Académique Documents

Professionnel Documents

Culture Documents

Working Capital Analysis-Sir

Transféré par

Tanvi NaharDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Working Capital Analysis-Sir

Transféré par

Tanvi NaharDroits d'auteur :

Formats disponibles

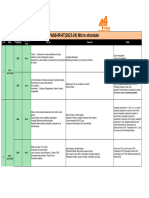

WORKING CAPITAL ANALYSIS As we know working capital is the life blood and the centre of a business.

Adequate amount of working capital is very much essential for the smooth running of the business. And the most important part is the efficient management of working capital in right time. The liquidity position of the firm is totally effected by the management of working capital. So, a study of changes in the uses and sources of working capital is necessary to evaluate the efficiency with which the working capital is employed in a business. This involves the need of working capital analysis. The analysis of working capital can be conducted through a number of devices, such as: 1. 2. 3. Ratio analysis. Fund flow analysis. Budgeting.

1. RATIO ANALYSIS A ratio is a simple arithmetical expression one number to another. The technique of ratio analysis can be employed for measuring short-term liquidity or working capital position of a firm. The following ratios can be calculated for these purposes: 1. Current ratio.

2. Quick ratio 3. Absolute liquid ratio 4. Inventory turnover. 5. Receivables turnover. 6. Payable turnover ratio. 7. Working capital turnover ratio. 8. Working capital leverage 9. Ratio of current liabilities to tangible net worth.

2. FUND FLOW ANALYSIS Fund flow analysis is a technical device designated to the study the source from which additional funds were derived and the use to which these sources were put. The fund flow analysis consists of:

a. b.

Preparing schedule of changes of working capital Statement of sources and application of funds.

It is an effective management tool to study the changes in financial position (working capital) business enterprise between beginning and ending of the financial dates.

3. WORKING CAPITAL BUDGET A budget is a financial and / or quantitative expression of business plans and polices to be pursued in the future period time. Working capital budget as a part of the total budge ting process of a business is prepared estimating future long term and short term working capital needs and sources to finance them, and then comparing the budgeted figures with actual performance for calculating the variances, if any, so that corrective actions may be taken in future. He objective working capital budget is to ensure availability of funds as and needed, and to ensure effective utilization of these resources. The successful implementation of working capital budget involves the preparing of separate budget for each element of working capital, such as, cash, inventories and receivables etc.

Vous aimerez peut-être aussi

- Campus Recruitment ApplicationDocument2 pagesCampus Recruitment ApplicationTanvi NaharPas encore d'évaluation

- Auditors' ReportDocument3 pagesAuditors' ReportTanvi NaharPas encore d'évaluation

- Mother Dairy - TanviDocument52 pagesMother Dairy - TanviTanvi Nahar60% (5)

- Vodafone FinDocument23 pagesVodafone FinTanvi NaharPas encore d'évaluation

- NOKIA (1) WacDocument10 pagesNOKIA (1) WacTanvi NaharPas encore d'évaluation

- Project Report - MEDocument35 pagesProject Report - METanvi NaharPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- T0000598REFTRGiDX 33RevG01052017 PDFDocument286 pagesT0000598REFTRGiDX 33RevG01052017 PDFThanhPas encore d'évaluation

- Motionless Electromagnetic GeneratorDocument8 pagesMotionless Electromagnetic Generatorraja100% (1)

- P 130881757895329843Document44 pagesP 130881757895329843Vijay MohanPas encore d'évaluation

- Urban Road Types 25.01.2022Document5 pagesUrban Road Types 25.01.2022Balogun IbrahimPas encore d'évaluation

- CSC:361-Software Engineering: Semester: Fall2020Document39 pagesCSC:361-Software Engineering: Semester: Fall2020hamsfayyazPas encore d'évaluation

- Day 4 - Lesson 15 Tuples: Python Mini-Course University of Oklahoma Department of PsychologyDocument20 pagesDay 4 - Lesson 15 Tuples: Python Mini-Course University of Oklahoma Department of PsychologyhuseyiPas encore d'évaluation

- Stability Analysis of Steel Storage Rack Structures PDFDocument7 pagesStability Analysis of Steel Storage Rack Structures PDFFabian Flemin BahamondePas encore d'évaluation

- Rotational Dynamics-07-Problems LevelDocument2 pagesRotational Dynamics-07-Problems LevelRaju SinghPas encore d'évaluation

- CSIE Fisa Disciplina - Baze de DateDocument4 pagesCSIE Fisa Disciplina - Baze de DateCostin CheluPas encore d'évaluation

- Como Desarmar Sony Vaio VGN-FE PDFDocument14 pagesComo Desarmar Sony Vaio VGN-FE PDFPeruInalambrico Redes InalambricasPas encore d'évaluation

- Vertical Ow Constructed Wetland Planted With Heliconia Psittacorum Used As Decentralized Post-Treatment of Anaerobic Ef Uent in Southern BrazilDocument10 pagesVertical Ow Constructed Wetland Planted With Heliconia Psittacorum Used As Decentralized Post-Treatment of Anaerobic Ef Uent in Southern BrazilAlfonso Ruiz PérezPas encore d'évaluation

- 02 WholeDocument344 pages02 WholeedithgclemonsPas encore d'évaluation

- Fiberlogic CarrierEthernet 842 5300 PresentationDocument41 pagesFiberlogic CarrierEthernet 842 5300 PresentationDuong Thanh Lam0% (1)

- Formula Sheet: Basic Trigonometric IdentitiesDocument4 pagesFormula Sheet: Basic Trigonometric Identitieschetan temkarPas encore d'évaluation

- Bates Stamped Edited 0607 w22 QP 61Document6 pagesBates Stamped Edited 0607 w22 QP 61Krishnendu SahaPas encore d'évaluation

- Solved - Which $1,000 Bond Has The Higher Yield To Maturity, A T...Document4 pagesSolved - Which $1,000 Bond Has The Higher Yield To Maturity, A T...Sanjna ChimnaniPas encore d'évaluation

- Data Visualization For Python - Sales Retail - r1Document19 pagesData Visualization For Python - Sales Retail - r1Mazhar MahadzirPas encore d'évaluation

- CH 1 Optical Fiber Introduction - 2Document18 pagesCH 1 Optical Fiber Introduction - 2Krishna Prasad PheluPas encore d'évaluation

- Sewage: Vag Hade Flap ValveDocument4 pagesSewage: Vag Hade Flap ValveAhmedRamadanPas encore d'évaluation

- Redox TitrationDocument5 pagesRedox TitrationchristinaPas encore d'évaluation

- Alimak Alc - IIDocument62 pagesAlimak Alc - IImoiburPas encore d'évaluation

- Residual Alkalinity Nomograph by John Palmer PDFDocument1 pageResidual Alkalinity Nomograph by John Palmer PDFcarlos pablo pabletePas encore d'évaluation

- Narayana Xii Pass Ir Iit (2023 24) PDFDocument16 pagesNarayana Xii Pass Ir Iit (2023 24) PDFRaghav ChaudharyPas encore d'évaluation

- Chap005 3Document26 pagesChap005 3Anass BPas encore d'évaluation

- Spare Parts List: Hydraulic BreakerDocument28 pagesSpare Parts List: Hydraulic BreakerTeknik MakinaPas encore d'évaluation

- Table of Trigonometric IdentitiesDocument2 pagesTable of Trigonometric IdentitiesVaios PeritogiannisPas encore d'évaluation

- Sap SCM TrainingDocument5 pagesSap SCM TrainingGLOBAL TEQPas encore d'évaluation

- 002 Ac Yoke B100-ParkerDocument2 pages002 Ac Yoke B100-ParkerNubia BarreraPas encore d'évaluation

- General Pathology Lecture Group 1 HandoutDocument6 pagesGeneral Pathology Lecture Group 1 HandoutCecille AnnPas encore d'évaluation

- Teaching Tactics and Teaching Strategy: Arthur W. Foshay'Document4 pagesTeaching Tactics and Teaching Strategy: Arthur W. Foshay'Ahmed DaibechePas encore d'évaluation