Académique Documents

Professionnel Documents

Culture Documents

Untitled

Transféré par

andrew_trotman1455Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Untitled

Transféré par

andrew_trotman1455Droits d'auteur :

Formats disponibles

In a speech to mark the centenary of the Department of Economics at the Universi ty of Aberystwyth, Spencer Dale Bank of England Chief

f Economist and member of th e Monetary Policy Committee (MPC) discusses the imperative of rebalancing the su pply side of the UK economy, and explains why this process poses significant cha llenges for UK monetary policy. Changes are required in the pattern of UK spending, but such changes cannot be e nough on their own, Dale insists. The types of goods and services that the UK p roduces must also shift, in order to match the re-orientation of demand. And it is this supply-side leg of rebalancing that he fears may prove more difficult an d potentially more disruptive for the economy. The required structural changes are broad and deep and, Dale argues, there is much more to supply side rebalancing than simply a bigger manufacturing sector. The tr aditional distinction between manufacturing and services is simply not meaningfu l in many successful companies today Dale observes, contending that we need to pro duce more of the goods and services others want to buy and which we have a compa rative advantage in producing. Moreover, firms and households will have to respo nd to other dimensions of rebalancing: to the relative decline in public sector spending; and to costs of obtaining credit that Dale considers unlikely to fall all the way back to pre-crisis levels. This slow and challenging journey towards rebalancing which the UK currently faces presents monetary policymakers, such as Dale, with two significant issues. The first follows from the observation that changes to the structure of an econo my can be associated with short-term pain. Dale assesses that We may need to take one step back to take two steps forward. During the period of adjustment, the p otential for the long-term unemployed to become detached from the labour market as skills get rusty or discouragement kicks in creates great uncertainty over th e drag from unemployment on wage growth, as well as causing enormous personal and social costs. The second policy issue is the impact of the stance of monetary policy on the pa ce of rebalancing and the delicate balancing act between providing short-term sup port to the economy without stifling the incentives for change. Dale is convince d that the substantial loosening in monetary policy undertaken in recent years w as essential in order to prevent the UK economy from falling into a deeper and mo re protracted recession. But at the same time he acknowledges that this loosening also served to blunt some of the incentives driving the rebalancing of our econ omy. It encourages people to spend more and save less, and slows the reallocatio n of capital and labour to more productive uses. In this context, Dale notes loose monetary policy can in part be thought of as a form of forbearance: putting off difficult changes and adjustments to a later day. Monetary policy must trade of f short-term support against stifling long-term change. Like good parenting, as D ale puts it, monetary policy should provide support but it cant protect us from th e harsh realities of life. Dale briefly reflects on the current outlook for inflation and monetary policy. He expects inflation to continue to fall back towards target, but thinks the cha nces of inflation being above or below 2% by the end of this year and into 2013 are somewhat more balanced than the best collective judgment of the MPC, publishe d in last months Inflation Report. Dale believes that inflation is just as likely to be above as below the inflation target in the medium term. Dale also explains that the MPC has recently begun to use a new forecasting plat form to produce its inflation projections. At the heart of this platform sits a relatively small central organising model, with a broad range of insights also incorporated from a suite of alternative economic models: Small and suite. For D ale, a much larger central model, for example one incorporating roles for banks and financial frictions, would still be an incomplete description of a complex re

ality, but also less useful as a tool for thinking through economic issues and for ming economic judgments. Dale stresses that the introduction of the new forecasti ng platform does not, of itself, imply any changes to the MPCs forecasts or to ho w we set policy."

Vous aimerez peut-être aussi

- BankiaDocument1 pageBankiaandrew_trotman1455Pas encore d'évaluation

- BuffettDocument1 pageBuffettandrew_trotman1455Pas encore d'évaluation

- Women On BoardsDocument20 pagesWomen On Boardsandrew_trotman1455Pas encore d'évaluation

- EUcouncilDocument2 pagesEUcouncilandrew_trotman1455Pas encore d'évaluation

- ISDADocument1 pageISDAandrew_trotman1455Pas encore d'évaluation

- JunckerDocument1 pageJunckerandrew_trotman1455Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Wickham. The Other Transition. From The Ancient World To FeudalismDocument34 pagesWickham. The Other Transition. From The Ancient World To FeudalismMariano SchlezPas encore d'évaluation

- Slavoj Zizek - A Permanent State of EmergencyDocument5 pagesSlavoj Zizek - A Permanent State of EmergencyknalltuetePas encore d'évaluation

- Presidents Address-Final 31 August 2017 For PrintingDocument10 pagesPresidents Address-Final 31 August 2017 For PrintingDavid OuldPas encore d'évaluation

- La Tolérance Et Ses Limites: Un Problème Pour L'ÉducateurDocument7 pagesLa Tolérance Et Ses Limites: Un Problème Pour L'ÉducateurFatima EL FasihiPas encore d'évaluation

- International Trade TheoryDocument35 pagesInternational Trade TheorySachin MalhotraPas encore d'évaluation

- China Total Competition Strategy (2020)Document10 pagesChina Total Competition Strategy (2020)Lian GianganPas encore d'évaluation

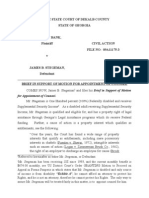

- Brief in Support of Motion To Appoint CounselDocument11 pagesBrief in Support of Motion To Appoint CounselJanet and James100% (1)

- SS 5 Aralin 1 PDFDocument26 pagesSS 5 Aralin 1 PDFChris Micah EugenioPas encore d'évaluation

- TNPSC Group 4 Govt Notes - Indian National Movement - EnglishDocument68 pagesTNPSC Group 4 Govt Notes - Indian National Movement - Englishdeebanmegam2Pas encore d'évaluation

- Burgum Gift CardsDocument3 pagesBurgum Gift CardsRob Port50% (2)

- BGR ApplicationFormDocument4 pagesBGR ApplicationFormRajaSekarPas encore d'évaluation

- North Korea Through The Looking GlassDocument273 pagesNorth Korea Through The Looking GlassLiz T.100% (3)

- 92300Document258 pages92300ranjit_singh_80Pas encore d'évaluation

- Northcote School EnrolmentDocument2 pagesNorthcote School EnrolmentfynnygPas encore d'évaluation

- GNS 111/103 Prof. C.A Onifade and S.N AtataDocument60 pagesGNS 111/103 Prof. C.A Onifade and S.N AtataImokhai AbdullahPas encore d'évaluation

- Rizal in London & ParisDocument32 pagesRizal in London & Parisvackla twoPas encore d'évaluation

- CBK Power Co LTD Vs CirDocument1 pageCBK Power Co LTD Vs CirlacbayenPas encore d'évaluation

- Enlightenment DBQ: Chapter 17 and 18Document15 pagesEnlightenment DBQ: Chapter 17 and 18Dimitrije RandjelovicPas encore d'évaluation

- Women Reservation Bill PDFDocument7 pagesWomen Reservation Bill PDFGabriella RuhilPas encore d'évaluation

- Colgate Palmolive vs. OpleDocument4 pagesColgate Palmolive vs. OpleHal JordanPas encore d'évaluation

- Funding Proposal - 13012023Document2 pagesFunding Proposal - 13012023Info Fer-OilPas encore d'évaluation

- Analisis Akses Masyarakat Dki Jakarta Terhadap Air Bersih Pasca Privatisasi Air Tahun 2009-2014Document18 pagesAnalisis Akses Masyarakat Dki Jakarta Terhadap Air Bersih Pasca Privatisasi Air Tahun 2009-2014sri marlinaPas encore d'évaluation

- G2C Model:passport Sewa: Assignment III E-CommerceDocument9 pagesG2C Model:passport Sewa: Assignment III E-CommercesagarPas encore d'évaluation

- Vidyanali Not Reg SchoolsDocument62 pagesVidyanali Not Reg SchoolssomunathayyaPas encore d'évaluation

- Class XII History 2010 DelhiDocument29 pagesClass XII History 2010 DelhiRamita UdayashankarPas encore d'évaluation

- SSRN Id2566126Document152 pagesSSRN Id2566126Tauseef AhmadPas encore d'évaluation

- SophoclesDocument2 pagesSophoclesDoan DangPas encore d'évaluation

- Nigeria Stability and Reconciliation Programme Volume 1Document99 pagesNigeria Stability and Reconciliation Programme Volume 1Muhammad NaseerPas encore d'évaluation

- TCWD 111 - Midterm ReviewerDocument10 pagesTCWD 111 - Midterm ReviewerGDHDFPas encore d'évaluation

- Monopolies and Restrictive Trade Practices Act 1969 MRTP Mechanism, Its Establishment, Features and FunctioningDocument37 pagesMonopolies and Restrictive Trade Practices Act 1969 MRTP Mechanism, Its Establishment, Features and FunctioningKamlesh MauryaPas encore d'évaluation