of EquitiesDocument5 pagesArithmetic of Equitiesrwmortell3580Pas encore d'évaluation

- A Brief Analysis of The Documentary Movie "Inside Job": Submitted To: Dr. Umer Iftikhar Malik (Iftikhar@ndu - Edu.pk)Document7 pagesA Brief Analysis of The Documentary Movie "Inside Job": Submitted To: Dr. Umer Iftikhar Malik (Iftikhar@ndu - Edu.pk)Haseeb AhmedPas encore d'évaluation

- What To Do With Your Money NowDocument8 pagesWhat To Do With Your Money NowDavid C. Leipold100% (1)

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Document103 pages2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- The Economi of Success: Twelve Things Politicians Don't Want You to KnowD'EverandThe Economi of Success: Twelve Things Politicians Don't Want You to KnowPas encore d'évaluation

- GEARS September 2013Document128 pagesGEARS September 2013Rodger Bland100% (3)

- Business Cycle Indicators HandbookDocument158 pagesBusiness Cycle Indicators HandbookAnna Kasimatis100% (1)

- Dollar Collapse InevitableDocument6 pagesDollar Collapse InevitablesmcjgPas encore d'évaluation

- America CLDocument11 pagesAmerica CLkakerotePas encore d'évaluation

- Our Government Has Run Out of MoneyDocument10 pagesOur Government Has Run Out of MoneykakerotePas encore d'évaluation

- Government Austerity Measures Next StepDocument9 pagesGovernment Austerity Measures Next StepkakerotePas encore d'évaluation

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakerotePas encore d'évaluation

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakerotePas encore d'évaluation

- The Real Crash America's Coming Bankruptcy - How To Save Yourself and Your CountryDocument10 pagesThe Real Crash America's Coming Bankruptcy - How To Save Yourself and Your CountryMacmillan Publishers67% (3)

- Approaches To Industrial RelationsDocument39 pagesApproaches To Industrial Relationslovebassi86% (14)

- America in PerilDocument12 pagesAmerica in PerilkakerotePas encore d'évaluation

- Skripsi - Perencanaan Lanskap Pasca Tambang BatubaraDocument105 pagesSkripsi - Perencanaan Lanskap Pasca Tambang Batubarahirananda sastriPas encore d'évaluation

- Our Government Has Run Out of MoneyDocument10 pagesOur Government Has Run Out of MoneykakerotePas encore d'évaluation

- Script For Performance Review MeetingDocument2 pagesScript For Performance Review MeetingJean Rose Aquino100% (1)

- Benetton (A) CaseDocument15 pagesBenetton (A) CaseRaminder NagpalPas encore d'évaluation

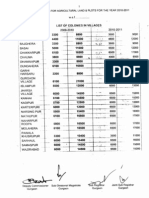

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDocument15 pagesCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakerotePas encore d'évaluation

- Financial Crisis TestDocument4 pagesFinancial Crisis TestMara LazarPas encore d'évaluation

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakerotePas encore d'évaluation

- Discussion Around The Article Linked BelowDocument12 pagesDiscussion Around The Article Linked BelowAllan WortPas encore d'évaluation

- Keynesian Economics Doesn't WorkDocument8 pagesKeynesian Economics Doesn't WorkkakerotePas encore d'évaluation

- TSW Journal Nov-Dec 2010Document16 pagesTSW Journal Nov-Dec 2010SchoolofWashingtonPas encore d'évaluation

- America AlDocument12 pagesAmerica AlkakerotePas encore d'évaluation

- 2010 Barrons IntvuDocument3 pages2010 Barrons IntvuZuresh PathPas encore d'évaluation

- RecessionDocument20 pagesRecessionTejas WaghuldePas encore d'évaluation

- Global Market Outlook July 2011Document8 pagesGlobal Market Outlook July 2011IceCap Asset ManagementPas encore d'évaluation

- 1.1 The CrisisDocument3 pages1.1 The CrisisSofia RossattiPas encore d'évaluation

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Document5 pagesMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatPas encore d'évaluation

- 7-12-11 Too Big To FailDocument3 pages7-12-11 Too Big To FailThe Gold SpeculatorPas encore d'évaluation

- The 2008 Financial Crisis: Causes, Response, and ConsequencesDocument22 pagesThe 2008 Financial Crisis: Causes, Response, and ConsequencesUNLV234Pas encore d'évaluation

- Macro 7Document12 pagesMacro 7Àlex SolàPas encore d'évaluation

- Sumner Gold Report May2015Document3 pagesSumner Gold Report May2015mercosurPas encore d'évaluation

- Economic and Market: A U.S. Recession?Document16 pagesEconomic and Market: A U.S. Recession?dpbasicPas encore d'évaluation

- Recession Part II-Here We GoDocument7 pagesRecession Part II-Here We GokakerotePas encore d'évaluation

- Recession Part II-Here We GoDocument8 pagesRecession Part II-Here We GokakerotePas encore d'évaluation

- Facts and FiguresDocument14 pagesFacts and FiguresJude Ruel MoraldePas encore d'évaluation

- Economic Environment Part 1 The Great RecessionDocument7 pagesEconomic Environment Part 1 The Great RecessionAnthony KallirisPas encore d'évaluation

- American Debt CrisisDocument5 pagesAmerican Debt CrisisSuraj MotwaniPas encore d'évaluation

- The US Economy For MohanonDocument10 pagesThe US Economy For Mohanonjatin_saikiaPas encore d'évaluation

- About The 2008 Stock Market CrashDocument8 pagesAbout The 2008 Stock Market CrashMohammed SajeePas encore d'évaluation

- Global Financial Crisis - Dr. Ayubur Rahman BhuyanDocument17 pagesGlobal Financial Crisis - Dr. Ayubur Rahman Bhuyanekab88Pas encore d'évaluation

- Iilm Institute For Higher Education 2009-11Document24 pagesIilm Institute For Higher Education 2009-11rathore31Pas encore d'évaluation

- Human Avarice - A SynthesisDocument3 pagesHuman Avarice - A SynthesisJohn Alex OliverPas encore d'évaluation

- Recession Part II-Here We GoDocument8 pagesRecession Part II-Here We GokakerotePas encore d'évaluation

- MAPs ProjectDocument7 pagesMAPs Projectpranav sreejithPas encore d'évaluation

- The Financial Crisis 2008Document12 pagesThe Financial Crisis 2008Elora madhusmita BeheraPas encore d'évaluation

- Selling America - A Bears ViewDocument3 pagesSelling America - A Bears ViewnagstrikesPas encore d'évaluation

- Nvestment Ompass: Quarterly CommentaryDocument4 pagesNvestment Ompass: Quarterly CommentaryPacifica Partners Capital ManagementPas encore d'évaluation

- United States Debt CrisisDocument2 pagesUnited States Debt CrisisSatish SonawalePas encore d'évaluation

- The Economist - Finacial CrisisDocument4 pagesThe Economist - Finacial CrisisEnzo PitonPas encore d'évaluation

- Big Picture: Reflections, Assessments, Outlook, ApproachDocument17 pagesBig Picture: Reflections, Assessments, Outlook, ApproachHenry BeckerPas encore d'évaluation

- Entrevista A Richard DuncanDocument10 pagesEntrevista A Richard DuncanEliseo RamosPas encore d'évaluation

- 2008 Financial CrisisDocument3 pages2008 Financial CrisisWeston International InstitutePas encore d'évaluation

- The Road To PerditionDocument3 pagesThe Road To PerditionBrian BarkerPas encore d'évaluation

- Sterling College of Arts, Commerce and Science: Topic: Global Recession and Its Contagious EffectsDocument34 pagesSterling College of Arts, Commerce and Science: Topic: Global Recession and Its Contagious EffectsAniket KhotPas encore d'évaluation

- How Secure Is The Global Financial System A Decade After The Crisis - McKinsey Set. 2018Document11 pagesHow Secure Is The Global Financial System A Decade After The Crisis - McKinsey Set. 2018GhaliPas encore d'évaluation

- The Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.Document17 pagesThe Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.brundbakenPas encore d'évaluation

- Fin CrisesDocument4 pagesFin CriseshelperforeuPas encore d'évaluation

- Brazil Russia India China South AfricaDocument3 pagesBrazil Russia India China South AfricaRAHULSHARMA1985999Pas encore d'évaluation

- Insights: Fallout From The US Debt DowngradeDocument4 pagesInsights: Fallout From The US Debt Downgradericky3833Pas encore d'évaluation

- The Great American Credit Collapse Pt2Document7 pagesThe Great American Credit Collapse Pt2auroradogPas encore d'évaluation

- The System of Government Budgeting Bangladesh: Motahar HussainDocument9 pagesThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadPas encore d'évaluation

- (Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayDocument3 pages(Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayYuri VillanuevaPas encore d'évaluation

- Year 2016Document15 pagesYear 2016fahadullahPas encore d'évaluation

- Bill CertificateDocument3 pagesBill CertificateRohith ReddyPas encore d'évaluation

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDocument13 pagesFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghPas encore d'évaluation

- BNI Mobile Banking: Histori TransaksiDocument1 pageBNI Mobile Banking: Histori TransaksiWebi SuprayogiPas encore d'évaluation

- Voltas Case StudyDocument27 pagesVoltas Case Studyvasistakiran100% (3)

- StatementsDocument2 pagesStatementsFIRST FIRSPas encore d'évaluation

- Business Economics - Question BankDocument4 pagesBusiness Economics - Question BankKinnari SinghPas encore d'évaluation

- Zubair Agriculture TaxDocument3 pagesZubair Agriculture Taxmunag786Pas encore d'évaluation

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDocument14 pagesLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaPas encore d'évaluation

- Delivering The Goods: Victorian Freight PlanDocument56 pagesDelivering The Goods: Victorian Freight PlanVictor BowmanPas encore d'évaluation

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- EOQ HomeworkDocument4 pagesEOQ HomeworkCésar Vázquez ArzatePas encore d'évaluation

- DX210WDocument13 pagesDX210WScanner Camiones CáceresPas encore d'évaluation

- KaleeswariDocument14 pagesKaleeswariRocks KiranPas encore d'évaluation

- Quijano ST., San Juan, San Ildefonso, BulacanDocument2 pagesQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzPas encore d'évaluation

- Coconut Oil Refiners Association, Inc. vs. TorresDocument38 pagesCoconut Oil Refiners Association, Inc. vs. TorresPia SottoPas encore d'évaluation

- Fabozzi Ch13 BMAS 7thedDocument36 pagesFabozzi Ch13 BMAS 7thedAvinash KumarPas encore d'évaluation

- Ape TermaleDocument64 pagesApe TermaleTeodora NedelcuPas encore d'évaluation

- Emergence of Entrepreneurial ClassDocument16 pagesEmergence of Entrepreneurial ClassKavya GuptaPas encore d'évaluation