Académique Documents

Professionnel Documents

Culture Documents

Employee Benefits 03

Transféré par

Nelva QuinioDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Employee Benefits 03

Transféré par

Nelva QuinioDroits d'auteur :

Formats disponibles

PRE REVIEW 1ST SEM S.Y.

2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

PAS 19 - EMPLOYEE BENEFITS I. DEFINITION It includes all forms of consideration given by an entity in exchange of services rendered by employees.

II. Short-term employee benefits due to be settled within twelve months after the end of the period in which the employees render the related services a. Salaries, wages and social security contributions b. Short term compensated absences such as paid annual leave and sick leave i. Accumulating compensated absences carried forward and can be used in future periods if the current periods entitlement is not used in full 1. Vesting employees are entitled 2. Nonvesting employees are not entitled ii. Nonaccumulating compensated absences do not carry forward c. Profit sharing and bonuses payable within twelve months only if there is a constructive obligation d. Nonmonetary benefits such as medical care, housing, car and free or subsidized goods Unpaid short term benefits accrued expenses Short term benefits paid in advance prepayments Cost of short term benefits expense as incurred III. Postemployment benefits employee benefits other than termination benefits, payable after completion of employment a. Retirement benefits b. Postemployment life insurance c. Postemployment medical care Formal or informal arrangements Defined benefit plans or defined contribution plans

Defined Contribution Plan The pension ultimately received by the former employee is a function of the contributions that have been made The cost of the employer is therefore fixed and predictable No legal or constructive obligation to meet shortfall Defined Benefit Plan The pension is based on a formula that is not simply based on the contributions made, and the employer retains a risk that they will not be enough to pay the pensions The eventual cost to the employer is therefore more difficult to predict

Funded or unfunded Postemployment benefit plans under the law 1. Social security system defined contribution 2. R.A 7641 defined benefit

IV. ACOUNTING FOR DEFINED CONTRIBUTION PLAN entity pays fixed contributions into a separate entity known as the fund and will have no legal or constructive obligation to pay further contributions

1. The contribution shall be recognized as expense in the period it is payable 2. The unpaid contribution at the end of the period shall be recognized as accrued expense 3. Any excess contribution shall be recognized as prepaid expense

V. ACCOUNTING FOR DEFINED BENEFIT PLAN an entitys obligation is to provide the agreed benefits to employees 1. BENEFITS EXPENSES =+Current service cost increase in the present value of the defined benefit obligation resulting from employee service in the current period + Interest cost increase in the PV of the DBO which arise because the benefits are one period closer to settlement (PBO, beg. x interest rate) - expected return on assets reflect the changes in the FV of plan assets held during the paid out of the fund (FVPA, beg x rate of return) +actuarial loss

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

-actuarial gain +past service cost actuarially computed present value of the retirement benefits payable in the future with respect to services rendered prior to the adaptation or amendment of a retirement plan +effect of any curtailment or settlement

2. PLAN ASSETS assets held by a long term benefit fund and qualifying insurance policies b. The assets are held by an entity that is legally separate from the reporting entity c. The assets are available to pay only employee benefits d. The assets are not available to the reporting entitys own creditors even in bankruptcy e. The assets cannot be returned to the reporting entity or can only be retuned if the remaining assets are sufficient enough to meet all employee benefits FV of plan assets beginning xx Add: contribution to the fund xx Actuarial gain xx Actual return xx Total xx Less: benefits paid xx Actuarial loss xx FV of plan assets ending xx 3. ACCUMULATED BENEFIT OBLIGATION the amount is based on current compensation level of employees and therefore includes no assumptions about future salary increase 4. PROJECTED BENEFIT OBLIGATION the amount includes future salary increase that the entity projects it will pay to employees during the remainder of their employment - PV of expected future payments required to settle the obligation arising from employee service in the current and future periods PBO beginning xx Add: Current service cost xx Past Service cost xx Actuarial loss xx Interest Cost xx Total xx Less: Benefits paid xx Actuarial gain xx PBO ending xx

5. UNDERFUNDING / OVERFUNDING Prepaid benefit cost FVPA > PBO ; overfunded ; noncurrent asset Accrued benefit cost FVPA < PBO ; underfunded ; noncurrent liability 6. PAST SERVICE COST Vested expense immediately Not vested amortized on a straight line basis over the period until it becomes vested ACTUARIAL GAINS / LOSSES the actual return > expected return = actuarial gain the actual return < expected return = actuarial loss the actual benefit obligation > expected obligation = actuarial loss the actual benefit obligation < expected obligation = actuarial gain a. Full recognition approach b. Corridor approach recognized a portion of actuarial gains and losses as income or expense if the net cumulative unrecognized actuarial gains and losses at the beginning of the current period exceed 10% of the greater between the PBO and FVPA (amortized over the remaining service period Amortization of Actuarial gain deducted in computation of total benefits expenses Amortization of Actuarial loss added in computation of total benefits expenses Unamortized actuarial gain credit in memo records Unamortized actuarial loss debit in memo records VI. OTHER LONG TERM EMPLOYEE BENEFITS a. Long term compensated absences such as long service or sabbatical leave b. Jubilee or other long-term benefit c. Long-term disability benefits If If If If

Prepared by: Ms. Rosalie S. Fernando

7.

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

d. Profit sharing and bonuses payable in more than twelve months after the end of the period in which the employees render the related service e. Deferred compensation payable in more than twelve months after the end of the period in which it is earned VII. DISCLOSURES DEFINED CONTRIBUTION PLAN a. General description of the plan b. The amount recognized as expense during the period DEFINED BENEFIT PLAN a. Accounting policy for recognizing actuarial gains and losses b. General description or the type of plan c. Reconciliation of the assets and liabilities recognized in the balance sheet d. Amounts included in the fair value of plan assets e. Reconciliation showing the movements during the period in the net liability or asset recognized in the balance sheet f. Total expense in the income statement for each of the following, and the line item of the income statement in which they are included Current service cost Interest cost Expected return on plan assets Actuarial gains and losses Past service cost Effect of any curtailment or settlement g. Actual return on plant assets h. Principal actuarial assumptions

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

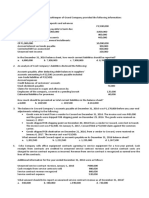

VIII. PRACTICE PROBLEMS: 1. Silay Company has established a defined pension plan for its employees. Annual payments under the pension plan are equal to 3% of an employees highest lifetime salary multiplied by the number of years with the entity. An employees salary in 2010 was P500,000. The employee is expected to retire in 10 years, and the salary increases are expected to average 4% per year during that period. As of December 31, 2010, the employee has worked for 15 years. The future value of 1 at 4% for 10 periods is 1.48. What is the annual pension payment that should be used in computing the projected benefit obligation on December 31, 2010? ________________________ 2. Woodstock Company was established a defined benefit pension plan for its lone employee. Annual payments under the pension plan are equal to the employees highest lifetime salary multiplied by 2% multiplied by number of year with the entity. As of the beginning of 2011, the employee had worked for Woodstock Company for 10 years. The salary in 2010 was P500,000. The employee is expected to retire in 25 years and the salary increases are expected to average 3% per year during that period. The employee is expected to live for 15 years after retirement. The discount rate is 8%. The relevant present value and future value factors are: PV of an ordinary annuity of 1 at 8% for 15 periods 8.559 PV of 1 at 8% for 25 periods 0.146 Future value of 1 at 3% for 25 periods 2.094 What is the projected benefit obligation on January 1, 2011? _________________ 3. A director of Easy Company shall receive a retirement benefit of 10% of the final salary per annum for a contractual period of three years. The director does not contribute to the scheme. The anticipated salary over the three years is P1,000,000 for 2010, P1,200,000 for 20111 and P1,440,000 for 2012. The discount rate is 5% Using the projected unit credit method, what is the estimated pension liability on December 31, 2011? _________________

4. Fair value of plan assets Projected benefit obligation

6,500,000 7,500,000

The accountant revealed the following information for the current year: Current service cost Interest cost settlement discount rate Actual return on plan assets Long-term rate of return on plan assets Contribution to the plan 1,600,000 10% 600,000 8% 1,500,000

What should be reported as employee benefit expense for the current year? ________________ 5. On January 1, 2010, Simple Company has a defined benefit plan with the following pension information: Fair value of plan assets Projected benefit obligation Cumulative unrecognized actuarial gains 50,000,000 45,000,000 8,000,000

On December 31, 2010, the fair value of the plan assets has risen by P5,000,000 and the projected benefit obligation has risen by P3,000,000. The actuarial gain is P4,000,000 during the current year and the average remaining service period of the employees is 20 years. Under the corridor approach, how much is the amortization of the actuarial gains for 2010? _________________ Under the full recognition approach, how much actuarial gain is included in other comprehensive income for 2010? ____________________ 6. Adam Company provided the following information on December 31, 2010.

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

Service cost Actual return on pension plan asset Interest cost Excess of expected return over actual return on pension plan asset 150,000 Amortization of deferred pension loss from prior years 240,000 Amortization of past service cost Contribution to pension fund

520,000 810,000 590,000

360,000 950,000

What is the net pension expense for 2010? _________________ 7. On January 1, 2010, the memorandum records of Cagayan de Oro Company showed the following balances related to its defined benefit plan: Fair value of plan assets Unamortized pas service cost Projected benefit obligation Prepaid/accrued benefit cost 8,000,000 1,500,000 (9,000,000) 500,000

The remaining average vesting period for the employees covered by the past service cost is 5 years. The transactions affecting the defined benefit plan for the current year are as follows: Current service cost Interest cost Expected and actual return on plan assets Contribution to the plan Benefits plan to retirees 1,500,000 800,000 500,000 2,000,000 1,000,000

In the December 31, 2010 statement of financial position, what should be reported as prepaid benefit cost? __________________________ 8. On January 1, 2010, Loch Company established a noncontributory defined benefit plan covering all employees and contributed P1,000,000 to the plan. On December 31, 2010, Loch determined that the 2010 current service and interest costs on the plan amount to P620,000. The expected and actual rate of return on plan assets for 2010 was 10%. What should be reported on December 31, 2010 as prepaid benefit cost? ________________ 9. Quebec Company adopted a defined benefit pension plan on January 1, 2010. Quebec amortizes the past service cost over 16 years and funds past service cost by making equal payments to the fund trustee at the end of each of the first ten years. The current service cost is fully funded at the end of each year. The following data are available for the current year: Current service cost Past service cost: Amortized Funded 220,000 83,400 114,400

What is the prepaid pension cost on December 31, 2010? ___________________ 10. Nice Company had the following balances relating to its defined benefit plan on December 31, 2010: Fair value of plan assets Past service cost unrecognized Net actuarial loss unrecognized Projected benefit obligation Present value of available future refund and reduction in future contribution 1,000,000 37,000,000 2,000,000 3,000,000 33,000,000

What should be reported as prepaid benefit cost in the December 31, 2010 statement of financial position? ___________________ 11. Libungan Company provided the following information concerning its defined benefit plan in the trustees memorandum records on January 1, 2010:

Prepared by: Ms. Rosalie S. Fernando

Page1

Fair value of plan assets Unamortized past service cost

9,500,000 2,600,000

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

Projected benefit obligation Unrecognized actuarial gain Prepaid/accrued benefit cost credit

(12,000,000) ( 1,000,000) ( 1,700,000)

years

The transactions for the current year related to the defined benefit plan are: Current service cost 1,800,000 Interest cost 1,300,000 Expected and actual return on plan assets 1,100,000 Contribution to the plan 2,700,000 Benefits paid to retirees 2,000,000 Increase in projected benefit obligation due to changes in actuarial assumptions 280,000 Amortization period of past service cost and actuarial gain 10 What amount should be reported as benefit expense for the current year? ________________ What is the fair value of plan assets on December 31, 2010? ___________________ What is the projected benefit obligation on December 31, 2010? ___________________ What is the net unrecognized actuarial gain on December 31, 2010? _________________ What is the balance of the prepaid/accrued benefit cost amount on December 31, 2010? ___________________ 12. Pension plan information for Winter Company is as follows: January 1, 2010 During 2010 250,000 December 31, 2010 Projected benefit obligation Accumulated benefit obligation Pension benefits paid to retired employees 3,500,000 2,800,000 4,200,000 3,100,000 10%

Projected obligation Accumulated benefit obligation Discount or settlement rate

Assuming no change in actuarial assumptions, what is the current service cost for 2010? ____________________________

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

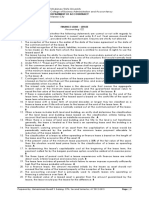

PAS 19 - EMPLOYEE BENEFITS POST TEST THEORIES: 1. Which is not a characteristic of short-term employee benefits? a. No actuarial assumptions are required to measure the benefit obligation. b. There is no possibility of any actuarial gain or loss. c. Short-term employee benefits by definition are payable no later than twelve months after the end of the current period. d. Short-term employee benefit obligations are measured on a discounted basis. 2. Which is incorrect concerning the recognition and measurement of a defined contribution plan? a. The contribution shall be recognized as expense in the period it is payable. b. Any unpaid contribution at the end of the period shall be recognized as accrued liability. c. Any excess contribution shall be recognized as prepaid expense but only to the extent that the prepayment will lead to a reduction in future payments or a cash refund. d. An entity shall not disclose the amount recognized as expense for a defined contribution plan. 3. Which is incorrect concerning the recognition and measurement of a defined contribution plan? a. The contribution shall be recognized as expense in the period it is payable. b. Any unpaid contribution at the end of the period shall be recognized as accrued liability. c. Any excess contribution shall be recognized as prepaid expense but only to the extent that the prepayment will lead to a reduction in future payments or a cash refund. d. An entity shall not disclose the amount recognized as expense for a defined contribution plan. 4. Which in incorrect concerning return on plan assets? a. The actual return on plan assets in one component of the expense recognized in the income statement. b. The difference between the expected return and actual return on plan assets is an actuarial gain or loss. c. The expected return on assets is based on market expectations, at the beginning of the period, for returns over the entire life of the related obligation. d. In determining the expected and actual return on plan assets, an entity shall deduct plan administration cost not included in actuarial assumptions used in measuring defined benefit obligation, and tax payable by the plan itself. 5. Which is correct concerning past service cost? I. The past service cost shall be expensed immediately when additional benefits vest immediately. II. If the benefits are not vested the past service cost is amortized on a straight line basis over the period until the benefits become vested. a. I only b. II only c. Both I and II d. Neither I nor II 6. The surplus contemplated under PAS 19 shall not exceed the sum of the a. Unrecognized past service cost and unrecognized actuarial loss. b. Unrecognized past service cost and present value of refund from the plan. c. Unrecognized actuarial loss and present value of refund from the plan. d. Unrecognized past service cost, unrecognized actuarial loss and present value of refund from the plan. 7. Demographic actuarial assumptions deal with all of the following, except a. Mortality, both during and after employment b. Rate of employee turnover c. Disability and early retirement d. Expected rate of return on plan assets

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

8. Which statement is correct concerning actuarial gains and losses? I. Actuarial gains and losses comprise of experience adjustments and the effects of changes in actuarial assumption. II. Actuarial gains and losses may result from increases or decreases in either the present value of defined benefits obligation or the fair value of plan assets. a. I only b. II only c. Both I and II d. Neither I nor II 9. An entity operates a defined benefit pension plan and changes it at the beginning of the current year to a defined contribution plan. The net pension liability after the plan amendment is less than the net pension liability before the plan amendments. How should the entity account for this change? a. The entity shall recognize a gain. b. The entity does not recognize a gain. c. The entity shall recognize a gain over the remaining service period of the employees. d. The entity shall recognize the gain but applies the 10% corridor approach. 10. The amount recognized as liability in the statement of financial position shall be the net total of the following amounts (choose the incorrect one) a. The present value of projected benefit obligation at the end of reporting period b. Plus any actuarial gain, less any actuarial losses, not yet recognized c. Plus any past service cost not yet recognized d. Minus the fair value of plan assets at the end of reporting period

PROBLEMS: 11. Abba Company has an unrecognized actuarial gain of P425,000 relating to its pension plan as of January 1, 2010. Management has chosen to amortize this deferral on a straight line basis over the 10-year average remaining service life of its employees. Additional facts about the pension plan as of January 1, 2010 are as follows: Projected benefit obligation Accumulated benefit obligation Fair value of plan assets Market related value of the pension fund (5-year weighted average) 2,050,000 1,900,000 1,500,000 1,350,000

What is the minimum amortization of unrecognized actuarial gain for 2010? a. 22,000 b. 23,500 c. 25,500 d. 29,000 12. Starex Company had the following pension-related balances on January 1, 2010: Projected benefit obligation Fair value of pension fund Unrecognized net pension loss Unrecognized past service cost 2,000,000 2,300,000 310,000 100,000

The average remaining service period of employees working on January 1, 2010 is five years. What is the amortization of the unrecognized net pension loss during the year? a. 62,000 b. 16,000 c. 20,000 d. 36,000 13. Tijuana Company operates a defined benefit plan and recognizes actuarial gains and losses in profit or loss under the corridor approach On January 1, 2010, the plan assets were P8,000,000, the defined benefit obligation was P9,000,000 and the unrecognized actuarial losses were P1,200,000. During the year ended December 31, 2010, actuarial gains of P150,000 arose. The average remaining working period of participating employees was 20 years on both January 1 and December 31, 2010 What is the amount of cumulative unrecognized actuarial losses on December 31, 2010? a. 1,050,000 b. 1,035,000 c. 1,185,000

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

d. 1,335,000 14. On January 1, 2010, Butuan Company has a defined benefit plan with the following details: Fair value of plan assets 8,000,000 Projected benefit obligation 7,000,000 Unrecognized net actuarial gain 1,500,000 Other relevant information for the current year is as follows: Current service cost Interest cost Contribution to the plan Expected return on plan assets Average service period of employees 1,800,000 700,000 1,500,000 8% 5 years

What is the employee benefit expense for the current year? a. 1,500,000 b. 1,560,000 c. 1,720,000 d. 2,500,000 15. Batanes Company obtains the following from its actuary on January 1, 2010: Projected benefit obligation Fair value of plan assets Unrecognized net actuarial loss 9,000,000 10,000,000 1,500,000

During the current year, the actuary determined the current service cost at P2,500,000 and interest cost at P900,000. The expected and actual return on plan assets was P1,200,000. The average remaining service period of the covered employees is 10 years. What is the benefit expense for the current year? a. 2,250,000 b. 2,200,000 c. 2,350,000 d. 3,400,000 16. On January 1, 2010, Sheryll Company adopted a defined benefit plan. The plans service cost of P750,000 was fully funded at the end of 2010. Past service cost was funded by a contribution of P300,000 in 2010. Amortization of past service cost was P120,000 for 2010. What is the prepaid pension cost on December 31, 2010? a. 180,000 b. 300,000 c. 420,000 d. 540,000 17. Zamba Company adopted a defined benefit plan on January 1, 2009. The plan does not provide any retroactive benefits for existing employees. The pension funding payment is made to the trustee on December 31 each year. The following information is available: Service cost Funding payment Interest on defined benefit obligation Expected and actual return on plan assets 2009 1,500,000 1,700,000 2010 1,650,000 1,850,000 150,000 180,000

In the December 31, 2010 statement of financial position, what should be reported as prepaid pension cost? a. 200,000 b. 250,000 c. 430,000 d. 400,000 18. The following information pertains to Lee Companys defined benefit plan for the current year: Current service cost Actual and expected gain on plan assets Unexpected loss on plan assets related to a disposal of a subsidiary Amortization of unrecognized past service cost Annual interest on pension liability 1,600,000 350,000 400,000 50,000 500,000

Prepared by: Ms. Rosalie S. Fernando

Page1

What amount should be reported as net periodic pension cost in the current year? a. 2,500,000 b. 2,200,000

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

c. 2,100,000 d. 1,800,000 19. Bronson Company sponsors a noncontributory defined benefit pension plan. On December 31, 2010, the end of the entitys accounting period, the entity received the projected benefit obligation report from the independent actuary. The following data were included: Pension benefits Paid Balance, PBO, at December 31, 2010 Interest cost Discount rate used by actuary 135,000 2,160,000 120,000 8%

What is the current service cost for 2010? a. 675,000 b. 810,000 c. 540,000 d. 255,000 20. The following information relates to the defined benefit pension plan of Ronald Company for the year ended December 31, 2010: Projected benefit obligation, January 1 Projected benefit obligation, December 31 Fair value of plan assets, January 1 Fair value of plan assets, December 31 Expected return on plan assets Amortization of deferred gain Employer contribution Benefits contribution Settlement rate 4,600,000 4,730,000 5,035,000 5,565,000 450,000 20,000 425,000 390,000 10%

What is the net periodic pension cost that should be reported in the income statement for 2010? a. 20,000 b. 90,000 c. 50,000 d. 70,000 21. Manaoag Company maintains a fund to cover its pension plan. The following data relate to the fund for the current year: January 1 FVPA 8,750,000 Market-related value of the pension fund (5-year weighted average)7,150,000 During year Pension benefits paid 600,000 Contribution made to the fund 700,000 Actual return on plan assets 950,000 What is the fair value of plan assets (FVPA) on December 31? a. 8,200,000 b. 9,800,000 c. 7,250,000 d. 8,850,000 Macro Company has a defined benefit pension plan. On January 1, 2010, the following balances were computed for the pension plan: Unrecognized pension gain 420,000 Fair value of pension fund 3,300,000 Market-related value of pension fund (5-year weighted average) 2,850,000 Projected benefit obligation 3,900,000 Accumulated benefit obligation 3,500,000 Net pension expense, exclusive of pension gain or loss component 530,000 It was anticipated that the pension plan would earn 12% of the market-related value of the pension fund in 2010. The actual return on the pension fund was P315,000. The entity has elected to amortize the unrecognized pension gains and losses over 10 years. 22. What is the amount of pension gain or loss deferral in 2010? c. 27,000 loss d. 27,000 gain e. 81,000 loss f. 81,000 gain 23. What is the amount of amortization of unrecognized pension gain or loss for 2010?

Prepared by: Ms. Rosalie S. Fernando

Page1

PRE REVIEW 1ST SEM S.Y. 2011-2012 PRACTICAL ACCOUNTING 1 / THEORY OF ACCOUNTS

a. 42,000 b. 39,300 c. 9,000 d. 3,000 24. What is the net pension expense after including the pension gain or loss component? a. 530,000 b. 527,000 c. 500,000 d. 560,000 25. What is the unrecognized pension gain or loss on December 31, 2010? a. 390,000 gain b. 390,000 loss c. 444,000 gain d. 444,000 loss

Prepared by: Ms. Rosalie S. Fernando

Page1

Vous aimerez peut-être aussi

- Activity 4-Post EbDocument7 pagesActivity 4-Post EbNhel AlvaroPas encore d'évaluation

- ApDocument8 pagesApMonina Cabalag100% (1)

- Retirement BenefitsDocument4 pagesRetirement BenefitsJona FranciscoPas encore d'évaluation

- 28 - Accounting For Income TaxesDocument2 pages28 - Accounting For Income TaxesralphalonzoPas encore d'évaluation

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument9 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionChristian Acab Gracia0% (1)

- AnnounceDocument14 pagesAnnounceskydawn0% (1)

- Accounting For Income Tax QuestionsDocument13 pagesAccounting For Income Tax QuestionsReina Erasmo SulleraPas encore d'évaluation

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document4 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jayr BV100% (1)

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- EMPLOYEE-BENEFITS AnswerkeyDocument6 pagesEMPLOYEE-BENEFITS AnswerkeyRiselle Ann Sanchez100% (2)

- BondsDocument3 pagesBondsMaketh.Man75% (4)

- FAR22 Share-Based Payments - With AnsDocument8 pagesFAR22 Share-Based Payments - With AnsAJ Cresmundo29% (7)

- Leases Part 2Document40 pagesLeases Part 2Danica RamosPas encore d'évaluation

- Directions: Highlight in Yellow Color Your Answer.: Employment Benefits TheoryDocument3 pagesDirections: Highlight in Yellow Color Your Answer.: Employment Benefits TheoryTracy Ann Acedillo100% (1)

- Quiz 14P - Income TaxDocument5 pagesQuiz 14P - Income TaxDolaypanPas encore d'évaluation

- Finance Lease: Demo Teaching PresentationDocument52 pagesFinance Lease: Demo Teaching PresentationFaye Reyes100% (2)

- ToA.1823 Share-Based Payment OnlineDocument2 pagesToA.1823 Share-Based Payment OnlineJolina Mancera0% (1)

- ch13 PDFDocument43 pagesch13 PDFerylpaez100% (3)

- Solution Set PDocument14 pagesSolution Set PChristina JazarenoPas encore d'évaluation

- FAR23 Employee Benefits - With AnsDocument13 pagesFAR23 Employee Benefits - With AnsAJ Cresmundo100% (1)

- Deferred TaxDocument6 pagesDeferred TaxJayson Manalo GañaPas encore d'évaluation

- Intermediate AccountingDocument36 pagesIntermediate AccountingJerome SarmientoPas encore d'évaluation

- B. No Liability Is. Recognized at Year-End For Any Unused EntitlementDocument2 pagesB. No Liability Is. Recognized at Year-End For Any Unused Entitlementfrancis dungcaPas encore d'évaluation

- Liabilities - QuizDocument7 pagesLiabilities - Quizkarenmae intangPas encore d'évaluation

- Quiiz 1Document4 pagesQuiiz 1max pPas encore d'évaluation

- Info 1Document28 pagesInfo 1Veejay Soriano Cuevas0% (1)

- P1 HSHSJSKDJHSHDocument8 pagesP1 HSHSJSKDJHSHabcdefg0% (1)

- Defined Benefit Plan Accounting ProceduresDocument46 pagesDefined Benefit Plan Accounting ProceduresEJ EduquePas encore d'évaluation

- Accounting For Income TaxesDocument17 pagesAccounting For Income TaxesKenn Adam Johan Gajudo67% (9)

- Book Value Per Share TQDocument6 pagesBook Value Per Share TQIvy SalisePas encore d'évaluation

- Problem 27 1Document2 pagesProblem 27 1CodeSeeker50% (2)

- Finance Lease - Lessee: Aklan Catholic CollegeDocument9 pagesFinance Lease - Lessee: Aklan Catholic CollegeLouisePas encore d'évaluation

- Appendix Ebleta MatsDocument17 pagesAppendix Ebleta MatsEl Yang0% (2)

- Answer: C - 465,000Document9 pagesAnswer: C - 465,000kyle G50% (2)

- R4acads Finacc ExtraDocument5 pagesR4acads Finacc ExtraChristine Herico CurryPas encore d'évaluation

- Intermediate Acctg 2 - MillanDocument6 pagesIntermediate Acctg 2 - MillanJuliana Ipo100% (1)

- Financial Accounting and Reporting Ii Final Quiz 2/3Document7 pagesFinancial Accounting and Reporting Ii Final Quiz 2/3Patrick Ferdinand Alvarez50% (2)

- Discussion Problems: FAR.2828-Notes Payable MAY 2020Document3 pagesDiscussion Problems: FAR.2828-Notes Payable MAY 2020stephen poncianoPas encore d'évaluation

- HHHDocument4 pagesHHHmitakumo uwu67% (6)

- Chapter 16 Employee BenefitsDocument56 pagesChapter 16 Employee BenefitsHammad Ahmad100% (27)

- Accounting For LeaseDocument75 pagesAccounting For LeaseRonnie Salazar53% (15)

- PRACTICAL ACCOUNTING I Quiz No. 2Document6 pagesPRACTICAL ACCOUNTING I Quiz No. 2ROB1015120% (2)

- Reviewer ToaDocument25 pagesReviewer ToaFlorence CuansoPas encore d'évaluation

- Practical Accounting 1Document22 pagesPractical Accounting 1Mica Gonzales63% (8)

- Liabilities Deferred TaxDocument3 pagesLiabilities Deferred TaxHikari0% (1)

- IA2Document14 pagesIA2Sitio BayabasanPas encore d'évaluation

- Deferred TaxesDocument17 pagesDeferred Taxesasdfghjkl100% (2)

- LeasesDocument5 pagesLeasesElla Montefalco50% (2)

- Chapter 11 FinAcc2Document13 pagesChapter 11 FinAcc2Kariz Codog0% (2)

- Lyka Problem TranscribedDocument4 pagesLyka Problem TranscribedAngelica Galicia0% (2)

- (P1) Retained EarningsDocument6 pages(P1) Retained Earningslooter198Pas encore d'évaluation

- Contest FARDocument31 pagesContest FARTerence Jeff Tamondong67% (3)

- BSA2BQuiz 3Document19 pagesBSA2BQuiz 3Monica Enrico0% (1)

- SPQ 003 Employee Benefits, Leases, and Other LiabilitiesDocument3 pagesSPQ 003 Employee Benefits, Leases, and Other LiabilitiesmarygraceomacPas encore d'évaluation

- Orca Share Media1577676523240Document4 pagesOrca Share Media1577676523240Jayr BVPas encore d'évaluation

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezPas encore d'évaluation

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoPas encore d'évaluation

- Postemployment BenefitsDocument22 pagesPostemployment BenefitsChoco ButternutPas encore d'évaluation

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpPas encore d'évaluation

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaPas encore d'évaluation

- Basic Financial Accounting by BalladaDocument608 pagesBasic Financial Accounting by BalladaNelva QuinioPas encore d'évaluation

- Baysa ParcorChapter 1-5 Answer KeyDocument52 pagesBaysa ParcorChapter 1-5 Answer KeymoonjiannePas encore d'évaluation

- Divine Mercy ChapletDocument1 pageDivine Mercy ChapletNelva QuinioPas encore d'évaluation

- Manual Accounting Practice SetDocument13 pagesManual Accounting Practice SetNguyen Thien Anh Tran100% (2)

- Tesda NC III Bookkeeping Reviewer 1Document41 pagesTesda NC III Bookkeeping Reviewer 1girl86% (7)

- Manual Accounting Practice SetDocument13 pagesManual Accounting Practice SetNguyen Thien Anh Tran100% (2)

- Marketing Aspect FinalDocument10 pagesMarketing Aspect FinalNelva QuinioPas encore d'évaluation

- The Great Book of Best Quotes of All Time. - OriginalDocument204 pagesThe Great Book of Best Quotes of All Time. - OriginalAbhi Sharma100% (3)

- Corporate Profile HLTMTDocument12 pagesCorporate Profile HLTMTAzihan AripinPas encore d'évaluation

- Fsav 5e - Errata 082718 PDFDocument26 pagesFsav 5e - Errata 082718 PDFAbhi AbhiPas encore d'évaluation

- Morepen Laboratories Press Release Q1 PDFDocument5 pagesMorepen Laboratories Press Release Q1 PDFgaurav chaudharyPas encore d'évaluation

- GST - Introduction To GST & Concept of SupplyDocument40 pagesGST - Introduction To GST & Concept of Supplydeepak singhalPas encore d'évaluation

- Steve Ballmer Email To Microsoft EmployeesDocument2 pagesSteve Ballmer Email To Microsoft EmployeesFOXBusiness.comPas encore d'évaluation

- Ratio NandiDocument71 pagesRatio NandiAnonymous 22GBLsme1100% (1)

- Aviation Management Page - 1Document12 pagesAviation Management Page - 1YamPas encore d'évaluation

- Project Report ON "To Study of Npa Management"Document64 pagesProject Report ON "To Study of Npa Management"Dhiraj KokarePas encore d'évaluation

- Nov 2001Document11 pagesNov 2001Altaf HussainPas encore d'évaluation

- North South University: Course-ACT310, Sec: 01 Individual Assignment On APEX Foods LTDDocument10 pagesNorth South University: Course-ACT310, Sec: 01 Individual Assignment On APEX Foods LTDMostafa haquePas encore d'évaluation

- PayslipDocument2 pagesPayslipAbdul JabarPas encore d'évaluation

- Habib Bank LimitedDocument21 pagesHabib Bank LimitedbilalzuberiPas encore d'évaluation

- Ecomom Post MortemDocument7 pagesEcomom Post Mortemashontell67% (3)

- Ratio AnalysisDocument11 pagesRatio AnalysisPrashant BhadauriaPas encore d'évaluation

- Diagnostic Exercises2Document32 pagesDiagnostic Exercises2HanaPas encore d'évaluation

- ACCT 3001 Chapter 5 Assigned Homework SolutionsDocument18 pagesACCT 3001 Chapter 5 Assigned Homework SolutionsPeter ParkPas encore d'évaluation

- Elphos Erald: Nine Arrested On Drug-Related ChargesDocument10 pagesElphos Erald: Nine Arrested On Drug-Related ChargesThe Delphos HeraldPas encore d'évaluation

- Sesi Ke 10&11Document40 pagesSesi Ke 10&11Ahmad ZahirPas encore d'évaluation

- ISAK 35 Non Profit Oriented EntitiesDocument48 pagesISAK 35 Non Profit Oriented Entitiesnabila dhiyaPas encore d'évaluation

- Annual Report 2017 PDFDocument216 pagesAnnual Report 2017 PDFemmanuelPas encore d'évaluation

- Lesson 10 - Manufacturing BusinessDocument4 pagesLesson 10 - Manufacturing BusinessVISITACION JAIRUS GWENPas encore d'évaluation

- 197 Dodge v. Ford Motor Co.Document1 page197 Dodge v. Ford Motor Co.MlaPas encore d'évaluation

- AppleDocument40 pagesApplesuryavamshirakesh10% (1)

- Prismatic SocietyDocument47 pagesPrismatic SocietyBach AchacosoPas encore d'évaluation

- Nguyen Huong A 12Document8 pagesNguyen Huong A 12Quỳnh Hương NguyễnPas encore d'évaluation

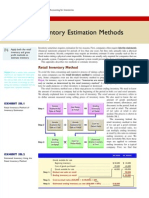

- Inventory EstimationDocument4 pagesInventory EstimationShy Ng0% (1)

- Asset Liability Management InbanksDocument26 pagesAsset Liability Management InbanksRomaMakhijaPas encore d'évaluation

- Unit I 17082019Document93 pagesUnit I 17082019mananPas encore d'évaluation

- NonLinear ScaleDocument4 pagesNonLinear ScaleSid KrishPas encore d'évaluation

- List of Important Committees in India and Their AreaDocument3 pagesList of Important Committees in India and Their AreaabhiPas encore d'évaluation