Académique Documents

Professionnel Documents

Culture Documents

First Group of Plans

Transféré par

kirillianDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

First Group of Plans

Transféré par

kirillianDroits d'auteur :

Formats disponibles

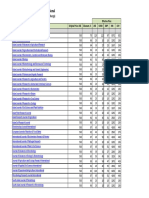

Effective Date: 04/01/2012 Applicant: 25, Male Spouse: 26, Female Children: 0

Click Plan Name for more information Monthly Premium Benefit Period Deductible Single Two-Person Family(1) Network Coinsurance - You Pay In-Network Providers Out-of-Network Providers Out of Pocket Maximum Single Two-Person Family(1) Lifetime Benefit Maximum Office Services - You Pay In-Network Providers

Blue Priority HSA/Alliance Select 1700B $ 296.65 Coordinates with drug deductible (5) $1,700 Family Deductibles apply $3,400 Wellmark Blue Cross and Blue Shield of Iowa 20% 40%

Blue Advantage Premier (SM) 1500 Blue Rx Value $ 351.85

Alliance Select Enhanced 1250 $ 453.95

Alliance Select Comprehensive 1000 $ 668.35

$1,500 $3,000 Wellmark Health Plan of Iowa, Inc. 30% coinsurance(9) Only allowed with Wellmark approval

$1,250 $2,500 $3,750

$1,000 $2,000 $3,000

Wellmark Blue Cross Wellmark Blue Cross and and Blue Shield of Iowa Blue Shield of Iowa 20% 40% 10% 30%

$3,700 In-Network/$5,700 Out-ofNetwork(4) Family Out-of-Pocket Maximums apply. $7,400 In-Network/$11,400 Out-ofNetwork(4) Unlimited Deductible and coinsurance apply to Office Visits, Office X-rays and Office Lab work

$4,500

$2,250 $4,500

$2,000 $4,000 $6,000 Unlimited

$9,000 Unlimited

$6,750 Unlimited

30% coinsurance, deductible waived

20% coinsurance; deductible waived

10% coinsurance; deductible waived Deductible; followed by 30% coinsurance

Out-of-Network Providers

Deductible and coinsurance apply Only allowed with Wellmark Deductible; followed by to Office Visits, Office X-rays and approval 40% coinsurance Office Lab work Deductible and coinsurance apply Deductible followed by coinsurance

Emergency Room Preventive and Routine Care (including well-child care up to age 7) In-Network Providers Out-of-Network Providers Maternity Prescription Drugs(10) Benefit Period Drug Deductible Tier 1 Tier 2 Tier 3 Tier 4 Specialty Preferred Specialty Non-Preferred Out-of-State Coverage/BlueCard Program Mental Health and Chemical Dependency Treatment Chiropractic Care Contraceptives

$150 (waived if admitted $100 (waived if admitted as inpatient following as inpatient following ER) ER)

Covered. Deductible and coinsurance waived. Covered. Deductible and coinsurance apply. Complications Only. Optional maternity benefit is available(6)

Covered. Deductible and coinsurance waived. Not Covered Complications Only. Optional maternity benefit is available(6). Blue Rx Value(12) $200 Single/$400 Family, waived for Tier 1 Greater of $5 or 25% Greater of $40 or 25% No Coverage No Coverage $100 copay Not Covered Only allowed for emergency services and accidental injury Covered; Limited Covered; Limited Covered

Covered. Deductible and Covered. Deductible and coinsurance waived. coinsurance waived. Covered. Deductible and Covered. Deductible and coinsurance apply. coinsurance apply. Complications Only Covered

Coordinates with medical deductible(5) After deductible, you pay greater of $8 or 25% After deductible, you pay greater of $35 or 25% After deductible, you pay greater of $50 or 25%

$0 Greater of $8 or 25% Greater of $30 or 25% Greater of $45 or 25%

$0 Greater of $8 or 25% Greater of $30 or 25% Greater of $45 or 25%

Yes Not Covered Covered Available as Optional Benefit

Yes Not Covered Covered Available as Optional Benefit

Yes Covered; Limited Covered Available as Optional Benefit

$500 Supplemental Accident (Optional) Dental (Optional) Monthly Premium

Not Available Available $ 296.65

Not Available Available $ 351.85

Available Available $ 453.95

Available Available $ 668.35

*A monthly service fee is applied to every contract. *Blue Advantage plans are underwritten by Wellmark Health Plan of Iowa, Inc. *Standard rates have been used to provide your quote. Actual rates vary based on your relative health status, demographics, tobacco usage, optional benefits and plan selection. Coverage is subject to the terms, limits and conditions of the contract. (1) The family deductible and out-of-pocket maximum can be met through any combination of family members. No one member will be required to meet more than the single deductible or out-of-pocket maximum amount to receive benefits for covered services during a benefit period. For HSAQualified plans, the entire family deductible must be met before benefits are payable. (2) Primary Care Practitioners (PCPs) include Family Practitioners, General Practitioners, Internal Medicine Practitioners, Obstetricians/Gynecologists, Pediatricians, Physicians Assistants and Advanced Registered Nurse Practitioners. For purposes of your copayment responsibility, Alliance Select and BlueCard PPO providers are classified as either primary care practitioners or nonprimary care practitioners. Before you receive office services from an Alliance Select or BlueCard PPO practitioner, call the customer service number on your ID card to determine whether your provider is classified as a primary care practitioner or a non-primary care practitioner for purposes of your copayment. The classification of providers in the Wellmark Provider Directory does not determine whether a provider is primary care or non-primary care for purposes of your office exam copayment. For example, a provider might be listed under multiple specialties in the Provider Directory (such as internal medicine and oncology), but is classified as a non-primary care practitioner for purposes of your copayment. (3) First three office visits in a benefit period. The terms of the benefit period deductible, coinsurance, and copayment for office visits depend in part upon whether an office visit is one of the first three per person in a benefit period. (4) Out-of-pocket amounts you pay for Alliance Select or non-Alliance Select covered services apply to both the Alliance Select and non-Alliance Select out-of-pocket maximums. (5) Amounts paid toward covered medical services or prescription drugs apply toward the benefit period deductible and out-of-pocket maximum. (6) If you chose the optional maternity coverage on your application, coverage for maternity services except for complications of pregnancy, will be subject to an exclusion period of 12 months. (7) Benefit Period Drug Deductible is $200 single; $400 two-person; $600 family. (8) Benefit Period Drug Deductible is $100 single; $200 two-person; $300 family. (9) Prosthetic limbs are subject to 20% coinsurance when using in-network providers. (10) Routine immunizations waive deductible, copayments and/or coinsurance when using the Blue Rx Preferred drug card. (11) Once your annual deductible is met, the additional $1,000 added to the out-of-pocket maximum must be met through the drug cost-sharing. (12) Members have the option under the Premier plan to buy down to Blue Rx Value. Members have the option under the Standard plan to buy up to Blue Rx Complete.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- John and RachelDocument1 pageJohn and RachelkirillianPas encore d'évaluation

- WCC 2009 UpdatesDocument2 pagesWCC 2009 UpdateskirillianPas encore d'évaluation

- SupplementDocument1 pageSupplementkirillianPas encore d'évaluation

- ShropshiresDocument2 pagesShropshireskirillianPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hirschprung Associated EnterocolitisDocument9 pagesHirschprung Associated Enterocolitiskeyla_shineeePas encore d'évaluation

- VMU BrochureDocument15 pagesVMU BrochurekarthiktaraPas encore d'évaluation

- Administration of The Behavioral Pediatrics Feeding Assessment SCDocument50 pagesAdministration of The Behavioral Pediatrics Feeding Assessment SCPaula Caceres RiveraPas encore d'évaluation

- The Use of Optokinetic Stimulation in VestibularDocument6 pagesThe Use of Optokinetic Stimulation in Vestibularbuku fisio0% (1)

- My Article B AngleDocument4 pagesMy Article B AngleNiyati VerulkarPas encore d'évaluation

- Bitter Kola PDFDocument2 pagesBitter Kola PDFadeolaodukoyaPas encore d'évaluation

- Septic ShockDocument26 pagesSeptic ShockIma SoniaPas encore d'évaluation

- Current Diagnosis Treatment Pediatrics 24Th Edition Edition William Hay Full ChapterDocument67 pagesCurrent Diagnosis Treatment Pediatrics 24Th Edition Edition William Hay Full Chapterbill.groff554100% (4)

- Apocrine Breast LesionsDocument7 pagesApocrine Breast LesionscandiddreamsPas encore d'évaluation

- National Antibiotic Guideline 2014 Full VersionDocument246 pagesNational Antibiotic Guideline 2014 Full Versionevonnecheah100% (2)

- 0.publication Charge NewDocument4 pages0.publication Charge NewWayan SusilaPas encore d'évaluation

- Cerebral Palsy in ChildrenDocument17 pagesCerebral Palsy in Childrenapi-320401765Pas encore d'évaluation

- Arterial Blood GasDocument6 pagesArterial Blood GasnsfanfoinPas encore d'évaluation

- Effects of Herbal Lollipops On Streptococcus Mutans Levels and The Dental Caries Experience of Children With Asthma Taking B2-Adrenergic Agonish DrugsDocument23 pagesEffects of Herbal Lollipops On Streptococcus Mutans Levels and The Dental Caries Experience of Children With Asthma Taking B2-Adrenergic Agonish Drugsinfo6680Pas encore d'évaluation

- Atlas of Oral Diseases 2016Document198 pagesAtlas of Oral Diseases 2016Desi Sri Astuti100% (1)

- Qa Tables FinalDocument11 pagesQa Tables Finalapi-337188982Pas encore d'évaluation

- Poisons List Alpha PDFDocument100 pagesPoisons List Alpha PDFmuhammad usman nasirPas encore d'évaluation

- Locations For Swallow Study or Feeding EvaluationDocument5 pagesLocations For Swallow Study or Feeding Evaluationapi-307578607Pas encore d'évaluation

- Intermittent ExotropiaDocument15 pagesIntermittent ExotropiakarenafiafiPas encore d'évaluation

- CPT® 2015: Watch For Changes in Vertebral Fracture AssessmentDocument3 pagesCPT® 2015: Watch For Changes in Vertebral Fracture AssessmenttimvrghsPas encore d'évaluation

- SBS Res Broker DentalClaimFormDocument2 pagesSBS Res Broker DentalClaimFormNarendra SubramanyaPas encore d'évaluation

- Patient Education: Colic (Excessive Crying) in Infants (Beyond The Basics)Document15 pagesPatient Education: Colic (Excessive Crying) in Infants (Beyond The Basics)krh5fnjnprPas encore d'évaluation

- 1 Childhood Nephrotic Syndrome - Diagnosis and ManagementDocument52 pages1 Childhood Nephrotic Syndrome - Diagnosis and ManagementThana Balan100% (1)

- Case Presentation OnDocument30 pagesCase Presentation OnShweta ChaurasiaPas encore d'évaluation

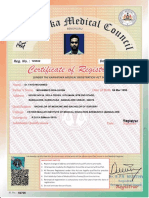

- KMC Registration CertificateDocument1 pageKMC Registration CertificateFahd Mohamed0% (1)

- Spek Ven Avea Full ClioDocument3 pagesSpek Ven Avea Full ClioRinawatiPas encore d'évaluation

- Syringes NeedlesDocument52 pagesSyringes NeedlesRamchandra KenyPas encore d'évaluation

- BDS PDFDocument16 pagesBDS PDFSimran KathuriaPas encore d'évaluation

- ICRP 126 RadonDocument76 pagesICRP 126 RadonSonia AragónPas encore d'évaluation

- Bosentan PI PDFDocument12 pagesBosentan PI PDFlaghatechinmayPas encore d'évaluation