Académique Documents

Professionnel Documents

Culture Documents

Max. Loan 310,375.00 Total Finance 160,000.00

Transféré par

Stanislav LazarovDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Max. Loan 310,375.00 Total Finance 160,000.00

Transféré par

Stanislav LazarovDroits d'auteur :

Formats disponibles

Question 3:

a.)

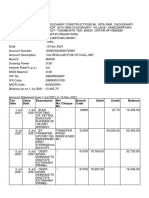

Alan Salary Karen Salary Karen Bonus Total Income Max. Loan 52,000.00 38,500.00 5,000.00 95,500.00 310,375.00 Savings Karens Flat Price Outstanding Mort. Potential Profit Total Finance 73,000.00 189,000.00 102,000.00 87,000.00 160,000.00

In order to calculate the maximum loan, I assume that their income consists of their salaries and Karens bonus and that they both remain constant during the period. Afterwards, the total income is multiplied by 3.25 which is how much banks are usually willing to lend for a joint salary. The result is the maximum available loan at the banks best rate of 75%.

b.)

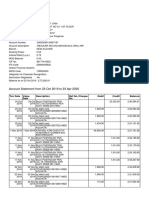

First, the different mortgages available have to be calculated before giving an advice. Mortgage Rate Available Balance Net Finance Flat 75% 90% 75% 90% 75% 90% Studio 108,750.00 130,500.00 201,625.00 179,875.00 123,750.00 145,500.00 1 Bedroom 172,500.00 207,000.00 137,875.00 103,375.00 102,500.00 137,000.00 2 Bedroom 281,250.00 337,500.00 29,125.00 -27,125.00 66,250.00 122,500.00 3 Bedroom 382,500.00 459,000.00 -72,125.00 -148,625.00 32,500.00 109,000.00 4 Bedroom 510,000.00 612,000.00 -199,625.00 -301,625.00 -10,000.00 92,000.00 The green colour indicates which mortgages Alan and Karen can afford, the rest are limited by the 310,375.00 maximum loan constraint. Therefore, they are able to afford the Studio, the 1 and 2 Bedroom flats. The Available Balance column shows the difference between the maximum allowance and the taken mortgage. The Net Finance column shows the total savings plus the mortgage minus the cost of the flat. The figure represents what is left from the savings after the purchase. Note, I assume Karen will sell his flat as soon as possible and before the next monthly payment occurs. Alan and Karen are able to afford the 2-Bedroom mortgage and they might be also considering having children in the future so they should reflect on that recommendation. Therefore, they should take the mortgage at 75% rate, which is 281,250.00. It has to be noted that if they reduce the rate this will result in lower debt but also in much lower net finance. A higher rate will result in higher figures of net finance, however because of the rate penalty, which occurs after 75% - the debt will be much higher.

c.)

Repayment Mortgage Interest Only Type 1 Type 2 Type 3 Intro. Payment 1,454.99 1,586.69 Interest 839.06 Fixed Payment 1,639.30 1,642.23 Sinking Fund 788.59 Monthly Payment 1627.65 Total Payment 389,008.78 390,802.83 Total Payment 390,637.11 The best mortgage so far is Type 1, which is a repayment mortgage with an introductory period of 2 years and 2.24%, which then reverts to 3.69%. Type 1 is clearly better then type 2 because both its monthly

payments are smaller and also in the end Alan and Karen have to pay less. By taking Type 3, they will pay less monthly fees, which are insignificant, and also by the end of the period they will again pay more than Type 1. Therefore, Type 1 repayment mortgage remains the best choice.

d.)

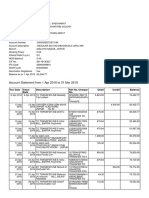

In order to evaluate if the decision will remain the same if interest rate changes I am going to construct a table, which will show the changes in total payments if interest rates went up or down by 1% and 2%.

Type 1

Decrease Increase Decrease Increase 323,259.73 461,959.08 355,210.42 424,610.67

Type 2

324,954.23 463,808.14 356,960.02 426,437.94

Type 3

323,974.45 464,343.87 356,399.76 426,638.45

2% 1%

Type 1 still remains the best choice as its total payment continues to be the smallest. However, it has to be noted that if the change occurs and Alan and Karen have taken either Type 1 or Type 2, which are repayment mortgages, nothing will change since the rate is fixed. The situation is different with the interest only mortgage. Here is a table showing the potential saving or losses: Interest only Increase No change Decrease 2% -72,950.30 0 65,749.05 33,798.36 1% -35,601.89

It can be observed that the potential losses are higher than the savings. The risk is bigger and rates cannot be easily predicted so Alan and Karen should not gamble on that. In conclusion Type 1 mortgage remains the best choice.

Vous aimerez peut-être aussi

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeD'EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomePas encore d'évaluation

- CH03Document5 pagesCH03Mohsin SadaqatPas encore d'évaluation

- 12Document8 pages12Ishaq EssaPas encore d'évaluation

- Soln 1Document5 pagesSoln 1rahulsbg01Pas encore d'évaluation

- Introduction to Personal Finance exam revisionDocument27 pagesIntroduction to Personal Finance exam revisionAnonymous p65I0YZVCPas encore d'évaluation

- Text 1Document11 pagesText 1Ray Joshua Angcan BalingkitPas encore d'évaluation

- Credit & Borrowing - Cambridge PDFDocument28 pagesCredit & Borrowing - Cambridge PDFdiana_kalinskaPas encore d'évaluation

- Fair Market Value QuipperDocument49 pagesFair Market Value QuipperfernandobenicemargarettePas encore d'évaluation

- Chapter 03Document4 pagesChapter 03Khanh NguyễnPas encore d'évaluation

- Quantitative Problem Chapter 3: Solution: PVDocument5 pagesQuantitative Problem Chapter 3: Solution: PVAni SubelianiPas encore d'évaluation

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedThùy LêPas encore d'évaluation

- TODAY at BULLET Chapter 2 TVM ContinuedDocument8 pagesTODAY at BULLET Chapter 2 TVM ContinuedSiêng Năng NèPas encore d'évaluation

- Quantitative Problem Chapter 3 SolutionsDocument5 pagesQuantitative Problem Chapter 3 SolutionsKhadija ShabbirPas encore d'évaluation

- Quantitative Problems Chapter 3Document5 pagesQuantitative Problems Chapter 3Shahzain RafiqPas encore d'évaluation

- MAPUA - EngEconLesson2 - Time Value of MoneyDocument39 pagesMAPUA - EngEconLesson2 - Time Value of MoneyRick SanchezPas encore d'évaluation

- Answer FIN 401 Exam2 Fall15 V1Document7 pagesAnswer FIN 401 Exam2 Fall15 V1mahmudPas encore d'évaluation

- Chapter 14 HW SolutionDocument10 pagesChapter 14 HW SolutionIsmail Özdemir100% (1)

- Answers To Chapter 7 QuestionsDocument7 pagesAnswers To Chapter 7 QuestionsAnna OsmanPas encore d'évaluation

- Calculate Yield to Maturity and Bond Prices Chapter 3Document11 pagesCalculate Yield to Maturity and Bond Prices Chapter 3VoThienTrucPas encore d'évaluation

- Module 8 Business MathematicsDocument26 pagesModule 8 Business MathematicsMaam AprilPas encore d'évaluation

- BUSINESS MATHEMATICS 2ND QUARTER 2nd WEEK LESSON Lesson Commission On Cash Basis, Installment Basis, Downpayment, Gross Balance, Current BalanceDocument12 pagesBUSINESS MATHEMATICS 2ND QUARTER 2nd WEEK LESSON Lesson Commission On Cash Basis, Installment Basis, Downpayment, Gross Balance, Current BalanceDearla Bitoon100% (1)

- Chapter 4 MemosDocument20 pagesChapter 4 MemosTheresa NelPas encore d'évaluation

- Problem Set 1 - Bonds and Time Value of MoneyDocument4 pagesProblem Set 1 - Bonds and Time Value of Moneymattgodftey1Pas encore d'évaluation

- 03a 1Document5 pages03a 1ravi.gullapalliPas encore d'évaluation

- Math 100 - Notes On Financial Math: 1. PercentagesDocument10 pagesMath 100 - Notes On Financial Math: 1. PercentagesLoviehh Mhae Gementiza BatingalPas encore d'évaluation

- A Loan To Help You Buy A Property - Long TermDocument48 pagesA Loan To Help You Buy A Property - Long Termlinda zyongwePas encore d'évaluation

- Business Math Lecture NotesDocument18 pagesBusiness Math Lecture NotesJean Marie LuposPas encore d'évaluation

- Risk Management Options and DerivativesDocument13 pagesRisk Management Options and DerivativesAbdu0% (1)

- Calculate Simple Interest Rates and DiscountsDocument3 pagesCalculate Simple Interest Rates and DiscountsDarwinPas encore d'évaluation

- FI 580 Final Exam XCLDocument28 pagesFI 580 Final Exam XCLjoannapsmith33Pas encore d'évaluation

- Explanation:: (Round Your Answer To 2 Decimal Places.)Document7 pagesExplanation:: (Round Your Answer To 2 Decimal Places.)Joel Christian MascariñaPas encore d'évaluation

- Amortization: ObjectivesDocument10 pagesAmortization: ObjectivesLara Lewis AchillesPas encore d'évaluation

- Predicting Loan Defaults Using Machine LearningDocument10 pagesPredicting Loan Defaults Using Machine LearningRaveendra Babu GaddamPas encore d'évaluation

- Solutions to textbook recommended problems and exercisesDocument14 pagesSolutions to textbook recommended problems and exercisesMunira TurarovaPas encore d'évaluation

- Activity Sheet In: Business FinanceDocument8 pagesActivity Sheet In: Business FinanceCatherine Larce100% (1)

- Fundamentals of Financial PlanningDocument6 pagesFundamentals of Financial PlanningJulius NgaregaPas encore d'évaluation

- Business Mathematics: For LearnersDocument12 pagesBusiness Mathematics: For LearnersJet Rollorata BacangPas encore d'évaluation

- Assignment 1-Answer KeyDocument3 pagesAssignment 1-Answer Keybexultan.batyrkhanovPas encore d'évaluation

- 8 - Interests CommissionsDocument46 pages8 - Interests Commissionsapi-267023512Pas encore d'évaluation

- GF520 Unit2 Assignment CorrectionsDocument7 pagesGF520 Unit2 Assignment CorrectionsPriscilla Morales86% (7)

- Commission NotesDocument2 pagesCommission Notesivanjade627Pas encore d'évaluation

- Compare Two LoansDocument1 pageCompare Two LoansglkgjkhgkgjjjgPas encore d'évaluation

- Week 3Document13 pagesWeek 3sdfklmjsdlklskfjdPas encore d'évaluation

- Simple Interest TasterDocument10 pagesSimple Interest TasterJessel GaboPas encore d'évaluation

- Finance Chpter 5 Time Value of MoneyDocument11 pagesFinance Chpter 5 Time Value of MoneyOmar Ahmed ElkhalilPas encore d'évaluation

- Sample Final Term Exam-Solutions PGDocument3 pagesSample Final Term Exam-Solutions PGYilin YANGPas encore d'évaluation

- Interest Rates and Bond Valuation: Answers To Concepts Review and Critical Thinking Questions 1Document8 pagesInterest Rates and Bond Valuation: Answers To Concepts Review and Critical Thinking Questions 1Diệu QuỳnhPas encore d'évaluation

- Financial Management - Bonds 2014Document34 pagesFinancial Management - Bonds 2014Joe ChungPas encore d'évaluation

- Amortisations and Sinking FundsDocument7 pagesAmortisations and Sinking FundsChari TawaPas encore d'évaluation

- ColumbiaDocument4 pagesColumbiaswami4ujPas encore d'évaluation

- Reading 1 The Time Value of MoneyDocument46 pagesReading 1 The Time Value of MoneyNeerajPas encore d'évaluation

- Chapter 6 - Bond ValuationDocument46 pagesChapter 6 - Bond ValuationHarith DaniealPas encore d'évaluation

- FV &PVDocument3 pagesFV &PVDudePas encore d'évaluation

- GMTC 1302 Q2 FPFDocument42 pagesGMTC 1302 Q2 FPFadrian jhon nainguePas encore d'évaluation

- Quantitative Problems Chapter 3Document5 pagesQuantitative Problems Chapter 3Deng JuniorPas encore d'évaluation

- Time Value of Money: A Self-Test: Personal Finance: Another PerspectiveDocument24 pagesTime Value of Money: A Self-Test: Personal Finance: Another PerspectiveFei Genuino Cruz100% (1)

- Calculate Life Insurance Premiums for Various PoliciesDocument15 pagesCalculate Life Insurance Premiums for Various PoliciesVijay AgrahariPas encore d'évaluation

- Ultimate First Time Home Buyer Guide: Step-By-Step Instructions On How to Buy Your First HomeD'EverandUltimate First Time Home Buyer Guide: Step-By-Step Instructions On How to Buy Your First HomePas encore d'évaluation

- ALM Coursework Feedback 2013Document3 pagesALM Coursework Feedback 2013Stanislav LazarovPas encore d'évaluation

- Duration and ConvexityDocument21 pagesDuration and ConvexityStanislav LazarovPas encore d'évaluation

- 2012 Ny Invest Sym p2Document11 pages2012 Ny Invest Sym p2Stanislav LazarovPas encore d'évaluation

- Insurance Markets Impacts of and Regulatory Response To The 2007-2009 Financial CrisisDocument91 pagesInsurance Markets Impacts of and Regulatory Response To The 2007-2009 Financial CrisisStanislav LazarovPas encore d'évaluation

- May 2009 - AnswersDocument7 pagesMay 2009 - AnswersStanislav LazarovPas encore d'évaluation

- Example of Good Practice in Management Report Writing For Inventory Course WorkDocument10 pagesExample of Good Practice in Management Report Writing For Inventory Course WorkStanislav LazarovPas encore d'évaluation

- Birla Institute of TechnologyDocument2 pagesBirla Institute of TechnologyKushagra SinghPas encore d'évaluation

- B Dam SBI Silchar AC PDFDocument3 pagesB Dam SBI Silchar AC PDFsanjibannathPas encore d'évaluation

- Chapter 12 (Saunders)Document13 pagesChapter 12 (Saunders)sdgdfs sdfsfPas encore d'évaluation

- Audit of Cash QuizDocument4 pagesAudit of Cash QuizAndy LaluPas encore d'évaluation

- Lloyds Bank StatementDocument2 pagesLloyds Bank StatementZheng Yang100% (1)

- SRS Document - Project ArrowDocument4 pagesSRS Document - Project ArrowRanier RanierPas encore d'évaluation

- Barclays Bank StatementDocument5 pagesBarclays Bank StatementwabiPas encore d'évaluation

- Your Cable Network:: Tax InvoiceDocument1 pageYour Cable Network:: Tax InvoiceBabu JuluriPas encore d'évaluation

- Receipt From STC Pay: Transaction ID: 54933029 Amount 60144.38 PKR MTCN 2256882453Document1 pageReceipt From STC Pay: Transaction ID: 54933029 Amount 60144.38 PKR MTCN 2256882453Imran AliPas encore d'évaluation

- Uhht BG 0 P Il 6 MP 6 GMDocument8 pagesUhht BG 0 P Il 6 MP 6 GMpaappaapPas encore d'évaluation

- A General Management Project On A Study On The Banking Sector With Special Reference To Basel Norms and Its Impact in IndiaDocument34 pagesA General Management Project On A Study On The Banking Sector With Special Reference To Basel Norms and Its Impact in IndiaAnil kadamPas encore d'évaluation

- Chase B Statement-MarDocument4 pagesChase B Statement-MarЮлия ПPas encore d'évaluation

- Banks in The PhilippinesDocument17 pagesBanks in The PhilippinesRosel Aubrey RemigioPas encore d'évaluation

- HSBC Premier Savings Terms & Charges Disclosure: EligibilityDocument3 pagesHSBC Premier Savings Terms & Charges Disclosure: EligibilityAndi PrabowoPas encore d'évaluation

- Indian Money MarketDocument2 pagesIndian Money MarketSandeep KulkarniPas encore d'évaluation

- Chapter 3 (The Time Value of Money)Document22 pagesChapter 3 (The Time Value of Money)Wilson Dhruba KuluntunuPas encore d'évaluation

- Exchange Rates ExercisesDocument8 pagesExchange Rates Exercisesarupkalita_aecPas encore d'évaluation

- "Credit Management of United Commercial Bank Limited" Which IsDocument17 pages"Credit Management of United Commercial Bank Limited" Which IsMahmud MishuPas encore d'évaluation

- Branch Code:04789 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:04789 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificatekabuldasPas encore d'évaluation

- Bionic Turtle FRM Practice Questions P1.T3. Financial Markets and Products Chapter 1. BanksDocument14 pagesBionic Turtle FRM Practice Questions P1.T3. Financial Markets and Products Chapter 1. BanksChristian Rey MagtibayPas encore d'évaluation

- Data Analysis and Interpretation TABLE 4.1 Age of The RespondentDocument60 pagesData Analysis and Interpretation TABLE 4.1 Age of The RespondenteshuPas encore d'évaluation

- End Chapter Solutions 2 and 3Document18 pagesEnd Chapter Solutions 2 and 3JpzellePas encore d'évaluation

- Invoice 54480Document1 pageInvoice 54480combatgoaPas encore d'évaluation

- Sumberuang - Id: Broker Firewoodfx BrokerDocument26 pagesSumberuang - Id: Broker Firewoodfx BrokerLentera HidupPas encore d'évaluation

- Account Activity Generated Through HBL MobileDocument2 pagesAccount Activity Generated Through HBL MobileSaqib NawazPas encore d'évaluation

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument12 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancevijay choudharyPas encore d'évaluation

- Schwab WireDocument4 pagesSchwab WirejamesPas encore d'évaluation

- Ack TanDocument1 pageAck TanHIMA HOSPITALPas encore d'évaluation

- San Carlos Milling Vs BPI, 1933Document2 pagesSan Carlos Milling Vs BPI, 1933Jesa FormaranPas encore d'évaluation

- Jharkhand University of Technology Fee ChallanDocument1 pageJharkhand University of Technology Fee ChallanAbhishek 18CED31Pas encore d'évaluation