Académique Documents

Professionnel Documents

Culture Documents

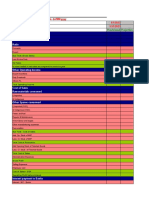

Exhibit 6.3 Margin Money For Working Capital

Transféré par

anon_285857320Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Exhibit 6.3 Margin Money For Working Capital

Transféré par

anon_285857320Droits d'auteur :

Formats disponibles

Exhibit 6.3 Margin Money for Working capital 1 Year No.

of Bank Amount of Margin Months Margin Amount Bank Money Amount requirements Availabily (4) Finance required ( 7) (2) ( 3) (5) (6)

Items

1. Indigenous raw materials / components Less: Trade credits Net indigenous raw materials / components 2. Imported raw materials / components 3. Consumable stores Less: Trade credit Net consumable stores 4. Wages and salaries 5. Cost of fuel, light and power, taxes, insurance, rent, etc. 6. Cost of repairs and maintenance 7. Packing and sales expenses ( other than salaries and wages on sale staff which should be included under 4 above ) 8. Stock and finished goods at cost excluding depreciation ( to be held for the period between production and realisation of sale proceeds ) 9. Stock of goods- in- process ( cost of production, excluding depreciation during the period taken for one complete cycle, i.e., from the raw material to the finished goods stage ) 10. Outstanding debtors 11. Other items of working capital, if any ( Excise duty payable on 1 month's sale, deposits for utilities, etc.) Less: Trade credits available on raw materials and consumables Net working capital

Exhibit 6.2 Estimates of Production and Sales ( Details may be furnished separately for each product and until the plant reaches maximum capacity utilisation ) Product Product 1st Yr. 1. Installed capacity ( qty. per day per annum ) 2nd Yr. 3rd Yr. 4th Yr. 1st Yr. 2nd Yr. 3rd Yr. 4th Yr.

2. No. of Working days 3. No. of shifts 4. Estimated production per day ( qty ) 5. Estimated annual production ( qty ) 6. Estimated output as % of plant capacity

7. Sales ( qty ) ( after adjusting stocks ) 8. Value of sales ( in ' 000 of Rs ) Product (I) ( II ) ( III ) Note: Production in the initial period should be assumed at a reasonable level of utilisation of capacity increasing gradually to attain full capacity in subsequent years.

Exhibit 6.4 Estimates of Working Results (This statement should be prepared for ten years) (In thousands of rupees) Year ending 20 A Cost of Production Administrative expenses Administrative salaries Remuneration to directors Professional fees Light, postage, telegrams and telephones, office supplies (stationery, Printing, etc.) Insurance and taxes on office property Miscellaneous B Total Administrative Expenses C Total Sales Expenses D Royalty and know-howj Payable E Total Cost of Production(A+B+C+D) F Expected Sales G Gross Profit Before Interest (F-E) Financial expenses Interest on term loans Interest on borrowings for working capital Guarantee commission H Total Financial Expenses I Depreciation J Operating Profit (G-H-I) K Other Income, if any (Given details) L Preliminary Expenses Written Off M Profit/Loss before Taxation ( J+K+L) N Provision for Taxation O Profit After Tax (M-N) Less Dividend on Preference Capital Equity Capital (with rate) P Retained Profit Add Depreciation Preliminary Expenses Written Off Q Net Cash Accruals

20

20

20

20 (ten years)

Note: Detailed working shall be provided for the calculation of depreciation (straightlline and income tax method) , interest, taxation, etc.

FINANCE -BALANCE SHEET

SOURCES OF FUNDS :

Share Capital Reserves Total Equity Share Warrants Equity Application Money

Yr 1

Yr 2

Yr 3

Yr 4

Yr 5

Total Shareholders Funds

Secured Loans Unsecured Loans

Total Debt Total Liabilities

APPLICATION OF FUNDS :

Gross Block Less : Accumulated Depreciation Less:Impairment of Assets Net Block Lease Adjustment Capital Work in Progress Investments Current Assets, Loans & Advances Inventories Sundry Debtors Cash and Bank Loans and Advances Total Current Assets Less : Current Liabilities and Provisions Current Liabilities Provisions Total Current Liabilities Net Current Assets Miscellaneous Expenses not written off Deferred Tax Assets Deferred Tax Liability Net Deferred Tax

Total Assets

Contingent Liabilities

Yr 6

Cash Flow Statement

Sources of Cash

Funds from operations Net Income (profit before Tax) +Depreciation +loss on sale of assets - profit on sale of assets - Interest Income + Interest expenses Issue of share capital New Equity Capital New Preference Capital Long term borrowings New debentures New Long term loans Sale of non-current assets Sale of Fixed assets Sale of Investments Interest income Increases in current liabilities Increase in creditors Increase in short term borrowings Increase in O/S expenses Increase in Income received in advance Decrease in current assets other than cash Dec in Inventory Decrease in Debtors Dec in Prepaid expenses Dec in O/S Income

Operating activities

Financing Activities

Investment activities

Working Capital changes

Uses Of cash

Payment of Dividend Taxes Redemption of Capital Equity Capital Preference Capital Redemption of Long term borrowings New debentures New Long term loans Interest expenses Purchase of non-current assets Purchas of Fixed assets Purchas of Investments Decrease in current liabilities Decrease in creditors Decrease in short term borrowings Decrease in O/S expenses Decrease in Income received in advance Increase in current assets other than cash Inc in Inventory Inc in Debtors Inc in Prepaid expenses Operating activities

Financing Activities Investment activities

Working Capital changes

inc in O/S Income

Working Capital changes

Cash flow from Operating activities

A

Sources of Cash

Funds from operations Net Income (profit before Tax) +Depreciation +loss on sale of assets - profit on sale of assets +Interest expenses - Interest income

Uses Of cash

Payment of Dividend Taxes

Operating profit before working capital changes

C

Sources of Cash

Increases in current liabilities Increase in creditors Increase in short term borrowings Increase in O/S expenses Increase in Income received in advance Decrease in current assets other than cash Dec in Inventory Decrease in Debtors Dec in Prepaid expenses Dec in O/S Income

Uses Of cash

Decrease in current liabilities Decrease in creditors Decrease in short term borrowings Decrease in O/S expenses Decrease in Income received in advance Increase in current assets other than cash Inc in Inventory Inc in Debtors Inc in Prepaid expenses inc in O/S Income

I

E

Net Cash flow from operating activities (A-B+C-D) Cash flow from Financing activities

Sources of Cash

Issue of share capital New Equity Capital New Preference Capital Long term borrowings New debentures New Long term loans

Uses Of cash

Redemption of Capital Equity Capital Preference Capital Redemption of Long term borrowings New debentures New Long term loans Interest paid

II

G

Net Cash flow from Financing activities (E-F) Cash flow from Investment activities

Sources of Cash

Sale of non-current assets Sale of Fixed assets Sale of Investments Interest income

Uses Of cash

H Purchase of non-current assets Purchas of Fixed assets Purchas of Investments

III

Net Cash flow from Investment activities (G-H)

Inc/Dec in cash I + II + III

Net cash equivalent at beginning Net cash equivalent at end Cash equivalent is equal to cash, bank, and near cash (Money market Instruments)

Cash flow estimation Investment Outlay 1

Total revenue less : total expenses

0 (xxx)

2 (xxx)

EBDIT

Less; Depreciation EBIT Less: Interest EBT Less: Tax EAT Add Depreciation

Opearting Cash Flow

Add Salvage Values

NCF

CF to all investors CF to equity investors CF to Debt Invetsors EAT+depreciation+both ST & LT Interest(1-t) EAT+depreciation- all principal repayments and capital expense EAT+depreciation+ LT Interest(1-t)

cost of capital opportunity cost of funds estimation of NPV IRR estimation Sensitivity Analysis

st(1-t) capital expense )

consider interest on Short term loan

Particulars Opening Stock of Raw Material Add: Purchase of Raw materials Add: Purchase Expenses Less: Closing stock of Raw Materials Raw Materials Consumed Direct Wages (Labour) Direct Charges Prime cost (1) Add :- Factory Over Heads: Factory Rent Factory Power Indirect Material Indirect Wages Supervisor Salary Drawing Office Salary Factory Insurance Factory Asset Depreciation Works cost Incurred Add: Opening Stock of WIP Less: Closing Stock of WIP Works cost (2) Add:- Administration Over Heads:Office Rent Asset Depreciation General Charges Audit Fees Bank Charges Counting house Salary Other Office Expenses Cost of Production (3) Add: Opening stock of Finished Goods Less: Closing stock of Finished Goods Cost of Goods Sold Add:- Selling and Distribution OH:Sales man Commission Sales man salary Traveling Expenses Advertisement Delivery man expenses Sales Tax Bad Debts

Amount Amount *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** ***

Cost of Sales (5) Profit (balancing figure) Sales

*** *** ***

Vous aimerez peut-être aussi

- Accounting and Finance Formulas: A Simple IntroductionD'EverandAccounting and Finance Formulas: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (8)

- For Balance Sheet and Retained Earnings Statement - Follow The Format in The BookDocument7 pagesFor Balance Sheet and Retained Earnings Statement - Follow The Format in The Booknhtsng123Pas encore d'évaluation

- Cma Format - 29.08.2022 - 12.13PMDocument12 pagesCma Format - 29.08.2022 - 12.13PMShreeRang ConsultancyPas encore d'évaluation

- Profit and Loss AccountDocument5 pagesProfit and Loss AccountLanston PintoPas encore d'évaluation

- Revised SCH VIDocument8 pagesRevised SCH VIParas ShahPas encore d'évaluation

- Particulars: Form II Operating StatementDocument26 pagesParticulars: Form II Operating StatementvineshjainPas encore d'évaluation

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745Pas encore d'évaluation

- 06 Financial Estimates and ProjectionsDocument19 pages06 Financial Estimates and ProjectionsSri RanjaniPas encore d'évaluation

- Statement of Change in Financial Position-5Document32 pagesStatement of Change in Financial Position-5Amit SinghPas encore d'évaluation

- MGMT 200 NotesDocument11 pagesMGMT 200 NotesCaroline CareyPas encore d'évaluation

- Cash Flow StatementsDocument4 pagesCash Flow StatementsUnbeatable 9503Pas encore d'évaluation

- Balance Sheet - Account FormDocument56 pagesBalance Sheet - Account FormRohit SinghPas encore d'évaluation

- Final Account BBADocument37 pagesFinal Account BBAgrivand100% (1)

- Balance Sheet Analysis PPT at Bec Doms BDocument25 pagesBalance Sheet Analysis PPT at Bec Doms BAARTI GUPTAPas encore d'évaluation

- IPTC CMA Bank FormatDocument12 pagesIPTC CMA Bank FormatRadhesh BhootPas encore d'évaluation

- Balance Sheet Analysis Sources of FundsDocument4 pagesBalance Sheet Analysis Sources of FundsMohammad Asraf Ul HaquePas encore d'évaluation

- Operating Activities Direct MethodDocument3 pagesOperating Activities Direct MethodGilbert KunongaPas encore d'évaluation

- Estimates of Working Results and Profitability (In Rs Lakhs Unless Otherwise Mentioned)Document19 pagesEstimates of Working Results and Profitability (In Rs Lakhs Unless Otherwise Mentioned)Sweta MishraPas encore d'évaluation

- Final Accounts/ Financial StatementsDocument53 pagesFinal Accounts/ Financial Statementsrachealll100% (1)

- Finance For Media CompaniesDocument70 pagesFinance For Media CompaniesrliritisPas encore d'évaluation

- ACC1002X Cheat Sheet 2Document1 pageACC1002X Cheat Sheet 2jieboPas encore d'évaluation

- Financial StatementsDocument20 pagesFinancial StatementsOmnath Bihari100% (1)

- Preparation of Financial StatementsDocument3 pagesPreparation of Financial StatementsMarc Eric Redondo0% (1)

- Ananta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowDocument40 pagesAnanta-02 - Mengenal Laporan Keuangan, Pajak, Dan Free Cash FlowKania SyahraPas encore d'évaluation

- Trading and Profit and Loss AccountDocument5 pagesTrading and Profit and Loss AccountDanish Azmi100% (1)

- Final AccountsDocument12 pagesFinal AccountsPraveenPas encore d'évaluation

- Cma AFSDocument14 pagesCma AFSvijayPas encore d'évaluation

- Basic AccountingDocument25 pagesBasic AccountingGaurav AgarwalPas encore d'évaluation

- Crest 2015fd AppraisalDocument22 pagesCrest 2015fd Appraisalcountryhomes03Pas encore d'évaluation

- CMA FinalDocument62 pagesCMA FinalKartik DoshiPas encore d'évaluation

- Financial Templates - W1Document7 pagesFinancial Templates - W1Abhijit BhattacharyaPas encore d'évaluation

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- MIS Financials Format XlsMISDocument78 pagesMIS Financials Format XlsMISarajamani78100% (1)

- Equity ValuationDocument2 424 pagesEquity ValuationMuteeb Raina0% (1)

- Financial Projection Template - NewDocument5 pagesFinancial Projection Template - NewNorhisham DaudPas encore d'évaluation

- Birla 3M LimitedDocument4 pagesBirla 3M LimitedanushageminiPas encore d'évaluation

- Prep Trading - Profit-And-Loss-Ac Balance SheetDocument25 pagesPrep Trading - Profit-And-Loss-Ac Balance Sheetfaltumail379100% (1)

- Financial Statement Analysis Questions We Would Like AnsweredDocument9 pagesFinancial Statement Analysis Questions We Would Like AnsweredthakurvinodPas encore d'évaluation

- of Revised Schdule Vi1Document43 pagesof Revised Schdule Vi1Jay RoyPas encore d'évaluation

- Cash Flow Analysis and Value Added MeasuresDocument19 pagesCash Flow Analysis and Value Added MeasuresShruti MaindolaPas encore d'évaluation

- Engineering Economy & FinanaceDocument94 pagesEngineering Economy & FinanaceAbhishek PilliPas encore d'évaluation

- Case Study Three: Anandam: Professor: Victor GoodmanDocument6 pagesCase Study Three: Anandam: Professor: Victor GoodmanYuki IsawaPas encore d'évaluation

- CashFlow With SolutionsDocument82 pagesCashFlow With SolutionsHermen Kapello100% (2)

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationDocument6 pagesFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraPas encore d'évaluation

- Accounting EquationDocument36 pagesAccounting EquationZainon Idris100% (1)

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplateSardar A A KhanPas encore d'évaluation

- Chapter12 - (Applied Auditing)Document5 pagesChapter12 - (Applied Auditing)Christian Ibañez AbenirPas encore d'évaluation

- AccountingDocument118 pagesAccountingReshmi R Nair100% (1)

- Free Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dDocument32 pagesFree Basic Short Financial Accounting - 2f20dc43 314d 49bf A7e8 F398e2c49e3dCareer and TechnologyPas encore d'évaluation

- Cash Flow Statement: Position of A Firm. Cash and Relevant Terms As Per AS-3 (Revised)Document17 pagesCash Flow Statement: Position of A Firm. Cash and Relevant Terms As Per AS-3 (Revised)Jebby VarghesePas encore d'évaluation

- 1 - Classification of AccountsDocument6 pages1 - Classification of AccountsKanganFatimaPas encore d'évaluation

- CA CheatSheetDocument3 pagesCA CheatSheetJonathanChanPas encore d'évaluation

- Cash Flow Statement Classification of ActivitiesDocument4 pagesCash Flow Statement Classification of ActivitiesAanchal MahajanPas encore d'évaluation

- 06-Projected Financial StatementsDocument7 pages06-Projected Financial StatementsMaria NisarPas encore d'évaluation

- Financial Statement AnalysisDocument17 pagesFinancial Statement AnalysisRaijo PhilipPas encore d'évaluation

- Financial Statements: Course Instructor Dewan Muktadir-Al-MukitDocument24 pagesFinancial Statements: Course Instructor Dewan Muktadir-Al-Mukitanu_pomPas encore d'évaluation

- Final AccountDocument10 pagesFinal AccountSaket AgarwalPas encore d'évaluation

- Final AccountsDocument27 pagesFinal AccountsNafis Siddiqui100% (1)

- Income Statement TemplateDocument4 pagesIncome Statement TemplateAnonymous gFcnQ4goPas encore d'évaluation

- PPP ThailandDocument18 pagesPPP ThailandenfrspitPas encore d'évaluation

- 131 International FinanceDocument300 pages131 International FinanceWhatsapp stutsPas encore d'évaluation

- Boat Eardops InvoiceDocument1 pageBoat Eardops Invoicelabbaik146Pas encore d'évaluation

- MCQ's On EconomicsDocument43 pagesMCQ's On Economicsnilesh jarhad67% (3)

- The Hindu Review August 2021Document45 pagesThe Hindu Review August 2021SHIKHA SHARMAPas encore d'évaluation

- Corporate Finace 1 PDFDocument4 pagesCorporate Finace 1 PDFwafflesPas encore d'évaluation

- Affidavit of TenancyDocument1 pageAffidavit of Tenancybhem silverio100% (1)

- Pen Memo 10393Document5 pagesPen Memo 10393avr1983Pas encore d'évaluation

- Wicktator Trade MaterialDocument11 pagesWicktator Trade MaterialrontechtipsPas encore d'évaluation

- Nature and Form of The Contract: Atty. DujuncoDocument9 pagesNature and Form of The Contract: Atty. DujuncoShaiPas encore d'évaluation

- Share Market ScamDocument14 pagesShare Market ScamPramod DasadePas encore d'évaluation

- Analysis of PELDocument3 pagesAnalysis of PELHasham NaveedPas encore d'évaluation

- Referralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrerDocument3 pagesReferralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrermikePas encore d'évaluation

- PT 2 Question Paper Class 8 Maths 2021-22Document2 pagesPT 2 Question Paper Class 8 Maths 2021-22Neha BansalPas encore d'évaluation

- The Big ShortDocument7 pagesThe Big ShortFrans Jd0% (1)

- Trends and Technology Timeline 2010Document1 pageTrends and Technology Timeline 2010Lynda KosterPas encore d'évaluation

- IT Sector ReviewDocument16 pagesIT Sector ReviewPratik RambhiaPas encore d'évaluation

- Week 5 - Efficient DiversificationDocument40 pagesWeek 5 - Efficient DiversificationshanikaPas encore d'évaluation

- Presentation - Sources - of - Finance - BST SEMINARDocument16 pagesPresentation - Sources - of - Finance - BST SEMINARManav MohantyPas encore d'évaluation

- Caf 6 All PDFDocument80 pagesCaf 6 All PDFMuhammad Yahya100% (1)

- Development of A Business PlanDocument18 pagesDevelopment of A Business Plansisay2001Pas encore d'évaluation

- Digest RR 14-2001 PDFDocument1 pageDigest RR 14-2001 PDFCliff DaquioagPas encore d'évaluation

- Impact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelDocument6 pagesImpact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelYusuf HusseinPas encore d'évaluation

- The Wall Street Journal 21 - 06 - 23Document32 pagesThe Wall Street Journal 21 - 06 - 23Juan Francisco Pagés NavarretePas encore d'évaluation

- Chapter 1Document37 pagesChapter 1bhawesh agPas encore d'évaluation

- ch07 - Intermediate Acc IFRS (Cash and Receivable)Document104 pagesch07 - Intermediate Acc IFRS (Cash and Receivable)irma cahyani kawiPas encore d'évaluation

- Final Soft Copy of Grant-in-Aid SchemeDocument14 pagesFinal Soft Copy of Grant-in-Aid SchemeTender infoPas encore d'évaluation

- CEO in United States Resume Valerie PerlowitzDocument10 pagesCEO in United States Resume Valerie PerlowitzValeriePerlowitzPas encore d'évaluation

- Full Download Fundamentals of Corporate Finance Asia Global 2nd Edition Ross Solutions ManualDocument36 pagesFull Download Fundamentals of Corporate Finance Asia Global 2nd Edition Ross Solutions Manualempiercefibberucql19100% (36)

- Chapter Two: The Financial Statement Auditing EnvironmentDocument34 pagesChapter Two: The Financial Statement Auditing EnvironmentKookies4Pas encore d'évaluation