Académique Documents

Professionnel Documents

Culture Documents

Form 1120-F Schedules M-1 M-2 reconciliation analysis

Transféré par

croyal01Description originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Form 1120-F Schedules M-1 M-2 reconciliation analysis

Transféré par

croyal01Droits d'auteur :

Formats disponibles

(Form 1120-F)

SCHEDULES M-1 and M-2

Department of the Treasury Internal Revenue Service Name of corporation

Reconciliation of Income (Loss) and Analysis of Unappropriated Retained Earnings per Books

OMB No. 1545-0126

Attach to Form 1120-F.

2011

Employer identification number

Schedule M-1

1 2 3 4

Reconciliation of Income (Loss) per Books With Income per Return Note. Schedule M-3 may be required instead of Schedule M-1see instructions.

7 Income recorded on books this year not included on this return (itemize): a Tax-exempt interest $ b Other (itemize):

Net income (loss) per books . . . . . Federal income tax per books . . . . Excess of capital losses over capital gains Income subject to tax not recorded on books this year (itemize):

8 5 Expenses recorded on books this year not deducted on this return (itemize): $ a Depreciation . . . . b Charitable contributions $ c Travel and entertainment $ d Other (itemize): Add lines 1 through 5 . . . . . . .

Deductions on this return not charged against book income this year (itemize): a Depreciation . . $ b Charitable contributions $ c Other (itemize):

9 10

Add lines 7 and 8 . . . . Incomeline 6 less line 9 .

. .

. .

. .

Schedule M-2

1 2 3

Analysis of Unappropriated Retained Earnings per Books

. . . . . . . . 5 a Cash . . b Stock . . c Property . Other decreases (itemize): Distributions: . . . . . .

Balance at beginning of year Net income (loss) per books . Other increases (itemize):

6 7 8

Add lines 1, 2, and 3 .

Add lines 5 and 6 . . . . . . . Balance at end of year (line 4 less line 7) . The part of luxury water travel expenses not deductible under section 274(m). Expenses for travel as a form of education. Other nondeductible travel and entertainment expenses. For more information, see Pub. 542. Line 7a. Tax-exempt interest. Report any tax-exempt interest received or accrued, including any exempt-interest dividends received as a shareholder in a mutual fund or other regulated investment company. Also report this same amount in item P at the top of page 2 of Form 1120-F.

Who Must File

Generally, any foreign corporation that is required to complete Form 1120-F, Section II must complete Schedules M-1 and M-2 (Form 1120-F). However, under some circumstances, a foreign corporation is required to complete (or may voluntarily complete) Schedule M-3 (Form 1120-F) in lieu of Schedule M-1. Complete Schedule M-3 in lieu of Schedule M-1 if total assets at the end of the tax year that are reportable on Schedule L are $10 million or more. A corporation filing Form 1120-F that is not required to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1. See the Instructions for Schedule M-3 (Form 1120-F) for more information. Note. If Schedule M-3 is completed in lieu of Schedule M-1, the corporation is still required to complete Schedule M-2. Do not complete Schedules M-1, M-2, and M-3 if total assets at the end of the tax year (Schedule L, line 17, column (d)) are less than $25,000.

Specific Instructions

Schedule M-1

Line 1. Net income (loss) per books. The foreign corporation must report on line 1 of Schedule M-1 the net income (loss) per the set or sets of books taken into account on Schedule L. Line 5c. Travel and entertainment expenses. Include any of the following: Meal and entertainment expenses not deductible under section 274(n). Expenses for the use of an entertainment facility. The part of business gifts over $25. Expenses of an individual over $2,000 that are allocable to conventions on cruise ships. Employee achievement awards over $400. The cost of entertainment tickets over face value (also subject to the 50% limit under section 274(n)). The cost of skyboxes over the face value of nonluxury box seat tickets.

Cat. No. 49678K

Schedule M-2

Line 1. Beginning balance of unappropriated retained earnings. Enter the beginning balance of unappropriated retained earnings per the set(s) of books taken into account on Schedule L. Note. For additional information for Schedule M-2 reporting, see the Instructions for Schedule M-3 (Form 1120-F).

Schedules M-1 and M-2 (Form 1120-F) 2011

For Paperwork Reduction Act Notice, see the Instructions for Form 1120-F.

Vous aimerez peut-être aussi

- Return of Private Foundation: Line 16)Document13 pagesReturn of Private Foundation: Line 16)diego76diegoPas encore d'évaluation

- The Bilderberg Group Tax Returns 2010Document23 pagesThe Bilderberg Group Tax Returns 2010Jonathan Robert Kraus (OutofMudProductions)Pas encore d'évaluation

- Form 990-P F: Return of Private FoundationDocument26 pagesForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesPas encore d'évaluation

- United Council Form 990 2010Document18 pagesUnited Council Form 990 2010Signe BrewsterPas encore d'évaluation

- FTG Irs Form 990-Ez 2008Document12 pagesFTG Irs Form 990-Ez 2008L. A. PatersonPas encore d'évaluation

- Claude R. Lambe Charitable Foundation 2002Document17 pagesClaude R. Lambe Charitable Foundation 2002cmf8926Pas encore d'évaluation

- Justice 990 2009Document12 pagesJustice 990 2009TheSceneOfTheCrimePas encore d'évaluation

- 2015 Two BrothersDocument43 pages2015 Two BrothersAnonymous Wu0bxv6p7Pas encore d'évaluation

- Justice 990 2003Document2 pagesJustice 990 2003TheSceneOfTheCrimePas encore d'évaluation

- Instructions GSTR-9Document9 pagesInstructions GSTR-9pankajPas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionFrancis Wolfgang UrbanPas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public Inspectiongeoffb1Pas encore d'évaluation

- Farview Foundation 2010 990Document36 pagesFarview Foundation 2010 990TheSceneOfTheCrimePas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921Document3 pagesShort Form Return of Organization Exempt From Income Tax: Inspectio Ec - 31, 20 04 94: 325 6921lesliebrodiePas encore d'évaluation

- Barbara and Barrie Seid Foundation 363342443 2011 08e875b6searchableDocument22 pagesBarbara and Barrie Seid Foundation 363342443 2011 08e875b6searchablecmf8926Pas encore d'évaluation

- Instructions For Form GSTR-9Document8 pagesInstructions For Form GSTR-9param.ginniPas encore d'évaluation

- Cash Flows From Operating ActivitiesDocument5 pagesCash Flows From Operating ActivitiesIrfan MansoorPas encore d'évaluation

- B2011 Guidebook 2 PDFDocument175 pagesB2011 Guidebook 2 PDFRkakie KlaimPas encore d'évaluation

- Short Form Return of Organization Exempt From Income Tax: Open To Public InspectionDocument4 pagesShort Form Return of Organization Exempt From Income Tax: Open To Public InspectionpittscherylPas encore d'évaluation

- Charles G. Koch Charitable Foundation 2004Document34 pagesCharles G. Koch Charitable Foundation 2004cmf8926Pas encore d'évaluation

- Foreign Tax Credit: A B C D eDocument2 pagesForeign Tax Credit: A B C D eSamer Mira BazziPas encore d'évaluation

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Pas encore d'évaluation

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyPas encore d'évaluation

- US Internal Revenue Service: f1120fm1 - DFTDocument2 pagesUS Internal Revenue Service: f1120fm1 - DFTIRSPas encore d'évaluation

- Olive Branch Foundation 2006 990Document28 pagesOlive Branch Foundation 2006 990TheSceneOfTheCrimePas encore d'évaluation

- Key Highlights of Simplified Form GSTR 9 and Form GSTR 9c PDFDocument2 pagesKey Highlights of Simplified Form GSTR 9 and Form GSTR 9c PDFPriyanka BahiratPas encore d'évaluation

- US Internal Revenue Service: I1120sm3 - 2005Document18 pagesUS Internal Revenue Service: I1120sm3 - 2005IRSPas encore d'évaluation

- F 1040 SeDocument2 pagesF 1040 SeseihnPas encore d'évaluation

- Partner's Share of Income, Deductions and CreditsDocument2 pagesPartner's Share of Income, Deductions and Creditsjlusong89Pas encore d'évaluation

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Partha Pratim BiswasPas encore d'évaluation

- Interim financial statements lending companiesDocument5 pagesInterim financial statements lending companiesEdsy MendozaPas encore d'évaluation

- F 1040 SeDocument2 pagesF 1040 SepdizypdizyPas encore d'évaluation

- AB Limited Form Schedule K-1 DonDocument1 pageAB Limited Form Schedule K-1 Donsarah.gleasonPas encore d'évaluation

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13api-253299751Pas encore d'évaluation

- FDPP FormsDocument12 pagesFDPP FormsMay Joy Janapon Torquido-KunsoPas encore d'évaluation

- Instructions ITR5 AY2021 22Document196 pagesInstructions ITR5 AY2021 22Nikhil KumarPas encore d'évaluation

- Olive Branch Foundation 2005 990Document21 pagesOlive Branch Foundation 2005 990TheSceneOfTheCrimePas encore d'évaluation

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocument20 pages2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlPas encore d'évaluation

- Form 990-PF Private Foundation ReturnDocument24 pagesForm 990-PF Private Foundation Returntrb216Pas encore d'évaluation

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisPas encore d'évaluation

- Return of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustDocument15 pagesReturn of Private Foundation or Sectio N 9a7 @L (11 Nonexempt Charitable TrustalavifoundationPas encore d'évaluation

- Institute For Liberty 202641983 2008 076b44aeDocument4 pagesInstitute For Liberty 202641983 2008 076b44aecmf8926Pas encore d'évaluation

- Circular 26 2019Document4 pagesCircular 26 2019SnehPas encore d'évaluation

- BE2015 Guidebook 2Document84 pagesBE2015 Guidebook 2ContenderCPas encore d'évaluation

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarPas encore d'évaluation

- Chick-Fil-A 2009 Tax RecordsDocument57 pagesChick-Fil-A 2009 Tax RecordsSergio Nahuel CandidoPas encore d'évaluation

- Gates Foundation 2009 IRS 990Document235 pagesGates Foundation 2009 IRS 990jointhefuturePas encore d'évaluation

- Fred Gellert Family Foundation 2008 990Document53 pagesFred Gellert Family Foundation 2008 990TheSceneOfTheCrimePas encore d'évaluation

- Financial Follow Up Report (FFR-II)Document3 pagesFinancial Follow Up Report (FFR-II)Kiran ThakkerPas encore d'évaluation

- David H Koch Charitable Foundation 480926946 2006 0325BAD4Document24 pagesDavid H Koch Charitable Foundation 480926946 2006 0325BAD4cmf8926Pas encore d'évaluation

- Income Analysis WorksheetDocument11 pagesIncome Analysis WorksheetRajasekhar Reddy AnekalluPas encore d'évaluation

- Cfi - Fy2004 - F990Document37 pagesCfi - Fy2004 - F990Didi RemezPas encore d'évaluation

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoPas encore d'évaluation

- Claude R Lambe Charitable Foundation 480935563 2011 08d6a523Document24 pagesClaude R Lambe Charitable Foundation 480935563 2011 08d6a523cmf8926Pas encore d'évaluation

- Farview Foundation 2011 990Document34 pagesFarview Foundation 2011 990TheSceneOfTheCrimePas encore d'évaluation

- West Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Document39 pagesWest Hempstead, NY Rotary Foundation IRS 990s, 2011-2013Peter M. HeimlichPas encore d'évaluation

- katrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZDocument13 pageskatrinaBlairDirectsVolunteers2011 841141304 - 201112 - 990EZuncleadolphPas encore d'évaluation

- Short Form .EZ Return of Organization Exempt From Income Tax 2012Document9 pagesShort Form .EZ Return of Organization Exempt From Income Tax 2012FIXMYLOANPas encore d'évaluation

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsD'Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsPas encore d'évaluation

- 1040 Exam Prep Module X: Small Business Income and ExpensesD'Everand1040 Exam Prep Module X: Small Business Income and ExpensesPas encore d'évaluation

- Week 5 Special Revenue and Measurement Focus and Basis of Accounting - ACTG343Document10 pagesWeek 5 Special Revenue and Measurement Focus and Basis of Accounting - ACTG343Marilou Arcillas PanisalesPas encore d'évaluation

- Babcock University Acct 434 Lecture 4 Double Taxation ReliefDocument24 pagesBabcock University Acct 434 Lecture 4 Double Taxation ReliefdemolaojaomoPas encore d'évaluation

- Bitumen Price List 1-09-2010 & 16-09-2010Document2 pagesBitumen Price List 1-09-2010 & 16-09-2010Vizag RoadsPas encore d'évaluation

- ASIA TRUST DEVELOPMENT BANK, INC Vs CIRDocument2 pagesASIA TRUST DEVELOPMENT BANK, INC Vs CIRPaolo NazarenoPas encore d'évaluation

- Benguet Corp. v. CIRDocument7 pagesBenguet Corp. v. CIRMika Aurelio100% (1)

- Anchor Bank Shanghai Branch Income Tax ExclusionDocument8 pagesAnchor Bank Shanghai Branch Income Tax ExclusiongracePas encore d'évaluation

- Bruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LDocument1 pageBruhat Bengaluru Mahanagara Palike - Revenue Department: Xjdœ LXD - /HZ Eud/ Eĺ Lbx¡E (6 E LManjunathPas encore d'évaluation

- Instructions ITR2 AY2021 22Document125 pagesInstructions ITR2 AY2021 22Help Tubestar CrewPas encore d'évaluation

- Ats New FormatDocument2 pagesAts New FormatJem MendenillaPas encore d'évaluation

- Philippine Guaranty Co Vs CIRDocument4 pagesPhilippine Guaranty Co Vs CIRJarvin David ResusPas encore d'évaluation

- 7th NFC Award 2010Document4 pages7th NFC Award 2010humayun313Pas encore d'évaluation

- De 4Document4 pagesDe 4fschalkPas encore d'évaluation

- New Exchange/Segment Activation Request Form: To, Angel Broking LimitedDocument2 pagesNew Exchange/Segment Activation Request Form: To, Angel Broking LimitedasdfPas encore d'évaluation

- Sales GST 285Document2 pagesSales GST 285ashish.asati1Pas encore d'évaluation

- 2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFDocument1 page2019 08 21 12 13 35 858 - 1566369815858 - XXXPC1439X - Itrv PDFSrishti Abhishek JainPas encore d'évaluation

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcPas encore d'évaluation

- Kotak Securities Payslip for August 2020Document1 pageKotak Securities Payslip for August 2020Aakash PrajapatiPas encore d'évaluation

- Rocket Man Incorporated Provided The Following Financial Statement Information ForDocument1 pageRocket Man Incorporated Provided The Following Financial Statement Information ForTaimour HassanPas encore d'évaluation

- Philippines Excise Tax ReturnDocument2 pagesPhilippines Excise Tax ReturnCJ GranadaPas encore d'évaluation

- Tax Residence TutorialDocument11 pagesTax Residence TutorialHazlina HusseinPas encore d'évaluation

- To Whom So Ever It May ConsernDocument1 pageTo Whom So Ever It May ConsernrajPas encore d'évaluation

- DA Arr Jan-22 To Mar-22Document6 pagesDA Arr Jan-22 To Mar-22JCCT Enforcement SHIVAMOGGAPas encore d'évaluation

- Ssm-Arry Urus SDN Bhd-Mar17Document6 pagesSsm-Arry Urus SDN Bhd-Mar17xidaPas encore d'évaluation

- Amazon Invoice2Document1 pageAmazon Invoice2Mohan KumarPas encore d'évaluation

- Chapter 4 - TaxesDocument28 pagesChapter 4 - TaxesabandcPas encore d'évaluation

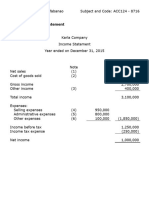

- ACC124 - Assignment On Income StatementDocument6 pagesACC124 - Assignment On Income StatementRuzuiPas encore d'évaluation

- Cotiviti India Private Limited: Payslip For The Month of January 2023Document1 pageCotiviti India Private Limited: Payslip For The Month of January 2023Kshitij MadnalPas encore d'évaluation

- Gov Acc Quiz 4, BeltranDocument2 pagesGov Acc Quiz 4, Beltranbruuhhhh0% (2)

- Temporary Differences (Result in Deferred Taxes)Document45 pagesTemporary Differences (Result in Deferred Taxes)chuynh18Pas encore d'évaluation

- How To Configure Ebtax For Vat TaxDocument17 pagesHow To Configure Ebtax For Vat TaxKaushik BosePas encore d'évaluation