Académique Documents

Professionnel Documents

Culture Documents

A Systematic Reduction in The Extent of Exposure To A Risk And/or The Likelihood of Its Occurrence. Also Called Risk Reduction

Transféré par

Ayush MorarkaDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Systematic Reduction in The Extent of Exposure To A Risk And/or The Likelihood of Its Occurrence. Also Called Risk Reduction

Transféré par

Ayush MorarkaDroits d'auteur :

Formats disponibles

A systematic reduction in the extent of exposure to a risk and/or the likelihood of its occurrence. Also called risk reduction.

Risk mitigation is the act of decreasing the riskiness of a project. Explore the article further to find out what type of risks are involved in a project and how a project manager can mitigate these risks.

What is Risk Mitigation?

Risk Mitigation, in context of a project, can be defined as a measure or set of measures taken by a project manager to reduce or eliminate the risks associated with a project. Risks can be of various types such as technical risks, monetary risks and scheduling based risks. The project manager takes complete authority of reducing the probability of occurrence of risks while executing a project.

Mitigating Technical Risks

When delegating tasks to individuals, their technical competency might be overlooked. If so, then the chances of the project getting delayed

and not meeting the deadline will increase. Such delays can be avoided by increasing the communication frequency between the team members and monitoring their work.

Another alternative is to divide a complex task between team members and then delegate each part to a single individual. By reducing a complex technical task into larger simple tasks, the execution time may increase but the chances of missing the deadline for task completion can be kept up as the risk involved in the task is being diversified by the project manager among multiple individuals.

AcuTech Consulting Group

www.AcuTech-Consulting.com

CFATS, PSM, PHA, HAZOP, SVA Consulting, Training, & Software

Ads by Google

Image Credit: Icon Finder/Alessandro Rei

Mitigating Monetary Risks

A project manager is exposed to various challenges and has to make critical decisions in seeing through the projects execution with minimal risk. Cost based risk factors are difficult to estimate and intuition in making decisions which may increase the costs of deploying a task should be avoided. A safer bet used by the project managers is to use sophisticated cost estimation techniques. Some of the techniques such as Critical Path Method (CPM)/Program Evaluation and Review Technique (PERT) are used to oversee deployment of a task or set of tasks and analyzing the risks involved. Advanced techniques such as Expected Monetary Value (EMV)provide an insight on financial gain or loss if an event does or does not occur.

Mitigating Scheduling Risks

Executing the right task at the right time would help in lowering the risk of not meeting the project due date. Tasks can be assigned to individuals in two ways. The first one is to calculate the estimated processing time of each of the tasks and executing the tasks based on the Shortest Processing Time (SPT). The second one is to define due dates for each of the tasks and process them based on the Earliest Due Date (EDD). A project manager is the best judge here as to which method he would like to use in scheduling the tasks and delegating them to the individuals associated with the execution of the project. An advanced method of decreasing the risks while scheduling of the work based tasks is by using the Monte Carlo Simulation method

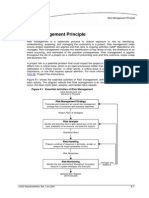

5. Risk Mitigation and Planning

5.1. Objectives of Risk Mitigation and Planning

The objectives of risk mitigation and planning are to explore risk response strategies for the highrisk items identified in the qualitative and quantitative risk analysis. The process identifies and assigns parties to take responsibility for each risk response. It ensures that each risk requiring a response has an owner. The owner of the risk could be an agency planner, engineer, or construction manager, depending on the

point in project development, or it could be a private sector contractor or partner, depending on the contracting method and risk allocation. Risk mitigation and planning efforts may require that agencies set policies, procedures, goals, and responsibility standards. Formalizing risk mitigation and planning throughout a highway agency will help establish a risk culture that should result in better cost management from planning through construction and better allocation of project risks that align teams with customer-oriented performance goals. Once the agency planner, engineers, and construction managers have thoroughly analyzed the critical set of risks, they are in a better position to determine the best course of action to mitigate those risks. Pennock and Haimes of the Center for Risk Management of Engineering Systems state that three key (14) questions can be posed for risk mitigation: 1. What can be done and what options are available? 2. What are the tradeoffs in terms of all costs, benefits, and risks among the available options? 3. What are the impacts of current decisions on future options? An understanding of these three questions is critical to risk mitigation and risk management planning. Question 1 addresses the available risk response options, which are presented in the following section. An understanding of questions 2 and 3 is necessary for risk planning because they determine the impact of both the immediate mitigation decisions and the flexibility of risk mitigation and planning on future events.

5.2. Risk Response Options

Risk identification, assessment, and analysis exercises form the basis for sound risk response options. A series of risk response actions can help agencies and their industry partners avoid or mitigate the identified risks. Wideman, in the Project Management Institute standard Project and Program Risk Management: A Guide to Managing Risks and Opportunities, states that a risk may be the following: Unrecognized, unmanaged, or ignored (by default). Recognized, but no action taken (absorbed by a mater of policy). Avoided (by taking appropriate steps). Reduced (by an alternative approach). Transferred (to others through contract or insurance). Retained and absorbed (by prudent allowances). Handled by a combination of the above. The above categorization of risk response options helps formalize risk management planning. The Caltrans Project Risk Management Handbook suggests a subset of strategies from the categorization (6) defined by Wideman above. The Caltrans handbook states that the project development team must identify which strategy is best for each risk and then design specific actions to implement that strategy. The strategies and actions in the handbook include the following: Avoidance-The team changes the project plan to eliminate the risk or to protect the project objectives from its impact. The team might achieve this by changing scope, adding time, or adding resources (thus relaxing the so-called triple constraint). Transference-The team transfers the financial impact of risk by contracting out some aspect of the work. Transference reduces the risk only if the contractor is more capable of taking steps to reduce the risk and does so. (This strategy is discussed in depth inChapter 6.). Mitigation-The team seeks to reduce the probability or consequences of a risk event to an acceptable threshold. It accomplishes this via many different means that are specific to the project and the risk. Mitigation steps, although costly and time consuming, may still be preferable to going forward with the unmitigated risk.

Acceptance-The project manager and team decide to accept certain risks. They do not change the project plan to deal with a risk or identify any response strategy other than agreeing to address the risk if it occurs. Given a clear understanding of the risks, their magnitude, and the options for response, an understanding of project risk will emerge. This understanding will include where, when, and to what extent exposure will be anticipated. The understanding will allow for thoughtful risk planning.

5.3. Risk Planning

Risk planning involves the thoughtful development, implementation, and monitoring of appropriate risk response strategies. The DOE's Office of Engineering and Construction Management defines risk (4) planning as the detailed formulation of a plan of action for the management of risk. It is the process to do the following: Develop and document an organized, comprehensive, and interactive risk management strategy. Determine the methods to be used to execute a risk management strategy. Plan for adequate resources. Risk planning is iterative and includes describing and scheduling the activities and processes to assess (identify and analyze), mitigate, monitor, and document the risk associated with a project. For large projects or projects with a high degree of uncertainty, the result should be a formal risk management plan. Planning begins by developing and documenting a risk management strategy. Early efforts establish the purpose and objective, assign responsibilities for specific areas, identify additional technical expertise needed, describe the assessment process and areas to consider, delineate procedures for consideration of mitigation and allocation options, dictate the reporting and documentation needs, and establish report requirements and monitoring metrics. This planning should also address evaluation of the capabilities of potential sources as well as early industry involvement.

5.4. Risk Planning Documentation

Each risk plan should be documented, but the level of detail will vary with the unique attributes of each project. Large projects or projects with high levels of uncertainty will benefit from detailed and formal risk management plans that record all aspects of risk identification, risk assessment, risk analysis, risk planning, risk allocation, and risk information systems, documentation, and reports. Projects that are smaller or contain minimal uncertainties may require only the documentation of a red flag item list that can be updated at critical milestones throughout the project development and construction.

5.4.1. Red Flag Item Lists

A red flag item list is created at the earliest stages of project development and maintained as a checklist during project development. It is perhaps the simplest form of risk identification and risk management. Not all projects will require a comprehensive and quantitative risk management process. A red flag item list can be used in a streamlined qualitative risk management process. A red flag item list is a technique to identify risks and focus attention on critical items that can impact the project's cost and schedule. Issues and items that can potentially impact project cost or schedule in a significant way are identified in a list, or red flagged, and the list is kept current as the project progresses through development and construction management. By listing items that can potentially impact a project's cost or schedule and by keeping the list current, the project team has a better perspective for setting proper contingencies and controlling risk. Occasionally, items considered risky are mentioned in planning but soon forgotten. The red flag item list facilitates communication among planners, engineers, and construction managers about these items. By maintaining a running list, these items will not disappear from consideration and then later cause problems.

Caltrans has developed a sample list of risks (see Appendix B) in its Project Risk Management (6) Handbook. While this sample list can be used to create a list of red flag items for a project, it is quite comprehensive and any single project's list of red flag items should not include all of these elements. The next section discusses risk charters, which is a more formalized and typically more quantitative extension of a red flag list.

5.4.2. Risk Charters

The creation of a risk charter is a more formal identification of risks than the listing of red flag items. Typically, it is completed as part of a formal and rigorous risk management plan. The risk charter provides project managers with a list of significant risks and includes information about the cost and schedule impacts of these risks. It also supports the contingency resolution process described in Chapter 6 by tracking changes in the magnitude of potential cost and schedule risk impacts as the project progresses through the development process and the risks are resolved. A risk charter is a document containing the results of a qualitative or quantitative risk analysis. It is similar to a list of red flag items, but typically contains more detailed information about the potential impact of the risks and the mitigation planning. The risk charter contains a list of identified risks, including description, category, and cause. It may contain measurements of magnitude such as the probability and impact of occurrence. It may also include proposed mitigation responses, "owners" of the risk, and current status. This method may be more effective than simply listing potential problem areas through red flagging because it integrates with the risk monitoring and control processes. The terms "risk charter" and "risk register" are synonymous in the highway industry. A risk charter is used as a management tool to identify, communicate, monitor, and control risks. It provides assistance in setting appropriate contingencies and equitably allocating risks. As part of a comprehensive risk management plan, the risk charter can help control cost escalation. It is appropriate for large or complex projects that have significant uncertainty. The charter organizes risks that can impact cost estimates and project delivery. A risk charter is typically based on either a qualitative or quantitative assessment of risk, rather than simple engineering judgment. The identified risks are listed with relevant information for quantifying, controlling, and monitoring. The risk charter may include relevant information such as the following: Risk description Status Date identified Project phase Functional assignment Risk trigger Probability of occurrence (percent) Impact ($ or days) Response actions Responsibility (task manager) Two examples of risk charters are in Appendix D. The first example, from Caltrans, is a spreadsheet that (6) forms the basis of the agency's risk management plan. The spreadsheet contains columns for identification, analysis, response strategy, and monitoring and control. The second example is from an (11) FTA report on risk assessment, which uses the term risk register synonymously with risk charter. The FTA risk register contains more quantitative risk assessment information than the Caltrans example, but the goal of the documentation is similar. FTA adds issues such as correlation among dependent components, type of distribution used to model the risk, and expected value of the risks.

5.4.3. Formal Risk Management Plan

The project development team's strategy to manage risk provides the project team with direction and basis for planning. The formal plan should be developed during the planning and scoping process and updated at subsequent project development phases. Since the agency and contractor team's ability to plan and build the facility affects the project's risks, industry can provide valuable insight into this area of consideration. The plan is the road map that tells the agency and contractor team how to get from where the project is today to where the public wants it to be in the future. Since it is a map, it may be specific in some areas, such as the assignment of responsibilities for agency and contractor participants and definitions, and general in other areas to allow users to choose the most efficient way to proceed. The following is a sample risk management plan outline: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. Introduction Summary Definitions Organization Risk management strategy and approach Risk identification Risk assessment and analysis Risk planning Risk allocation Risk charter and risk monitoring Risk management information system, documentation, and reports Each risk plan should be documented, but the level of detail will vary with the unique attributes of each project. Red flag item lists, risk charters, and formal risk management plans provide flexibility in risk management documentation.

5.5. Conclusions

Risk mitigation and planning use the information from the risk identification, assessment, and analysis processes to formulate response strategies for key risks. Common strategies are avoidance, transference, mitigation, or acceptance. The mitigation and planning exercises must be documented in an organized and comprehensive fashion that clearly assigns responsibilities and delineates procedures for mitigation and allocation of risks. Common documentation procedures frequently include the creation of red flag item lists, risk charters, and formal risk management planning documentation. Risk mitigation and planning efforts may necessitate that agencies set policies, procedures, goals, and responsibility standards. Formalizing risk mitigation and planning throughout the agency will help establish a risk culture that should result in better cost management from planning through construction and better allocation of project risks that align teams with customer-oriented performance goals.

Risk & Diversification

Risk is inherent in investing and is a requirement to grow capital. In our view, the best way to reduce risk is through owning a concentrated, yet well-diversified portfolio of profitable, industry-leading businesses. There are two types of risks associated with investing: Systematic risk: the general risk associated with investing in capital markets. This type of risk cannot be diversified away, as it refers to macroeconomic factors such as interest rates and inflation that affect the market as a whole. Unsystematic risk: the risk that is unique to a specific company. This type of risk can be largely mitigated through diversification.

Diversification comes in many forms. The basic theory of diversification is that spreading your investments across a number of securities in different sectors, industries and geographic regions reduces the risk that your portfolio will suffer a significant setback if a particular stock, industry or region is particularly hard hit.

How Much is Enough?

Market-beating managers express their insights in concentrated portfolios that differ dramatically from the character of the broad market. - David SwensenRecognizing the merits of diversification, the question becomes how much is adequate to effectively mitigate risk. We believe that owning a core group of 20-30 stocks in a diversified cross-section of the economy provides plenty of diversification. Risk can be further mitigated by possessing extensive knowledge of the stocks you own, and by purchasing them at reasonable valuations. It is a misconception that the more stocks you own, the better diversified you are. If the stocks you own all fall in the same industry or are exposed to the same unsystematic risks, you have achieved little diversification. A number of academic studies have concluded that owning roughly 20 randomly selected stocks provides ample diversification to the point where theres little unsystematic risk. The more stocks that are added to a portfolio beyond this point, the greater your chances of mirroring the index.

Beware of Overdiversification

Overdiversification is an investing error that plagues many fund managers and investors alike. A portfolio comprised of too many stocks stands little chance of outperforming the market. Overdiversified portfolios own a little of everything but a lot of nothing and are in essence a high-cost replication of an index. Moreover, the more stocks a manager has to follow, the less of an expert on each stock they bec

Vous aimerez peut-être aussi

- Project Scope Management: Syllabus For Chapter 4Document10 pagesProject Scope Management: Syllabus For Chapter 4rehan44Pas encore d'évaluation

- CH 5 RiskDocument12 pagesCH 5 RiskHager MassoudPas encore d'évaluation

- PM 016 Summer 2013Document7 pagesPM 016 Summer 2013Mohammed ThoufeeqPas encore d'évaluation

- Project Risk Management TemplateDocument6 pagesProject Risk Management TemplateJr HaumaPas encore d'évaluation

- Lecture Notes On SPM Unit-4 Risk Analysis and ManagementDocument5 pagesLecture Notes On SPM Unit-4 Risk Analysis and ManagementtusgPas encore d'évaluation

- Question 1 & Question 2Document9 pagesQuestion 1 & Question 2UMAIR AHMEDPas encore d'évaluation

- Risk Mitigation PlanningDocument8 pagesRisk Mitigation Planningchand777Pas encore d'évaluation

- 11 Project Management l11Document29 pages11 Project Management l11Manal Ali GhanemPas encore d'évaluation

- Decision TMA2 AnswerDocument5 pagesDecision TMA2 AnswerYosef DanielPas encore d'évaluation

- Project Risk ManagementDocument12 pagesProject Risk ManagementRadeeshaPas encore d'évaluation

- Chapter 11Document2 pagesChapter 11Zahrul ArafahPas encore d'évaluation

- Widimongar W. Jarque - Project - Risk - Management - Teng 439Document11 pagesWidimongar W. Jarque - Project - Risk - Management - Teng 439Widimongar JarquePas encore d'évaluation

- 1 Risk Management Principle: Tool 2EDocument6 pages1 Risk Management Principle: Tool 2EpekanselandarPas encore d'évaluation

- Bec 3324: Project Management Year Iii - Semester Ii Session 7Document35 pagesBec 3324: Project Management Year Iii - Semester Ii Session 7Tharindu PereraPas encore d'évaluation

- Risk Mitigation and PlanningDocument14 pagesRisk Mitigation and PlanningNikita Sangal100% (1)

- Risk ManagementDocument8 pagesRisk ManagementMy HaHPas encore d'évaluation

- Risk Management PlanDocument8 pagesRisk Management PlanubadjatePas encore d'évaluation

- Chapter 6-Risk Decision & ActionsDocument28 pagesChapter 6-Risk Decision & ActionsErmia MogePas encore d'évaluation

- 4.5 PresentationDocument13 pages4.5 PresentationHajar SadikiPas encore d'évaluation

- Risk Management in Executive Planning-PHILIP OMAR FAMULARCANODocument14 pagesRisk Management in Executive Planning-PHILIP OMAR FAMULARCANOPHILIP OMAR FAMULARCANOPas encore d'évaluation

- It Management ProjectDocument6 pagesIt Management Projectokello simon peterPas encore d'évaluation

- IMPLEMENTINGRISKMITIGATIONMONITORINGANDMANAGEMENTINITPROJECTSDocument9 pagesIMPLEMENTINGRISKMITIGATIONMONITORINGANDMANAGEMENTINITPROJECTSCertified PAPas encore d'évaluation

- 08 MarchewkaDocument57 pages08 Marchewkablackphoenix303Pas encore d'évaluation

- Risk Management in Construction Project ManagementDocument3 pagesRisk Management in Construction Project ManagementDeyb TV GamingPas encore d'évaluation

- ManagementDocument13 pagesManagementMOHAMED SLIMANIPas encore d'évaluation

- Assignment 4 RiskDocument19 pagesAssignment 4 RiskMohola Tebello GriffithPas encore d'évaluation

- Project Risk Identification Analysis and Response TemplateDocument5 pagesProject Risk Identification Analysis and Response TemplateAshraf SeragPas encore d'évaluation

- Risk Management 2Document8 pagesRisk Management 2ubadjatePas encore d'évaluation

- Risk Response PlanningDocument5 pagesRisk Response Planningubadjate100% (1)

- Decision TheoryDocument3 pagesDecision TheorySeyfe MesayPas encore d'évaluation

- PRM Lecture 6 - PLAN RISK RESPONSESDocument30 pagesPRM Lecture 6 - PLAN RISK RESPONSESYasi EemoPas encore d'évaluation

- Chapter 12 Project Risk ManagementDocument38 pagesChapter 12 Project Risk ManagementJaya ShresthaPas encore d'évaluation

- Research 1Document4 pagesResearch 1karl facturanPas encore d'évaluation

- RiskDocument4 pagesRiskadylanPas encore d'évaluation

- Chapter 2 - Looking at Projects RISKDocument22 pagesChapter 2 - Looking at Projects RISKErmia MogePas encore d'évaluation

- Basic Risk Analysis & Mitigation ProcessDocument18 pagesBasic Risk Analysis & Mitigation ProcessMd Mahadi Hasan RemalPas encore d'évaluation

- Risk Is Defined As Any Uncertain Event Management EssayDocument5 pagesRisk Is Defined As Any Uncertain Event Management EssayHND Assignment HelpPas encore d'évaluation

- Project Risk ManagementDocument16 pagesProject Risk ManagementRishabhGuptaPas encore d'évaluation

- Riskmanagement 12592328544536 Phpapp02Document29 pagesRiskmanagement 12592328544536 Phpapp02Jyothi RameshPas encore d'évaluation

- Risk Management1Document10 pagesRisk Management1ubadjatePas encore d'évaluation

- Master of Business Administration MBA Semester 2 MB0049 - Project Management (4 Credits) (Book ID: B1632) Assignment-Marks 60Document10 pagesMaster of Business Administration MBA Semester 2 MB0049 - Project Management (4 Credits) (Book ID: B1632) Assignment-Marks 60rasikapatil111Pas encore d'évaluation

- Assessment 3 - Script in Word FormatDocument4 pagesAssessment 3 - Script in Word FormatVladimir BloodymirPas encore d'évaluation

- Project Management AssignmentDocument12 pagesProject Management AssignmentHimanshu yogiPas encore d'évaluation

- RiskDocument10 pagesRiskFabian YslaPas encore d'évaluation

- Risk Management PlanDocument16 pagesRisk Management Plandrsuresh26Pas encore d'évaluation

- 6.0 Risk ManagementDocument43 pages6.0 Risk ManagementAizuddinHakimBennyPas encore d'évaluation

- Lecture-6 RiskDocument51 pagesLecture-6 RiskZafar Farooq100% (2)

- Unit VDocument24 pagesUnit VPrasad PatilPas encore d'évaluation

- Lecture 7 RiskDocument59 pagesLecture 7 RiskSidra Majeed100% (1)

- Ilovepdf Merged 4c7bdd33 159a 4e13 8c6b De1ec358b3caDocument75 pagesIlovepdf Merged 4c7bdd33 159a 4e13 8c6b De1ec358b3cagopalprajapatimoviePas encore d'évaluation

- Classical Project Risk Management PracticesDocument16 pagesClassical Project Risk Management PracticesDr. Ghulam DastgeerPas encore d'évaluation

- UNIT 5 Risk ManagementDocument15 pagesUNIT 5 Risk ManagementhiteshmehtaudemyPas encore d'évaluation

- Pm652 Lm6 NotesDocument5 pagesPm652 Lm6 NotesNatasha ReavesPas encore d'évaluation

- L06 Risk Response PlanningDocument23 pagesL06 Risk Response Planninghappiest1Pas encore d'évaluation

- Answer 1: IntroductionDocument9 pagesAnswer 1: IntroductionAman SharmaPas encore d'évaluation

- HR ExecutiveDocument16 pagesHR ExecutiveAli AbbasPas encore d'évaluation

- Se 5Document11 pagesSe 5gcyvuPas encore d'évaluation

- Project Risk Management: Shwetang Panchal Sigma Institute of Management StudiesDocument40 pagesProject Risk Management: Shwetang Panchal Sigma Institute of Management StudiesShwetang Panchal100% (1)

- Managing Project Risks (2021 Update) - 042340Document11 pagesManaging Project Risks (2021 Update) - 042340Joseph Kwafo MensahPas encore d'évaluation

- How to Control Risks Affecting a Project?D'EverandHow to Control Risks Affecting a Project?Évaluation : 5 sur 5 étoiles5/5 (2)