Académique Documents

Professionnel Documents

Culture Documents

Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2

Transféré par

Karishma JaisinghaniTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2

Transféré par

Karishma JaisinghaniDroits d'auteur :

Formats disponibles

Profit and Loss Account For the year ended March 31, 2010 Column1

I. Rs. in 000 Year Ended Rs. in 000 Year Ended Column4 31-Mar-09 163,322,611 32,906,035 196,228,646 89,111,044 55,328,058 29,340,152 173,779,254 22,449,392 25,746,345 48,195,737 5,612,349 4,253,841 722,940 5,900 2,244,939 938,660 (138,550) 34,555,658 48,195,737

Column2

INCOME Interest earned Other income Total

Column3 31-Mar-10 161,729,000 38,076,106 199,805,106 77,862,988 57,644,827 34,810,282 Total 170,318,097 29,487,009 34,555,658 Total 64,042,667 7,371,752 5,492,919 912,305 9,343 2,948,701 1,994,599 (14,900) 45,327,948 Total 64,042,667

II.

EXPENDITURE Interest expended Operating expenses Provisions and contingencies [includes provision for income tax of Rs. 1,340,44 lacs (Previous year : Rs. 1,054,31 lacs)]

III.

PROFIT Net Profit for the year Profit brought forward

IV.

APPROPRIATIONS Transfer to Statutory Reserve Proposed dividend Tax (including cess) on dividend Dividend (including tax / cess thereon) pertaining to previous year paid during the year Transfer to General Reserve Transfer to Capital Reserve Transfer to / (from) Investment Reserve Account Balance carried over to Balance Sheet

V. Basic EARNINGS PER EQUITY SHARE (Face value Rs. 10 per share) Diluted Rs. 67.56 66.87 Rs. 52.85 52.59

Rs. in 000 Year Ended Column5 31-Mar-08 101,150,087 22,831,425 123,981,512 48,871,146 37,456,168 21,752,268 108,079,582 15,901,930 19,320,397 35,222,327 3,975,483 3,012,680 512,005 621 1,590,193 385,000 25,746,345 35,222,327

Rs. 46.22 45.59

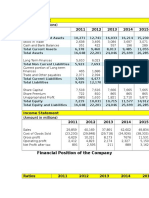

Balance Sheet As at March 31, 2010 Column1

CAPITAL AND LIABILITIES Capital Equity Share Warrants Reserves and Surplus Employees Stock Options (Grants) Outstanding Deposits Borrowings Other Liabilities and Provisions Total ASSETS Cash and Balances with Reserve Bank of India Balances with Banks and Money at Call and Short notice Investments Advances Fixed Assets Other Assets Total Contingent Liabilities Bills for Collection 154,832,841 144,591,147 586,076,161 1,258,305,939 21,228,114 59,551,495 2,224,585,697 4,790,515,044 81,248,646 135,272,112 39,794,055 588,175,488 988,830,473 17,067,290 63,568,314 1,832,707,732 4,059,816,885 85,522,390 125,531,766 22,251,622 493,935,382 634,268,934 11,750,917 44,027,411 1,331,766,032 5,930,080,864 69,207,148 210,618,369 29,135 1,674,044,394 129,156,925 206,159,441 2,224,585,697 4,577,433 4,253,841 4,009,158 142,209,460 54,870 1,428,115,800 91,636,374 162,428,229 1,832,707,732 1,007,685,910 45,949,235 163,158,482 1,331,766,032 111,428,076 3,544,329 Rs. in 000 As at Rs. in 000 As at Column4 31-Mar-09 As at Column5 31-Mar-08

Column2

Column3 31-Mar-10

Financial Ratios : Liquidity Ratios Column1 Column2

Current Ratio

Qucik Ratio ( Acid Test ) Cash Ratio Leverage Ratios

Debt Equity Ratio

Debt Asset Ratio

Interest Coverage Ratio

Fixed charge Coverage Ratio

Turnover Ratios

Inventory Turnover

Debtors Turnover

Average Collection Period

Fixed Asset Turnover

Total Asset Turnover Profitability Ratios

Gross Profit Margin

Net Profit Margin

Return on Assets

Return on Capital employed

Return on Equity Valuation ratios

Price - earnings Ratio ( PE )

Market value to Book value

Q - Ratio ( also known as Tobin's Ratio )

Column3

Column4 Column5 Column6 Mar-10 Mar-09 Mar-08 Current Assets Current Liabilities Current Assets - Inventories Current Liabilities Cash and Bank + Marketable Securities Current Liabilities 0.86 0.77 0.71

0.86

0.77

0.71

1.45

1.08

0.91

Debt Equity Debt Assets Profit before Interest and tax Interest

0.600102

0.608769

0.3996545

0.0580589 0.8292387 0.7911563

0.3787038

0.251926

0.3253848

Profit before Interest and tax + Depreciation Interest +( Repayment of Loan )/1-Tax Adjustment

COGS Average Inventory Net Credit Sales Average Debtors 365 Debtors Turnover Net Sales Average Net Fixed Assets 7.6186231 9.5693347 8.6078463

Net Sales Average Total Assets

0.0727007 0.0891155 0.0759518

Gross Profit Net Sales Net Profit Net Sales Profit after Tax Average Total Assets Profit before interest and tax Average Total Assets Profit after tax Average Equity

18.23%

13.75%

15.72%

18.23%

13.75%

15.72%

2.84%

2.59%

2.61%

2.88%

2.63%

2.64%

13.28%

14.83%

13.39%

Market price per share Earnings per share Market value per share Book value per share

9.4434577 12.071902 13.803548

3.9126509 2.6629691 2.0904074 163.0608 239.5822 305.20367

Market value of Equity and Liabilities Estimated replacement cost of assets

Column7 Remarks / Definition

Column8 Column9

Industry considers current ratio of 2:1 as satisfactory. It is noticed the ratio is increasing and so recommended to maintain a consistent growth. Industry considers quick ratio of 1:1 as satisfactory. As the ratio is near to the standards we recommend to maintain it. Marketable seucrities mean Short term Investments

Debt means long term OR long term + short term Equity means Equity share Capital + Reserves & Su Normally,Bankers do not accept debt equity ratio more than 2:1. As the ratio is decreasing it is feasible from both the perspectives. Debt means long term OR long term + short term Asset means Total of Balance Sheet Ass The ratio is favourable over the period of yrs as the assests are financed more through equity rather than debt. Interest is interest on Debt At this point of time the company is not generating sufficient revenues to satisfy interest expenses.

Tax adjustment is tax rate

It seems like the assets of the company are not well utilized as compared to previous year

In 2009 assets were generating better sales or revenue as compared to 2008 but in 2010 asset T/o ratio has fallen d

The gross profit margin has shown significant rise in 2010 as compared to 2009 which is good from the point of vie

Net profit margin is safety cushion for a company. However higher margin is preferable for the company.

Higher the ratio,indicates that the assets are well employed which is highly contributing in generating revenues.

ROCE should always be higher than the rate at which the company borrows.

Earnings per share = Profit after Tax / No.of equity shares Lower ratio denotes that there is lack of confidence in the company and the market overlooks the stock of the com

Book value per share = Net worth / No.of equity shares Net worth = Equity Share Capital + Reserves & Surplus

share Capital + Reserves & Surplus

ans Total of Balance Sheet Asset side h equity rather than debt.

rest expenses.

010 asset T/o ratio has fallen down again which signifies lower efficiency in generating sales or revenue.

h is good from the point of view of the company.

le for the company.

ng in generating revenues.

overlooks the stock of the company.

Vous aimerez peut-être aussi

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryD'EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Account-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueD'EverandAccount-Based Marketing: How to Target and Engage the Companies That Will Grow Your RevenueÉvaluation : 1 sur 5 étoiles1/5 (1)

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhPas encore d'évaluation

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43Pas encore d'évaluation

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalPas encore d'évaluation

- Rupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Document17 pagesRupees 000: Unconsolidated Statement of Financial Position As at December 31, 2011Jamal GillPas encore d'évaluation

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadPas encore d'évaluation

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadPas encore d'évaluation

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarPas encore d'évaluation

- AirThread G015Document6 pagesAirThread G015sahildharhakim83% (6)

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibPas encore d'évaluation

- FMDocument233 pagesFMparika khannaPas encore d'évaluation

- Balance Sheet of Titan IndustriesDocument24 pagesBalance Sheet of Titan IndustriesAkanksha NandaPas encore d'évaluation

- Itc LTD Financial Analysis: Group 4Document20 pagesItc LTD Financial Analysis: Group 4Kanav ChaudharyPas encore d'évaluation

- Fin Feasibiltiy Zubair Reg 54492Document9 pagesFin Feasibiltiy Zubair Reg 54492kzubairPas encore d'évaluation

- CompanyDocument19 pagesCompanyMark GrayPas encore d'évaluation

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiPas encore d'évaluation

- Session 1 2021 SharedDocument44 pagesSession 1 2021 SharedPuneet MeenaPas encore d'évaluation

- Blue Dart Express LTD.: CompanyDocument5 pagesBlue Dart Express LTD.: CompanygirishrajsPas encore d'évaluation

- Term 1 ProjectDocument9 pagesTerm 1 ProjectNiraj ThakurPas encore d'évaluation

- Financial Position of The Engro FoodsDocument2 pagesFinancial Position of The Engro FoodsJaveriarehanPas encore d'évaluation

- Introduction of MTM: StatementDocument23 pagesIntroduction of MTM: StatementALI SHER HaidriPas encore d'évaluation

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarPas encore d'évaluation

- Group 2 BUS 303 AssignmentDocument3 pagesGroup 2 BUS 303 Assignmentduch mangPas encore d'évaluation

- Preeti 149Document16 pagesPreeti 149Preeti NeelamPas encore d'évaluation

- CTC - Corporate Update - 10.02.2014Document6 pagesCTC - Corporate Update - 10.02.2014Randora LkPas encore d'évaluation

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Document13 pagesFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviPas encore d'évaluation

- HW2b Walmart SolutionDocument16 pagesHW2b Walmart Solutionherrajohn100% (1)

- Executive SummaryDocument12 pagesExecutive SummaryShehbaz HameedPas encore d'évaluation

- Teuer Furniture A Case Solution PPT (Group-04)Document13 pagesTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Group 2 RSRMDocument13 pagesGroup 2 RSRMAbid Hasan RomanPas encore d'évaluation

- Atlas BankDocument145 pagesAtlas BankWaqas NawazPas encore d'évaluation

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajPas encore d'évaluation

- M.Shahnam Ul Hassan ProjectDocument13 pagesM.Shahnam Ul Hassan ProjectM.ShahnamPas encore d'évaluation

- Aali - Icmd 2010 (A01) PDFDocument2 pagesAali - Icmd 2010 (A01) PDFArdheson Aviv AryaPas encore d'évaluation

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarPas encore d'évaluation

- Final Report (Renata Limited) RYA FIN440Document51 pagesFinal Report (Renata Limited) RYA FIN440Prince AhmedPas encore d'évaluation

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiPas encore d'évaluation

- ITC Consolidated FinancialsDocument49 pagesITC Consolidated FinancialsVishal JaiswalPas encore d'évaluation

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesPas encore d'évaluation

- Re Ratio AnalysisDocument31 pagesRe Ratio AnalysisManish SharmaPas encore d'évaluation

- Information On Dena BankDocument17 pagesInformation On Dena BankPradip VishwakarmaPas encore d'évaluation

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungPas encore d'évaluation

- Indian Oil Corporation Project 2Document30 pagesIndian Oil Corporation Project 2Rishika GoelPas encore d'évaluation

- Ashok LeylandDocument1 832 pagesAshok Leylandjadhavshankar100% (1)

- AT&T Vs MegafonDocument18 pagesAT&T Vs MegafonMikhay IstratiyPas encore d'évaluation

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.Pas encore d'évaluation

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969Pas encore d'évaluation

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Document9 pagesICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunPas encore d'évaluation

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlPas encore d'évaluation

- Atul Auto (ATUAUT) : Market Rewards PerformanceDocument5 pagesAtul Auto (ATUAUT) : Market Rewards PerformanceGaurav JainPas encore d'évaluation

- Balance Sheet of Maple Leaf: AssetsDocument18 pagesBalance Sheet of Maple Leaf: AssetsKamran RasoolPas encore d'évaluation

- Asok 06 08Document1 pageAsok 06 08rahulbalujaPas encore d'évaluation

- HDFC Bank Ratio AnalysisDocument14 pagesHDFC Bank Ratio Analysissunnykumar.m2325Pas encore d'évaluation

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocument5 pagesSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgPas encore d'évaluation

- Wooly Cox Limited: Common Size Balance Sheet Description/Year 15-MarDocument12 pagesWooly Cox Limited: Common Size Balance Sheet Description/Year 15-Marmahiyuvi mahiyuviPas encore d'évaluation

- Singer BangladeshDocument16 pagesSinger BangladeshMahbubur RahmanPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerD'EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerPas encore d'évaluation

- Hedge FundsDocument87 pagesHedge FundsTayebe RostamzadePas encore d'évaluation

- Topic 1: Overview of Financial Systems Test 1 SECTION1: Match The Terms With Suitable Explanations ExplanationsDocument33 pagesTopic 1: Overview of Financial Systems Test 1 SECTION1: Match The Terms With Suitable Explanations Explanationsnghiep tranPas encore d'évaluation

- Khunt Jaydeep 12403Document3 pagesKhunt Jaydeep 12403hiren4kachhadiyaPas encore d'évaluation

- Project On Working CapitalDocument48 pagesProject On Working CapitalSandeepKhandelwalPas encore d'évaluation

- Financial MarketDocument8 pagesFinancial Marketindusekar83Pas encore d'évaluation

- Introduction To Financial Statement Analysis 1.1 Background of The TopicDocument70 pagesIntroduction To Financial Statement Analysis 1.1 Background of The TopicThanuja BhaskarPas encore d'évaluation

- Tesla Inc - Research CaseDocument8 pagesTesla Inc - Research CaseJui ShindePas encore d'évaluation

- Canadian Capital Providers Guide0415Document141 pagesCanadian Capital Providers Guide0415kohinoordas2007100% (1)

- Implementing Strategies: Marketing, Finance/Accounting, R&D, and CIS IssuesDocument45 pagesImplementing Strategies: Marketing, Finance/Accounting, R&D, and CIS IssuesNikolas SkPas encore d'évaluation

- Heidelbergcement Annual Report 2016Document308 pagesHeidelbergcement Annual Report 2016someshPas encore d'évaluation

- Financial AnalysisDocument16 pagesFinancial Analysisraobabar21Pas encore d'évaluation

- 18P81E0023-capital Structure Jultratech CementDocument52 pages18P81E0023-capital Structure Jultratech CementMohmmedKhayyumPas encore d'évaluation

- Fin 202 S1 2016Document29 pagesFin 202 S1 2016herueuxPas encore d'évaluation

- Capital Structure NotesDocument56 pagesCapital Structure NotesChanchal Chawla100% (1)

- Finmar 1 5Document11 pagesFinmar 1 5Bhosx KimPas encore d'évaluation

- CA Final Afm t380Document257 pagesCA Final Afm t380Bijay AgrawalPas encore d'évaluation

- Columbia Business School - Investment Banking GuideDocument58 pagesColumbia Business School - Investment Banking Guideweeping.peaPas encore d'évaluation

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshPas encore d'évaluation

- Unit 1 FM Bba 4Document18 pagesUnit 1 FM Bba 4Ram KrishnaPas encore d'évaluation

- Heart of Darkness Essay TopicsDocument4 pagesHeart of Darkness Essay Topicsafibzfwdkaesyf100% (2)

- Yes Bank Equity AnalysisDocument4 pagesYes Bank Equity AnalysisShaloo MinzPas encore d'évaluation

- Ratio Analysis - CEAT Tyres LTDDocument18 pagesRatio Analysis - CEAT Tyres LTDagrawal.ace911450% (2)

- Suggested Answer - Syl16 - December 2019 - Paper - 17 Final ExaminationDocument24 pagesSuggested Answer - Syl16 - December 2019 - Paper - 17 Final ExaminationRohit KunduPas encore d'évaluation

- RESA MASPW-TheoriesDocument11 pagesRESA MASPW-TheoriesMellaniPas encore d'évaluation

- Capitalstructuretheory 090408162048 Phpapp02Document22 pagesCapitalstructuretheory 090408162048 Phpapp02Khodeez NingthoujamPas encore d'évaluation

- Capital Structure of Birla TyresDocument76 pagesCapital Structure of Birla TyresSunil Vicky VohraPas encore d'évaluation

- Chapter 4 - Introduction To Risk ManagementDocument60 pagesChapter 4 - Introduction To Risk Managementcalun12100% (1)

- Chapter 4 - Financial Statements of CompaniesDocument198 pagesChapter 4 - Financial Statements of CompaniesVaidehee MishraPas encore d'évaluation

- R56 Fundamentals of Credit AnalysisDocument23 pagesR56 Fundamentals of Credit AnalysisDiegoPas encore d'évaluation

- Capital Structure Financial Performance and SustaiDocument15 pagesCapital Structure Financial Performance and SustaiskambalePas encore d'évaluation